Professional Documents

Culture Documents

Bonds - July 27 2022

Bonds - July 27 2022

Uploaded by

Lisle Daverin Blyth0 ratings0% found this document useful (0 votes)

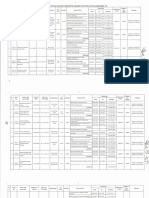

8 views3 pagesThe document provides market and commodity figures for July 27, 2022, including total market turnover statistics, foreign client market turnover statistics, index levels, ALBI constituent bonds, other rates, and nominal bond curves. Total market turnover for the current day was over 25 billion rand, while year-to-date turnover was over 5.8 trillion rand. Several bond indices were listed along with their yields, levels, and month-to-date and year-to-date returns. Details on individual bonds that make up the ALBI index were also given.

Original Description:

Bonds - July 27 2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides market and commodity figures for July 27, 2022, including total market turnover statistics, foreign client market turnover statistics, index levels, ALBI constituent bonds, other rates, and nominal bond curves. Total market turnover for the current day was over 25 billion rand, while year-to-date turnover was over 5.8 trillion rand. Several bond indices were listed along with their yields, levels, and month-to-date and year-to-date returns. Details on individual bonds that make up the ALBI index were also given.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesBonds - July 27 2022

Bonds - July 27 2022

Uploaded by

Lisle Daverin BlythThe document provides market and commodity figures for July 27, 2022, including total market turnover statistics, foreign client market turnover statistics, index levels, ALBI constituent bonds, other rates, and nominal bond curves. Total market turnover for the current day was over 25 billion rand, while year-to-date turnover was over 5.8 trillion rand. Several bond indices were listed along with their yields, levels, and month-to-date and year-to-date returns. Details on individual bonds that make up the ALBI index were also given.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Markets and Commodity figures

27 July 2022

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1,486 25.91 bn Rbn 24.95 165 30.88 bn Rbn 28.25

Week to Date 5,142 105.66 bn Rbn 97.88 1,017 193.51 bn Rbn 179.74

Month to Date 29,212 862.89 bn Rbn 789.70 5,570 1,022.95 bn Rbn 942.90

Year to Date 195,549 5,854.51 bn Rbn 5,635.07 41,089 7,868.78 bn Rbn 7,419.12

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 60 2.09 bn Rbn 1.85 19 3.36 bn Rbn 2.83

Current Day Sell 53 2.58 bn Rbn 2.38 21 6.95 bn Rbn 6.69

Net 7 -0.49 bn Rbn -0.54 -2 -3.59 bn Rbn -3.86

Buy 185 10.72 bn Rbn 9.78 53 11.49 bn Rbn 9.49

Week to Date Sell 152 9.42 bn Rbn 8.62 85 25.36 bn Rbn 24.82

Net 33 1.31 bn Rbn 1.16 -32 -13.88 bn Rbn -15.33

Buy 1,274 96.25 bn Rbn 85.92 340 71.36 bn Rbn 57.79

Month to Date Sell 1,224 110.67 bn Rbn 97.16 420 121.12 bn Rbn 113.96

Net 50 -14.42 bn Rbn -11.24 -80 -49.77 bn Rbn -56.17

Buy 9,863 680.41 bn Rbn 644.55 1,945 361.14 bn Rbn 318.77

Year to Date Sell 10,453 785.04 bn Rbn 733.61 2,896 837.11 bn Rbn 798.59

Net -590 -104.63 bn Rbn -89.06 -951 -475.97 bn Rbn -479.82

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 All Bond Index 10.289% 811.128

Top 20 Composite 810.859 0.53% -1.41%

GOVI 10.294%

ALBI20 Issuer Class Split - 799.645

GOVI 799.362 0.50% -1.51%

OTHI 10.226%

ALBI20 Issuer Class Split - 868.657

OTHI 868.594 0.92% -0.36%

CILI15 3.364%

Composite Inflation 318.316

Linked Index Top 15 319.798 -1.48% 1.74%

ICOR 2.348%

CILI15 Issuer Class 404.469

Split - ICOR 404.895 0.46% 5.34%

IGOV 3.367%

CILI15 Issuer Class 315.122

Split - IGOV 316.636 -1.49% 1.64%

ISOE 3.959%

CILI15 Issuer Class 339.861

Split - ISOE 340.752 -2.50% 2.74%

MMI JSE Money Market Index

0 302.636 302.590 0.32% 2.51%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Nov 2023

AFRICA 8.740% 8.750% 6.72% 8.79%

R203 REPUBLIC OF SOUTH

Aug 2025

AFRICA 10.000% 10.005% 8.33% 10.37%

ES18 ESKOM HOLDINGSAprLIMITED

2026 10.050% 10.055% 8.47% 10.42%

R204 REPUBLIC OF SOUTH

Oct 2026

AFRICA 9.180% 9.185% 7.54% 10.03%

R207 REPUBLIC OF SOUTH

Dec 2026

AFRICA 9.150% 9.155% 7.57% 9.52%

R208 REPUBLIC OF SOUTH

Nov 2027

AFRICA 11.250% 11.255% 9.47% 11.62%

ES23 ESKOM HOLDINGS

NovLIMITED

2028 11.660% 11.665% 9.87% 12.03%

DV23 DEVELOPMENT JanBANK

2030

OF SOUTHERN

10.650%AFRICA 10.655% 9.04% 11.09%

R2023 REPUBLIC OF SOUTH

Feb 2031

AFRICA 10.955% 10.975% 9.31% 11.41%

ES26 ESKOM HOLDINGS

MarLIMITED

2032 11.085% 11.100% 9.47% 11.52%

R186 REPUBLIC OF SOUTH

Sep 2033

AFRICA 12.285% 12.290% 10.84% 12.78%

R2030 REPUBLIC OF SOUTH

Jul 2034

AFRICA 12.105% 12.110% 10.55% 12.60%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 11.335% 11.340% 9.89% 11.83%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 11.335% 11.340% 9.89% 11.83%

ES33 ESKOM HOLDINGSJanLIMITED

2037 11.510% 11.505% 10.08% 11.99%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 11.575% 11.565% 10.23% 12.05%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 11.485% 11.475% 10.22% 11.97%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 12.635% 12.625% 11.29% 13.12%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 11.560% 11.550% 10.30% 12.07%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 11.515% 11.510% 10.22% 12.03%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate5.310% 5.310% 3.58% 5.32%

JIBAR1 JIBAR 1 Month 5.575% 5.575% 3.74% 5.58%

JIBAR3 JIBAR 3 Month 5.717% 5.708% 3.89% 5.72%

JIBAR6 JIBAR 6 Month 6.625% 6.617% 4.66% 6.63%

RSA 2 year retail bond 8.75% 0 0 0

RSA 3 year retail bond 9.25% 0 0 0

RSA 5 year retail bond 10.50% 0 0 0

RSA 3 year inflation linked retail

2.75%

bond 0 0 0

RSA 5 year inflation linked retail

3.00%

bond 0 0 0

RSA 10 year inflation linked retail

4.00%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Families Schools and Communities Together For Young Children PDFDocument2 pagesFamilies Schools and Communities Together For Young Children PDFMisty17% (6)

- Bowing Styles in Irish Fiddle Playing Vol 1 - David LythDocument58 pagesBowing Styles in Irish Fiddle Playing Vol 1 - David LythEmma Harry100% (1)

- Bonds - May 22 2022Document3 pagesBonds - May 22 2022Lisle Daverin BlythNo ratings yet

- Similarities and Contrast of Metaphysical, Epistemological and Axiological Position of Reconstruction To Idealism and RealismDocument6 pagesSimilarities and Contrast of Metaphysical, Epistemological and Axiological Position of Reconstruction To Idealism and RealismJebjeb C. Braña100% (1)

- LETTER - Interview InviteDocument2 pagesLETTER - Interview InviteElviraNo ratings yet

- Bank Shi-Urkantzu 4 PDFDocument91 pagesBank Shi-Urkantzu 4 PDFJames Johnson100% (3)

- Bonds - July 25 2022Document3 pagesBonds - July 25 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 26 2022Document3 pagesBonds - July 26 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 24 2022Document3 pagesBonds - July 24 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 28 2022Document3 pagesBonds - July 28 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 20 2022Document3 pagesBonds - July 20 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Bonds - February 17 2022Document3 pagesBonds - February 17 2022Lisle Daverin BlythNo ratings yet

- Bonds - February 8 2022Document3 pagesBonds - February 8 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 25 2022Document3 pagesBonds - April 25 2022Lisle Daverin BlythNo ratings yet

- Bonds - March 13 2022Document3 pagesBonds - March 13 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 21 2022Document3 pagesBonds - July 21 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 22 2022Document3 pagesBonds - November 22 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 21 2022Document3 pagesBonds - April 21 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 9 2022Document3 pagesBonds - November 9 2022Lisle BlythNo ratings yet

- Bonds - November 1 2021Document3 pagesBonds - November 1 2021Lisle Daverin BlythNo ratings yet

- Bonds - October 18 2022Document3 pagesBonds - October 18 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Bonds - October 18 2020Document3 pagesBonds - October 18 2020Lisle Daverin BlythNo ratings yet

- Bonds - September 27 2022Document3 pagesBonds - September 27 2022Lisle Daverin BlythNo ratings yet

- Bonds - October 14 2021Document3 pagesBonds - October 14 2021Lisle Daverin BlythNo ratings yet

- Bonds - August 30 2022Document3 pagesBonds - August 30 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 28 2022Document3 pagesBonds - September 28 2022Lisle Daverin BlythNo ratings yet

- Bonds - August 25 2022Document3 pagesBonds - August 25 2022Lisle Daverin BlythNo ratings yet

- Bonds - March 10 2022Document3 pagesBonds - March 10 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 30 2022Document3 pagesBonds - September 30 2022Lisle Daverin BlythNo ratings yet

- Bonds - October 13 2020Document3 pagesBonds - October 13 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 31 2022Document3 pagesBonds - May 31 2022Lisle Daverin BlythNo ratings yet

- Bonds - October 27 2021Document3 pagesBonds - October 27 2021Lisle Daverin BlythNo ratings yet

- Bonds - October 14 2020Document3 pagesBonds - October 14 2020Lisle Daverin BlythNo ratings yet

- Bonds - July 4 2022Document3 pagesBonds - July 4 2022Lisle Daverin BlythNo ratings yet

- Bonds - March 30 2022Document3 pagesBonds - March 30 2022Lisle BlythNo ratings yet

- Bonds - October 17 2022Document3 pagesBonds - October 17 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Bonds - October 31 2022Document3 pagesBonds - October 31 2022Lisle BlythNo ratings yet

- Bonds - July 17 2022Document3 pagesBonds - July 17 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 28 2020Document3 pagesBonds - April 28 2020Lisle Daverin BlythNo ratings yet

- Bonds - July 28 2021Document3 pagesBonds - July 28 2021Lisle Daverin BlythNo ratings yet

- Bonds - August 24 2022Document3 pagesBonds - August 24 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 1 2022Document3 pagesBonds - September 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 26 2022Document3 pagesBonds - May 26 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 9 2020Document3 pagesBonds - July 9 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 10 2022Document3 pagesBonds - May 10 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 5 2022Document3 pagesBonds - July 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 27 2020Document3 pagesBonds - April 27 2020Lisle Daverin BlythNo ratings yet

- Bonds - July 13 2022Document3 pagesBonds - July 13 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 19 2022Document3 pagesBonds - May 19 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 29 2020Document3 pagesBonds - April 29 2020Lisle Daverin BlythNo ratings yet

- Bonds - April 13 2020Document3 pagesBonds - April 13 2020Lisle Daverin BlythNo ratings yet

- Bonds - April 12 2022Document3 pagesBonds - April 12 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 5 2022Document3 pagesBonds - December 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 23 2022Document3 pagesBonds - November 23 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 10 2019Document3 pagesBonds - April 10 2019Tiso Blackstar GroupNo ratings yet

- Bonds - June 8 2022Document3 pagesBonds - June 8 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 18 2022Document3 pagesBonds - May 18 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 23 2020Document3 pagesBonds - April 23 2020Lisle Daverin BlythNo ratings yet

- Bonds - February 23 2022Document3 pagesBonds - February 23 2022Lisle BlythNo ratings yet

- Bonds - March 7 2022Document3 pagesBonds - March 7 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 21 2020Document3 pagesBonds - May 21 2020Lisle Daverin BlythNo ratings yet

- Liberty - December 11 2022Document1 pageLiberty - December 11 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 11 2022Document1 pageFuel Prices - December 11 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 9 2022Document1 pageFuel Prices - December 9 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 1 2022Document3 pagesBonds - December 1 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - December 5 2022Document2 pagesFairbairn - December 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 9 2022Document3 pagesBonds - December 9 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 6 2022Document2 pagesSanlam Stratus Funds - December 6 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 6 2022Document1 pageFuel Prices - December 6 2022Lisle Daverin BlythNo ratings yet

- Liberty - December 1 2022Document1 pageLiberty - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 6 2022Document3 pagesBonds - December 6 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - November 29 2022Document2 pagesFairbairn - November 29 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 5 2022Document3 pagesBonds - December 5 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 1 2022Document2 pagesSanlam Stratus Funds - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 30 2022Document3 pagesBonds - November 30 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 1 2022Document1 pageFuel Prices - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 23 2022Document3 pagesBonds - November 23 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 29 2022Document3 pagesBonds - November 29 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 29 2022Document1 pageFuel Prices - November 29 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 23 2022Document1 pageFuel Prices - November 23 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 21 2022Document3 pagesBonds - November 21 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 22 2022Document3 pagesBonds - November 22 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 22 2022Document1 pageFuel Prices - November 22 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - November 21 2022Document1 pageFuel Prices - November 21 2022Lisle Daverin BlythNo ratings yet

- PCW Guidelines For Developing and Implementing Gender Responsive Programs and Projects 1993Document51 pagesPCW Guidelines For Developing and Implementing Gender Responsive Programs and Projects 1993Randell ManjarresNo ratings yet

- Activity Question To Ponder OnDocument3 pagesActivity Question To Ponder OnMatthew Frank Melendez QuerolNo ratings yet

- Chương 3Document22 pagesChương 3Mai Duong ThiNo ratings yet

- Civil Engineer ListDocument9 pagesCivil Engineer ListMohammad AtiqueNo ratings yet

- Mesh Force Modelling and Parametric Studies For Compound Oscillatory Roller ReducerDocument18 pagesMesh Force Modelling and Parametric Studies For Compound Oscillatory Roller ReducerdimtecNo ratings yet

- Hoang Huy HoangDocument12 pagesHoang Huy Hoanghoang hoangNo ratings yet

- Review On Evolution of HackingDocument23 pagesReview On Evolution of HackingMlm RaviNo ratings yet

- Training DW PDFDocument31 pagesTraining DW PDFCeliaZurdoPerladoNo ratings yet

- Ermias TesfayeDocument111 pagesErmias TesfayeYayew MaruNo ratings yet

- LayoffDocument2 pagesLayoffPooja PandaNo ratings yet

- Modals of InferenceDocument5 pagesModals of InferenceMerry Lovelyn Celez100% (1)

- Sustainability 13 10705 v2 PDFDocument18 pagesSustainability 13 10705 v2 PDFVũ Ngọc Minh ThuNo ratings yet

- Power Industry IN INDIADocument21 pagesPower Industry IN INDIAbb2No ratings yet

- CLIC Catalogue PDFDocument28 pagesCLIC Catalogue PDFsangram patilNo ratings yet

- BIO and CHEMDocument13 pagesBIO and CHEMKingfrancis Buga-asNo ratings yet

- Wages Structure in India Under The Minimum Wages Act 1948Document61 pagesWages Structure in India Under The Minimum Wages Act 1948Karan Bhutani100% (4)

- FlIk GtAVp4 NBFC Business PlanDocument20 pagesFlIk GtAVp4 NBFC Business PlanPTC INIDANo ratings yet

- Exercise 6-4 ,: Nora Aldawood - By: Alanoud AlbarakDocument6 pagesExercise 6-4 ,: Nora Aldawood - By: Alanoud AlbarakmichelleNo ratings yet

- Job Description GRIDDocument2 pagesJob Description GRIDSwapnil ShethNo ratings yet

- Updated Judicial Notice and ProclamationDocument5 pagesUpdated Judicial Notice and Proclamational malik ben beyNo ratings yet

- Khurram Baig: Professional Experience (ISLAM ENGINEERING (PVT) LTD. (Feb-19 To Date) Designation (Chief Accountant)Document2 pagesKhurram Baig: Professional Experience (ISLAM ENGINEERING (PVT) LTD. (Feb-19 To Date) Designation (Chief Accountant)Wazeeer AhmadNo ratings yet

- Direct & Indirect SpeechDocument29 pagesDirect & Indirect SpeechHumanist English ManNo ratings yet

- English Language 2001 WAEC Past Questions - MyschoolDocument1 pageEnglish Language 2001 WAEC Past Questions - Myschooldosumuahmod47No ratings yet

- Barclays 2 Capital David Newton Memorial Bursary 2006 MartDocument2 pagesBarclays 2 Capital David Newton Memorial Bursary 2006 MartgasepyNo ratings yet