Professional Documents

Culture Documents

Fund Tech

Fund Tech

Uploaded by

Bina ShahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fund Tech

Fund Tech

Uploaded by

Bina ShahCopyright:

Available Formats

FUNDTECH

What is FundTech?

An intelligent portfolio created by Robo Advisory with a combination of fundamental and technical

parameters which is suitable for active investors who want to invest in companies with positive

financial trend subject to thresholds of Quality and Valuation.

Key Features of FundTech

Multicap Portfolio Quant based model to Pre-defined Well defined Risk

with combination of identify stocks basis Exit criteria Management

different market caps. parameter like quality, to weed out losers framework for

Valuation, Financial from portfolios. Sector/Stock weights.

trend & Technical.

Investment Universe, Process & Strategy

• Dynamic Portfolio creation comprising of 10 to 20 stocks

• Identifying stocks through screening based on parameters like Quality, Valuation, Financial

Trend & Technical Parameters

• Maximum exposure of 30% in any sector & 10% in a single stock

USP Active Investment

Stratgey

Robo Managed

Process

Combination of Fundamental

& Technical Parameters

Rebalancing Strategy

• Continuous re-evaluation of portfolio in case of adverse change in the stock selection criteria

• Corporate governance issue in the company

• Stock underperformance between 15-25% Vs Benchmark BSE500

For Whom?

Investors with aggressive risk profile having an investment horizon of minimum 3 – 5 years.

Basic Details

NO. OF STOCKS BENCHMARK RISK TIME FRAME

10-20 BSE500 Aggressive 3-5 years RIA

RIA offered by Vivekam Financial Services Private Ltd.

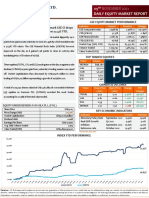

FUNDTECH Performance

Jun-22(%) 3 M(%) 6 M(%) 1 Yr.(%) LTD(%)

FUNDTECH -10.01 -17.97 -25.44 -4.39 28.17

BSE 500 -5.21 -10.00 -10.44 -0.65 22.18

*Launch Date October 2020. Model Portfolio Performance as on 30th June 2022, computed from launch date. Clients Actual Portfolio

Stocks/ Returns May Vary depending on their entry date. LTD Returns are CAGR

Top Stock Holding

TATA SRF

GHCL Ltd. OIL INDIA GAIL

ELXSI

SIP LUMP SUM

Option: Systematic investment on Dates (1,8,18,22) Option: One Time Investment

Min Amount: 2.5 lakhs

Min Amount: Rs. 10,000

Top Up: Min Rs. 25000 & in multiples of Rs. 1000

Top Up: Investment will be done in LUMP SUM MODE

Subscription mode: Upfront Subscription or Fixed

Subscription mode: Only Fixed Fee Model

Fee Model

Withdrawal: Full Withdrawal: Full or Partial

Charges of FundTech Subscription

Upfront Subscription Fixed fees Model

RIA Charges: 2% p.a (Chargeable Half yearly at 1% for RIA Charges: 20% performance Fees above 10%

6 months) Hurdle rate (Charged quarterly) Higher water

Brokerage: 0.50% + statutory costs marked with Maximum Fees cap at `1.25 Lakhs

Exit Load: 0.5%

Brokerage: 1.00% + Statutory costs.

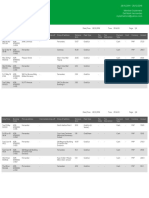

How to subscribe to FundTech through MOFSL?

Log in to MO Investor App > From Main menu select Invest Now

Step 1:

Log in to MO Investor Web > Select Help Me Invest

Step 2: Select Intelligent Advisory Products > Select FundTech Step 5: Select Subscription Model

Step 3: Select Start SIP or Lumpsum Step 6: RIA Generates Advice

Step 4: Complete KYC & Risk profiler Step 7: You give consent & Invest In Portfolio

View Video

Scan QR Code to download MO Investor App

Available on Android & Apple

For more information, email us - iapquery@motilaloswal.com

Intelligent Advisory Portfolios

Mo�lal Oswal Financial Services Limited (MOFSL)* Member of NSE, BSE, MCX, NCDEX CIN No.: L67190MH2005PLC153397

Registered Office Address: Mo�lal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai-400025; Tel No.: 022-71934263; Website www.mo�laloswal.com.

Correspondence Office Address: Palm Spring Centre, 2nd Floor, Palm Court Complex, New Link Road, Malad (West), Mumbai- 400 064. Tel No: 022 7188 1000. Registra�on Nos.: Mo�lal Oswal

Financial Services Limited (MOFSL)*: INZ000158836. (BSE/NSE/MCX/NCDEX); CDSL and NSDL: IN-DP-16-2015; Research Analyst: INH000000412. AMFI: ARN - 146822; Investment Adviser:

INA000007100; Insurance Corporate Agent: CA0579. Mo�lal Oswal Asset Management Company Ltd. (MOAMC): PMS (Registra�on No.: INP000000670); PMS and Mutual Funds are offered through

MOAMC which is group company of MOFSL. Mo�lal Oswal Wealth Management Ltd. (MOWML): PMS (Registra�on No.: INP000004409) is offered through MOWML, which is a group company of

MOFSL. • Mo�lal Oswal Financial Services Limited is a distributor of Mutual Funds, PMS, Fixed Deposit, Bond, NCDs, Insurance Products , Investment advisor and IPOs.etc • Real Estate is offered

through Mo�lal Oswal Real Estate Investment Advisors II Pvt. Ltd. which is a group company of MOFSL. • Private Equity is offered through Mo�lal Oswal Private Equity Investment Advisors Pvt. Ltd

which is a group company of MOFSL. • Research & Advisory services is backed by proper research. Please read the Risk Disclosure Document prescribed by the Stock Exchanges carefully before

inves�ng. There is no assurance or guarantee of the returns. PMS is not offered in Commodity Deriva�ves segment. Details of Compliance Officer: Name: Neeraj Agarwal, Email ID: na@mo�-

laloswal.com, Contact No.:022-71881085. *MOSL has been amalgamated with Mo�lal Oswal Financial Services Limited (MOFSL) w.e.f August 21, 2018 pursuant to order dated July 30, 2018 issued

by Hon'ble Na�onal Company Law Tribunal, Mumbai Bench. The informa�on is only for consump�on by the client and such material should not be redistributed. The securi�es quoted are exemplary

and are not recommendatory. Brokerage will not exceed SEBI prescribed limit. Customer having any query/feedback/ clarifica�on may write to query@mo�laloswal.com. In case of grievances for

Securi�es Broking write to grievances@mo�laloswal.com, for DP to dpgrievances@mo�laloswal.com.

Investment in securi�es market are subject to market risks, read all the related documents carefully before inves�ng.

MOFSL is ac�ng as distributor of Investment Advisory services for Vivekam Financial Services Private Ltd: Registra�on no. INA200000316. This is not Exchange traded product. All disputes with respect

to the distribu�on ac�vity, would not have access to Exchange investor redressal forum or Arbitra�on mechanism.

You might also like

- Practice Problem On Capital BudgetingDocument29 pagesPractice Problem On Capital BudgetingPadyala Sriram91% (11)

- Project Coordinator Exam Ligutan KennethDocument18 pagesProject Coordinator Exam Ligutan KennethAB12A3 - Lauron Nicole NiñaNo ratings yet

- Additional Request FormDocument2 pagesAdditional Request Formali46% (13)

- COINBASE - 2023 Crypto Market OutlookDocument57 pagesCOINBASE - 2023 Crypto Market OutlookSubhan ArifinNo ratings yet

- Lit ReviewDocument3 pagesLit ReviewMahnoor BajwaNo ratings yet

- Project Rupee RaftaarDocument220 pagesProject Rupee Raftaarrdx216No ratings yet

- Article 7 - Drivers of The Use and Facilitators, and Obstacles of The Evolution of Big Data by The Audit ProfessionDocument12 pagesArticle 7 - Drivers of The Use and Facilitators, and Obstacles of The Evolution of Big Data by The Audit ProfessionFakhmol RisepdoNo ratings yet

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- Construction Contract Insurance and Indemnification Clauses: Presenting A Live 90 Minute Webinar With Interactive Q&ADocument110 pagesConstruction Contract Insurance and Indemnification Clauses: Presenting A Live 90 Minute Webinar With Interactive Q&AKevinNo ratings yet

- Drydock 6Document1 pageDrydock 6sugumarNo ratings yet

- 2011 New York CAPCO Program ReportDocument104 pages2011 New York CAPCO Program ReportJen Fifield100% (1)

- Aof Sibichep 1Document19 pagesAof Sibichep 1Sibichen PhilipNo ratings yet

- SiriusXM PSAP Overview Document 446655 7Document4 pagesSiriusXM PSAP Overview Document 446655 7AdityaNo ratings yet

- What Is Ns Mid & Small Cap?Document2 pagesWhat Is Ns Mid & Small Cap?Bina ShahNo ratings yet

- Ns Industry ChampDocument2 pagesNs Industry ChampBina ShahNo ratings yet

- March April and May Schemes and Reports 2023Document124 pagesMarch April and May Schemes and Reports 2023adhikar007No ratings yet

- Presentation Super BowlDocument8 pagesPresentation Super BowlAdeelSiddiqueNo ratings yet

- Small Case and Wealth BasketDocument27 pagesSmall Case and Wealth BasketManishSharmaNo ratings yet

- Department of Foreign Affairs: Passport Application FormDocument4 pagesDepartment of Foreign Affairs: Passport Application FormEdwin DebelenNo ratings yet

- Profile - Dr. Shiva Narayan PHDDocument3 pagesProfile - Dr. Shiva Narayan PHDDr. Shiva NarayanNo ratings yet

- Counterfeit Deterrent Features For The Next-Generation Currency Design (PDFDrive)Document145 pagesCounterfeit Deterrent Features For The Next-Generation Currency Design (PDFDrive)allUddinNo ratings yet

- Ipl Player ListDocument7 pagesIpl Player ListShail Mishra100% (1)

- Model Airplane News 1959-06Document71 pagesModel Airplane News 1959-06Thomas KirschNo ratings yet

- Doing Business in China OverviewDocument36 pagesDoing Business in China OverviewĐào Phương OanhNo ratings yet

- Current: Current Shots 365 Yearly MagazineDocument112 pagesCurrent: Current Shots 365 Yearly MagazineShourya GautamNo ratings yet

- China's Wolf Warrior' Diplomats Use Political Warfare Against USDocument52 pagesChina's Wolf Warrior' Diplomats Use Political Warfare Against USKeithStewartNo ratings yet

- Future and Growth of Life InsuranceDocument4 pagesFuture and Growth of Life InsuranceRENUKA THOTENo ratings yet

- PDF 04 Partnership Liquidation DLDocument38 pagesPDF 04 Partnership Liquidation DLSofia SerranoNo ratings yet

- 1542 Jeffrey D Zients Oge 278eDocument11 pages1542 Jeffrey D Zients Oge 278eWashington ExaminerNo ratings yet

- Happiness Slipping Away Unhappy IndiaDocument6 pagesHappiness Slipping Away Unhappy IndiaEditor IJTSRDNo ratings yet

- Impact of Public Debt On Nigeria's EconomyDocument6 pagesImpact of Public Debt On Nigeria's EconomyKIU PUBLICATION AND EXTENSIONNo ratings yet

- CertificateDocument1 pageCertificateShamsurahman ShamsiNo ratings yet

- LYNIFER Business PlanDocument56 pagesLYNIFER Business PlanCALVINS OJWANGNo ratings yet

- Sept 2022 Belmont Poll Release - FinalDocument3 pagesSept 2022 Belmont Poll Release - FinalJack SterneNo ratings yet

- Amity Law School: Case AnalysisDocument10 pagesAmity Law School: Case AnalysisRishab Choudhary100% (1)

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Terms and Conditions 27 06 PDFDocument4 pagesTerms and Conditions 27 06 PDFShreyash NaikwadiNo ratings yet

- Koetsier v. Does 1-486 - Complaint (Copyright)Document16 pagesKoetsier v. Does 1-486 - Complaint (Copyright)Sarah BursteinNo ratings yet

- Our Protagonists: The Firm The InvestorDocument14 pagesOur Protagonists: The Firm The InvestorSrabasti NandiNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate GovernanceBenita BijuNo ratings yet

- F2 Chap 1 2Document22 pagesF2 Chap 1 2Sean R Bn100% (1)

- Karber UndergroundFacilities-Full 2011 ReducedDocument357 pagesKarber UndergroundFacilities-Full 2011 ReducedugyaNo ratings yet

- 16341128120083003a 01Document2 pages16341128120083003a 01Mosaraf HossainNo ratings yet

- Exercise 3.0 ANSWERDocument3 pagesExercise 3.0 ANSWERmaizurah abdullahNo ratings yet

- Dec - Nithya - istqbAT - Vue Bill2Document2 pagesDec - Nithya - istqbAT - Vue Bill2kumarinithuNo ratings yet

- Chapter 2Document20 pagesChapter 2Muhamad FaisalNo ratings yet

- Popular Mechanics South Africa #10 (2017)Document105 pagesPopular Mechanics South Africa #10 (2017)Lester SaquerNo ratings yet

- Ok - Fao - Org-4 AQUACULTURE METHODS AND PRACTICES A SELECTED REVIEWDocument49 pagesOk - Fao - Org-4 AQUACULTURE METHODS AND PRACTICES A SELECTED REVIEWVicente SalanapNo ratings yet

- SBTalent Camp Audition FormDocument1 pageSBTalent Camp Audition FormKyledana FranciscoNo ratings yet

- TruecallerDocument29 pagesTruecallerSijan BhusalNo ratings yet

- Redbus TicketDocument4 pagesRedbus TicketNiharika RangasamudramNo ratings yet

- GSC3610 QigDocument25 pagesGSC3610 QigRishab SharmaNo ratings yet

- FBI - Hairs, Fibers, Crime, and Evidence, Part 2, by Deedrick (Forensic Science Communications, July 2000)Document4 pagesFBI - Hairs, Fibers, Crime, and Evidence, Part 2, by Deedrick (Forensic Science Communications, July 2000)Talix M. LizcanoNo ratings yet

- Understanding China's Maritime Policy 21st Century Maritime Silk Road - Teng JianqunDocument5 pagesUnderstanding China's Maritime Policy 21st Century Maritime Silk Road - Teng JianqunGobin SookramNo ratings yet

- 2020 ProspectusDocument20 pages2020 ProspectusMbogi TokaNo ratings yet

- TOPIC 5-Budgetary PlanningDocument73 pagesTOPIC 5-Budgetary PlanningDashania GregoryNo ratings yet

- Commercial Law Syllabus With NotesDocument73 pagesCommercial Law Syllabus With NotesVictoria Ashley PepitoNo ratings yet

- IAE393248Document7 pagesIAE393248Raman GuptaNo ratings yet

- MC - Reinsurance Market - 1694602900Document76 pagesMC - Reinsurance Market - 1694602900amin.touahriNo ratings yet

- In Gov transport-RVCER-TN39BP7999Document1 pageIn Gov transport-RVCER-TN39BP7999Navin RsNo ratings yet

- 2021 2022 Xtreme WA Mock Trial CaseDocument73 pages2021 2022 Xtreme WA Mock Trial CaseGrace RosenNo ratings yet

- Angel One: Leaner, Stronger, Faster - A Transformed Broker!Document36 pagesAngel One: Leaner, Stronger, Faster - A Transformed Broker!Ravi KumarNo ratings yet

- Prime PortfolioDocument2 pagesPrime PortfolioBina ShahNo ratings yet

- What Is Alpha Bluechip?Document2 pagesWhat Is Alpha Bluechip?Bina ShahNo ratings yet

- What Is NS 5Tx5T?: Investment Universe, Process & StrategyDocument2 pagesWhat Is NS 5Tx5T?: Investment Universe, Process & StrategyBina ShahNo ratings yet

- Prime PortfolioDocument2 pagesPrime PortfolioBina ShahNo ratings yet

- No. of Stocks Benchmark Risk Time Frame RIA: What Is Zodiac?Document2 pagesNo. of Stocks Benchmark Risk Time Frame RIA: What Is Zodiac?Bina ShahNo ratings yet

- What Is Ns Mid & Small Cap?Document2 pagesWhat Is Ns Mid & Small Cap?Bina ShahNo ratings yet

- Investment Universe, Process & Strategy: What Is Abakkus Smart Flexi Cap Portfolio?Document2 pagesInvestment Universe, Process & Strategy: What Is Abakkus Smart Flexi Cap Portfolio?Bina ShahNo ratings yet

- Ns Industry ChampDocument2 pagesNs Industry ChampBina ShahNo ratings yet

- Takoya Carter-Navy-Federal-Credit-Union-August - StatementDocument4 pagesTakoya Carter-Navy-Federal-Credit-Union-August - StatementVicky KeNo ratings yet

- Ketan Parekh ScamDocument31 pagesKetan Parekh Scamolkp151019920% (1)

- Final Project Kyc FinalDocument70 pagesFinal Project Kyc FinalAnonymous HackerNo ratings yet

- Bonos Convertibles 11 SepDocument18 pagesBonos Convertibles 11 SepDIANA CABALLERONo ratings yet

- Practica Modulo 6 EnunciadosDocument3 pagesPractica Modulo 6 EnunciadosJulian Brescia2No ratings yet

- Customer Satisfaction of Dutch Bangla Bank LTDDocument40 pagesCustomer Satisfaction of Dutch Bangla Bank LTDMd. Monirul IslamNo ratings yet

- U.S.basel .III .Final .Rule .Visual - MemoDocument79 pagesU.S.basel .III .Final .Rule .Visual - Memoswapnit9995No ratings yet

- UP Tax Review NotesDocument163 pagesUP Tax Review NotesramlivsolisNo ratings yet

- Order 111-8312509-9530631Document1 pageOrder 111-8312509-9530631Adrian PlataNo ratings yet

- A Step by Step Guide To Construct A Financial Model Without Plugs and Without Circularity For Valuation PurposesDocument21 pagesA Step by Step Guide To Construct A Financial Model Without Plugs and Without Circularity For Valuation PurposesK Park100% (1)

- Metropolitan Bank & Trust Company vs. CADocument4 pagesMetropolitan Bank & Trust Company vs. CAJetJuárezNo ratings yet

- Finance Analyst - Finance All in One BundleDocument16 pagesFinance Analyst - Finance All in One Bundleyogesh patilNo ratings yet

- Department of Business Administration. Assignment 2: Financial ManagementDocument63 pagesDepartment of Business Administration. Assignment 2: Financial ManagementAmmar Ahmad EEDNo ratings yet

- Monetary Policy of BangladeshDocument26 pagesMonetary Policy of Bangladeshsuza054No ratings yet

- PSE Trading Participant SIPF and SCCP MemberDocument1 pagePSE Trading Participant SIPF and SCCP MemberAnnNo ratings yet

- Capital Market (Article Review) 1Document3 pagesCapital Market (Article Review) 1dipika upretyNo ratings yet

- Daily Equity Market Report - 09.11.2021Document1 pageDaily Equity Market Report - 09.11.2021Fuaad DodooNo ratings yet

- Transunion Credit Report User Guide: South AfricaDocument8 pagesTransunion Credit Report User Guide: South Africasonal10No ratings yet

- Certified Business AccountantDocument11 pagesCertified Business AccountantRicky MartinNo ratings yet

- Allegation On Integrity of Metrobank'S Internal Banking System and ControlDocument14 pagesAllegation On Integrity of Metrobank'S Internal Banking System and ControlDyheeNo ratings yet

- Share Based Compensation LectureDocument2 pagesShare Based Compensation LectureKimberly AsuncionNo ratings yet

- DALDA AR QuestionaireDocument8 pagesDALDA AR QuestionaireAnum ImranNo ratings yet

- Unicon Investment SolutionsDocument4 pagesUnicon Investment SolutionsVignesh Prabhu RamalingamNo ratings yet

- Section 1: CHAPTER 4: Extinguishment of ObligationsDocument9 pagesSection 1: CHAPTER 4: Extinguishment of ObligationsFrancis Dan Grecia SoltesNo ratings yet

- Mytaxi PH, Inc (008-479-980) 2/F, Rear Tower, Wilcon It Hub, Chino Roces Cor, Edsa, Bangkal Makati City, 1233 Manila, PhilippinesDocument4 pagesMytaxi PH, Inc (008-479-980) 2/F, Rear Tower, Wilcon It Hub, Chino Roces Cor, Edsa, Bangkal Makati City, 1233 Manila, PhilippinesDM HernandezNo ratings yet

- 1.1 Forex Key To CorrectionDocument4 pages1.1 Forex Key To Correctionalibanto.sherwinNo ratings yet

- Installment SaleDocument16 pagesInstallment Salerenuka03No ratings yet