Professional Documents

Culture Documents

Egotiable Nstruments AW: Executive Committee Subject Committee Members

Egotiable Nstruments AW: Executive Committee Subject Committee Members

Uploaded by

Argel CosmeCopyright:

Available Formats

You might also like

- Villanueva AgencyDocument851 pagesVillanueva AgencyAnica Gomez100% (13)

- Nego Law-Reviewer-Aquino and AgbayaniDocument74 pagesNego Law-Reviewer-Aquino and AgbayaniCha Galang100% (6)

- 2019 Form Mag FeedDocument9 pages2019 Form Mag FeedJosephine Kawayo100% (1)

- Mutual Rescission of ContractDocument2 pagesMutual Rescission of Contractpam100% (4)

- Affidavit of Quitclaim With Indemnity Agreement With SPADocument1 pageAffidavit of Quitclaim With Indemnity Agreement With SPAArchie Osuna33% (3)

- MOADocument4 pagesMOAAnne RojNo ratings yet

- Sinumpaang SalaysayDocument9 pagesSinumpaang SalaysayArgel CosmeNo ratings yet

- Nego San BedaDocument24 pagesNego San Bedataktak69100% (3)

- (PDF) Nego Law-Reviewer-Aquino and Agbayani - Compress PDFDocument74 pages(PDF) Nego Law-Reviewer-Aquino and Agbayani - Compress PDFAnonymous qjsSkwF100% (1)

- Administrative Law in Tanzania. A Digest of CasesFrom EverandAdministrative Law in Tanzania. A Digest of CasesRating: 4.5 out of 5 stars4.5/5 (12)

- Mutual Non-Disclosure Non-CircumventionDocument4 pagesMutual Non-Disclosure Non-CircumventionblogjobnetNo ratings yet

- San Beda College of Law: Negotiable Instruments Law (Nil)Document24 pagesSan Beda College of Law: Negotiable Instruments Law (Nil)Rollie AngNo ratings yet

- (295341110) San Beda 2005 Negotiable InstrumentDocument33 pages(295341110) San Beda 2005 Negotiable InstrumentButternut23No ratings yet

- Negotiable Instruments Law (Nil) : (Act No. 2031, Effective June 2, 1911Document24 pagesNegotiable Instruments Law (Nil) : (Act No. 2031, Effective June 2, 1911David MesaNo ratings yet

- Negotiable Instruments ReviewerDocument67 pagesNegotiable Instruments ReviewercamilhamjaNo ratings yet

- Negotiable Instruments LawDocument54 pagesNegotiable Instruments LawCharles Decripito FloresNo ratings yet

- San Beda 2005 Negotiable InstrumentDocument24 pagesSan Beda 2005 Negotiable InstrumentRingo Dungog100% (1)

- Negotiable Instruments LawDocument50 pagesNegotiable Instruments LawAbigail Faye Roxas100% (1)

- San Beda NILDocument24 pagesSan Beda NILMichelle Silva100% (1)

- Nego Law Reviewer Aquino and AgbayaniDocument74 pagesNego Law Reviewer Aquino and AgbayaniMheryza De Castro PabustanNo ratings yet

- Negotiable Instruments Law (Nil) : San Beda College of LawDocument24 pagesNegotiable Instruments Law (Nil) : San Beda College of LawJam RoxasNo ratings yet

- Personal Notes Nego Law ReviewerDocument11 pagesPersonal Notes Nego Law ReviewerCherry Pie PoleaNo ratings yet

- San Beda College of Law: 6 M A C LDocument24 pagesSan Beda College of Law: 6 M A C LRaymart Zervoulakos IsaisNo ratings yet

- NEGODocument24 pagesNEGOTj AllasNo ratings yet

- Negotiable Instruments (Aquino and Agbayani Notes) 1: de Los SantosDocument66 pagesNegotiable Instruments (Aquino and Agbayani Notes) 1: de Los SantosJohndale de los SantosNo ratings yet

- Nego ReviewerDocument80 pagesNego ReviewerMVSNo ratings yet

- Negotiable Instruments LawDocument13 pagesNegotiable Instruments LawApple MarieNo ratings yet

- Instruments Law ReviewerDocument11 pagesInstruments Law ReviewerSam MaligatNo ratings yet

- Nego ReviewerDocument75 pagesNego ReviewerAstrid Sheevette Ong100% (2)

- San Beda College of Law 6 MEMORY AID inDocument24 pagesSan Beda College of Law 6 MEMORY AID inRoberto OberoNo ratings yet

- Reviewer in NegoDocument7 pagesReviewer in NegoJoan BartolomeNo ratings yet

- Nego San BedaDocument24 pagesNego San BedaPrincess BanquilNo ratings yet

- 2008 Lei NegoDocument50 pages2008 Lei NegoDave SolarisNo ratings yet

- Lecture Notes On Negotiable InstrumentsDocument72 pagesLecture Notes On Negotiable InstrumentsAmarra Astudillo RoblesNo ratings yet

- Negotiable Instrument LawDocument24 pagesNegotiable Instrument LawTin GomezNo ratings yet

- San Beda College of Law: Negotiable Instruments Law (Nil)Document24 pagesSan Beda College of Law: Negotiable Instruments Law (Nil)Kimberley Dela Cruz- Matammu100% (1)

- Nego Slides Part 1Document184 pagesNego Slides Part 1Ryan A. SuaverdezNo ratings yet

- Negotiable Instruments Memo Aid390935500Document25 pagesNegotiable Instruments Memo Aid390935500Christine PalisNo ratings yet

- Nego ReviewerDocument10 pagesNego ReviewerSHERYL PARADERONo ratings yet

- Negotiable Instruments Law ReviewerDocument11 pagesNegotiable Instruments Law ReviewerLester PioquintoNo ratings yet

- Reviewer Negotiable Instruments Law 2014 02 16 PDFDocument34 pagesReviewer Negotiable Instruments Law 2014 02 16 PDFPV PalmaNo ratings yet

- Negotiable Instruments Law ReviewerDocument10 pagesNegotiable Instruments Law ReviewerEdwin VillaNo ratings yet

- Nego GN 2021Document59 pagesNego GN 2021Envy LaceNo ratings yet

- LAW-negotiable-instruments-law-lecture NotesDocument36 pagesLAW-negotiable-instruments-law-lecture NotesOlive Grace CaniedoNo ratings yet

- Commercial Paper and Credit and Secured Transaction MORESDocument20 pagesCommercial Paper and Credit and Secured Transaction MORESReymark Mores100% (2)

- Nego Notes PDFDocument51 pagesNego Notes PDFSandra DomingoNo ratings yet

- Negotiable Instruments Law ReviewerDocument10 pagesNegotiable Instruments Law ReviewerLester PioquintoNo ratings yet

- Negotiable Instrument ReviewerDocument10 pagesNegotiable Instrument ReviewerRoosevelt GuerreroNo ratings yet

- NIL MidtermDocument28 pagesNIL MidtermAnonymous B0aR9GdNNo ratings yet

- Nego Reviewer KweenDocument38 pagesNego Reviewer KweenRIZELLE BERNADINE MALANGENNo ratings yet

- Negotiable Instruments (Word)Document74 pagesNegotiable Instruments (Word)MaanNo ratings yet

- Handout in Negotiable InstrumentDocument38 pagesHandout in Negotiable InstrumentJahazielle DelacruzNo ratings yet

- NEGOTIABLE - INSTRUMENTS - LAW Notes HCDCDocument23 pagesNEGOTIABLE - INSTRUMENTS - LAW Notes HCDCChrissy SabellaNo ratings yet

- Negotiable Instruments Law DigestDocument4 pagesNegotiable Instruments Law DigestAldrinNo ratings yet

- Law On Negotiable Instruments (Memory Aid)Document24 pagesLaw On Negotiable Instruments (Memory Aid)Christian De Leon100% (1)

- Commercial Law, Professors Sundiang and Aquino) : Common Form of Bill of ExchangeDocument11 pagesCommercial Law, Professors Sundiang and Aquino) : Common Form of Bill of ExchangeLizzy WayNo ratings yet

- Negotiable Instruments Law ReviewerDocument8 pagesNegotiable Instruments Law ReviewerKath100% (1)

- Negotiable Instruments Law ReviewerDocument8 pagesNegotiable Instruments Law ReviewerRowbby GwynNo ratings yet

- Negotiable Instruments Law (Nil) : I. General Concepts Negotiable Instrument (Ni)Document24 pagesNegotiable Instruments Law (Nil) : I. General Concepts Negotiable Instrument (Ni)Vou-jok MangelenNo ratings yet

- Negotiable Instruments Law - Philippine Law ReviewersDocument49 pagesNegotiable Instruments Law - Philippine Law ReviewersRenalyn DarioNo ratings yet

- Nego ReviewerDocument6 pagesNego ReviewerJohnny Castillo SerapionNo ratings yet

- Compact Review NILDocument27 pagesCompact Review NILMark LozanoNo ratings yet

- Law Reviewer PDFDocument38 pagesLaw Reviewer PDFNICAEL ARVIN VALMONTENo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesFrom EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesNo ratings yet

- Bar Review Companion: Remedial Law: Anvil Law Books Series, #2From EverandBar Review Companion: Remedial Law: Anvil Law Books Series, #2Rating: 3 out of 5 stars3/5 (2)

- Orphans and DogsDocument1 pageOrphans and DogsArgel CosmeNo ratings yet

- League of Provinces Vs DENRDocument29 pagesLeague of Provinces Vs DENRArgel CosmeNo ratings yet

- Dual Citizenship Is Different From Dual AllegianceDocument2 pagesDual Citizenship Is Different From Dual AllegianceArgel CosmeNo ratings yet

- The LawyerDocument1 pageThe LawyerArgel CosmeNo ratings yet

- Affidavit Lost BaggageDocument3 pagesAffidavit Lost BaggageArgel CosmeNo ratings yet

- Affidavit of DiscrepancyDocument2 pagesAffidavit of DiscrepancyArgel CosmeNo ratings yet

- Affidavit of DiscrepancyDocument2 pagesAffidavit of DiscrepancyArgel CosmeNo ratings yet

- Affidavit of Damaged VehicleDocument1 pageAffidavit of Damaged VehicleArgel Cosme100% (1)

- 03 Transfer Taxes (Edited May 26) FINALDocument22 pages03 Transfer Taxes (Edited May 26) FINALArgel CosmeNo ratings yet

- TRANSPODocument36 pagesTRANSPOArgel CosmeNo ratings yet

- Intellectual PropertyDocument42 pagesIntellectual PropertyArgel CosmeNo ratings yet

- 05 NIRC Remedies (Edited May 27) FINALDocument39 pages05 NIRC Remedies (Edited May 27) FINALArgel CosmeNo ratings yet

- 04 VAT 132-159 (Edited May 27)Document29 pages04 VAT 132-159 (Edited May 27)Argel CosmeNo ratings yet

- Pardo de Tavera V CacdacDocument3 pagesPardo de Tavera V CacdacArgel CosmeNo ratings yet

- Insurance LawDocument40 pagesInsurance LawArgel CosmeNo ratings yet

- Four Bills and A TaxDocument1 pageFour Bills and A TaxArgel CosmeNo ratings yet

- Tax RemediesDocument34 pagesTax RemediesArgel Cosme100% (1)

- Safelift Inflatables Contact: 09159891765/09494443903/02-82510304 Bounce House Rental Agreement & Liability ReleaseDocument2 pagesSafelift Inflatables Contact: 09159891765/09494443903/02-82510304 Bounce House Rental Agreement & Liability ReleaseArgel CosmeNo ratings yet

- El Banco Espanol V PalancaDocument15 pagesEl Banco Espanol V PalancaArgel CosmeNo ratings yet

- Jocson V RoblesDocument2 pagesJocson V RoblesArgel CosmeNo ratings yet

- Perido Vs PeridoDocument1 pagePerido Vs PeridoArgel CosmeNo ratings yet

- People Vs SchneckenbergerDocument2 pagesPeople Vs SchneckenbergerArgel CosmeNo ratings yet

- Real Property TaxDocument13 pagesReal Property TaxArgel Cosme100% (2)

- Wiegel Vs Sempio DyDocument1 pageWiegel Vs Sempio DyArgel CosmeNo ratings yet

- LCD Digest For Rem 1 Session 2Document29 pagesLCD Digest For Rem 1 Session 2Argel CosmeNo ratings yet

- LCD Digest For Rem 1 Session 3 (Reformatted)Document23 pagesLCD Digest For Rem 1 Session 3 (Reformatted)Argel CosmeNo ratings yet

- SPA (Represent in Trial) .Editha Dela CruzDocument2 pagesSPA (Represent in Trial) .Editha Dela CruzArgel CosmeNo ratings yet

- Trading Income - July 2023Document8 pagesTrading Income - July 2023maharajabby81No ratings yet

- Seminar 9 and 10 - Charges and MorgagesDocument12 pagesSeminar 9 and 10 - Charges and MorgagesDiana WangamatiNo ratings yet

- Name: Sahil Verma ROLL NO.: 2148 Semester: Second YEAR: 2019-2024 Course: B.A.Llb (Hons) Sushmita SinhaDocument4 pagesName: Sahil Verma ROLL NO.: 2148 Semester: Second YEAR: 2019-2024 Course: B.A.Llb (Hons) Sushmita SinhaSahil VermaNo ratings yet

- Lim v. Moldex Land, Inc.Document1 pageLim v. Moldex Land, Inc.Cyrus AvelinoNo ratings yet

- Addendum To AdvDocument3 pagesAddendum To AdvJames Hydoe ElanNo ratings yet

- Trade Finance Transactions SMS and E-Mail Notification Enrollment FormDocument2 pagesTrade Finance Transactions SMS and E-Mail Notification Enrollment FormTasneef ChowdhuryNo ratings yet

- Yon Mitori International Industries v. Union Bank of The PhilippinesDocument4 pagesYon Mitori International Industries v. Union Bank of The PhilippinesLorna IlustrisimoNo ratings yet

- De Los Santos vs. Luciano G.R. No. 40958. August 11, 1934Document5 pagesDe Los Santos vs. Luciano G.R. No. 40958. August 11, 1934Martee BaldonadoNo ratings yet

- Gonzales Vs PNBDocument3 pagesGonzales Vs PNBKacel CastroNo ratings yet

- Bonds Life InsuranceDocument2 pagesBonds Life InsuranceMa MooherdmanNo ratings yet

- Lumut Maritime Terminal SDN BHD Leave Application Form: DivisionDocument4 pagesLumut Maritime Terminal SDN BHD Leave Application Form: DivisionShahriman AsmawiNo ratings yet

- Liberty Mutual v. Devere ConstructionDocument62 pagesLiberty Mutual v. Devere ConstructionJennifer EmertNo ratings yet

- Commencement of Works Vs Commencement of Works Program (FIDIC Rainbow Conditions of Contracts)Document15 pagesCommencement of Works Vs Commencement of Works Program (FIDIC Rainbow Conditions of Contracts)Anoop NimkandeNo ratings yet

- Provisional Remedies TSN 2019Document88 pagesProvisional Remedies TSN 2019Devilleres Eliza Den100% (1)

- CASE DIGEST On Republication and Revival of WillsDocument9 pagesCASE DIGEST On Republication and Revival of WillsBeverlyn JamisonNo ratings yet

- WEEK 1 (September 24) : - Contracts of Real Security - Contracts of Personal SecurityDocument11 pagesWEEK 1 (September 24) : - Contracts of Real Security - Contracts of Personal SecurityDANICA FLORESNo ratings yet

- 6 & 74 of 2015Document27 pages6 & 74 of 2015NITIN GUPTANo ratings yet

- 523-561 Property CasesDocument27 pages523-561 Property CasesAiza SaraNo ratings yet

- All Form - Minimum Wages ActDocument12 pagesAll Form - Minimum Wages Acthdpanchal86No ratings yet

- Bidding Document For MTPP OMSCDocument193 pagesBidding Document For MTPP OMSCFaher Gaosel WatamamaNo ratings yet

- Divorce DeedDocument3 pagesDivorce DeedHumaira KaleemNo ratings yet

- Family Law 2Document14 pagesFamily Law 2Naveen SihareNo ratings yet

- Primary Objective (RA 11211) : Salient AmendmentsDocument25 pagesPrimary Objective (RA 11211) : Salient AmendmentsSam OneNo ratings yet

- Proteus Professional Licence AgreementDocument3 pagesProteus Professional Licence AgreementPrawidya DestiantoNo ratings yet

Egotiable Nstruments AW: Executive Committee Subject Committee Members

Egotiable Nstruments AW: Executive Committee Subject Committee Members

Uploaded by

Argel CosmeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Egotiable Nstruments AW: Executive Committee Subject Committee Members

Egotiable Nstruments AW: Executive Committee Subject Committee Members

Uploaded by

Argel CosmeCopyright:

Available Formats

NEGOTIABLE INSTRUMENTS 3. Civil Code – Applies suppletorily.

LAW Functions of Negotiable Instruments:

1. It operates as a substitute for money.

Negotiable Instrument 2. It is a medium of exchange.

It is a written contract for the payment of money and 3. It is a credit instrument that increases credit

passes from one person to another as money, in circulation.

such manner as to give a holder in due course the 4. It increases the purchasing power in circulation.

right to hold the instrument free from defenses 5. It is a proof of transaction (AQUINO, Notes and

available to prior parties (SUNDIANG & AQUINO, Cases on Banking Laws and Negotiable

Reviewer on Commercial Law (2013), p.5) Instruments Law (2009), p.7 [hereinafter

[hereinafter SUNDIANG & AQUINO, Reviewer]. AQUINO, Negotiable Instruments]).

Requisites: (WU-POA) A negotiable instrument is not a legal tender

1. Must be in Writing and signed by the maker or

drawer; Legal Tender – (Without referring to a particular

2. Must contain an Unconditional promise or order country): It is that kind of currency which the law

to pay a sum certain in money; compels a creditor to receive in payment of a debt,

3. Must be Payable on demand, or at a fixed or be it public, or private, provided it is tendered in the

determinable future time; right amount.

4. Must be payable to Order or to bearer; and

5. When the instrument is Addressed to a drawee, All notes and coins issued by the Bangko Sentral

he must be named or otherwise indicated therein shall be fully guaranteed by the Government of the

with reasonable certainty (NEGOTIABLE Republic of the Philippines and shall be the legal

INSTRUMENTS LAW, Sec.1 [hereinafter NIL]). tender in the Philippines for all debts, both public

and private as provided for under Sec. 52, New

Governing Laws: Central Bank Act R.A. 7653 and BSP Circular No.

1. N.I.L. (Act No. 2031) – Negotiable Instruments 537, series of 2006.

Law. The provisions of the NIL apply ONLY to

negotiable instruments. Pursuant to the law stated above, the maximum

amount of coins to be considered as legal tender is

Note: If the instrument is not negotiable, the adjusted as follows:

pertinent provisions of the Civil Code or pertinent a. One thousand pesos (P1,000) for denominations

special laws should apply (GSIS v, CA, G.R. No. of 1-Peso, 5-Peso and 10-Peso coins; and

L-40824, February 23, 1989). b. One hundred pesos (P100) for denominations of

1-centavo, 5-centavo, and 25-centavo coins.

2. Code of Commerce – Negotiable instruments

are also governed by the provisions of the Code Checks representing demand deposits do not have

of Commerce that were not impliedly repealed by legal tender power and their acceptance in the

the NIL. payment of debts, both public and private, is at the

option of the creditor: Provided, however, that a

The provisions on crossed checks are still in check which has been cleared and credited to the

force because there is no provision in the NIL account of the creditor shall be equivalent to a

that deals with crossed checks (Chan Wan v. Tan delivery to the creditor of cash in an amount equal to

Kim, G.R. L-15380, September 30, 1960). the amount credited to his account (R.A. 7653, Sec.

60).

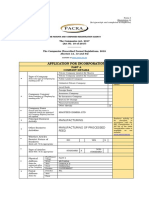

EXECUTIVE COMMITTEE SUBJECT COMMITTEE MEMBERS

SYLVESTER AUSTRIA overall chairperson, LARA ANGELA MAGULTA subject chair, Jeffrey Bajita, Mark Julius Batugal,

REYNOLD ORSUA chairperson for JOSE AMELITO BELARMINO II assistant Frances Juliene Buendia, Dan Yunus

academics, JOE VINCENT AGUILA subject chair, CAMILLE MAY MEDINA Cabrera, Jennel Chu, Edgar Cruz,

chairperson for hotel operations, LYNDON edp, ROWNEYLIN SIA negotiable Charles De Belen, Jennyllette

RUTOR vice-chairperson for operations, instruments law, ALFREDERICK Dignadice, Clarissa Heromina Esguerra,

RODEL JAMES PULMA vice-chairperson ARANETA insurance law, YVETE MARIE Pamela Faller, Hanna Sharleen

Florendo, Celine-Maria Janolo,

for secretariat, DENISE DIANNE SOLA, transportation law, LOWELL

Charlotte King, Lorena Lerma Lunar,

MAGBUHOS vice-chairperson for finance, FREDRICK MADRILENO, corporation

Rosecellini Mamaclay, Jasmine Rose

IAN DANIEL GALANG vice-chairperson for law, LE BON EIRRES PASCUA, law on Maquiling, Florianne Marzan, Rose

electronic data processing, intellectual property, KHARIS Anne Menor, Trixie Jane Neri,

JOMARC PHILIP DIMAPILIS vice- MANAHAN, banking law, REI-ANNE Charmagne Pedrozo, Louisa Marie

chairperson for logistics SANTOS, special laws Quintos, Toni Faye Tan, Patricia Ester

ALBERTO RECALDE, JR. vice-chairperson Verzosa

for membership

Impairment Clause: The delivery of a note payable amount of interest for a specified length of time

to order or a bill of exchange or any other mercantile and to repay the loan on expiration date.

document shall produce payment only when they 3. Debenture – is a promissory note backed by

have been encashed or through the fault of creditor, general credit of a corporation and usually not

the value is impaired (CIVIL CODE, Art. 1249). secured by a mortgage or lien on any specific

property.

Features of a Negotiable Instrument: 4. Bank note – promissory note of the issuing bank

1. Negotiability – It is that attribute or property which is payable to bearer on demand (AQUINO,

whereby a bill or note or check may pass from Negotiable Instruments, supra at 14).

hand to hand similar to money, so as to give the

holder in due course the right to hold the II. Bill of Exchange (BE)

instrument and to collect the sum payable for An unconditional order, in writing, addressed by

himself free from defenses. one person to another, signed by the person

giving it, requiring the person to whom it is

2. Accumulation of Secondary Contracts – When addressed to pay, on demand or at a fixed or

negotiable instruments are transferred through determinable future time, a sum certain in money,

negotiation, secondary contracts are to order or to bearer (NIL, Sec. 126).

accumulated because the indorsers become

secondarily liable not only to their immediate Parties

transferees, but also to any holder or any party. 1. Drawer – person who draws the bill of exchange

These indorsers are liable to said holder or and orders the drawee to pay a sum certain in

whoever may be compelled to pay the money;

instruments (AQUINO, Negotiable Instruments, 2. Drawee – the person to whom the order to pay is

supra at 11). addressed in a bill of exchange. He becomes the

acceptor when he accepts the order to pay made

by the drawer. It is only when he becomes an

KINDS OF NEGOTIABLE acceptor that he becomes primarily liable

INSTRUMENTS (SUNDIANG & AQUINO, Reviewer supra at 13).

I. Promissory Note (PN) Thus, prior to the acceptance of a bill of

It is an unconditional promise, in writing, made by exchange, there is no party primarily liable.

one person to another, signed by the maker

engaging to pay, on demand or at a fixed or Legal Basis: A bill of itself does not operate as

determinable future time, a sum certain in money, an assignment of funds in the hands of the

to order or to bearer (NIL, Sec. 184). drawee available for payment thereof, and the

drawee is not liable until and unless he accepts

Parties the same (NIL, Sec. 127).

1. Maker – person who makes the promissory note

and promises to pay the amount stated therein; 3. Payee – party in whose favor the bill is drawn or

2. Payee – person who is to receive payment. is payable.

May 1, 2013 May 1, 2013

Payee Manila Payee Manila

P10,000 P10, 000

Ten (10) days after date, I promise to pay to Ten (10) days after date, pay Mr. A or order

Mr. A or order the sum of ten thousand pesos the sum ten thousand pesos (10,000).

(10,000).

Maker Sgd. Mr. B Drawer Sgd. Mr. B

Kinds of Promissory Notes: To: Mr. Z Drawee / Acceptor

1. Certificate of deposit – a form of promissory President, XYZ Corp

note which is a written acknowledgment of a Mendiola, Manila

bank of its receipt of a certain sum with a promise

to repay the same. The parties need not all be distinct persons. Indeed,

2. Bond – certificate or evidence of a debt on which a bill will be valid where there is only one party to it,

the issuing company or governmental body for one may draw on himself payable to his own

promises to pay the bondholders a specified order, that is, the two parties to the bill can be the

same person (DE LEON, The Philippine Negotiable

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

2

Instruments Law (and allied laws) Annotated (2013), Instances when a BILL OF EXCHANGE may be

p.23 [hereinafter DE LEON, Negotiable Instruments treated as a PROMISSORY NOTE at the election

Law]). of the HOLDER: (CALFS)

1. Drawee does not have the Capacity to contract

Kinds of Bills of Exchange:

(NIL, Sec. 130);

1. Time draft – payable at a fixed date.

2. Where the bill is Ambiguous (NIL, Sec.17[e]);

2. Sight or demand draft – payable when the

3. Where the bill is drawn on a person who is

holder presents it for payment.

Legally absent;

3. Trade acceptance – the seller (as drawer)

4. Drawee is a Fictitious person (NIL, Sec. 130);

orders the buyer (as drawee) to pay a sum

5. The drawer and the drawee are the Same person

certain to the same seller (payee).

(NIL, Sec. 130);

4. Banker’s acceptance – a time draft across the

face of which the drawee bank has written the

Distinctions between a Bill of Exchange and

word “accepted.” The bank is normally an

Check

accommodation payor that lends it credit to the

Bill of Exchange Check

buyer, who in return, will pay the bank

When payable

commissions and other charges.

5. Clean bill of exchange – no document is May be payable on

attached when presentment for payment or demand or at a fixed or Always payable on

acceptance is made. determinable future demand

time

6. Documentary bill of exchange – document/s

is/are attached when presented for payment or Presentment

acceptance. Need not be presented

7. Check – it is the most common form of bill of for acceptance.

Must be presented for

exchange. It is a bill of exchange drawn on a However, if the holder

acceptance (NIL, Sec.

bank payable on demand (NIL, Sec. 185) requests and the

143)

(AQUINO, Negotiable Instruments Law, supra at banker desires, banker

13). may accept

Drawn on deposit

Distinctions between Promissory Note and Bill Need NOT be drawn on

of Exchange a deposit, hence it is

Promissory not necessary that the Drawn on deposit,

Bill of Exchange drawer of a bill of otherwise, there would

Note

Nature exchange should have be fraud

Unconditional promise Unconditional order funds in the hands of

the drawee

Number of parties

When presentment made

Involves three (3)

parties May be presented for Must be presented for

payment within payment within a

Involves two (2) parties reasonable time after reasonable time after

However, a drawee is

not a party until he its last negotiation its issuance

accepts the bill. Effect of acceptance/ certification

Liability of creator If certified - drawer/

If accepted - drawer/

Drawer is only indorsers are

Maker is primarily liable indorser remains liable

secondarily liable discharged

Presentment Effect of drawer’s death

May involve two (2) Death of a drawer of a

Death of the drawer of

Only one (1) presentments: BOE, with the

a check, with the

presentment: for 1) for acceptance (in knowledge of the bank,

knowledge of the bank,

payment cases provided in Sec. does not revoke the

revokes the authority of

143) and 2) for payment authority of the drawee

the banker to pay

Right to limit liability to pay

Drawer may insert in the

Maker of note may not Other parties to a negotiable instrument:

instrument an express

insert an express

stipulation limiting or 1. Indorser – a person placing his signature upon

stipulation limiting or

negating his own liability an instrument other than as maker, drawer, or

negating his own liability

to the holder (NIL, Sec. acceptor; a person who transfers or negotiates

to the holder

61)

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

3

an instrument by indorsement completed by instrument as a negotiable one. It is merely a simple

delivery. contract in writing and is evidence of such intangible

2. Indorsee, in the case of instrument payable to rights as may have been created by the assent of

order; the parties (DE LEON, Negotiable Instruments Law,

3. Persons negotiating by mere delivery; supra at 17).

4. Persons to whom the instrument is negotiated by

mere delivery, in case the instrument is payable Distinctions between Negotiable Instruments

to bearer. and Non-Negotiable Instruments

5. Holder – payee or indorsee of a bill or note who Negotiable Non-Negotiable

is in possession of it or the bearer thereof (NIL, Instruments Instruments

Sec. 191). Applicable law

6. Acceptor – a drawee who accepts the order to Only NI is governed by Application of the NIL

pay made by the drawer. It is only when a the NIL is only by analogy

drawee becomes an acceptor that he is primarily Transferability

liable. Transferable by Transferable only by

7. Referee in case of need (NIL, Sec.131) – a negotiation or by Assignment

person who may be designated in the instrument assignment

as the person who may be resorted to by the Transferee

parties in case of dispute (SUNDIANG & The transferee can be a

AQUINO, Reviewer, supra at 13). The transferee

HDC if all the

8. Accommodation Party – one who has signed remains to be an

requirements under

the instrument as maker, drawer, acceptor or assignee and can

Sec. 52 are complied

indorser, without receiving value therefore, and never be a HDC

with

for the purpose of lending his name to some Defenses

other person (NIL, Sec. 29). A holder in due course All defenses available

takes the NI free from to prior parties may be

Incidents in the Life of a Negotiable Instrument: personal defenses and raised against the last

(PIN-PAD-PND-PD) defects in title transferee

1. Preparation and signing complete with all the

Nature of title

requisites provided for in Section 1 of the NIL

Requires clean title,

2. Issuance - first delivery of the instrument to the

one that is free from

payee

any infirmities in the Transferee acquires a

3. Negotiation - transfer from one person to another

instrument and defects derivative title only

so as to constitute the transferee a holder

of title of prior

4. Presentment for acceptance, in certain kinds of

transferors

Bills of Exchange

Solvency of the debtor

5. Acceptance - written assent of the drawee to the

Solvency of debtor is in

order

a sense guaranteed by

6. Dishonor by non-acceptance - refusal to accept

the indorsers because Solvency of debtor is

by the drawee

they engage that the not guaranteed under

7. Presentment for payment - the instrument is

instrument will be Art. 1628 of the CC

shown to the maker or drawee/acceptor for him

accepted, paid or both unless expressly

to pay

and that they will pay if stipulated

8. Notice of dishonor - notice to persons secondarily

liable that the maker or the drawee/acceptor the instrument is

refused to pay or to accept the instrument dishonored

9. Dishonor by non-payment - refusal to pay by the

maker or drawee/acceptor Examples of non-negotiable instruments:

10. Protest 1. Treasury Warrant – it is payable out of a

11. Discharge (AQUINO, Negotiable Instruments, particular fund of the national treasury

supra at 20-21). (Metrobank v. CA, G.R. No. 88866, February 18,

1991).

2. Postal Money Orders

N O N -N E G O T I A B L E a. Regulations or restrictions are imposed on

postal money orders which are inconsistent

INSTRUMENTS with the character of a NI. The rules provide for

Non-negotiable instruments – those which does not more than one indorsement and that

not meet the requirements laid down to qualify an payment may be withheld under a variety of

circumstances;

SAN BEDA COLLEGE OF LAW

4 2014 CENTRALIZED BAR OPERATIONS

b. The post office is not run by the government for “writing” includes print (AQUINO, Negotiable

commercial profit, but for public service Instruments, supra at 28).

(Philippine Education Co., Inc. v. Soriano, G.R.

No. L-22405, June 30, 1971). b. Signature

3. Letters of Credit – it does not contain an May be in one’s own handwriting, or it may be

unconditional promise or order to pay because printed, engraved, lithographed or

payment or advancement made by the entity photographed, so long as the signature is

(bank) requested to pay should be made only if affixed by the one signing with the intent to

the third person (seller) presents certain authenticate the writing (AQUINO, Negotiable

documents. In addition, it is payable to a Instruments, supra at 28).

specified person and not to order.

4. Trust Receipt – it is not negotiable under the NIL Signature is prima facie evidence of his

because it is an evidence of ownership of goods intention to be bound as either maker or

not money (SUNDIANG & AQUINO, Reviewer, drawer. However, if the signature is so placed

supra at 12). upon the instrument that it is not clear in what

5. Negotiable Document of Title, Bill of Lading capacity the person intended to sign, he is

and Warehouse Receipt – it is not a negotiable deemed an indorser (NIL, Sec. 17[f]) and not

instrument because it represents goods, not a maker or drawer.

money.

6. Certificate of Stocks – it is not negotiable One who signs under a trade or assumed

because there is no order or promise to pay. It is name shall be liable to the same extent as if

a written evidence of shareholdings of a person he had signed in his own name (NIL, Sec. 18).

in a corporation. Thus, it does not represent an

obligation to pay a sum certain in money 2. It must contain an Unconditional promise or

(AQUINO, Negotiable Instruments, supra at 39). order to pay a sum certain in money

7. Cash Disbursement Voucher – it is not a a. Unconditional Promise or Order to pay

negotiable instrument because it is nothing more The word “promise” or “order” need not

than a receipt evidencing payment by borrowers appear in the instrument to satisfy the

of the loans previously extended to them. requirements of Section 1. Any word/s

8. Negotiable Order of Withdrawal – it is not equivalent to a promise or assumption of

negotiable because it is payable to a specified responsibility for the payment of the note (like

person. “payable”, “I agree to pay”, etc.) on the face of

an instrument is/are sufficient to constitute a

“promise to pay.”

NEGOTIABILITY

There is no “promise” if there is a mere

Factors that affect the determination of acknowledgement of debt (Jimenez v. Bucoy,

negotiability of instruments: (WART) G.R. No. L-10221, February 28, 1958).

1. The Whole of the instrument shall be considered;

2. Only what Appears on the face of the instrument Mere authority and/or request to pay render

shall be considered; the instrument non-negotiable because it does

3. Requisites enumerated in Sec.1 of the NIL; and not contain an order to pay.

4. Should contain words or Terms of negotiability

such as “order” or “bearer” (AQUINO, Negotiable The promise or order is conditional if the

Instruments, supra at 23). promise or order is made to depend on a

contingent event. Even if the contingent event

Requisites of Negotiability: (WU-POA) occurs, the instrument is not converted into a

1. It must be in Writing and signed by the maker negotiable instrument. Under Articles 1173

or drawer and 1181 of the Civil Code, a condition is a

a. Writing future and contingent event, or a past event

Section 1 of the NIL does not specify the unknown to parties, the happening or non-

materials that should be used in writing the happening of which will either give rise to an

instrument nor the material on which the obligation or extinguish existing obligations.

writing should be made. Hence, the writing Thus, the negotiability of an instrument is

may be printed, in ink or in pencil, and it may destroyed if it contains a resolutory or

be written on any material that substitutes suspensive condition (AQUINO, Negotiable

paper. Section 191 of the NIL provides that Instruments, supra at 31).

the word “written” includes printed, and the

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

5

An unqualified order or promise to pay is drawee may not be fully (AQUINO, Negotiable

unconditional though coupled with: reimbursed (AQUINO, Instruments, supra at

i. An indication of a particular fund out of Negotiable Instruments, 34).

which reimbursement is to be made, or a supra at 33).

particular account to be debited with the

amount; or Subject to another transaction (non-

ii. A statement of the transaction which gives negotiable)

rise to the instrument. But an order or The instrument is rendered non-negotiable

promise to pay out of a particular fund is not when the promise or order is subject to the

unconditional (NIL, Sec. 3). terms and conditions of the transaction stated,

(VILLANUEVA, Commercial Law Review,

Fund for Reimbursement v. Particular Fund (2004)) [hereinafter VILLANUEVA,

for Payment Test Commercial Law]. Even if the separate

Does the instrument carry the general credit contract is not in itself conditional, the fact that

of the drawer or the maker, or only the credit the instrument is burdened by the restrictions

of a particular fund (GUEVARRA, Handbook of the separate contract makes it conditional

th

of Commercial Law, 10 ed., p.354) and thus, non-negotiable.

[hereinafter GUEVARRA, Commercial Law].

Reference to another transaction

Distinctions between Fund for Reimbursement (negotiable)

and Particular Fund for Payment Reference to another transaction or document

Fund for Particular Fund for must be descriptive rather than restrictive. It

Reimbursement Payment must only give information that it was issued

Acts Involved in connection with a particular transaction or

There is only one act- document and not make the order or promise

the drawee pays dependent on or burdened by the other

Drawee pays the payee transaction (AQUINO, Negotiable Instruments,

directly from the

from his own funds; supra at 32).

particular fund

afterwards, the drawee

indicated. Payment is

pays himself from the b. Payable in sum certain in money

subject to the condition

particular fund indicated A sum is certain if the amount to be

that the fund is

sufficient unconditionally paid by the maker or drawee

Nature of Fund Indicated can be determined on the face of the

Particular fund instrument, and it is not affected by the fact

that the exact amount is arrived at only after a

indicated is not the

Particular fund mathematical computation (AQUINO,

direct source of

indicated is the direct Negotiable Instruments, supra at 45).

payment but only the

source of payment

source of

The certainty is not affected although it is

reimbursement

to be paid: (ISA-Ex-Co)

Effect

i. With Interest; or

Unconditional Conditional

ii. By Stated installments;

Example

For the amount to be certain:

Pay to the order of A Pay to the order of A 1. The amount of each installment is

P10, 000 and debit the P10, 000 out of my indicated; and

same from my account account with you 2. The due date is fixed or at least

Sgd. B Sgd. B determinable.

Note: This is negotiable Note: This is not iii. By stated installments with a statement that

because the order is negotiable because upon default in payment of any installment

unconditional. What is payment is subject to or interest, the whole shall become due

reflected is an absolute the condition that the (Acceleration clause);

obligation to pay the account from which iv. With Exchange, whether at a fixed rate or at

amount of P10,000.00. payment is to be made a current rate; or

If the funds in the has sufficient funds. No v. With cost of Collection or attorney’s fees, in

account are insufficient, payment will be made if case payment shall not be made at maturity

there would still be an the amount in the (NIL, Sec. 2).

obligation to pay the account contains less

payee although the than P10,000.00

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

6

An instrument which contains an order or An instrument payable upon a contingency is

promise to do any act in addition to payment of not negotiable, and the happening of the

money is not negotiable. But the negotiable event does not cure the defect (NIL, Sec. 4).

character of an instrument otherwise negotiable

is not affected by a provision which gives the Acceleration Clause

holder an election to require something to be The negotiability of an instrument is not

done in lieu of payment of money (e.g. either affected even if it is to be paid by stated

deliver 2, 000 Pesos or 2 sacks of rice) (NIL, Sec. installments, with a provision, that upon

5). This is because there still remains to be an default in payment of any installment or of

absolute obligation to pay a sum certain in money interest, the whole shall become due (NIL,

(AQUINO, Negotiable Instruments, supra at 44). Sec. 2).

An instrument is still negotiable although the Insecurity Clause

amount to be paid is expressed in currency that Provisions in the contract which allow the

is not legal tender so long as it is expressed in holder to accelerate payment “if he deems

money (PNB v. Zulueta, G.R. No. L-7271, himself insecure” renders the instrument non-

August 30, 1957). negotiable because the holder’s whim and

caprice prevail without the fault of the maker

Under Section 1 of RA 8183, all monetary (AQUINO, Negotiable Instruments, supra at

obligations shall be settled in the Philippine 50).

currency which is the legal tender in the

Philippines. However, the parties may now, not Extension Clause

only in the case of negotiable instrument, but any An instrument is payable at a definite time if

contract involving payment of debt in money, by its terms, it is payable at a definite time

validly agree that payment should be made in a subject to extension at the option of the

foreign currency under R.A. 8183 which repealed holder, or to extension to a further definite

the Uniform Currency Act or R.A. 529. time at the option of the maker or acceptor or

automatically upon or after a specified event

3. Payable on demand or at a fixed or or act (e.g. payable after 2 years from date

determinable future time subject to extension for another year at the

a. When Payable on Demand option of the maker) (SUNDIANG & AQUINO,

i. When expressed to be payable on demand, Reviewer, supra at 21).

at sight or on presentation;

Payment on Installments

The word “sight” means upon If the instrument states that the amount shall

presentment. be paid in two equal installments, the second

being payable on a fixed date, the instrument

ii. In which no time for payment is expressed; can be considered negotiable since the first

installment would then be payable on demand

Where an instrument is issued, accepted or (VITUG, Pandect of Commercial Law and

indorsed when overdue, it is, as regards the Jurisprudence, (2006)) [hereinafter, VITUG,

person so issuing, accepting, or indorsing it, Commercial Law].

payable on demand (NIL, Sec. 7).

4. Payable to Order or Bearer

b. Payable at a Fixed or Determinable Future This means that an instrument, to be negotiable,

Time must contain words of negotiability. These words

i. At a fixed period after date or sight; are indispensable because it serves as an

After sight – means after the drawee has expression of consent that the instrument may be

seen the instrument upon the presentment transferred by negotiation. The consent is

for acceptance; indispensable since a maker assumes greater

ii. On or before a fixed or determinable future risk under a negotiable instrument than under a

time specified therein; or non-negotiable instrument (AQUINO, Negotiable

iii. On or at a fixed period after the occurrence Instruments, supra at 51).

of a specified event which is certain to

happen, though the time of happening is a. Payable to Order (NIL, Sec. 8)

uncertain (NIL, Sec. 4).

The instrument is payable to order where it is

drawn payable to the order of a specified

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

7

person, or to him or his order. It may be drawn receive the proceeds of the check. This

payable to the order of: usually occurs when the maker places a

name of an existing payee on the check for

i. A payee who is not the maker, drawer or convenience or to cover up an illegal activity

drawee; (PNB v. Rodriguez, G.R. No. 170325,

September 26, 2008).

The payee must be named or otherwise

indicated therein with reasonable certainty In a fictitious-payee situation, the drawee

(NIL, Sec 8). bank is absolved from liability and the

drawer bears the loss. When faced with a

If there is no payee, in an instrument that is check payable to a fictitious payee, it is

payable to order, no one could indorse the treated as a bearer instrument that can be

instrument. negotiated by delivery. One cannot expect a

fictitious payee to negotiate the check by

Subject to the rules in Sec. 13, 14, and 15 on placing his indorsement thereon. Since the

incomplete instruments, leaving the payee maker knew this limitation, he must have

blank may make the instrument non- intended for the instrument to be negotiated

negotiable because an instrument payable by mere delivery (PNB v. Rodriguez, G.R.

to order may be negotiated ONLY by No. 170325, September 26, 2008).

indorsement AND delivery.

iv. When the name of the payee does Not

ii. The drawer or maker; purport to be the name of any person such

as pay to cash or pay to the order of money;

A note payable to the order of the maker is

not complete until indorsed by him (NIL, A check that is payable to the order of cash

Sec. 184). is payable to bearer (Ang Tek Lian v. CA,

G.R. L-2516, September 25, 1950).

Where the instrument is payable to the

order of the drawer and it is accepted by the Reason: In this case, the payee named is

drawee, the instrument is equivalent to a one who does not exist and has never

promissory note made by the acceptor in existed. Since indorsement is obviously

favor of the drawer (AGBAYANI, impossible, the manifest intention of the

Commercial Laws of the Philippines, (1992) drawer is to make the instrument a bearer

[hereinafter AGBAYANI, Commercial paper negotiable by delivery.

Laws]).

v. When the Only or last indorsement is an

iii. The drawee; indorsement in blank (NIL, Sec. 9).

iv. Two or more payees jointly;

v. One or some of several payees; or An order instrument is negotiated by

vi. The holder of an office for a time being. delivery and indorsement. Indorsement can

either be special or blank indorsement.

b. Payable to Bearer When negotiation is made through an

A negotiable instrument is payable to bearer indorsement in blank coupled with delivery,

when: (EPF-NO) it converts the order instrument into a bearer

instrument and may further be negotiated by

i. When it is Expressed to be so payable; or delivery only. ONCE A BEARER

ii. When it is payable to a Person named INSTRUMENT ALWAYS A BEARER

therein or to bearer; INSTRUMENT even if indorsed specially

iii. When it is payable to the order of a (NIL, Sec. 40).

Fictitious or non-existing person, and such

fact was known to the person making it so Only instruments under subsections A and

payable (NIL, Sec. 9); B are bearer instruments on its face. Those

under subsections C, D, and E are order

Fictitious Payee Rule instruments on its face.

An actual, existing, and living payee may

also be “fictitious” if the maker of the check

did not intend for the payee to in fact

SAN BEDA COLLEGE OF LAW

8 2014 CENTRALIZED BAR OPERATIONS

Distinctions between Instruments Payable to d. Gives the holder an election to require

Order and those Payable to Bearer something to be done in lieu of payment of

Instruments payable Instruments payable money (NIL, Sec. 5).

to order to bearer

Payee 2. Omissions (DVP-SM)

a. It is not Dated – The date referred is the date

The payee must be The payee need not be of the making or drawing of the instrument. If

named or indicated with indicated. It is enough the instrument is not dated, it will be

reasonable certainty. that it is expressed to

considered to be dated as of the time it was

be payable to bearer.

issued (NIL, Sec. 17 [c]).

Negotiation

It is negotiated by It is negotiated by mere However, Section 13 of NIL provides that

indorsement coupled delivery. where an instrument expressed to be payable

with delivery. at a fixed period after date is issued undated,

Conversion or where the acceptance of an instrument is

Instrument originally Instrument originally payable at a fixed period after sight is

payable to order can be payable to bearer undated, any holder may insert therein the

converted into a bearer cannot be converted true date of issue or acceptance, and the

instrument through into order instrument. A instrument shall be payable accordingly. The

blank indorsement. bearer instrument is insertion of a wrong date does not avoid the

always a bearer instrument in the hands of a subsequent

instrument and can be holder in due course; but as to him, the date

negotiated by mere so inserted is to be regarded as the true date.

delivery even if

specially indorsed. Where the instrument is dated, such date is

deemed prima facie to be the true date of the

5. When the instrument is Adressed to a drawee, making, drawing, acceptance, or indorsement,

he must be named or otherwise indicated as the case may be (NIL, Sec. 11).

therein with reasonable certainty

This requirement is applicable only to a bill of b. It does not specify the Value given or that any

exchange. However, omission of drawee may be value has been given;

filled later on (NIL, Sec. 14). Reason: Every negotiable instrument is

deemed prima facie to have been issued with

A bill may be addressed to 2 or more drawees valuable consideration (NIL, Sec. 24).

jointly, whether they are partners or not, but NOT

to 2 or more drawees in the alternative or in c. It does not specify the Place where it is drawn

succession (NIL, Sec. 128). or where it is payable;

Provisions and Omissions that do not affect the In case no place for payment is indicated in

Negotiability of Instruments the instrument, the place of presentment shall

be:

1. Provisions which: i. The address of the person who will make

a. Authorizes the sale of collateral securities in the payment if his address is indicated in the

case the instrument is not paid at maturity; instrument; or

b. Authorizes a confession of judgment if the ii. If no address is indicated, the usual place of

instrument is not paid at maturity; business or residence of the person who will

make payment (NIL, Sec. 73).

Confession of judgment is authority given in

advance by the obligor to another to confess d. It bears a Seal;

judgment in case of future litigation. It does e. It designates a particular kind of current

not affect the negotiability of instruments Money in which payment is to be made (NIL,

(AQUINO, Negotiable Instruments, supra at Sec. 6).

68).

3. Acceptance

c. Waives the benefit of any law intended for the The acceptance of a bill of exchange is not

advantage or protection of the obligor; or important in the determination of its negotiability.

The nature of acceptance is important only on the

determination of the kind of liabilities of the

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

9

parties involved (PBCom v. Aruego, G.R. Nos. L- The ambiguity is taken contra proferentem, that

25836-37, January 31, 1981). is, construed against the party who caused the

ambiguity and could have avoided it by the

4. Indorsement exercise of a little more care (Equitable Banking

The presence of an indorsement of the Corporation v. Intermediate Appellate Court, G.R.

instrument does not affect the negotiability of the No. L-74451, May 25, 1988).

instrument.

However, where a note is drawn to the maker’s TRANSFER

own order, it is not complete until indorsed by

him (NIL, Sec. 184).

If an instrument is negotiable, it may be transferred

through (1) negotiation; (2) assignment or (3) by

Moreover, an indorser may prohibit further

operation of law.

negotiation of the instrument, (restrictive

indorsement) in which case, subsequent

1. Negotiation

transferees can no longer be considered holders

It is the transfer of the instrument from one

(NIL, Sec. 36).

person to another so as to constitute the

transferee the holder thereof (NIL, Sec. 191).

INTERPRETATION OF 2. Assignment

NEGOTIABLE INSTRUMENTS It is a method of transferring a negotiable or non-

negotiable instrument whereby the assignee

merely steps into the shoes of the assignor and

The rules in this section are applicable only when acquires the instrument subject to all defenses

the instrument is ambiguous or uncertain or when that may be set up against the transferor.

there are omissions therein. If the terms are clear,

the instrument must be enforced as it reads. A person taking a negotiable instrument by

assignment in a separate piece of paper takes it

Where the meaning is doubtful, the courts have subject to the rules applying to assignment. And

adopted the policy of resolving in favor of the where the holder of the bill payable to order

negotiability of the instrument. transferred it without indorsement, it operates as

an equitable assignment.

Rules:

1. Words prevail over figures. However, the amount If an instrument is not negotiable, it can still be

in numbers will control if the amount in words is transferred but only through assignment.

not clear.

2. Interest stipulated runs from the date of the Distinctions between Negotiation and

instrument or, if undated, from its issue. Assignment

3. If undated, the instrument is deemed dated at its Negotiation Assignment

issue. Applicable Law

4. Written words prevail over printed provisions. Governed by the NIL

5. When a person writes something on a document (Sesbreño v. CA, G.R. Governed by the Civil

that already contains printed words, the No. 89252, May 24, Code

presumption is that the written words or figures 1993)

represent the real intent of the person who is Type of Transaction

writing. It can be inferred that his intention is to Pertains to contracts in

Pertains to NI

modify what is printed on the document. general

6. When there is doubt whether the instrument is a Nature of the Transferee

bill or note, the holder, at his election, may treat it The transferee is a

as either as a bill or as a note. The transferee is a

holder who may be a

7. When it is not clear in what capacity a person mere assignee

holder in due course

signs, he is deemed an indorser; As to possibility of becoming holder in due

8. When two or more persons sign “We promise to course

pay,” their liability is joint (each liable for his part)

but if they sign “I promise to pay,” the liability is The transferee can be a The transferee can

solidary (each can be compelled to comply with holder in due course in never be a holder in

the entire obligation). proper cases due course

Availability of defenses

SAN BEDA COLLEGE OF LAW

10 2014 CENTRALIZED BAR OPERATIONS

Holder in due course Assignee takes the the intention of giving effect to it (DE LEON,

may be free from instrument subject to Negotiable Instruments Law).

personal defenses the defenses obtaining

available among the among the original Delivery – is the transfer of possession with

parties parties intent to transfer title (NIL, Sec. 15 & 16). It is the

transfer of possession of the instrument by the

Rights Acquired maker or drawer with the intention to transfer title

Assignee steps into the to the payee and recognize him as holder thereof

Holder in due course

shoes of the assignor (De la Victoria v. Burgos, G.R. No. 111190, June

may acquire a better

and merely acquires 27, 1995).

right than the right of

whatever rights the

the transferor

assignor may have 2. Subsequent Negotiation – an instrument is

negotiated when it is transferred from one person

The distinction between negotiation and to another in such a manner as to constitute the

assignment is immaterial to the holder when: transferee the holder thereof (NIL, Sec. 30).

a. There is no available defense between the a. If payable to bearer, a negotiable instrument

parties; may be negotiated by mere delivery.

b. It is also immaterial between immediate or b. If payable to order, a NI may be negotiated

contracting parties or privies because defenses by indorsement completed by delivery.

may always be raised against each other

based on their contract. Incomplete negotiation of ORDER instrument

It exists when the holder of an instrument,

3. By operation of law payable to his order, transfers it for value without

a. By the death of holder, where the title vests in indorsing it. The transfer vests in the transferee

his personal representatives; the following rights:

b. By the bankruptcy of the holder, where the a. Title which the transferor had therein; and

title vests in his assignee or trustee; b. Right to have the indorsement of the

c. Upon the death of a joint payee or indorsee, in transferor.

which case the title vests in the surviving

payee or indorsee in general (AGBAYANI, The instrument is, in effect, merely assigned to

Commercial Laws, supra). the transferee. It is only at the time of

indorsement that the transferee acquires all the

rights of a holder. The requisites of a HDC must,

NEGOTIATION therefore, be present at the time of such

indorsement and not at the time of delivery.

How Negotiation takes place: The transaction is an equitable assignment. The

transferee acquires the instrument subject to

1. Issuance – It is the first delivery of the defenses and equities available among prior

instrument, complete in form, to a person who parties. Thus, the transferee acquires the legal

takes it as a holder (NIL, Sec. 191). title of the transferor, the right to have the

Note: Issuance to the payee is negotiation indorsement of the transferor and the right, as

because the transfer constitutes the payee the holder of legal title, to maintain legal action

holder of the instrument (AQUINO, Negotiable against the maker or acceptor or other party

Instruments, supra at 96). liable to the transferor (BPI v. CA, G.R. No.

136202, January 25, 2007).

It can be inferred from the definition of the word

“issue” that delivery is the final act essential to Transferees in this situation do not enjoy the

the consummation of the instrument as an presumption of ownership in favor of holders.

obligation. Without delivery, the instrument Mere possession of a negotiable instrument does

cannot be deemed as issued (AQUINO, not in itself conclusively establish either the right

Negotiable Instruments, supra at 97). of the possessor to receive payment, or of the

Steps: right of one who has made payment to be

a. Mechanical act of writing the instrument discharged from liability (BPI v. CA, G.R. No.

completely and in accordance with the 136202, January 25, 2007).

requirements of Sec. 1; and

b. The delivery of the complete instrument by the For the purpose of determining whether the

maker or drawer to the payee or holder with transferee is a holder in due course, the

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

11

negotiation takes effect as of the time when the is necessary to further negotiate the

indorsement is made. Hence, before the instrument (NIL, Sec. 34).

indorsement, the transferee is not a holder (NIL,

Sec. 49). If the instrument is originally payable to

bearer, it may nevertheless be further

3. Indorsement – the writing of the name of the negotiated by mere delivery even if the

indorser on the instrument with the intent either to original bearer indorsed it specially (NIL, Sec.

transfer the title to the same, or to strengthen the 40).

security of the holder by assuming a contingent

liability for its future payment, or both. b. Blank – Specifies no person to whom or to

whose order the instrument is to be payable

(NIL, Sec. 34).

INDORSEMENT

Rules on Blank Indorsement:

How Indorsements are Made i. If originally payable to order and negotiated

The indorsement must be written: by special indorsement, it can be further

1. On the instrument itself; or negotiated by indorsement completed by

2. Upon a paper attached thereto (allonge). The delivery;

signature of the indorser without additional words ii. If originally payable to order and negotiated

is sufficient (NIL, Sec. 31). by blank indorsement, it can be negotiated

further by mere delivery; or

Where the indorsement is written in an allonge, the iii. The holder may convert a blank

same must be tacked or pasted on the instrument so indorsement into a special indorsement by

as to become part of it; otherwise, it cannot be writing over the signature of the indorser in

considered an allonge. blank any contract consistent with the

character of the indorsement (NIL, Sec. 35).

The signature of the indorser, without any additional

words, is a sufficient indorsement (NIL, Sec. 30). 2. As to presence or absence of limitations

(absolute/conditional)

Indorsement may be made in any form, as long as it

is meant to be an indorsement. a. Absolute – One by which the indorser binds

himself to pay, upon no other condition than

Nature: An indorsement is not only a mode of failure of prior parties to do so; and upon due

transfer, it is also a contract. notice to him of such failure (DE LEON, Law

on Negotiable Instruments, supra at 176).

Indorsement as a contract

Unless the indorsement is qualified (NIL, Sec. 65), b. Conditional – One by which the indorser

every indorser is a new obligor and the terms are imposes some other conditions to his liability

found on the face of the bill or note, with the or on the indorsee’s right to collect the

additional obligation that if the instrument is proceeds of the instrument (Id. at 176).

dishonored by non-payment or non-acceptance, and

notice is given to the indorser, the latter will pay for If an indorsement is conditional, the party

it. required to pay the instrument may disregard

the condition. He may make payment to the

Kinds of Indorsement indorsee or his transferee whether the

1. As to the methods of negotiation (special/ condition has been fulfilled or not. But any

blank) person to whom the instrument so indorsed is

negotiated will hold the same, or the proceeds

a. Special – Specifies the person to whom or to thereof, subject to the rights of the person

whose order, the instrument is to be payable, indorsing conditionally (NIL, Sec. 39).

and the indorsement of such indorsee is

necessary to the further negotiation of the Conditional indorsement does not render an

instrument (NIL, Sec. 34). instrument non-negotiable but if the condition

is on the face of the instrument, the condition

If the instrument is originally payable to order, renders it non-negotiable as the promise or

and it is negotiated by the payee by special order therein would not be unconditional (DE

indorsement, the indorsement of the indorsee LEON, Law on Negotiable Instruments, supra

at 176).

SAN BEDA COLLEGE OF LAW

12 2014 CENTRALIZED BAR OPERATIONS

3. As to the kind of title transferred: Qualified indorsement is usually resorted to if the

indorser wants to transfer his rights over the

Restrictive Indorsement instrument but does not want to assume

responsibilities under the secondary contract.

General Rule: An instrument negotiable in its

ORIGIN continues to be negotiable. Effects of Qualified Indorsement:

Exception: When the instrument had been a. A qualified indorser has limited liability, i.e., he

restrictively indorsed or discharged by payment is secondarily liable for breach of warranties

or otherwise (NIL, Sec. 47). as an indorser under Section 65 unless such

indorsement specifically excludes such

An instrument is restrictive when it: (PAT) warranties. Thus, he is liable if the instrument

a. Prohibits further negotiation of the is dishonored by non- acceptance or non-

instrument; or payment due to:

b. Constitutes the indorsee as the Agent of the i. Forgery – warranty as to genuineness;

indorser (e.g. indorsement for deposit); or ii. Lack of good title on the part of the indorser

c. Vests the Title in the indorsee in trust for or – warranty as to good title;

to the use of some other persons (NIL, Sec iii. Lack of capacity to indorse on the part of the

36). prior parties – warranty as to capacity to

contract; or

For the second and third type of restrictive iv. Fact that at the time of the endorsement, the

indorsement, the instrument may still be instrument was valueless or not valid, and

negotiated by the indorsee but the he knew of the fact – warranty as to

subsequent indorsee will also be an agent or ignorance of certain facts.

trustee. Since the title of the first indorsee is

that of an agent or trustee, he can only b. A qualified indorsement does not impair the

transfer the same title of an agent or trustee negotiable character of the instrument (NIL,

to the subsequent transferee (AQUINO, Sec. 38);

Negotiable Instruments, supra at 116). c. A qualified indorser is liable to all the parties

who derive their title through his indorsement.

Effects of Restrictive Indorsement: (RAT)

Confers upon the indorsee the right to: 5. Other kinds of indorsement (joint / irregular)

a. Receive payment of the instrument;

b. Bring any Action thereon that the indorser a. Joint Indorsement – All must indorse when

could bring; an instrument is payable to the order of two or

c. Transfer his rights as such indorsee, where more payees or indorsees who are not

the form of the indorsement authorizes him to partners, all must indorse (NIL, Sec. 41).

do so (NIL, Sec. 37).

Reason: To make it an indorsement of the

Mere absence of words implying power to entire instrument because if only one

negotiate does not make an indorsement indorses, he passes only his part of the

restrictive (NIL, Sec. 36). It must clearly indicate instrument.

that further negotiation is prevented (AQUINO, Exceptions:

Negotiable Instruments, supra at 115). i. Where the payee or indorsee are partners;

and

4. As to scope of liability of indorser ii. Where the payee or indorsee indorsing has

authority to indorse for the others.

Qualified – Constitutes the indorser a mere

assignor of the title to the instrument (NIL, Sec. b. Irregular – A person who, not otherwise a

38). It is made by adding to the indorser's party to an instrument, places thereon his

signature words like "sans recourse,” “without signature in blank before delivery (NIL, Sec.

recourse", "indorser not holder", "at the indorser's 64).

own risk", other terms of similar import. Liability of Irregular Indorser:

i. If the instrument is payable to the order of a

“Without Recourse”– means without resort to a third person, he is liable to the payee and to

person secondarily liable after the default of the all subsequent parties.

person primarily liable. ii. If the instrument is payable to the order of

the maker or drawer, or is payable to

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

13

bearer, he is liable to all parties subsequent If the indorsement bears a date, the presumption

to the maker or drawer. would be that the date written is the true date (NIL,

iii. If he signs for the accommodation of the Sec. 11).

payee, he is liable to all parties subsequent

to the payee. As to Place of Indorsement

Except where the contrary appears, every

Rules on Indorsement: indorsement is presumed to have been made at the

1. The indorsement must be of the entire place where the instrument is dated (NIL, Sec. 46).

instrument. An indorsement which purports to

transfer to the indorsee a part only of the amount Negotiation by a prior party

payable, or which purports to transfer the Where an instrument is negotiated back to a prior

instrument to two or more indorsees severally, party, such party may reissue and further

does not operate as a negotiation of the negotiate the same. But he is not entitled to enforce

instrument (NIL, Sec. 32). payment thereof against any intervening party to

whom he was personally liable (NIL, Sec. 50).

Exception: When the instrument had been paid

in part, it may be indorsed as to the residue. Reason: To avoid circuitousness of suits.

2. Where an instrument is drawn or indorsed to a Where the instrument is paid by a party secondarily

person as “cashier” or other fiscal officer of a liable thereon, it is not discharged; but the party so

bank or corporation, it is deemed prima facie to paying it is remitted to his former rights as regards

be payable to the bank or corporation of which he all prior parties, and he may strike out his own and

is an officer, and may be negotiated by either all subsequent indorsements, and again negotiate

indorsement of the bank or corporation or the instrument except

indorsement of the officer (NIL, Sec.42). a. Where it is payable to the order of a third person,

and has been paid by the drawer; and

Nevertheless the cashier or the treasurer may b. Where it was made or accepted for

prove that the instruments were in fact indorsed accommodation, and has been paid by the party

to them in their personal capacities and not to the accommodated (NIL, Sec. 121).

corporations. They can prove that they own the

instruments. Reason for the exceptions: The ones who made

payment are those who are ultimately liable to pay

3. Where the name of a payee or indorsee is the obligation.

wrongly designated or misspelled, he may

indorse the instrument as therein described Striking out of Indorsement

adding, if he thinks fit, his proper signature (NIL, The holder may at any time strike out any

Sec.43). indorsement which is not necessary to his title (NIL,

Sec. 48).

4. Where a person is under obligation to indorse in

a representative capacity, he may indorse in Effect: The indorser whose indorsement is struck

such terms as to negate personal liability (NIL, out, and all indorsers subsequent to him are thereby

Sec. 44). relieved from liability on the instrument (NIL, Sec.

a. He must add words describing himself as 48).

agent;

b. He must disclose his principal; If the instrument is negotiated by special

c. He must be duly authorized in writing. indorsement, the holder has no right to strike out

such indorsement nor can he convert the special

Presumptions as to time and place of indorsement into a blank indorsement.

indorsement

When holder may strike out indorsement:

As to Time of Indorsement 1. Instrument originally payable to bearer

General Rule: Negotiation is deemed prima facie to By virtue of Sec. 48, the holder may strikeout all

have been effected before the instrument is intervening indorsement or any of them for none

overdue. of them is necessary to his title.

Exception: If the indorsement bears a date after the

maturity of the instrument (NIL, Sec. 45). 2. Instrument originally payable to order

When a blank indorsement is followed by special

indorsement and the holder strikes out all

SAN BEDA COLLEGE OF LAW

14 2014 CENTRALIZED BAR OPERATIONS

indorsements subsequent to the blank An instrument is incomplete when it is wanting

indorsement, the instrument would become in any material particular proper to be inserted

payable to bearer as the last indorsement would in a negotiable instrument without which the

be in blank. The special indorsements are not same will not be complete (NIL, Sec. 14). BUT

necessary to the holder’s title as he could have if the omission is not an important particular,

acquired title to the instrument by mere delivery such omission will not deprive the holder of

(DE LEON, Law on Negotiable Instruments). the right of a holder in due course.

The indorser may not strikeout the payee’s Reason: The taking of an incomplete

indorsement since the instrument is payable to instrument puts the purchaser on inquiry as to

order, it can’t be validly negotiated without his why it is incomplete. If he fails to do so, he

indorsement. takes the instrument subject to all defenses.

b. Regular on its face

HOLDER To render the instrument irregular under sec

52(a), the alteration must be visible or

Holder apparent on the face of the instrument, for if it

A holder is a payee or indorsee of a bill or note who is not apparent, the matter is governed solely

is in possession of it or the bearer thereof (NIL, Sec. by section 124 which renders the instrument

191, par. 7). The holder of an order instrument is the void (DE LEON, Law on Negotiable

payee or indorsee while the holder of a bearer Instruments, supra at 200).

instrument is the payee or bearer (SUNDIANG &

AQUINO, Reviewer, supra at 32). 2. That he has become a holder of it before it

was Overdue and without notice that it had

Classes of Holders: been previously dishonored, if such was the

1. Holders In Due Course – one who has taken the fact;

instrument under the conditions of Sec. 52 and

holds the instrument free from personal defenses a. Before overdue

available to prior parties. A holder who takes an overdue instrument is

2. Simple Holders Or Holders Not In Due Course put on inquiry although he is not actually

– one who became a holder without any, some or aware of any existing defense of a prior party

all of the requisites under Sec. 52. He holds the (AQUINO, Negotiable Instruments, supra at

instrument subject to the same defenses as if it 126).

were non-negotiable. He may enforce the

instrument and receive payment therefore. Date of maturity

3. Holders For Value – where value has at anytime i. The date of maturity is the time fixed

been given for the instrument, the holder is therein.

deemed a holder for value in respect to all parties ii. If it is payable on demand, the date of

who become such prior to that time (NIL, maturity is determined at the time of

Sec.26). presentment.

Note: Under the law, presentment must be

Importance of the Classification made within a reasonable time after its

Each class of holders has defenses which are issue, if it is a promissory note, or after the

available to one class and which may not be last negotiation thereof, it is a bill of

available to other classes (DE LEON, Law on exchange (NIL, Sec. 71).

Negotiable Instruments, supra). iii. If the instrument is payable on the

occurrence of a specified event which is

If there are no defenses, the distinction between a certain to happen, the date of maturity is

HDC and one who is not a HDC is immaterial fixed by the happening of the event (NIL,

(AQUINO, Negotiable Instruments, supra). Sec 4 [c]).

Holder in Due Course (HDC) An overdue instrument may still be

A holder in due course is a holder who has taken the negotiated, but the holder cannot be holder

instrument under the following conditions: (COVI) in due course.

1. That the instrument is Complete and regular Demand Instruments

upon its face; Where an instrument payable on demand is

a. Complete negotiated on an unreasonable length of time

SAN BEDA COLLEGE OF LAW

2014 CENTRALIZED BAR OPERATIONS

15

after its issue, the holder is not deemed a HDC Consideration is not relevant to the