Professional Documents

Culture Documents

Transaction S Assets Liabilities Owner'S Equity Debit Credit Debit Credit Debit Credit

Transaction S Assets Liabilities Owner'S Equity Debit Credit Debit Credit Debit Credit

Uploaded by

ErineaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transaction S Assets Liabilities Owner'S Equity Debit Credit Debit Credit Debit Credit

Transaction S Assets Liabilities Owner'S Equity Debit Credit Debit Credit Debit Credit

Uploaded by

ErineaCopyright:

Available Formats

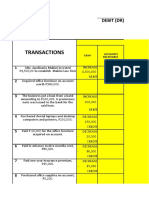

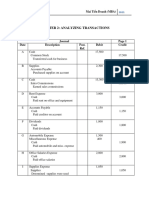

TRANSACTION ASSETS LIABILITIES OWNER’S EQUITY

S

DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT

1.Investment of Cash 50,000 J. Dela Cruz

50,000 by Engr. Debit EQUITY

J.Dela Cruz to 50,000

his business Credit

2.Payment of Cash 300 Taxes and

business taxes Credit Licenses

300 300

Debit

3.Purchase of Office Cash 10,000

office furniture Furniture Credit

for cash 10,000 10,000

Debit

4.Purchase of Office Account

office Equipment Payable

equipment on 15,000 15,000

account 15,000 Debit Credit

5.Partial Cash Account

payment of the 12,000 Payable

account in no. Credit 12,000

#4 12,000 Debit

6. Payment of Cash 5,000 Rent Expenses

office rent for Credit 5,000

the month Debit

5,000

7. Receipt of Cash Fees

cash for 30,000 Income/Professional

professional Debit fees

services 30,000 Credit

rendered to a

client 30,000

8. Billing of Account Fees Income

another client Receivables Credit

for professional 5,000

services Debit

rendered 5,000

9. Partial Cash, Account

collection in 3,000 Receivable

cash for the Debit 3,000

billing made in Credit

no.#8 3,000

10. Payment of Cash Salaries and

salaries of 8,000 Wages

employees for Credit 8,000

the month Debit

8,000

11. Payment of Cash Utilities

water and 1,000 Expenses

electricity for Credit 1,000

the month Debit

1,000

12. Withdrawal Cash J. Dela Cruz

of cash by 7,000 Credit Drawing

Engr.J dela Cruz

for his personal

use 7,000

You might also like

- Bookkeeping Case Study 1Document10 pagesBookkeeping Case Study 1Manu Madaan75% (4)

- Page 1 of 5 Statement Summary May 2021 Statement Period 5/1/2021 - 5/31/2021Document5 pagesPage 1 of 5 Statement Summary May 2021 Statement Period 5/1/2021 - 5/31/2021PhillipNo ratings yet

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- Upcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingDocument8 pagesUpcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingJames FranklinNo ratings yet

- Journal (Remedios Palaganas)Document2 pagesJournal (Remedios Palaganas)Mika CunananNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- ACC 111 Final Exam: Name: - Rachel PedersenDocument9 pagesACC 111 Final Exam: Name: - Rachel PedersenJonalyn LastimadoNo ratings yet

- Calpine Part1Document14 pagesCalpine Part1Prachi KhaitanNo ratings yet

- Unit 2 Tutorial Worksheet AnswersDocument15 pagesUnit 2 Tutorial Worksheet AnswersHhvvgg BbbbNo ratings yet

- Activity 1 - JournalizingDocument2 pagesActivity 1 - JournalizingJesther Nasa-anNo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Diaz - Journal EntriesDocument4 pagesDiaz - Journal EntriesPangitkaNo ratings yet

- Financial Accounting Journalization and Trial BalanceDocument5 pagesFinancial Accounting Journalization and Trial BalanceRemy Rose LetranNo ratings yet

- CHP 2 Exam Preparation ProblemsDocument3 pagesCHP 2 Exam Preparation ProblemsShawn JohnstonNo ratings yet

- Module-2-3 4Document27 pagesModule-2-3 4arjunarcamoNo ratings yet

- Acc 111 Exam Review 1 Notes and SolutionDocument12 pagesAcc 111 Exam Review 1 Notes and SolutionGeorgeNo ratings yet

- SOLUTIONS3Document6 pagesSOLUTIONS3peterpark0903No ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Do It 2Document2 pagesDo It 2Khanh QuyenNo ratings yet

- ITDocument4 pagesITNamnam PacheNo ratings yet

- FAR - Module 6 - Act. 6 AnswerDocument15 pagesFAR - Module 6 - Act. 6 AnswerAngel Justine Bernardo100% (6)

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Exercise 2 For Service Journalizing: 1 DebitDocument1 pageExercise 2 For Service Journalizing: 1 DebitZymon Andrew MaquintoNo ratings yet

- Assignment 2 Q 3.7 & 3.8Document2 pagesAssignment 2 Q 3.7 & 3.8ehte19797177No ratings yet

- Louie Anne R. Lim - 03 Activity 1Document3 pagesLouie Anne R. Lim - 03 Activity 1Louie Anne LimNo ratings yet

- Accounting Aug 31Document7 pagesAccounting Aug 31Mary Ingrid Arellano RabulanNo ratings yet

- Unit 1: Introduction of Business EquationDocument14 pagesUnit 1: Introduction of Business EquationAnees GillaniNo ratings yet

- Performance Task #6 Rules of Debit and CreditDocument1 pagePerformance Task #6 Rules of Debit and CredittineNo ratings yet

- Answer Key Chapter 3Document60 pagesAnswer Key Chapter 3HectorNo ratings yet

- Fabm 1Document6 pagesFabm 1Adam CuencaNo ratings yet

- Mid Term AccountingDocument10 pagesMid Term AccountingAhmad ZakariaNo ratings yet

- Step 1Document4 pagesStep 1Carls AligwayNo ratings yet

- Accounting For Sole Proprietorship Problem3-6Document3 pagesAccounting For Sole Proprietorship Problem3-6Rocel Domingo100% (1)

- CASE 1: PM Company: Total Current Asset 1,750,000Document3 pagesCASE 1: PM Company: Total Current Asset 1,750,000JanineD.MeranioNo ratings yet

- CASE 1: PM Company Requirement: Compute For The Total Current Asset On Dec 31, 2X14Document3 pagesCASE 1: PM Company Requirement: Compute For The Total Current Asset On Dec 31, 2X14JanineD.MeranioNo ratings yet

- Practice Question and Answer On Preparing JournalDocument3 pagesPractice Question and Answer On Preparing JournalNaz JrNo ratings yet

- Class Exercise Sheet FourDocument9 pagesClass Exercise Sheet Fourcarol mohasebNo ratings yet

- Managerial AccountingDocument10 pagesManagerial AccountingAbdisen TeferaNo ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Lecture - RevisedDocument8 pagesLecture - RevisedDanny LeonenNo ratings yet

- Assets Are Resources Owned by A Business. They Are Things of Value Used in Carrying Out Such Activities As Production and ExchangeDocument24 pagesAssets Are Resources Owned by A Business. They Are Things of Value Used in Carrying Out Such Activities As Production and ExchangeRegine Alesna AlcoberNo ratings yet

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- S. Roces (Closing)Document11 pagesS. Roces (Closing)Jesseric RomeroNo ratings yet

- UntitledDocument17 pagesUntitledJoshua Arjay V. ToveraNo ratings yet

- Activity in FABM 2Document2 pagesActivity in FABM 2CHERIE MAY ANGEL QUITORIANONo ratings yet

- IntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Document137 pagesIntAcc 1 by Valix 2023 Edition Answer Key From Chapter 4-14Bella Flair100% (1)

- IA Chapter-8-10Document8 pagesIA Chapter-8-10Christine Joyce EnriquezNo ratings yet

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet

- AssessmentDocument20 pagesAssessmentJenecil JavierNo ratings yet

- Preparing Financial StatementsDocument29 pagesPreparing Financial StatementsEnlightenMENo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Amaliya Quiz Tutor Finacc 1 Week 2Document8 pagesAmaliya Quiz Tutor Finacc 1 Week 2Amaliya MalikovaNo ratings yet

- Assignment - J&RDocument6 pagesAssignment - J&RJie SapornaNo ratings yet

- NLKT - PR2-2B - GR8Document5 pagesNLKT - PR2-2B - GR8kimphuc3819No ratings yet

- Accounting 02182021Document4 pagesAccounting 02182021badNo ratings yet

- BSA1B.pcoa006. Aggabao, John Oliver M.prelim Quiz 1Document23 pagesBSA1B.pcoa006. Aggabao, John Oliver M.prelim Quiz 1Nikko Vher CadornioNo ratings yet

- Chapter 12-14Document18 pagesChapter 12-14Serena Van Der WoodsenNo ratings yet

- Answer Chapter 1Document5 pagesAnswer Chapter 1Nguyễn Châu Mỹ KiềuNo ratings yet

- Chapter 2 AccountingDocument12 pagesChapter 2 Accountingmoon loverNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Las 1 Atom and ElementDocument2 pagesLas 1 Atom and ElementErineaNo ratings yet

- Activity 1Document3 pagesActivity 1ErineaNo ratings yet

- Quiz2 Directions Using Signal WordsDocument1 pageQuiz2 Directions Using Signal WordsErineaNo ratings yet

- BFAST FormDocument1 pageBFAST FormErineaNo ratings yet

- PA3 Directions Using Signal WordsDocument2 pagesPA3 Directions Using Signal WordsErineaNo ratings yet

- Christian Living Education 1Document2 pagesChristian Living Education 1ErineaNo ratings yet

- WikipediaDocument2 pagesWikipediaErineaNo ratings yet

- Week 4: Identifying The Inquiry and Stating The Problem: Topic Sources Research TopicDocument2 pagesWeek 4: Identifying The Inquiry and Stating The Problem: Topic Sources Research TopicErineaNo ratings yet

- 169Document3 pages169ErineaNo ratings yet

- LAS 2 - Rocks and MineralsDocument3 pagesLAS 2 - Rocks and MineralsErineaNo ratings yet

- Critical Reading Strategies Activity TVL ICTDocument2 pagesCritical Reading Strategies Activity TVL ICTErineaNo ratings yet

- 21 Century Literature From The Philippines and The WorldDocument5 pages21 Century Literature From The Philippines and The WorldErineaNo ratings yet

- 1526Document2 pages1526ErineaNo ratings yet

- First Quarter AY 2020-2021, First Semester Grade 11 - 21 Century Literature Name: - Date: - Teacher: - Year and SectionDocument5 pagesFirst Quarter AY 2020-2021, First Semester Grade 11 - 21 Century Literature Name: - Date: - Teacher: - Year and SectionErineaNo ratings yet

- All Chapter QuizDocument32 pagesAll Chapter QuizRebecaNo ratings yet

- AAA Master Agreement For Derivates Trading and Forward TransactionsDocument3 pagesAAA Master Agreement For Derivates Trading and Forward TransactionsjarrmexicoNo ratings yet

- Option Floor and Caps Collars MFI FINALDocument20 pagesOption Floor and Caps Collars MFI FINALamit_harry100% (2)

- Quiz 1Document9 pagesQuiz 1Czarhiena SantiagoNo ratings yet

- In The Books of M/S. Vikas Trading Co.: Date Particulars Debit Credit CGST SGST IgstDocument12 pagesIn The Books of M/S. Vikas Trading Co.: Date Particulars Debit Credit CGST SGST IgstBlossom KaurNo ratings yet

- Internship Report Overview of Islami Bank Bangladesh LimitedDocument20 pagesInternship Report Overview of Islami Bank Bangladesh LimitedSISkobir100% (1)

- R&R Swot PestleDocument5 pagesR&R Swot Pestle4696506No ratings yet

- Assessment of Non-Performing Loan Management System of Oromia International Bank in Case of Wolkite BranchDocument31 pagesAssessment of Non-Performing Loan Management System of Oromia International Bank in Case of Wolkite BranchAjaib ZinabNo ratings yet

- Credit Management of Sonali Bank Limited27 6Document49 pagesCredit Management of Sonali Bank Limited27 6Md Alamgir KabirNo ratings yet

- Branding Strategy of BKash, Final ReportDocument35 pagesBranding Strategy of BKash, Final Reportmd. nazmul100% (1)

- ATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - July 2022Document4 pagesATRAM ASIA EQUITY OPPORTUNITY FEEDER FUND KIIDS - July 2022Rohit BadaveNo ratings yet

- LINDA CANALES - e - Statement - 71840000009446982Document6 pagesLINDA CANALES - e - Statement - 71840000009446982Steven LeeNo ratings yet

- Journal of Business Economics and ManagementDocument21 pagesJournal of Business Economics and Managementsajid bhattiNo ratings yet

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDocument8 pagesChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanNo ratings yet

- Required: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisDocument3 pagesRequired: Using These Data, Construct The December 31, Year 5 Balance Sheet For Your AnalysisJARED DARREN ONGNo ratings yet

- Cash Flow StatementDocument40 pagesCash Flow Statementtairakazida100% (3)

- 165207019767Document281 pages165207019767warehouseNo ratings yet

- Does PPP Eliminate Concerns About Long Term Exchange Rate RiskDocument1 pageDoes PPP Eliminate Concerns About Long Term Exchange Rate Risktrilocksp SinghNo ratings yet

- Simulation 5 - Appendix BDocument5 pagesSimulation 5 - Appendix BnelsonquilelliNo ratings yet

- 2008 Global Economic Crisi1Document8 pages2008 Global Economic Crisi1Carlos Rodriguez TebarNo ratings yet

- Lecture Chapter 5Document32 pagesLecture Chapter 5Mai HiếuNo ratings yet

- Bank's Lending Functions and Types of LoansDocument26 pagesBank's Lending Functions and Types of LoansAshish Gupta100% (1)

- Calpine CorporationDocument20 pagesCalpine CorporationAbhishek GuptaNo ratings yet

- Mini Case - Chapter 4Document5 pagesMini Case - Chapter 4mfitani100% (1)

- Management of Financail Instutions - Chapter 1 BBS 4th YearDocument29 pagesManagement of Financail Instutions - Chapter 1 BBS 4th YearProjohn Chaudhary50% (2)

- Valix MCQ Chapt 9 10 11 14 PDFDocument26 pagesValix MCQ Chapt 9 10 11 14 PDFRengeline LucasNo ratings yet

- Investment & Gambling: Asst - Prof .Seena Alappatt Dept of Management StudiesDocument24 pagesInvestment & Gambling: Asst - Prof .Seena Alappatt Dept of Management Studiesseena15No ratings yet