Professional Documents

Culture Documents

Acounting G

Acounting G

Uploaded by

Alyssa Epi0 ratings0% found this document useful (0 votes)

25 views2 pagesQuark Spy Equipment manufactures espionage equipment using a job-order costing system. In January, it purchased $1.4 million in raw materials, incurred $316,000 in direct labor costs for 7,900 hours, and $163,200 in indirect labor costs for 10,200 hours. It also spent $190,500 on building depreciation, $890,700 on equipment depreciation, and $79,600 on utilities. The cost of jobs finished was $2.49 million and cost of goods sold was $2.38 million, while sales totaled $3.57 million.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentQuark Spy Equipment manufactures espionage equipment using a job-order costing system. In January, it purchased $1.4 million in raw materials, incurred $316,000 in direct labor costs for 7,900 hours, and $163,200 in indirect labor costs for 10,200 hours. It also spent $190,500 on building depreciation, $890,700 on equipment depreciation, and $79,600 on utilities. The cost of jobs finished was $2.49 million and cost of goods sold was $2.38 million, while sales totaled $3.57 million.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views2 pagesAcounting G

Acounting G

Uploaded by

Alyssa EpiQuark Spy Equipment manufactures espionage equipment using a job-order costing system. In January, it purchased $1.4 million in raw materials, incurred $316,000 in direct labor costs for 7,900 hours, and $163,200 in indirect labor costs for 10,200 hours. It also spent $190,500 on building depreciation, $890,700 on equipment depreciation, and $79,600 on utilities. The cost of jobs finished was $2.49 million and cost of goods sold was $2.38 million, while sales totaled $3.57 million.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

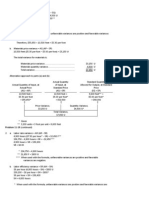

Quark Spy Equipment manufactures espionage equipment.

Quark uses a job-order cost system and

applies overhead to jobs the basis of direct labor-hours. For the current year, Quark estimated that it

would work 100,000 direct labor-hours and incur $20,000,000 of manufacturing overhead cost. The

following summarized information relates to January of the current year. The raw materials purchased

include both direct and indirect materials.

Raw materials purchased on account .............................. $1,412,000

Direct materials requisitioned into production ................ $1,299,500

Indirect materials requisitioned into production ............. $98,000

Direct labor cost (7,900 hours @ $40 per hour) .............. $316,000

Indirect labor cost (10,200 hours @ $16 per hour) ......... $163,200

Depreciation on the factory building ............................... $190,500

Depreciation on the factory equipment ........................... $890,700

Utilities for the factory .................................................... $79,600

Cost of jobs finished ........................................................ $2,494,200

Cost of jobs sold .............................................................. $2,380,000

Sales (all on account) ...................................................... $3,570,000

Required:

Prepare journal entries to record Quark's transactions for the month of January. Do not close out the

manufacturing overhead account

Answer:

Raw Materials ........................................................ 1,412,000

Accounts Payable ......................................... 1,412,000

Work in Process ..................................................... 1,299,500

Manufacturing Overhead ....................................... 98,000

Raw Materials .............................................. 1,397,500

Work in Process ..................................................... 316,000

Manufacturing Overhead ....................................... 163,200

Salaries and Wages Payable (or Cash) ......... 479,200

Work in Process ..................................................... 1,580,000

Manufacturing Overhead ............................. 1,580,000

($20,000,000/100,000) × 7,900

Manufacturing Overhead ....................................... 1,160,800

Accumulated Depreciation, Building ........... 190,500

Accumulated Depreciation, Equipment ....... 890,700

Utilities Payable (or Cash) ........................... 79,600

Finished Goods ...................................................... 2,494,200

Work in Process ........................................... 2,494,200

Cost of Goods Sold................................................ 2,380,000

Finished Goods ............................................ 2,380,000

Accounts Receivable ............................................. 3,570,000

Sales ............................................................. 3,570,000

You might also like

- Chap02 Rev. FI5 Ex 2Document18 pagesChap02 Rev. FI5 Ex 2Khate KDb100% (1)

- Exercises - Job Order CostingDocument7 pagesExercises - Job Order CostingJericho DupayaNo ratings yet

- Advance Financial Accounting and Reporting (AFAR) : Cost Accounting Cost AccumulationDocument18 pagesAdvance Financial Accounting and Reporting (AFAR) : Cost Accounting Cost AccumulationGwen Sula LacanilaoNo ratings yet

- A) $130 B) $170 C) $140 D) $60 Level: Medium LO: 2,3,4Document24 pagesA) $130 B) $170 C) $140 D) $60 Level: Medium LO: 2,3,4Ngọc MinhNo ratings yet

- QuestionsDocument13 pagesQuestionsKRZ. Arpon Root Hacker100% (1)

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- College of Business and Accountancy Bachelor of Science in AccountancyDocument3 pagesCollege of Business and Accountancy Bachelor of Science in AccountancyJhon Clark CuengcoNo ratings yet

- SC PracticeDocument6 pagesSC Practicefatima airis aradais100% (1)

- Job CostingDocument3 pagesJob Costingshakibsahel0No ratings yet

- Prelim Cost AcctngDocument2 pagesPrelim Cost AcctngAnonymous JgyJLTqpNS0% (1)

- Flexible BudgetDocument3 pagesFlexible BudgetGregorian JerahmeelNo ratings yet

- 1Document3 pages1Sunshine Vee0% (1)

- Materials Inventory P148,200 ? Work-in-Process Inventory 33,000 ? Finished Goods Inventory .. 166,000 P143,200 Cost of Goods Sold 263,400Document3 pagesMaterials Inventory P148,200 ? Work-in-Process Inventory 33,000 ? Finished Goods Inventory .. 166,000 P143,200 Cost of Goods Sold 263,400NinaNo ratings yet

- Financial Accounting Questions and Solutions Chapter 3Document7 pagesFinancial Accounting Questions and Solutions Chapter 3bazil360No ratings yet

- Job Order Costing QuizbowlDocument27 pagesJob Order Costing QuizbowlsarahbeeNo ratings yet

- Job Order Costing SAMPLE PROBLEMSDocument3 pagesJob Order Costing SAMPLE PROBLEMSDiane Cris DuqueNo ratings yet

- Cost and MGT Acct AssignmentDocument3 pagesCost and MGT Acct Assignmentasnake libsieNo ratings yet

- Standard CostingDocument2 pagesStandard CostingsumairaNo ratings yet

- Chapter 1-2 Examples OnlineDocument9 pagesChapter 1-2 Examples Onlinedeniz turkbayragi100% (1)

- Questions and AnswersDocument13 pagesQuestions and Answerss3ki0No ratings yet

- Additonal ProblemsDocument8 pagesAdditonal ProblemsMohammed Al ArmaliNo ratings yet

- Exercise STD CostingDocument1 pageExercise STD CostingMaria Callista LovinaNo ratings yet

- Cost AccountingDocument5 pagesCost Accountingrumelrashid_seuNo ratings yet

- Worksheet1-Basics & COGSDocument5 pagesWorksheet1-Basics & COGSmohsinmustafa.2001No ratings yet

- T7-Exer Sol - 1Document7 pagesT7-Exer Sol - 1Sharif Mohamad HalimNo ratings yet

- Standarvd Cost & VarianceDocument3 pagesStandarvd Cost & Variancemohammad bilalNo ratings yet

- CH 3Document12 pagesCH 3Firas HamadNo ratings yet

- Chapter 3 Try ItDocument2 pagesChapter 3 Try ItLy VõNo ratings yet

- HACC428 Tutorial QuestionsDocument36 pagesHACC428 Tutorial QuestionstapiwanashejakaNo ratings yet

- Acct2302 E3Document12 pagesAcct2302 E3zeeshan100% (1)

- Chapter 2Document16 pagesChapter 2Manish SadhuNo ratings yet

- Key Chapter 2 & 3Document9 pagesKey Chapter 2 & 3bxp9b56xv4No ratings yet

- Problem 2Document18 pagesProblem 2HaideBrocalesNo ratings yet

- Soal Introduction To Cost Terms and PurposesDocument6 pagesSoal Introduction To Cost Terms and PurposesSugata SNo ratings yet

- VarianceDocument2 pagesVarianceKenneth Bryan Tegerero Tegio0% (1)

- Exam I - Review - AnswersDocument13 pagesExam I - Review - AnswersJayson Hoang100% (1)

- Cost Accounting Midterm Exam 2018.editedDocument3 pagesCost Accounting Midterm Exam 2018.editedMarites ArcenaNo ratings yet

- Accounting JDocument3 pagesAccounting JAlyssa EpiNo ratings yet

- MA Mids Muneeb Ahmed 10180Document11 pagesMA Mids Muneeb Ahmed 10180zainNo ratings yet

- Predetermined Overhead Rates - ProblemsDocument2 pagesPredetermined Overhead Rates - ProblemsShaina Jean PiezonNo ratings yet

- Job Costing QuestionsDocument5 pagesJob Costing Questionsfaith olaNo ratings yet

- Acct Bah WDocument4 pagesAcct Bah WAbby Sta AnaNo ratings yet

- Akuntansi Biaya - Tugas E4-23Document3 pagesAkuntansi Biaya - Tugas E4-23Rizkya Ajrin ArtameviaNo ratings yet

- Acc 121 - 2023 Test - Code 2-1Document2 pagesAcc 121 - 2023 Test - Code 2-1okwejiechoice41No ratings yet

- Cost Accounting and Control Assignment #1Document3 pagesCost Accounting and Control Assignment #1カリン カリンNo ratings yet

- Activity Based Costing SystemDocument18 pagesActivity Based Costing SystemMAXA FASHIONNo ratings yet

- Assignment One and TwoDocument5 pagesAssignment One and Twowalelign yigezawNo ratings yet

- Dayag Job Order Costing - CompressDocument15 pagesDayag Job Order Costing - Compressmxndcysecond02No ratings yet

- Revision - Process Job Costing & OverheadDocument3 pagesRevision - Process Job Costing & OverheadXiiao WenNo ratings yet

- Job CostingDocument9 pagesJob CostingShan rNo ratings yet

- Assignment 1111Document8 pagesAssignment 1111SAAD HUSSAINNo ratings yet

- 7.standard Cost ProblemDocument2 pages7.standard Cost ProblemFatema TujNo ratings yet

- Exer 2 (Overhead) QDocument2 pagesExer 2 (Overhead) QFerl ElardoNo ratings yet

- Accounting FDocument2 pagesAccounting FAlyssa EpiNo ratings yet

- Activity Based CostingproblemsDocument6 pagesActivity Based CostingproblemsDebarpan HaldarNo ratings yet

- Chapter 2 - Selected AnswersDocument16 pagesChapter 2 - Selected AnswersJohsyutNo ratings yet

- Problem1:: SolutionDocument20 pagesProblem1:: SolutionPeter WagdyNo ratings yet

- Experiences, Achievements, Developments: The Ups and Downs of the Machine Tool Industries in Germany, Japan and the United StatesFrom EverandExperiences, Achievements, Developments: The Ups and Downs of the Machine Tool Industries in Germany, Japan and the United StatesNo ratings yet

- Programming Arduino Next Steps: Going Further with Sketches, Second EditionFrom EverandProgramming Arduino Next Steps: Going Further with Sketches, Second EditionRating: 3 out of 5 stars3/5 (3)

- Statement 1Document1 pageStatement 1Alyssa EpiNo ratings yet

- Puti CompanyDocument2 pagesPuti CompanyAlyssa EpiNo ratings yet

- Special CheckDocument1 pageSpecial CheckAlyssa EpiNo ratings yet

- The Following Are Available For ABC CompanyDocument2 pagesThe Following Are Available For ABC CompanyAlyssa EpiNo ratings yet

- The Effective Interest Rate On Bonds Is Higher Than The Stated Rate When Bonds SellDocument2 pagesThe Effective Interest Rate On Bonds Is Higher Than The Stated Rate When Bonds SellAlyssa Epi0% (1)

- Accounting JDocument3 pagesAccounting JAlyssa EpiNo ratings yet

- Gain On Life Insurance SettlementDocument1 pageGain On Life Insurance SettlementAlyssa EpiNo ratings yet

- Answer: D: Use The Following To Answer Questions 92-95Document3 pagesAnswer: D: Use The Following To Answer Questions 92-95Alyssa EpiNo ratings yet

- Accounting HDocument2 pagesAccounting HAlyssa EpiNo ratings yet

- Accounting FDocument2 pagesAccounting FAlyssa EpiNo ratings yet

- A289A289M-97 (2013) Standard Specification For Alloy Steel Forgings For Nonmagnetic Retaining Rings For GeneratorsDocument3 pagesA289A289M-97 (2013) Standard Specification For Alloy Steel Forgings For Nonmagnetic Retaining Rings For GeneratorsShico1983No ratings yet

- Parkers' AstrologyDocument424 pagesParkers' Astrologyvictoria20051998No ratings yet

- Manual 360 VisonicDocument70 pagesManual 360 VisonicRicardo Ortega Carbajal0% (1)

- Consumer Brand Relationship PDFDocument8 pagesConsumer Brand Relationship PDFAkshada JagtapNo ratings yet

- ANT330 Lab Report 7Document4 pagesANT330 Lab Report 7aviNo ratings yet

- 216B2, 226B2, 232B2, 236B2, 242B2, Electrical System 247B2 and 257B2 Multi-Terrain Loader and 252B2 Skid Steer LoaderDocument4 pages216B2, 226B2, 232B2, 236B2, 242B2, Electrical System 247B2 and 257B2 Multi-Terrain Loader and 252B2 Skid Steer LoaderAirton SenaNo ratings yet

- Biography of Schacht PDFDocument52 pagesBiography of Schacht PDFpjrgledhillNo ratings yet

- Job Interview Questions OkDocument2 pagesJob Interview Questions OkJaqueline FernándezNo ratings yet

- EID Vol15No1Document151 pagesEID Vol15No1ImmortalYawnNo ratings yet

- Samsung Brittle Fracture Evaluation - Additional Scope P23-0105-R3Document5 pagesSamsung Brittle Fracture Evaluation - Additional Scope P23-0105-R3Vipin NairNo ratings yet

- Slug LowDocument13 pagesSlug LowDr Mohammed AzharNo ratings yet

- Media and Information Literacy Is Defined As An Access To InformationDocument2 pagesMedia and Information Literacy Is Defined As An Access To InformationmarvinNo ratings yet

- 01 Formulae, Equations and Amount of SubstanceDocument19 pages01 Formulae, Equations and Amount of SubstanceRaja ShahrukhNo ratings yet

- E Commerce Chap 1Document28 pagesE Commerce Chap 1Jannatul FardusNo ratings yet

- Oral Iron ProductsDocument2 pagesOral Iron ProductsOlga BabiiNo ratings yet

- 8) Copper & Copper Alloy SpecificationsDocument3 pages8) Copper & Copper Alloy Specificationsnavas1972No ratings yet

- Samsung UA55KU7000 55 Inch 139cm Smart Ultra HD LED LCD TV User ManualDocument18 pagesSamsung UA55KU7000 55 Inch 139cm Smart Ultra HD LED LCD TV User ManualGuruprasad NagarajasastryNo ratings yet

- 2016 ORION Consolidated Audit ReportDocument112 pages2016 ORION Consolidated Audit ReportJoachim VIALLONNo ratings yet

- Gut DecontaminationDocument17 pagesGut DecontaminationRaju NiraulaNo ratings yet

- 1 Notes and HW On Even Odd and NeitherDocument3 pages1 Notes and HW On Even Odd and NeitherAlin LyndaNo ratings yet

- Ephesians 4 - InterlinearDocument5 pagesEphesians 4 - InterlinearSidney AlmeidaNo ratings yet

- Uv-Visibles Electronic TransitionDocument25 pagesUv-Visibles Electronic TransitionZareen Rashid Choudhury100% (1)

- IC Style Guide 2020Document20 pagesIC Style Guide 2020John Kihungi100% (1)

- Reconsidering Mary of BethanyDocument18 pagesReconsidering Mary of BethanyGeorgeAbhayanandOicNo ratings yet

- Fluid and ElectrolytesDocument23 pagesFluid and ElectrolytesNanaNo ratings yet

- How Deep Is Your LoveDocument1 pageHow Deep Is Your LoveJanina JaworskiNo ratings yet

- 9 tribologyofGO-UHWMPEDocument10 pages9 tribologyofGO-UHWMPEA P BNo ratings yet

- Result Phase III - A, B - Lot (23!03!2024)Document15 pagesResult Phase III - A, B - Lot (23!03!2024)xxxlordimpalerxxxNo ratings yet

- JTG D20-2006 EngDocument113 pagesJTG D20-2006 EngchikwawaNo ratings yet

- M23 Paper 1 - Official Exam Paper - TZ2Document4 pagesM23 Paper 1 - Official Exam Paper - TZ2sealyzon0fpsNo ratings yet