Professional Documents

Culture Documents

Engr. Charity Hope Gayatin

Engr. Charity Hope Gayatin

Uploaded by

medwin moralesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engr. Charity Hope Gayatin

Engr. Charity Hope Gayatin

Uploaded by

medwin moralesCopyright:

Available Formats

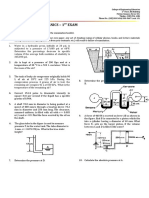

CE40-2/A2

24/07/2022

MORAELS, Medwin Miguel M.

Student Number CE/3

2017130414

M3-CPR-10%

Class Produced Reviewer

STRAIGHT LINE METHOD:

1. A company has a balance cost of 100,000 and has an estimated salvage value of 8,500 at the

end of 10 years of lifetime. What would the book value after 4 years? Use the straight-line

method for finding the depreciation.

Given: CO 100,000

CL 8,500

L 5 years

n 4 years

number of years BVB Depreciation Cost Accumulated depreciation BVE

1 100,000 18300 18300 81,700

2 81,700 18300 36600 63,400

3 63,400 18300 54900 45,100

4 45,100 18300 73200 26,800

5 26,800 18300 91500 8,500

ENGR. CHARITY HOPE GAYATIN

SINKING FUND METHOD

2. A techsupport company bought equipment for their servers. The equipment cost is 600,000

pesos. Other expenses like installation are equivalent to 4,000 pesos. The equipment is

expected to have a life of 14 years with a salvage value of 10% of the original cost of the

equipment. Determine the value at the end of 7 years by sinking fund method at 12%

interest.

Given: Co 604,000

CL 60000

L 14

n 7

Interest 12%

number of years BVB Depreciation Cost Accumulated depreciation BVE

0 0 16793.95788 0 604,000

1 604,000 16793.95788 16793.95788 587,206

2 587,206 16793.95788 35603.19071 551,603

3 551,603 16793.95788 56669.53148 494,933

4 494,933 16793.95788 80263.83314 414,669

5 414,669 16793.95788 106689.451 307,980

6 307,980 16793.95788 136286.143 171,694

7 171,694 16793.95788 169434.438 2,259

8 2,259 16793.95788 206560.5285 -204,301

9 -204,301 16793.95788 248141.7498 -452,443

10 -452,443 16793.95788 294712.7177 -747,156

11 -747,156 16793.95788 346872.2017 -1,094,028

12 -1,094,028 16793.95788 405290.8237 -1,499,319

13 -1,499,319 16793.95788 470719.6805 -1,970,038

14 -1,970,038 16793.95788 544000 -2,514,038

Matheson’s Formula (2 problems).

ENGR. CHARITY HOPE GAYATIN

3. A specific type of NFT bored ape loses 12% of its value each year. The NFT costs 30,000

pesos originally. Make out a schedule showing the yearly depreciation, the total depreciation,

and the book value at the end of each year for 7 years.

Given: CO 30,000

L 7

K 12%

number of years BVB Depreciation Cost Accumulated depreciation BVE

0 0 0 0 30,000

1 30,000 3600 18300 26,400

2 26,400 3168 36600 23,232

3 23,232 2787.84 54900 20,444

4 20,444 2453.2992 73200 17,991

5 17,991 2158.903296 91500 15,832

4. Determine the rate of depreciation, the total depreciation up to the end of the 8th year and

the book value at the end of 8 years for an asset that costs ₱15,000 new and has an

estimated scrap value of ₱2,000 at the end of 10 years by (a) the declining balance method

and (b) the double declining balance method.

Given: CO ₱15,000.00

CL ₱2,000.00

L 10

n 8

no. of yrs BVB K Depreciation cost Accumulated depreciation BVE

0 ₱15,000.00 18.2488% ₱0.00 ₱0.00 ₱15,000.00

1 ₱15,000.00 18.2488% ₱2,737.33 ₱2,737.33 ₱12,262.67

2 ₱12,262.67 18.2488% ₱2,237.80 ₱4,975.12 ₱10,024.88

3 ₱10,024.88 18.2488% ₱1,829.42 ₱6,804.55 ₱8,195.45

4 ₱8,195.45 18.2488% ₱1,495.58 ₱8,300.12 ₱6,699.88

5 ₱6,699.88 18.2488% ₱1,222.65 ₱9,522.77 ₱5,477.23

6 ₱5,477.23 18.2488% ₱999.53 ₱10,522.31 ₱4,477.69

7 ₱4,477.69 18.2488% ₱817.13 ₱11,339.43 ₱3,660.57

8 ₱3,660.57 18.2488% ₱668.01 ₱12,007.44 ₱2,992.56

9 ₱2,992.56 18.2488% ₱546.11 ₱12,553.55 ₱2,446.45

10 ₱2,446.45 18.2488% ₱446.45 ₱13,000.00 ₱2,000.00

Double Declining Balance Method.

ENGR. CHARITY HOPE GAYATIN

5. Determine the rate of depression, the total depreciation up to the end of the 9 th year and the

book value at the end of 9 year for an asset that costs 20,000 pesos new and has an

estimated scrap value of 2,000 pesos at the end of 11 years by using double declining

balance method.

Given: Co 20,000

CL 2000

L 11

n 9

no. of

yrs BVB K Depreciation cost Accumulated depreciation BVE

0 0 18% 0 20,000

1 20,000 18% 3636.363636 3,636 16,364

2 16,364 18% 2975.206612 6,612 13,388

3 13,388 18% 2434.259955 9,046 10,954

4 10,954 18% 1991.667236 11,037 8,963

5 8,963 18% 1629.54592 12,667 7,333

6 7,333 18% 1333.264844 14,000 6,000

7 6,000 18% 1090.853054 15,091 4,909

8 4,909 18% 892.5161351 15,984 4,016

9 4,016 18% 730.2404742 16,714 3,286

10 3,286 18% 597.4694789 17,311 2,689

11 2,689 18% 488.8386645 17,800 2,200

Sum of the Year Digit Method

ENGR. CHARITY HOPE GAYATIN

6. A Computer costs 150,000 pesos. It has estimated to have a life of 6 years, with a salvage

value at the end of its life of 1,000 pesos. Determine the book value at the end of each year of

life. Use the Sum of year digit method.

Given: Co 150,000

CL 1000

L 6

number of years BVB Depreciation Cost Accumulated depreciation BVE

1 150,000 42571.42857 42571.42857 107,429

2 107,429 35476.19048 35476.19048 114,524

3 114,524 28380.95238 28380.95238 121,619

4 121,619 21285.71429 21285.71429 128,714

5 128,714 14190.47619 14190.47619 135,810

6 135,810 7095.238095 7095.238095 142,905

Total number of

n= 21

ENGR. CHARITY HOPE GAYATIN

You might also like

- Flexural Analysis of BeamsDocument50 pagesFlexural Analysis of BeamsIsmail FarajpourNo ratings yet

- Hydraulics Plate 3 & 4asDocument3 pagesHydraulics Plate 3 & 4asNero James SiaNo ratings yet

- Only The Paranoid SurviveDocument6 pagesOnly The Paranoid SurviveDivyesh Shah29% (7)

- A. Straight Line MethodDocument4 pagesA. Straight Line MethodEliza Gail ConsuegraNo ratings yet

- M3 CPR QuinaDocument7 pagesM3 CPR Quinamapua boisNo ratings yet

- 7 Osborne Reynold'S Demonstration: Mapúa UniversityDocument11 pages7 Osborne Reynold'S Demonstration: Mapúa UniversityJemuel FloresNo ratings yet

- Freshly Poured Concrete Approximates A Fluid With SG 2.40. The Figure Below Shows ADocument1 pageFreshly Poured Concrete Approximates A Fluid With SG 2.40. The Figure Below Shows ARannie Ayaay Jr.No ratings yet

- Head Losses LectureDocument1 pageHead Losses Lecturebang sieNo ratings yet

- Statics of Rigid BodiesDocument11 pagesStatics of Rigid Bodiesdonald escalanteNo ratings yet

- What Upward Force (KN) Is To Be Applied at The Free End To Prevent The Beam From Deflecting?Document15 pagesWhat Upward Force (KN) Is To Be Applied at The Free End To Prevent The Beam From Deflecting?Jhoriz QuilloNo ratings yet

- Plate No. 1Document7 pagesPlate No. 1haeeyNo ratings yet

- Mechanics of Solids - (Riveted and Welded Joints)Document37 pagesMechanics of Solids - (Riveted and Welded Joints)TusherNo ratings yet

- PDF Probability (Refresher) PDFDocument46 pagesPDF Probability (Refresher) PDFDivine Joy Atractivo PinedaNo ratings yet

- Psad - 16Document2 pagesPsad - 16SamNo ratings yet

- Ce 343L - Fluid Mechanics - 1 ExamDocument2 pagesCe 343L - Fluid Mechanics - 1 ExamMichelle Daarol100% (1)

- Engineering Economics FormularsDocument9 pagesEngineering Economics FormularsFe Ca Jr.No ratings yet

- GE415 MidtermExamDocument15 pagesGE415 MidtermExamVlaire Janrex LondoñoNo ratings yet

- 1.introduction of OrificeDocument20 pages1.introduction of OrificeJohn Andre MarianoNo ratings yet

- Activity Sheet 4Document3 pagesActivity Sheet 4Shiebastian ArietaNo ratings yet

- Drills 1 QuestionnaireDocument3 pagesDrills 1 QuestionnaireNeo GarceraNo ratings yet

- Mathematics - TOPIC 13.5 Economics - 17 August 2022Document28 pagesMathematics - TOPIC 13.5 Economics - 17 August 2022mike reyesNo ratings yet

- TOS 06 Student's PDFDocument1 pageTOS 06 Student's PDFCed Calzado0% (1)

- 112Document10 pages112Memo LyNo ratings yet

- Sample Problems:: SG 0.90 SG 0.0Document1 pageSample Problems:: SG 0.90 SG 0.0Jessa San PedroNo ratings yet

- Unit 2 Time and Money D PDFDocument2 pagesUnit 2 Time and Money D PDFCarmelo Janiza LavareyNo ratings yet

- Prepared By: Engr. Jeffrey P. LandichoDocument10 pagesPrepared By: Engr. Jeffrey P. LandichoNoel So jrNo ratings yet

- Of The Bar by Equating The Strain: Problem 2.7-9Document16 pagesOf The Bar by Equating The Strain: Problem 2.7-9EDiane LlanosNo ratings yet

- Structural Steel Design ReviewDocument6 pagesStructural Steel Design ReviewJohn vincent SalazarNo ratings yet

- Practice ProblemsFluidsDocument4 pagesPractice ProblemsFluidsRitsu TainakaNo ratings yet

- Pipes Dia. Length Friction "F" 1 900 MM 1500 M 0.0208 2 600 MM 450 M 0.0168 3 450 MM 1200 M 0.0175Document1 pagePipes Dia. Length Friction "F" 1 900 MM 1500 M 0.0208 2 600 MM 450 M 0.0168 3 450 MM 1200 M 0.0175John Mortel AparicioNo ratings yet

- RCD RulDocument54 pagesRCD RulCj GuerreroNo ratings yet

- Ce Great Minds PrebDocument5 pagesCe Great Minds PrebSharaGailFuscabloNo ratings yet

- Fluid Mechanics (4th Year)Document2 pagesFluid Mechanics (4th Year)Jaypee Calamba100% (1)

- Keyanalytic ExamDocument5 pagesKeyanalytic ExamIvy Vanessa OlapNo ratings yet

- Page 11 of 11Document39 pagesPage 11 of 11John Paulo GregorioNo ratings yet

- INSTRUCTIONS: Read The Following Problems and Answer The Questions, Choosing TheDocument15 pagesINSTRUCTIONS: Read The Following Problems and Answer The Questions, Choosing TheCharis GilbuenaNo ratings yet

- Ce 601 Set C PDFDocument9 pagesCe 601 Set C PDFJade Paul D. BesanaNo ratings yet

- Fluids M4Document21 pagesFluids M4Lolly UmaliNo ratings yet

- Exam in Fluids1Document4 pagesExam in Fluids1Prince Winderic Gaza AclanNo ratings yet

- Practice Exam # 1 Correl 1Document3 pagesPractice Exam # 1 Correl 1Dani LubosNo ratings yet

- ProblemsetDocument6 pagesProblemsetMaryll TapiaNo ratings yet

- Statics of Rigid Bodies FrictionDocument24 pagesStatics of Rigid Bodies FrictionAcademic FreezePleaseNo ratings yet

- FN Module2 Fluid Statics BouyancyDocument5 pagesFN Module2 Fluid Statics BouyancyJustin Paul VallinanNo ratings yet

- Theory Part 02 PDF FormatDocument9 pagesTheory Part 02 PDF Formatlonyx27100% (1)

- P5 3B Bernardo KathryneDocument5 pagesP5 3B Bernardo KathryneKATHRYNE BERNARDONo ratings yet

- Cee 117 Sim SDL CompleteDocument234 pagesCee 117 Sim SDL CompleteRyan DelicaNo ratings yet

- Local Media3983018567083363738Document6 pagesLocal Media3983018567083363738Venus Kate GevaNo ratings yet

- Ce Reference SummaryDocument3 pagesCe Reference SummaryWendelyn Garcia0% (1)

- Midterm Exam: Soil CDocument3 pagesMidterm Exam: Soil CKathlyn Mae BeberinoNo ratings yet

- Problem - 7A PDFDocument9 pagesProblem - 7A PDFMonicaNo ratings yet

- XVI To XVII PDFDocument28 pagesXVI To XVII PDFAmira Ramlee0% (1)

- 2021NOV MSTHC UnlockedDocument6 pages2021NOV MSTHC UnlockedKristelle V. TorrealbaNo ratings yet

- Cagsawa, Ryan I. (Sce101-10 Problems)Document7 pagesCagsawa, Ryan I. (Sce101-10 Problems)Ryan CagsawaNo ratings yet

- Republic of The Philippines: Set - ADocument5 pagesRepublic of The Philippines: Set - AAnthony Jay PoraqueNo ratings yet

- 3331 ST7008 Prestressed Concrete QBDocument11 pages3331 ST7008 Prestressed Concrete QBsundar100% (1)

- Two Compartments A and B Are Connected by An Orifice Having A 150Document4 pagesTwo Compartments A and B Are Connected by An Orifice Having A 150matthew cometaNo ratings yet

- A. Straight Line MethodDocument5 pagesA. Straight Line MethodEliza Gail ConsuegraNo ratings yet

- Table2 5Document3 pagesTable2 5Alexander 'Tory' HinchliffeNo ratings yet

- Yolanda Resort FSDocument17 pagesYolanda Resort FSnyx100% (1)

- Morales Medwin Ese150-2 A72 Assignment3Document3 pagesMorales Medwin Ese150-2 A72 Assignment3medwin moralesNo ratings yet

- Morales, Medwin Miguel M. 2017130414 ESE150-2 / A74, Assignment 1: Ecology in Your CommunityDocument2 pagesMorales, Medwin Miguel M. 2017130414 ESE150-2 / A74, Assignment 1: Ecology in Your Communitymedwin moralesNo ratings yet

- M1 CPR MoralesDocument4 pagesM1 CPR Moralesmedwin moralesNo ratings yet

- Engr. Charity Hope GayatinDocument3 pagesEngr. Charity Hope Gayatinmedwin moralesNo ratings yet

- Mapua University: Internal and External Rate of ReturnDocument1 pageMapua University: Internal and External Rate of Returnmedwin moralesNo ratings yet

- S05 S06 AIBS IBM NumentaDocument16 pagesS05 S06 AIBS IBM NumentaL SANGEETHA IPM 2019-24 BatchNo ratings yet

- PWC AC Kolkata Tax Associate JDDocument4 pagesPWC AC Kolkata Tax Associate JDAngalakurthy Vamsi KrishnaNo ratings yet

- Chapter 7 Developing Good Work EthicsDocument23 pagesChapter 7 Developing Good Work Ethicscj.terragoNo ratings yet

- Module 1 IntroductionDocument11 pagesModule 1 IntroductionnohoNo ratings yet

- Goulash CommunismDocument9 pagesGoulash CommunismArohnesNo ratings yet

- Torrent PharmaDocument212 pagesTorrent PharmaBharath NaniNo ratings yet

- Q.1 List and Explain in Brief The Methods of Selection of ConsultantsDocument8 pagesQ.1 List and Explain in Brief The Methods of Selection of ConsultantsLiju KoshyNo ratings yet

- MOHAN Nexa ShowroomDocument8 pagesMOHAN Nexa Showroomkotreshkp kpNo ratings yet

- Economics Practice Sheets N22Document101 pagesEconomics Practice Sheets N22joyboyishehereNo ratings yet

- SALN Form 2017 Downloadable Word and PDF FileDocument2 pagesSALN Form 2017 Downloadable Word and PDF FileGlads D. Ferrer-JimlanoNo ratings yet

- Port Development in Malaysia An Introduction To The Countrys Evolving Port Landscape DEFDocument26 pagesPort Development in Malaysia An Introduction To The Countrys Evolving Port Landscape DEFmichaelheong2018No ratings yet

- Student's Name:: Unit 1 - Activity 2Document6 pagesStudent's Name:: Unit 1 - Activity 2Jhon GonzálezNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument69 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Material-Removal Processes: Cutting: Manufacturing Processes For Engineering Materials, 4th EdDocument30 pagesMaterial-Removal Processes: Cutting: Manufacturing Processes For Engineering Materials, 4th EdIgce MechNo ratings yet

- Salary Authorization & AgreementDocument2 pagesSalary Authorization & AgreementMiles LabadoNo ratings yet

- IBM UNIT 4 Part 1Document102 pagesIBM UNIT 4 Part 1RitikaNo ratings yet

- Solution Manual and Case Solutions For Strategic Management A Competitive Advantage Approach 14th Edition by DavidDocument24 pagesSolution Manual and Case Solutions For Strategic Management A Competitive Advantage Approach 14th Edition by DavidSarahOrtizcjnfd100% (42)

- Del Castillo v. RichmondDocument2 pagesDel Castillo v. RichmondRaymond ChengNo ratings yet

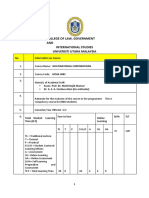

- College of Law, Government AND International Studies Universiti Utara MalaysiaDocument8 pagesCollege of Law, Government AND International Studies Universiti Utara MalaysiaAqilah FuadNo ratings yet

- Lab 10 97Document2 pagesLab 10 97Phạm Tiến ĐạtNo ratings yet

- Case Ih Tractor Mxu 100110115125135 Mxu Maxxum Pro Operators Manual 82999091Document22 pagesCase Ih Tractor Mxu 100110115125135 Mxu Maxxum Pro Operators Manual 82999091zolefiw100% (59)

- 01 - Business Environment - 230421Document9 pages01 - Business Environment - 230421Xcill EnzeNo ratings yet

- Business Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1Document2 pagesBusiness Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1monikaNo ratings yet

- Assigment Law299 1Document3 pagesAssigment Law299 1Syamiza SyahirahNo ratings yet

- Transaction: Marathon Futurex, A & B Wing, 12th Floor, N. M. Joshi Marg, Lower Parel, Mumbai - 400013 1800-22-3345Document21 pagesTransaction: Marathon Futurex, A & B Wing, 12th Floor, N. M. Joshi Marg, Lower Parel, Mumbai - 400013 1800-22-3345Nishant MeghwalNo ratings yet

- Joint Arrangements Answer Key Chapter 10 Problems 4 To 7Document3 pagesJoint Arrangements Answer Key Chapter 10 Problems 4 To 7Jeane Mae BooNo ratings yet

- LL.B., Sem.-III 203: Principles of Taxation Law: Seat No.Document2 pagesLL.B., Sem.-III 203: Principles of Taxation Law: Seat No.Pooja ShahNo ratings yet

- Chapter 3Document12 pagesChapter 3Karl Alvin Reyes HipolitoNo ratings yet

- Module 1 - Lesson 2 - PR3Document68 pagesModule 1 - Lesson 2 - PR3Cressia Mhay BaroteaNo ratings yet