Professional Documents

Culture Documents

Mean and Standard Deviation Solution

Mean and Standard Deviation Solution

Uploaded by

C.E.O AnnieCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mean and Standard Deviation Solution

Mean and Standard Deviation Solution

Uploaded by

C.E.O AnnieCopyright:

Available Formats

Mean and Standard Deviation Solution Strictly Confidential

Table of Contents

#VALUE!

Notes

This Excel model is for educational purposes only and should not be used for any other reason.

All content is Copyright material of CFI Education Inc.

https://corporatefinanceinstitute.com/

© 2019 CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected under international copyright and trademark laws.

No part of this publication may be modified, manipulated, reproduced, distributed, or transmitted in any form by any means, including photocopying, recording, or other electronic or mechanical methods,

© Corporate Finance Institute. All rights reserved.

Mean and Standard Deviation Solution

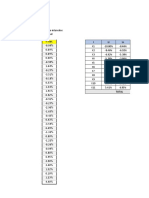

The standard deviation of a stock's return is often used as a measure of risk.

The more volatile, or risky, the returns, the larger the variation in closing prices.

For the following two stocks, calculate their mean return and standard deviation and determine which stock is "riski

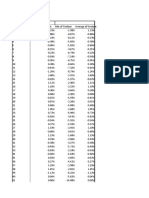

American Airlines (AMR)

Day Returns Mean x-mean x-mean squared

1 3.13% 1.08% 2.05% 0.04%

2 2.11% 1.08% 1.04% 0.01%

3 -1.83% 1.08% -2.90% 0.08%

4 2.11% 1.08% 1.03% 0.01%

5 4.88% 1.08% 3.80% 0.14%

6 -2.27% 1.08% -3.35% 0.11%

7 2.67% 1.08% 1.59% 0.03%

8 -5.14% 1.08% -6.21% 0.39%

9 2.74% 1.08% 1.66% 0.03%

10 -5.55% 1.08% -6.63% 0.44%

11 7.16% 1.08% 6.08% 0.37%

12 2.10% 1.08% 1.03% 0.01%

13 7.51% 1.08% 6.44% 0.41%

14 4.02% 1.08% 2.94% 0.09%

15 -0.81% 1.08% -1.89% 0.04%

16 -1.41% 1.08% -2.49% 0.06%

17 -2.03% 1.08% -3.11% 0.10%

18 6.10% 1.08% 5.02% 0.25%

19 0.68% 1.08% -0.40% 0.00%

20 -4.63% 1.08% -5.70% 0.33%

2.94%

Variance 0.15%

Mean 1.08% Standard Deviation 3.93%

Using AVERAGE 1.08% Using STDEV 3.93%

Based on the standard deviation of returns, AMR is riskier than WMT.

and determine which stock is "riskier" based on it's return volatilty.

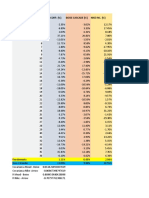

Wal-Mart (WMT)

Day Returns Mean x-mean x-mean squared

1 0.24% -0.12% 0.35% 0.00%

2 0.84% -0.12% 0.96% 0.01%

3 -0.46% -0.12% -0.34% 0.00%

4 1.12% -0.12% 1.24% 0.02%

5 1.52% -0.12% 1.64% 0.03%

6 -0.44% -0.12% -0.32% 0.00%

7 -0.10% -0.12% 0.02% 0.00%

8 -2.14% -0.12% -2.02% 0.04%

9 -0.57% -0.12% -0.45% 0.00%

10 0.47% -0.12% 0.59% 0.00%

11 -1.73% -0.12% -1.61% 0.03%

12 0.20% -0.12% 0.32% 0.00%

13 -0.60% -0.12% -0.48% 0.00%

14 -0.04% -0.12% 0.08% 0.00%

15 0.11% -0.12% 0.23% 0.00%

16 -1.03% -0.12% -0.91% 0.01%

17 -1.04% -0.12% -0.92% 0.01%

18 0.65% -0.12% 0.77% 0.01%

19 -0.22% -0.12% -0.10% 0.00%

20 0.83% -0.12% 0.95% 0.01%

0.16%

Variance 0.01%

Mean -0.12% Standard Deviation 0.92%

Using AVERAGE -0.12% Using STDEV 0.92%

You might also like

- Instant Download Global Health 4th Edition Ebook PDF PDF FREEDocument18 pagesInstant Download Global Health 4th Edition Ebook PDF PDF FREEfelipe.canada376100% (57)

- Tamriel Adventurer's Guide v2.1 (Reduced)Document204 pagesTamriel Adventurer's Guide v2.1 (Reduced)dynamiczeroNo ratings yet

- AMFEIX - Monthly Report (August 2019)Document5 pagesAMFEIX - Monthly Report (August 2019)PoolBTCNo ratings yet

- Tasas de Rendimiento 30 Asfi-ValoresDocument4 pagesTasas de Rendimiento 30 Asfi-ValoresRoger David Camargo CondeNo ratings yet

- AMFEIX - Monthly Report (October 2019)Document15 pagesAMFEIX - Monthly Report (October 2019)PoolBTCNo ratings yet

- Calibración ExcelDocument3 pagesCalibración ExcelMICHAEL MEDINA FLORESNo ratings yet

- EvoviviDocument8 pagesEvoviviBENNo ratings yet

- Mutual Fund Student DataDocument10 pagesMutual Fund Student DataJANHVI HEDANo ratings yet

- Hedge Fund Statistical Analysis: Prepared ForDocument5 pagesHedge Fund Statistical Analysis: Prepared Forbillroberts981No ratings yet

- AMFEIX - Monthly Report (May 2020)Document17 pagesAMFEIX - Monthly Report (May 2020)PoolBTCNo ratings yet

- ColoviviDocument8 pagesColoviviBENNo ratings yet

- Four Moment Risk Decomposition No VBADocument13 pagesFour Moment Risk Decomposition No VBAPeter UrbaniNo ratings yet

- Price and Return Data For Walmart (WMT) and Target (TGT)Document8 pagesPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17No ratings yet

- AMFEIX - Monthly Report (March 2020)Document17 pagesAMFEIX - Monthly Report (March 2020)PoolBTCNo ratings yet

- Ενότητα 3.3 - Παράδειγμα κατασκευής χαρτοφυλακίου με συνάρτηση χρησιμότηταςDocument3 pagesΕνότητα 3.3 - Παράδειγμα κατασκευής χαρτοφυλακίου με συνάρτηση χρησιμότηταςagis.condtNo ratings yet

- AMFEIX - Monthly Report (April 2020)Document16 pagesAMFEIX - Monthly Report (April 2020)PoolBTCNo ratings yet

- Determinacion de Portafolio OptimoDocument8 pagesDeterminacion de Portafolio OptimoDanie RomaniNo ratings yet

- FISM 11-12 AssignmentDocument2 pagesFISM 11-12 AssignmentSaksham BavejaNo ratings yet

- Accounts (A), Case #KE1056Document25 pagesAccounts (A), Case #KE1056Amit AdmuneNo ratings yet

- Pc2 2022-2 Plantilla CorregidaDocument7 pagesPc2 2022-2 Plantilla CorregidaDiego PeiranoNo ratings yet

- Long Lasting ResourcesDocument41 pagesLong Lasting ResourcesOsmar ZayasNo ratings yet

- Semana 2 ForoDocument26 pagesSemana 2 ForoLaura HernandezNo ratings yet

- Act 3Document2 pagesAct 3Aranza LozaNo ratings yet

- Punto 1 Trabajo ColaborativoDocument32 pagesPunto 1 Trabajo ColaborativoSantander EljaiekNo ratings yet

- MacroDocument4 pagesMacroLina M Galindo GonzalezNo ratings yet

- New Risk MGT FrameworkDocument12 pagesNew Risk MGT Frameworkibodacredit51No ratings yet

- Correlation-and-P I GDocument11 pagesCorrelation-and-P I GCamiloArenasBonillaNo ratings yet

- Blackjack Excel Zen vs. Omega ComparisonDocument2 pagesBlackjack Excel Zen vs. Omega ComparisonKarthik S. IyerNo ratings yet

- Absence Effetif 2021 2022 Sur 20Document246 pagesAbsence Effetif 2021 2022 Sur 20Bouzarmine Mohammed El HabibNo ratings yet

- Problem22 1 SolutionDocument5 pagesProblem22 1 SolutionmarouaachacheNo ratings yet

- TP Eco FinanciereDocument2 pagesTP Eco Financiereange vanelle tchoungaNo ratings yet

- Balanced Scorecard Report: Corporate Owner Fresnillo OperationsDocument4 pagesBalanced Scorecard Report: Corporate Owner Fresnillo OperationsShun De VazNo ratings yet

- Ch8 VaRCVaROptDocument229 pagesCh8 VaRCVaROptvaskoreNo ratings yet

- Parte InferencialDocument46 pagesParte InferencialLeidy Tatiana MartinezNo ratings yet

- Calculate Portfolio Sharpe RatioDocument7 pagesCalculate Portfolio Sharpe RatioazamopulentNo ratings yet

- Monthly Returns Excess ReturnsDocument4 pagesMonthly Returns Excess ReturnsSagar KansalNo ratings yet

- Chronos: Kinea Multimercado FI - Maio 2018Document1 pageChronos: Kinea Multimercado FI - Maio 2018Matheus BrandãoNo ratings yet

- CRSP Deciles Size Study Per2019 12 31Document3 pagesCRSP Deciles Size Study Per2019 12 31AnDReW DisHNo ratings yet

- Date Blue Dart Bluestarco Blue Dart BluestarcoDocument9 pagesDate Blue Dart Bluestarco Blue Dart BluestarcoBerkshire Hathway coldNo ratings yet

- Lyxor Chinah Lyxor Msindia Existing Portfolio Product of Deviation From The MeanDocument3 pagesLyxor Chinah Lyxor Msindia Existing Portfolio Product of Deviation From The MeanChin Yee LooNo ratings yet

- Weekly DataDocument22 pagesWeekly DataAshishNo ratings yet

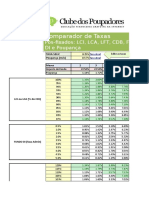

- CP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIDocument5 pagesCP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIeduardolavratiNo ratings yet

- MES Mead Corp. (%) Boise Cascade (%) Nike Inc. (%)Document4 pagesMES Mead Corp. (%) Boise Cascade (%) Nike Inc. (%)Enrique de Jesús Ramos CastelanNo ratings yet

- Dna Trading Forex - Rudutz GroupDocument30 pagesDna Trading Forex - Rudutz GroupFaisal Tasdiq DawamNo ratings yet

- Glucose Solute ConcentrationDocument1 pageGlucose Solute ConcentrationaytajNo ratings yet

- Menghitung BetaDocument136 pagesMenghitung BetaAnnisa WisdayatiNo ratings yet

- ESTADSTICADocument28 pagesESTADSTICALeidy dayana Mejia castroNo ratings yet

- Q3 2022-FinalDocument71 pagesQ3 2022-FinalcarunsbbhNo ratings yet

- Kondisi Ekonomi P1 E (R) 1 2 3 4 5 6 7 R % R % R - E (R) R - E (R)Document10 pagesKondisi Ekonomi P1 E (R) 1 2 3 4 5 6 7 R % R % R - E (R) R - E (R)Bella AngelinaNo ratings yet

- UntitledDocument2 pagesUntitledBoubker imaneNo ratings yet

- Ejercicios ForoDocument56 pagesEjercicios ForoLaura HernandezNo ratings yet

- Book 3Document2 pagesBook 3sowmith16No ratings yet

- TABLE: Modal Participating Mass Ratios Case Mode Period UX UY UZ Sum UX Sum UY Sum UZDocument2 pagesTABLE: Modal Participating Mass Ratios Case Mode Period UX UY UZ Sum UX Sum UY Sum UZsowmith16No ratings yet

- Izza InvestmentDocument3 pagesIzza InvestmentizzaNo ratings yet

- Latihan CAPM CALDocument6 pagesLatihan CAPM CALanwarchoiNo ratings yet

- Nutritional Status Report of Cabiao National High SchoolDocument4 pagesNutritional Status Report of Cabiao National High SchoolLorraine VenzonNo ratings yet

- Tasas - TerminadoDocument8 pagesTasas - TerminadojeanNo ratings yet

- Indic AdoresDocument4 pagesIndic AdoresVicit LainezNo ratings yet

- Libro1 1Document26 pagesLibro1 1Yuli MenesesNo ratings yet

- UntitledDocument2 pagesUntitledrositaNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Technomelt Ks 207 enDocument2 pagesTechnomelt Ks 207 enTilimpea Cristian SorinNo ratings yet

- Sae J10-2018Document5 pagesSae J10-2018Nasty100% (2)

- Summer of 42Document148 pagesSummer of 42John Robert SassoNo ratings yet

- Java Programming 9th Edition Farrell Solutions ManualDocument24 pagesJava Programming 9th Edition Farrell Solutions ManualPatrickMillerkoqd100% (53)

- Introduction To Brain and Behavior 5th Edition Kolb Test BankDocument23 pagesIntroduction To Brain and Behavior 5th Edition Kolb Test Bankimpresssarcosis.ulis7u100% (43)

- Solution Manual For Accounting Principles Weygandt Kieso Kimmel Trenholm Kinnear Barlow 6th Canadian EditionDocument18 pagesSolution Manual For Accounting Principles Weygandt Kieso Kimmel Trenholm Kinnear Barlow 6th Canadian Editionpryingly.curdlessri8zpNo ratings yet

- Consumer Goods Giant Unilever Iterates 50 Percent Faster With 3D PrintingDocument2 pagesConsumer Goods Giant Unilever Iterates 50 Percent Faster With 3D PrintingjamesstaylorNo ratings yet

- Ebook Law For Business Students 12Th Edition PDF Full Chapter PDFDocument67 pagesEbook Law For Business Students 12Th Edition PDF Full Chapter PDFdennis.vashaw794100% (35)

- Foundation Plan Roof Beam Plan: C D E B A 14.00m C D E B ADocument1 pageFoundation Plan Roof Beam Plan: C D E B A 14.00m C D E B AJohn Carl SalasNo ratings yet

- SolidWorks Surfacing and Complex Shape Modeling Bible by Matt Lombard-004-005Document2 pagesSolidWorks Surfacing and Complex Shape Modeling Bible by Matt Lombard-004-005Mario Jorge RamalhoNo ratings yet

- Cixi City v. Yita - ComplaintDocument23 pagesCixi City v. Yita - ComplaintSarah BursteinNo ratings yet

- Fractions WorksheetDocument2 pagesFractions Worksheetjs cyberzoneNo ratings yet

- Free Download Ruthless Elites An Enemies To Lovers Romance Royal Elite Academy Series Book 2 A Savannah Mafia Romance M A Lee Full Chapter PDFDocument52 pagesFree Download Ruthless Elites An Enemies To Lovers Romance Royal Elite Academy Series Book 2 A Savannah Mafia Romance M A Lee Full Chapter PDFcarolina.barron698100% (18)

- Order WORD3256112Document2 pagesOrder WORD3256112Carlos Ediver Arias RestrepoNo ratings yet

- Advertising and Imc Principles and Practice 10Th Edition Moriarty Test Bank Full Chapter PDFDocument29 pagesAdvertising and Imc Principles and Practice 10Th Edition Moriarty Test Bank Full Chapter PDFjames.graven613100% (21)

- College Accounting 14th Edition Price Solutions ManualDocument26 pagesCollege Accounting 14th Edition Price Solutions Manualniblicktartar.nevn3100% (31)

- Patent CasesDocument34 pagesPatent CasesDenise FranchescaNo ratings yet

- Rociador Esfr K25 VictaulicDocument6 pagesRociador Esfr K25 VictaulicmareNo ratings yet

- Aquapol™ 102S: Solvent Technical FeaturesDocument1 pageAquapol™ 102S: Solvent Technical FeaturesLong An DoNo ratings yet

- GHAZIABAD ENGINEERING CO. (P) LTD. Vs CERTIFYING OFFICER, KANPUR AND ANR.Document29 pagesGHAZIABAD ENGINEERING CO. (P) LTD. Vs CERTIFYING OFFICER, KANPUR AND ANR.BHAVYANSHI DARIYANo ratings yet

- Rm5151 Research Methodology and IprDocument14 pagesRm5151 Research Methodology and IprMy Phone You100% (1)

- A Critical Analysis On The Denial of Inventroship Rights To AI and Creative ComputersDocument10 pagesA Critical Analysis On The Denial of Inventroship Rights To AI and Creative ComputersSergios PapastergiouNo ratings yet

- Copyright NotesDocument15 pagesCopyright NotesCharles DumasiNo ratings yet

- Let S Count LegsDocument12 pagesLet S Count LegsShakira HeNo ratings yet

- Auditing Problems Test Banks - IntangiblesDocument5 pagesAuditing Problems Test Banks - IntangiblesAlliah Mae ArbastoNo ratings yet

- Intellectual Property Law - CPA REVIEWDocument5 pagesIntellectual Property Law - CPA REVIEWjoyceNo ratings yet

- Instant Download Global Business 4th Edition Mike Peng Solutions Manual PDF Full ChapterDocument32 pagesInstant Download Global Business 4th Edition Mike Peng Solutions Manual PDF Full ChapterDianaChangmtyx100% (12)

- Multi-Point Sliding Door Latch (US Patent 5820170)Document13 pagesMulti-Point Sliding Door Latch (US Patent 5820170)PriorSmartNo ratings yet