Professional Documents

Culture Documents

Notas Calçados

Notas Calçados

Uploaded by

Pedro Uchida0 ratings0% found this document useful (0 votes)

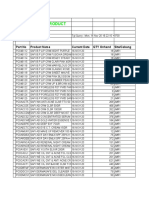

3 views6 pagesThis document contains financial and valuation metrics for multiple companies across various categories and subcategories. Metrics included company name, grades for categories like debt, valuation, efficiency, and growth. It also includes more specific indicator grades for metrics such as liquidity, ratios, margins, and revenue/income growth rates. The table provides a breakdown of scores for each company and financial or valuation indicator.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains financial and valuation metrics for multiple companies across various categories and subcategories. Metrics included company name, grades for categories like debt, valuation, efficiency, and growth. It also includes more specific indicator grades for metrics such as liquidity, ratios, margins, and revenue/income growth rates. The table provides a breakdown of scores for each company and financial or valuation indicator.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views6 pagesNotas Calçados

Notas Calçados

Uploaded by

Pedro UchidaThis document contains financial and valuation metrics for multiple companies across various categories and subcategories. Metrics included company name, grades for categories like debt, valuation, efficiency, and growth. It also includes more specific indicator grades for metrics such as liquidity, ratios, margins, and revenue/income growth rates. The table provides a breakdown of scores for each company and financial or valuation indicator.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 6

company grade category category_grade subcategory subcategory_grade

GRND 6.746125 DEBT 10 LIQUIDITY 10

GRND 6.746125 DEBT 10 LIQUIDITY 10

GRND 6.746125 DEBT 10 CASH_FLOW 10

GRND 6.746125 DEBT 10 CASH_FLOW 10

GRND 6.746125 VALUATION 5.692 VALUATION 5.692

GRND 6.746125 VALUATION 5.692 VALUATION 5.692

GRND 6.746125 VALUATION 5.692 VALUATION 5.692

GRND 6.746125 VALUATION 5.692 VALUATION 5.692

GRND 6.746125 VALUATION 5.692 VALUATION 5.692

GRND 6.746125 EFFICIENCY 6.2925 FINANCIAL_RETURNS 3.71

GRND 6.746125 EFFICIENCY 6.2925 FINANCIAL_RETURNS 3.71

GRND 6.746125 EFFICIENCY 6.2925 FINANCIAL_RETURNS 3.71

GRND 6.746125 EFFICIENCY 6.2925 MARGINS 8.875

GRND 6.746125 EFFICIENCY 6.2925 MARGINS 8.875

GRND 6.746125 EFFICIENCY 6.2925 MARGINS 8.875

GRND 6.746125 GROWTH 5 GROWTH 5

GRND 6.746125 GROWTH 5 GROWTH 5

GRND 6.746125 GROWTH 5 GROWTH 5

ARZZ 6.3971979167 DEBT 6.105 LIQUIDITY 5.75

ARZZ 6.3971979167 DEBT 6.105 LIQUIDITY 5.75

ARZZ 6.3971979167 DEBT 6.105 CASH_FLOW 6.46

ARZZ 6.3971979167 DEBT 6.105 CASH_FLOW 6.46

ARZZ 6.3971979167 VALUATION 2.579 VALUATION 2.579

ARZZ 6.3971979167 VALUATION 2.579 VALUATION 2.579

ARZZ 6.3971979167 VALUATION 2.579 VALUATION 2.579

ARZZ 6.3971979167 VALUATION 2.579 VALUATION 2.579

ARZZ 6.3971979167 VALUATION 2.579 VALUATION 2.579

ARZZ 6.3971979167 EFFICIENCY 7.758125 FINANCIAL_RETURNS 7.64124999999999

ARZZ 6.3971979167 EFFICIENCY 7.758125 FINANCIAL_RETURNS 7.64124999999999

ARZZ 6.3971979167 EFFICIENCY 7.758125 FINANCIAL_RETURNS 7.64124999999999

ARZZ 6.3971979167 EFFICIENCY 7.758125 MARGINS 7.875

ARZZ 6.3971979167 EFFICIENCY 7.758125 MARGINS 7.875

ARZZ 6.3971979167 EFFICIENCY 7.758125 MARGINS 7.875

ARZZ 6.3971979167 GROWTH 9.14666666666666 GROWTH 9.14666666666666

ARZZ 6.3971979167 GROWTH 9.14666666666666 GROWTH 9.14666666666666

ARZZ 6.3971979167 GROWTH 9.14666666666666 GROWTH 9.14666666666666

ALPA 3.4181979167 DEBT 5.5155 LIQUIDITY 3.346

ALPA 3.4181979167 DEBT 5.5155 LIQUIDITY 3.346

ALPA 3.4181979167 DEBT 5.5155 CASH_FLOW 7.685

ALPA 3.4181979167 DEBT 5.5155 CASH_FLOW 7.685

ALPA 3.4181979167 VALUATION 1.631 VALUATION 1.631

ALPA 3.4181979167 VALUATION 1.631 VALUATION 1.631

ALPA 3.4181979167 VALUATION 1.631 VALUATION 1.631

ALPA 3.4181979167 VALUATION 1.631 VALUATION 1.631

ALPA 3.4181979167 VALUATION 1.631 VALUATION 1.631

ALPA 3.4181979167 EFFICIENCY 2.00962499999999 FINANCIAL_RETURNS 1.0625

ALPA 3.4181979167 EFFICIENCY 2.00962499999999 FINANCIAL_RETURNS 1.0625

ALPA 3.4181979167 EFFICIENCY 2.00962499999999 FINANCIAL_RETURNS 1.0625

ALPA 3.4181979167 EFFICIENCY 2.00962499999999 MARGINS 2.95674999999999

ALPA 3.4181979167 EFFICIENCY 2.00962499999999 MARGINS 2.95674999999999

ALPA 3.4181979167 EFFICIENCY 2.00962499999999 MARGINS 2.95674999999999

ALPA 3.4181979167 GROWTH 4.51666666666666 GROWTH 4.51666666666666

ALPA 3.4181979167 GROWTH 4.51666666666666 GROWTH 4.51666666666666

ALPA 3.4181979167 GROWTH 4.51666666666666 GROWTH 4.51666666666666

CAMB 5.5103854167 DEBT 1.24699999999999 LIQUIDITY 1.91899999999999

CAMB 5.5103854167 DEBT 1.24699999999999 LIQUIDITY 1.91899999999999

CAMB 5.5103854167 DEBT 1.24699999999999 CASH_FLOW 0.575

CAMB 5.5103854167 DEBT 1.24699999999999 CASH_FLOW 0.575

CAMB 5.5103854167 VALUATION 10 VALUATION 10

CAMB 5.5103854167 VALUATION 10 VALUATION 10

CAMB 5.5103854167 VALUATION 10 VALUATION 10

CAMB 5.5103854167 VALUATION 10 VALUATION 10

CAMB 5.5103854167 VALUATION 10 VALUATION 10

CAMB 5.5103854167 EFFICIENCY 6.787875 FINANCIAL_RETURNS 8.875

CAMB 5.5103854167 EFFICIENCY 6.787875 FINANCIAL_RETURNS 8.875

CAMB 5.5103854167 EFFICIENCY 6.787875 FINANCIAL_RETURNS 8.875

CAMB 5.5103854167 EFFICIENCY 6.787875 MARGINS 4.70075

CAMB 5.5103854167 EFFICIENCY 6.787875 MARGINS 4.70075

CAMB 5.5103854167 EFFICIENCY 6.787875 MARGINS 4.70075

CAMB 5.5103854167 GROWTH 4.00666666666666 GROWTH 4.00666666666666

CAMB 5.5103854167 GROWTH 4.00666666666666 GROWTH 4.00666666666666

CAMB 5.5103854167 GROWTH 4.00666666666666 GROWTH 4.00666666666666

VULC 5.4331875 DEBT 4.079 LIQUIDITY 5.658

VULC 5.4331875 DEBT 4.079 LIQUIDITY 5.658

VULC 5.4331875 DEBT 4.079 CASH_FLOW 2.5

VULC 5.4331875 DEBT 4.079 CASH_FLOW 2.5

VULC 5.4331875 VALUATION 7.83099999999999 VALUATION 7.83099999999999

VULC 5.4331875 VALUATION 7.83099999999999 VALUATION 7.83099999999999

VULC 5.4331875 VALUATION 7.83099999999999 VALUATION 7.83099999999999

VULC 5.4331875 VALUATION 7.83099999999999 VALUATION 7.83099999999999

VULC 5.4331875 VALUATION 7.83099999999999 VALUATION 7.83099999999999

VULC 5.4331875 EFFICIENCY 4.61275 FINANCIAL_RETURNS 5.9615

VULC 5.4331875 EFFICIENCY 4.61275 FINANCIAL_RETURNS 5.9615

VULC 5.4331875 EFFICIENCY 4.61275 FINANCIAL_RETURNS 5.9615

VULC 5.4331875 EFFICIENCY 4.61275 MARGINS 3.264

VULC 5.4331875 EFFICIENCY 4.61275 MARGINS 3.264

VULC 5.4331875 EFFICIENCY 4.61275 MARGINS 3.264

VULC 5.4331875 GROWTH 5.21 GROWTH 5.21

VULC 5.4331875 GROWTH 5.21 GROWTH 5.21

VULC 5.4331875 GROWTH 5.21 GROWTH 5.21

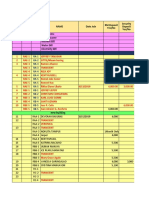

indicator indicator_grade

GENERAL_LIQUIDITY 10

CURRENT_RATIO 10

INTEREST_COVERAGE_RATIO 10

DL_TO_EBITDA 10

PRICE_TO_EARNINGS 5.27

PRICE_TO_BOOK 9.83

PEG_RATIO 6.34

EV_TO_EBITDA 5.4

PRICE_TO_SALES 2.09

ROE 3.33

ROIC 1.87

ROA 10

GROSS_MARGIN 2.5

NET_MARGIN 10

EBITDA_MARGIN 10

CAGR_REVENUE 5

CAGR_NET_INCOME 2.5

CAGR_EBITDA 7.5

GENERAL_LIQUIDITY 7.5

CURRENT_RATIO 5

INTEREST_COVERAGE_RATIO 7.5

DL_TO_EBITDA 5.42

PRICE_TO_EARNINGS 2.72

PRICE_TO_BOOK 0

PEG_RATIO 2.85

EV_TO_EBITDA 2.5

PRICE_TO_SALES 5

ROE 7.88

ROIC 7.71

ROA 6.77

GROSS_MARGIN 10

NET_MARGIN 7.5

EBITDA_MARGIN 7.5

CAGR_REVENUE 10

CAGR_NET_INCOME 10

CAGR_EBITDA 7.44

GENERAL_LIQUIDITY 5.32

CURRENT_RATIO 2.5

INTEREST_COVERAGE_RATIO 6.11

DL_TO_EBITDA 9.26

PRICE_TO_EARNINGS 0

PRICE_TO_BOOK 3.66

PEG_RATIO 0

EV_TO_EBITDA 0.31

PRICE_TO_SALES 4.03

ROE 0

ROIC 2.5

ROA 0

GROSS_MARGIN 7.5

NET_MARGIN 0

EBITDA_MARGIN 4.31

CAGR_REVENUE 3.3

CAGR_NET_INCOME 7.34

CAGR_EBITDA 2.91

GENERAL_LIQUIDITY 2.5

CURRENT_RATIO 1.67

INTEREST_COVERAGE_RATIO 1.15

DL_TO_EBITDA 0

PRICE_TO_EARNINGS 10

PRICE_TO_BOOK 10

PEG_RATIO 10

EV_TO_EBITDA 10

PRICE_TO_SALES 10

ROE 10

ROIC 10

ROA 2.5

GROSS_MARGIN 5.64

NET_MARGIN 4.07

EBITDA_MARGIN 5

CAGR_REVENUE 1.33

CAGR_NET_INCOME 0.69

CAGR_EBITDA 10

GENERAL_LIQUIDITY 1.36

CURRENT_RATIO 7.5

INTEREST_COVERAGE_RATIO 2.5

DL_TO_EBITDA 2.5

PRICE_TO_EARNINGS 8.41

PRICE_TO_BOOK 5.32

PEG_RATIO 7.5

EV_TO_EBITDA 9.45

PRICE_TO_SALES 7.5

ROE 5.77

ROIC 5.61

ROA 7.5

GROSS_MARGIN 1.02

NET_MARGIN 7.32

EBITDA_MARGIN 0

CAGR_REVENUE 7.5

CAGR_NET_INCOME 7.5

CAGR_EBITDA 0.63

You might also like

- Notas ComputaçãoDocument6 pagesNotas ComputaçãoPedro UchidaNo ratings yet

- Notas MedicamentosDocument9 pagesNotas MedicamentosPedro UchidaNo ratings yet

- Brosur TOYOTADocument2 pagesBrosur TOYOTAAdhe DjalaNo ratings yet

- Control Facturas PremezcladoDocument3 pagesControl Facturas Premezcladodiego fernando gironNo ratings yet

- MS Excel Cheat SheetDocument1,023 pagesMS Excel Cheat SheetxdoubledutchessNo ratings yet

- Cek Tanker LoraDocument9 pagesCek Tanker LoraPutri WulandariNo ratings yet

- FOOD GOUP Subfranquicias Corte 20.08.20Document9 pagesFOOD GOUP Subfranquicias Corte 20.08.20Dora RobayoNo ratings yet

- 84 Export Sample....Document13 pages84 Export Sample....suhana.aliroNo ratings yet

- Health Lab No. Lab Date Sampled Date Model Asset ID Asset SerialDocument25 pagesHealth Lab No. Lab Date Sampled Date Model Asset ID Asset SerialAbner VillanuevaNo ratings yet

- Ralphs - Pres. Ave. (RLJ TRADING) SO01-16-1916-33-30Document2 pagesRalphs - Pres. Ave. (RLJ TRADING) SO01-16-1916-33-30Kris LopezNo ratings yet

- DOZERDocument2 pagesDOZERJackson PhinniNo ratings yet

- Estudio de Llantas en ServicioDocument2 pagesEstudio de Llantas en ServicioEdson Joao MtzNo ratings yet

- Disscor Budget 2020 FDocument114 pagesDisscor Budget 2020 FRicardo DelacruzNo ratings yet

- Jak 76 Bulan Oktober 2023Document150 pagesJak 76 Bulan Oktober 2023M.esa notriantoNo ratings yet

- Dr. AnyDocument9 pagesDr. AnyMeika RustiadiNo ratings yet

- Revenue Rank Consultan Ts Rank Revenue / Consultant Rank MBA Hiring Rank Revenue ($ Millions)Document6 pagesRevenue Rank Consultan Ts Rank Revenue / Consultant Rank MBA Hiring Rank Revenue ($ Millions)Ayush GoyalNo ratings yet

- PH ScanDocument35 pagesPH Scanalan benedettaNo ratings yet

- 0310 Delivery - OrdercutsDocument15 pages0310 Delivery - Ordercutsshrine obenietaNo ratings yet

- TPCI Superstar and Beng Beng Share It Price Off AllocationDocument6 pagesTPCI Superstar and Beng Beng Share It Price Off AllocationfernandinolingatNo ratings yet

- Interest Rate Structure Up To January 2021Document8 pagesInterest Rate Structure Up To January 2021Rogérs Rizzy MugangaNo ratings yet

- EXECEL NayeliDocument21 pagesEXECEL NayeliLUISA NALLELI CAMACHO - NUÑEZNo ratings yet

- CPT PCM NHSNDocument307 pagesCPT PCM NHSNYrvon RafaNo ratings yet

- Cost Center Text JAN FEBDocument9 pagesCost Center Text JAN FEBjdgregorioNo ratings yet

- MP2 Sample ComputationDocument12 pagesMP2 Sample Computationcloud_fantasyNo ratings yet

- Promo Promo: Suku Bunga Kur Suku Bunga KurDocument1 pagePromo Promo: Suku Bunga Kur Suku Bunga Kurmarsel indiezNo ratings yet

- Stope Sc1 DetailDocument568 pagesStope Sc1 DetailSergio Rodrigo Espinoza SernaquéNo ratings yet

- List Summary Product: Part No Product Name Current Date QTY Onhand Site/CabangDocument6 pagesList Summary Product: Part No Product Name Current Date QTY Onhand Site/CabangAgung SiCowok AssikandUgalNo ratings yet

- Budget 2018 - Final Approved by BODDocument118 pagesBudget 2018 - Final Approved by BODMuhammad SamiNo ratings yet

- Scooter: Agility 1° Revision Agility 2° Revision Agility 3° RevisionDocument4 pagesScooter: Agility 1° Revision Agility 2° Revision Agility 3° RevisionJonathan Alexander Rojas BlancoNo ratings yet

- Billing Report - 02-16-23Document9 pagesBilling Report - 02-16-23Wilman FigueroaNo ratings yet

- Adam - Monthly Cash Flow 2014Document9 pagesAdam - Monthly Cash Flow 2014Ismi RochaniNo ratings yet

- Cashflow Shaft Untuk Area Open TranceDocument4 pagesCashflow Shaft Untuk Area Open Trancecv.sashyjayaabadiNo ratings yet

- Calculos Islr PNDocument4 pagesCalculos Islr PNMarlyn AcostaNo ratings yet

- Belum MonitoringDocument7 pagesBelum Monitoringthesukinem77No ratings yet

- Particion Ciclos 90 y 91 Agosto 2020Document447 pagesParticion Ciclos 90 y 91 Agosto 2020LUIS EDUARDO PARRA CRUZNo ratings yet

- Codigos SapDocument6 pagesCodigos SapVictor Mario Lozano GarciaNo ratings yet

- 12-Month Income Statement Profit-And-Loss Statement - Sheet1Document2 pages12-Month Income Statement Profit-And-Loss Statement - Sheet1api-462952636100% (1)

- PMS April 2023Document34 pagesPMS April 2023FarhanNo ratings yet

- CPT PCM NHSNDocument298 pagesCPT PCM NHSNBiko LabbitNo ratings yet

- Cash Flow Hasil Kegiatan Pppe (Ibpe) Tahun Ii 2017 (Oktober 2016-Oktober 2017)Document2 pagesCash Flow Hasil Kegiatan Pppe (Ibpe) Tahun Ii 2017 (Oktober 2016-Oktober 2017)EG. A 2015No ratings yet

- MRR Status Storekeeper QA/QC Inspector M.R.R. Issued Date M.R.R. NoDocument24 pagesMRR Status Storekeeper QA/QC Inspector M.R.R. Issued Date M.R.R. NoChiranjeevi AnilNo ratings yet

- 9.5 CorreasDocument4 pages9.5 Correasp2conysanNo ratings yet

- PAKET Special DP (Agya & Calya) : Prima Credit Life Non Prima Credit LifeDocument8 pagesPAKET Special DP (Agya & Calya) : Prima Credit Life Non Prima Credit Lifedepan belakangNo ratings yet

- Davao Bajada Project Venn Edited GGCDocument791 pagesDavao Bajada Project Venn Edited GGCJuliet SimoganNo ratings yet

- Data Per TGL 11 DesDocument10 pagesData Per TGL 11 Desfaishal fourtyeightNo ratings yet

- Daily Update 15102009Document1 pageDaily Update 15102009barkiexecutiveNo ratings yet

- 36Document1 page36RE musicNo ratings yet

- Accounting ErrorDocument15 pagesAccounting ErrorNitishJhaNo ratings yet

- General-Catalog - Technical-Reference Tables of Payload by Speed AccelerationDocument46 pagesGeneral-Catalog - Technical-Reference Tables of Payload by Speed AccelerationanhkysuvndnNo ratings yet

- Teams / Statistics: Home Away P W D L GF GA PT P W D L GF GA PTDocument1 pageTeams / Statistics: Home Away P W D L GF GA PT P W D L GF GA PTChiccondie ChimalaNo ratings yet

- Book 1Document5 pagesBook 1Semarang APBNo ratings yet

- 29-Sep 30-Sep 1-Oct 2-Oct: Abbank 1223.75 ABBANK 1211.5 ABBANK 1211.5 ABBANKDocument91 pages29-Sep 30-Sep 1-Oct 2-Oct: Abbank 1223.75 ABBANK 1211.5 ABBANK 1211.5 ABBANKchopol727No ratings yet

- AmitSrivastava 21275 TQMDocument7 pagesAmitSrivastava 21275 TQMShruti ShrivastavaNo ratings yet

- MKS PRJDocument4 pagesMKS PRJKASIRAJANNo ratings yet

- Date HS CodeDocument8 pagesDate HS CodeVipin GoyalNo ratings yet

- Asmed Martes 20Document5 pagesAsmed Martes 20Aaronis VegaNo ratings yet

- Date Client Chantier Produit QTSDocument3 pagesDate Client Chantier Produit QTSmed.zbairiNo ratings yet

- Betting on Horses - Utilising Price Changes for ProfitFrom EverandBetting on Horses - Utilising Price Changes for ProfitRating: 1 out of 5 stars1/5 (1)

- Carrier Code List NumericDocument79 pagesCarrier Code List Numerics6656No ratings yet

- Socorro Sepulveda LawasDocument2 pagesSocorro Sepulveda LawasBuen LibetarioNo ratings yet

- Stepsmart Assignment July 30Document15 pagesStepsmart Assignment July 30MeconNo ratings yet

- Evaluation of Real Yarn Diameter - Processing, Dyeing & Finishing - Features - The ITJDocument6 pagesEvaluation of Real Yarn Diameter - Processing, Dyeing & Finishing - Features - The ITJBoubker Kharchafi100% (1)

- Riverside County FY 2020-21 First Quarter Budget ReportDocument50 pagesRiverside County FY 2020-21 First Quarter Budget ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- VMware Tanzu EditionsDocument2 pagesVMware Tanzu Editionspooria aazamNo ratings yet

- STIC Invoice Timesheet FormDocument2 pagesSTIC Invoice Timesheet FormMike Lawrence CadizNo ratings yet

- Information Technology Project Management, Seventh Edition 2Document24 pagesInformation Technology Project Management, Seventh Edition 2Waleed KhanNo ratings yet

- Overtourism Causes Implications and Solutions 1St Ed Edition Hugues Seraphin Full ChapterDocument67 pagesOvertourism Causes Implications and Solutions 1St Ed Edition Hugues Seraphin Full Chapterevelyn.kennedy635100% (6)

- Group 5 PRACTICAL RESEARCHDocument28 pagesGroup 5 PRACTICAL RESEARCHJefford Vinson ValdehuezaNo ratings yet

- International Financial Management 7Th Edition Eun Resnick 9780077861605 0077861604 Test Bank Full Chapter PDFDocument36 pagesInternational Financial Management 7Th Edition Eun Resnick 9780077861605 0077861604 Test Bank Full Chapter PDFdale.reed280100% (24)

- A Mini Project Report On 3d Project Edited CollegeDocument30 pagesA Mini Project Report On 3d Project Edited CollegeBADAS POOJANo ratings yet

- Badge: Printables - Girl ScoutsDocument3 pagesBadge: Printables - Girl ScoutsLaura Rajsic-Lanier0% (1)

- Typical HVAC Report - 2Document34 pagesTypical HVAC Report - 2Maxmore KarumamupiyoNo ratings yet

- Sdtechandeducation - In-Emerging Trends in Computer and Information Technology Practice MCQ Question Amp AnswerDocument16 pagesSdtechandeducation - In-Emerging Trends in Computer and Information Technology Practice MCQ Question Amp Answer09whitedevil90No ratings yet

- Weller WCB 2 Mjerac Tempearture PDFDocument1 pageWeller WCB 2 Mjerac Tempearture PDFslvidovicNo ratings yet

- ICI Pakistan LimitedDocument74 pagesICI Pakistan LimitedZeeshan GillNo ratings yet

- Women EntrepreneursDocument27 pagesWomen Entrepreneursurvashirthr86No ratings yet

- CAA Service Regulations 2014Document185 pagesCAA Service Regulations 2014WaqarNo ratings yet

- Moogsoft Aiops Buyers GuideDocument16 pagesMoogsoft Aiops Buyers GuideChandan KumarNo ratings yet

- Cable Test Vans and Systems: Prepared For AnythingDocument20 pagesCable Test Vans and Systems: Prepared For AnythingAndrew SetiawanNo ratings yet

- Manual de Instalacion Marmita F-GL (20-100) - Man PDFDocument12 pagesManual de Instalacion Marmita F-GL (20-100) - Man PDFPitter M Montilla NNo ratings yet

- App 005 Exam FqeDocument6 pagesApp 005 Exam FqeRhea Ann Ramirez VenturaNo ratings yet

- Design of Concrete Ring Type Foundation For Storage TankDocument6 pagesDesign of Concrete Ring Type Foundation For Storage TankNabil Al-KhirdajiNo ratings yet

- Account Statement564Document12 pagesAccount Statement564Kiran SNNo ratings yet

- Vice President Customer Care in Dallas TX Resume Susan RardinDocument2 pagesVice President Customer Care in Dallas TX Resume Susan RardinSusanRardin100% (1)

- Crash 2024 02 26 - 16.22.56 ClientDocument6 pagesCrash 2024 02 26 - 16.22.56 Clientaf3paypalNo ratings yet

- Allen Solly Skinny PDFDocument23 pagesAllen Solly Skinny PDFnishkarsh mauryaNo ratings yet

- CVDocument6 pagesCVGoce StavreskiNo ratings yet

- Utilisation of Plastic WasteDocument31 pagesUtilisation of Plastic WasteMohammed Quadir KhanNo ratings yet