Professional Documents

Culture Documents

5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8w

5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8w

Uploaded by

Carlo AlfonsoCopyright:

Available Formats

You might also like

- Sample Quiet Title With Adverse PossessionDocument9 pagesSample Quiet Title With Adverse Possessionautumngrace100% (7)

- BIR Rulings On Nominee SharesDocument8 pagesBIR Rulings On Nominee SharesJenny Pasic LomibaoNo ratings yet

- The 1987 Constitution of The Philippines Article Iii Bill of Rights "Section 9"Document17 pagesThe 1987 Constitution of The Philippines Article Iii Bill of Rights "Section 9"Hyacinth Reyes Valero100% (1)

- CBRE - Epicentre - Receivers Report - July 2021 - Notice of FilingDocument8 pagesCBRE - Epicentre - Receivers Report - July 2021 - Notice of FilingWCNC DigitalNo ratings yet

- Bir 363-14Document5 pagesBir 363-14msdivergentNo ratings yet

- Rmo 17-16Document11 pagesRmo 17-16Nash Ortiz Luis100% (1)

- 2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubDocument3 pages2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubRen Mar CruzNo ratings yet

- 2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdDocument3 pages2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdRen Mar CruzNo ratings yet

- BIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawDocument3 pagesBIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawCarlo AlfonsoNo ratings yet

- BIR RULING NO. 028-02: KNECHT, IncorporatedDocument4 pagesBIR RULING NO. 028-02: KNECHT, IncorporatedCarlo AlfonsoNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- Bir Ruling No. 108-93Document4 pagesBir Ruling No. 108-93matinikkiNo ratings yet

- RR 05-09 (Sale of RP)Document7 pagesRR 05-09 (Sale of RP)joefieNo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- BIR Ruling 1133-18 (Liquidating Dividends)Document4 pagesBIR Ruling 1133-18 (Liquidating Dividends)Lee Anne YabutNo ratings yet

- RR 04-08 (Sale of RP)Document7 pagesRR 04-08 (Sale of RP)joefieNo ratings yet

- Bir Ruling 197-93 (May 7, 1993)Document5 pagesBir Ruling 197-93 (May 7, 1993)matinikkiNo ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- Da 404 05Document4 pagesDa 404 05fatmaaleahNo ratings yet

- Itad Ruling No. 033-03: Sycip Salazar Hernandez & GatmaitanDocument7 pagesItad Ruling No. 033-03: Sycip Salazar Hernandez & Gatmaitanrian.lee.b.tiangcoNo ratings yet

- BIR RULING NO. 498-93: Pastelero Law OfficeDocument2 pagesBIR RULING NO. 498-93: Pastelero Law OfficeLee Anne YabutNo ratings yet

- 2008-BIR Ruling (DA - C-182 559-08)Document8 pages2008-BIR Ruling (DA - C-182 559-08)Jay MirandaNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- Itad Bir Ruling No. 063-18Document7 pagesItad Bir Ruling No. 063-18Ren Mar CruzNo ratings yet

- 2004 BIR - Ruling - DA 430 04 - 20210505 13 1dgx0pDocument3 pages2004 BIR - Ruling - DA 430 04 - 20210505 13 1dgx0pVence EugalcaNo ratings yet

- SG ITAD Ruling No. 019-03Document4 pagesSG ITAD Ruling No. 019-03Paul Angelo TombocNo ratings yet

- BIR RULING NO. 278-13: Noritake Porcelana MFG., IncDocument3 pagesBIR RULING NO. 278-13: Noritake Porcelana MFG., IncJoyceMendozaNo ratings yet

- Bir RulingDocument4 pagesBir Rulingdranreb ursabiaNo ratings yet

- BIR - Ruling DA-263-00 (20 June 2000)Document2 pagesBIR - Ruling DA-263-00 (20 June 2000)josephine.t.ycongNo ratings yet

- BIR Ruling DA-C-179 464-09 (18 August 2009)Document3 pagesBIR Ruling DA-C-179 464-09 (18 August 2009)josephine.t.ycongNo ratings yet

- 7333-1998-Bir Ruling No. 029-98 PDFDocument3 pages7333-1998-Bir Ruling No. 029-98 PDFjeffreyNo ratings yet

- BIR RULING NO. 018-97: R.S. Bernaldo & AssociatesDocument2 pagesBIR RULING NO. 018-97: R.S. Bernaldo & AssociatesLouisse Salazar InguilloNo ratings yet

- BIR Ruling No. 1397-18Document4 pagesBIR Ruling No. 1397-18SGNo ratings yet

- SEC Opinion (November 16, 1982) Atty. Leonen R. GutierrezDocument3 pagesSEC Opinion (November 16, 1982) Atty. Leonen R. GutierrezAlyssa Marie MartinezNo ratings yet

- 2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Document3 pages2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Boss NikNo ratings yet

- Bir Ruling (Da-117-03)Document5 pagesBir Ruling (Da-117-03)Marlene TongsonNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- BIR Ruling No. 307-82Document2 pagesBIR Ruling No. 307-82Alfred Hernandez CampañanoNo ratings yet

- RR 17-03Document15 pagesRR 17-03firstdummyNo ratings yet

- Chamber of Real Estate and Builders' Association v. RomuloDocument19 pagesChamber of Real Estate and Builders' Association v. RomuloNxxxNo ratings yet

- BIR Ruling No. 634-19Document5 pagesBIR Ruling No. 634-19SGNo ratings yet

- Bir Ruling Da 141 99Document3 pagesBir Ruling Da 141 99Nash Ortiz LuisNo ratings yet

- 6028-Tax AssignmentDocument6 pages6028-Tax AssignmentFiniti Financials Consultants LLPNo ratings yet

- BIR Ruling DA-648-04Document2 pagesBIR Ruling DA-648-04Phoebe SpaurekNo ratings yet

- Capital Gains TAX (Chapter 23.01)Document36 pagesCapital Gains TAX (Chapter 23.01)Thulani NdlovuNo ratings yet

- Bir Ruling (Da-147-06) - GcsDocument4 pagesBir Ruling (Da-147-06) - GcsElie FernNo ratings yet

- 28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFDocument2 pages28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFAleezah Gertrude RaymundoNo ratings yet

- BIR RULING NO. 317-92: Sycip, Gorres, Velayo & CoDocument3 pagesBIR RULING NO. 317-92: Sycip, Gorres, Velayo & CoLeulaDianneCantosNo ratings yet

- BIR RulingDocument3 pagesBIR RulingyakyakxxNo ratings yet

- Tenant AdvisoryDocument1 pageTenant AdvisoryJanetNo ratings yet

- Itad Bir Ruling No. 065-05Document4 pagesItad Bir Ruling No. 065-05msdivergentNo ratings yet

- RR 2-2001Document7 pagesRR 2-2001Eumell Alexis PaleNo ratings yet

- Ey French Parliament Approves Finance Bill For 2021Document5 pagesEy French Parliament Approves Finance Bill For 2021kgrb22mjqsNo ratings yet

- Bir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesDocument3 pagesBir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesThe GiverNo ratings yet

- Tax Feb 17Document103 pagesTax Feb 17Lolit CarlosNo ratings yet

- 1999 ITAD RulingsDocument97 pages1999 ITAD RulingsJerwin DaveNo ratings yet

- General Principles CasesDocument294 pagesGeneral Principles CasesAnne OcampoNo ratings yet

- MTF Tax Journal July 2021Document27 pagesMTF Tax Journal July 2021Earle EdraNo ratings yet

- CIR v. CADocument2 pagesCIR v. CALynne SanchezNo ratings yet

- Conveyancing Rough Draft 2Document23 pagesConveyancing Rough Draft 2Sylvia G.No ratings yet

- TDS On Transfer of Immovable PropertyDocument5 pagesTDS On Transfer of Immovable PropertyAmit NuwalNo ratings yet

- SWOTApril 9th Meeting Flyer - 3-25Document1 pageSWOTApril 9th Meeting Flyer - 3-25swotdcNo ratings yet

- Deed of Reconveyance Sample (US Format)Document1 pageDeed of Reconveyance Sample (US Format)emilyn_gerona2000100% (1)

- Mercado and Mercado vs. Espiritu, 37 Phil. 215, No. 11872 December 1, 1917Document19 pagesMercado and Mercado vs. Espiritu, 37 Phil. 215, No. 11872 December 1, 1917Lester AgoncilloNo ratings yet

- Property DealsDocument17 pagesProperty DealsRachel Torres100% (1)

- Bir Valuation of GiftsDocument1 pageBir Valuation of GiftsSarah AljowderNo ratings yet

- Government Service Insurance System, G.R. No. 186242: Republic of The Philippines Supreme Court ManilaDocument18 pagesGovernment Service Insurance System, G.R. No. 186242: Republic of The Philippines Supreme Court ManilaTan Mark AndrewNo ratings yet

- HLURB Citizen CharterDocument20 pagesHLURB Citizen CharterDarlon B. SerenioNo ratings yet

- Filinvest Land IncDocument39 pagesFilinvest Land Incarishya24No ratings yet

- Sps Padilla Vs Velasco Case DigestDocument2 pagesSps Padilla Vs Velasco Case DigestDamienNo ratings yet

- GA FHA Condo ApprovalsDocument18 pagesGA FHA Condo Approvalsbenholt09No ratings yet

- WRFC Marketing BookDocument44 pagesWRFC Marketing Bookjhoulihan9323No ratings yet

- PETW3 Workbook Unit 19Document19 pagesPETW3 Workbook Unit 19Adriano Gomes da SilvaNo ratings yet

- Provincial Capitol of Cavite Space ProgrammingDocument37 pagesProvincial Capitol of Cavite Space ProgrammingMark RodriguezNo ratings yet

- AuthorizationDocument74 pagesAuthorizationGeneva50% (2)

- Sacramento Railyards Development AgreementDocument225 pagesSacramento Railyards Development AgreementBilly LeeNo ratings yet

- G.R. No. 175763 Heirs of Spouses Tanyag v. Gabriel PDFDocument12 pagesG.R. No. 175763 Heirs of Spouses Tanyag v. Gabriel PDFmehNo ratings yet

- Transfer of PropertyDocument17 pagesTransfer of PropertyParul NayakNo ratings yet

- 9-27 FullDocument29 pages9-27 Fullxc kelNo ratings yet

- Judicial AffidavitDocument6 pagesJudicial AffidavitXhain Psypudin100% (4)

- Chapter 1. Valuation Concepts and PrinciplesDocument15 pagesChapter 1. Valuation Concepts and PrinciplesLeo LigutanNo ratings yet

- IL Loan Brokerage Agreement and Loan Brokerage Disclosure Statement PDFDocument2 pagesIL Loan Brokerage Agreement and Loan Brokerage Disclosure Statement PDFJohn TurnerNo ratings yet

- 27 G.R. No. 162045 March 28, 2006 Ong Vs OlasimanDocument3 pages27 G.R. No. 162045 March 28, 2006 Ong Vs OlasimanrodolfoverdidajrNo ratings yet

- 2012 - Samelo Vs Manotok Sevices Inc - GR No. 170509 June 27, 2012Document1 page2012 - Samelo Vs Manotok Sevices Inc - GR No. 170509 June 27, 2012Lyka Lim PascuaNo ratings yet

- A Project Report ON Analysis of Real Estate Investment' ATDocument48 pagesA Project Report ON Analysis of Real Estate Investment' ATSamuel DavisNo ratings yet

- Europe Mall Pioneer Solal DiesDocument7 pagesEurope Mall Pioneer Solal Diesapi-238318344No ratings yet

- JOSEFINA V. NOBLEZA, Petitioner, v. SHIRLEY B. NUEGA, G.R. No. 193038, March 11, 2015 FactsDocument1 pageJOSEFINA V. NOBLEZA, Petitioner, v. SHIRLEY B. NUEGA, G.R. No. 193038, March 11, 2015 FactsEda Angelica Concepcion Buena-BagcatinNo ratings yet

5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8w

5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8w

Uploaded by

Carlo AlfonsoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8w

5701-1991-Conveyance of The Real Property by The20210505-12-1o05w8w

Uploaded by

Carlo AlfonsoCopyright:

Available Formats

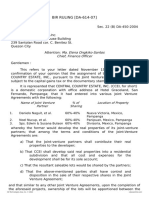

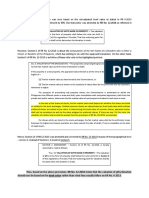

December 23, 1991

BIR RULING NO. 270-91

66 000-00 270-91

Gentlemen :

This refers to your letter dated March 4, 1991 stating that Montiel, Inc.

is a duly registered domestic corporation incorporated in 1965 and doing

business solely in the Philippines; that it is engaged in the realty business

actually owns only a parcel of land with certain improvements; that it now

intends to shorten the life of its corporate existence and dissolve its business

operations which will require the distribution of its assets consisting of said

real property to the stockholders in the form of liquidating dividends; and

that the distribution of the said real estate property by the corporation to its

stockholders will involve conveyance of title and ownership in said real

property to its stockholders. cdtech

In connection therewith, you now request a ruling as to whether the

conveyance of the aforesaid real property by the corporation to its

stockholders in the form of liquidating dividends is subject to documentary

stamp tax.

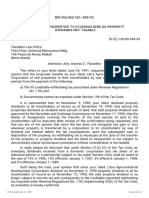

In reply thereto, please be informed that the Deed of Conveyance of

the aforementioned property as liquidating dividends to be executed by the

corporation in favor of its stockholders is subject to documentary stamp tax.

(Section 173, Tax Code, as amended)

In all cases involving sale, exchange or any disposition of real property

as in this case, where real property is being distributed, by the corporation to

its stockholders as liquidating dividends, the tax base for documentary

stamp tax purposes is the fair market value or zonal value of the real

property. (RMO No. 41-91)

The stockholders who will receive a portion of the parcel of land as

liquidating dividends upon the surrender of his corresponding shareholding

realizes capital gain or loss. The gain, if any, derived by the individual

stockholders consisting of the difference between the fair market value of

the liquidating dividends and the adjusted cost to the stockholders of their

respective shareholding in the corporation (Sec. 66 (a); Sec. 256, Income Tax

Regulations) shall be subject to income tax at the rates prescribed under

Section 21 (a) of the Tax Code, as amended by Executive Order No. 37.

Moreover, pursuant to Section 33 (b) of the Tax Code, as amended, only 50%

of the aforementioned capital gain is reportable for income tax purposes if

the shares were held by the individual stockholders for more than twelve

months and 100% of the capital gains if the shares were held for less than

twelve months.

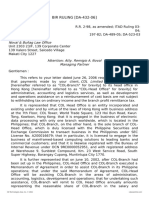

Moreover, the distribution by Montiel, Inc. to its stockholders as

liquidating dividends of its assets consisting of a parcel of land in complete

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

liquidation or dissolution is not subject to the creditable withholding tax on

sales, exchanges or transfers of real property under Revenue Regulations

No. 1-90, as implemented by Revenue Memorandum Circular No. 7-90.

After payment of the corresponding documentary stamp tax, the real

property may be registered by the Register of Deeds concerned in the name

of the stockholders. aisadc

Very truly yours,

(SGD.) JOSE U. ONG

Commissioner

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Sample Quiet Title With Adverse PossessionDocument9 pagesSample Quiet Title With Adverse Possessionautumngrace100% (7)

- BIR Rulings On Nominee SharesDocument8 pagesBIR Rulings On Nominee SharesJenny Pasic LomibaoNo ratings yet

- The 1987 Constitution of The Philippines Article Iii Bill of Rights "Section 9"Document17 pagesThe 1987 Constitution of The Philippines Article Iii Bill of Rights "Section 9"Hyacinth Reyes Valero100% (1)

- CBRE - Epicentre - Receivers Report - July 2021 - Notice of FilingDocument8 pagesCBRE - Epicentre - Receivers Report - July 2021 - Notice of FilingWCNC DigitalNo ratings yet

- Bir 363-14Document5 pagesBir 363-14msdivergentNo ratings yet

- Rmo 17-16Document11 pagesRmo 17-16Nash Ortiz Luis100% (1)

- 2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubDocument3 pages2009 CKL - Real - Estate - Corp.20220525 12 1gi6gubRen Mar CruzNo ratings yet

- 2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdDocument3 pages2007 Central - Country - Estate - Inc.20220602 11 1vb3vtdRen Mar CruzNo ratings yet

- BIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawDocument3 pagesBIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawCarlo AlfonsoNo ratings yet

- BIR RULING NO. 028-02: KNECHT, IncorporatedDocument4 pagesBIR RULING NO. 028-02: KNECHT, IncorporatedCarlo AlfonsoNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- Bir Ruling No. 108-93Document4 pagesBir Ruling No. 108-93matinikkiNo ratings yet

- RR 05-09 (Sale of RP)Document7 pagesRR 05-09 (Sale of RP)joefieNo ratings yet

- Bir Ruling Da (Vat 050) 282 09Document3 pagesBir Ruling Da (Vat 050) 282 09doraemoanNo ratings yet

- BIR Ruling 1133-18 (Liquidating Dividends)Document4 pagesBIR Ruling 1133-18 (Liquidating Dividends)Lee Anne YabutNo ratings yet

- RR 04-08 (Sale of RP)Document7 pagesRR 04-08 (Sale of RP)joefieNo ratings yet

- Bir Ruling 197-93 (May 7, 1993)Document5 pagesBir Ruling 197-93 (May 7, 1993)matinikkiNo ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- Da 404 05Document4 pagesDa 404 05fatmaaleahNo ratings yet

- Itad Ruling No. 033-03: Sycip Salazar Hernandez & GatmaitanDocument7 pagesItad Ruling No. 033-03: Sycip Salazar Hernandez & Gatmaitanrian.lee.b.tiangcoNo ratings yet

- BIR RULING NO. 498-93: Pastelero Law OfficeDocument2 pagesBIR RULING NO. 498-93: Pastelero Law OfficeLee Anne YabutNo ratings yet

- 2008-BIR Ruling (DA - C-182 559-08)Document8 pages2008-BIR Ruling (DA - C-182 559-08)Jay MirandaNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- Itad Bir Ruling No. 063-18Document7 pagesItad Bir Ruling No. 063-18Ren Mar CruzNo ratings yet

- 2004 BIR - Ruling - DA 430 04 - 20210505 13 1dgx0pDocument3 pages2004 BIR - Ruling - DA 430 04 - 20210505 13 1dgx0pVence EugalcaNo ratings yet

- SG ITAD Ruling No. 019-03Document4 pagesSG ITAD Ruling No. 019-03Paul Angelo TombocNo ratings yet

- BIR RULING NO. 278-13: Noritake Porcelana MFG., IncDocument3 pagesBIR RULING NO. 278-13: Noritake Porcelana MFG., IncJoyceMendozaNo ratings yet

- Bir RulingDocument4 pagesBir Rulingdranreb ursabiaNo ratings yet

- BIR - Ruling DA-263-00 (20 June 2000)Document2 pagesBIR - Ruling DA-263-00 (20 June 2000)josephine.t.ycongNo ratings yet

- BIR Ruling DA-C-179 464-09 (18 August 2009)Document3 pagesBIR Ruling DA-C-179 464-09 (18 August 2009)josephine.t.ycongNo ratings yet

- 7333-1998-Bir Ruling No. 029-98 PDFDocument3 pages7333-1998-Bir Ruling No. 029-98 PDFjeffreyNo ratings yet

- BIR RULING NO. 018-97: R.S. Bernaldo & AssociatesDocument2 pagesBIR RULING NO. 018-97: R.S. Bernaldo & AssociatesLouisse Salazar InguilloNo ratings yet

- BIR Ruling No. 1397-18Document4 pagesBIR Ruling No. 1397-18SGNo ratings yet

- SEC Opinion (November 16, 1982) Atty. Leonen R. GutierrezDocument3 pagesSEC Opinion (November 16, 1982) Atty. Leonen R. GutierrezAlyssa Marie MartinezNo ratings yet

- 2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Document3 pages2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Boss NikNo ratings yet

- Bir Ruling (Da-117-03)Document5 pagesBir Ruling (Da-117-03)Marlene TongsonNo ratings yet

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmDocument4 pages2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoNo ratings yet

- BIR Ruling No. 307-82Document2 pagesBIR Ruling No. 307-82Alfred Hernandez CampañanoNo ratings yet

- RR 17-03Document15 pagesRR 17-03firstdummyNo ratings yet

- Chamber of Real Estate and Builders' Association v. RomuloDocument19 pagesChamber of Real Estate and Builders' Association v. RomuloNxxxNo ratings yet

- BIR Ruling No. 634-19Document5 pagesBIR Ruling No. 634-19SGNo ratings yet

- Bir Ruling Da 141 99Document3 pagesBir Ruling Da 141 99Nash Ortiz LuisNo ratings yet

- 6028-Tax AssignmentDocument6 pages6028-Tax AssignmentFiniti Financials Consultants LLPNo ratings yet

- BIR Ruling DA-648-04Document2 pagesBIR Ruling DA-648-04Phoebe SpaurekNo ratings yet

- Capital Gains TAX (Chapter 23.01)Document36 pagesCapital Gains TAX (Chapter 23.01)Thulani NdlovuNo ratings yet

- Bir Ruling (Da-147-06) - GcsDocument4 pagesBir Ruling (Da-147-06) - GcsElie FernNo ratings yet

- 28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFDocument2 pages28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFAleezah Gertrude RaymundoNo ratings yet

- BIR RULING NO. 317-92: Sycip, Gorres, Velayo & CoDocument3 pagesBIR RULING NO. 317-92: Sycip, Gorres, Velayo & CoLeulaDianneCantosNo ratings yet

- BIR RulingDocument3 pagesBIR RulingyakyakxxNo ratings yet

- Tenant AdvisoryDocument1 pageTenant AdvisoryJanetNo ratings yet

- Itad Bir Ruling No. 065-05Document4 pagesItad Bir Ruling No. 065-05msdivergentNo ratings yet

- RR 2-2001Document7 pagesRR 2-2001Eumell Alexis PaleNo ratings yet

- Ey French Parliament Approves Finance Bill For 2021Document5 pagesEy French Parliament Approves Finance Bill For 2021kgrb22mjqsNo ratings yet

- Bir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesDocument3 pagesBir Ruling No. 508-12: Deguzman Celis & Dionisio Law OfficesThe GiverNo ratings yet

- Tax Feb 17Document103 pagesTax Feb 17Lolit CarlosNo ratings yet

- 1999 ITAD RulingsDocument97 pages1999 ITAD RulingsJerwin DaveNo ratings yet

- General Principles CasesDocument294 pagesGeneral Principles CasesAnne OcampoNo ratings yet

- MTF Tax Journal July 2021Document27 pagesMTF Tax Journal July 2021Earle EdraNo ratings yet

- CIR v. CADocument2 pagesCIR v. CALynne SanchezNo ratings yet

- Conveyancing Rough Draft 2Document23 pagesConveyancing Rough Draft 2Sylvia G.No ratings yet

- TDS On Transfer of Immovable PropertyDocument5 pagesTDS On Transfer of Immovable PropertyAmit NuwalNo ratings yet

- SWOTApril 9th Meeting Flyer - 3-25Document1 pageSWOTApril 9th Meeting Flyer - 3-25swotdcNo ratings yet

- Deed of Reconveyance Sample (US Format)Document1 pageDeed of Reconveyance Sample (US Format)emilyn_gerona2000100% (1)

- Mercado and Mercado vs. Espiritu, 37 Phil. 215, No. 11872 December 1, 1917Document19 pagesMercado and Mercado vs. Espiritu, 37 Phil. 215, No. 11872 December 1, 1917Lester AgoncilloNo ratings yet

- Property DealsDocument17 pagesProperty DealsRachel Torres100% (1)

- Bir Valuation of GiftsDocument1 pageBir Valuation of GiftsSarah AljowderNo ratings yet

- Government Service Insurance System, G.R. No. 186242: Republic of The Philippines Supreme Court ManilaDocument18 pagesGovernment Service Insurance System, G.R. No. 186242: Republic of The Philippines Supreme Court ManilaTan Mark AndrewNo ratings yet

- HLURB Citizen CharterDocument20 pagesHLURB Citizen CharterDarlon B. SerenioNo ratings yet

- Filinvest Land IncDocument39 pagesFilinvest Land Incarishya24No ratings yet

- Sps Padilla Vs Velasco Case DigestDocument2 pagesSps Padilla Vs Velasco Case DigestDamienNo ratings yet

- GA FHA Condo ApprovalsDocument18 pagesGA FHA Condo Approvalsbenholt09No ratings yet

- WRFC Marketing BookDocument44 pagesWRFC Marketing Bookjhoulihan9323No ratings yet

- PETW3 Workbook Unit 19Document19 pagesPETW3 Workbook Unit 19Adriano Gomes da SilvaNo ratings yet

- Provincial Capitol of Cavite Space ProgrammingDocument37 pagesProvincial Capitol of Cavite Space ProgrammingMark RodriguezNo ratings yet

- AuthorizationDocument74 pagesAuthorizationGeneva50% (2)

- Sacramento Railyards Development AgreementDocument225 pagesSacramento Railyards Development AgreementBilly LeeNo ratings yet

- G.R. No. 175763 Heirs of Spouses Tanyag v. Gabriel PDFDocument12 pagesG.R. No. 175763 Heirs of Spouses Tanyag v. Gabriel PDFmehNo ratings yet

- Transfer of PropertyDocument17 pagesTransfer of PropertyParul NayakNo ratings yet

- 9-27 FullDocument29 pages9-27 Fullxc kelNo ratings yet

- Judicial AffidavitDocument6 pagesJudicial AffidavitXhain Psypudin100% (4)

- Chapter 1. Valuation Concepts and PrinciplesDocument15 pagesChapter 1. Valuation Concepts and PrinciplesLeo LigutanNo ratings yet

- IL Loan Brokerage Agreement and Loan Brokerage Disclosure Statement PDFDocument2 pagesIL Loan Brokerage Agreement and Loan Brokerage Disclosure Statement PDFJohn TurnerNo ratings yet

- 27 G.R. No. 162045 March 28, 2006 Ong Vs OlasimanDocument3 pages27 G.R. No. 162045 March 28, 2006 Ong Vs OlasimanrodolfoverdidajrNo ratings yet

- 2012 - Samelo Vs Manotok Sevices Inc - GR No. 170509 June 27, 2012Document1 page2012 - Samelo Vs Manotok Sevices Inc - GR No. 170509 June 27, 2012Lyka Lim PascuaNo ratings yet

- A Project Report ON Analysis of Real Estate Investment' ATDocument48 pagesA Project Report ON Analysis of Real Estate Investment' ATSamuel DavisNo ratings yet

- Europe Mall Pioneer Solal DiesDocument7 pagesEurope Mall Pioneer Solal Diesapi-238318344No ratings yet

- JOSEFINA V. NOBLEZA, Petitioner, v. SHIRLEY B. NUEGA, G.R. No. 193038, March 11, 2015 FactsDocument1 pageJOSEFINA V. NOBLEZA, Petitioner, v. SHIRLEY B. NUEGA, G.R. No. 193038, March 11, 2015 FactsEda Angelica Concepcion Buena-BagcatinNo ratings yet