Professional Documents

Culture Documents

Weekly Capital Market Report - Week Ending 05.08.2022

Weekly Capital Market Report - Week Ending 05.08.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

You might also like

- Bloomberg Aptitude Test BATDocument35 pagesBloomberg Aptitude Test BATqcfinanceNo ratings yet

- Weekly Capital Market Report - Week Ending 12.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 12.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 29.07.2022 2022-07-29Document2 pagesWeekly Capital Market Report Week Ending 29.07.2022 2022-07-29Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 02.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 02.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 24.06.2022 2022-06-24Document2 pagesWeekly Capital Market Report Week Ending 24.06.2022 2022-06-24Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 13.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 13.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 22.07.2022 2022-07-22Document2 pagesWeekly Capital Market Report Week Ending 22.07.2022 2022-07-22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 25.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 28.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 28.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 04.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.02.2022Document3 pagesWeekly Capital Market Report - Week Ending 25.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.03.2022Document3 pagesWeekly Capital Market Report - Week Ending 04.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 15.10.2021Document2 pagesWeekly Capital Market Recap Week Ending 15.10.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 03.06.2022 2022-06-03Document2 pagesWeekly Capital Market Report Week Ending 03.06.2022 2022-06-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 29.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 29.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2022Document1 pageDaily Equity Market Report - 08.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.08.2022Document1 pageDaily Equity Market Report - 10.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 22.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 22.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2021Document1 pageDaily Equity Market Report - 05.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 16-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 16-04-2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.08.2022Document1 pageDaily Equity Market Report - 15.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.08.2022Document1 pageDaily Equity Market Report - 17.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.09.2022Document1 pageDaily Equity Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 03.09.2021Document2 pagesWeekly Capital Market Recap Week Ending 03.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- JP Morgan Case StudyDocument29 pagesJP Morgan Case StudyChiranshu KumarNo ratings yet

- Diteg - 2Document6 pagesDiteg - 2Đỗ Cẩm VânNo ratings yet

- AMN Healthcare Services, Inc. AHS: QQQQQDocument8 pagesAMN Healthcare Services, Inc. AHS: QQQQQdbskingNo ratings yet

- Three "Good" Reasons For Paying Dividends : Aswath DamodaranDocument32 pagesThree "Good" Reasons For Paying Dividends : Aswath DamodaranEXII iNo ratings yet

- FYBBA - Maths Project - Yash KhairnarDocument31 pagesFYBBA - Maths Project - Yash KhairnarYash KhairnarNo ratings yet

- Jensen (1967) - The Performance of Mutual Funds in The Period 1945-1965Document37 pagesJensen (1967) - The Performance of Mutual Funds in The Period 1945-1965pvbrandaoNo ratings yet

- Role of Financial IntermediariesDocument105 pagesRole of Financial IntermediariesMaria AngelicaNo ratings yet

- Useful Bloomberg Functions: News Equity Index OverviewDocument3 pagesUseful Bloomberg Functions: News Equity Index Overviewkarasa1No ratings yet

- EkadDocument3 pagesEkadErvin KhouwNo ratings yet

- What American Teens & Adults Know About EconomicsDocument82 pagesWhat American Teens & Adults Know About EconomicsDaniel HollowayNo ratings yet

- Ownership TypesDocument16 pagesOwnership TypesShubham Nag50% (2)

- Meghna Kashyap - Corporate Finance - Sem IX, Roll No.90Document28 pagesMeghna Kashyap - Corporate Finance - Sem IX, Roll No.90mukteshNo ratings yet

- The Black Scholes FormulaDocument12 pagesThe Black Scholes FormulaNiyati ShahNo ratings yet

- Penny Stock Promo ReviewDocument1 pagePenny Stock Promo ReviewJ_BechampOmpregaNo ratings yet

- Variable and Fs AnalysisDocument8 pagesVariable and Fs AnalysisChristian Rey Sandoval DelgadoNo ratings yet

- Consignment AccountingDocument21 pagesConsignment Accountingshubham yadavNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- Chapter 2Document47 pagesChapter 2Daphne Perez100% (1)

- Part 2 PDFDocument9 pagesPart 2 PDFAnonymous R9644t9RNo ratings yet

- Investment Income and Expenses: (Including Capital Gains and Losses)Document76 pagesInvestment Income and Expenses: (Including Capital Gains and Losses)Kenny Svatek100% (1)

- What Is Portfolio ManagementDocument14 pagesWhat Is Portfolio Managementnisha.shahi076No ratings yet

- CFA Secret Sauce QuintedgeDocument23 pagesCFA Secret Sauce QuintedgejagjitbhaimbbsNo ratings yet

- Finance ExecutiveDocument18 pagesFinance ExecutiveSam ONiNo ratings yet

- Hutchison Whampoa SolutionDocument6 pagesHutchison Whampoa SolutionIvan Baranov100% (1)

- Major Project Role of Domestic Institutional Investors On Indian Capital MarketDocument11 pagesMajor Project Role of Domestic Institutional Investors On Indian Capital MarketAbhimanyuBhardwajNo ratings yet

- I2i News Paper 16557291155 6156721471470176020Document60 pagesI2i News Paper 16557291155 6156721471470176020milinshah247No ratings yet

- The Complete Beginner's Guide To Technical AnalysisDocument10 pagesThe Complete Beginner's Guide To Technical AnalysisAngie LeeNo ratings yet

- MultibaggersDocument33 pagesMultibaggersgbcoolguyNo ratings yet

- Ia3 Finals PDFDocument36 pagesIa3 Finals PDFVivienne Rozenn LaytoNo ratings yet

Weekly Capital Market Report - Week Ending 05.08.2022

Weekly Capital Market Report - Week Ending 05.08.2022

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Capital Market Report - Week Ending 05.08.2022

Weekly Capital Market Report - Week Ending 05.08.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

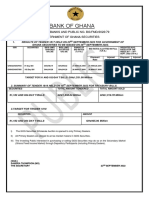

5TH AUGUST 2022

WEEKLY CAPITAL MARKET REPORT

INVESTMENT TERM OF THE WEEK GSE EQUITY MARKET PERFORMANCE

Blue Chip: A blue chip is a stock of a well-established corporation Indicator Current Week Previous Change

with a reputation for reliability, quality, and financial stability. Blue Week

chip stocks are usually the market leaders in their sectors and have GSE-Composite Index 2,396.52 2,518.86 -122.34 pts

a market capitalization running into billions of cedis. They are the YTD (GSE-CI) -14.08% -9.70% 45.15%

most popular stocks to buy, due to their long track records of steady GSE-Financial Stock Index 2,092.90 2,103.58 -10.68 pts

YTD (GSE-FSI) -2.74% -2.24% 22.32%

earnings or paying dividends. During economic slowdowns,

Market Cap. (GH¢ MN) 62,827.57 64,383.34 -1,555.77

investors turn to blue chip stocks to protect their investments. Volume Traded 66,164,780 314,961 20907.29%

ETFs: GREAT DEAL FOR INVESTORS Value Traded (GH¢) 50,649,299.41 3,231,680.95 1467.27%

An exchange traded fund (ETF) is a type of security that tracks an

index, sector, commodity, or other asset, but which can be TOP TRADED EQUITIES

purchased or sold on a stock exchange the same as a regular stock. Ticker Volume Value (GH¢)

New Gold ETF (GLD), an exchange traded fund sponsored by Absa MTNGH 65,693,984 49,551,905.91

Capital, offers the opportunity to invest in gold bullion. CAL 121,140 90,848.24

sssssS GCB 70,523 352,615.00

The company issues listed instruments (structured as debentures) ACCESS 70,274 195,838.75 97.83%

backed by physical gold. Each debenture is approximately SIC 64,616 20,677.12

equivalent to 1/100 ounces of gold bullion, which is held with a secure

depository on behalf of investors. The debentures are listed on the KEY ECONOMIC INDICATORS

Ghana Stock Exchange (GSE) and six other African stock exchanges. Indicator Current Previous

Monetary Policy Rate July 2022 19.00% 19.00%

The current share price of New Gold ETF (GLD) is GH¢157.20. Real GDP Growth March 2022 3.3% 5.4%

EQUITY MARKET HIGHLIGHTS: The Ghana Stock Market Inflation June 2022 29.8% 27.6%

Source: GSS, BOG, GBA

tumbles 122.34 points over the week to close at 2,396.52;

returns -14.08% YTD. GAINERS & DECLINERS

Ticker Close Price Open Price Price Y-t-D

Market activity for the week fell 122.34 points to close at 2,396.52 (GH¢) (GH¢) Change Change

points translating into a YTD return of -14.08%. The GSE Financial GLD 157.20 150.76 6.44 44.75%

ACCESS 3.00 2.55 0.45 -4.76%

Stock Index (GSE-FSI) also lost 10.68 points to close at 2,092.90

CAL 0.75 0.74 0.01 -13.79%

points translating into a YTD return of -2.74%. Twenty-four (24) TOTAL 4.09 4.10 -0.01 -18.53%

equities traded over the week, ending with three (3) gainers and four ETI 0.15 0.16 -0.01 7.14%

SOGEGH 0.96 1.06 -0.10 -20.00%

(4) decliners. GLD, ACCESS and CAL were the gainers as they gained MTNGH 0.80 0.91 -0.11 -27.93%

GH¢6.44, GH¢0.45 and GH¢0.01 respectively whilst the decliners

were TOTAL, ETI, SOGEGH and MTNGH as they lost GH¢0.01, GSE-CI & GSE-FSI YTD PERFORMANCE

sssssss

5.00%

GH¢0.01, GH¢0.10 and GH¢0.11 respectively. As a result, Market -2.74%

Capitalization decreased by GH¢1,555.77 million to close the trading 0.00%

SS 4-Jan 4-Feb 4-Mar 4-Apr 4-May 4-Jun 4-Jul 4-Au

week at GH¢62.83 billion.

-5.00%

A total of 66,164,780 shares valued at GH¢50,649,299.41 traded

S -10.00%

during the week. Compared with the previous trading week, this

week’s data shows a 20907.29% improvement in volume traded and -15.00% -14.08%

1467.27% improvement in trade turnover. Scancom PLC. (MTNGH)

-20.00%

accounted for 97.83% of the total value traded and recorded the GSE-CI GSE-FSI

most volumes traded.

SBL RECOMMENDED PICKS EQUITY UNDER REVIEW:

ACCESS BANK GHANA PLC. (ACCESS)

Equity Price Opinion Market Outlook

Share Price GH¢3.00

MTN GHANA GH¢ 0.80 Strong 2022 Q1 Financials Higher Ask Price

Price Change (YtD) -4.76%

BOPP GH¢ 6.00 Strong 2022 Q1 Financials Low offers

Market Cap. (GH¢) GH¢521.84 billion

CAL BANK GH¢ 0.75 Strong 2022 Q1 Financials Available offers

Dividend Yield 26.42%

ECOBANK GH¢ 6.85 Strong 2022 Q1 Financials Bargain bids

Earnings Per Share GH¢2.3230

SOGEGH GH¢0.96 Strong 2022 Q1 Financials Low demand Avg. Daily Volumes 2,298

FANMILK GH¢ 3.00 Positive Sentiment Low demand Value Traded (YtD) GH¢1,704,318

SUMMARY OF JUNE 2022 EQUITY MARKET ACTIVITIES GSE AGAINST SELECTED AFRICAN STOCK MARKETS

Indicator June June % Change Country Current Level YTD

2022 2021

2,396.52 -14.08%

(Ghana) GSE-CI

GSE-CI YTD CHANGE -8.74% 24.70% -

(Botswana) BGSMDC 7,261.04 1.14%

GSE-CI 2,545.48 2,643.67 -3.71%

(Egypt) EGX-30 10,043.23 14.59%

GSE-FSI YTD CHANGE 1.17% 6.74% -

(Kenya) NSE ASI 142.01 5.94%

GSE-FSI 2,176.97 1,871.41 16.33%

(Nigeria) NGSE ASI 50,722.33 -2.86%

VOLUME 48.23 M 37.47 M 28.73%

(South Africa) JSE ASI 69,519.25 6.81%

VALUE (GH¢) 45.26 M 50.33 M -10.08%

(WAEMU) BRVM 209,24 0.94%

MKT. CAP. (GH¢M) 64,841.21 61,331.40 5.72%

Source: Bloomberg

ADVANCERS & ACCESS, TBL, SIC | ETI, GOIL,

DECLINERS SOGEGH, GCB, CAL, GLD

Source: Ghana Stock

S Exchange, SBL Research

COMMODITIES MARKET

CURRENCY MARKET

Commodity Closing Previous YTD

Currency Closing Previous YTD

Week Week (%)

Week Week Change

(GH¢) (GH¢) %

BRENT CRUDE OIL 95.41 110.02 20.59%

DOLLAR 8.0001 7.6120 -24.92%

(US$/bbl.)

POUND 9.6341 9.2642 -15.64%

EURO 8.1243 7.7658 -15.95% GOLD 1,774.38 1,763.17 -2.76%

YEN 0.0591 0.0571 -11.60% (US$/oz)

YUAN 1.1825 1.1279 -20.11%

CFA FRANC 80.7407 84.4674 18.98% 2,268.48 2,236.91 -7.41%

COCOA

Source: Bank of Ghana (US$/MT)

Source: Bloomberg, Bullion by Post, ICCO

JUSTIFICATIONS FOR INCLUDING STOCKS IN A PORTFOLIO ANALYSTS

Typically, stocks outperform all other investment options over a ten-year period

Godwin Kojo Odoom: Senior Research Analyst

making them a must for long term portfolio.

They are excellent vehicles for retirement. Obed Owusu Sackey: Analyst

Except for a few short periods, stocks have consistently outpaced the rate of inflation.

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Bloomberg Aptitude Test BATDocument35 pagesBloomberg Aptitude Test BATqcfinanceNo ratings yet

- Weekly Capital Market Report - Week Ending 12.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 12.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 29.07.2022 2022-07-29Document2 pagesWeekly Capital Market Report Week Ending 29.07.2022 2022-07-29Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 26.08.2022Document2 pagesWeekly Capital Market Report - Week Ending 26.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 15.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 15.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 02.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 02.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.07.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 24.06.2022 2022-06-24Document2 pagesWeekly Capital Market Report Week Ending 24.06.2022 2022-06-24Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 10.06.2022Document2 pagesWeekly Capital Market Report - Week Ending 10.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 08.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 08.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 13.05.2022Document2 pagesWeekly Capital Market Report - Week Ending 13.05.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 22.07.2022 2022-07-22Document2 pagesWeekly Capital Market Report Week Ending 22.07.2022 2022-07-22Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 25.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 28.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 28.01.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 01.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 01.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 11.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 11.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 04.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 25.02.2022Document3 pagesWeekly Capital Market Report - Week Ending 25.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.02.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.02.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 04.03.2022Document3 pagesWeekly Capital Market Report - Week Ending 04.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 15.10.2021Document2 pagesWeekly Capital Market Recap Week Ending 15.10.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Report Week Ending 03.06.2022 2022-06-03Document2 pagesWeekly Capital Market Report Week Ending 03.06.2022 2022-06-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.06.2022Document1 pageDaily Equity Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 29.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 29.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2022Document1 pageDaily Equity Market Report - 08.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.03.2022Document1 pageDaily Equity Market Report - 09.03.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.04.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.08.2022Document1 pageDaily Equity Market Report - 10.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 22.04.2022Document2 pagesWeekly Capital Market Report - Week Ending 22.04.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2021Document1 pageDaily Equity Market Report - 05.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2022Document1 pageDaily Equity Market Report - 06.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 16-04-2021Document2 pagesWeekly Financial Market Review - Week Ending 16-04-2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.08.2022Document1 pageDaily Equity Market Report - 15.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.08.2022Document1 pageDaily Equity Market Report - 17.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 31.08.2022Document1 pageDaily Equity Market Report - 31.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 12.09.2022Document1 pageDaily Equity Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 03.09.2021Document2 pagesWeekly Capital Market Recap Week Ending 03.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- JP Morgan Case StudyDocument29 pagesJP Morgan Case StudyChiranshu KumarNo ratings yet

- Diteg - 2Document6 pagesDiteg - 2Đỗ Cẩm VânNo ratings yet

- AMN Healthcare Services, Inc. AHS: QQQQQDocument8 pagesAMN Healthcare Services, Inc. AHS: QQQQQdbskingNo ratings yet

- Three "Good" Reasons For Paying Dividends : Aswath DamodaranDocument32 pagesThree "Good" Reasons For Paying Dividends : Aswath DamodaranEXII iNo ratings yet

- FYBBA - Maths Project - Yash KhairnarDocument31 pagesFYBBA - Maths Project - Yash KhairnarYash KhairnarNo ratings yet

- Jensen (1967) - The Performance of Mutual Funds in The Period 1945-1965Document37 pagesJensen (1967) - The Performance of Mutual Funds in The Period 1945-1965pvbrandaoNo ratings yet

- Role of Financial IntermediariesDocument105 pagesRole of Financial IntermediariesMaria AngelicaNo ratings yet

- Useful Bloomberg Functions: News Equity Index OverviewDocument3 pagesUseful Bloomberg Functions: News Equity Index Overviewkarasa1No ratings yet

- EkadDocument3 pagesEkadErvin KhouwNo ratings yet

- What American Teens & Adults Know About EconomicsDocument82 pagesWhat American Teens & Adults Know About EconomicsDaniel HollowayNo ratings yet

- Ownership TypesDocument16 pagesOwnership TypesShubham Nag50% (2)

- Meghna Kashyap - Corporate Finance - Sem IX, Roll No.90Document28 pagesMeghna Kashyap - Corporate Finance - Sem IX, Roll No.90mukteshNo ratings yet

- The Black Scholes FormulaDocument12 pagesThe Black Scholes FormulaNiyati ShahNo ratings yet

- Penny Stock Promo ReviewDocument1 pagePenny Stock Promo ReviewJ_BechampOmpregaNo ratings yet

- Variable and Fs AnalysisDocument8 pagesVariable and Fs AnalysisChristian Rey Sandoval DelgadoNo ratings yet

- Consignment AccountingDocument21 pagesConsignment Accountingshubham yadavNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- Chapter 2Document47 pagesChapter 2Daphne Perez100% (1)

- Part 2 PDFDocument9 pagesPart 2 PDFAnonymous R9644t9RNo ratings yet

- Investment Income and Expenses: (Including Capital Gains and Losses)Document76 pagesInvestment Income and Expenses: (Including Capital Gains and Losses)Kenny Svatek100% (1)

- What Is Portfolio ManagementDocument14 pagesWhat Is Portfolio Managementnisha.shahi076No ratings yet

- CFA Secret Sauce QuintedgeDocument23 pagesCFA Secret Sauce QuintedgejagjitbhaimbbsNo ratings yet

- Finance ExecutiveDocument18 pagesFinance ExecutiveSam ONiNo ratings yet

- Hutchison Whampoa SolutionDocument6 pagesHutchison Whampoa SolutionIvan Baranov100% (1)

- Major Project Role of Domestic Institutional Investors On Indian Capital MarketDocument11 pagesMajor Project Role of Domestic Institutional Investors On Indian Capital MarketAbhimanyuBhardwajNo ratings yet

- I2i News Paper 16557291155 6156721471470176020Document60 pagesI2i News Paper 16557291155 6156721471470176020milinshah247No ratings yet

- The Complete Beginner's Guide To Technical AnalysisDocument10 pagesThe Complete Beginner's Guide To Technical AnalysisAngie LeeNo ratings yet

- MultibaggersDocument33 pagesMultibaggersgbcoolguyNo ratings yet

- Ia3 Finals PDFDocument36 pagesIa3 Finals PDFVivienne Rozenn LaytoNo ratings yet