Professional Documents

Culture Documents

Basic Estimation Techniques: Essential Concepts

Basic Estimation Techniques: Essential Concepts

Uploaded by

Rohit SinhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basic Estimation Techniques: Essential Concepts

Basic Estimation Techniques: Essential Concepts

Uploaded by

Rohit SinhaCopyright:

Available Formats

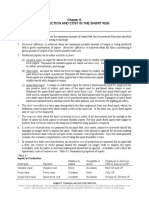

Chapter 4:

BASIC ESTIMATION TECHNIQUES

Essential Concepts

1. A simple linear regression model relates a dependent variable Y to a single independent (or

explanatory) variable X in a linear fashion

The intercept parameter (a) gives the value of Y at the point where the regression line crosses the Y-

axis, which is the value of Y when X is zero. The slope parameter (b) gives the change in Y associated

with a one-unit change in X ( ).

2. Because the variation in Y is affected not only by variation in X but also by various random effects as

well, the actual value of Y cannot be predicted exactly. The regression equation is correctly

interpreted as providing the average value, or the expected value, of Y for a given value of X.

3. Parameter estimates are obtained by choosing values of a and b that minimize the sum of the squared

residuals. The residual is the difference between the actual value of Y and the fitted value of Y, .

This method of estimating a and b is called the method of least-squares, and the estimated regression

line, is called the sample regression line. The sample regression line is an estimate of the

true regression line.

4. The estimates and do not, in general, equal the true values of a and b. Since and are

computed using data from a random sample, the estimates themselves are random variables—the

estimates would vary in value from one random sample to another random sample. Statisticians have

shown that the distribution of values that the estimates might take is centered around the true value of

the parameter. An estimator is unbiased if the average value, or the expected value, of the estimator is

equal to the true value of the parameter. The method of least-squares can produce unbiased estimates

of a and b.

5. It is the randomness of the parameter estimates that necessitates testing for statistical significance.

Just because the estimate is not zero does not mean the true value of b is not zero. Even when b does

equal zero, it is still possible that the sample will produce a least-squares estimate that is different

from zero. Thus, it is necessary to determine if there is sufficient statistical evidence in the sample to

indicate that Y is truly related to X (i.e., ).

6. There are two ways to determine whether an estimated parameter is statistically significant. Either a t-

test can be performed or the p-value for the parameter estimate can be examined.

7. To perform a t-test for significance, a researcher must first determine the level of significance for the

test. The significance level of a test is the probability of finding a parameter estimate to be

significantly different from zero when, in fact, b is zero. This mistake is called a Type I error. Lower

levels of significance, other things equal, are more desirable. One minus the level of significance is

called the level of confidence.

Once the level of significance is chosen, the t-ratio is computed as

Chapter 4: Basic Estimation Techniques

2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

where is the standard error of the estimate Next, the critical value of t is found in the t-table at

the end of your textbook. Choose the critical t-value with degrees of freedom for the desired

level of significance, where n is the number of observations and k is the number of parameters being

estimated. If the absolute value of the t-ratio is greater (less) than the critical t-value, then is (is not)

statistically significant.

8. An alternative method of assessing the statistical significance of parameter estimates is to treat as

statistically significant only those parameter estimates whose p-values are smaller than the maximum

acceptable significance level. The p-value gives the exact level of significance for a parameter

estimate, which is the probability of finding significance when none exists.

9. The coefficient of determination R2 measures the percentage of the total variation in the dependent

variable that is explained by the regression equation. The value of R2 ranges from 0 to 1. A high R2

indicates Y and X are highly correlated and the scatter diagram tightly fits the sample regression line.

10. The F-test is used to test for significance of the overall regression equation. The F-statistic from the

computer printout is compared to the critical F-value obtained from the F-table at the end of your

textbook. The critical F-value is identified by two separate degrees of freedom and the significance

level. The first of the degrees of freedom is and the second is . If the value for the

calculated F-statistic (calculated by the computer) exceeds the critical F-value, the regression

equation overall is statistically significant at the specified significance level. Alternatively, if the p-

value for the F-statistic is smaller than the acceptable level of significance, the equation as a whole is

statistically significant.

11. Multiple regression uses more than one explanatory variable to explain the variation in the dependent

variable. The coefficient for each of the explanatory variables measures the change in Y associated

with a one-unit change in that explanatory variable ( ).

12. Two types of nonlinear models can be easily transformed into linear models that can be estimated

using linear regression analysis. These are quadratic regression models and log-linear regression

models.

(a) Quadratic regression models are appropriate when the curve fitting the scatter plot is either -

shaped or -shaped. A quadratic equation, Y = a + bX + cX2, can be transformed into a linear

form by computing a new variable Z = X2, which is then substituted for X2 in the regression. Then,

the regression equation to be estimated is Y = a + bX + cZ.

(b) Log-linear regression models are appropriate when the relation takes the multiplicative

exponential form: Y = aXbZc. The equation is transformed by taking natural logarithms:

The coefficients b and c are elasticities. For example, b measures the percent change in Y that results

when X changes by 1 percent.

Chapter 4: Basic Estimation Techniques

2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Answers to Applied Problems

1. a. The intercept a is expected to be positive because even if no advertising is undertaken, some sales

are expected to occur. b is expected to have a positive sign since Vanguard's sales are positively

related to its level of advertising expenditures. Vanguard's sales should be inversely related to its

rivals' expenditures on advertising, so c is expected to be negative.

b. a is the sales of Bright Side detergent when neither Vanguard nor its rivals advertise. b is ΔS/ΔA,

the increase in Bright Side sales attributable to a $1,000 per week increase in advertising

expenditures by Vanguard. c is ΔS/ΔR, the decrease in Bright Side sales attributable to a $1,000

per week increase in advertising expenditures by Vanguard's rivals.

c. The exact level of significance of is 0.0128. There is only a 1.28% chance that b = 0, which is

better than the 10 percent level required by the marketing director.

d. The exact level of significance of is 0.0927. There is a 9.27% chance that rivals’ spending on

advertising does not affect Vanguard’s sales (i.e., b = 0), which is just barely better than the 10

percent level required by the marketing director.

e. About 78 percent of the variation in sales remains unexplained. Find additional explanatory

variables that have a significant affect on S. The manager might try adding the price of its

detergent and the prices of its rivals’ detergents.

f. = 175,086 + 0.855 40,000 – 0.284 100,000 = $180,886 of sales each week.

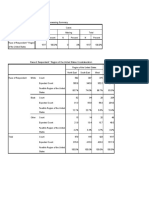

2. a. At the 95% level of confidence, the critical F-value is Fk–1,n–k = F1,15 = 4.54. Since the computed

F-ratio 42.674 is greater than 4.54, the regression equation provides evidence of a statistically

significant relation. Note also that 74% of the variation in V is explained by the equation.

b. The critical t-value for n – k = 15 degrees of freedom and a 95% level of confidence is 2.131. For

ˆ: t = 25.418 > 2.131; statistically significant. If Proposition 103 has no impact on auto insurance

premiums in any given county, P = 0, and the expected percentage of voters favoring Proposition

103 in that particular county is given by:

V = 53.682 – 0.528(0) = 53.682,

or 53.7% are expected to favor Proposition 103.

c. For : t = |–6.519| > 2.131; statistically significant

Remember that both V and P are measured as percentages. Thus, a 1% increase in P is estimated

to result in a 0.53% decrease in V. A 10% increase in P is expected to result in a 5.3% (= 0.53

10) decrease in V.

Note: All of the p-values are so small that you could quickly determine that all tests would find

significance at extremely high levels of confidence.

Chapter 4: Basic Estimation Techniques

2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

3. a. The F-statistic provides evidence that the regression equation as a whole is statistically

significant. The p-value for the F-statistic is significant at less than 0.01%. The R2 indicates the

regression equation explains 83% of the variation in E. The p-values for the individual

coefficients are:

For : the p-value = 0.2369, or there is a 23.69% chance that a = 0.

For the p-value = 0.0023, or there is only a 0.23% chance that b = 0.

b. Since ΔE/ΔN is estimated to be 32.31, each extra ticket sold in December is expected to increase

annual earnings by $32.31.

c. = 25,042,000 + 32.31 950,000 = $55,736,500 for the year.

4. a. Estimate the model

Q' = a' + bH ' + cS ' ,

where Q' = ln Q, a' = ln a, H ' = ln H, and S ' = ln S.

b. b = %ΔQ/%ΔH

c = %ΔQ/%ΔS

A 20% increase in S will increase Q by 5.1% (= 0.2550 x 20).

c. Perform an F-test. The 5 percent F-value is Fk–1,n–k = F2,50 = 3.18. Since 29.97 > 3.18, the overall

equation is statistically significant. The p-value for the F indicates significance below the 0.01%

level.

d. 54.52% of the variation in Q is explained by this model. The R2 could be increased by adding

some additional explanatory variables such as the sales experience of the salespersons employed.

Whether the sales day is a weekday or a Saturday/Sunday, and the level of advertising in

newspapers the previous week.

e. The critical t-ratio is tn–k = t50 ≈ 2.

For : t = 3.80 > 2; statistically significant. The p-value indicates exact significance at the

0.04% level. Since = ln , = eˆ', and = 2.5. Since = 2.5 H 0 .3517S 0 .2550,

= 2.5(0)0.3517 (0)0.2550 = 0.

Sales are expected to be zero because in the nonlinear form Q is zero when either H or S is zero.

f. For : t = 3.44 > 2; statistically significant. The p-value indicates exact significance at the

0.12% level.

Since b = %ΔQ / %ΔH, is the estimated percentage increase in sales attributable to increase the

hours of operation by 1%, all else constant. Since = 0.3517, a 10 percent decrease in H will

decrease sales by 3.52 percent (= 0.3517 10).

Chapter 4: Basic Estimation Techniques

2016 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any

manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

You might also like

- Solution Manual For Critical Thinking The Art of Argument 2nd Edition SampleDocument36 pagesSolution Manual For Critical Thinking The Art of Argument 2nd Edition SampleGreg Burroughs100% (47)

- RegressionDocument3 pagesRegressionPankaj2cNo ratings yet

- Multiple RegressionDocument100 pagesMultiple RegressionNilton de SousaNo ratings yet

- Chpter 4 emDocument27 pagesChpter 4 emMuhammad Hanief Al-KautsarNo ratings yet

- CH 4. BAsic Estimation TechniqueDocument27 pagesCH 4. BAsic Estimation TechniquedanarNo ratings yet

- 1.08 Hypothesis Testing - AnswersDocument29 pages1.08 Hypothesis Testing - Answersgustavo eichholzNo ratings yet

- Cfa Level 1 - Quantitative Review: Calculate Mean and Standard Deviation of Expected ReturnsDocument5 pagesCfa Level 1 - Quantitative Review: Calculate Mean and Standard Deviation of Expected ReturnsNoroNo ratings yet

- (The Mcgraw-Hill Economics Series) Christopher Thomas, S. Charles Maurice-Managerial Economics-McGraw-Hill Education (2015)Document84 pages(The Mcgraw-Hill Economics Series) Christopher Thomas, S. Charles Maurice-Managerial Economics-McGraw-Hill Education (2015)danyalNo ratings yet

- Block 5 MS 08 CorrelationDocument13 pagesBlock 5 MS 08 CorrelationHarish PadmanabanNo ratings yet

- Regression AnalysisDocument20 pagesRegression AnalysisAnkit SaxenaNo ratings yet

- Linear Regression - Six Sigma Study GuideDocument17 pagesLinear Regression - Six Sigma Study GuideSunilNo ratings yet

- Probit ModelDocument5 pagesProbit ModelNidhi KaushikNo ratings yet

- Linear Regression - Lok - 2Document31 pagesLinear Regression - Lok - 2LITHISH RNo ratings yet

- Dafm Cia 2 - 2227610Document16 pagesDafm Cia 2 - 2227610ARATHY SUJAYA VENU 2227610No ratings yet

- Module 3 EDADocument14 pagesModule 3 EDAArjun Singh ANo ratings yet

- Multiple RegressionDocument100 pagesMultiple RegressionAman Poonia100% (1)

- BAB 7 Multiple Regression and Other Extensions of The SimpleDocument17 pagesBAB 7 Multiple Regression and Other Extensions of The SimpleClaudia AndrianiNo ratings yet

- Semester Test 1 Medical Solutions MemoDocument11 pagesSemester Test 1 Medical Solutions Memogaming.og122No ratings yet

- Review-Multiple Regression-Multiple ChoiceDocument6 pagesReview-Multiple Regression-Multiple ChoiceNguyễn Tuấn Anh100% (1)

- L15-Correlation and RegressionDocument19 pagesL15-Correlation and RegressionRamesh G100% (1)

- Regcorr 5Document20 pagesRegcorr 5sigmasundarNo ratings yet

- Evans - Analytics2e - PPT - 07 and 08Document49 pagesEvans - Analytics2e - PPT - 07 and 08MY LE HO TIEUNo ratings yet

- Chapter 3 DEMAND ESTIMATION 3Document38 pagesChapter 3 DEMAND ESTIMATION 3The TwitterNo ratings yet

- CH 14Document12 pagesCH 14Piyush rajNo ratings yet

- Multiple Regression AnalysisDocument14 pagesMultiple Regression AnalysisDhara KanungoNo ratings yet

- Multicollinearity Assignment April 5Document10 pagesMulticollinearity Assignment April 5Zeinm KhenNo ratings yet

- Session: 27: TopicDocument62 pagesSession: 27: TopicMikias BekeleNo ratings yet

- (UM20MB502) - Unit 4 Hypothesis Testing and Linear Regression - Notes 1. Define Regression Analysis and List Their CharacteristicsDocument6 pages(UM20MB502) - Unit 4 Hypothesis Testing and Linear Regression - Notes 1. Define Regression Analysis and List Their CharacteristicsPrajwalNo ratings yet

- Statistics 578 Assignment 5 HomeworkDocument13 pagesStatistics 578 Assignment 5 HomeworkMia Dee100% (5)

- Regression Analysis Summary NotesDocument6 pagesRegression Analysis Summary NotesAbir AllouchNo ratings yet

- Statistical Inference, Regression SPSS ReportDocument73 pagesStatistical Inference, Regression SPSS ReportIjaz Hussain BajwaNo ratings yet

- Evaluation Metrics:: Confusion MatrixDocument7 pagesEvaluation Metrics:: Confusion MatrixNithya PrasathNo ratings yet

- Regression AnalysisDocument5 pagesRegression AnalysisProject bvusde UGcourseNo ratings yet

- What Is Linear RegressionDocument14 pagesWhat Is Linear RegressionAvanijaNo ratings yet

- Steps in Logistic RegressionDocument5 pagesSteps in Logistic RegressionsilencebrownNo ratings yet

- Term End Examination: Descriptive Answer ScriptDocument5 pagesTerm End Examination: Descriptive Answer ScriptAbhishek ChoudharyNo ratings yet

- Statistical EstimationDocument31 pagesStatistical EstimationAgung Nuza DwiputraNo ratings yet

- U02Lecture06 RegressionDocument25 pagesU02Lecture06 Regressiontunio.bscsf21No ratings yet

- Assignment On Probit ModelDocument17 pagesAssignment On Probit ModelNidhi KaushikNo ratings yet

- Correlation and RegressionDocument37 pagesCorrelation and RegressionLloyd LamingtonNo ratings yet

- Ch. 8 Measures of AssociationDocument8 pagesCh. 8 Measures of AssociationEtsub SamuelNo ratings yet

- Edab Module - 3Document17 pagesEdab Module - 3Chirag 17No ratings yet

- Buss. Stat CH-2Document13 pagesBuss. Stat CH-2Jk K100% (2)

- Number of Observations: It: Number of Variables Plus 1'. Here We Want To Estimate For 1 Variable Only, So Number ofDocument3 pagesNumber of Observations: It: Number of Variables Plus 1'. Here We Want To Estimate For 1 Variable Only, So Number ofQuynh Ngoc DangNo ratings yet

- CH 4 Multiple Regression ModelsDocument28 pagesCH 4 Multiple Regression Modelspkj009No ratings yet

- 1518 (Assignment 2) - Packages IiiDocument6 pages1518 (Assignment 2) - Packages IiiHira NaeemNo ratings yet

- Linear Regression - Important Notes RegressionDocument3 pagesLinear Regression - Important Notes RegressionmeajagunNo ratings yet

- SMMDDocument10 pagesSMMDAnuj AgarwalNo ratings yet

- Simple RegressionDocument35 pagesSimple RegressionHimanshu JainNo ratings yet

- Lecture 3Document22 pagesLecture 3Watani BidamiNo ratings yet

- Business Forecasting: Individual AssignmentDocument4 pagesBusiness Forecasting: Individual AssignmentAnjali SomaniNo ratings yet

- Reading 07-Correlation and RegressionDocument18 pagesReading 07-Correlation and Regression杨坡No ratings yet

- Assignment IIDocument5 pagesAssignment IIsarah josephNo ratings yet

- REGRESSIONDocument8 pagesREGRESSIONManvi AgrawalNo ratings yet

- 3-Linear Regreesion-AssumptionsDocument28 pages3-Linear Regreesion-AssumptionsMonis KhanNo ratings yet

- MAS III Review Question PrelimDocument17 pagesMAS III Review Question PrelimJana LingcayNo ratings yet

- Inbound 3436585116711604873Document51 pagesInbound 3436585116711604873Grace GecomoNo ratings yet

- Medical Statistics from Scratch: An Introduction for Health ProfessionalsFrom EverandMedical Statistics from Scratch: An Introduction for Health ProfessionalsNo ratings yet

- Sample Size for Analytical Surveys, Using a Pretest-Posttest-Comparison-Group DesignFrom EverandSample Size for Analytical Surveys, Using a Pretest-Posttest-Comparison-Group DesignNo ratings yet

- Production and Cost in The Short Run: Essential ConceptsDocument7 pagesProduction and Cost in The Short Run: Essential ConceptsRohit SinhaNo ratings yet

- Managerial Decisions For Firms With Market Power: Essential ConceptsDocument8 pagesManagerial Decisions For Firms With Market Power: Essential ConceptsRohit SinhaNo ratings yet

- Managerial Decisions in Competitive Markets: Essential ConceptsDocument8 pagesManagerial Decisions in Competitive Markets: Essential ConceptsRohit SinhaNo ratings yet

- Production and Cost Estimation: Essential ConceptsDocument6 pagesProduction and Cost Estimation: Essential ConceptsRohit SinhaNo ratings yet

- Production and Cost in The Long Run: Essential ConceptsDocument6 pagesProduction and Cost in The Long Run: Essential ConceptsRohit SinhaNo ratings yet

- Theory of Consumer Behavior: Essential ConceptsDocument4 pagesTheory of Consumer Behavior: Essential ConceptsRohit SinhaNo ratings yet

- Elasticity and Demand: Essential ConceptsDocument5 pagesElasticity and Demand: Essential ConceptsRohit SinhaNo ratings yet

- ROHIT - SINHA - Andrea - Jung MailDocument1 pageROHIT - SINHA - Andrea - Jung MailRohit SinhaNo ratings yet

- Managers, Profits, and Markets: Essential ConceptsDocument6 pagesManagers, Profits, and Markets: Essential ConceptsRohit SinhaNo ratings yet

- MSW 006 Social Work ResearchDocument393 pagesMSW 006 Social Work ResearchAshutosh Sharma100% (2)

- Pengaruh Kualitas Pelayanan, Harga Dan Lokasi Terhadap Kepuasan Pelanggan Cafe MilkmooDocument20 pagesPengaruh Kualitas Pelayanan, Harga Dan Lokasi Terhadap Kepuasan Pelanggan Cafe MilkmooRobert SeranNo ratings yet

- Worksheet I CRT and Logic 2016Document5 pagesWorksheet I CRT and Logic 2016zekarias wondafrashNo ratings yet

- Paired Sample T-TestDocument5 pagesPaired Sample T-TestAre MeerNo ratings yet

- Hasil Analisis DaraDocument4 pagesHasil Analisis DaraPuskesmas BatujajarNo ratings yet

- Chi Square Test: Case Processing SummaryDocument4 pagesChi Square Test: Case Processing Summaryfaisalshafiq1No ratings yet

- Mustang Telehandler 742 744 944 1155 Service Manual 913237bDocument22 pagesMustang Telehandler 742 744 944 1155 Service Manual 913237bnicoleorr110382okaNo ratings yet

- DATT Group Project - REGDocument19 pagesDATT Group Project - REGrao saadNo ratings yet

- BIVARIATDocument4 pagesBIVARIATSilmi RamdhaniatiNo ratings yet

- Given:: No. Beginners Developing Approaching Proficiency Proficient AdvanceDocument3 pagesGiven:: No. Beginners Developing Approaching Proficiency Proficient AdvancesatoukookieNo ratings yet

- Mix Method Research - Chapter 1 (2010)Document41 pagesMix Method Research - Chapter 1 (2010)brenyoka100% (1)

- Chapter 7: Hypothesis Testing: Procedures in Hypothesis Testing Statistical Power Factors That Affect PowerDocument46 pagesChapter 7: Hypothesis Testing: Procedures in Hypothesis Testing Statistical Power Factors That Affect PowerDebela LemesaNo ratings yet

- Zimmerman 2012 A Note On Consistency of Non-Parametric Rank Tests and Related Rank TransformationsDocument23 pagesZimmerman 2012 A Note On Consistency of Non-Parametric Rank Tests and Related Rank TransformationsCarlos AndradeNo ratings yet

- Deductive Reasoning: Everyday ExamplesDocument3 pagesDeductive Reasoning: Everyday ExamplesClarence RamosNo ratings yet

- Science ReportDocument2 pagesScience ReportGesele MilanNo ratings yet

- Chomsky On QuineDocument16 pagesChomsky On QuineJustin ColleyNo ratings yet

- 2 PDFDocument12 pages2 PDFGag PafNo ratings yet

- Activity 2 and Activity 3Document4 pagesActivity 2 and Activity 3Nicole TolaybaNo ratings yet

- Mock Exam Solution Empirical Methods For FinanceDocument6 pagesMock Exam Solution Empirical Methods For FinanceVilhelm CarlssonNo ratings yet

- Economics Grade 9 Part TwoDocument27 pagesEconomics Grade 9 Part Twohabtamulegese24No ratings yet

- 08 Test of SignificanceDocument21 pages08 Test of SignificanceadmirodebritoNo ratings yet

- Chapter FourDocument65 pagesChapter FourKhanNo ratings yet

- Utting Skeptics in Their PlaceDocument280 pagesUtting Skeptics in Their PlacejoeswouNo ratings yet

- GST 107 by Dr. Amos IchobaDocument21 pagesGST 107 by Dr. Amos IchobaOseghale MichaelNo ratings yet

- Gustav Mie TheorieDocument52 pagesGustav Mie TheoriejuanNo ratings yet

- 4 Regression InferenceDocument36 pages4 Regression Inferencefitra purnaNo ratings yet

- Jamestown Steel Company Manufactures and Assembles... : Step-By-StepDocument4 pagesJamestown Steel Company Manufactures and Assembles... : Step-By-Stepmesba HoqueNo ratings yet

- Quarter K-12 Learning Competencies MelcsDocument4 pagesQuarter K-12 Learning Competencies MelcstitserscradleNo ratings yet

- Gec 104 Final Module 3Document9 pagesGec 104 Final Module 3Danica Marie RegaladoNo ratings yet