Professional Documents

Culture Documents

Set. 2 Test No. 1

Set. 2 Test No. 1

Uploaded by

JOHAN JOJOOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Set. 2 Test No. 1

Set. 2 Test No. 1

Uploaded by

JOHAN JOJOCopyright:

Available Formats

detouub -

BAIC ONCEnAXTimf'}

Pantner sop ? O ARKS 2S

Rulen t h e aksence f (Pastnesship Derd

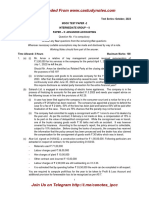

9) supta and Singh were partaers ip a fiqm, Their ixed, capitals were

Jain400,000, Gupta 76,00,000 ànd'Singh'10,00,000.THeý weré sharing profits

inthetatiö of thelr capitäls. The tiri Was éngaged in?the processing and

distribution of flavoured milk. The partnership deed pIovided fo interest on

Ncaptaat 10% për annuih Durihg tie yeaf ended 31st Mârth, 2014' the firmm

earned'å profit of 1,47,000.

Showing your working'nbtès clearly, prepare profit and loss appropriation account

of the fim.

3 M and N werepartnersin tim sharing ptotits in the rätio of3:4:5. ieir fixed

capitals were LR 4,00,000, M7 5,00;000 and N R6,00,000 respectively. ne

partnership deed pQvided-for the follawing

i)Interest on capitak@ 6%peännun.

(i) Salary of 30,000 pèr annum to N.

ii) Interest dn partneris

drawings willt be charged @12%°per annum.

During the year ended 31st March, 2008 the firm earned a profit of 2,70,000.

L withdrew 10,000 on 1st April, 2008, M withdrew 12000 on 31st September,

2008 andN withdrew 15,000 on31st-December2008

Prepare

2009.

proft and loss

approprntiop. arcoupt for. ths year ended 31st March,

A and B are partners iñ a firm sharing profit and losses in the ratio of 3 2. The

was the balance sheet of the firm as at 31st March, 2010.

olowing

Balance Sheet

as at 31st March, 20110

Liabilities Amt () Assets Amt(

Capital Acs Sundry Assets 80,000

60.000

20,000 80,000

80,000 80,000

The profits 30,000 for the year ended 31st March, 2010 were divided between

the partners without allowing interest on capital @ 12% per annum and salary ta

A@R 1,000 per month. During the year, A withdrew 10,000 and B7 20;000.

Pass the necessary adjustment joumal entry and show your working clearly.

'.A.B and C were partners in a fim. On 1st April, 2008, their fixed capitals stood at

50,000, 725,000 and 7 25,000 respecively.

As per the provisions of the partnership deed

) B was entitled for a salary of 5,000 perannym.

(i) All the partners were entitled to interest.on capital at 5% per annum.

(iii) Profits were to be shared in the ratio of capitals.

The net profit forthe year ending 31st March, 2009of 33,000 and

31st March, 2010 of7 45,000 was divided equally without providing for the above

terms

Pass an adjustment journal entry to rectify the above error.

6/ Mkesh and Ramesh are partners shanng profits a d losses in the

fespectively. They admit Rupesh as a partner with 1/4 sharé in prónits ith

ratio .of 21

guarantee that his share of profit shall be. atleast ? 55,000. The net proit ofthe firm

for the year ending 31st March, 2013 was ? 1,60,000. Prepare profit and loss

approprnation account. A

1 Dihngish etseen FRnctrakrg E ked apibs

You might also like

- M and B 3 3rd Edition Dean Croushore Solutions ManualDocument35 pagesM and B 3 3rd Edition Dean Croushore Solutions Manualallodiumerrantialwmpi100% (27)

- Memorandum and Articles of Association Draft 1Document19 pagesMemorandum and Articles of Association Draft 1bill_issak2148No ratings yet

- HQ01 Partnership Formation and OperationDocument9 pagesHQ01 Partnership Formation and OperationJean Ysrael Marquez50% (4)

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Tar Ge T 100: JS AccountancyDocument33 pagesTar Ge T 100: JS Accountancyvishal joshiNo ratings yet

- Set. 2. Test No.1 Answer KeyDocument5 pagesSet. 2. Test No.1 Answer KeyJOHAN JOJONo ratings yet

- CTF Edited Solved Paper 1Document2 pagesCTF Edited Solved Paper 1Umesh JaiswalNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- Class 12Document33 pagesClass 12vaibhav dangiNo ratings yet

- 12 Ac 3 CH Test1oDocument6 pages12 Ac 3 CH Test1orohitmahto18158920No ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Partnership QuestionsDocument11 pagesPartnership QuestionsTRIPTI GUPTANo ratings yet

- Past Adjustment QuestionsDocument7 pagesPast Adjustment Questionskvjlano2No ratings yet

- Stormy Waters 20 MARKSDocument2 pagesStormy Waters 20 MARKSisabella.desa04No ratings yet

- FundamentalDocument4 pagesFundamentalPainNo ratings yet

- 9 Partnership Question 3Document5 pages9 Partnership Question 3kautiNo ratings yet

- Topper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573Document15 pagesTopper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573gauravNo ratings yet

- 11 Sample PaperDocument40 pages11 Sample Papergaming loverNo ratings yet

- 15 Sample Papers Accountancy 2019-20Document119 pages15 Sample Papers Accountancy 2019-20hardik50% (2)

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- Admission WorksheetDocument9 pagesAdmission WorksheetShristi BishtNo ratings yet

- Test-chapter-1-Accountancy 12Document5 pagesTest-chapter-1-Accountancy 12Umesh JaiswalNo ratings yet

- Accounting For Partnership Firm - Fundamentals QuestionsDocument13 pagesAccounting For Partnership Firm - Fundamentals Questionsvipulagrawal098No ratings yet

- Screenshot 2023-08-14 at 1.31.19 PMDocument4 pagesScreenshot 2023-08-14 at 1.31.19 PMEri ChaNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- 1 Test Series Accountancy 12th (Fundamentals of Partnership)Document2 pages1 Test Series Accountancy 12th (Fundamentals of Partnership)Rav NeetNo ratings yet

- Paper For Term-1 2020-21 For Accountancy Xii PDFDocument11 pagesPaper For Term-1 2020-21 For Accountancy Xii PDFPrashil AgrawalNo ratings yet

- Acc Xii Pt1 PreptDocument5 pagesAcc Xii Pt1 PreptNishi AroraNo ratings yet

- +2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845Document9 pages+2 Accounts RTP 2023-24 Partnership Fundamental & Goodwill - 29089845vanshkapoorr3No ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- TB Meningitis Fact Sheet Dec 2017Document13 pagesTB Meningitis Fact Sheet Dec 2017Brix ArriolaNo ratings yet

- 04 Sample PaperDocument45 pages04 Sample Papergaming loverNo ratings yet

- Question Bank CH-Retirement and DeathDocument6 pagesQuestion Bank CH-Retirement and Deathsuchitasingh1106No ratings yet

- Screenshot 2023-03-11 at 12.52.38 PM PDFDocument56 pagesScreenshot 2023-03-11 at 12.52.38 PM PDFpalak sanghviNo ratings yet

- Xii Acct WDocument11 pagesXii Acct WFree Fire KingNo ratings yet

- AccountsDocument22 pagesAccountsRakesh AryaNo ratings yet

- Partnership Fundamentals WorksheetDocument7 pagesPartnership Fundamentals Worksheetmpsaj1177b9No ratings yet

- FundamentalsDocument2 pagesFundamentalsyvs12311No ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- CA Inter Adv Account Q MTP 2 Nov23 Castudynotes ComDocument7 pagesCA Inter Adv Account Q MTP 2 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- Half Yearly Examination (2011 - 12) : Delhi Public School, Jodhpur Subject - Accountancy Class - XIIDocument7 pagesHalf Yearly Examination (2011 - 12) : Delhi Public School, Jodhpur Subject - Accountancy Class - XIImarudev nathawatNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Test 3 QPDocument7 pagesTest 3 QPDharmateja ChakriNo ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- Class XII Assignment - 3 Accounting For Partnership Firms-Fundamentals 1Document5 pagesClass XII Assignment - 3 Accounting For Partnership Firms-Fundamentals 1Lester WilliamsNo ratings yet

- Accountancy Revision Test 1Document3 pagesAccountancy Revision Test 1KHUSHI ARORA SOSHNo ratings yet

- Accounts TestDocument2 pagesAccounts TestAPS Apoorv prakash singhNo ratings yet

- 28 07 2023 - 344571Document4 pages28 07 2023 - 344571Boda TanviNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- Sunil Panda Commerce Classes (SPCC) Accounts Term 2 Home Work Retirement & DeathDocument3 pagesSunil Panda Commerce Classes (SPCC) Accounts Term 2 Home Work Retirement & DeathBinoy TrevadiaNo ratings yet

- Partnership and Non-For-Profit OrganisationsDocument4 pagesPartnership and Non-For-Profit OrganisationsJoshi DrcpNo ratings yet

- Sample Paper 2 G 12 - Accountancy - SUMMER BREAKDocument9 pagesSample Paper 2 G 12 - Accountancy - SUMMER BREAKpriya longaniNo ratings yet

- Suggested Answers Global Financial Reporting StandardsDocument49 pagesSuggested Answers Global Financial Reporting StandardsNagabhushanaNo ratings yet

- Accounts XiiDocument12 pagesAccounts XiiTanya JainNo ratings yet

- Issues in Partnership Accounts: Basic ConceptsDocument40 pagesIssues in Partnership Accounts: Basic Conceptsjsus22No ratings yet

- Additional Questions-7Document8 pagesAdditional Questions-7Ak AgarwalNo ratings yet

- Tutorial Pre & Post (Changes During The Year)Document5 pagesTutorial Pre & Post (Changes During The Year)Ellie QarinaNo ratings yet

- Fundamental Test Mix Batch - 1Document1 pageFundamental Test Mix Batch - 1Harsh ShahNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Language Society Culture Cultural Heritage United Nations Educational, Scientific, and Cultural OrganizationDocument2 pagesLanguage Society Culture Cultural Heritage United Nations Educational, Scientific, and Cultural OrganizationJOHAN JOJONo ratings yet

- Fifty People Were Surveyed and Only 20Document1 pageFifty People Were Surveyed and Only 20JOHAN JOJONo ratings yet

- Social ProjectDocument5 pagesSocial ProjectJOHAN JOJONo ratings yet

- How Pigeon Different From Other BirdsDocument1 pageHow Pigeon Different From Other BirdsJOHAN JOJONo ratings yet

- Freedom Fighter SpeechDocument1 pageFreedom Fighter SpeechJOHAN JOJONo ratings yet

- Set. 2. Test No.1 Answer KeyDocument5 pagesSet. 2. Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Set 1 Test No.1 Answer KeyDocument4 pagesSet 1 Test No.1 Answer KeyJOHAN JOJONo ratings yet

- Set 1 Test No.1Document1 pageSet 1 Test No.1JOHAN JOJONo ratings yet

- Proforma Invoice: Tera Software LimitedDocument1 pageProforma Invoice: Tera Software LimitedSigitek Software ServicesNo ratings yet

- Ritesh Agarwal - WikipediaDocument30 pagesRitesh Agarwal - Wikipediapproject345No ratings yet

- Jammu & Kashmir State Electricity Regulatory Commission: Tariff OrderDocument108 pagesJammu & Kashmir State Electricity Regulatory Commission: Tariff OrderBilal AhmadNo ratings yet

- PPDA Contracts 2023Document56 pagesPPDA Contracts 2023richard.musiimeNo ratings yet

- Be 20231208Document6 pagesBe 20231208jherwi.ocretoNo ratings yet

- Cash Flow Statement Example1Document3 pagesCash Flow Statement Example1ScribdJrNo ratings yet

- Investment Portfolio Management - AssignmentDocument20 pagesInvestment Portfolio Management - AssignmentSahan RodrigoNo ratings yet

- Tempalte e BankingDocument12 pagesTempalte e Bankingcorneles tuanakottaNo ratings yet

- Realme 7 (Mist Blue, 128 GB) : Keep This Invoice and Manufacturer Box For Warranty PurposesDocument1 pageRealme 7 (Mist Blue, 128 GB) : Keep This Invoice and Manufacturer Box For Warranty PurposesBishal KhatriNo ratings yet

- Ijrpr2741 Study On Investor Perception Towards Stock Market InvestmentDocument19 pagesIjrpr2741 Study On Investor Perception Towards Stock Market InvestmentAbhay RanaNo ratings yet

- Up7714bma5 00Document1 pageUp7714bma5 00akhmad mukhsinNo ratings yet

- ACCA108 Problem 15-11 To 15-14Document3 pagesACCA108 Problem 15-11 To 15-14Dominic RomeroNo ratings yet

- 1995 Jan07 Subject-1995Document110 pages1995 Jan07 Subject-1995anonymous284.1.11No ratings yet

- Account Statement: NSDL Payments BankDocument3 pagesAccount Statement: NSDL Payments BankPunam PanditNo ratings yet

- ch06 Time Value of MoneyDocument44 pagesch06 Time Value of MoneyMortarezNo ratings yet

- Internship Report On SME Banking of Jamuna Bank Limited: Submitted ToDocument68 pagesInternship Report On SME Banking of Jamuna Bank Limited: Submitted ToMahmud HossainNo ratings yet

- Al Deardwarf S Cousin Zwerg Makes Plaster Garden Gnomes The TechnologyDocument2 pagesAl Deardwarf S Cousin Zwerg Makes Plaster Garden Gnomes The Technologytrilocksp SinghNo ratings yet

- MANAGERIAL ECONOMICS Module 3 DEMAND AND PRICINGDocument3 pagesMANAGERIAL ECONOMICS Module 3 DEMAND AND PRICINGJohn DelacruzNo ratings yet

- Section 7 of Court Fee ActDocument15 pagesSection 7 of Court Fee Actzenab tayyab 86No ratings yet

- Atikah Beauty SalonDocument15 pagesAtikah Beauty SalonEko Firdausta TariganNo ratings yet

- CHP 6 Eko 2Document10 pagesCHP 6 Eko 2Golden Ting Chiong SiiNo ratings yet

- Solutions To Further Problems: John C. HullDocument4 pagesSolutions To Further Problems: John C. HullAA BB MMNo ratings yet

- PP On Fuel StationDocument20 pagesPP On Fuel StationGurraacha Abbayyaa100% (2)

- Polash Depo Mengecat USM Pack 1Document2 pagesPolash Depo Mengecat USM Pack 1Arifa HasnaNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Unit 3.1 Notes (ANS)Document15 pagesUnit 3.1 Notes (ANS)Szeman YipNo ratings yet

- Weekend Report: New Month, New Numbers: Gold Weekly With 3-Mo. AvgDocument7 pagesWeekend Report: New Month, New Numbers: Gold Weekly With 3-Mo. AvgSoren K. GroupNo ratings yet