Professional Documents

Culture Documents

JPM Investment Outlook

JPM Investment Outlook

Uploaded by

AceCopyright:

Available Formats

You might also like

- Financial Management:: Understanding Financial Statements, Taxes, and Cash FlowsDocument102 pagesFinancial Management:: Understanding Financial Statements, Taxes, and Cash FlowsArgem Jay PorioNo ratings yet

- 07april 2021 India DailyDocument65 pages07april 2021 India DailyMaruthee SharmaNo ratings yet

- Morning Wrap 20231215Document9 pagesMorning Wrap 20231215Anurag PharkyaNo ratings yet

- QFR 03-March 2022 LDocument70 pagesQFR 03-March 2022 LNapolean DynamiteNo ratings yet

- 03july 2020 - India - Daily PDFDocument108 pages03july 2020 - India - Daily PDFChaitanya KekreNo ratings yet

- AP Newsletter Moderate September19Document15 pagesAP Newsletter Moderate September19sujeet panditNo ratings yet

- Public Shariah MFR August 2021Document47 pagesPublic Shariah MFR August 2021UmmiNo ratings yet

- Morning Wrap 20240314Document6 pagesMorning Wrap 20240314Raj VaswaniNo ratings yet

- Screenshot 2022-07-24 at 9.04.59 PMDocument46 pagesScreenshot 2022-07-24 at 9.04.59 PMieda1718No ratings yet

- Market Outlook 2Document26 pagesMarket Outlook 2amrejpal773No ratings yet

- QFR (PRS) March 2022Document20 pagesQFR (PRS) March 2022Napolean DynamiteNo ratings yet

- Equity Market Review November 2023Document5 pagesEquity Market Review November 2023final bossuNo ratings yet

- Weekly Market Snapshot: Philippine EquitiesDocument2 pagesWeekly Market Snapshot: Philippine EquitiesJM CrNo ratings yet

- The GIC WeeklyDocument12 pagesThe GIC WeeklyedgarmerchanNo ratings yet

- IndiaMorningBrief 20jun2022Document10 pagesIndiaMorningBrief 20jun2022PranavPillaiNo ratings yet

- Weekly Report - 3 Aug 2007Document5 pagesWeekly Report - 3 Aug 2007api-3840085No ratings yet

- Global Market Review Outlook-May 2023Document3 pagesGlobal Market Review Outlook-May 2023YasahNo ratings yet

- Ashmore Weekly Commentary 27 Jan 2023Document3 pagesAshmore Weekly Commentary 27 Jan 2023Jordanata TjiptarahardjaNo ratings yet

- Economic Outlook 2H22Document30 pagesEconomic Outlook 2H22AriefNoviantoWongsoharjoNo ratings yet

- MFR Period Ended 29 October 2021-LockedDocument69 pagesMFR Period Ended 29 October 2021-LockedChoon Fong LeeNo ratings yet

- Weekly Market RecapDocument2 pagesWeekly Market RecapLưuVănViếtNo ratings yet

- Weekly Brief 14 October 2022Document8 pagesWeekly Brief 14 October 2022saifulbohariNo ratings yet

- Chapter Three: Capital Marker Analysis of BangladeshDocument31 pagesChapter Three: Capital Marker Analysis of BangladeshGolam Samdanee TaneemNo ratings yet

- I Care Oct'08Document8 pagesI Care Oct'08rashmipraNo ratings yet

- Ashmore Weekly Commentary 5 Jan 2024Document3 pagesAshmore Weekly Commentary 5 Jan 2024bagus.dpbri6741No ratings yet

- 11february 2020 India DailyDocument120 pages11february 2020 India DailyRakesh SethiaNo ratings yet

- Weekly Investment Outlook - Aug 09 2010Document6 pagesWeekly Investment Outlook - Aug 09 2010Shikhar BhatiaNo ratings yet

- 4.a.b (MM) Monthly Fund Focus ListDocument13 pages4.a.b (MM) Monthly Fund Focus Listmark.qianNo ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- 08july 2019 India DailyDocument103 pages08july 2019 India DailyRakesh SethiaNo ratings yet

- India Daily 22082022 BKDocument71 pagesIndia Daily 22082022 BKRohan RustagiNo ratings yet

- Round Up of Fund Managers ActivitiesDocument27 pagesRound Up of Fund Managers Activitiesapi-3733080No ratings yet

- TD Economics: The Weekly Bottom LineDocument6 pagesTD Economics: The Weekly Bottom LinePaola VerdiNo ratings yet

- India Daily: June 3, 2021Document78 pagesIndia Daily: June 3, 2021mmNo ratings yet

- IndiaMorningBrief 7jul2023Document11 pagesIndiaMorningBrief 7jul2023Ranjan JainNo ratings yet

- Insentif Dan Relaksasi Pajak Di Masa Pandemi Covid-19Document24 pagesInsentif Dan Relaksasi Pajak Di Masa Pandemi Covid-19kacaribuantonNo ratings yet

- ICICI Prudential MF Head Start - 07062022Document2 pagesICICI Prudential MF Head Start - 07062022Chucha LullNo ratings yet

- ScotiaBank JUN 11 Weekly TrendDocument9 pagesScotiaBank JUN 11 Weekly TrendMiir ViirNo ratings yet

- MY Rates Strategy Update 254759Document8 pagesMY Rates Strategy Update 254759yennielimclNo ratings yet

- Economic Indicators 2019Document2 pagesEconomic Indicators 2019MeeroButtNo ratings yet

- IDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Document28 pagesIDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Essantio DeniraNo ratings yet

- Scotia Weekly TrendsDocument11 pagesScotia Weekly Trendsdaniel_austinNo ratings yet

- Wealth Insights Newsletter March 2021Document49 pagesWealth Insights Newsletter March 2021P.S.K.B MohanNo ratings yet

- Morning - India 20220425 Mosl Mi PG022Document22 pagesMorning - India 20220425 Mosl Mi PG022Deepak KhatwaniNo ratings yet

- Weekly Market RecapDocument2 pagesWeekly Market RecapmarianoveNo ratings yet

- Fred Presentation 5-31-2016Document17 pagesFred Presentation 5-31-2016retiredcatholicNo ratings yet

- Market Pulse - April 2019Document12 pagesMarket Pulse - April 2019p comNo ratings yet

- Market Technical Reading: Stronger Buying Momentum On The Bluechips - 05/03/2010Document6 pagesMarket Technical Reading: Stronger Buying Momentum On The Bluechips - 05/03/2010Rhb InvestNo ratings yet

- Invest in UTI Gilt Fund - Debt Mutual Funds - UTI Mutual FundDocument12 pagesInvest in UTI Gilt Fund - Debt Mutual Funds - UTI Mutual FundRinku MishraNo ratings yet

- Weekly Headings SnapshotDocument1 pageWeekly Headings SnapshotgarciamorillopabloNo ratings yet

- BIMBSec Corp Day - 2022 Economic OutlookDocument17 pagesBIMBSec Corp Day - 2022 Economic Outlookmuhammad ihsanNo ratings yet

- 18may 2021 - India - DailyDocument105 pages18may 2021 - India - DailyAshutosh PatidarNo ratings yet

- JPM Investment OutlookDocument2 pagesJPM Investment OutlookAceNo ratings yet

- Morning Cuppa 22-FebDocument2 pagesMorning Cuppa 22-FebNitin ChauhanNo ratings yet

- Market Technical Reading - Remain Bullish On Short - To Medium-Term Outlook - 09/08/2010Document6 pagesMarket Technical Reading - Remain Bullish On Short - To Medium-Term Outlook - 09/08/2010Rhb InvestNo ratings yet

- M&A Conference - Global Markets and MacroeconomicsDocument20 pagesM&A Conference - Global Markets and Macroeconomicsjm petit100% (1)

- Currency Daily Report, June 21 2013Document4 pagesCurrency Daily Report, June 21 2013Angel BrokingNo ratings yet

- IDR Bond Market Update 13 September 2021 (Eng)Document5 pagesIDR Bond Market Update 13 September 2021 (Eng)Manonsih VictoryaNo ratings yet

- Morning Cuppa 12-DecDocument2 pagesMorning Cuppa 12-DecSaroNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- GS Global Fixed Income WeeklyDocument9 pagesGS Global Fixed Income WeeklyAceNo ratings yet

- Bank of America Capital Market OutlookDocument8 pagesBank of America Capital Market OutlookAceNo ratings yet

- Standard Chartered Weekly Market ViewDocument11 pagesStandard Chartered Weekly Market ViewAceNo ratings yet

- Moody's Weekly OutlookDocument23 pagesMoody's Weekly OutlookAceNo ratings yet

- Blackrock Weekly OutlookDocument6 pagesBlackrock Weekly OutlookAceNo ratings yet

- DBS Market OutlookDocument5 pagesDBS Market OutlookAceNo ratings yet

- Blackrock Weekly OutlookDocument6 pagesBlackrock Weekly OutlookAceNo ratings yet

- FX Get DoneDocument2 pagesFX Get DoneDev GogoiNo ratings yet

- Sales Management-Chapter 1Document18 pagesSales Management-Chapter 1Ashik PaulNo ratings yet

- Calculate-Ped-And-Yed A Level Business EdexcelDocument9 pagesCalculate-Ped-And-Yed A Level Business EdexcelNarmeen LodhiNo ratings yet

- Kingfisher CaseDocument8 pagesKingfisher CaseBizEasy AdvisorsNo ratings yet

- 5 Bar Reversal Pattern: Buy SetupDocument1 page5 Bar Reversal Pattern: Buy Setupalistair7682No ratings yet

- MKT Report DigiMartDocument63 pagesMKT Report DigiMartSabrina RahmanNo ratings yet

- Cost Concepts Exercises With AnswersDocument7 pagesCost Concepts Exercises With AnswersBRYLL RODEL PONTINONo ratings yet

- Chap 017Document48 pagesChap 017Farah ThabitNo ratings yet

- 6 APT Slides ch10Document53 pages6 APT Slides ch10Zoe RossiNo ratings yet

- The Role of Women Entrepreneurs in Economic DevelopmentDocument5 pagesThe Role of Women Entrepreneurs in Economic DevelopmentRomika DhingraNo ratings yet

- MakeMyTrip SEOUL NEWDocument3 pagesMakeMyTrip SEOUL NEWbindu mathaiNo ratings yet

- InvestIndia - PLI Textiles - VFDocument44 pagesInvestIndia - PLI Textiles - VFTushar JoshiNo ratings yet

- Recent Updated Citibank Account Statement-20220417 To 20221014 - UnlockedDocument22 pagesRecent Updated Citibank Account Statement-20220417 To 20221014 - UnlockedMayank YadavNo ratings yet

- 102 TUTORIAL CH 7 GDP and CPIDocument3 pages102 TUTORIAL CH 7 GDP and CPIJustin St DenisNo ratings yet

- Invoice-2024-02-11 11 - 02Document1 pageInvoice-2024-02-11 11 - 02arunkumarmevadaNo ratings yet

- Implementing The Government Accounting Manual (Gam) : (For National Government Agencies)Document25 pagesImplementing The Government Accounting Manual (Gam) : (For National Government Agencies)Joann Rivero-SalomonNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationMonica MangobaNo ratings yet

- SEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inDocument13 pagesSEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inshubhendra mishraNo ratings yet

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Socialism in TanzaniaDocument12 pagesSocialism in TanzaniaGiadaNo ratings yet

- Solved Paper I - 2021Document41 pagesSolved Paper I - 2021Eswar AnaparthiNo ratings yet

- 2020-20211003 LLB TycDocument94 pages2020-20211003 LLB TycGeeta GuptaNo ratings yet

- Dealer Application FormDocument8 pagesDealer Application FormminNo ratings yet

- Humentum Finance Health Check 2022Document13 pagesHumentum Finance Health Check 2022Emmanuel LompoNo ratings yet

- SAP Repetitive ManufacturingDocument12 pagesSAP Repetitive ManufacturingLarisa SchiopuNo ratings yet

- TT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarDocument5 pagesTT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarNGỌC ĐIỆP TRẦNNo ratings yet

- Group Report Financial ManagementDocument21 pagesGroup Report Financial ManagementNur Nabilah NoranizamNo ratings yet

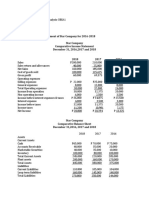

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Af201 Revision Package s1, 2021Document4 pagesAf201 Revision Package s1, 2021Rachna ChandNo ratings yet

JPM Investment Outlook

JPM Investment Outlook

Uploaded by

AceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JPM Investment Outlook

JPM Investment Outlook

Uploaded by

AceCopyright:

Available Formats

|

The Weekly Brief 22 March 2021

Thought of the week Market statistics

The US economic outlook has improved substantially since the Federal Reserve (Fed) Change (%) Level Change (bps)

published their last forecasts three months ago. Vaccine rollout is progressing at pace, and a

huge stimulus package is adding to household savings that were already elevated thanks to Equities Week ago YTD Year ago Bond spreads 19/03 Week ago YTD Year ago

the generosity of fiscal support last year. The Fed now expects that the US economy will grow MSCI Europe 0.1 6.2 47.1 Global IG 98 0 -2 -193

by 6.5% in 2021. But while growth is likely to be strong as the economy reopens, how DAX 1.9 7.7 71.6 EMBIG (USD) 316 -10 -7 -318

transitory any rise in inflation proves to be is uncertain, and so the markets’ focus on the 387 4 -22 -707

CAC 40 -0.8 8.2 59.2 Global High Yld

Fed’s reaction to economic developments is likely to intensify and may lead to heightened

volatility in Treasury markets. Investors can take comfort however, that should markets IBEX -1.7 5.6 37.2 Bond yields (10 yr)

become disorderly then the Fed would likely take action to maintain favourable financial FTSE MIB 0.4 9.2 59.9 UK 0.84 2 64 4

conditions and keep the economy on the path to full employment.

FTSE 100 -0.7 4.8 34.1 Germany -0.29 1 29 -11

Markets expect two Fed hikes by the end of 2023

% Fed funds rate and market expectations S&P 500 -0.7 4.5 65.2 USA 1.72 10 81 60

7 TOPIX 3.1 11.6 60.6 Japan 0.11 0 9 3

Federal funds rate MSCI EM -0.9 5.0 70.6 EMD* (local fx) 4.94 7 72 -114

6

MSCI China -0.4 3.6 62.7 Commodities Change (%)

Market expectations on 18 March 2021 (mean)

5 MSCI Brazil 1.6 -2.5 69.2 Brent $/bbl 65 -6.8 24.6 126.7

MSCI AC World -0.4 5.1 63.6 Gold $/oz 1735 1.8 -8.1 17.7

4 Energy -5.4 19.5 79.0 Copper $/lb 4.12 -0.5 17.3 87.4

3 Materials -1.5 7.1 83.1 Currency Level

Industrials -0.2 8.0 72.6 $ per € 1.19 1.19 1.22 1.07

2 Cons discr. 0.3 4.2 93.2 £ per € 0.86 0.86 0.90 0.92

1 Cons staples 0.8 -1.2 22.3 $ per £ 1.39 1.39 1.37 1.17

Healthcare 0.9 0.8 37.8 ¥ per € 130 130 126 118

0 Financials -0.6 13.1 64.6 ¥ per $ 109 109 103 110

'00 '02 '04 '06 '08 '10 '12 '14 '16 '18 '20 '22 '24 '26

Technology -1.1 0.7 82.7 CHF per € 1.11 1.11 1.08 1.05

Source: Bloomberg, US Federal Reserve, J.P. Morgan Asset Management. Market expectations are

calculated using OIS forwards. Data as of 18 March 2021. Telecom svc 0.0 9.1 67.2

Volatility (%)

The week ahead Utilities 0.3 -0.7 25.2

VIX 21 21 23 72

Days Country Event Period Survey Prior Value -0.1 9.6 57.7

Mon Japan Leading index Jan - 99.1 Growth -0.8 0.7 67.9

Tue UK Unemployment rate Jan - 5.1% 4-week Macro GDP (%)† CPI (%) Valuation Fwd P/E

Wed US PMI manufacturing Mar 59.5 58.6

moving

Euro PMI manufacturing Mar - 57.9 Eurozone -2.6 0.9 MSCI Europe 17.1

UK PMI manufacturing Mar - 55.1 Fund flows ($bn) w/e 12/03 w/e 05/03 avg. 4.0 0.7 14.4

UK FTSE 100

Japan PMI manufacturing Mar - 51.4 Equity 1.7 -13.9 -7.1 US 4.1 1.7 S&P 500 21.7

US PMI services Mar 60.0 59.8 Fixed income 3.5 15.0 11.5 Japan 11.7 -0.4 MSCI EM 15.3

Euro PMI services Mar - 45.7 Money market 29.7 18.5 18.8 China 10.8 -0.2 MSCI World 20.2

UK PMI services Mar - 49.5

Euro Consumer confidence Mar - -14.8

UK CPI (y/y) Feb - 0.7% Note: All index returns are total returns in local currency. Fund flows are for US-domiciled funds only,

excluding ETFs. *Term = index duration. †GDP q/q seasonally adjusted annual rate.

Fri UK Retail sales excl. fuel (y/y) Feb - -3.8%

|

The Weekly Brief

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-

making, the program explores the implications of current economic data and changing market conditions. For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing

communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs,

as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the

dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature

or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for

illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users

should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to

their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes

only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given

and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation

agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management

business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and

internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following

entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by

local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and

territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is

authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in

which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures

Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management

(Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan

Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and

761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only. For U.S. only: If you are a person with a

disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2021 JPMorgan Chase & Co. All rights reserved.

0903c02a81fb9234

Unless otherwise stated, all data is as of 19/03/2021. Economic releases: Bloomberg.

Equities: All data represents total returns for the stated period.

Fund flows: ICI.

Bond Yields: JPMorgan EMBIG OAS over Treasuries ; Barclays Global Aggregate Corporate OAS; Barclays Global High Yield OAS; Government bond yields: Source: Tullett Prebon Information, UK Government Bonds 10 Year Note Generic Bid Yield; German Government Bonds 10

Year Debencher; Japan 10 Year Bond Benchmark; US Generic Government 10 Year Yield.

Commodities: WTI and Brent are the crude oil price in $ per barrel, gold is $ per troy ounce, copper is $ per pound.

Rates: Bank of England Official Bank Rate; ECB Minimum Bid Refinancing Rate 1 Week; Federal Funds Target Rate; Bank of Japan Target Rate of Unsecured Overnight Call Rate; Bank of China 1 Year Best Lending Rate.

Macro: Headline CPI year on year percentage change; GDP growth quarter on quarter seasonally adjusted annualised rate.

You might also like

- Financial Management:: Understanding Financial Statements, Taxes, and Cash FlowsDocument102 pagesFinancial Management:: Understanding Financial Statements, Taxes, and Cash FlowsArgem Jay PorioNo ratings yet

- 07april 2021 India DailyDocument65 pages07april 2021 India DailyMaruthee SharmaNo ratings yet

- Morning Wrap 20231215Document9 pagesMorning Wrap 20231215Anurag PharkyaNo ratings yet

- QFR 03-March 2022 LDocument70 pagesQFR 03-March 2022 LNapolean DynamiteNo ratings yet

- 03july 2020 - India - Daily PDFDocument108 pages03july 2020 - India - Daily PDFChaitanya KekreNo ratings yet

- AP Newsletter Moderate September19Document15 pagesAP Newsletter Moderate September19sujeet panditNo ratings yet

- Public Shariah MFR August 2021Document47 pagesPublic Shariah MFR August 2021UmmiNo ratings yet

- Morning Wrap 20240314Document6 pagesMorning Wrap 20240314Raj VaswaniNo ratings yet

- Screenshot 2022-07-24 at 9.04.59 PMDocument46 pagesScreenshot 2022-07-24 at 9.04.59 PMieda1718No ratings yet

- Market Outlook 2Document26 pagesMarket Outlook 2amrejpal773No ratings yet

- QFR (PRS) March 2022Document20 pagesQFR (PRS) March 2022Napolean DynamiteNo ratings yet

- Equity Market Review November 2023Document5 pagesEquity Market Review November 2023final bossuNo ratings yet

- Weekly Market Snapshot: Philippine EquitiesDocument2 pagesWeekly Market Snapshot: Philippine EquitiesJM CrNo ratings yet

- The GIC WeeklyDocument12 pagesThe GIC WeeklyedgarmerchanNo ratings yet

- IndiaMorningBrief 20jun2022Document10 pagesIndiaMorningBrief 20jun2022PranavPillaiNo ratings yet

- Weekly Report - 3 Aug 2007Document5 pagesWeekly Report - 3 Aug 2007api-3840085No ratings yet

- Global Market Review Outlook-May 2023Document3 pagesGlobal Market Review Outlook-May 2023YasahNo ratings yet

- Ashmore Weekly Commentary 27 Jan 2023Document3 pagesAshmore Weekly Commentary 27 Jan 2023Jordanata TjiptarahardjaNo ratings yet

- Economic Outlook 2H22Document30 pagesEconomic Outlook 2H22AriefNoviantoWongsoharjoNo ratings yet

- MFR Period Ended 29 October 2021-LockedDocument69 pagesMFR Period Ended 29 October 2021-LockedChoon Fong LeeNo ratings yet

- Weekly Market RecapDocument2 pagesWeekly Market RecapLưuVănViếtNo ratings yet

- Weekly Brief 14 October 2022Document8 pagesWeekly Brief 14 October 2022saifulbohariNo ratings yet

- Chapter Three: Capital Marker Analysis of BangladeshDocument31 pagesChapter Three: Capital Marker Analysis of BangladeshGolam Samdanee TaneemNo ratings yet

- I Care Oct'08Document8 pagesI Care Oct'08rashmipraNo ratings yet

- Ashmore Weekly Commentary 5 Jan 2024Document3 pagesAshmore Weekly Commentary 5 Jan 2024bagus.dpbri6741No ratings yet

- 11february 2020 India DailyDocument120 pages11february 2020 India DailyRakesh SethiaNo ratings yet

- Weekly Investment Outlook - Aug 09 2010Document6 pagesWeekly Investment Outlook - Aug 09 2010Shikhar BhatiaNo ratings yet

- 4.a.b (MM) Monthly Fund Focus ListDocument13 pages4.a.b (MM) Monthly Fund Focus Listmark.qianNo ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- 08july 2019 India DailyDocument103 pages08july 2019 India DailyRakesh SethiaNo ratings yet

- India Daily 22082022 BKDocument71 pagesIndia Daily 22082022 BKRohan RustagiNo ratings yet

- Round Up of Fund Managers ActivitiesDocument27 pagesRound Up of Fund Managers Activitiesapi-3733080No ratings yet

- TD Economics: The Weekly Bottom LineDocument6 pagesTD Economics: The Weekly Bottom LinePaola VerdiNo ratings yet

- India Daily: June 3, 2021Document78 pagesIndia Daily: June 3, 2021mmNo ratings yet

- IndiaMorningBrief 7jul2023Document11 pagesIndiaMorningBrief 7jul2023Ranjan JainNo ratings yet

- Insentif Dan Relaksasi Pajak Di Masa Pandemi Covid-19Document24 pagesInsentif Dan Relaksasi Pajak Di Masa Pandemi Covid-19kacaribuantonNo ratings yet

- ICICI Prudential MF Head Start - 07062022Document2 pagesICICI Prudential MF Head Start - 07062022Chucha LullNo ratings yet

- ScotiaBank JUN 11 Weekly TrendDocument9 pagesScotiaBank JUN 11 Weekly TrendMiir ViirNo ratings yet

- MY Rates Strategy Update 254759Document8 pagesMY Rates Strategy Update 254759yennielimclNo ratings yet

- Economic Indicators 2019Document2 pagesEconomic Indicators 2019MeeroButtNo ratings yet

- IDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Document28 pagesIDX Capital Market Investment Outlook 2018 - Tito Sulistio - 31 Oct 2017Essantio DeniraNo ratings yet

- Scotia Weekly TrendsDocument11 pagesScotia Weekly Trendsdaniel_austinNo ratings yet

- Wealth Insights Newsletter March 2021Document49 pagesWealth Insights Newsletter March 2021P.S.K.B MohanNo ratings yet

- Morning - India 20220425 Mosl Mi PG022Document22 pagesMorning - India 20220425 Mosl Mi PG022Deepak KhatwaniNo ratings yet

- Weekly Market RecapDocument2 pagesWeekly Market RecapmarianoveNo ratings yet

- Fred Presentation 5-31-2016Document17 pagesFred Presentation 5-31-2016retiredcatholicNo ratings yet

- Market Pulse - April 2019Document12 pagesMarket Pulse - April 2019p comNo ratings yet

- Market Technical Reading: Stronger Buying Momentum On The Bluechips - 05/03/2010Document6 pagesMarket Technical Reading: Stronger Buying Momentum On The Bluechips - 05/03/2010Rhb InvestNo ratings yet

- Invest in UTI Gilt Fund - Debt Mutual Funds - UTI Mutual FundDocument12 pagesInvest in UTI Gilt Fund - Debt Mutual Funds - UTI Mutual FundRinku MishraNo ratings yet

- Weekly Headings SnapshotDocument1 pageWeekly Headings SnapshotgarciamorillopabloNo ratings yet

- BIMBSec Corp Day - 2022 Economic OutlookDocument17 pagesBIMBSec Corp Day - 2022 Economic Outlookmuhammad ihsanNo ratings yet

- 18may 2021 - India - DailyDocument105 pages18may 2021 - India - DailyAshutosh PatidarNo ratings yet

- JPM Investment OutlookDocument2 pagesJPM Investment OutlookAceNo ratings yet

- Morning Cuppa 22-FebDocument2 pagesMorning Cuppa 22-FebNitin ChauhanNo ratings yet

- Market Technical Reading - Remain Bullish On Short - To Medium-Term Outlook - 09/08/2010Document6 pagesMarket Technical Reading - Remain Bullish On Short - To Medium-Term Outlook - 09/08/2010Rhb InvestNo ratings yet

- M&A Conference - Global Markets and MacroeconomicsDocument20 pagesM&A Conference - Global Markets and Macroeconomicsjm petit100% (1)

- Currency Daily Report, June 21 2013Document4 pagesCurrency Daily Report, June 21 2013Angel BrokingNo ratings yet

- IDR Bond Market Update 13 September 2021 (Eng)Document5 pagesIDR Bond Market Update 13 September 2021 (Eng)Manonsih VictoryaNo ratings yet

- Morning Cuppa 12-DecDocument2 pagesMorning Cuppa 12-DecSaroNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- GS Global Fixed Income WeeklyDocument9 pagesGS Global Fixed Income WeeklyAceNo ratings yet

- Bank of America Capital Market OutlookDocument8 pagesBank of America Capital Market OutlookAceNo ratings yet

- Standard Chartered Weekly Market ViewDocument11 pagesStandard Chartered Weekly Market ViewAceNo ratings yet

- Moody's Weekly OutlookDocument23 pagesMoody's Weekly OutlookAceNo ratings yet

- Blackrock Weekly OutlookDocument6 pagesBlackrock Weekly OutlookAceNo ratings yet

- DBS Market OutlookDocument5 pagesDBS Market OutlookAceNo ratings yet

- Blackrock Weekly OutlookDocument6 pagesBlackrock Weekly OutlookAceNo ratings yet

- FX Get DoneDocument2 pagesFX Get DoneDev GogoiNo ratings yet

- Sales Management-Chapter 1Document18 pagesSales Management-Chapter 1Ashik PaulNo ratings yet

- Calculate-Ped-And-Yed A Level Business EdexcelDocument9 pagesCalculate-Ped-And-Yed A Level Business EdexcelNarmeen LodhiNo ratings yet

- Kingfisher CaseDocument8 pagesKingfisher CaseBizEasy AdvisorsNo ratings yet

- 5 Bar Reversal Pattern: Buy SetupDocument1 page5 Bar Reversal Pattern: Buy Setupalistair7682No ratings yet

- MKT Report DigiMartDocument63 pagesMKT Report DigiMartSabrina RahmanNo ratings yet

- Cost Concepts Exercises With AnswersDocument7 pagesCost Concepts Exercises With AnswersBRYLL RODEL PONTINONo ratings yet

- Chap 017Document48 pagesChap 017Farah ThabitNo ratings yet

- 6 APT Slides ch10Document53 pages6 APT Slides ch10Zoe RossiNo ratings yet

- The Role of Women Entrepreneurs in Economic DevelopmentDocument5 pagesThe Role of Women Entrepreneurs in Economic DevelopmentRomika DhingraNo ratings yet

- MakeMyTrip SEOUL NEWDocument3 pagesMakeMyTrip SEOUL NEWbindu mathaiNo ratings yet

- InvestIndia - PLI Textiles - VFDocument44 pagesInvestIndia - PLI Textiles - VFTushar JoshiNo ratings yet

- Recent Updated Citibank Account Statement-20220417 To 20221014 - UnlockedDocument22 pagesRecent Updated Citibank Account Statement-20220417 To 20221014 - UnlockedMayank YadavNo ratings yet

- 102 TUTORIAL CH 7 GDP and CPIDocument3 pages102 TUTORIAL CH 7 GDP and CPIJustin St DenisNo ratings yet

- Invoice-2024-02-11 11 - 02Document1 pageInvoice-2024-02-11 11 - 02arunkumarmevadaNo ratings yet

- Implementing The Government Accounting Manual (Gam) : (For National Government Agencies)Document25 pagesImplementing The Government Accounting Manual (Gam) : (For National Government Agencies)Joann Rivero-SalomonNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationMonica MangobaNo ratings yet

- SEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inDocument13 pagesSEBI (Prohibition of Insider Trading) Regulations, 2015 - Taxguru - inshubhendra mishraNo ratings yet

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Socialism in TanzaniaDocument12 pagesSocialism in TanzaniaGiadaNo ratings yet

- Solved Paper I - 2021Document41 pagesSolved Paper I - 2021Eswar AnaparthiNo ratings yet

- 2020-20211003 LLB TycDocument94 pages2020-20211003 LLB TycGeeta GuptaNo ratings yet

- Dealer Application FormDocument8 pagesDealer Application FormminNo ratings yet

- Humentum Finance Health Check 2022Document13 pagesHumentum Finance Health Check 2022Emmanuel LompoNo ratings yet

- SAP Repetitive ManufacturingDocument12 pagesSAP Repetitive ManufacturingLarisa SchiopuNo ratings yet

- TT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarDocument5 pagesTT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarNGỌC ĐIỆP TRẦNNo ratings yet

- Group Report Financial ManagementDocument21 pagesGroup Report Financial ManagementNur Nabilah NoranizamNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Af201 Revision Package s1, 2021Document4 pagesAf201 Revision Package s1, 2021Rachna ChandNo ratings yet