Professional Documents

Culture Documents

Concepts of Accounting

Concepts of Accounting

Uploaded by

NISHANTH P CHOYAL 22285120 ratings0% found this document useful (0 votes)

6 views1 pageThis document discusses the components of financial statements including purchases, direct expenses, indirect expenses, sales, gross profit, and net profit. It explains that gross profit is calculated as sales minus purchases and direct expenses. Indirect expenses are then deducted from gross profit along with other incomes added to determine net profit or loss. The net profit or loss is then transferred to the capital account in the balance sheet.

Original Description:

Original Title

Concepts of accounting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses the components of financial statements including purchases, direct expenses, indirect expenses, sales, gross profit, and net profit. It explains that gross profit is calculated as sales minus purchases and direct expenses. Indirect expenses are then deducted from gross profit along with other incomes added to determine net profit or loss. The net profit or loss is then transferred to the capital account in the balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageConcepts of Accounting

Concepts of Accounting

Uploaded by

NISHANTH P CHOYAL 2228512This document discusses the components of financial statements including purchases, direct expenses, indirect expenses, sales, gross profit, and net profit. It explains that gross profit is calculated as sales minus purchases and direct expenses. Indirect expenses are then deducted from gross profit along with other incomes added to determine net profit or loss. The net profit or loss is then transferred to the capital account in the balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

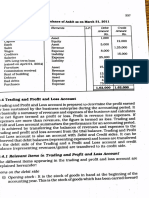

inancial Statements - I 343

f good~ and/ or rendering of services to customers h~ve proved profitable for

1e busmess ?r not. Purchases is one of the main constituents of expenses in

usiness organisation. Besides purchases, the remaining expenses are divided

1to two categories, viz. direct expenses and indirect expenses. ·

Direct expenses means all expenses directly connected with the manufacture,

urchase of goods and bringing them to the point of sale. Direct expenses

1clude carriage inwards, freight inwards, wages, factory lighting, coal, water

nd feul, royalty on production, etc. _In our example- I, besides ,purchase·s,

>Ur more items of expenses are listed. These are wages, _salaries, rent of

uilding and bad debts. Out of these items, wages is treated as direct expense

rhile· the other thr~e are treated as indirect expenses. .

Similarly, sales constitute the main item of revenue for the business. The

Kcess of sales over purchases and direct expenses is called gross profit. If

1e .amount of purchases including direct expenses is more than the sales

~venue, the resultant figure is gros~ loss. The computation of gross profit .

an be shown in the form of equation as : •

G:r:oss Profit= Sales - (Purchases+ Direct Expenses)

The gross profit or the gross loss is transferred to profit and loss account.

The indirect expenses are transferred to the debit side of the second part,

iz. profit and loss account. All reventie/g~ns other than sales are transferred

) the credit side of the profit and loss account. If the total of the credit side of

1e profit and l?ss account is more than the total of the debit side,_the difference

, the net profit fol' the period of which it is being prepared. On the other hand,

· the total of the debit side is more than the total of the credit side, the

ifference is the net loss incurred by the business frrm. In an equation form,

: i~ shown as follows :

Net Profit = Gross Profit + Other Incomes - Indirect Expenses ·

Net profit or net loss so computed is transferred to the capital account in

he balance sheet by way of the following entry :

(i) For transfer of net profit

· Profit and Loss A/ c Dr.

To Capital A/ C

(ii) For transfer of net loss

Capital A/ c Dr.

To Profit .and Loss A/ c .

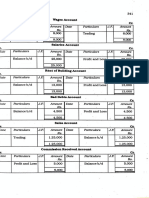

_ we are now redrafting the trading and profit and loss account to show gross

1rofit and net profit of Anldt for 'the year ended March ~l, 2011._The r~drafted

radlng and profit and Joss account will look like as shown JS shown m fig111 e 9.3.

You might also like

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Preparation of Final Accounts - With Regard To OrganisationDocument24 pagesPreparation of Final Accounts - With Regard To OrganisationsureshNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat Sheetazulceleste0_0100% (1)

- Final Accounts NotesDocument6 pagesFinal Accounts NotesVinay K TanguturNo ratings yet

- Module 3 Final AccountsDocument31 pagesModule 3 Final Accountskaushalrajsinhjanvar427No ratings yet

- Profit and LosssDocument31 pagesProfit and LosssMaulick JainNo ratings yet

- Trading AccountDocument12 pagesTrading AccountVinay NaikNo ratings yet

- Acf100 New ImportantDocument10 pagesAcf100 New ImportantNikunjGuptaNo ratings yet

- Financial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)Document7 pagesFinancial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)yashwini2827No ratings yet

- Final AcountsDocument20 pagesFinal Acountskarthikeyan01No ratings yet

- Class Notes: Class: XI Topic: Financial StatementDocument3 pagesClass Notes: Class: XI Topic: Financial StatementRajeev ShuklaNo ratings yet

- Financial StatementsDocument8 pagesFinancial Statementsmanthansaini8923No ratings yet

- Afm Research AssignmentDocument13 pagesAfm Research AssignmentNISHANo ratings yet

- Sole Proprietorship Final AccountsDocument23 pagesSole Proprietorship Final Accountsjaiccha420No ratings yet

- Trading and Profit Loss AccountDocument8 pagesTrading and Profit Loss AccountOrange Noida100% (1)

- Book Keeping MaterialsDocument64 pagesBook Keeping MaterialsAmanda Watson100% (1)

- Definition and Explanation:: Debit Side ItemsDocument17 pagesDefinition and Explanation:: Debit Side ItemsSovan NandyNo ratings yet

- Binayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurDocument9 pagesBinayak Academy,: Gandhi Nagar 1 Line, Near NCC Office, BerhampurkunjapNo ratings yet

- Final AccountsDocument7 pagesFinal Accountssubhasishmajumdar0% (2)

- VU Lesson 8Document5 pagesVU Lesson 8ranawaseem100% (1)

- Fabm ReviewerDocument16 pagesFabm Reviewersab lightningNo ratings yet

- Final AccountsDocument40 pagesFinal AccountsCA Deepak Ehn100% (1)

- Purchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsDocument4 pagesPurchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsSiva SankariNo ratings yet

- Statement of Comprehensive IncomeDocument25 pagesStatement of Comprehensive IncomeAngel Nichole ValenciaNo ratings yet

- Final Accounts/ Financial StatementsDocument53 pagesFinal Accounts/ Financial Statementsrachealll100% (1)

- Class Note 2Document18 pagesClass Note 2Abdallah HassanNo ratings yet

- Finalaccount 180112112514Document14 pagesFinalaccount 180112112514Sukhram PermarNo ratings yet

- Test of Whether Something Is An Asset IsDocument9 pagesTest of Whether Something Is An Asset IsMehrose AhmedNo ratings yet

- Chapter 4 Final Accounts PDFDocument32 pagesChapter 4 Final Accounts PDFkamalkavNo ratings yet

- Income Statement - Cost AccountingDocument5 pagesIncome Statement - Cost AccountingIlayaraja BoopathyNo ratings yet

- AccountancyDocument45 pagesAccountancyBRISTI SAHANo ratings yet

- Example of Direct and Indirect ExpensesDocument14 pagesExample of Direct and Indirect ExpensesEnamul HaqueNo ratings yet

- Unit 1 Book Keeping, Accounting, AS & IFRS PDFDocument43 pagesUnit 1 Book Keeping, Accounting, AS & IFRS PDFShreyash PardeshiNo ratings yet

- Fabm ReviewerDocument7 pagesFabm Reviewersab lightningNo ratings yet

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithNo ratings yet

- Final Accounts (Financial Statements)Document6 pagesFinal Accounts (Financial Statements)Raaghav SrinivasanNo ratings yet

- Measuring National Output and National IncomeDocument11 pagesMeasuring National Output and National IncomeAzharNo ratings yet

- 14 - Financial Statement - I (175 KB) PDFDocument21 pages14 - Financial Statement - I (175 KB) PDFramneekdadwalNo ratings yet

- Financial Statements: Reference Books: Accountancy by D. K. Goel Rajesh Goel OR Double Entry Book Keeping by T. S. GrewalDocument21 pagesFinancial Statements: Reference Books: Accountancy by D. K. Goel Rajesh Goel OR Double Entry Book Keeping by T. S. GrewalNischay GuptaNo ratings yet

- Lesson-8 Income StatementsDocument5 pagesLesson-8 Income Statementsanmolgarg129No ratings yet

- Financial Accounting (1st Semester)Document143 pagesFinancial Accounting (1st Semester)ngodisha07No ratings yet

- Financial StatementsDocument20 pagesFinancial StatementsOmnath Bihari100% (1)

- 02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountDocument14 pages02, Accounting & Financial Analysis: 13, Preparation of Profit and Loss Accounts Loss AccountHOD Dept of BBA Vels UniversityNo ratings yet

- Accnts 2021-22Document24 pagesAccnts 2021-22Hari RamNo ratings yet

- Profit and LossDocument88 pagesProfit and LossbhuvaneshwarimmcoNo ratings yet

- 9 Financial Statement - Part ADocument33 pages9 Financial Statement - Part AMariam AhmedNo ratings yet

- Jaiib 4rd JuneDocument45 pagesJaiib 4rd JuneDeepesh SrivastavaNo ratings yet

- Final AccountsDocument25 pagesFinal Accountsbarakkat7275% (4)

- Chapter 20Document30 pagesChapter 20soniadhingra1805No ratings yet

- Final Accounts: Receipts & Expenditure Adjustment & Closing Entries Final Accounts of Manufacturing ConcernsDocument9 pagesFinal Accounts: Receipts & Expenditure Adjustment & Closing Entries Final Accounts of Manufacturing ConcernsVidhi Patel100% (1)

- 1.final Accounts by NavkarDocument24 pages1.final Accounts by NavkarKID ZONENo ratings yet

- Fisa LecturaDocument1 pageFisa LecturaLaurentiu PopoviciNo ratings yet

- E-Book - Final Accounts - PDF OnlyDocument34 pagesE-Book - Final Accounts - PDF OnlyAshish GuptaNo ratings yet

- Accounting Terms: DirectionDocument5 pagesAccounting Terms: Directionkthesmart4No ratings yet

- Final Accounts:: Definition and ExplanationDocument22 pagesFinal Accounts:: Definition and ExplanationAmith LaddaNo ratings yet

- What Are Accounts ExpensesDocument4 pagesWhat Are Accounts ExpensesMary Joyce SiyNo ratings yet

- Eco 8Document1 pageEco 8NISHANTH P CHOYAL 2228512No ratings yet

- Eco 2Document1 pageEco 2NISHANTH P CHOYAL 2228512No ratings yet

- Eco 3Document1 pageEco 3NISHANTH P CHOYAL 2228512No ratings yet

- Eco 1Document1 pageEco 1NISHANTH P CHOYAL 2228512No ratings yet

- EconomicsDocument1 pageEconomicsNISHANTH P CHOYAL 2228512No ratings yet

- Concepts of FinanceDocument1 pageConcepts of FinanceNISHANTH P CHOYAL 2228512No ratings yet

- (A) To Present A True: The BDocument1 page(A) To Present A True: The BNISHANTH P CHOYAL 2228512No ratings yet

- Accounting ConceptDocument1 pageAccounting ConceptNISHANTH P CHOYAL 2228512No ratings yet

- Advance AccountingDocument7 pagesAdvance AccountingPutri anjjarwatiNo ratings yet

- Accounting PrinciplesDocument20 pagesAccounting PrinciplesAlly AsiNo ratings yet

- Techno Computer Training CenterDocument11 pagesTechno Computer Training CenterAlemnew SisayNo ratings yet

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDocument14 pagesSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- Ia Vol 3 Valix Solman 2019Document105 pagesIa Vol 3 Valix Solman 2019Janel dela Cruz100% (1)

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument20 pagesCambridge International Examinations Cambridge International General Certificate of Secondary Educationcharmainemakumbe60No ratings yet

- Prepaire Operational BudgetsDocument29 pagesPrepaire Operational BudgetsAshenafi AbdurkadirNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisAreti SatoglouNo ratings yet

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Document5 pages03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IINo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument12 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- EN - Free Excel Templates Nonprofit AccountingDocument19 pagesEN - Free Excel Templates Nonprofit AccountingCarlos FlammenschwertNo ratings yet

- Ratio Analysis NBPDocument16 pagesRatio Analysis NBPArshad M Yar100% (1)

- Financial Accounting With International Financial Reporting Standards 4th Edition Weygandt Solutions ManualDocument46 pagesFinancial Accounting With International Financial Reporting Standards 4th Edition Weygandt Solutions ManualJordanChristianqryox100% (14)

- FSAV 6e - Errata 103023Document37 pagesFSAV 6e - Errata 103023Issa MosaNo ratings yet

- 215 Chap04 ForecastingDocument30 pages215 Chap04 Forecastingtyrone21No ratings yet

- FIN2004 - 2704 Week 2Document80 pagesFIN2004 - 2704 Week 2ZenyuiNo ratings yet

- Adv 1 - 5 - Intercompany Profit Transactions - Inventories #2Document52 pagesAdv 1 - 5 - Intercompany Profit Transactions - Inventories #2Hasnah RosydahNo ratings yet

- GoStudy CFA L1 - Introduction To FSA PDFDocument24 pagesGoStudy CFA L1 - Introduction To FSA PDFMaria haneffNo ratings yet

- Cash Credit Proposal For Bank FinanceDocument15 pagesCash Credit Proposal For Bank Financeajaya thakurNo ratings yet

- Weekly Post-Class Online Quiz #3Document10 pagesWeekly Post-Class Online Quiz #3Nghi AnNo ratings yet

- Intermediate Accounting Reporting and Analysis 1st Edition Wahlen Solutions Manual 1Document131 pagesIntermediate Accounting Reporting and Analysis 1st Edition Wahlen Solutions Manual 1willie100% (46)

- Fabm1 Quarter3 Module 8 Week 8 Week 9Document19 pagesFabm1 Quarter3 Module 8 Week 8 Week 9Princess Nicole EsioNo ratings yet

- RTP Financial Reporting CapiiiDocument39 pagesRTP Financial Reporting CapiiiManoj ThapaliaNo ratings yet

- LATAM AIRLINES GROUP S A 09-2012 (Inglés)Document172 pagesLATAM AIRLINES GROUP S A 09-2012 (Inglés)chequeadoNo ratings yet

- PTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTDocument21 pagesPTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTran Pham Quoc ThuyNo ratings yet

- AF208 Revision Package S2 2019Document30 pagesAF208 Revision Package S2 2019Navin N Meenakshi ChandraNo ratings yet

- Rapport de MadioDocument88 pagesRapport de Madioroni jeufoNo ratings yet