Professional Documents

Culture Documents

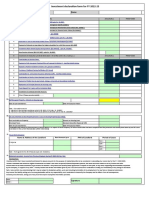

Income Tax Material: Unit 9 - Deductions

Income Tax Material: Unit 9 - Deductions

Uploaded by

KARAN WADHWA 2012168Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Material: Unit 9 - Deductions

Income Tax Material: Unit 9 - Deductions

Uploaded by

KARAN WADHWA 2012168Copyright:

Available Formats

INCOME TAX MATERIAL

Deduction & Total Income

Unit 9 – Deductions

Deductions under chapter VI -A is restricted to Gross Total Income & deduction cannot be carry forward.

Deduction under chapter VI-A is not allowed against LTCG, LTCG u/s 112A, STCG u/s 111A &

special rates of tax income.

Part A : Payment Related Deductions

Sec 80C : Specified Investments

a. Eligible Assessee: Individual & HUF

b. Amount of deduction Rs.1,50,000 [Maximum Limit]

c. Eligible Investments:

1. Life insurance premium:

Amount deduction

If policy issued before 01-04-2012 a. Premium paid

b. 20% of Policy value

Whichever is lower

If policy issued on or after 01-04-2012 a. Premium paid

b. 10% of Policy value

Whichever is lower

If policy issued on or after 01-04-2013 for a. Premium paid

person with disability u/s 80U or person b. 15% of Policy value

suffering from specified disease (u/s 80DDB) Whichever is lower

2. Amount deposited in Public Provident Fund (PPF)

(For assesse, spouse, children)

3. Employee’s contribution to Statutory Provident Fund, Recognised Provident fund (SPF & RPF)

4. Amount invested in NSC as well as interest accrued on NSC.

5. Repayment of loan taken banks & financial institution for purchase or construction of House.

6. Fixed deposit in a scheduled bank or post office for 5 years or more.

7. Tuition fees paid for education of children.

[Max 2 children for full time education in India]

8. Deposit in notified bonds of NABARD

9. Deposit in Senior Citizen Saving Scheme.

10. Contribution towards Unit Linked Insurance Plan (ULIP)

11. Notified units of Mutual Funds or UTI.

12. Notified pension scheme of UTI or MF.

13. Deposit in Sukanya Samridhi Scheme A/c. [for individual himself/herself or any girl child of

individual or girl child for whom such individual is a legal guardian]

14. Stamp duty, registration fee for acquisition of house property.

CHRIST (Deemed to be University) – B.Com (F&A) Page 1

INCOME TAX MATERIAL

Deduction & Total Income

Sec 80CCC: Contribution to Pension Fund of LIC or other insurance company

Eligible Assessee: Individual

Amount of Deduction: Max Rs.1,50,000

Sec 80CCD: Contribution to Pension scheme of Central Govt. / New pension Scheme/ Atal Pension Yojna

Eligible Assesee: Individual

Amount of deduction

Salaried Employee Other Individuals

Employees contribution **** Assesee’s contribution ****

10% of salary **** 20% of GTI ****

Whichever is lower Whichever is lower

.

Sec 80CCD(1B): Additional deduction upto Rs.50,000 shall be allowed other than contributions u/s

80CCD(1).

Sec 80CCD(2): Employers contribution to NPS for the benefit of Employee

Employer contribution is first taxable under the head salary in hands of Employee & then he gets deduction

u/s 80CCD(2) Contribution is by

Central Government being Employer Other Employer

a. Employers Contribution **** c. Employers Contribution ****

b. 14% of salary **** d. 10% of salary ****

Whichever is lower Whichever is lower

Sec 80CCE : Aggregate deduction u/s 80C+80CCC+80CCD(1) is restricted to Maximum Rs.1,50,000

Sec 80D: Deduction in respect of Medical insurance premium, central govt. Health Scheme, Preventive Health

checkup & Medical Treatment

• Eligible Assesse: Individual & HUF

• For whom:

Individual – Self, House, Parents & dependent children

HUF – Any member of HUF.

• Mode of payment

Any mode other than cash, but payment of preventive health checkup can be made in cash.

• Amount of deduction

Individual HUF

Category – A Self, Spouse, Dependent Parents Members

Children

a. Medical insurance premium Yes Yes Yes

b. CG Health Scheme Yes

c. Preventive Health checkup Yes Yes

General deduction (a+b+c) Max Rs.25,000 Max Rs.25,000 Max Rs.25,000

CHRIST (Deemed to be University) – B.Com (F&A) Page 2

INCOME TAX MATERIAL

Deduction & Total Income

+

Additional deduction (when medical Max Rs.25,000 Max Rs.25,000 Max Rs.25,000

insurance policy taken on the life of

senior citizen) Age 60 or more

Category - B

Medical Expenditure of senior Max Rs.50,000 Max Rs.50,000 Max Rs.50,000

citizen (age 60 or more) &

Mediclaim premium not paid for

such person.

Maximum deduction (A+B) Max Rs.50,000 Max Rs.50,000 Max Rs.50,000

Notes:

1. Aggregate payment for preventive health checkup of self, spouse, dependent children & parents to the

extent of Rs.5,000. However the said deduction of Rs.5,000/- is within the overall limit of Rs.25000 or

Rs. 50,000/-.

2. Deduction where premium for health insurance is paid lump sum.

Appropriate fraction of lump sum premium allowance as deduction: In a case where Mediclaim

premium is paid in lumpsum for more than one year, then, the deduction allowable under this section

for each of the relevant previous year would be equal to the appropriate fraction of such lump sum

payment.

Sec 80DD: Deduction in respect of Medical treatment & Maintenance of Handicapped dependent relative.

a. Eligible Assessee: Resident Individual & HUF

b. Amount of deduction: Flat deduction

i. Normal disability = Rs.75,000

ii Severe diability = Rs.1,25,000

c. Assessee should incur expenses on medical treatment or deposit any amount for maintenance of such

handicapped dependent relative

d. Relative Individual – spouse, brother, sister, children, mother, father.

HUF – Any member of HUF.

Sec 80DDB: Deduction in respect of medical treatment of specified diseases

a. Eligible Assessee: Resident Individual / HUF

b. Amount of deduction

Actual Expenses ****

Or

Maximum Rs.40,000/Rs.1,00,000 ****

Whichever is lower

CHRIST (Deemed to be University) – B.Com (F&A) Page 3

INCOME TAX MATERIAL

Deduction & Total Income

Notes:

1. Assesee should incur expenses on medical treatment or deposit any amount for maintenance of such

handicapped dependent relative.

2. Relative Individual – Spouse, brother, sister, children, mother, and father.

3. In case of HUF – Any member of HUF

Sec – 80U Deduction for handicapped assesse

a. Eligible Assessee: Resident Individual

b. Amount of deduction: Flat deduction

Normal Disability : Rs.75,000

Sever Disability : Rs.1,25,000

Sec - 80E Sec - 80EE

Assessee Individual Individual

Loan Loan for pursuing his higher education for Loan for acquisition of residential house

himself or his relative property

Amount of Interest amount for a period of 8 consecutive Max Rs.50,000

deduction years starting first deduction should be claimed u/s24(b) of

house property (upto 2,00,00o) & remaining

int deduction u/s 80EE

Conditions a. Loan should be taken from bank or financial

institution for acquisition of residential

property

b. Purchase price of house upto Rs.50 lakh

c. Loan should be sanctioned between 1-4-

2016 to 31-3-2017

d. Loan amount upto Rs.35 lakh

e. Assessee does not own any residential

house on date of sanction of loan.

80EEA 80EEB

Assessee Individual Individual

Loan Loan for acquisition of residential house Loan for electric vehicle

property

Amount of Max Rs.1,50,000 Max Rs.1,50,000

deduction first deduction should be claimed u/s24(b) of

house property (upto 2,00,00o) & remaining

int deduction u/s 80EE

CHRIST (Deemed to be University) – B.Com (F&A) Page 4

INCOME TAX MATERIAL

Deduction & Total Income

Conditions a. Loan should be taken from bank or financial a. Loan should be taken for purchase of an

institution for acquisition of residential electric vehicle.

property b. Loan should be sanctioned between 1-4-

b. Purchase price of house upto Rs.45 lakh 2019 to 31-3-2023

c. Loan should be sanctioned between 1-4- c. Loan should be sanctioned by a FI (bank or

2019 to 31-3-2020 specified NBFC’s)

d. The individual should not be eligible to d. The assesse should be an individual.

claim deduction u/s 80EE

e. Assessee does not own any residential

house on date of sanction of loan.

Donation

Sec – 80G

a. Eligible assesse: Any person

b. Quantum of deduction:

I I. Donation qualifying for 100% deduction, without any qualifying limit

1. The National Defence Fund set up by the central government

2. Prime Minister’s National Relief Fund

3. Prime Minister’s Armenia Earthquake Relief Fund

4. The Africa (Public Contributions-India) Fund

5. The National Children’s Fund

6. The National Foundation for Communal Harmony

7. Approved University or educational institution of national eminence

8. Chief Minister’s Earthquake Relief Fund, Maharashtra

9. Any fund set up by the State Government of Gujarat exclusively for providing relief to the victims of

the Gujarat earthquake

10. Any Zila Saksharta Samiti constituted in any district for improvement of primary education in

villages and towns and for literacy and post-literacy activities

11. National Blood Transfusion Council or any State Blood Transfusion Council

12. Any State Government Fund set up to provide medical reliefs to the poor

13. The Army Central Welfare Fund or Indian Naval Benevolent Fund or Air Force Central Welfare

Fund

14. The Andhra Pradesh Chief Minister’s Cyclone Relief Fund, 1996

15. The National illness Assistance Fund

16. The Chief Ministers Relief Fund or Lieutenant Governor’s Relief Fund in respect of any state or

union territory

17. The National Sports Fund set up by the Central Government

18. The National Cultural Fund set up by the Central Government

CHRIST (Deemed to be University) – B.Com (F&A) Page 5

INCOME TAX MATERIAL

Deduction & Total Income

19. The Fund for Technology Development and Application set up by the Central Government

20. Nation Trust for welfare of persons with Autism, Cerebal Palsy, Mental Retardation and Multiple

Disabilities

21. The Swach Bharat Kosh

22. The Clean Ganga

23. The National Fund for Control of Drug Abuse

II Donation qualifying for 50% deduction, without any qualifying limit

1. The Jawaharlal Nehru Memorial Fund

2. Prime Minister’s Drought Relief Fund

3. Indira Gandhi Memorial Trust

4. Rajiv Gandhi Foundation

III Donation qualifying for 100% deduction, subject to qualifying limit

1. The government or to any approved local authority, institution or association for promotion of

family planning.

2. Sum paid by company as donation to the Indian Olympic Assocaition or any other

association/institution established by the govt for development of infra for sports or games, or the

sponsorship of sports and games in India.

IV Donation qualifying for 50% deduction, subject to qualifying limit

1. Any institution or Fund established in India for charitable purposes fulfilling prescribed conditions

2. The government or any local authority for utilization for any charitable purpose other than the

purpose of promoting family planning

3. An authority constituted for housing accommodation or for purpose of planning, development or

improvement of cities, towns, and villages, or both.

4. Any corporation established for promoting the interests of the members of a minority community

5. For renovation or repair of temple, mosque, gurdwara, church or other place of historic,

archaeological or artistic importance or which is a place of public worship

Qualifying limit:

Step 1: Adjusted total income i.e., GTI reduced by the following:

a. Deductions under chapter VI-A, expect under section 80G

b. Short-term capital gain taxable u/s 111A

c. Long-term capital gains taxable u/s 112 & 112A

d. Any income on which income tax is not payable.

Step 2: Calculate 10% of adjusted total income

Step 3: Calculate the actual donation

CHRIST (Deemed to be University) – B.Com (F&A) Page 6

INCOME TAX MATERIAL

Deduction & Total Income

Step 4: Lower of Step 2 or Step 3

Step 5: the said deduction is adjusted first against donations qualifying for 100% deduction. Thereafter,

50% of balance qualifies for deduction u/s 80G.

Note: No deduction shall be allowed in respect of donation of any sum exceeding Rs.2,000 unless such sum

is paid by any mode other than cash.

.

Sec – 80 GG

a. Eligible Assessee: Any assessee who is not in receipt of HRA qualifying for exemption u/s 10(13A) from

employer and who pays rent for accommodation occupied by him for residential purpose.

b. Conditions

1. The assesse should not be receiving any HRA.

2. Expenditure incurred by him on rent exceed 10% of hi total income.

3. Accommodation should be occupied by the assesse for the purpose of his own residence.

4. Assessee or his spouse or his minor child or a HUF should not own any accommodation at the place

where he resides or perform duties of his office or employment or carries on his business or

profession.

c. Quantum of deduction:

1. Actual rent paid – 10% of adjusted total income

2. 25% of adjusted total income

3. Rs.5,000 p.m.

Whichever is lower

Sec – 80GGA

a. Eligible assesse: Any assesse not having income under “Profits and gains of business or profession”,

who makes donations to scientific research or rural development.

b. Quantum of deduction: Entire amount of donations.

Note: No deduction shall be allowed in respect of donation of any sum exceeding 10,000 unless such sum is

paid by any mode other than cash.

Sec – 80GGB

a. Eligible assesse: Indian company

b. Quantum of deduction: entire of donation

Sec – 80GGC

a. Eligible assesse: Any person

b. Quantum of deduction: Entire amount of donations.

Political Party means a political party registered under sec – 29 A of The Representation of the People Act,

1951.

Sec – 80JJAA Deduction in respect of Employment of new employees

Eligible Assessee: Any assesse engaged in Business & to whom Sec 44Ab applies (i.e., T/O exceeds Rs.1 cr)

CHRIST (Deemed to be University) – B.Com (F&A) Page 7

INCOME TAX MATERIAL

Deduction & Total Income

Amount of deduction: 30% Additional Employee cost (deduction allowed for 3 consecutive years)

Additional Employee cost: total employment paid or payable to additional employees employed during the PY.

1. In case of existing business, additional employee cost shall be Nil, if

a. There is no increase in the total number of employees.

b. Emoluments paid otherwise than by A/C payee Cheque/ Draft/NEFT/RTGS (means paid in cash)

2. In case of New Business – Additional employee cost shall be emoluments paid / payable to employees

employed during that PY.

3. Additional employees do not include –

- Employee whose emoluments > Rs.25,000 p.m.

- Employee employed for less than 240 days in PY (in case of manufacture of apparel or footwear or

leather products then 150 days)

- Employee does not participate in RPF.

- Employee for whom the entire contribution is paid by Government under Employees Pension

Scheme notified in accordance with the provision of Employees Provident Funds & Miscellaneous

Provision Act, 1952.

Note – If an employee is employed during the previous year for less than 240 days or 150 days, as the case may

be, in the immediately succeeding year, he shall be deemed to have been employed in the succeeding year.

Accordingly, the employer would be entitled to deduction of 30% of additional employee cost of such emloyees

in the succeeding year.

Part B : Revenue based deduction

Section Eligible Assessee Eligible Income Permissible Deduction

80QQB Resident Individual, Royalty income etc,. of authors of Income derived in the exercise of

being an author certain books other than text profession or Rs.3,00,000

books. whichever is less.

80RRB Resident Individual Royalty on patents Whole of such income or

being a patentee Rs.3,00,000 whichever is less.

80 TTA Individual or a HUF, Interest on deposits in saving Actual Interest Or

Other than a resident account Rs.10,000

senior citizen Whichever is lower

80 TTB Resident Senior Interest on deposits with banking Actual Interest Or

Citizen company, co-operative society Rs.50,000

engaged in banking or a post Whichever is lower

CHRIST (Deemed to be University) – B.Com (F&A) Page 8

INCOME TAX MATERIAL

Deduction & Total Income

➢ Total Income: Total income has to be computed as per the provisions contained in the Income-tax Act,

1961. The following steps has to be followed for computing the total income of an assessee:

Step-1: Determination of residential status.

Step-2: Classification of income under different heads.

Step-3: Computation of income under each head after providing for permissible deductions/exemptions.

Step-4: Clubbing of income of spouse, minor child etc.

Step-5: Set-off or carry forward and set-off of losses.

Step-6: Computation of Gross Total Income.

Step-7: Deductions from Gross Total Income.

Step-8: Computation of Total Income.

Step-9: Application of the rates of tax on the total income.

Step-10: Surcharge/Rebate under section 87A.

Step-11: Health and education cess on income-tax.

Step-12: Advance Tax and Tax Deducted at Source.

Step-13: Tax Payable/ Tax Refundable.

CHRIST (Deemed to be University) – B.Com (F&A) Page 9

You might also like

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- Taller Planeación AgregadaDocument3 pagesTaller Planeación AgregadaJulio RodelNo ratings yet

- Dynamic Modeling Using Aspen HYSYS® For Oil and Gas - Course Number EB1105.06.04Document205 pagesDynamic Modeling Using Aspen HYSYS® For Oil and Gas - Course Number EB1105.06.04Kumar100% (6)

- Deductions From Gross Total IncomeDocument4 pagesDeductions From Gross Total Income887 shivam guptaNo ratings yet

- Chapter-7 DeductionDocument7 pagesChapter-7 DeductionBrinda RNo ratings yet

- Deduction ProvisionsDocument11 pagesDeduction ProvisionsdevasrisaivNo ratings yet

- ClubbingDocument8 pagesClubbingSiddharth VaswaniNo ratings yet

- Deductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeDocument28 pagesDeductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeAmar ItagiNo ratings yet

- Deductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeDocument29 pagesDeductions: Basic Rule The Aggregate Amount of Deductions Under Sections 80C To 80U Cannot Exceed The Gross Total IncomeashpakkhatikNo ratings yet

- Income Tax Rate 2010Document6 pagesIncome Tax Rate 2010Vishal JwellNo ratings yet

- DEDUCTIONS FROM GROSS TOTAL INCOME (CHAPTER VI-A (Autosaved)Document19 pagesDEDUCTIONS FROM GROSS TOTAL INCOME (CHAPTER VI-A (Autosaved)rathnamano186No ratings yet

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenDocument8 pagesInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaNo ratings yet

- Unit 4 Deductions From Gross Total IncomeDocument31 pagesUnit 4 Deductions From Gross Total IncomeDisha GuptaNo ratings yet

- Deductions 2021 22Document5 pagesDeductions 2021 22Karan RajakNo ratings yet

- Deductions To Be Made in Computing Total IncomeDocument36 pagesDeductions To Be Made in Computing Total Incomerathnamano186No ratings yet

- 2-Income Tax Rules For The Year 2011-12Document6 pages2-Income Tax Rules For The Year 2011-12Nataraj PvnNo ratings yet

- Revised - DeductionsDocument29 pagesRevised - Deductionsdevkinger1212No ratings yet

- Income Tax Guide FY 2023-24Document11 pagesIncome Tax Guide FY 2023-24akshay yadavNo ratings yet

- Section 80C To 80U 1Document41 pagesSection 80C To 80U 1karanmasharNo ratings yet

- TaxPlanning06 07Document17 pagesTaxPlanning06 07Lathif PashaNo ratings yet

- Question:-Q Write Note On Deduction U/s 80 C To 80 UDocument15 pagesQuestion:-Q Write Note On Deduction U/s 80 C To 80 UnikhilNo ratings yet

- D COMPUTATION OF TOTAL INCOME (TAX) LatestDocument6 pagesD COMPUTATION OF TOTAL INCOME (TAX) LatestOmkar NakasheNo ratings yet

- Deductions - For StudentsDocument29 pagesDeductions - For Studentsdevkinger1212No ratings yet

- Section 80C To 80UDocument41 pagesSection 80C To 80UanupchicheNo ratings yet

- Income Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011Document6 pagesIncome Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011jhancyNo ratings yet

- Atc AtuDocument9 pagesAtc AtuKeshav SagarNo ratings yet

- Direct TaxDocument13 pagesDirect TaxUMMYSALMA DAMANIANo ratings yet

- Guidelines For Income Tax Deduction FY15-16Document14 pagesGuidelines For Income Tax Deduction FY15-16Sharad ShahNo ratings yet

- Guidance Note FY 20-21 - Submitting Investment ProofDocument11 pagesGuidance Note FY 20-21 - Submitting Investment Proofdeepakraj610No ratings yet

- On Employee Tax SavingDocument21 pagesOn Employee Tax SavingChaitanya MadisettyNo ratings yet

- GIT - Total Income Exam QP - 18-3-2020Document18 pagesGIT - Total Income Exam QP - 18-3-2020geddadaarunNo ratings yet

- Chapter ViaDocument4 pagesChapter ViaCA Gourav JashnaniNo ratings yet

- 80D DeductionDocument6 pages80D DeductionsedunairNo ratings yet

- Income-Tax-Fy2016-17 Income-Tax Benefits From Life Insurance and Rates For Assessment Year 2017-2018 (Financial Year 2016-2017)Document3 pagesIncome-Tax-Fy2016-17 Income-Tax Benefits From Life Insurance and Rates For Assessment Year 2017-2018 (Financial Year 2016-2017)Puran Singh LabanaNo ratings yet

- Deductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActDocument8 pagesDeductions From Gross Total Income: Deductions Allowable Under Various Sections of Chapter VIA of Income Tax ActalisagasaNo ratings yet

- Computing Adjusted Gross Total Income: Investment Based Deductions Income Based Deduction Special DeductionsDocument5 pagesComputing Adjusted Gross Total Income: Investment Based Deductions Income Based Deduction Special Deductions6804 Anushka GhoshNo ratings yet

- Salient Features:: LIC Introduces New Jeevan Nidhi' - Deferred Pension PlanDocument5 pagesSalient Features:: LIC Introduces New Jeevan Nidhi' - Deferred Pension PlanPramod Kumar SaxenaNo ratings yet

- What Is TaxDocument5 pagesWhat Is TaxVenkatesh YerramsettiNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Section 80 CDocument5 pagesSection 80 CAmit RoyNo ratings yet

- Income Tax Section 80Document19 pagesIncome Tax Section 80DEV HUGENNo ratings yet

- MRP 12th Plan GuidelinesDocument9 pagesMRP 12th Plan GuidelinesDeepanjali NigamNo ratings yet

- ASSESSMENT YEAR 2014 Tax Rates and DetailsDocument6 pagesASSESSMENT YEAR 2014 Tax Rates and Detailsamit2201No ratings yet

- Deductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Document37 pagesDeductions Under Chapter VI A - d17d562d b594 4627 9fb3 E1efc2352b13Subiksha LakshNo ratings yet

- Deductions Under IT Act PDFDocument64 pagesDeductions Under IT Act PDFRipunjoy SonowalNo ratings yet

- Form C GuidelinesDocument9 pagesForm C GuidelinesaminashNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- DEDUCTIONSDocument16 pagesDEDUCTIONSArpit VermaNo ratings yet

- TM Module IV NotesDocument16 pagesTM Module IV NotesAnkur DubeyNo ratings yet

- Inc Tax DedDocument38 pagesInc Tax DedpoojaNo ratings yet

- Crosswalk CPA Review: Tax UpdateDocument4 pagesCrosswalk CPA Review: Tax UpdateAdhira VenkatNo ratings yet

- q4xRQ-4 Resources 5848 DT CMA Final Part 2 2020-21 Lyst2690Document183 pagesq4xRQ-4 Resources 5848 DT CMA Final Part 2 2020-21 Lyst2690Gaurav GaurNo ratings yet

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationDocument10 pagesNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaNo ratings yet

- Income Tax ProjectDocument26 pagesIncome Tax ProjectVinay KumarNo ratings yet

- Income Tax Savings SectionsDocument2 pagesIncome Tax Savings Sectionsharvinder thukralNo ratings yet

- 80C Deductions: LIC, PF, PPF EtcDocument6 pages80C Deductions: LIC, PF, PPF EtcMerwyn DsouzaNo ratings yet

- DeductionsDocument7 pagesDeductionsManjeet KaurNo ratings yet

- Deductions U/S 80C TO 80U: By: Sumit BediDocument69 pagesDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniNo ratings yet

- Deductions U/S 80C TO 80UDocument55 pagesDeductions U/S 80C TO 80UAnshu kumarNo ratings yet

- Lesson 4: Qualitative Research in Different Areas of KnowledgeDocument9 pagesLesson 4: Qualitative Research in Different Areas of KnowledgeCarmela Del MarNo ratings yet

- 1 s2.0 S1044580316303412 MainDocument15 pages1 s2.0 S1044580316303412 MainShariful IslamNo ratings yet

- Storytelling For Marketing and Entrepreneurship: - Course ManualDocument41 pagesStorytelling For Marketing and Entrepreneurship: - Course ManualRebeca CapelattoNo ratings yet

- D3E8008FB63-Body On Board DiagnosticDocument172 pagesD3E8008FB63-Body On Board DiagnosticAymen HammiNo ratings yet

- EVACS16 Installation ManualDocument17 pagesEVACS16 Installation ManualRonaldo RomeroNo ratings yet

- Effect of Taxes and Subsidies On Market EquilibriumDocument16 pagesEffect of Taxes and Subsidies On Market EquilibriumPrasetyo HartantoNo ratings yet

- Christian Eminent College: Department of Computer Science and ElectronicsDocument6 pagesChristian Eminent College: Department of Computer Science and Electronicsfake id1No ratings yet

- Revision Process of MeasurementDocument3 pagesRevision Process of MeasurementAISHAH IWANI BINTI ZULKARNAIN A22DW0732No ratings yet

- Test 2Document2 pagesTest 2maingocttNo ratings yet

- Rme April 2019 Exam 7 Key PDFDocument8 pagesRme April 2019 Exam 7 Key PDFJevan CalaqueNo ratings yet

- English 2023Document2 pagesEnglish 2023Kamran YousifNo ratings yet

- Mivan Technology Reasearch PaperDocument4 pagesMivan Technology Reasearch PaperKushal Patil100% (8)

- EFHSIS MilestonesDocument26 pagesEFHSIS Milestoneszhei43No ratings yet

- Gmail - Booking Confirmation On IRCTC, Train - 13154, 05-Nov-2019, SL, NFK - SDAHDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 13154, 05-Nov-2019, SL, NFK - SDAHJetha LalNo ratings yet

- HMT306 Food Processing and PreservationDocument431 pagesHMT306 Food Processing and Preservationgumnani.rewachandNo ratings yet

- DILG Resources 2013108 9774ac16f4 PDFDocument2 pagesDILG Resources 2013108 9774ac16f4 PDFJhacie OronganNo ratings yet

- Sixty Years of Indian ParliamentDocument19 pagesSixty Years of Indian ParliamentPawan SharmaNo ratings yet

- Murray's Catering MenuDocument12 pagesMurray's Catering MenuMarketingNo ratings yet

- Presentation JSDMDocument10 pagesPresentation JSDMRani RajNo ratings yet

- Tugas Bahasa Inggris 1 - 15 April 2020 Name: Rosevil Pairunan Class:x Mipa 1 Read The Following Text Carefully!Document6 pagesTugas Bahasa Inggris 1 - 15 April 2020 Name: Rosevil Pairunan Class:x Mipa 1 Read The Following Text Carefully!Juwita CrysiaNo ratings yet

- Harman/Kardon AVR 254 Service Manual)Document189 pagesHarman/Kardon AVR 254 Service Manual)jrubins100% (1)

- Cayenne Turbo S E-Hybrid Models - Brochure PDFDocument23 pagesCayenne Turbo S E-Hybrid Models - Brochure PDFErmin ŠakušićNo ratings yet

- EUROPART Inter Catalog MB Truck 2014 ENDocument400 pagesEUROPART Inter Catalog MB Truck 2014 ENBoumediene CHIKHAOUINo ratings yet

- P1125P1/P1250E1: Output RatingsDocument6 pagesP1125P1/P1250E1: Output Ratingsmohsen_cumminsNo ratings yet

- Appellants: Renu Tandon vs. Respondent: Union of India (UOI)Document7 pagesAppellants: Renu Tandon vs. Respondent: Union of India (UOI)aridaman raghuvanshiNo ratings yet

- Bridgeing The Gap Between Academia and IndustryDocument3 pagesBridgeing The Gap Between Academia and Industrypankaj_97No ratings yet

- Referee Report AAS - Fauzan Arsa RamadhianDocument4 pagesReferee Report AAS - Fauzan Arsa RamadhianRamadhan Satrio WibowoNo ratings yet

- Business-Math Module 4Document12 pagesBusiness-Math Module 4Kenny Jones Amlos100% (1)