Professional Documents

Culture Documents

Equity REIT - Sample Balance Sheet

Equity REIT - Sample Balance Sheet

Uploaded by

merag76668Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity REIT - Sample Balance Sheet

Equity REIT - Sample Balance Sheet

Uploaded by

merag76668Copyright:

Available Formats

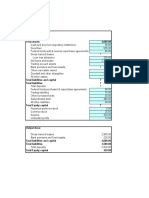

Equity REIT - Sample Balance Sheet

($ in Millions)

Last Historical

Period

Assets:

Real Estate:

Land: $ 1,000

Buildings and Improvements: 3,800

Furniture, Fixtures & Equipment: 500

Gross Real Estate Operating Assets: 5,300

Less: Accumulated Depreciation: (1,500)

Net Operating Real Estate: 3,800

Construction in Progress: 500

Land Held for Development: 300

Real Estate Assets Held for Sale: 200

Total Real Estate, Net of Accumulated Depreciation: 4,800

Cash & Cash-Equivalents: 180

Investments in Equity Interests: 150

Capitalized Financing Fees: 20

Accounts Receivable, Net: 100

Prepaid Expenses & Other Assets: 150

Total Assets: $ 5,400

Liabilities & Shareholders' Equity:

Total Debt, Net of Discounts: $ 2,000

Accounts Payable: 100

Accrued Expenses & Other Liabilities: 200

Total Liabilities: 2,300

Redeemable Noncontrolling Interests: 100

Shareholders' Equity:

Noncontrolling Interests: 100

Preferred Stock: -

Common Stock & Additional Paid-In Capital: 3,300

Treasury Stock: -

Retained Earnings: (200)

Accumulated Other Comprehensive Loss: (200)

Total Shareholders' Equity: $ 3,000

Total Liabilities & SE: $ 5,400

Equity REIT - Sample Net Asset Value Model

($ in Millions Except Per Share Data)

Assumed 12-Month Current

Cap Rate: Forward NOI: Value:

Capitalized Income:

NOI Contribution from:

Wholly-Owned Properties: 5.5% $ 300 $ 5,455

Unconsolidated Joint Ventures: 5.5% 10 182

Third-Party Management Fees: 15.0% 5 33

Balance Sheet % of BS Current

Value: Value: Value:

Balance Sheet Assets:

Non-Operating Real Estate Assets:

Construction in Progress: 500 110.0% 550

Land Held for Development: 300 105.0% 315

Real Estate Assets Held for Sale: 200 100.0% 200

Other Balance Sheet Assets:

Cash & Cash-Equivalents: 180 100.0% 180

Investments in Equity Interests: 150 0.0% -

Capitalized Financing Fees: 20 100.0% 20

Accounts Receivable, Net: 100 100.0% 100

Prepaid Expenses & Other Assets: 150 100.0% 150

Total Asset Value: $ 7,185

Liabilities:

Total Debt, Net of Discounts: $ 2,000 100.0% $ 2,000

Accounts Payable: 100 100.0% 100

Accrued Expenses & Other: 200 100.0% 200

Total Liabilities Value: 2,300

Other Claims on Equity:

Noncontrolling Interests (Excl. OP): 100 100.0% 100

Preferred Stock: - 100.0% -

Total Other Claims on Equity Value: 100

Net Asset Value: $ 4,785

Diluted Shares: 100.0

OP Units & Restricted Shares: 5.0

Total Diluted Shares & Units Outstanding: 105.0

Net Asset Value Per Share: $ 45.57

Current Stock Price: $ 30.00

Premium / (Discount) to NAV Per Share: (34.2%)

You might also like

- Sheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalanceDocument4 pagesSheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalancePrince Frederic Mangambu100% (1)

- 70 02 Oil Gas StatementsDocument10 pages70 02 Oil Gas Statementsmerag76668No ratings yet

- 72 08 NAV Part 1 Revenue AfterDocument80 pages72 08 NAV Part 1 Revenue Aftermerag76668No ratings yet

- Managerial Finance AssignmentDocument5 pagesManagerial Finance AssignmentvinneNo ratings yet

- Solution of Finanical Statement AnalysisDocument14 pagesSolution of Finanical Statement AnalysisMUHAMMAD AZAM100% (2)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Fisher Separation TheoremDocument31 pagesFisher Separation TheoremArdi Gunardi0% (3)

- Zumra Company S Annual Accounting Year Ends On December 31 It PDFDocument1 pageZumra Company S Annual Accounting Year Ends On December 31 It PDFhassan taimourNo ratings yet

- DMGT302 Fundamentals of Project Management PDFDocument229 pagesDMGT302 Fundamentals of Project Management PDFNIKHILTJ100% (1)

- 60 06 RegulationsDocument5 pages60 06 Regulationsmerag76668No ratings yet

- 02 24 Free Cash FlowDocument10 pages02 24 Free Cash FlowSharon BolañosNo ratings yet

- Balance Sheet Rules SummaryDocument4 pagesBalance Sheet Rules SummaryCristina Bejan100% (1)

- 60 03 BS To IS AfterDocument10 pages60 03 BS To IS Aftermerag76668No ratings yet

- 02 24 Free Cash FlowDocument17 pages02 24 Free Cash FlowAnil RatnaniNo ratings yet

- Assumptions: Commercial Bank - Income Statement Loan Loss Reserve CalculationsDocument2 pagesAssumptions: Commercial Bank - Income Statement Loan Loss Reserve CalculationsziuziNo ratings yet

- Practical Problem:: Gross Loans and LeasesDocument6 pagesPractical Problem:: Gross Loans and LeasesSuraz Thapa MagarNo ratings yet

- 02 24 Free Cash FlowDocument6 pages02 24 Free Cash FlowcherifsambNo ratings yet

- Chap 005Document10 pagesChap 005Phan AnhNo ratings yet

- Bank Regulatory CapitalDocument9 pagesBank Regulatory CapitalDristi PoddarNo ratings yet

- Income Statement - Apple Balance Sheet - Apple Personal "Balance Sheet"Document4 pagesIncome Statement - Apple Balance Sheet - Apple Personal "Balance Sheet"jitenNo ratings yet

- Intangible ExercisesDocument2 pagesIntangible ExercisesMurtaza BadriNo ratings yet

- Income Statement - Apple Balance Sheet - Apple Cash Flow StatementDocument4 pagesIncome Statement - Apple Balance Sheet - Apple Cash Flow StatementRohan BahriNo ratings yet

- Chap 005Document8 pagesChap 005Anass BNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Report of Condition Total AssetsDocument8 pagesReport of Condition Total AssetsJohn Joshua S. GeronaNo ratings yet

- Chap 006Document15 pagesChap 006Phan AnhNo ratings yet

- Fin Statement AnalysisDocument24 pagesFin Statement AnalysiskarlistonsitompulNo ratings yet

- 60 05 CL Provisions AfterDocument4 pages60 05 CL Provisions Aftermerag76668No ratings yet

- TM 7 AklDocument6 pagesTM 7 AklSyam Nr100% (1)

- Discounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Document9 pagesDiscounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Haysam TayyabNo ratings yet

- Chapter 5Document17 pagesChapter 5Belay MekonenNo ratings yet

- Finance1 Problem1 121013094019 Phpapp01 PDFDocument13 pagesFinance1 Problem1 121013094019 Phpapp01 PDFMauro SacamayNo ratings yet

- Discounted Cash Flow AnalysisDocument5 pagesDiscounted Cash Flow AnalysisoussemNo ratings yet

- Ch02 Mini CaseDocument11 pagesCh02 Mini CaseCarl GarrettNo ratings yet

- Income Statement: RevenueDocument5 pagesIncome Statement: RevenueBalaji GaneshNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- ABC Income Statement (Millons) 2018: Short Term InvestmentsDocument20 pagesABC Income Statement (Millons) 2018: Short Term InvestmentsAlejo valenzuelaNo ratings yet

- DW CorpDocument20 pagesDW CorpAlejo valenzuelaNo ratings yet

- Section 3 Modified - Ch5+Ch6Document8 pagesSection 3 Modified - Ch5+Ch6Dina AlfawalNo ratings yet

- Debt Policy and ValueDocument7 pagesDebt Policy and ValueMuhammad Nabil EzraNo ratings yet

- BNK 603 - Tutorial 2 2020Document3 pagesBNK 603 - Tutorial 2 2020Stylez 2707No ratings yet

- Chapter 8 Consolidation IDocument18 pagesChapter 8 Consolidation IAkkama100% (1)

- Financial Statements, Cash Flow AnalysisDocument41 pagesFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- Midterm Excel Worksheet - OlivieriDocument14 pagesMidterm Excel Worksheet - OlivieriEmanuele OlivieriNo ratings yet

- Kasus Chapter 4.answerDocument3 pagesKasus Chapter 4.answermadesugandhiNo ratings yet

- Book Value Per Share: Name: Date: QuizDocument3 pagesBook Value Per Share: Name: Date: QuizLara FloresNo ratings yet

- Tugas AklDocument5 pagesTugas AklJessica HutabaratNo ratings yet

- 1 - Advanced Financial Accounting Individual Assignment IDocument6 pages1 - Advanced Financial Accounting Individual Assignment IEyasuNo ratings yet

- Kelompok 6 - UTS AKMDocument18 pagesKelompok 6 - UTS AKM21-010 Desi MailaniNo ratings yet

- 2a - Financial Analysis (Compatibility Mode)Document57 pages2a - Financial Analysis (Compatibility Mode)Thai NguyenNo ratings yet

- 1 - Acc 311 Exam II Spring 2015Document9 pages1 - Acc 311 Exam II Spring 2015MUHAMMAD AZAMNo ratings yet

- Tier 1 capital/TA (Tier 1+tier 2) /TA Tier 1 capital/RWA Including OBS Items (Tier 1+tier 2) /RAW Including OBS ItemsDocument10 pagesTier 1 capital/TA (Tier 1+tier 2) /TA Tier 1 capital/RWA Including OBS Items (Tier 1+tier 2) /RAW Including OBS ItemsThảo ĐỗNo ratings yet

- Comfy Home Financials - HW7 For Students - Spring 2022-4Document12 pagesComfy Home Financials - HW7 For Students - Spring 2022-4Sunil SharmaNo ratings yet

- VM 1Document2 pagesVM 1alliahnahNo ratings yet

- QuestionsDocument1 pageQuestionsjesicaNo ratings yet

- Current AssetsDocument3 pagesCurrent AssetsFelicity CabreraNo ratings yet

- Chapter 3Document4 pagesChapter 324a4013096No ratings yet

- Chapter Five PrintDocument18 pagesChapter Five PrintGedionNo ratings yet

- Ratio Analysis For CADocument7 pagesRatio Analysis For CAShahid MahmudNo ratings yet

- Financial AnalysisDocument44 pagesFinancial AnalysisPravin NimbalkarNo ratings yet

- Assignment 1 - Solution Guide Private EquityDocument7 pagesAssignment 1 - Solution Guide Private Equitynoah.e.janitzaNo ratings yet

- Advance AccountingDocument7 pagesAdvance AccountingPutri anjjarwatiNo ratings yet

- Target Corporation - Equity Value and Enterprise ValueDocument3 pagesTarget Corporation - Equity Value and Enterprise Valuemerag76668No ratings yet

- LBO Model - CompletedDocument12 pagesLBO Model - CompletedJennifer HsuNo ratings yet

- Afa Ii Assignment IiDocument2 pagesAfa Ii Assignment Iiworkiemelkamu400100% (1)

- 70 07 Key Metrics Ratios AfterDocument16 pages70 07 Key Metrics Ratios Aftermerag76668No ratings yet

- 70 04 Oil Gas Accounting AfterDocument4 pages70 04 Oil Gas Accounting Aftermerag76668No ratings yet

- 80 03 Apartment Construction AfterDocument5 pages80 03 Apartment Construction Aftermerag76668No ratings yet

- 60 06 RegulationsDocument5 pages60 06 Regulationsmerag76668No ratings yet

- 70 06 Reserves To Statements AfterDocument4 pages70 06 Reserves To Statements Aftermerag76668No ratings yet

- 60 06 RegulationsDocument10 pages60 06 Regulationsmerag76668No ratings yet

- 60 04 Is CFSDocument13 pages60 04 Is CFSmerag76668No ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- 13 10 Debt Schedules Part 1 Mandatory AfterDocument13 pages13 10 Debt Schedules Part 1 Mandatory Aftermerag76668No ratings yet

- 61 02 Charge Offs Recoveries AfterDocument3 pages61 02 Charge Offs Recoveries Aftermerag76668No ratings yet

- 60 02 Balance SheetDocument2 pages60 02 Balance Sheetmerag76668No ratings yet

- 61 01 Overview Loan Projections AfterDocument2 pages61 01 Overview Loan Projections Aftermerag76668No ratings yet

- 60 03 BS To IS AfterDocument10 pages60 03 BS To IS Aftermerag76668No ratings yet

- Name Address City State ZIP Sales Rep ID Hire Date Base Salary Annual Salary Increase Commission RateDocument28 pagesName Address City State ZIP Sales Rep ID Hire Date Base Salary Annual Salary Increase Commission Ratemerag76668No ratings yet

- ($ in Millions Except Per Share Data) : Input and Assumptions - Jpmorgan Chase & Co. and Suntrust Banks IncDocument35 pages($ in Millions Except Per Share Data) : Input and Assumptions - Jpmorgan Chase & Co. and Suntrust Banks Incmerag76668No ratings yet

- 60 05 CL Provisions AfterDocument4 pages60 05 CL Provisions Aftermerag76668No ratings yet

- Programme L2 2008 2009 DoubleDocument2 pagesProgramme L2 2008 2009 Doublemerag76668No ratings yet

- CS EMEA Day 4 Course ManualDocument60 pagesCS EMEA Day 4 Course Manualmerag76668No ratings yet

- Park Hotels & Resorts Inc. - Operating Model and Valuation: Name Name Name Year Date $ As Stated Millions # # % % %Document10 pagesPark Hotels & Resorts Inc. - Operating Model and Valuation: Name Name Name Year Date $ As Stated Millions # # % % %merag76668No ratings yet

- XL 02 PC 05 Cleaning Up Data AfterDocument27 pagesXL 02 PC 05 Cleaning Up Data Aftermerag76668No ratings yet

- 07 12 Sensitivity Tables AfterDocument30 pages07 12 Sensitivity Tables Aftermerag76668No ratings yet

- Simple LBO Model - Equity Value and Enterprise Value in A Cash-Free, Debt-Free DealDocument2 pagesSimple LBO Model - Equity Value and Enterprise Value in A Cash-Free, Debt-Free Dealmerag76668No ratings yet

- Target Corporation - Equity Value and Enterprise ValueDocument3 pagesTarget Corporation - Equity Value and Enterprise Valuemerag76668No ratings yet

- 23 12 YHOO LBO Model Debt Schedules Mandatory Repayments AfterDocument138 pages23 12 YHOO LBO Model Debt Schedules Mandatory Repayments Aftermerag76668No ratings yet

- (Marty Kaan) : Professional ExperienceDocument2 pages(Marty Kaan) : Professional Experiencemerag76668No ratings yet

- REIT NAV Model ExamplesDocument5 pagesREIT NAV Model Examplesmerag76668No ratings yet

- CFO Leadership Amidst The COVID-19 Crisis - WRDocument6 pagesCFO Leadership Amidst The COVID-19 Crisis - WRJohny SarangayNo ratings yet

- Aud Prob ReceivablesDocument13 pagesAud Prob ReceivablesJoey WassigNo ratings yet

- Company LawDocument263 pagesCompany LawGumisiriza BrintonNo ratings yet

- Due Diligence Danone Final 2008-10-31 For WebDocument31 pagesDue Diligence Danone Final 2008-10-31 For WebstefanNo ratings yet

- Research Paper On Financial Market in IndiaDocument7 pagesResearch Paper On Financial Market in Indiauyqzyprhf100% (1)

- Business Valuation Update: October 2010 Vol. 16 No. 10Document47 pagesBusiness Valuation Update: October 2010 Vol. 16 No. 10bharatramnaniNo ratings yet

- Introduction To Treasury Management: Here Is Where Your Presentation BeginsDocument25 pagesIntroduction To Treasury Management: Here Is Where Your Presentation BeginsAngelie AnilloNo ratings yet

- Inter Audit 24 7Document3 pagesInter Audit 24 7rounakagarwal2630No ratings yet

- Gross Income (Residence Vs Source) 2023Document22 pagesGross Income (Residence Vs Source) 2023molemothekaNo ratings yet

- Capital Gains by R. Devarajan Additional Director, ICAIDocument43 pagesCapital Gains by R. Devarajan Additional Director, ICAIkiranshingoteNo ratings yet

- India Business Law Journal PDFDocument96 pagesIndia Business Law Journal PDFranjanjhallbNo ratings yet

- Report KhulnaDocument52 pagesReport KhulnaRaka SiddiquaNo ratings yet

- Accounting For ManagementDocument2 pagesAccounting For ManagementShibasish BhattacharyaNo ratings yet

- Confirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Document3 pagesConfirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Shyam SunderNo ratings yet

- CP011 Eng ScrapDocument16 pagesCP011 Eng ScrapCitadel MeruNo ratings yet

- 2016 2017 - Lembar Jawaban Ukk AkuntansiDocument79 pages2016 2017 - Lembar Jawaban Ukk Akuntansitomy andriyantoNo ratings yet

- Pergerakan Valuasi Saham LQ45 - 021323Document1 pagePergerakan Valuasi Saham LQ45 - 021323Agus SNo ratings yet

- PDF FileDocument3 pagesPDF FileNOMFUNDO SENOSINo ratings yet

- 12 y 72Document5 pages12 y 72Alexis AlipudoNo ratings yet

- ImfDocument19 pagesImfAashay AgarwalNo ratings yet

- Uslovi Za Putno - EngleskiDocument15 pagesUslovi Za Putno - EngleskiJasmin TafićNo ratings yet

- Sentiment Analysis Report For WE 010612 - Market Slips Into Reversal ModeDocument8 pagesSentiment Analysis Report For WE 010612 - Market Slips Into Reversal ModeProshareNo ratings yet

- MACD and Technical AnalysisDocument20 pagesMACD and Technical AnalysisThugy Dee100% (3)

- Gotesco PropertiesDocument14 pagesGotesco PropertiesVal Peralta-NavalNo ratings yet

- Exercise Workbook Sem 4 Individual AssignmentDocument8 pagesExercise Workbook Sem 4 Individual Assignmentsiti amaliyaNo ratings yet

- Hydrochem AnalysisDocument7 pagesHydrochem AnalysisSaransh Kejriwal100% (2)

- ADM 2350 Final Exam Winter 2011 Version 1 SolutionsDocument18 pagesADM 2350 Final Exam Winter 2011 Version 1 SolutionsIshan VashishtNo ratings yet