Professional Documents

Culture Documents

Invest in This Smallcase Here

Invest in This Smallcase Here

Uploaded by

MalavShahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invest in This Smallcase Here

Invest in This Smallcase Here

Uploaded by

MalavShahCopyright:

Available Formats

Last Updated on: 15 Aug 2022

ARQ Prime by Angel One

15 stock portfolio selected based on multi factor model and

quantitative analytics

6Y CAGR

Medium Volatility

29.20% Since: May 12, 2016

smallcase rationale

ARQ Prime is a long only equity portfolio.

ARQ Prime recommends stocks for investment based on a set of rules, free from

human intervention or human bias. In the world of investing - it is called "Smart

Beta". ARQ Prime adopts the time-tested and proven rules for investing in stocks.

ARQ scans all types of stocks to pick Winners: Value stocks, Quality stocks, High

Momentum stocks, Growth stocks across marketcap.

Index Beating Performance:

ARQ has performed consistently through the midcap fall, NBFC crisis and even

during the current COVID-19 Crisis. ARQ Prime is tested against the most

challenging market conditions to deliver the performance driven results.

Optimised Risk-Reward:

ARQ Prime identi ies the timing to enter and exit the markets. It’s strong risk

management system cuts the losses early and allows pro its to run longer be big,

thereby maximising pro its and reducing draw downs/losses

The smallcase usually follows a weekly rebalance schedule. However, During

times of volatility, There might be more rebalances as needed

Created by SEBI Reg. Number Subscription Type

Angel One — Free

Invest in this smallcase here

Methodology

De ining the universe

All publicly traded companies on the National Stock Exchange of

India are included in the universe

Research

The team has built a data driven algorithm which includes both

technical and fundamental parameters to pick up the best stock

portfolio

Historical back-testing

The smallcase has showcased large historical out performance as

observed in the back testing reports

Constituent Screening

ARQ Prime adopts the time-tested and proven rules for investing

in stocks. ARQ scans all types of stocks to pick Winners: Value

stocks, Quality stocks, High Momentum stocks, Growth stocks.

Weighting

The strategy has a ixed weight age to each new entering stock.

The existing stocks are not equally balanced every week.

Rebalance

This smallcase will be rebalanced on an as-needed basis

Ratios

Ratio smallcase Equity Mid & Small Cap

PE Ratio 31.84 26.83

PB Ratio 5.08 3.18

Sharpe Ratio 1.85 1.12

Dividend Yield (%) 1.02 1.70

Important Fields

Inception Date Launch Date Marketcap Category

May 12, 2016 May 12, 2016 Equity Mid & Small Cap

Review Frequency Last Reviewed Next Review On

Need Basis August 8, 2022 To Be Decided

Market Cap Distribution

Large Cap Mid Cap Small Cap

29.51% 36.21% 34.28%

Live Data Comparison with Equity Mid & Small Cap

ARQ Prime by Angel One with Equity Mid & Small Cap

500

400

300

200

100

2017 2018 2019 2020 2021 2022

The performance graphs & numbers are calculated using only the live data and

includes rebalances. Past performance doesn't include cost or guarantee future

returns.

Backtested Data Comparison with Equity Mid & Small Cap

ARQ Prime by Angel One with Equity Mid & Small Cap

100

50

-50

-100

1940 1960 1980 2000

The performance graphs & numbers are calculated using only the backtested

data. Past performance doesn't include cost or guarantee future returns.

Returns over various periods

6M Returns 1Y Returns 3Y Returns 5Y Returns

smallcase smallcase smallcase smallcase

-3.24% 5.85% 171.37% 233.84%

Equity Mid &… Equity Mid &… Equity Mid &… Equity Mid &…

1.63% 8.26% 100.13% 75.34%

How to invest

De initions and Disclosures

CAGR

CAGR (compounded annual growth rate) is a useful measure of growth or

performance of a portfolio. Every year returns generated by a portfolio are

different. Let's say if a portfolio is live for 3 years and returns generated by the

portfolio are 5%, 15% & -7%, respectively in the irst, second and third year. Then

we calculate CAGR as a return number that would give the same terminal

investment value at the end of three years, as we get when the portfolio gains by

5% & 15% in the irst two years and drops by 7% in the third year. The CAGR in this

case would be 3.94%. This means that you will always end up with the same

investment value at the end of the third year, if your portfolio gains by 3.94% every

year or 5%, 15% and -7%, respectively in the irst, second and third year.

In simple words, it indicates the annual return generated by the smallcase from

the date of launch. For smallcases live for less than 1 year, absolute returns in the

applicable time period are shown. Only live data is considered for all calculations.

Returns and CAGR numbers don’t include backtested data.

P.S. - CAGR calculation methodology got updated from 25th Apr’22 on all

smallcase Platforms. Please read this post to understand the changes in detail

Volatility Label

Changing stock prices on a daily basis results in luctuating investment value of

your portfolio. If the daily change in the investment value of a portfolio is too

drastic, it means prices of stocks in the portfolio are changing very rapidly. Such

portfolios have High Volatility. Every smallcase is categorized into one of the three

volatility buckets - High Volatility, Medium Volatility and Low Volatility. This is done

by comparing smallcase volatility vs broader market volatility.

Investing in High Volatility smallcases means that change in your investment

values can be very sudden and drastic. Following table represents the logic

followed to categorize smallcases into various volatility buckets

Volatility Ratio (VR) Label

VR >= 1.3 High Volatility

0.8 <=VR< 1.3 Medium Volatility

VR < 0.8 Low Volatility

Volatility Ratio = Average annual rolling standard deviation of the smallcase

divided by the average annual rolling standard deviation of the Nifty 50 Index,

since launch of the smallcase.

Calculation of Volatility if the smallcase is less than 1 year old

If the weight of Equities in the portfolio is less than 40%, the smallcase will

be considered ‘Low Volatility’

If the weight of Equities in the portfolio is between 40% to 70%, the

smallcase will be considered ‘Medium Volatility’

If the weight of Equities in the portfolio is greater than 70%, then the weight

of large-cap stocks within the equities portion is taken into consideration

If the weight of large-cap stocks is more than 70%, the smallcase is

considered as ‘Medium Volatility’

If the weight of large-cap stocks is less than 70%, the smallcase is

considered as ‘High Volatility’

For smallcases where manager has not prescribed any weights, equal weights are

assumed for calculations.

Segment

Stocks/ETFs belonging to a smallcase are categorized under different segments.

Weightage of a segment is calculated as sum of weights of all stocks belonging to

that segment. Suppose 4 stocks, with each having a weight of 10%, belong to the

Food Products segment. Then the weight of the Food Product segment in the

smallcase will be 40% (4*10)

For smallcases where manager has not prescribed any weights, equal weights are

assumed for calculations.

Review

Rebalancing is the process of periodically reviewing and updating the

constituents of a smallcase. This is done to ensure that constituents in the

smallcase continue to re lect the underlying theme or strategy

Market Cap Categorization of Stocks

All the stocks listed on NSE(National Stock Exchange) are arranged in decreasing

order of Market Cap, so that the stock with the largest market cap gets 1st Rank.

Stocks ranked equal to or below 100 are categorized as Large Cap. Stocks ranked

below or equal to 250, but ranked above 100 are categorized as Mid Cap stocks.

Stocks ranked above 250 are categorized as smallcap

Market Cap Categorization of smallcases

If the sum of weights of constituent large cap stocks is greater than 50%,

then smallcase is categorized as Largecap

If the sum of weights of constituent mid cap stocks is greater than 50%, then

smallcase is categorized as Midcap

If the sum of weights of constituent small cap stocks is greater than 50%,

then smallcase is categorized as Smallcap

If the sum of weights of constituent large cap stocks is greater than 30%,

sum of weights of mid cap stocks are greater than 30%, and sum of weights

of large cap and mid cap stocks are greater than 80%, then smallcase is

categorized as Large & Midcap

If the sum of weights of constituent small cap stocks is greater than 30%,

sum of weights of mid cap stocks are greater than 30%, and sum of weights

of small cap and mid cap stocks are greater than 80%, then smallcase is

categorized as Mid & Smallcap

If none of the above conditions are met, then smallcase is categorized as

Multicap

Marketcap category of a smallcase might be different from the above

mentioned, if the creator/manager of the smallcase speci ically de ines a

particular category

For smallcases where manager has not prescribed any weights, equal weights are

assumed for calculations.

General Investment Disclosure

Charts and performance numbers on the platform do not include any backtested

data. Please refer to the Returns Calculation Methodology to check how returns are

calculated on the platform. Data used for calculation of historical returns and

other information is provided by exchange approved third party data vendors and

has neither been audited nor validated by the Company. For smallcases where

weights are not provided by the creator, Equal weights are used to calculate all

returns, numbers and ratios on the platform.

Smallcase factsheets might include strategy backtest, if provided by the creator

of the smallcase. This is included to help users analyze performance of the

smallcase across different economic cycles and long time horizons. STPL has not

veri ied the backtest performed by the manager. We make no representations or

warranties (expressed or implied) to any recipient on the contents of the backtest.

Any information included in the backtest, should never be construed as our

representation or endorsement for the same. STPL is not involved in the generation

of the backtest and are not responsible for the contents of the same, nor do we

verify the accuracy of the same. We do not have control over the backtest

performed by the creator/manager of the smallcase and neither do we play a

determinative role in any calculation of the same.

"Back-testing" is the application of a quantitative model to historical market data

to generate hypothetical performance during a prior period. Use of back-tested

data has inherent limitations including the following:

a. The results do not re lect the results of actual trading or the effect of material

economic and market conditions on the decision-making process, but were

achieved by means of retrospective application, which may have been

designed with the bene it of hindsight.

b. Calculation of such back-tested performance data is based on assumptions

integral to the model which may or may not be testable and are therefore

subject to losses.

c. Actual performance may differ signi icantly from back-tested performance.

Back-tested results are not adjusted to re lect the reinvestment of dividends

and other income and, except where otherwise indicated, do not include the

effect of back-tested transaction costs.

d. Back-tested returns do not represent actual returns and should not be

interpreted as an indication of such.

e. Please note that past performance does not guarantee future returns.

All information present in this document and related material is to help investors

in their decision making process and shall not be considered as a

recommendation or solicitation of an investment or investment strategy. Investors

are responsible for their investment decisions and are responsible to validate all

the information used to make the investment decision. Investor should understand

that his/her investment decision is based on personal investment needs and risk

tolerance, and information available in this document and related material is one

among many other things that should be considered while making an investment

decision.

Stock and ETF investments are subject to market risks, read all related documents

carefully. Investors should consult their inancial advisors if in doubt about

whether the product is suitable for them.

Angel One Disclosures

Please visit www.angelbroking.com for detailed disclosures, terms and conditions.

Please visit Angel One for detailed disclosures, terms and conditions.

You might also like

- The EverDocument136 pagesThe EverMalavShah98% (58)

- Virtual Memory Lab-2Document14 pagesVirtual Memory Lab-2Hafiz Muhammad Umar Aslam0% (1)

- ZSCOREDocument10 pagesZSCORENitin Govind BhujbalNo ratings yet

- Global Equity Momentum A Craftsmans PerspectiveDocument39 pagesGlobal Equity Momentum A Craftsmans Perspectivelife_enjoyNo ratings yet

- Assignment 1 - Investment AnalysisDocument5 pagesAssignment 1 - Investment Analysisphillimon zuluNo ratings yet

- Ritual of The Rose Cross (Golden Dawn)Document4 pagesRitual of The Rose Cross (Golden Dawn)solomon5678No ratings yet

- Agbmo 0012Document1 pageAgbmo 0012Anushree AyanavaNo ratings yet

- Nivmo 0001Document1 pageNivmo 0001rav prashant SinghNo ratings yet

- Scmo 0029Document1 pageScmo 0029ssvivekanandhNo ratings yet

- Nivtr 0001Document1 pageNivtr 0001Guru Prasanna VNo ratings yet

- PE Ratio 32.22 23.49 PB Ratio 5.31 3.41 Sharpe Ratio 1.26 1.11 Dividend Yield (%) 1.42 1.48Document1 pagePE Ratio 32.22 23.49 PB Ratio 5.31 3.41 Sharpe Ratio 1.26 1.11 Dividend Yield (%) 1.42 1.48ഓൺലൈൻ ആങ്ങളNo ratings yet

- SCTR 0014Document1 pageSCTR 0014Sumeet SoniNo ratings yet

- Estmo 0001Document1 pageEstmo 0001ShahamijNo ratings yet

- SCTR 0014Document1 pageSCTR 0014tamaldNo ratings yet

- Bamimo 0001Document1 pageBamimo 0001sarha sharma0% (1)

- SCNM 0012Document1 pageSCNM 0012kishoremarNo ratings yet

- Mi - ST - ATH: Invest in This Smallcase HereDocument1 pageMi - ST - ATH: Invest in This Smallcase HerehamsNo ratings yet

- WRTNM 0001Document1 pageWRTNM 0001p srivastavaNo ratings yet

- Fallen Angels: Invest in This Smallcase HereDocument1 pageFallen Angels: Invest in This Smallcase HereSahil ChadhaNo ratings yet

- Wydmo 0005Document1 pageWydmo 0005Lakshminarayanan RaghuramanNo ratings yet

- Invest in This Smallcase Here: Top 100 Stocks With Equity Large CapDocument1 pageInvest in This Smallcase Here: Top 100 Stocks With Equity Large CapKingui DevNo ratings yet

- ATARAXIA FUND LP Inception August 2019Document8 pagesATARAXIA FUND LP Inception August 2019JBPS Capital ManagementNo ratings yet

- Risk Measures: Risk Analysis Distribution of ReturnsDocument7 pagesRisk Measures: Risk Analysis Distribution of ReturnsJBPS Capital ManagementNo ratings yet

- Return: 23.12 (8Y Cagr) Risk: Medium: Wealthbasket DescriptionDocument5 pagesReturn: 23.12 (8Y Cagr) Risk: Medium: Wealthbasket DescriptionJinesh ShahNo ratings yet

- Stock Screener PDFDocument9 pagesStock Screener PDFClaude Bernard100% (2)

- 9 27 2016 ShillerEnhancedCAPEDocument5 pages9 27 2016 ShillerEnhancedCAPEThorHollisNo ratings yet

- Angel PlatinumDocument14 pagesAngel Platinumvishal royNo ratings yet

- Analyzing Mutal Fund PerformanceDocument4 pagesAnalyzing Mutal Fund PerformanceMeghananda s oNo ratings yet

- Gprmo 0003Document1 pageGprmo 0003ApNo ratings yet

- Analyse Mutual Fund Portfolio - 7 Important ParametersDocument3 pagesAnalyse Mutual Fund Portfolio - 7 Important Parametersdvg6363238970No ratings yet

- Portfolio Management FerdinandDocument13 pagesPortfolio Management FerdinandFerdinand Troedu P GultomNo ratings yet

- Turtle Growth: Return: 21.86 (15Y CAGR) RISK: MEDIUMDocument5 pagesTurtle Growth: Return: 21.86 (15Y CAGR) RISK: MEDIUMJinesh ShahNo ratings yet

- Portfolio ManagementDocument15 pagesPortfolio ManagementtanviNo ratings yet

- Investment Analysis and Portfolio Management - BDocument3 pagesInvestment Analysis and Portfolio Management - BjadgugNo ratings yet

- Portfolio Management StudentDocument76 pagesPortfolio Management StudentMuhammad HasnainNo ratings yet

- Smallcap Growth StrategyDocument4 pagesSmallcap Growth StrategyyashNo ratings yet

- Active Passive MGTDocument17 pagesActive Passive MGTrcleonard84No ratings yet

- Chapter 6Document53 pagesChapter 6Naeemullah baigNo ratings yet

- Background:: Source: Spreadsheet WorkingsDocument4 pagesBackground:: Source: Spreadsheet WorkingsNikita SharmaNo ratings yet

- The Value Line Investment Survey: Quick Start GuideDocument2 pagesThe Value Line Investment Survey: Quick Start GuideJamie GiannaNo ratings yet

- Equity AnalysisDocument6 pagesEquity AnalysisVarsha Sukhramani100% (1)

- Analyzing Mutual Fund RiskDocument7 pagesAnalyzing Mutual Fund RiskSriKesavaNo ratings yet

- Tatton Tracker Active Quarterly Report Oct-Dec 19Document6 pagesTatton Tracker Active Quarterly Report Oct-Dec 19Danny DawsonNo ratings yet

- Assignment 1 - Investment AnalysisDocument5 pagesAssignment 1 - Investment Analysisphillimon zuluNo ratings yet

- Portfolio Construction TechniquesDocument11 pagesPortfolio Construction TechniquesArthur KingNo ratings yet

- 815e9 Motilal Oswal SP Bse Value Etf Index Fund PPT Presentation Sep 2023Document64 pages815e9 Motilal Oswal SP Bse Value Etf Index Fund PPT Presentation Sep 2023kishore13No ratings yet

- Rocketship: Return: - 7.46 (3M ABS) RISK: HIGHDocument5 pagesRocketship: Return: - 7.46 (3M ABS) RISK: HIGHJinesh ShahNo ratings yet

- FT India Life Stage 20s (G) : Snapshot of The SchemeDocument11 pagesFT India Life Stage 20s (G) : Snapshot of The SchemeSaloni MalhotraNo ratings yet

- What Is ACE (Advise On Combination Equity) ?: Coming SoonDocument9 pagesWhat Is ACE (Advise On Combination Equity) ?: Coming Soonraj_gargiNo ratings yet

- Why CAGR Is Often BetterDocument17 pagesWhy CAGR Is Often BetterPrince AdyNo ratings yet

- Gundlach Nov 2018Document54 pagesGundlach Nov 2018Zerohedge100% (5)

- METHODOLOGY AND ProcedureDocument17 pagesMETHODOLOGY AND ProcedureSanjeev JhaNo ratings yet

- Sector Report For Basic MaterialsDocument14 pagesSector Report For Basic Materialstaree156No ratings yet

- Mutual Fund Selection ProcessDocument11 pagesMutual Fund Selection ProcessspeedenquiryNo ratings yet

- TR SupermanDocument77 pagesTR SupermanZerohedge80% (10)

- Executive SummaryDocument19 pagesExecutive SummaryMd. Real MiahNo ratings yet

- ValueResearchFundcard DSPBRTop100EquityReg 2011jun22Document6 pagesValueResearchFundcard DSPBRTop100EquityReg 2011jun22Aditya TipleNo ratings yet

- ITC Project ReportDocument50 pagesITC Project ReportKeshavNo ratings yet

- Equity Portfolio ManagementDocument22 pagesEquity Portfolio ManagementMayur DaveNo ratings yet

- Project CMA SPDocument34 pagesProject CMA SPalponseNo ratings yet

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Virtual Investment GameDocument22 pagesVirtual Investment GameAnish DhakalNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Ebay Checklist PDFDocument1 pageEbay Checklist PDFMalavShahNo ratings yet

- Gann D MethodDocument7 pagesGann D MethodMalavShahNo ratings yet

- Titan Company Limited: Migration of The Rating Outstanding On The Medium-Term Rating Scale To The Long-Term Rating ScaleDocument5 pagesTitan Company Limited: Migration of The Rating Outstanding On The Medium-Term Rating Scale To The Long-Term Rating ScaleMalavShahNo ratings yet

- HDFC ScamDocument17 pagesHDFC ScamMalavShahNo ratings yet

- Implant-Retained External Auricular Prosthesis: A Review: For Last 10 YearsDocument1 pageImplant-Retained External Auricular Prosthesis: A Review: For Last 10 YearsMalavShahNo ratings yet

- Gooya 2013Document4 pagesGooya 2013MalavShahNo ratings yet

- 1993 Chan CHDocument2 pages1993 Chan CHMalavShahNo ratings yet

- A Marriage Proposal by Anton ChekovDocument2 pagesA Marriage Proposal by Anton ChekovJade MBNo ratings yet

- CEE Download Full Info - 07.15 PDFDocument29 pagesCEE Download Full Info - 07.15 PDFFaizal FezalNo ratings yet

- Article Debate en 6 CkäDocument5 pagesArticle Debate en 6 CkäkerstinbergekNo ratings yet

- Rockwood January 1st 2015Document80 pagesRockwood January 1st 2015Security Lock DistributorsNo ratings yet

- PracticalDocument5 pagesPracticalMarjorrie C. BritalNo ratings yet

- Sankalp Final ProjectDocument40 pagesSankalp Final Projectsankalp mohantyNo ratings yet

- Topic 1: Introduction To Nursing TheoryDocument24 pagesTopic 1: Introduction To Nursing Theoryalmira garciaNo ratings yet

- Ntroduction: Dr. Hammad Iqbal SheraziDocument14 pagesNtroduction: Dr. Hammad Iqbal SherazisamoleNo ratings yet

- Zohdy, Eaton & Mabey - Application of Surface Geophysics To Ground-Water Investigations - USGSDocument63 pagesZohdy, Eaton & Mabey - Application of Surface Geophysics To Ground-Water Investigations - USGSSalman AkbarNo ratings yet

- Laporan MekanikDocument23 pagesLaporan MekanikNofrinto FloryNo ratings yet

- Acute Coronary SyndromeDocument9 pagesAcute Coronary Syndromekimchi girlNo ratings yet

- Chapter 1 (Part 2) : Computer Networking: A Top Down ApproachDocument25 pagesChapter 1 (Part 2) : Computer Networking: A Top Down ApproachHassan RazaNo ratings yet

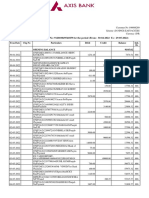

- Statement of Axis Account No:912010049541859 For The Period (From: 30-04-2022 To: 29-05-2022)Document5 pagesStatement of Axis Account No:912010049541859 For The Period (From: 30-04-2022 To: 29-05-2022)Rahul BansalNo ratings yet

- 80010768Document11 pages80010768ArmanNo ratings yet

- Valemount Directory Prospect ListDocument45 pagesValemount Directory Prospect Listjordan gallowayNo ratings yet

- The Efficiency of Electrocoagulation in Treating Wastewater From A Dairy Industry, Part I: Iron ElectrodesDocument8 pagesThe Efficiency of Electrocoagulation in Treating Wastewater From A Dairy Industry, Part I: Iron ElectrodesazerfazNo ratings yet

- Class 10 English Sermon at BenarasDocument8 pagesClass 10 English Sermon at BenarasG Yogeeta JainNo ratings yet

- Enrichment Exercise No. 3 Problem Solving Exercise. Now That You Have Learned The Nature, Scope, FunctionsDocument2 pagesEnrichment Exercise No. 3 Problem Solving Exercise. Now That You Have Learned The Nature, Scope, FunctionsQueenVictoriaAshleyPrietoNo ratings yet

- Protections Study SDP1-1: Sur Desalination - Oman (SDP1-1)Document27 pagesProtections Study SDP1-1: Sur Desalination - Oman (SDP1-1)Ayoub CherkaouiNo ratings yet

- Drums and Hardware: General CatalogDocument39 pagesDrums and Hardware: General CatalogmiquNo ratings yet

- India Data Center OpportunityDocument7 pagesIndia Data Center OpportunitysharatjuturNo ratings yet

- Daaa 1 IntroductionDocument33 pagesDaaa 1 IntroductionNathan ReedNo ratings yet

- Which Functor Is The Projective Line?Document16 pagesWhich Functor Is The Projective Line?flores3831_814460512No ratings yet

- Usmc Vector 21Document64 pagesUsmc Vector 21David PerrinNo ratings yet

- Company Profile MARET 2021Document17 pagesCompany Profile MARET 2021【88】 KuroNo ratings yet

- Project Based Learning (PBL) : Jammu University 2 Year B.Ed. Paper 202/3 Sem: IIDocument19 pagesProject Based Learning (PBL) : Jammu University 2 Year B.Ed. Paper 202/3 Sem: IIvaldemarsilvaNo ratings yet

- Concurrent EngineeringDocument16 pagesConcurrent EngineeringAnusha MandavaNo ratings yet

- Course Syllabus: L&S 126 Strategy Formulation First Semester SY 2012 - 2013 Instructors & ScheduleDocument5 pagesCourse Syllabus: L&S 126 Strategy Formulation First Semester SY 2012 - 2013 Instructors & ScheduleJullie Kaye Frias DiamanteNo ratings yet