Professional Documents

Culture Documents

Corporate Reporting July 16 Mark Plan

Corporate Reporting July 16 Mark Plan

Uploaded by

swarna dasCopyright:

Available Formats

You might also like

- Events API DocumentationDocument5 pagesEvents API Documentationmario librerosNo ratings yet

- Graded Quesions Complete Book0 PDFDocument344 pagesGraded Quesions Complete Book0 PDFFarrukh AliNo ratings yet

- MDMA-Assisted Psychotherapy Therapist Adherence and Competence Ratings ManualDocument38 pagesMDMA-Assisted Psychotherapy Therapist Adherence and Competence Ratings ManualCyberterton4No ratings yet

- Black Drama Results: Act 1, Scene 1: Imprisonment of A ShadowDocument15 pagesBlack Drama Results: Act 1, Scene 1: Imprisonment of A Shadowjohn7tago100% (2)

- Calculating Cable Pulling TensionsDocument4 pagesCalculating Cable Pulling TensionsNilesh ButeNo ratings yet

- Corporate Reporting Mark July 2019 PlanDocument31 pagesCorporate Reporting Mark July 2019 Planswarna dasNo ratings yet

- CR November 15 SolutionsDocument21 pagesCR November 15 Solutionsswarna dasNo ratings yet

- CR November 2016 Mark Plan-1Document26 pagesCR November 2016 Mark Plan-1Isavic AlsinaNo ratings yet

- Corporate Reporting Answers: Advanced Level Examination JULY 2016 Mock Exam 1Document32 pagesCorporate Reporting Answers: Advanced Level Examination JULY 2016 Mock Exam 1Suman UroojNo ratings yet

- MBA 8 Year 2 Accounting For Decision Making Workbook January 2020Document94 pagesMBA 8 Year 2 Accounting For Decision Making Workbook January 2020weedforlifeNo ratings yet

- Acquisition & Mergers ValuationDocument18 pagesAcquisition & Mergers ValuationAqeel HanjraNo ratings yet

- Financial Instruments (April 2009)Document51 pagesFinancial Instruments (April 2009)Imran AuliyaNo ratings yet

- Accounting Standards Based Questions PDFDocument24 pagesAccounting Standards Based Questions PDFGaurav GangNo ratings yet

- Lecture 1 - Concepts and EthicsDocument10 pagesLecture 1 - Concepts and EthicsNikki MathysNo ratings yet

- Graded Quesions Complete Book0Document344 pagesGraded Quesions Complete Book0Irimia Mihai Adrian100% (1)

- Business Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538Document9 pagesBusiness Accounting Assignment: Submitted By: Akash Yadav Course: Bms 1 Year ROLL No.: 6538akash yadavNo ratings yet

- DeVry University Walmart ProjectDocument12 pagesDeVry University Walmart ProjectKristin ParkerNo ratings yet

- ACC61304 202303 FE Marking SchemeDocument8 pagesACC61304 202303 FE Marking SchemeTeng Jun tehNo ratings yet

- Case 7.3 and 8Document24 pagesCase 7.3 and 8Bertha Muhammad SyahNo ratings yet

- MSA 1 Summer 2018Document15 pagesMSA 1 Summer 2018RSM PakistanNo ratings yet

- Week 10 Lecture 2 SlidesDocument23 pagesWeek 10 Lecture 2 Slidesfa22msmg0011No ratings yet

- Finance and Investment Cycle - Module AUD 300 2024Document20 pagesFinance and Investment Cycle - Module AUD 300 2024kekanarose356No ratings yet

- BSBMGT605B - Assessment Task 2Document7 pagesBSBMGT605B - Assessment Task 2Ghie MoralesNo ratings yet

- ANS 2016 MARCH - Financial - Accounting - Reporting - Fundamentals - March - 2016 - English - MediumDocument16 pagesANS 2016 MARCH - Financial - Accounting - Reporting - Fundamentals - March - 2016 - English - MediumJahanzaib ButtNo ratings yet

- Disclosure Issues: Financial Instruments With Characteristics of EquityDocument29 pagesDisclosure Issues: Financial Instruments With Characteristics of EquityMohammedYousifSalihNo ratings yet

- Case Set 7 - Subsequent Events and Going ConcernDocument5 pagesCase Set 7 - Subsequent Events and Going ConcernTimothy WongNo ratings yet

- Consolidated Financial Statements of Samsung Electronics Co., Ltd. and Its Subsidiaries Index To Financial StatementsDocument103 pagesConsolidated Financial Statements of Samsung Electronics Co., Ltd. and Its Subsidiaries Index To Financial StatementsAlen Vincent JosephNo ratings yet

- ANS MARCH 2015 Financial - Accounting - Reporitng - Fundamentals - March - 2015 - English - MediumDocument16 pagesANS MARCH 2015 Financial - Accounting - Reporitng - Fundamentals - March - 2015 - English - MediumJahanzaib ButtNo ratings yet

- Corporate Reporting November 2018Document28 pagesCorporate Reporting November 2018swarna dasNo ratings yet

- Lecture 2 Tutorial SoluitionDocument3 pagesLecture 2 Tutorial SoluitionEleanor ChengNo ratings yet

- CH 2 Lecture NoteDocument36 pagesCH 2 Lecture Notebobawako5No ratings yet

- Framework For Preparation and Presentation of Financial StatementsDocument5 pagesFramework For Preparation and Presentation of Financial Statementssamartha umbareNo ratings yet

- Reading 12 Evaluating Quality of Financial Reports - AnswersDocument62 pagesReading 12 Evaluating Quality of Financial Reports - AnswersNeerajNo ratings yet

- ACCT 4440 Class NotesDocument18 pagesACCT 4440 Class NotesadammorettoNo ratings yet

- Accounting Unit 1 HomeworkDocument8 pagesAccounting Unit 1 Homeworkyeelinxu1128No ratings yet

- Estimation of Cash FlowsDocument31 pagesEstimation of Cash FlowsAyman SobhyNo ratings yet

- SBR TutorialsDocument11 pagesSBR TutorialskityanNo ratings yet

- Individual Assignment 2A - Conceptual Framework For Financial ReportingDocument10 pagesIndividual Assignment 2A - Conceptual Framework For Financial ReportingEGI PRANAJAYANo ratings yet

- Assignment: Af304: AuditingDocument12 pagesAssignment: Af304: AuditingJeThro LockingtonNo ratings yet

- NAS for MEsDocument71 pagesNAS for MEsrabin067khatriNo ratings yet

- Paper F-1 Fianancial Operation: Syllabus Content Learning Outcome: Hours Quiz/Home AssignmentsDocument5 pagesPaper F-1 Fianancial Operation: Syllabus Content Learning Outcome: Hours Quiz/Home AssignmentsAslam SiddiqNo ratings yet

- FAR2 NotesDocument132 pagesFAR2 NotesCarlito DiamononNo ratings yet

- Sen Finance Sen Finance Sen Finance Sen Finance: CFA® Level IDocument31 pagesSen Finance Sen Finance Sen Finance Sen Finance: CFA® Level IPavel LahaNo ratings yet

- Accounting Standards1Document22 pagesAccounting Standards1Mahendra KashyapNo ratings yet

- Soutions To Practice Problems For Modules 1 & 2Document17 pagesSoutions To Practice Problems For Modules 1 & 2b1234naNo ratings yet

- SBR Revision Article pt3Document10 pagesSBR Revision Article pt3Harikesa KalasilvanNo ratings yet

- G18 - L - Afm - Case Study - Q1 To Q4 - TheoryDocument5 pagesG18 - L - Afm - Case Study - Q1 To Q4 - Theoryjr ylvsNo ratings yet

- Indian and International Accounting StandardsDocument13 pagesIndian and International Accounting StandardsBhanu PrakashNo ratings yet

- AlphaDocument2 pagesAlphaTiya AmuNo ratings yet

- ValuationDocument24 pagesValuationAkhil BansalNo ratings yet

- Lec 6Document26 pagesLec 6Mohamed AliNo ratings yet

- AFM Tution A! Class VersionDocument11 pagesAFM Tution A! Class VersionMalcom Tafara MazengeraNo ratings yet

- ACC4023W April Test 2022 SolutionDocument8 pagesACC4023W April Test 2022 SolutionJessica albaNo ratings yet

- Accounting Standard Notes by Anand R. BhangariyaDocument96 pagesAccounting Standard Notes by Anand R. BhangariyaSanjana SharmaNo ratings yet

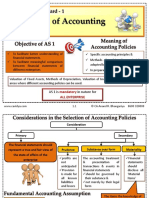

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesvenumadhavanNo ratings yet

- Principles of ManagementDocument6 pagesPrinciples of ManagementDumisani NyirendaNo ratings yet

- Ch. 02 Types of FinancingDocument85 pagesCh. 02 Types of FinancingUmesh Raj Pandeya100% (1)

- Solutions - Chapter 8Document16 pagesSolutions - Chapter 8Dre ThathipNo ratings yet

- Kit AnswersDocument33 pagesKit AnswersHarshNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- Investment Climate Reforms: An Independent Evaluation of World Bank Group Support to Reforms of Business RegulationsFrom EverandInvestment Climate Reforms: An Independent Evaluation of World Bank Group Support to Reforms of Business RegulationsNo ratings yet

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- Chapter 6 Intangible AssetsDocument28 pagesChapter 6 Intangible Assetsswarna dasNo ratings yet

- Chapter 11 GA Consolidated BSDocument50 pagesChapter 11 GA Consolidated BSswarna dasNo ratings yet

- Chapter 7 Revenue & InventoriesDocument34 pagesChapter 7 Revenue & Inventoriesswarna dasNo ratings yet

- Chapter 5 PPEDocument54 pagesChapter 5 PPEswarna dasNo ratings yet

- CORPORATE REPORTING - MA-2022 - QuestionDocument7 pagesCORPORATE REPORTING - MA-2022 - Questionswarna dasNo ratings yet

- Chapter 1 FrameworkDocument40 pagesChapter 1 Frameworkswarna dasNo ratings yet

- Financial Accounting: Professional Stage Application LevelDocument6 pagesFinancial Accounting: Professional Stage Application Levelswarna dasNo ratings yet

- Chapter 3 Cash Flow StatementDocument38 pagesChapter 3 Cash Flow Statementswarna dasNo ratings yet

- Time Allowed - 3.30 Hours Total Marks - 100: Page 1 of 7Document7 pagesTime Allowed - 3.30 Hours Total Marks - 100: Page 1 of 7swarna dasNo ratings yet

- STRATEGIC BUSINESS MANAGEMENT Nov Dec 18Document4 pagesSTRATEGIC BUSINESS MANAGEMENT Nov Dec 18swarna dasNo ratings yet

- AS Financial Corporate Reporting May Jun 2016Document5 pagesAS Financial Corporate Reporting May Jun 2016swarna dasNo ratings yet

- CORPORATE REPORTING Nov Dec 18Document6 pagesCORPORATE REPORTING Nov Dec 18swarna dasNo ratings yet

- 1 Corporate ReportingDocument6 pages1 Corporate Reportingswarna dasNo ratings yet

- July 2021 Corporate Reporting ExamDocument20 pagesJuly 2021 Corporate Reporting Examswarna dasNo ratings yet

- Annual Budget For The Operating Costs: Page 1 of 4Document4 pagesAnnual Budget For The Operating Costs: Page 1 of 4swarna dasNo ratings yet

- Time Allowed - 3 Hours Total Marks - 100: Business AnalysisDocument5 pagesTime Allowed - 3 Hours Total Marks - 100: Business Analysisswarna dasNo ratings yet

- Case StudyDocument15 pagesCase Studyswarna dasNo ratings yet

- Corporate Reporting July 2017 Mark PlanDocument25 pagesCorporate Reporting July 2017 Mark Planswarna dasNo ratings yet

- AS Case Study May Jun 2016Document16 pagesAS Case Study May Jun 2016swarna dasNo ratings yet

- AS SBM-Business ValuationDocument36 pagesAS SBM-Business Valuationswarna dasNo ratings yet

- Corporate Reporting Mark July 2019 PlanDocument31 pagesCorporate Reporting Mark July 2019 Planswarna dasNo ratings yet

- Corporate Reporting July 2021 Mark PlanDocument38 pagesCorporate Reporting July 2021 Mark Planswarna dasNo ratings yet

- Corporate Reporting November 2018Document28 pagesCorporate Reporting November 2018swarna dasNo ratings yet

- CR November 15 SolutionsDocument21 pagesCR November 15 Solutionsswarna dasNo ratings yet

- CR Questions Nov 18 Questions FinalDocument18 pagesCR Questions Nov 18 Questions Finalswarna dasNo ratings yet

- Pe III Taxation II May Jun 2010Document3 pagesPe III Taxation II May Jun 2010swarna dasNo ratings yet

- Taxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For TheDocument4 pagesTaxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For Theswarna dasNo ratings yet

- Pe III Taxation II Nov Dec 2010Document2 pagesPe III Taxation II Nov Dec 2010swarna dasNo ratings yet

- Chapter 5: Cost of Capital Dec 2014Document7 pagesChapter 5: Cost of Capital Dec 2014swarna dasNo ratings yet

- Chapter 5: Cost of Capital Dec 2014: TK 000 TK 000Document4 pagesChapter 5: Cost of Capital Dec 2014: TK 000 TK 000swarna dasNo ratings yet

- Liebherr Brochure Boom Pumps enDocument20 pagesLiebherr Brochure Boom Pumps enVikash PanditNo ratings yet

- Economics For Business and ManagementDocument56 pagesEconomics For Business and ManagementABDALLAHNo ratings yet

- Solar Humidity Controller: Project GuideDocument31 pagesSolar Humidity Controller: Project Guidesneha sahuNo ratings yet

- A30 CismDocument14 pagesA30 CismRohan SharmaNo ratings yet

- Img 0004Document7 pagesImg 0004velavan100% (1)

- Passover From Wikipedia, The Free EncyclopediaDocument22 pagesPassover From Wikipedia, The Free EncyclopediaArxhenta ÇupiNo ratings yet

- Module 5 Communication Aids and Strategies Using Tools of TechnologyDocument4 pagesModule 5 Communication Aids and Strategies Using Tools of TechnologyPammieNo ratings yet

- Guided Reading Lesson PlanDocument4 pagesGuided Reading Lesson Planapi-311848745No ratings yet

- Cit 15 SyllabusDocument5 pagesCit 15 Syllabusapi-235716776No ratings yet

- Perception On CatcallingDocument19 pagesPerception On CatcallingJasmin Delos ReyesNo ratings yet

- Welcome Vendors Meet: Beml LimitedDocument40 pagesWelcome Vendors Meet: Beml LimitedamandeepNo ratings yet

- Drill Daily Check SheetDocument3 pagesDrill Daily Check SheetNikhil MadaneNo ratings yet

- Sparsh Idt FinalDocument12 pagesSparsh Idt FinalSparsh vatsNo ratings yet

- Department of Business Administration: Submitted ToDocument15 pagesDepartment of Business Administration: Submitted Topinky271994No ratings yet

- Questions Energy Surfaces and Spontaneous ReactionsDocument2 pagesQuestions Energy Surfaces and Spontaneous Reactionshernys NietoNo ratings yet

- Presn. On Gen. SWRDDocument60 pagesPresn. On Gen. SWRDbijoy100% (1)

- Design Basis For Nht/Unit 02: SnamprogettiDocument2 pagesDesign Basis For Nht/Unit 02: Snamprogettimohsen ranjbarNo ratings yet

- CDP+ Version 10 (Guide)Document124 pagesCDP+ Version 10 (Guide)Pew IcamenNo ratings yet

- UPI Linking SpecificationDocument42 pagesUPI Linking Specificationananya26196No ratings yet

- BSN1-2 Lab Activity 2.2 Proteins DenaturationDocument3 pagesBSN1-2 Lab Activity 2.2 Proteins DenaturationCristine EchaveNo ratings yet

- 7 - Simulations and PFDsDocument23 pages7 - Simulations and PFDsIslam SolimanNo ratings yet

- Title Business Partner Number Bus Part Cat Business Partner Role Category Business Partner GroupingDocument16 pagesTitle Business Partner Number Bus Part Cat Business Partner Role Category Business Partner GroupingRanjeet KumarNo ratings yet

- Bluetooth Car Using ArduinoDocument13 pagesBluetooth Car Using ArduinoRainy Thakur100% (1)

- Deped Order No.31 S. 2020 Interim Guidelines For Assessment and Grading in Light of The Basic Education Learning Continuity PlanDocument24 pagesDeped Order No.31 S. 2020 Interim Guidelines For Assessment and Grading in Light of The Basic Education Learning Continuity PlanAlyssa AlbertoNo ratings yet

- Requirement and Specifications: Chapter - 3Document17 pagesRequirement and Specifications: Chapter - 3Chandrashekhar KuriNo ratings yet

- Using Powerpoint Effectively in Your PresentationDocument5 pagesUsing Powerpoint Effectively in Your PresentationEl Habib BidahNo ratings yet

Corporate Reporting July 16 Mark Plan

Corporate Reporting July 16 Mark Plan

Uploaded by

swarna dasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Reporting July 16 Mark Plan

Corporate Reporting July 16 Mark Plan

Uploaded by

swarna dasCopyright:

Available Formats

Corporate Reporting – Advanced level – July 16

MARK PLAN AND EXAMINER’S COMMENTARY – Corporate Reporting July 2016

This report includes:

a summary of the scenario and requirements for each question

the technical and skills marks available for each part of the requirement

a description of how skills should be demonstrated

detailed points for a full answer

examiner’s commentary on candidates’ performance

The information set out below was that used to mark the questions. Markers were encouraged to use discretion

and to award partial marks where a point was either not explained fully or made by implication.

Question 1

Scenario

The candidate is asked to review the work of an audit senior who has summarised the minutes of board

meetings during the audit of Earthstor an AIM-Listed company. The audit senior identified the company’s

financial reporting treatment of the transactions in the minutes in a separate exhibit. The CEO of Earthstor

dominates the board which presents both ethical and governance issues. The finance director has resigned

after raising concerns over transactions with a supplier TraynorCo and has not been replaced. Potentially

Earthstor is assisting TraynerCo to evade tax in a non UK tax jurisdiction. The candidate is required to review

the work of the audit senior and identify appropriate financial reporting treatments for the transactions noted in

the minutes which include an interest free loan in a foreign currency to a supplier; an equity investment in a

foreign company; IAS 40 issues in respect of a foreign investment property; and website development costs.

Requirements Marks Skills assessed

(1) Explain the financial reporting 18 Assimilate and demonstrate understanding of

implications of each of the a large amount of complex information.

transactions noted from the board Identify appropriate accounting treatments for

minutes by Greg (Exhibit 2 and 3). complex transactions including an interest

Recommend appropriate accounting free loan in a foreign currency to a supplier;

adjustments. Please ignore any tax equity investment in a foreign company; IAS

implications of these adjustments. 40 issues in respect of a foreign investment

property; and website development costs.

Apply technical knowledge to identify

inappropriate accounting adjustments.

Recommend appropriate accounting

adjustments

(2) Identify the key audit risks arising from 10 Assimilate knowledge, drawing upon question

each of the transactions (Exhibits 2 content to identify key audit risks

and 3) and recommend the audit Describe relevant audit procedures required

procedures we will need to complete to provide verification evidence for each risk.

to address each risk.

(3) Prepare a revised draft statement of 5 Assimilate adjustments to prepare draft

financial position at 30 June 2016 statement of financial position.

(Exhibit 1). This should include any

adjustments identified in (1) above.

(4) Explain any corporate governance 7 Assimilate information to identify potential

issues for Earthstor that you identify problems with the governance of Earthstor.

from Greg’s file note (Exhibit 2). Also Identify potential ethical and money-

explain any ethical issues for our audit laundering issues.

firm and set out any actions that our Discuss appropriate responses and actions

firm should take. for the firm in respect of the potential ethical

issues.

Total 40

Copyright © ICAEW 2016. All rights reserved. Page 1 of 25

Corporate Reporting – Advanced level – July 16

Working paper for the attention of Tom Chang

Financial reporting treatment and key disclosure requirements of each of the transactions noted by Greg

Loan to TraynerCo

The loan to TraynerCo represents a financial asset for Earthstor. IAS39 para 43 requires a financial asset to be

measured initially at fair value. A zero interest rate loan issued at par would not result in an arm’s length

transaction and IAS 39 AG 64 requires the fair value in such a case to be determined as the present value of

the cash receipts under the effective interest rate method. The discount rate should be that on similar loans.

The loan will fall within IAS 39’s definition of loans and receivables and should be subsequently measured at

amortised cost.

The initial fair value of the loan when issued on 1 July 2015 is therefore:

MYR20 million / (1.06)2 = MYR17.800 million

In terms of £ sterling this would be translated at this date as:

MYR17.800 million /5 = £3.560million

The difference of £0.44 million between the £4 million recognised by the company in trade and other receivables

and £3.56 million is recognised as an expense in profit or loss.

Each year the unwinding will be treated as finance income. It would be appropriate to use the amortised cost

method as the loan is a non-derivative financial asset; there is a determinable repayment date and the intention

appears to hold the investment to maturity. The loan at the financial year end of 30 June 2016 is:

MYR17.8 million x 1.06 = MYR18.87 million

This is a monetary asset and would be translated at the year-end rate of £1 = MYR6. In the financial statements

of Earthstor it would therefore be translated as:

MYR18.87 million /6 = £3.15 million

There are two elements to this transaction for financial reporting purposes:

(i) interest income on the loan; and

(ii) exchange loss.

Interest income

The interest income is recognised at the effective rate, even though there is no cash interest received. As the

interest accrues over the year, it is translated at the average exchange rate.

The interest cost in MYR is therefore:

MYR17.8 million x 6% = MYR1.07 million

Translated using the average rate into £ this is:

MYR1.07 million / 5.5 = £0.20 million

Exchange loss

The exchange loss has two elements:

On the interest

On the loan

The exchange loss on the interest is:

Copyright © ICAEW 2016. All rights reserved. Page 2 of 25

Corporate Reporting – Advanced level – July 16

MYR1.07 million/5.5 – MYR1.07 million/6 = £0.02 million

The exchange loss on the loan is:

MYR17.8 million/5 – MYR17.8 million/6 = £0.59 million

£’000

Interest income 200

Exchange loss:

On interest (20)

On loan (590)

410

This reconciles with the opening balance divided by the opening exchange rate less the closing balance divided

by the closing exchange rate as above (£3.56m - £3.15m) = £0.41 million.

The loan is currently recognised at MYR20 million / 5 = £4 million and should be recognised at £3.15 million.

Exchange differences and interest should be reported as part of profit or loss. An adjustment is required as

follows:

£000

Dr Loans and receivables 3,150

Cr Trade receivables 4,000

Dr Exchange differences – retained earnings (0.02 + 0.59) 610

Cr Interest income – retained earnings 200

Dr Interest cost – (£4m – £3.56m) 440

TraynerCo Loan - Audit risks and procedures

Audit risk Audit procedures

The supplier may not be able to repay the loan Check procedures used to verify the

and it would then be impaired. This is a key risk creditworthiness of the supplier when the loan

as there are no cash interest payments to was originally extended.

observe that these can at least be serviced.

Verify the terms of the loan and whether any

security has been pledged if the loan is not

repaid – e.g. enquire whether there is a charge

over assets as security for the loan.

Examine correspondence (legal

correspondence, board minutes, as well as

letters/emails/memos with TraynerCo) for any

possibility of early repayment.

The market rate of interest of 6% may not be a Compare rates to corporate loans to similar

risk equivalent in which case the measurement companies where interest is paid in full.

of the loan and the interest payments would be

incorrect.

Classification of the loan as loans and Confirm terms by examining the loan

receivables may be inappropriate. agreement.

Examine correspondence for any possibility of

early repayment.

There is a control risk in authorising a large Review level of authorisation of loan (main

loan on favourable terms. board).

Copyright © ICAEW 2016. All rights reserved. Page 3 of 25

Corporate Reporting – Advanced level – July 16

Review treasury procedures to attest

information on creditworthiness, legal advice

and means of drawing up loan agreements.

Consider whether there is a risk of a link Examine the contractual supply agreement with

between the provision of the loan and the cost TraynerCo for example deep discounting of

of goods from TraynerCo - the CEO has purchase cost of goods as part of loan

referred to a deal on the rent and this may also agreement.

apply to the loan. Prepare analytical procedures on history of

cost of goods from TraynerCo.

Risk of incorrect exchange rates. Verify exchange rates and estimate average

exchange rates.

Confirm the date on which loan was extended.

TraynerCo - equity investment

The investment in TraynerCo is an equity investment and should be categorised as available for sale because it

is for the long term and not intended for immediate sale. The movement in the fair value of an AFS asset is

taken to other comprehensive income including foreign currency exchange gains and losses (except in the case

of an impairment).

IAS39 para 43 states that (unless the financial asset is measured FVTPL) the transaction costs are added to

value of the asset, not written off to profit or loss. Therefore, Earthstor’s treatment of the legal costs is correct.

IFRS 13 defines fair value as 'the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date'. Fair value is a market-based

measurement, not an entity-specific measurement. It focuses on assets and liabilities and on exit (selling)

prices. It also takes into account market conditions at the measurement date. In other words, it looks at the

amount for which the holder of an asset could sell it and the amount which the holder of a liability would have to

pay to transfer it. IFRS 13 states that valuation techniques must be those which are appropriate and for which

sufficient data are available. Entities should maximise the use of relevant observable inputs and minimise the

use of unobservable inputs.

With regards to the investment in TraynerCo, there is no observable quoted price for the shares. There is

evidence that the price has fallen because Henry Min has sold a further 10% of the shares for MYR 36 million

and therefore the fair value recognised at 1 October 2015 may have changed at 30 June 2016. Where no active

market exists and no reliable fair value is available, equity investments, such as the unquoted equity investment

in TraynerCo can be measured at cost less impairment.

The exclusion is only appropriate for financial instruments linked to unquoted equity investments such as

TraynerCo.

The question is whether the subsequent sale of a further 10% of the shares in TraynerCo by Henry Min

represents a fall in the fair value of the shares at the year-end due to: 1) market conditions or 2) because the

company is performing poorly or 3) because the initial valuation was incorrect either deliberately or

unintentionally as suggested by the comments made by the finance director.

There is also a question of whether the valuation is reliable - If the valuation is not reliable the investment should

be continued to be recognised at cost.

If the fall is due to market conditions, then the loss including the exchange difference is taken to OCI. If the

asset is subsequently determined to be impaired, the loss previously recognised in other comprehensive income

should be reclassified to profit or loss, even though the asset has not been derecognised. The impairment loss

to be reclassified is the difference between the acquisition cost and current fair value.

There is insufficient information to determine whether the fair value of TraynerCo has been impaired or whether

the movement represents a change in the fair value. Or whether the transaction was not at fair value originally.

Until further information is obtained I have assumed that the value has fallen due to market conditions and

therefore the following adjustments are required:

Copyright © ICAEW 2016. All rights reserved. Page 4 of 25

Corporate Reporting – Advanced level – July 16

(Alternative assumptions are also acceptable).

Recognition and subsequent recognition

£’000

Initial recognition of shares is MYR45m / 5 including transaction costs 9,500

At year end MYR36m /6 6,000

Loss to be recognised in OCI 3,500

Assuming that the loss should be recognised in other comprehensive income therefore an adjustment is

required as follows:

£’000

Dr AFS - TraynerCo 1,500

Cr Translation reserve 1,500

Cr AFS - TraynerCo 3,500

Dr OCI/AFS reserve 3,500

Being reversal of translation of AFS asset and movement in fair value

IFRS 7 requires disclosure of risks relating to financial instruments which include credit, currency, interest rate,

liquidity, loans payable and market risk. For each type of risk, disclosure is required of the exposures to each

risk and how they arise, the entities policies and processes for managing risk and any changes from previous

period.

TraynerCo Equity investment - Audit risks and procedures

Audit risk Audit procedures

There is a risk that management have not Consider the guidance provided in the design

understood the significance of fall in price for of audit procedures set out in IAPN 1000.

the shares in relation to this equity instrument Review and assess the valuations made by the

and the additional disclosure required under directors.

IFRS 7 resulting in incorrect measurement and Ensure disclosure of risks is appropriate and in

recognition compliance with IFRS 7.

Agree the cost of acquisition of the shares to

legal documents, share certificates and

payment.

A key risk is that supporting evidence may not Obtain third party evidence of the valuation at

be available in respect of the valuation as the 30 June 2016.

shares are unquoted. Consider the nature of the fall in fair value in

the light of other information about TraynerCo –

by reference to financial statements, cash flow

projections.

(Consider whether there is a risk of a link Examine the contract for the acquisition of the

between the provision of the equity finance and shares and ensure that this is not related to the

the cost of goods from TraynerCo -the CEO supply agreement for goods.

has referred to a deal on the rent and this may

also apply to the equity finance. Prepare analytical procedures on history of

cost of goods from TraynerCo.

Risk of inaccurate exchange rates. Verify exchange rates)

Copyright © ICAEW 2016. All rights reserved. Page 5 of 25

Corporate Reporting – Advanced level – July 16

Singapore investment property

The property should be recognised as an investment property. The company has adopted the fair value method

to account for investment properties and therefore the property should be revalued at the year end to its fair

value. Movement on the change in fair value of investment properties is recognised in profit or loss.

The Singapore investment property should be recognised at cost on 1 February 2016 and the change in fair

value measured as follows:

£’000

At 1 February 2016 SG$10,000,000 /2.1 4,762

At 30 June 2016 SG$11,000,000 /2.7 4,074

Change in fair value 688

The property should be separately recognised as investment property.

£’000

Dr Operating costs (retained earnings) 688

Cr PPE 4,762

Dr Investment property 4,074

Investment property

Audit risk Audit procedures

The valuation presents a significant risk as this Check that fair value has been measured in

may not be a market price in an active market accordance

with IFRS 13

Obtain more recent evidence of the

market value and confirm the

reasonableness of the valuation

Agree valuation to evidence of other

sale

Recalculate gain or loss on change in

fair value and agree

to amount in statement of profit or loss

and other comprehensive income

Consider the use of an auditor’s expert

to perform valuation

There is a risk that management lack of Confirm compliance with IAS 40/IFRS 13, for

expertise will result in inadequate disclose example:

Disclosure of policy adopted

If fair value model adopted disclosure

of a reconciliation of

carrying amounts of investment

property at the beginning and end of

the period

Website development costs

The costs of acquiring and developing software that is not integral to the related hardware should be capitalised

separately as an intangible asset. This does not include internal website development and maintenance costs

which are expensed as incurred unless representing a technological advance leading to future economic

benefit.

Capitalised software costs include external direct costs of material and services and the payroll and payroll

related costs for employees who are directly associated with the project.

Capitalised software development costs provided they meet the criteria under SIC 32 and IAS 38 - the fact that

the costs integrate the website with other process systems of the business and are not merely providing content

and advertising would suggest that they do - should be stated at historic cost less accumulated amortisation.

Copyright © ICAEW 2016. All rights reserved. Page 6 of 25

Corporate Reporting – Advanced level – July 16

Amortisation is calculated on a straight-line basis over the assets’ expected economic lives. Amortisation is

included within administrative expenses in the statement of profit or loss.

Therefore, Earthstor has probably incorrectly capitalised the planning costs, and also possibly the fees paid to

Tanay and the photography and graphic design costs (further information is required on the nature of these

expense). These costs should be expensed during the year. An amortisation charge of £22 million / 7 years’ x

2/12 = £524,000 is required to be charged from 1 May 2016. Although this is below the materiality level on its

own but taken together with the incorrect capitalisation of costs, this should be adjusted:

£’000

Dr Operating expenses (£3,000,000 +£1,300,000 + £5,000,000 + 9,824

£524,000

Cr Intangible assets 9,824

Reporting to Audit committee

The adjustments will be required to be reported to the Audit committee as they are all above the agreed

£120,000 reportable limit.

Audit risk Audit procedures

Given the increased capital expenditure during Obtain details of internal software development

the year there is a risk that both external and costs and agree to:

internally generated expenditure relating to the

website have been incorrectly capitalised Invoices from third parties

instead of being written off through the income Where the costs relate to staff costs,

statement. agree to time records.

There is a risk that the useful life of seven Ensure that costs capitalised are incremental

years may be excessive given the nature of the costs relating to the project and not time spent

expenditure on management

Consider the appropriateness of the useful life,

enquire of appropriate management and past

history of similar projects.

Related party transactions

TraynerCo

TraynerCo is a supplier and although there is significant interdependence between Earthstor and TraynerCo,

TraynerCo is not a related party of Earthstor.

Copyright © ICAEW 2016. All rights reserved. Page 7 of 25

Corporate Reporting – Advanced level – July 16

Revised statement of financial position as at 30 June 2016

£'000 £’000

Non-current assets Revised

Intangible assets - website 31,300 - 9,824 21,476

Financial asset - TraynerCo 8,000 - 2,000 6,000

PPE 56,309 - 4,762 51,547

Investment property 4,074

Loan to TraynerCo 3,150

Current assets

Inventories 144,380 144,380

Trade and other receivables 22,420 – 4,000 18,420

Cash and cash equivalents 71,139 71,139

Total assets 333,548 320,186

EQUITY AND LIABILITIES

Equity

Ordinary share capital (£1/€1 10,000 10,000

shares)

AFS reserve (1,500) + (2,000) (3,500)

Retained earnings 163,362 – 850 – 688 - 9824 152,000

Non-current liabilities 12,175 12,175

Current liabilities 149,511 149,511

Total liabilities and equity 333,548 320,186

Ethical and corporate governance implications

Dominic appears to dominate the board which represents a governance issue – but not necessarily an ethical

issue. There seems to be no separation between the chair of the board’s role and the CEO. The company is

also operating without a finance director which would again present a governance issue as the board would not

be operating with the appropriate skills to manage the company effectively. The board is therefore not acting

effectively and there is a lack of transparency in the Dominic’s behaviour.

A deal appears to have been made to charge no rent to TraynerCo in exchange for lower cost of goods sold.

There may potentially be an ethical issue as the company may be entering into a transaction which could be

assisting a supplier company to evade tax in a non-UK tax jurisdiction. However, more detail of the tax

treatment of the rental deduction and the taxation of profits would need to be obtained and consulting a tax

expert in Singapore and Malaysia. Also need to ensure that Earthstor’s tax position is correct and that the

company is paying the correct UK taxes.

There may be an intimidation threat if Dominic attempts to intimidate the audit staff – the firm should ensure that

appropriately briefed and experienced staff are assigned to the audit.

As there is no finance director, the firm may face a management threat if it acts in the finance director role.

Actions the firm should take:

The increase in audit risk should be addressed with additional audit procedures in respect of the above

transactions.

AIM listed companies are not required to make disclosures of compliance with the provisions of the UK

Corporate Governance Code. However, ISA 260 requires matters of concern to be raised with those charged

with governance; the audit committee would be a point of contact to raise concerns. In addition, information

published in the financial statements should be reviewed for consistency and appropriate professional

Copyright © ICAEW 2016. All rights reserved. Page 8 of 25

Corporate Reporting – Advanced level – July 16

scepticism. In respect of the potential tax evasion, further information should be obtained and the matter

reported with the firm’s money laundering officer. The firm will need to engage expert tax advice in Malaysia and

Singapore.

Examiners’ comments

General comments

This was the best answered question on the paper, especially with regards to the financial reporting treatment

and identification of risks and procedures. Very few candidates commented on the need to report to the audit

committee.

Detailed comments

(1) Financial reporting treatment

Many candidates identified (erroneously) a related party issue with this question and those who did often produced

lengthy explanations of the disclosures that would be required. Some better answers identified that there was an

issue with transactions not conducted at arm’s length, but that this did not create a related party.

The financial asset aspects of the question were often not handled well. In relation to the interest-free loan, weaker

candidates simply accounted for the foreign currency movement and disregarded discounting and interest

altogether. Only a small number of candidates who managed to discount the opening receivable could explain

that discounting resulted in an initial expense in the profit or loss. Some recognised that the transaction resulted

in the recognition of a receivable but then accounted for the unwinding of the receivable (interest income) as a

cost to profit or loss. Some even considered the asset was a liability. However, this was a relatively difficult topic

and it was pleasing that so many candidates did manage to make the necessary adjustments correctly.

In relation to the investment in 10% of Trayner’s shares, it was quite common to find candidates accounting for

this as an associate and therefore recommending the equity method. Sometimes this was as a result of arguments

that Earthstor and Trayner are very closely linked, and that the apparent overpayment for the 10% investment

could have involved a premium related to significant influence. However, in many cases it appeared that

candidates think that an investment of 10% automatically results in significant influence. Most candidates,

however, did manage to correctly classify this as an AFS investment and most (but not all) of them realised that

the treatment of transaction costs was correct. However, many thought that the creation of a translation reserve

was also correct. Occasionally there were some reasoned debates demonstrating higher skills about the nature

of and reason for the movement in the fair value and these were credited in the marking.

Most candidates gained marks on the website asset. Weaker candidates took the opportunity to write out sections

of the standards for the markers to read – unfortunately the marks at this level are for the application of knowledge

to the scenario – to gain marks the candidate has to explain why a particular standard applies to the scenario.

However, in general candidates were able to articulate that costs for the website should only be capitalised when

future economic benefit had been demonstrated. Almost all then went on to undertake a reasonable calculation

of the amortisation for the period.

There were some surprising errors in relation to the mainstream topic of investment property. A substantial

minority of candidates put time and effort into isolating the foreign currency effect of the investment property fair

value movement and reporting it separately, which is not required. More surprising at this level was the readiness

to post the fair value movement to a revaluation reserve rather than to profit or loss. Many candidates got tangled

up in lengthy explanations about the granting of rent-free accommodation to TraynerCo.

(2) Audit risks and procedures

In general, the audit risks and procedures were sufficiently well identified and discussed for candidates to score

highly with many scoring close to maximum marks for this section. Marks were lost when the audit tests were not

appropriately linked to the scenario or were repetitious. The best answers highlighted the recoverability issues

with the TraynerCo loan and suggested appropriate procedures to address this risk. However, a significant

number thought that an acceptable approach to many risks would be to obtain management representations,

despite the governance and ethical issues discussed in relation to Dominic Roberts in the last section of the

question.

Copyright © ICAEW 2016. All rights reserved. Page 9 of 25

Corporate Reporting – Advanced level – July 16

Candidates should identify the main risk with each issue. Weaker candidates start by discussing the exchange

rates and the correct discount factors and then do not comment on the more obvious issues like the recoverability

of the loan. Candidates score better if they produce quality rather than quantity.

For the investment many discussed disclosure as an AFS investment and the exchange rate issues again but did

not think that the fall in value would be significant (some had called it a non- adjusting post period end event).

This meant that the procedures were weak too.

The risks surrounding the website and the investment property were identified more clearly.

Procedures were not thought through well. Many mentioned looking at board minutes although it was clear from

the question that Dominic may not have discussed/minuted these and had cancelled meetings.

There was a lot of discussion about related parties which was not relevant. Many thought the incorrect/insufficient

disclosures of related parties was the main risk for some issues.

There was also a lot of discussion about the reliance of Earthstor on Trayner for supplies and that there was a

going concern risk for Earthstor. The question said that if they could not buy supplies from Trayner they may not

be able to trade successfully in the footwear market but this was sometimes interpreted as imminent corporate

failure for Earthstor.

(3) Statement of financial position

Most candidates were able to use their own figures from section 1 to complete enough of the key elements of this

section. However, few presented the loan to Trayner separately from trade receivables and many candidates

failed to demonstrate that the balance sheet should balance.

(4) Corporate governance and ethics

The corporate governance element of this section was generally well completed with most candidates identifying

the dominance of Dominic Roberts, lack of segregation of CEO/chairman and the cancelling of board meetings

as indicative of poor corporate governance. Some very weak candidates speculated on the nature of the ‘close

friendship’ with Henry and said this was unethical.

However, many incorrectly noted that, as the company was AIM listed, it was required to comply with the

Corporate Governance Code, rather than it being best practice.

The ethics section was poorly completed by most. A large proportion of candidates interpreted the requirement

as relating to Dominic Roberts ethics rather than the audit firm’s and commented on potential unethical business

practices. Where candidates did interpret the question correctly, few raised anything other than the intimidation

threat as an ethical issue. Very few recognised the potential for tax evasion. Consequently, the ‘actions’ were very

limited.

Copyright © ICAEW 2016. All rights reserved. Page 10 of 25

Corporate Reporting – Advanced level – July 16

Question 2 - EyeOP

The candidate is working in the finance department of a listed company, HiDef plc, and is required to respond to

the instructions of the CEO. HiDef has an investment in EyeOP Ltd and is planning to acquire a controlling

interest. The candidate is required to explain the impact of financial reporting issues including: the calculation of

consolidated goodwill; the correction for the accounting treatment of the company’s pension scheme obligations;

the treatment of development costs and revenue recognition. Having made appropriate adjustments, the

candidate is required to prepare a draft forecast statement of comprehensive income assuming HiDef makes

the acquisition of EyeOP’s shares. Finally, the candidate is required to analyse the impact of the acquisition on

key performance targets.

Requirements Marks Skills assessed

1) Calculate the goodwill relating to 4

the proposed purchase of Use technical knowledge to calculate the

650,000 ordinary shares in goodwill on consolidation.

EyeOP on 1 August 2016, which

would be included in HiDef’s

consolidated statement of

financial position for the year

ending 30 November 2016. For

this purpose, use the expected

fair value of EyeOP’s net assets

at 1 August 2016 of £63 million.

2) Explain the impact of each of the 12 Assimilate complex information in order to

outstanding financial reporting recommend appropriate accounting

issues (Exhibit 1) on EyeOP’s adjustments

forecast financial statements for Apply technical knowledge to the

the year ending 31 December information in the scenario to determine the

2016. Recommend appropriate appropriate accounting for pension

adjustments using journal entries. accounting, development costs and revenue

recognition

Clearly set out and explain appropriate

accounting journals

3) Prepare a revised forecast 6 Assimilate and use adjustments identified in

consolidated statement of (2) in drafting the statements requested.

comprehensive income for HiDef Use knowledge of financial statement

for the year ending 30 November presentation to present the financial

2016. Assume that HiDef statements in appropriate format

acquires 650,000 shares in Appreciate that control threshold passed

EyeOP on 1 August 2016 and and therefore a gain on re-measurement to

incorporate any adjustments you fair value arises which is recognised in profit

recommend in respect of the or loss

outstanding financial reporting Appreciate that previous gains are also

issues (Exhibit 1). reclassified to profit or loss.

4) Analyse the impact of the 8 Analyse information to determine EyeOP’s

acquisition of 650,000 shares in impact on the performance ratios

EyeOP on HiDef’s key Determine the predicted impact for 2017

performance targets (Exhibit 2) Conclude on the extent to which

for the year ending 30 November performance targets are met subsequent to

2016 and, where possible, for the the acquisition.

year ending 30 November 2017.

Total 30

Copyright © ICAEW 2016. All rights reserved. Page 11 of 25

Corporate Reporting – Advanced level – July 16

1. Calculate the goodwill relating to the proposed purchase of 650,000 ordinary shares in EyeOP on 1 August

2016, which would be included in HiDef’s consolidated statement of financial position for the year ending

30 November 2016. For this purpose, use the expected fair value of EyeOP’s net assets at 1 August 2016

of £63 million.

Goodwill is calculated as:

£m

Fair value of consideration paid to acquire control 85.0

Non-controlling interest (valued using the proportion of net assets method) 18.9

30% x £63 million

Fair value of previously held equity interest at acquisition date 6.2

110.1

Fair value of net assets of EyeOP 63.0

Goodwill 47.1

This calculation assumes that there is no impact on the net assets figure at 1 August 2016 arising from the

correction of the errors identified below in EyeOP’s financial statements for the year ending 31 December 2016.

2. Explain the impact of each of the outstanding financial reporting issues (Exhibit 1) on EyeOP’s forecast

financial statements for the year ending 31 December 2016. Recommend appropriate adjustments

using journal entries.

Pension schemes (Working 1)

Scheme B appears to be a defined contribution plan therefore the accounting treatment adopted by the finance

assistant is correct. This is a defined contribution plan because there is no obligation on the part of EyeOP other

than to pay its contribution of 7% to the pension fund.

Scheme A is a defined benefit plan because EyeOP has provided a guarantee over and above its obligations to

make contributions. Therefore, the contribution of £6.4 million in respect of scheme A should be credited from

the statement of profit or loss and debited to the net benefit obligation. The service cost of £5.9 million and

finance cost of £1.9 million (see calculation below) should be charged to the profit or loss.

In addition, a gain on re-measurement must be calculated and taken to OCI as follows:

Plan assets Plan

£m obligations

£m

At 1 December 2015 22.0 (60.0)

Interest cost on obligation (5% x £60m) (3)

Interest on plan assets (5% x £22m 1.1

Current service cost (5.9)

Payments to pensioners (2.1) 2.1

Contribution paid 6.4

Curtailment (4.2)

Sub total 27.4 71.0

Gain/(Loss) on re-measurement recognised in 5.2 (3.5)

OCI

At 30 November 2016 32.6 (74.5)

Tutorial note: Above table shown for marking purposes – a merged presentation also acceptable.

Copyright © ICAEW 2016. All rights reserved. Page 12 of 25

Corporate Reporting – Advanced level – July 16

Recommended adjustments:

£m

Dr Finance costs (£3 million - £1.1 million = £1.9 million) 1.9

Cr Net benefit obligation 1.9

Dr Operating expenses (£5.9 million + £4.2 million) 10.1

Cr Net benefit obligation 10.1

Dr Net benefit obligation 6.4

Cr Operating expenses 6.4

Cr OCI 1.7

Dr Net benefit obligation 1.7

IAS 19 requires that the interest should be calculated on the net benefit obligation. This means that the amount

recognised in the profit or loss is the net of interest charge on the obligation and the interest income on the

assets. Therefore, the actual return on the plan assets is not relevant here.

EyeOP has taken on an additional liability in respect of the senior employees made redundant – this cost is a

curtailment cost which is charged to the statement of profit or loss.

Medsee camera – revenue recognition (working 2)

This item does not represent a non- recurring item and it is incorrect to expense all the development costs as it

is possible that some of the costs should be capitalised.

In the period to 1 January 2016 not all the criteria in IAS 38 appear to have been satisfied as the technical

breakthrough in relation to the project happened on 1 January 2016, and so the costs of £4 million a month

should be expensed in the statement of profit or loss. Therefore, the treatment was correct for the financial

statements for the year ended 31 December 2015 as the probable future economic benefits were uncertain

before that date.

Once the technical breakthrough was made on 1 January 2016, the development costs should have been

capitalised until the project was completed on 30 April 2016. An intangible asset of £14 million (4 x £3.5 million)

should therefore have been created.

The following adjustment is therefore required:

£m

Dr Intangible asset 14

Cr Profit or loss 14

Once sales of the Medsee commenced in May 2016, the development costs should be amortised. This could be

done either on a time or sales basis. I recommend that £14 million is amortised over the number of Medsee

cameras delivered to customers at 30 November 2016. This gives an amortisation charge of £200,000 (£14

million x 50/3500).

£m

Dr Operating expenses 0.2

Cr Intangible asset 0.2

Revenue should only be recognised once the risks in relation to the orders for the cameras have been

transferred to the buyer. This normally is upon delivery, and so revenue in respect of only 50 cameras should be

included in the statement of profit or loss 50 x £60,000 = £3 million. The cash received in relation to orders not

yet fulfilled should be treated as deferred income.

The adjusting journal is therefore:

£m

Dr Revenue 33.00

Cr Receivables 24.75

Cr Deferred income 8.25

Copyright © ICAEW 2016. All rights reserved. Page 13 of 25

Corporate Reporting – Advanced level – July 16

The accrual for cost of sales should therefore be removed in relation to the original journal for revenue.

£m

Dr Payables 12.1

Cr Cost of sales (550 x £22,000) 12.1

EyeOP draft statement of profit or loss

First draft Adjustment Ref to Revised draft

£m £m working £m

Revenue 178.9 (33) 2 145.9

Cost of sales (92.6) 12.1 2 (80.5)

Operating expenses (36.3) (10.1) 6.4 1 (40.2)

(0.2) 2

Non recurring item (14.0) 14.0 2 0

Finance cost (12.2) (1.9) 1 (14.1)

Profit before tax 23.8 11.1

Income tax expense (4.8) (4.8)

Profit for the year 19.0 6.3

OCI (Gain) 1.7 1 1.7

3. Prepare a revised forecast consolidated statement of comprehensive income for HiDef for the year

ending 30 November 2016. Assume that HiDef acquires 650,000 shares in EyeOP on 1 August 2016

and incorporate any adjustments you recommend in respect of the outstanding financial reporting

issues (Exhibit 1).

Consolidation adjustments

Disposal of previously held shareholding in EyeOP

When control is achieved:

o Any previously held equity shareholding should be treated as if it had been disposed of and the

reacquired at fair value at the acquisition date.

o Any gain or loss on re-measurement to fair value should be recognised in profit or loss in the period.

One of the consequences of the previously held equity being treated as disposed of is that any unrealised gains

in respect of it become realised at the acquisition date.

As the shares in EyeOP were previously classified as an available-for-sale financial asset, any gains in respect

of it which were previously recognised in other comprehensive income should now be reclassified from other

comprehensive income to profit or loss.

Therefore, the following journal is required in HiDef’ statement of comprehensive income to dispose of the

shareholding in EyeOP before consolidation:

£m

Dr Investment in EyeOP £2.5m + £1.8m = £3.7m to increase to 3.7

£6.2m

Dr Other comprehensive income and AFS reserve - recycle to PorL 1.8

Cr Profit or loss 5.5

To recognise the gain on the deemed disposal existing prior to

control being obtained.

IFRS 10 states that where a subsidiary prepares accounts to a different reporting date from the parent, that

subsidiary may prepare additional statements to the reporting date of the rest of the group, or if this is not

possible, the subsidiary’s financial statements may be used for consolidation provided that the gap is three

months or less and that adjustments are made for the effects of significant transactions.

Copyright © ICAEW 2016. All rights reserved. Page 14 of 25

Corporate Reporting – Advanced level – July 16

EyeOP

2016

Adjusted Consolidated

£m £m £m £m

Revenue 383.0 145.9 x 4/12 48.6 431.6

Cost of sales 264.2 80.5 x 4/12 26.8 291.0

Gross profit 118.8 65.4 21.8 140.6

Administrative expenses (102.0) (40.2) x 4/12 (13.4) (115.4)

Profit on disposal of EyeOP

investment 5.5 5.5

Profit from operations 22.3 25.2 8.4 30.7

Finance costs (5.5) (14.1) x4/12 (4.7) (10.2)

Profit before tax 16.8 11.1 3.7 20.5

Income tax (2.3) (4.8) x 4/12 (1.6) (3.9)

Profit for the year 14.5 6.3 2.1 16.6

Other comprehensive income

(1.8) 1.7

for the year 1.7 (0.1)

Total comprehensive income

12.7 8.0

for the year 3.8 16.5

Profit attributable to:

Owners of HiDef 16.0

Non-controlling interest 0.6

Consolidated statement of other comprehensive income

Profit for the year 16.6

Reclassification of gain on available for sale investment (1.8)

Re-measurement gains on defined benefit pension plan 1.7

Total comprehensive income for the year 16.5

Total comprehensive income attributable to:

Owners of HiDef 15.4

Non-controlling interest (3.8 x 30%) 1.1

4. Analyse the impact of the acquisition of 650,000 shares in EyeOP on HiDef’s key performance targets

(Exhibit 2) for the year ending 30 November 2016 and, where possible, for the year ending 30

November 2017.

1. Revenue increase by 7%

Consolidating the adjusted revenue of EyeOP results in the revenue target being met in the year ending 30

November 2016.

£400 million x 107% = £428 million compared to projected revenue including EyeOP for 4 months, of £431.6

million.

Next year the target will also be met as predicted revenue will be £578.4m (see below) which represents a 34%

increase on the revenue for 2016. However, in subsequent years without further initiatives or acquisitions,

revenue will remain constant and therefore the growth will need to be either organic or from other acquisitions.

Copyright © ICAEW 2016. All rights reserved. Page 15 of 25

Corporate Reporting – Advanced level – July 16

2. Gross profit of 35%

This target is currently not predicted to be achieved either with (32.5%) or without (31%) the acquisition of the

650,000 EyeOP shares. EyeOP achieves a gross profit percentage of 45% compared to HiDef 31%. The

acquisition will not have a significant impact in achieving this target in the current financial year because only 4

months of EyeOP’s results will be consolidated with HiDef’s. In addition, the impact of the Medsee contract on

the consolidated gross profit for the current financial year is relatively small because only the sale of 50 cameras

should be recognised in revenue.

The margin predicted on the Medsee contract in 2017 and subsequently is 63%:

£m

Revenue (3500/4 = 875 cameras x £60,000) 52.50

Cost of sales (875 x £22,000) 19.25

Gross profit 33.25

EyeOP’s gross margin in 2016 excluding the revenue from the 50 new imaging cameras contract is as follows:

£m £m £m

Revenue 145.9 -3.0 142.9

Cost of sales 80.5 -1.1 79.4

Gross profit 65.4 63.5

44.8% 44.4%

The directors should be sceptical about EyeOP’s assertions regarding the margin achievable on the Medsee

contract as currently it is significantly greater than the margin achieved on its other contracts. There may also be

additional fixed costs.

In 2017, 100% of EyeOP’s results for the entire year will be included in the consolidated statement of profit or

loss which will increase the overall gross profit percentage. Given the assumption that other revenues and costs

will remain constant, the contract for the sale of imaging cameras therefore represents further additional

revenue for the group.

EyeOP’s gross profit for the year ended 30 November 2017 would include an additional £33.25 million from the

Medsee contract which would be consolidated together with its results for the entire year (assuming these

remain constant) in the group financial statements for the year ending 30 November 2017 (see working below).

Predicted group revenue and gross profit for the year ending 30 November 2017.

Revenue Cost of

sales

EyeOP £m £m

2016 excluding Medsee 142.9 79.4

Add: new contract additional revenue 875 52.5 19.3

cameras

Projected for year ending 31.12.2017 195.4 98.7

Add HiDef 383.0 264.2

Group revenue 578.4 362.9

Group cost of sales (362.9)

Gross profit 215.4

GP % 37.3%

The group gross profit percentage for the year ending 30 November 2017 is likely to be 37% which would mean

that the target of 35% would be met next year.

Tutorial note: the amortisation of the development costs could also be included in cost of sales.

Copyright © ICAEW 2016. All rights reserved. Page 16 of 25

Corporate Reporting – Advanced level – July 16

3. EBITDAR/Interest more than 10 times

The finance cost is a significant figure on EyeOP’s profit or loss indicating that EyeOP is highly geared. In

addition, EyeOP has a significant pension obligation which affects this cost.

EBITDAR before consolidation of EyeOP £m

Profit from operations 16.8

Add:

Depreciation 28.1

Lease rentals 35.5

80.4

Interest 5.5

EBITDAR/Interest 14.6 times

Before consolidation, this key ratio target has been met comfortably. On consolidation of EyeOP, the ratio

decreases to 9.6 times and therefore the target of 12 times will not be met.

EBITDAR after consolidation of EyeOP £m

Group profit from operations 30.7

Add:

Depreciation (£4.1m x 4/12) + £28.1m 29.5

Lease rentals (£5.5m x 4/12) + 35.5m 37.3

Amortisation of

development

costs £0.2m x 4/12 = £0.06m 0.1

97.6

Interest 10.2

EBITDAR/Interest 9.6 times

Examiner’s comments

General comments

This question was generally well answered by most candidates although some found the sections relating to

the production of a PorL and subsequent analysis quite challenging.

Detailed comments

(1) Goodwill calculation

This was extremely well completed by candidates with many scoring full marks.

(2) FR issues

Candidates attempted this element well. Most identified the difference between the two pension schemes

and were able to calculate correctly and account for the movements in the defined benefit scheme. In

addition, the issues in relation to the capitalisation of the Medsee expenses were well discussed. Many

then went on to correctly identify that there should also be an adjustment to revenue and cost of sales,

although often missing the deferred income element.

Some candidates became confused between the two pension schemes, but follow through marks were

given where information was correctly applied. Marks were lost however when candidates were not explicit

regarding which statement the various movements should be posted to.

A worrying aspect of some candidates’ answers was the lack of understanding regarding the recognition

of revenue with many failing to apply the recognition criteria as the point of delivery.

(3) Financial Statements

Copyright © ICAEW 2016. All rights reserved. Page 17 of 25

Corporate Reporting – Advanced level – July 16

Whilst most candidates were able to complete the basic requirements of this question, many did not

correctly identify the time period over which the results of EyeOP should be apportioned and/or did not

time apportion the profit adjustments in addition to the original PorL amounts.

Some of the more common errors were:

Adjusting EyeOP but then failing to add it to Hi-Def;

Inability to work out the number of months between 1 August 2016 to 30 November 2016 (it is 4 months

not 5 or 11);

Adjusting HiDef rather than EyeOP;

Not recycling gain on AFS £1.8m to PorL;

Taking 70% of EyeOP’s revenue and expenses;

(4) KPI’s

There were few candidates who made a satisfactory attempt at this question – calculating the ratios and

then linking the data back to the scenario for both the current and future periods. Of the remaining

candidates, the majority just calculated some ratios and then concluded whether or not the KPI was met;

a significant minority did not attempt this element of the question.

Copyright © ICAEW 2016. All rights reserved. Page 18 of 25

Corporate Reporting – Advanced level – July 16

Question 3

Outline of question

This question requires the candidate to provide accounting advice on an arrangement which may include a

lease and then to identify the risks associated with the audit of PPE, together with an outline audit approach.

The question required the application of knowledge of IFRIC4 and lease accounting and the ability to

differentiate between inherent, control and detection risks. The candidate was also required to prepare an

outline audit plan using appropriate approaches and timing for the given situation.

Requirements Marks Skills assessed

(1) Draft a response to Karel’s request for 6 Assimilate complex information in order to

advice on the financial reporting produce appropriate accounting

implications of the proposed agreement adjustments

with Beddezy on the TT financial Apply knowledge of relevant accounting

statements for the year ending 31 August standards to the information in the scenario

2016 (Exhibit 3). You can ignore any tax to appreciate that the rights of use of the

or deferred tax consequences. two assets result in different accounting

response.

Determine that the management training

centre arrangement results in a lease

under IAS 17.

Identify the need for further information

needed to conclude on whether the training

centre arrangement results in an operating

or finance lease.

Provide reasoned calculations regarding

the NPV of the MLP to determine the

arrangement is not a finance lease.

Clearly set out and explain appropriate

accounting adjustments.

(2) Identify and explain the inherent, control 12 Apply technical knowledge to explain risks

and detection audit risks associated with relevant to the scenario.

our audit of the PPE balance in TT’s Assimilate information to identify control

financial statements for the year ending activities relevant to audit assertions.

31 August 2016. Identify weaknesses in control and impact

on audit procedures.

Determine the additional information

needed to ensure audit assertion is met.

(3) Prepare an outline audit approach for 12 Appreciate that evidence of good controls

TT’s PPE balance at 31 August 2016 over additions last year should again be

which explains those aspects of our audit tested for effectiveness and informal nature

of PPE where: of recording system indicate controls would

not be effective.

a) we are able to test and place reliance on Identify the need for an auditor’s expert in

the operating effectiveness of controls; terms of valuations

Identify specific areas for audit software for

b) we will need expert input; depreciation arithmetic, samples for control

c) audit software can be used to achieve a testing, to identify unusual journal entries

more efficient audit; Appreciate that substantive analytical

procedures over depreciation calculations

d) substantive analytical procedures will will be effective.

provide us with adequate audit Determine areas where tests of control

assurance; and would be required – e.g. additions,

e) tests of details can be performed during classification and existence

our interim audit visit.

Total marks 30

Copyright © ICAEW 2016. All rights reserved. Page 19 of 25

Corporate Reporting – Advanced level – July 16

(1) Draft response to Karel’s request for advice

Draft financial reporting advice

The proposed arrangement with Beddezy involves both the sale of a piece of land and ongoing

arrangements in respect of 2 buildings which will be built on it.

To determine how both the initial land sale and the ongoing arrangements should be accounted for, it is

necessary to consider whether the arrangements in respect of the buildings constitute lease

arrangements. This is addressed by IFRIC4.

Key considerations are whether:

(i) the arrangement is fulfilled by the use of a specific asset – that is clearly the case in both

elements of the arrangement here as both have a specified asset which it is intended that TT

will use in some way – in one case the hotel and in the other the management training centre;

and

(ii) the arrangement conveys the right to use the asset. In both cases TT will obtain more than an

insignificant amount of the asset’s output which is the first requirement. However, for the

arrangement to qualify as a lease:

a. TT will need to have the ability to operate the asset or to direct others to do so or the

ability to control physical access to it while obtaining or controlling more than an

insignificant amount of the output or other utility of the asset; or

b. There must be only a remote possibility that parties other than TT will take more than an

insignificant proportion of the asset’s output and the price is not fixed per unit or linked to

the market price at the time of delivery.

In the case of the hotel, this condition is not met as TT will not have the ability to operate the

hotel and there is more than a remote possibility that more than an insignificant amount of its

capacity will be taken by parties other than TT. Indeed, TT has no commitment to take any

rooms.

In the case of the management training centre, the condition is met as the centre will be

operated by TT and its manager will supervise those controlling access to the building. It will

also have exclusive use of the centre. The arrangement does therefore include a lease for

the management centre and this should be accounted for under IAS17.

Having established that the arrangement contains a lease, it is necessary to return to the sale of the land

and consider how that should be accounted for. Half of the land which has been sold will be used for the

hotel and TT has no right to re-acquire that land and no lease over it during the term of that arrangement.

That element of the sale should therefore be accounted for as a disposal, resulting in the disposal of an

asset with a carrying amount of £1.5 million (assuming the entire plot is priced at the same price per acre)

and the recognition of a profit of £1 million in the period in which the arrangement is signed. Further

information is needed to assess whether the price for the land is a fair market price given that the sale is

part of a much more complex arrangement.

This entry will give rise to an increase in net assets as the profit is recognised.

The financial accounting treatment of the sale and lease back of the land provided for the management

training centre and for the centre itself will depend on whether the lease is considered a finance lease or

an operating lease. That will depend on whether the risks and rewards of ownership remain with TT or

have been transferred to Beddezy.

For the land element, it is likely to be an operating lease as the land will have a useful life considerably in

excess of 15 years and the option to re-acquire the land and building is at market value and it is by no

means certain to be exercised.

For the building lease, we need to consider in turn the factors which would normally lead to a lease being

considered a finance lease:

- The lease contains no automatic transfer of ownership to TT at the end of the term;

Copyright © ICAEW 2016. All rights reserved. Page 20 of 25

Corporate Reporting – Advanced level – July 16

- TT’s option to purchase back the land along with the building on it is at market value and so there is

no real certainty as to whether that option will be exercised;

- The asset’s economic life is not known at present. The lease term is for 15 years which seems less

than the “normal” expected life of a building but that will depend on the construction and further

information is required to conclude on this point.

- The present value of the lease payments cannot be calculated without first determining what element

of the payments relates to the cleaning, maintenance, security and reception services to be provided

as this would need to be excluded from the calculation. The cost of the building to Beddezy will be £4

million. Excluding the element (of £100,000 per annum) which relates to staff costs and services, the

minimum lease payments (undiscounted) will be £3 million (15 times £200,000).

However, this covers the lease of the land as well as the building. Apportioning between them in the

ratio of the cost to Beddezy would mean that (£3 million x 4.0/6.5) = 1.84 million would relate to the

building even before discounting. This is only 46% of the cost. Even if none of the lease payment is

allocated to the service element, total lease payments will be £4.5 million which is 69% of the total

cost to Beddezy of both land and buildings without any discounting. We can therefore conclude that

the net present value of the minimum lease payments will not amount to substantially all of the fair

value of the asset.

This criterion for a finance lease is not met.

- If the training centre were a specialised building, then it would be classified as a finance lease.

However, as the building has a wide variety of uses, this would not appear to be the case. Hence

this criterion for a finance lease is not met.

We can therefore conclude that the lease is an operating lease.

Financial reporting adjustments

The element of the lease payments which relates to the services to be provided should be taken to profit

or loss as a charge in the period in which those services are provided.

The land sale for the management training centre will be recognised immediately as for the hotel.

Assuming that the sale of land is determined to be at fair value, £1 million profit will be recognised

immediately and the lease and service payments recognised over the course of the lease in the period to

which they relate. If the land sale is determined to be at above fair value, then an element of the profit

(equal to the difference between the proceeds and the fair value) will be deferred and recognised over

the period of the lease. As above the profit recognition will increase net assets.

(Should the planned changes to IAS 17 lease accounting take place, the accounting will change and the

lease liability and asset will be recognised in the statement of financial position.)

(2) Identification and explanation of audit risks associated with PPE