Professional Documents

Culture Documents

EdMngt 304 Tadit, Annalou

EdMngt 304 Tadit, Annalou

Uploaded by

Annalou TaditOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EdMngt 304 Tadit, Annalou

EdMngt 304 Tadit, Annalou

Uploaded by

Annalou TaditCopyright:

Available Formats

Name: ANNALOU B.

TADIT

Professor: MARIO M. BERMUDEZ, CESO VI, DM

Subject: FINANCIAL PLANNING AND BUDGETING (EdMngt 304)

Date: April 1, 2022

1. Prepare an Individual Financial Plan for three (3) years showing your

salary/income, expenses, savings and expenses. Include in your plan how

will you monitor it. You are free to use any available financial plan

template.

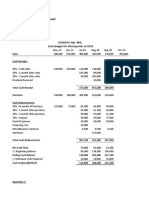

YEAR 2022 YEAR 2023 YEAR 2024 TOTAL

INCOME

Salary 156, 000.00 156, 000.00 156, 000.00 468, 000.00

Interest Income 144, 000.00 144, 000.00 144, 000.00 432, 000.00

900, 000.00

SAVINGS

Bank 24, 000.00 24, 000.00 24, 000.00 72, 000.00

72, 000.00

EXPENSES

Electricity 25, 200.00 25, 200.00 25, 200.00 75, 600.00

Water 3, 360.00 3, 360.00 3, 360.00 10, 080.00

Car Renewal and

Maintenance 10, 000.00 10, 000.00 10, 000.00 30, 000.00

Load 3, 600.00 3, 600.00 3, 600.00 10, 800.00

Gasoline 36, 000.00 36, 000.00 36, 000.00 108, 000.00

Groceries 60, 000.00 60, 000.00 60, 000.00 180, 000.00

Clothing 10, 000.00 10, 000.00 10, 000.00 30, 000.00

GSIS Loan 5, 241.20 5, 241.20 5, 241.20 15, 723.60

Bank Loan 120, 445.44 120, 445.44 120, 445.44 361, 336.32

Majar Services 5, 400.00 5, 400.00 5, 400.00 16, 200.00

837, 739.92

TOTAL INCOME +TOTAL SAVINGS-TOTAL EXPENSES=

900,T 000.00+72,

h i s 739.92=134,f 260.08i

000.00-837, n a n c i a

134, 260.08/3= 44, 753.36/3

= 44, 753.36/12

= 3, 729.45 this will be my additional savings every month.

savings that manage my finances and reach my goals in life.

2. Submit a Reflection Paper on the importance of financial planning to you

as an individual. Reflect on your personal practice as you contextualize its

importance.

Financial planning is a continuous process that can assist me in making

well-informed decisions that will help me to reach my life's objectives.

When I was in my younger years I always heard this statement from my

mother, “spend your money/baon wisely” that’s why I get a certain amount buying

candies and paper and selling them inside our classroom. Until now that I have my

own family and own my business I practice every time I receive a “blessing”

coming from my work. My parents taught me to save or put some money for future

use.

It is important to save money since it allows us to build wealth. As a result,

we are able to earn more money not for today but for future needs. Savings acts

as a safety net for unexpected events. Finally, one of the determinants of how

affluent we are or will become is our ability to save money.

3. Compute your school’s approximate monthly Maintenance and Other

Operating Expenses (MOOE) based on your current enrolment, number of

teachers, number of classrooms and number of graduates. Use your e-

BEIS data in the computation.

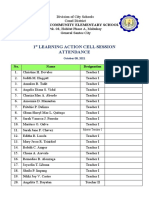

Habitat Community Elementary School has a 555 total population

of learners from Grade IV to VI, thirteen (13) instructional rooms,

eighteen (18) classroom teachers and at the end of the school year, the

school has 174 learners who will graduate.

PUBLIC SCHOOL’S MOOE ELEMENTARY

Fixed Cost 117, 600

Enrolment Cost 300

Teachers Cost 6, 000

Classroom Cost 4, 500

Graduating Cost 376

Computation:

=117, 600+(4, 500 x 13)+ (6, 000 x 18)+(300 x 555)+(376 x 174)

= 117, 600+ 58, 500+108, 000+166, 500+65, 424

= 516, 024/12 months

= 43, 002/month

You might also like

- Acc10007 Assignment 3Document22 pagesAcc10007 Assignment 3danniel100% (1)

- Crunch The Numbers-FinalDocument3 pagesCrunch The Numbers-FinalAlexis Weisman0% (1)

- Winfield CaseDocument8 pagesWinfield CaseAbhinandan Singh67% (3)

- GROUP ASSIGNMENT - FIN420 (Ratio Analysis) (Nestle Vs Dutch Lady)Document28 pagesGROUP ASSIGNMENT - FIN420 (Ratio Analysis) (Nestle Vs Dutch Lady)Zamil AimanNo ratings yet

- Nguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceDocument14 pagesNguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceNgọc MaiNo ratings yet

- Life Insurance Programming From The Consumer's View PointDocument5 pagesLife Insurance Programming From The Consumer's View PointimranNo ratings yet

- Analysis and Application of Financial InformationDocument15 pagesAnalysis and Application of Financial InformationSuman Kumar SamantaNo ratings yet

- Dombivli Shikshan Prasarak Mandals K. V. Pendharkar College of Arts, Science and Commerce (Autonomous)Document7 pagesDombivli Shikshan Prasarak Mandals K. V. Pendharkar College of Arts, Science and Commerce (Autonomous)Sujal BedekarNo ratings yet

- Accounting GroupDocument17 pagesAccounting GroupNethmi JayawardhanaNo ratings yet

- Dutch Lady Company - Construct A Cash Budget (Task Group) - Kba2431a - Fin420Document12 pagesDutch Lady Company - Construct A Cash Budget (Task Group) - Kba2431a - Fin420MOHAMAD IZZANI OTHMANNo ratings yet

- Simplest Offer: Charisma Mind WorldwideDocument2 pagesSimplest Offer: Charisma Mind WorldwideSai Prudhviraj GudipalliNo ratings yet

- CF Tutorial 11 - SolutionsDocument5 pagesCF Tutorial 11 - SolutionschewNo ratings yet

- Document (6) - 3Document5 pagesDocument (6) - 3Sujal BedekarNo ratings yet

- Business Proposal TemplateDocument5 pagesBusiness Proposal Templatenatnael ebrahimNo ratings yet

- Name: GAKO, Maria Kim T. Rating: Course: Bachelor of Elementary Education Date: My 10 Year Financial Literacy Strategic Development Plan (2025-2035)Document2 pagesName: GAKO, Maria Kim T. Rating: Course: Bachelor of Elementary Education Date: My 10 Year Financial Literacy Strategic Development Plan (2025-2035)Mabel GakoNo ratings yet

- Case Study 3 Wake Up and Smell The CoffeeDocument25 pagesCase Study 3 Wake Up and Smell The CoffeeCheveem Grace Emnace100% (1)

- Usefulness of Financial Forecasting andDocument7 pagesUsefulness of Financial Forecasting andHambeca PHNo ratings yet

- ACT202 Group03 Project FinalDocument14 pagesACT202 Group03 Project FinalHot ShotNo ratings yet

- Assignment AnswerDocument7 pagesAssignment AnswerTemesgenNo ratings yet

- Reviewer For Midterm XFINMAR A224and A225Document5 pagesReviewer For Midterm XFINMAR A224and A225ralph11240308No ratings yet

- Pauta Examen Nov 2022 PF22002Document6 pagesPauta Examen Nov 2022 PF22002Andres RebolledoNo ratings yet

- Individual Case:Business Memo AssignmentDocument6 pagesIndividual Case:Business Memo AssignmentNathan MustafaNo ratings yet

- Ils Gen Math Abelgas Stem 116Document4 pagesIls Gen Math Abelgas Stem 116Thryxia Coreen AbelgasNo ratings yet

- English For Finance and Banking: Case Study 1: Savings/Investing PlanDocument8 pagesEnglish For Finance and Banking: Case Study 1: Savings/Investing PlanNgôThịThanhHuyềnNo ratings yet

- SMC (Case Study)Document5 pagesSMC (Case Study)The BoxNo ratings yet

- Working Capital Manageme NT: Weekend Assignment: 3Document10 pagesWorking Capital Manageme NT: Weekend Assignment: 3Ankit KhandelwalNo ratings yet

- Brief Exercise 7-1 (10 Minutes)Document45 pagesBrief Exercise 7-1 (10 Minutes)Ashish BhallaNo ratings yet

- AssignmentDocument11 pagesAssignmentkireeti415No ratings yet

- Answers 8-1: Surname 1Document6 pagesAnswers 8-1: Surname 1Alkadir del AzizNo ratings yet

- Cabiltes MMWORLD PT - Research-PaperDocument9 pagesCabiltes MMWORLD PT - Research-PaperJoielyn CabiltesNo ratings yet

- Chapter 10 How Costs Behave Practice QuestionsDocument7 pagesChapter 10 How Costs Behave Practice QuestionsNCTNo ratings yet

- Assesmnet Task 1Document6 pagesAssesmnet Task 1Anonymous XYQ2ceuNo ratings yet

- Chapter 3Document6 pagesChapter 3Pauline Keith Paz ManuelNo ratings yet

- Lucky's Sports: Presented By: Laxman Masal Roll No. 33Document10 pagesLucky's Sports: Presented By: Laxman Masal Roll No. 33hitman2986No ratings yet

- FM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Document34 pagesFM Eco Full Test 1 Unscheduled Nov 2023 Solution 1691563701Srushti AgarwalNo ratings yet

- Financial Plan Final DraftDocument6 pagesFinancial Plan Final Draftahnaf tahmidNo ratings yet

- Akpk (Problem Ratio)Document5 pagesAkpk (Problem Ratio)Nur AishahNo ratings yet

- Finance Assignment 2Document12 pagesFinance Assignment 2fotimaxusanova855No ratings yet

- Corporate FinanceDocument9 pagesCorporate FinanceMayur AgarwalNo ratings yet

- TVM Problems SolutionsDocument3 pagesTVM Problems SolutionsEmirī PhoonNo ratings yet

- MAF 551 - Exercise 2 - Answer Question 1 - Seri Melur Institution - Ridzuan Bin Saharun 2017700141Document3 pagesMAF 551 - Exercise 2 - Answer Question 1 - Seri Melur Institution - Ridzuan Bin Saharun 2017700141RIDZUAN SAHARUNNo ratings yet

- Review Questions For Final Exam ACC210Document13 pagesReview Questions For Final Exam ACC210AaaNo ratings yet

- VII. Instructions: Startup Expenses & CapitalizationDocument8 pagesVII. Instructions: Startup Expenses & CapitalizationPriyanshi Agrawal 1820149No ratings yet

- Cos Accounting AssignmentDocument7 pagesCos Accounting AssignmentSujal BedekarNo ratings yet

- Assignment 2Document6 pagesAssignment 2Devesh MauryaNo ratings yet

- Jaylarry B Math ASSMNTDocument20 pagesJaylarry B Math ASSMNTjaylarrydeanNo ratings yet

- Lecture 1: Welcome To Fundamental of Business Economics: Abdul Quadir XlriDocument26 pagesLecture 1: Welcome To Fundamental of Business Economics: Abdul Quadir XlriNarendra N. SinghNo ratings yet

- Titus KituliDocument12 pagesTitus KituliJonathan LinjeNo ratings yet

- BC0150010 FM ProjectDocument12 pagesBC0150010 FM ProjectKrishnaNo ratings yet

- This Study Resource Was: Add Question HereDocument4 pagesThis Study Resource Was: Add Question HereJayvee Ramos RuedaNo ratings yet

- RequiredDocument2 pagesRequiredElliot RichardNo ratings yet

- Caso Toy World IncDocument18 pagesCaso Toy World IncLuis Fernando MoraNo ratings yet

- Modul Jawaban Koeliah: Akuntansi BiayaDocument16 pagesModul Jawaban Koeliah: Akuntansi BiayaAndika Putra SalinasNo ratings yet

- Valuation Methods - Activity 1Document5 pagesValuation Methods - Activity 1Rosario BacaniNo ratings yet

- Ace Oct8 BFDocument4 pagesAce Oct8 BFAce ClarkNo ratings yet

- Sam and Sara DebtDocument46 pagesSam and Sara DebtAk Rana10% (10)

- Test 1 (2019672728) (NBF2D)Document5 pagesTest 1 (2019672728) (NBF2D)Masnur Aina Md RajehNo ratings yet

- Case 20Document11 pagesCase 20MayaNo ratings yet

- (Answers) R1 20200924153547prl3 - Final - ExamDocument21 pages(Answers) R1 20200924153547prl3 - Final - ExamArslan HafeezNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document18 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Annalou TaditNo ratings yet

- 1Document1 page1Annalou TaditNo ratings yet

- Belief or Practice Resulting From Ignorance, Fear of The Unknown, Trust in Magic or Chance, or A False Conception of CausationDocument10 pagesBelief or Practice Resulting From Ignorance, Fear of The Unknown, Trust in Magic or Chance, or A False Conception of CausationAnnalou TaditNo ratings yet

- 1 Learning Action Cell Session Attendance: Habitat Community Elementary SchoolDocument4 pages1 Learning Action Cell Session Attendance: Habitat Community Elementary SchoolAnnalou TaditNo ratings yet

- Material Traceability Quality Surveillance Report Checklist Form Batam Fabrication YardDocument1 pageMaterial Traceability Quality Surveillance Report Checklist Form Batam Fabrication Yard4romi89No ratings yet

- Ducar Complaint 2Document3 pagesDucar Complaint 2Thomas MeinersNo ratings yet

- Chapter1-Focusondecisionmaking Man. Acc.Document188 pagesChapter1-Focusondecisionmaking Man. Acc.eltonNo ratings yet

- Tncs Signature Clean VersionDocument14 pagesTncs Signature Clean VersionQqwtryNo ratings yet

- Payslip JMT 012024 950236Document1 pagePayslip JMT 012024 950236ayanbhargav3No ratings yet

- VlookupDocument608 pagesVlookupamiera norazmiNo ratings yet

- Copy - Volume Spurt, Technical Analysis ScannerDocument2 pagesCopy - Volume Spurt, Technical Analysis ScannerVimalahar rajagopalNo ratings yet

- SEO and Its Importance For BusinessDocument3 pagesSEO and Its Importance For Businessenjeela subediNo ratings yet

- Challan - Return TcsDocument1 pageChallan - Return TcsLalNo ratings yet

- Journal of Retailing and Consumer Services: Mengjia Gao, Lin HuangDocument11 pagesJournal of Retailing and Consumer Services: Mengjia Gao, Lin HuangErfina Mei RahmawatiNo ratings yet

- Solved The Outstanding Stock in Red Blue and Green Corporations EachDocument1 pageSolved The Outstanding Stock in Red Blue and Green Corporations EachAnbu jaromiaNo ratings yet

- YFC Projects Private Limited (YPPL) : Rating RationaleDocument2 pagesYFC Projects Private Limited (YPPL) : Rating Rationalelalit rawatNo ratings yet

- ACCT - Assignment 2Document6 pagesACCT - Assignment 2Chau ToNo ratings yet

- A Report On Big Bazaar - Pantaloon Retail (India) Ltd.Document109 pagesA Report On Big Bazaar - Pantaloon Retail (India) Ltd.SUMANTO SHARAN82% (11)

- Unit II IrlwDocument82 pagesUnit II IrlwSaravanan ShanmugamNo ratings yet

- Capital Budgeting PDocument14 pagesCapital Budgeting PAjayNo ratings yet

- Entrepreneurship Concept and Case Study: Khadim Ali Shah Bukhari Institute of Information and TechnologyDocument20 pagesEntrepreneurship Concept and Case Study: Khadim Ali Shah Bukhari Institute of Information and TechnologymuhammadsaadkhanNo ratings yet

- Cost&management OverheadsDocument16 pagesCost&management OverheadsAlexa KintuNo ratings yet

- IEC 60865-1 1993 - Short-Circuit Currents-Calculation of Effects-Part 1definitions and Calculation Methods.Document121 pagesIEC 60865-1 1993 - Short-Circuit Currents-Calculation of Effects-Part 1definitions and Calculation Methods.AgpKNo ratings yet

- Class Notes IA Marks Guidelines First Grade CollegeDocument52 pagesClass Notes IA Marks Guidelines First Grade CollegeyallappaNo ratings yet

- SCOPE OF WORK For ELEVATOR PREVENTIVE MAINTENANCE & REPAIR SERVICESDocument10 pagesSCOPE OF WORK For ELEVATOR PREVENTIVE MAINTENANCE & REPAIR SERVICESRodolfo ValençaNo ratings yet

- Unit I Fundamentals of DesignDocument8 pagesUnit I Fundamentals of DesignChaitanya YengeNo ratings yet

- Service GuranteeDocument2 pagesService GuranteeKevo KarisNo ratings yet

- Invoice GDR 15Document1 pageInvoice GDR 15Marco SantellaNo ratings yet

- Int411 Software Project ManagementDocument1 pageInt411 Software Project ManagementProtyay HatrickNo ratings yet

- An Assessment of Implementing Green HRM Practices OnDocument16 pagesAn Assessment of Implementing Green HRM Practices OnNoha MorsyNo ratings yet

- Figueroa V MERS Corp. Inc., David Stern, Chase Home Finance 10-61296 DocketDocument38 pagesFigueroa V MERS Corp. Inc., David Stern, Chase Home Finance 10-61296 Docketlarry-612445No ratings yet

- e-StatementBRImo 099701050646532 Dec2023 20231220 202008Document1 pagee-StatementBRImo 099701050646532 Dec2023 20231220 202008frysel27No ratings yet

- Leetcode Top 75 SQLDocument3 pagesLeetcode Top 75 SQLDO YOU KNOWNo ratings yet