Professional Documents

Culture Documents

Meaning:: Foreign Institutional Investors (Fiis)

Meaning:: Foreign Institutional Investors (Fiis)

Uploaded by

Harshita MarmatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meaning:: Foreign Institutional Investors (Fiis)

Meaning:: Foreign Institutional Investors (Fiis)

Uploaded by

Harshita MarmatCopyright:

Available Formats

Foreign Institutional Investors (FIIs)

Meaning:

Foreign Institutional Investors (FII) is an investment fund or a gathering of investors.

Such a fund is registered in a foreign country, i.e. not in the country it is investing in.

Such institutional investors mostly involve hedge funds, mutual funds, pension funds,

insurance bonds, high-value debentures, investment banks etc.

We use this term FII for foreign players investing funds in the financial market

of India. They play a big role in the development of our economy. The amount of

funds they invest is very considerable.

So when such FII’s buy shares and securities the market is bullish and trends

upwards. The opposite may also happen when they withdraw their funds from the

markets. So they have considerable sway over the market.

Foreign institutional investors play a very important role in any economy. These

are the big companies such as investment banks, mutual funds etc, who invest

considerable amount of money in the Indian markets. With the buying of securities

by these big players, markets trend to move upward and vice-versa. They exert

strong influence on the total inflows coming into the economy.

Market regulator SEBI has over 1450 foreign institutional investors registered with

it. The FIIs are considered as both a trigger and a catalyst for the market

performance by encouraging investment from all classes of investors which further

leads to growth in financial market trends under a self-organized system.

Advantages

FII’s will enhance the flow of capital into the country

These investors generally prefer equity over debt. So this will also help

maintain and even improve the capital structures of the companies they are

investing in.

They have a positive effect on the competition in the financial markets

FII help with the financial innovation of capital markets

These institutions are professionally managed by asset managers and analysts.

They generally improve the capital markets of the country.

Disadvantages

The demand for the local currency (rupee) increases. This can cause severe

inflation in the economy.

These FII’s drive the fortune of big companies in which they invest. But their

buying and selling of securities have a huge impact on the stock market. The

smaller companies are taken along for the ride.

Sometimes these FII’s seek only short-term returns. When they pull their

investments banks can face a shortage of funds.

Difference between FDI and FII

Firstly FDI is a direct investment made in one particular business or company. The

aim is to get a controlling interest in the business. FII, on the other hand, are funds

which are invested in the foreign financial market.

There are many regulations and rules with respect to FDI. In fact, there are some

industries like nuclear energy, agriculture etc. where there can be no foreign direct

investment. But FII has fewer barriers for entry or exit from the market.

FDI is not only transfer of funds or capital. There is a transfer of technology, R&D,

know-how, strategies, technical knowledge, and many other such aspects. In the case

of FII, only the transfer of funds is there.

You might also like

- Difference Between MNC and TNC, FDI & FII, Performance Appraisal&Performance ManagementDocument2 pagesDifference Between MNC and TNC, FDI & FII, Performance Appraisal&Performance Managementnneehal100% (2)

- Finance GuruDocument2 pagesFinance GuruSajith RadhakrishnanNo ratings yet

- Fdi and FiiDocument3 pagesFdi and FiiVineet SainiNo ratings yet

- Final Economics ProjectDocument15 pagesFinal Economics ProjectNishant ShahNo ratings yet

- Write A Note On FDI and FII and Their ImportanceDocument2 pagesWrite A Note On FDI and FII and Their Importancevishal sinhaNo ratings yet

- F-69 FinanceDocument7 pagesF-69 FinanceNikita RaoNo ratings yet

- Do Fiis Impact Volatility of Indian Stock Market ?: Jatinder LoombaDocument14 pagesDo Fiis Impact Volatility of Indian Stock Market ?: Jatinder LoombaNidhi KhandelwalNo ratings yet

- Group-6 Presentation On FIIDocument42 pagesGroup-6 Presentation On FIIPankaj Kumar Bothra100% (1)

- Foreign Institutional InstitutionsDocument15 pagesForeign Institutional Institutionsjagdish002No ratings yet

- Business Govt. and SocietyDocument9 pagesBusiness Govt. and SocietyAanya SinghNo ratings yet

- Advantages FIIDocument10 pagesAdvantages FIIjatankitNo ratings yet

- Fdi Vs FiiDocument2 pagesFdi Vs FiiRamu BanothNo ratings yet

- FDI Vs FIIDocument1 pageFDI Vs FIIMallika ShettyNo ratings yet

- Impt of FiiDocument5 pagesImpt of FiiBrock LoganNo ratings yet

- Foreign Investor ProjectDocument22 pagesForeign Investor ProjectwaghaNo ratings yet

- What Is FII?: AdvantagesDocument10 pagesWhat Is FII?: AdvantagesNikkNo ratings yet

- Regulated by SEBI, The FPI Regime Is A Route For Foreign Investment in IndiaDocument3 pagesRegulated by SEBI, The FPI Regime Is A Route For Foreign Investment in Indiapranita mundraNo ratings yet

- Indian Stock MarketsDocument25 pagesIndian Stock MarketsNidhi GuptaNo ratings yet

- Notes of Security Market Operations FiiDocument5 pagesNotes of Security Market Operations FiiHilal AhmadNo ratings yet

- Ijrfm Volume 2, Issue 4 (April 2012) (ISSN 2231-5985) Impact of Foreign Institutional Investor On The Stock MarketDocument14 pagesIjrfm Volume 2, Issue 4 (April 2012) (ISSN 2231-5985) Impact of Foreign Institutional Investor On The Stock MarketNaveen KumarNo ratings yet

- Fdi & FpiDocument3 pagesFdi & FpiPanav MohindraNo ratings yet

- FinalDocument21 pagesFinalankushga100% (6)

- Final Project On FDI and FIIDocument39 pagesFinal Project On FDI and FIIReetika BhatiaNo ratings yet

- What Is Foreign Investment?: Foreign Direct Investments Include Long-Term Physical Investments Made byDocument7 pagesWhat Is Foreign Investment?: Foreign Direct Investments Include Long-Term Physical Investments Made bychuchu tvNo ratings yet

- Assignment On IbDocument11 pagesAssignment On IbRajashree MuktiarNo ratings yet

- Foreign Institutional InvestorDocument22 pagesForeign Institutional InvestorAshish Baniwal100% (1)

- FDI Vs FIIDocument6 pagesFDI Vs FIINarendra VasavanNo ratings yet

- FII Fluctuations in IndiaDocument1 pageFII Fluctuations in IndiaAkshat ShahNo ratings yet

- Foreign Direct Investment (FDI) Is Defined As The Type of Investment IntoDocument8 pagesForeign Direct Investment (FDI) Is Defined As The Type of Investment IntoJaya Geet KwatraNo ratings yet

- Mod 4 BeDocument25 pagesMod 4 BePratha JainNo ratings yet

- Foreign Institutional Investments and Its Influence On Equity Stock Market in IndiaDocument14 pagesForeign Institutional Investments and Its Influence On Equity Stock Market in IndiaNeha KumariNo ratings yet

- FDI and FIIDocument17 pagesFDI and FIIsharathNo ratings yet

- FII Equity Investment and Indian Capital Market - An Empirical InvestigationDocument8 pagesFII Equity Investment and Indian Capital Market - An Empirical Investigation90vijayNo ratings yet

- Definition of 'Foreign Institutional Investor - FII'Document24 pagesDefinition of 'Foreign Institutional Investor - FII'Preeja ChandranNo ratings yet

- Research Paper On FIIDocument20 pagesResearch Paper On FIIchitkarashellyNo ratings yet

- Unit V International Capital MovementsDocument27 pagesUnit V International Capital Movementsnuk.2021018028No ratings yet

- Mohan Babu Final ProjectDocument50 pagesMohan Babu Final ProjectMohan Babu Nandyala0% (1)

- Fundamentals of Capital MarketDocument37 pagesFundamentals of Capital MarketBharat TailorNo ratings yet

- Institutional Investment in IndiaDocument12 pagesInstitutional Investment in IndiaawakerashmiNo ratings yet

- FDI Vs FPI - Meaning, Difference Between FDI and FPIDocument1 pageFDI Vs FPI - Meaning, Difference Between FDI and FPILoganNo ratings yet

- Fiis and Their Influence On Indian Capital MarketsDocument8 pagesFiis and Their Influence On Indian Capital MarketsRohit GuptaNo ratings yet

- FII (Foreign Institutional Investor) in India and Its Impact On Indian Stock Market For Last Five YearsDocument37 pagesFII (Foreign Institutional Investor) in India and Its Impact On Indian Stock Market For Last Five YearsAbhishek RathodNo ratings yet

- A Study On Impact of Fiis On Indian Stock MarketDocument12 pagesA Study On Impact of Fiis On Indian Stock MarketagsanyamNo ratings yet

- Term Paper-Business Environment Topic:Foreign Institution InvestmentDocument29 pagesTerm Paper-Business Environment Topic:Foreign Institution InvestmentRahul TargotraNo ratings yet

- Fundamentals of Capital MarketDocument24 pagesFundamentals of Capital MarketBharat TailorNo ratings yet

- Definition of Foreign InvestmentDocument5 pagesDefinition of Foreign InvestmentEsther AdepojuNo ratings yet

- Foreign Direct InvestmentDocument5 pagesForeign Direct InvestmentRiddhee GosarNo ratings yet

- Job Coaching For All MNC Caal 9908701362Document7 pagesJob Coaching For All MNC Caal 9908701362balki123No ratings yet

- IMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIs) AND MACRO ECONOMIC FACTORS ON INDIAN STOCK MARKETSDocument27 pagesIMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIs) AND MACRO ECONOMIC FACTORS ON INDIAN STOCK MARKETSece_shreyas100% (2)

- First Chapter ManjuDocument14 pagesFirst Chapter ManjuManju MessiNo ratings yet

- Introduction of FdiDocument5 pagesIntroduction of Fdijalpashingala1231707No ratings yet

- Foreign InvestmentDocument2 pagesForeign InvestmentHemanta PahariNo ratings yet

- Fdi and FiiDocument19 pagesFdi and FiiManju TripathiNo ratings yet

- Black BookDocument50 pagesBlack Bookwagha75% (4)

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingFrom EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingNo ratings yet

- ETFs Unveiled: A Journey Through Innovation and Impact: Exploring the Past, Present, and Future of Exchange-Traded FundsFrom EverandETFs Unveiled: A Journey Through Innovation and Impact: Exploring the Past, Present, and Future of Exchange-Traded FundsNo ratings yet

- Socioculture EnvironmentDocument28 pagesSocioculture EnvironmentHarshita MarmatNo ratings yet

- Mutual FundsDocument31 pagesMutual FundsHarshita MarmatNo ratings yet

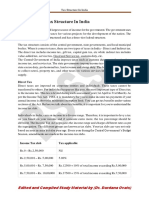

- Sources of Revenue: Source # 1. TaxDocument2 pagesSources of Revenue: Source # 1. TaxHarshita MarmatNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- BBA3-BUSINESS ENVIRONMENT-UT5-MD2-Strategies For Going GlobalDocument28 pagesBBA3-BUSINESS ENVIRONMENT-UT5-MD2-Strategies For Going GlobalHarshita MarmatNo ratings yet

- BEDocument2 pagesBEHarshita MarmatNo ratings yet

- Technological EnvDocument33 pagesTechnological EnvHarshita MarmatNo ratings yet

- Fiscal PolicyDocument11 pagesFiscal PolicyHarshita MarmatNo ratings yet

- Schools, Markets, Banks and Hospitals in Neral: Distance From Nisarg - SparshDocument3 pagesSchools, Markets, Banks and Hospitals in Neral: Distance From Nisarg - SparshKomal TawdeNo ratings yet

- SM Industry Analysis Assignment 1Document11 pagesSM Industry Analysis Assignment 1nazninNo ratings yet

- Fa1 1Document2 pagesFa1 1RyanNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument25 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureConverse CareersNo ratings yet

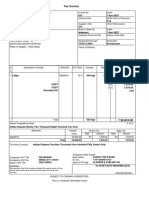

- GCB - Tender No.58 - INV - ACH - 2019 - Supply of A Containerized Wastewater Treatment PlantDocument2 pagesGCB - Tender No.58 - INV - ACH - 2019 - Supply of A Containerized Wastewater Treatment PlantOussama AmaraNo ratings yet

- CHAPTER 2-CostingDocument64 pagesCHAPTER 2-Costingdawit gashuNo ratings yet

- Chapter 3 Entrepreneurship PDFDocument25 pagesChapter 3 Entrepreneurship PDFAfework DessieNo ratings yet

- BillingDocument1,151 pagesBillingmarie marcelinoNo ratings yet

- CA20151210 CO 001-AAA-2 Rudy Provoost 230908Document35 pagesCA20151210 CO 001-AAA-2 Rudy Provoost 230908CH GREESHMANo ratings yet

- Audit of InvestmentsDocument6 pagesAudit of InvestmentsDestiny LazarteNo ratings yet

- Case 12 Heinz FIN 635Document39 pagesCase 12 Heinz FIN 635jack stauberNo ratings yet

- MCX Cotton ContractDocument11 pagesMCX Cotton ContractRAJARSHI Sinha (IN)No ratings yet

- Day AlanDocument1 pageDay AlanTechnetNo ratings yet

- Jodisec Logistics - Deal CalculationDocument1 pageJodisec Logistics - Deal CalculationXolani Radebe RadebeNo ratings yet

- MDE - Session1 and 2Document39 pagesMDE - Session1 and 2shruthinNo ratings yet

- Quiz 10Document1 pageQuiz 10Panda ErarNo ratings yet

- Zomato LTD.: Investing Key To Compounding Long Term GrowthDocument5 pagesZomato LTD.: Investing Key To Compounding Long Term GrowthAvinash GollaNo ratings yet

- SEBI Portfolio - Feb 2020Document347 pagesSEBI Portfolio - Feb 2020Tapan LahaNo ratings yet

- Practice Set 2 For Quiz 3Document13 pagesPractice Set 2 For Quiz 3martinNo ratings yet

- Journal, T Accounts, WorksheetDocument10 pagesJournal, T Accounts, Worksheetkenneth coronelNo ratings yet

- Decentralization and Segment ReportingDocument3 pagesDecentralization and Segment ReportingYousuf SoortyNo ratings yet

- Chapter 2 - Standardisation and Food Food LegislationDocument49 pagesChapter 2 - Standardisation and Food Food LegislationLam Thoại NguyễnNo ratings yet

- Asset Reconstruction Companies (Arcs) : Tax and Regulatory FrameworkDocument34 pagesAsset Reconstruction Companies (Arcs) : Tax and Regulatory Frameworksumit guptaNo ratings yet

- Accountingdefinition: Financial Accounting Accounting Accounting Accounting Accounting InstallationDocument5 pagesAccountingdefinition: Financial Accounting Accounting Accounting Accounting Accounting InstallationRahul Kumar RajakNo ratings yet

- 10 Business Plan QuestionsDocument15 pages10 Business Plan QuestionsprabhatkumararjunNo ratings yet

- Corporate FinanceDocument42 pagesCorporate FinanceNguyễn Thụy Ngọc HânNo ratings yet

- Soneva Total Impact Assessment 2018Document32 pagesSoneva Total Impact Assessment 2018Maud RamillonNo ratings yet

- PT Cahaya Xii Akl SMK KartiniDocument40 pagesPT Cahaya Xii Akl SMK Kartiniwahyudi yudiNo ratings yet

- Abm Research 2Document171 pagesAbm Research 2Mark Agustin Magbanua BarcebalNo ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableDonna ValentinNo ratings yet