Professional Documents

Culture Documents

Note For Report 1

Note For Report 1

Uploaded by

Grasya PasquinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Note For Report 1

Note For Report 1

Uploaded by

Grasya PasquinCopyright:

Available Formats

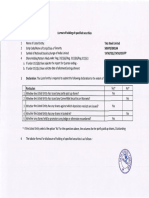

CONSUMER FRAUD

Occurs when consumers attempt to deceive businesses for their own gain.

- Involves intentional deception to derive an unfair economic advantage by an

individual or group over an organization

- deceptive practices that cause other party to suffer financial or other

losses.

Examples

Price Tag Switching- occurs when an a customer attempts to purchase

an item at a discounted price by tampering with the price tag.

Item switching

Lying for age discounts and etc.

Return policies misuse

Collusion an employee colludes with a supplier to arrange payment of

the supplier's invoices for work that has not been completed or goods

that have not been received. The employee is typically sufficiently senior or

trusted to authorize the payment of the invoice.

Guile - when the customer distract an employee from the fact that the

customer accidentally hit some displays and destroy it, by immediately

turning on the charm and launching into a fascinating story just to

escape from the incident and not be blamed by the business.

Financial Misconduct

Means Fraud, Gross Negligence or Intentional or Willful Misconduct that

contributes, directly or indirectly, to the company’s financial or operational

results.

Examples

Misstatements and other irregularities in company records, including the

intentional misstatement of the results of operations or financial wrongdoings.

Forgery or other alteration of company documents.

Fraud and other unlawful acts.

Insider Trading

You can purchase shares of stocks either through an initial public

offering (IPO) or through the open market (also referred to as the

secondary market). Shares sold through IPOs are offered for the first time to

the public by the company (primary market) whereby proceeds of the sale go

directly to the company

Not all the time

For example, if an insider sold 10,000 shares on Monday, June 12, he or she

would have to report the sale to the SEC by Wednesday, June 14. To deter

insider trading, insiders are prevented from buying and selling their company

stock within a six-month period, thereby encouraging insiders to buy stock

only when they feel the company will perform well over the long term.

Jeffrey Skilling/Enron Corporation

Jeffrey Skilling was involved in multiple white-collar crimes during his time

with Enron. One of those crimes included insider trading. Hiding the

company’s dire financial status, Skilling dumped $60 million worth of Enron

stock before he quit the company just before it got embroiled in a complicated

bankruptcy.

R. Foster Winans/The Wall Street Journal

Journalist and columnist Winans found himself facing the scrutiny of the

market watchdog when he gave information of his upcoming articles regarding

certain stocks to stockbrokers, earning $31,000 in the process.

Albert H. Wiggin/Chase National Bank

Wiggin was perhaps one of the first prolific cases of insider trading in the 20th

century. During the 1929 Wall Street market crash spiralling from the ‘Black

Thursday’ event, which later led to the Great Depression, Wiggin had short

calls on 40,000 shares of Chase National Bank. Wiggin was the head of the

bank and had a vested interest in running his own company into the ground.

Martha Stewart/ImClone Systems

Famous American businesswoman and TV personality Martha Stewart

received an illegal tip from her stockbroker regarding ImClone receiving some

bad news that would cause the stock prices to slump. Using the tip, Stewart

sold her stocks and came under the lens of the SEC.

Problems can become ethical issues as a result of changing societal values.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

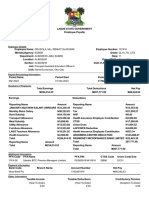

- ODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFDocument1 pageODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFOluwayemisi EbijimiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Special Power of Attorney For Sellers (HQP-HLF-274, V01)Document2 pagesSpecial Power of Attorney For Sellers (HQP-HLF-274, V01)Atoy Liby OjeñarNo ratings yet

- NATIONAL INTERNAL REVENUE CODE OF 1997 As Amended by Republic ActDocument4 pagesNATIONAL INTERNAL REVENUE CODE OF 1997 As Amended by Republic ActGrasya PasquinNo ratings yet

- Intellectual Property Rights: Involve The Legal Protection of Intellectual Property Such As Music, Books, and MoviesDocument5 pagesIntellectual Property Rights: Involve The Legal Protection of Intellectual Property Such As Music, Books, and MoviesGrasya PasquinNo ratings yet

- Report D ManagementDocument7 pagesReport D ManagementGrasya PasquinNo ratings yet

- Intellectual Property RightsDocument5 pagesIntellectual Property RightsGrasya PasquinNo ratings yet

- Report A ManagementDocument17 pagesReport A ManagementGrasya PasquinNo ratings yet

- Types of Intellectual Property Rights in The PhilippinesDocument7 pagesTypes of Intellectual Property Rights in The PhilippinesGrasya PasquinNo ratings yet

- Report 2Document6 pagesReport 2Grasya PasquinNo ratings yet

- Report 1Document17 pagesReport 1Grasya PasquinNo ratings yet

- Supplier Lifecycle Management (SLM)Document4 pagesSupplier Lifecycle Management (SLM)SandraNo ratings yet

- Advanced Financial Accounting IDocument7 pagesAdvanced Financial Accounting IRoNo ratings yet

- Master Job InterviewsDocument90 pagesMaster Job Interviewsclaudia.mesquita7181No ratings yet

- Group 1 - Understanding EconomicsDocument30 pagesGroup 1 - Understanding EconomicsVina NallaresNo ratings yet

- Pre and Post Shareholding PatternDocument32 pagesPre and Post Shareholding PatternEsha ChaudharyNo ratings yet

- Assignment 3 PDFDocument2 pagesAssignment 3 PDFAlie GurreaNo ratings yet

- RDX StrategyDocument75 pagesRDX StrategyChetan Sharma100% (1)

- Challenges Facing EQUITY BANKDocument52 pagesChallenges Facing EQUITY BANKSimon Muteke50% (2)

- CH 09 MBADocument20 pagesCH 09 MBAManvitha ReddyNo ratings yet

- Impact of Covid-19 On Banking SectorDocument2 pagesImpact of Covid-19 On Banking SectorAtia KhalidNo ratings yet

- Accounting Standard - 11: Accounting For The Effects of Changes in Foreign Exchange RatesDocument10 pagesAccounting Standard - 11: Accounting For The Effects of Changes in Foreign Exchange RatesAkash ChavdaNo ratings yet

- Crowd Real Estate Site TrackingDocument56 pagesCrowd Real Estate Site TrackingahgonzalezpNo ratings yet

- SAS9 FIN081 1st Periodical ExamDocument17 pagesSAS9 FIN081 1st Periodical ExamIra CuñadoNo ratings yet

- Zomato Blinkit ArticleDocument4 pagesZomato Blinkit ArticleAashish BaidNo ratings yet

- Mathcom Grade 6 Idm 2024Document6 pagesMathcom Grade 6 Idm 2024abegail.ponteresNo ratings yet

- Becg Case Study 2Document4 pagesBecg Case Study 2nidhibhopalNo ratings yet

- Marketing EnvironmentDocument7 pagesMarketing EnvironmentAda Araña DiocenaNo ratings yet

- Quiz On Dissolution and Winding Up Name: Section: Date: ScoreDocument2 pagesQuiz On Dissolution and Winding Up Name: Section: Date: ScorePalileo KidsNo ratings yet

- Infrastructure Development Within The Context of Africa's Cooperation With New and Emerging Development PartnersDocument106 pagesInfrastructure Development Within The Context of Africa's Cooperation With New and Emerging Development PartnersKadmiri. SNo ratings yet

- DEIF - Assessing Leanness Level With Demand Dynamics in A Multi-Stage Production SystemDocument26 pagesDEIF - Assessing Leanness Level With Demand Dynamics in A Multi-Stage Production SystemPaula CeconiNo ratings yet

- Mock Exam 2 - SolutionsDocument23 pagesMock Exam 2 - SolutionsYolandé du ToitNo ratings yet

- Deed of Agreement Blank-V9-Doa-SblcDocument20 pagesDeed of Agreement Blank-V9-Doa-SblcLIOE JINNo ratings yet

- Revised Format For Filing Affidavit Regarding Criminal Background, Assets, Liabilities and Educational Qualifications.Document7 pagesRevised Format For Filing Affidavit Regarding Criminal Background, Assets, Liabilities and Educational Qualifications.Nikhil SinghNo ratings yet

- Ramesh Singh Indian Economy Class 17Document66 pagesRamesh Singh Indian Economy Class 17Abhijit NathNo ratings yet

- Soal Latihan TOEFL Structure 2023 PDFDocument2 pagesSoal Latihan TOEFL Structure 2023 PDFFellype diorgennes Cordeiro Gomes100% (1)

- TYBFM A 36 Vignesh Khandelwal Black BookDocument74 pagesTYBFM A 36 Vignesh Khandelwal Black Bookpreet doshiNo ratings yet

- Quo-Tfn-Spi-21-055 Pt. Pamapersada Nusantara Req Quote - Pama Erka Q Part Genuine Komatsu For Pc2000 Ref by Email 19052021Document1 pageQuo-Tfn-Spi-21-055 Pt. Pamapersada Nusantara Req Quote - Pama Erka Q Part Genuine Komatsu For Pc2000 Ref by Email 19052021Taufan NanjayaNo ratings yet

- Managerial DecisionsDocument85 pagesManagerial DecisionsVy NguyenNo ratings yet