Professional Documents

Culture Documents

Abm 004 - Reviewer

Abm 004 - Reviewer

Uploaded by

Mary Beth Dela Cruz0 ratings0% found this document useful (0 votes)

20 views8 pagesFinance involves the management of monetary resources and has three categories: public, corporate, and personal. Financial management aims to maximize a company's wealth through efficient allocation of funds. Key finance roles include the CFO, comptroller, treasurer, and internal auditors. A finance manager's responsibilities encompass financing, investing, daily operations, and dividend policies. Financial systems allow for the exchange of funds between lenders, borrowers, and intermediaries using various instruments and markets.

Original Description:

Original Title

ABM 004 - REVIEWER

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinance involves the management of monetary resources and has three categories: public, corporate, and personal. Financial management aims to maximize a company's wealth through efficient allocation of funds. Key finance roles include the CFO, comptroller, treasurer, and internal auditors. A finance manager's responsibilities encompass financing, investing, daily operations, and dividend policies. Financial systems allow for the exchange of funds between lenders, borrowers, and intermediaries using various instruments and markets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views8 pagesAbm 004 - Reviewer

Abm 004 - Reviewer

Uploaded by

Mary Beth Dela CruzFinance involves the management of monetary resources and has three categories: public, corporate, and personal. Financial management aims to maximize a company's wealth through efficient allocation of funds. Key finance roles include the CFO, comptroller, treasurer, and internal auditors. A finance manager's responsibilities encompass financing, investing, daily operations, and dividend policies. Financial systems allow for the exchange of funds between lenders, borrowers, and intermediaries using various instruments and markets.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

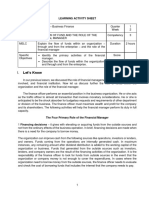

ABM 004 - REVIEWER 1

Defining Finance and Identifying who are Responsible for

Financial Management within the Organization

Finance - a branch of economics concerned with resource allocation as well

as resource management, resource acquisition and investment.

Finance 3 distinct categories: public finance, corporate finance and

personal finance.

ABM 004 - REVIEWER 2

Financial management refers to the efficient and effective management of

money (funds) in such a manner as to accomplish the objectives of the

organization.

- These decisions will ultimately affect the markets perception of the

company and influence the share of price.

- The goal of financial management is to maximize company’s wealth.

POSITIONS IN THE FINANCE DEPARTMENT

1. Chief Financial Officer (CFO) - provides both operational and

programmatic support to the organization. The CFO supervises the finance

unit and is the chief financial spokesperson for the organization. The CFO

reports directly to the President/Chief Executive Officer (CEO) and

directly assists the Chief Operating Officer (COO) on all strategic and

tactical matters as they relate to budget management, cost benefit

analysis, forecasting needs and the securing of new funding.

2. Comptroller - is in charge of overseeing the daily accounting

operations of a business. In a small business, the comptroller may be

responsible for doing all the accounting tasks for the business.

3. Treasurer - is responsible for corporate liquidity, investments, and

risk management related to the company's financial activities.

4. Internal auditors - work within businesses and organizations to monitor

and evaluate how well risks are being managed, the business is being

governed and internal processes are working.

ABM 004 - REVIEWER 3

Describing the Functions and Roles of Finance Manager

Functions of Financial Manager

Financing - includes making decisions on how to fund long term investment

such as company expansions and working capital which deals with the day to

day operations of the company (i.e., purchase of inventory, payment of

operating expenses, etc.) This also involves determining the appropriate

capital structure of the company. Capital structure refers to how much of

your total assets are financed by debt and how much is financed by equity.

Investing - a finance manager function that includes choosing which type

of investment should it invest in that would secure the best profits.

Investments may be short or long term.

Operating - deals with the daily operations of the company. It also

involves determining how to finance working capital account such as

accounts receivable and inventories.

Dividend Policies - Cash dividends are paid by corporations to existing

shareholders based on their shareholdings in the company as a return on

their investment. The role of a financial manager is to determine when the

company should declare cash dividends.

ABM 004 - REVIEWER 4

Introducing the Concept of Financial System

Financial System - is the system that enable lenders and borrowers to

exchange fund. It covers the financial transactions and the exchange of

money between investors, lenders and borrowers.

Financial Markets - organized forums in which the suppliers and users of

various types of funds can make transactions directly.

Financial Institutions - intermediaries that channel the savings of

individuals, businesses, and governments into loans or investments.

Private Placements - the sale of a new security directly to an investor or

group of

investors

Financial Instruments - is a real or a virtual document representing a

legal agreement involving some sort-of monetary value. These can be

securities like corporate bonds or equity like shares of stocks.

Suppliers of Fund/Lenders - the holders of financial asset

Demanders of Fund/Borrowers - the users of financial asset or the makers

of financial liabilities and equity instruments.

Method of Transfering Funds:

Direct Finance - refers to lending by ultimate borrowers with no

intermediary

Indirect Finance - refers to lending by an ultimate lender to a financial

intermediary that then relends to ultimate borrowers.

ABM 004 - REVIEWER 5

Identifying the Types of Financial Markets, Financial

Instruments and Financial Institutions

Financial Instruments

- When a financial instrument is issued, it gives rise to a financial

asset on one hand and a financial liability or equity instrument on the

other.

Financial Assets:

- Cash

- An equity instrument of another entity.

- A contractual right to receive cash or another financial asset from

another entity.

- Notes Receivable

- Loans Receivable

- Investments in Stocks

- Investments in Bonds

Financial Liability

- Notes Payable

- Loans Payable

- Bonds Payable

Debt and Equity Instrument:

Debt Instrument- generally has fixed returns due to fixed interest rates.

- Bonds - an instrument of indebtedness.

- Treasury Bond and Treasury Bills - issued by the Philippine government

- Corporate Bonds - issued by the publicly listed companies.

ABM 004 - REVIEWER 6

Equity Instruments - have varied returns based on the performance of the

issuing company.

- Stocks - an instrument of ownership.

- Preferred Stocks - has priority over a common stock in terms of claims

over the asset of a company.

- Common stocks - the holders of these are the real owners of the company.

If the company’s growth is spurring, the common stockholders will benefit

on the growth.

Financial Market

Money Market are a venue wherein securities with short-term maturities (1

year or less) are sold.

Capital Market - securities with long term maturities are sold. The key

capital market securities are bonds and both common stock and preferred

stocks.

Primary Market - Financial market in which securities are initially issued;

the only market in which the issuer is directly involved in the

transaction.

Secondary Market - Financial market in which preowned securities (those

that are not new issues) are traded.

Financial Institutions

Commercial Banks - individuals deposit funds at commercial banks, which

use the deposited funds to provide commercial loans to firms and personal

loans to individuals.

Insurance Companies - pool the payments of individuals and invest the

proceeds in various securities until the funds are needed to pay off

claims by policyholders.

ABM 004 - REVIEWER 7

Mutual Funds - owned by investment companies which enable small investors

to enjoy the benefits of investing in a diversified portfolio of

securities purchased on their behalf by professional investment managers.

Pension Funds - receive payments from employees and invest the proceeds on

their behalf.

Other Financial Institutions - include pension funds like Government

Service Insurance System(GSIS) and Social Security System(SSS), investment

banks, credit unions, among others.

Preparing Horizontal Analysis for Financial Statements

Horizontal analysis (also known as trend analysis) is a financial

statement analysis technique that shows changes in the amounts of

corresponding financial statement items over a period of time. It is a

useful tool to evaluate the trend situations.

ABM 004 - REVIEWER 8

Preparing Vertical Analysis for Financial Statements

Vertical analysis (also known as common-size analysis) is a popular method

of financial statement analysis that shows each item on a statement as a

percentage of a base figure within the statement.

You might also like

- Sept Bank - NewDocument9 pagesSept Bank - NewLisa HesterNo ratings yet

- The 4 Hour Workweek, Expanded and Updated by Timothy Ferriss - ExcerptDocument38 pagesThe 4 Hour Workweek, Expanded and Updated by Timothy Ferriss - ExcerptCrown Publishing Group23% (946)

- Capital BudgetingDocument89 pagesCapital BudgetingtirumaleshNo ratings yet

- Lesson 1 Business FinanceDocument50 pagesLesson 1 Business FinanceJasmine MendozaNo ratings yet

- Business Finance ReviewerDocument8 pagesBusiness Finance ReviewerLilac LucyNo ratings yet

- CourseSummary Q3Document16 pagesCourseSummary Q3nani.faminialNo ratings yet

- Some What Solved QB-Financial Mnagement-MBM633Document7 pagesSome What Solved QB-Financial Mnagement-MBM633Amit KumarNo ratings yet

- Corporate LawDocument15 pagesCorporate LawLaxmi WankhedeNo ratings yet

- FM Ch-1 IntroductionDocument27 pagesFM Ch-1 IntroductionNatnael Asfaw0% (1)

- READINGS 1business FinanceDocument1 pageREADINGS 1business FinanceWilhelmina L. RomanNo ratings yet

- Financial Management IDocument62 pagesFinancial Management Ihasenabdi30No ratings yet

- Chapter 1Document7 pagesChapter 1HananNo ratings yet

- 1 Long Test ReviewerDocument15 pages1 Long Test Reviewerjennie martNo ratings yet

- An Overview of Finantial ManagementDocument30 pagesAn Overview of Finantial ManagementGizaw BelayNo ratings yet

- Untitled DocumentDocument5 pagesUntitled DocumentMarjorie Salvador ValleNo ratings yet

- Planning, Organizing, Directing and Controlling: Estimation of Capital RequirementsDocument4 pagesPlanning, Organizing, Directing and Controlling: Estimation of Capital RequirementsJG ElbaNo ratings yet

- Finman Midterm ReviewerDocument12 pagesFinman Midterm ReviewerNoneh EardNo ratings yet

- Attachment Tutor 2Document6 pagesAttachment Tutor 2Florielyn Asto ManingasNo ratings yet

- Principles of Managerial Finance HandoutsDocument2 pagesPrinciples of Managerial Finance HandoutsFatima Asprer100% (1)

- Financial ManagementDocument31 pagesFinancial ManagementShashikant MishraNo ratings yet

- Fm-I Chap-I EditedDocument29 pagesFm-I Chap-I Editedtibebu5420No ratings yet

- BA100FMREVIEWERDocument8 pagesBA100FMREVIEWERMadelyn GayolNo ratings yet

- Business FinanceDocument90 pagesBusiness FinanceSandara beldo100% (1)

- Finance FunctionDocument10 pagesFinance Functionadmire007No ratings yet

- Business FinanceDocument52 pagesBusiness FinanceJayMoralesNo ratings yet

- Finance Chapter 1Document11 pagesFinance Chapter 1MayNo ratings yet

- Finance FunctionDocument25 pagesFinance FunctionKane0% (1)

- Business Finance ReviewerDocument4 pagesBusiness Finance ReviewerDubu GloryNo ratings yet

- Chapter 1 STOCKS 101Document4 pagesChapter 1 STOCKS 101Annadelle Dimatulac LeeNo ratings yet

- Introduction To Business FinanceDocument4 pagesIntroduction To Business FinanceHennessy Shania Gallera ArdienteNo ratings yet

- Malvik ProjectDocument95 pagesMalvik ProjectKamal ShahNo ratings yet

- Financial ManagementDocument43 pagesFinancial Managementonly_vimaljoshi100% (3)

- Chapter 1Document17 pagesChapter 1Tasebe GetachewNo ratings yet

- Importance of Finance:-: Chapter - 1Document102 pagesImportance of Finance:-: Chapter - 1VidyaNo ratings yet

- Business Studies NotesDocument30 pagesBusiness Studies NotesEngineers UniqueNo ratings yet

- Finance Chapter 1Document32 pagesFinance Chapter 1Tamzid Ahmed AnikNo ratings yet

- Investment Environment and Investment Management ProcessDocument3 pagesInvestment Environment and Investment Management ProcessGina BallNo ratings yet

- Chapter 1 - Overview of Corporate FinanceDocument26 pagesChapter 1 - Overview of Corporate Finance21124014No ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementISLAND ROYASNo ratings yet

- Cap Market Reviewer Prelm CastilloDocument4 pagesCap Market Reviewer Prelm CastilloMargaux Julienne CastilloNo ratings yet

- Role and Environment of Managerial FinanceDocument7 pagesRole and Environment of Managerial Financeliesly buticNo ratings yet

- Definition of FinanceDocument9 pagesDefinition of FinanceIni IchiiiNo ratings yet

- Business FinanceDocument32 pagesBusiness FinanceEowyn DianaNo ratings yet

- FM NotesDocument61 pagesFM Noteskunal taldarNo ratings yet

- CF NotesDocument5 pagesCF Notes087-Md Arshad Danish KhanNo ratings yet

- Define Finance: Finance Is Defined As The Management of Money and IncludesDocument5 pagesDefine Finance: Finance Is Defined As The Management of Money and IncludesGil TeodosipNo ratings yet

- Financial Management Teaching Material1Document72 pagesFinancial Management Teaching Material1Semere Deribe100% (2)

- Business FinanceDocument19 pagesBusiness FinanceMarjorie GabonNo ratings yet

- A Study of Financial Performance Through RatiosDocument91 pagesA Study of Financial Performance Through RatiosPrashanth PBNo ratings yet

- Module 1 FM NotesDocument18 pagesModule 1 FM NotesDachu DarshanNo ratings yet

- FinanceDocument117 pagesFinancenarendraidealNo ratings yet

- Finance NotesDocument5 pagesFinance NotesflordeliciousssNo ratings yet

- Let's Know: Learning Activity SheetDocument8 pagesLet's Know: Learning Activity SheetWahidah BaraocorNo ratings yet

- Finance and InvestmentDocument16 pagesFinance and InvestmentMohamedi ZuberiNo ratings yet

- The Domestic and International Financial Market - Alfinda and AbionDocument9 pagesThe Domestic and International Financial Market - Alfinda and Abionspp9g6qg6cNo ratings yet

- Roxanne Babe B. Castro ABM-1: Let's Dig inDocument4 pagesRoxanne Babe B. Castro ABM-1: Let's Dig inRoxie CastroNo ratings yet

- Some of The Important Functions of Stock Exchange/Secondary Market Are Listed BelowDocument3 pagesSome of The Important Functions of Stock Exchange/Secondary Market Are Listed BelowNadir ShahNo ratings yet

- FM 1-3Document53 pagesFM 1-3zeleke fayeNo ratings yet

- Bumanglag BES9 Page 267Document3 pagesBumanglag BES9 Page 267Michael Sean BumanglagNo ratings yet

- Financial MNGT Module1Document39 pagesFinancial MNGT Module1Stephanie FrescoNo ratings yet

- Business Finance For Video Module 1Document11 pagesBusiness Finance For Video Module 1Bai NiloNo ratings yet

- Tactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionFrom EverandTactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionNo ratings yet

- Mapeh 4QDocument9 pagesMapeh 4QMary Beth Dela CruzNo ratings yet

- Gen 002 ReviewerDocument2 pagesGen 002 ReviewerMary Beth Dela CruzNo ratings yet

- Abm 006 - ReviewerDocument8 pagesAbm 006 - ReviewerMary Beth Dela CruzNo ratings yet

- Abm 005 - ReviewerDocument6 pagesAbm 005 - ReviewerMary Beth Dela CruzNo ratings yet

- Abm 003 - ReviewerDocument12 pagesAbm 003 - ReviewerMary Beth Dela CruzNo ratings yet

- App 002 - ReviewerDocument9 pagesApp 002 - ReviewerMary Beth Dela CruzNo ratings yet

- Mutasi Transaksi - PermataME6574 - 81202124833Document3 pagesMutasi Transaksi - PermataME6574 - 81202124833jainulNo ratings yet

- IX. How To Read Financial Bond Pages: Notes HDocument7 pagesIX. How To Read Financial Bond Pages: Notes HZvioule Ma FuentesNo ratings yet

- Topic 14 - Part 2 StudentsDocument29 pagesTopic 14 - Part 2 StudentsAlariq JoeNo ratings yet

- SAP FICO ERP 会计科目中英文对照表Document7 pagesSAP FICO ERP 会计科目中英文对照表yixiu188No ratings yet

- M 025Document3 pagesM 025Gilbert Aldana GalopeNo ratings yet

- Accounting For Banking Institutions PDFDocument45 pagesAccounting For Banking Institutions PDFNchendeh ChristianNo ratings yet

- Regulatory Bodies in Financial SystemDocument10 pagesRegulatory Bodies in Financial SystemSarvesh Kumar Shukla100% (1)

- About Bosna Bank International (BBI)Document1 pageAbout Bosna Bank International (BBI)HasoNo ratings yet

- Spouses Puerto vs. CA (Digest)Document2 pagesSpouses Puerto vs. CA (Digest)Samantha Nicole100% (1)

- NG Gee Yeong V RHB Bank (2019) 2 CLJ 429Document10 pagesNG Gee Yeong V RHB Bank (2019) 2 CLJ 429Alae KieferNo ratings yet

- Sbi MaDocument251 pagesSbi MaHMS DeedNo ratings yet

- NPS Subscribe Master Change Form CS S2Document7 pagesNPS Subscribe Master Change Form CS S2Shailesh Marwaha100% (1)

- Bank NewsletterDocument4 pagesBank Newsletterapi-239769913No ratings yet

- Notes To The Annals of TacitusDocument391 pagesNotes To The Annals of TacitusFarahNo ratings yet

- Banking Industry KYIDocument199 pagesBanking Industry KYIYasmeen MahammadNo ratings yet

- General Math 2019-2020Document4 pagesGeneral Math 2019-2020Werty Gigz DurendezNo ratings yet

- Theories of Financial IntermediationDocument38 pagesTheories of Financial Intermediationnira_1100% (1)

- ARCC - New ARCCDocument85 pagesARCC - New ARCCasombrado.cscdNo ratings yet

- Genoa: This Article Is About The Italian Port City. For Other Uses, See andDocument5 pagesGenoa: This Article Is About The Italian Port City. For Other Uses, See andOlegseyNo ratings yet

- Spouses Reyes v. BPI (2006)Document5 pagesSpouses Reyes v. BPI (2006)springchicken88No ratings yet

- Marphil Export Vs Allied BankingDocument34 pagesMarphil Export Vs Allied BankingAngel AmarNo ratings yet

- Bcoc - 137 PDFDocument3 pagesBcoc - 137 PDFShiv KumarNo ratings yet

- 10 News LetterDocument40 pages10 News LetterTarek DomiatyNo ratings yet

- Southern v. Barbosa Facts:: ChanroblesvirtuallawlibraryDocument1 pageSouthern v. Barbosa Facts:: ChanroblesvirtuallawlibraryanalynNo ratings yet

- MCQ - 2022Document58 pagesMCQ - 2022Master Mind100% (1)

- Barclays Bank PLC Terms April 2021 - Ibim10360Document12 pagesBarclays Bank PLC Terms April 2021 - Ibim10360THNo ratings yet

- Victor Bulmer-Thomas-Britain and Latin America - A Changing Relationship (2008)Document251 pagesVictor Bulmer-Thomas-Britain and Latin America - A Changing Relationship (2008)Teo KupradzeNo ratings yet

- General Awareness: SBI Probationary Officers (PO) Written Exam General Awareness Sample Questions and AnswersDocument13 pagesGeneral Awareness: SBI Probationary Officers (PO) Written Exam General Awareness Sample Questions and AnswersAditya VermaNo ratings yet