Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsFinal Reviewer 2ndmid BM

Final Reviewer 2ndmid BM

Uploaded by

Rawr rawrThis document discusses various types of employee compensation and benefits. It defines salary earners, wage earners, and piece-rate earners. It also covers gross and net earnings, standard deductions from earnings, overtime and night shift pay rates, premium pay rates, retirement benefits, maternity leave benefits, and taxable versus non-taxable benefits. Key benefits discussed include retirement pay, 13th month pay, laundry allowance, unused leave payouts, uniform allowance, and medical assistance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Chapter 10-Compensation Income: True or FalseDocument15 pagesChapter 10-Compensation Income: True or FalseJarren Basilan57% (7)

- Financial Management ReviewerDocument59 pagesFinancial Management Reviewerkristoffer88% (8)

- Bus Math-Module 5.4 Gross and Net EarningDocument51 pagesBus Math-Module 5.4 Gross and Net Earningaibee patatagNo ratings yet

- APICS - CPIM - 2019 - PT 2 - Mod 1 - SecFDocument23 pagesAPICS - CPIM - 2019 - PT 2 - Mod 1 - SecFS.DNo ratings yet

- Income Tax Banggawan Chapter 10Document18 pagesIncome Tax Banggawan Chapter 10Earth Pirapat100% (5)

- Business Math Lesson1 Week 4Document6 pagesBusiness Math Lesson1 Week 4REBECCA BRIONESNo ratings yet

- BJZPP3740D Partb 2021-22Document3 pagesBJZPP3740D Partb 2021-22sagar lovzNo ratings yet

- Business Math - W4 - W5 - Wage EarnersDocument7 pagesBusiness Math - W4 - W5 - Wage Earnerscj100% (4)

- FABM2 Q2W5 TaxationDocument8 pagesFABM2 Q2W5 TaxationDanielle SocoralNo ratings yet

- Business Math Q2 Week 3Document9 pagesBusiness Math Q2 Week 3john100% (1)

- Salaries and WagesDocument2 pagesSalaries and WagesMisha Dela Cruz CallaNo ratings yet

- Busmath Reviewer 2ND Quarter 2022 2023Document1 pageBusmath Reviewer 2ND Quarter 2022 2023Nikko BautistaNo ratings yet

- Gross Net IncomeDocument14 pagesGross Net IncomeRisalyn MitraNo ratings yet

- Salary, Wage and IncomeDocument6 pagesSalary, Wage and Incomevyhmwqcqn8No ratings yet

- Lesson 2 Wk10 4th Fundamental Operations of Mathematics As Applied in Salaries and Wages StudentDocument11 pagesLesson 2 Wk10 4th Fundamental Operations of Mathematics As Applied in Salaries and Wages StudentFrancine Arielle Bernales100% (1)

- Math ReviewerFinalsDocument17 pagesMath ReviewerFinalssamgyupNo ratings yet

- ModuleDocument6 pagesModuleGe Ne VieveNo ratings yet

- Compensation Income (Notes)Document6 pagesCompensation Income (Notes)Anonymous LC5kFdtc100% (1)

- Tax RatesDocument37 pagesTax RatesMelanie OngNo ratings yet

- CHAPTER 11 Compensation IncomeDocument15 pagesCHAPTER 11 Compensation IncomeGIRLNo ratings yet

- Business Math Q2Document9 pagesBusiness Math Q2Cezter AbutinNo ratings yet

- Bus Math-Module 5.3 Benefits of A Wage EarnerDocument60 pagesBus Math-Module 5.3 Benefits of A Wage Earneraibee patatagNo ratings yet

- Introduction To Salaries Wages Income and BenefitsDocument14 pagesIntroduction To Salaries Wages Income and BenefitsYAHIKOヤヒコYUICHIゆいちNo ratings yet

- BM Module 3 4 Q2W3 4 For PDFDocument5 pagesBM Module 3 4 Q2W3 4 For PDFDanica De veraNo ratings yet

- Ruy Lopez Main LineDocument8 pagesRuy Lopez Main Linekurtdelacruz102No ratings yet

- BUSINESS MATHEMATICS Lesson 5 IONDocument9 pagesBUSINESS MATHEMATICS Lesson 5 IONPurple. Queen95100% (2)

- IncomeTax Banggawan2019 Ch10Document10 pagesIncomeTax Banggawan2019 Ch10Noreen Ledda100% (1)

- Unit 3 Accounting For Labour CostsDocument54 pagesUnit 3 Accounting For Labour Costsjoseswartzsr31No ratings yet

- My report-WPS OfficeDocument4 pagesMy report-WPS OfficeMichaela PingolNo ratings yet

- Chapter 3Document14 pagesChapter 3fhagos003No ratings yet

- Week 3 - Salary, WageDocument21 pagesWeek 3 - Salary, WageKristiane Joie MicoNo ratings yet

- Presentation of Business DataDocument3 pagesPresentation of Business DataSheilaMarieAnnMagcalasNo ratings yet

- BUS. MATH Q2 - Week3Document4 pagesBUS. MATH Q2 - Week3DARLENE MARTINNo ratings yet

- BUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONDocument14 pagesBUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONJASON DAVID AMARILANo ratings yet

- Chapter 3Document14 pagesChapter 3fhagos003No ratings yet

- SalaryDocument25 pagesSalaryKylee NathanielNo ratings yet

- Salary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesDocument9 pagesSalary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesAlmirah H. AliNo ratings yet

- Business Math 12Document9 pagesBusiness Math 12Scottie James Martin FaderangaNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- Lesson 4 and 5Document7 pagesLesson 4 and 5Fatima Elsan OrillanNo ratings yet

- Payroll Accounting: Chapter Two Payroll CalculationsDocument20 pagesPayroll Accounting: Chapter Two Payroll Calculations409005091No ratings yet

- 4.03 Key Terms For Preparing PayrollDocument21 pages4.03 Key Terms For Preparing Payrollapi-262218593No ratings yet

- Compensation IncomeDocument5 pagesCompensation IncomePaula Mae Dacanay100% (1)

- Acca Accounting For LabourDocument54 pagesAcca Accounting For LabourKiri chrisNo ratings yet

- Salaries and Wages: Prepared By: Ms. Jaeneth D. SimondoDocument47 pagesSalaries and Wages: Prepared By: Ms. Jaeneth D. SimondoJenny Stypay100% (1)

- Benefits and Services-HrmDocument27 pagesBenefits and Services-Hrmrizalleneangiela44No ratings yet

- Employee Compensation Refers ToDocument10 pagesEmployee Compensation Refers ToDaniiNo ratings yet

- Business Math SLHT 3Document7 pagesBusiness Math SLHT 3Zia Belle Bedro - LuardoNo ratings yet

- Compensation Income and Fringe BenefitsDocument3 pagesCompensation Income and Fringe BenefitsAbigail VergaraNo ratings yet

- Non Taxable Employee BenefitsDocument7 pagesNon Taxable Employee BenefitsGeomari D. BigalbalNo ratings yet

- Tax On Compensation Income: Activi TY SheetDocument14 pagesTax On Compensation Income: Activi TY SheetJudylyn SakitoNo ratings yet

- BUS. MATH Q2 - Week4Document5 pagesBUS. MATH Q2 - Week4DARLENE MARTIN100% (1)

- Module - 2 Incomes From Salary and Income From House PropertyDocument7 pagesModule - 2 Incomes From Salary and Income From House PropertyNikitha AlpetNo ratings yet

- Salary Wage Income BenefitsDocument23 pagesSalary Wage Income BenefitsIan SumastreNo ratings yet

- Business Math Report WEEK 1Document25 pagesBusiness Math Report WEEK 1HOney Mae Alecida OteroNo ratings yet

- Whichever Is Lower: A) DeductionsDocument3 pagesWhichever Is Lower: A) Deductions8151 KATALE PRIYANKANo ratings yet

- Labor EducationDocument37 pagesLabor EducationEd FeranilNo ratings yet

- CH 2 - Pay FudDocument21 pagesCH 2 - Pay FudbavanthinilNo ratings yet

- Tax43-013-Compensation IncomeDocument22 pagesTax43-013-Compensation Incomelowi shooNo ratings yet

- Salaries and WagesDocument61 pagesSalaries and WagesSnow WhiteNo ratings yet

- SKI Presentation Final YKDocument34 pagesSKI Presentation Final YKbosskaeNo ratings yet

- Business Mathematics Benefits of Wage EarnersDocument6 pagesBusiness Mathematics Benefits of Wage EarnersZeus Malicdem100% (1)

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- HumRes Assignment 4Document2 pagesHumRes Assignment 4Rawr rawrNo ratings yet

- A Specialized Industry Is A Distinct Market That Has A Unique Way of Accounting For Transactions and Reporting Its Financial ResultsDocument1 pageA Specialized Industry Is A Distinct Market That Has A Unique Way of Accounting For Transactions and Reporting Its Financial ResultsRawr rawrNo ratings yet

- Assignment 4Document3 pagesAssignment 4Rawr rawrNo ratings yet

- DIT and OC ProblemDocument1 pageDIT and OC ProblemRawr rawrNo ratings yet

- RFBT AssignmentDocument1 pageRFBT AssignmentRawr rawrNo ratings yet

- Audit Theo LectureDocument2 pagesAudit Theo LectureRawr rawrNo ratings yet

- Materials JITDocument5 pagesMaterials JITRawr rawrNo ratings yet

- Assignment 7Document3 pagesAssignment 7Rawr rawrNo ratings yet

- EssayDocument1 pageEssayRawr rawrNo ratings yet

- HumRes Assignment 1Document3 pagesHumRes Assignment 1Rawr rawrNo ratings yet

- HumRes Assignment 5Document2 pagesHumRes Assignment 5Rawr rawrNo ratings yet

- Assignment 8Document2 pagesAssignment 8Rawr rawrNo ratings yet

- Assignment 5Document3 pagesAssignment 5Rawr rawrNo ratings yet

- PRM Assignment 5Document3 pagesPRM Assignment 5Rawr rawrNo ratings yet

- Operations Assignment 2Document3 pagesOperations Assignment 2Rawr rawrNo ratings yet

- PM Assignment 3Document4 pagesPM Assignment 3Rawr rawrNo ratings yet

- Universal Robina Corporation:: Holy Angel UniversityDocument5 pagesUniversal Robina Corporation:: Holy Angel UniversityRawr rawrNo ratings yet

- PRM Assignment 6Document2 pagesPRM Assignment 6Rawr rawrNo ratings yet

- Operations Assignment 7Document5 pagesOperations Assignment 7Rawr rawrNo ratings yet

- Operations Assignment 1Document3 pagesOperations Assignment 1Rawr rawrNo ratings yet

- Ope Assignment 5Document4 pagesOpe Assignment 5Rawr rawrNo ratings yet

- Operations Reflection 1Document3 pagesOperations Reflection 1Rawr rawrNo ratings yet

- GB ReflectionDocument1 pageGB ReflectionRawr rawrNo ratings yet

- Tax DiscussionDocument4 pagesTax DiscussionRawr rawrNo ratings yet

- Management Assignment 7Document3 pagesManagement Assignment 7Rawr rawrNo ratings yet

- PM Assignment 1Document3 pagesPM Assignment 1Rawr rawrNo ratings yet

- Stratax Online DiscussionDocument8 pagesStratax Online DiscussionRawr rawrNo ratings yet

- Ethics Quiz 2Document3 pagesEthics Quiz 2Rawr rawrNo ratings yet

- Reflection On Job AnalysisDocument2 pagesReflection On Job AnalysisRawr rawrNo ratings yet

- Dividend Decision: HTET, UPTET Qualified)Document42 pagesDividend Decision: HTET, UPTET Qualified)KumarNo ratings yet

- Maths Lit p1 Gr12 QP June 2022 - EnglishDocument13 pagesMaths Lit p1 Gr12 QP June 2022 - Englishnombusoz608No ratings yet

- Income Tax - DEA-1Document83 pagesIncome Tax - DEA-1Crick CompactNo ratings yet

- ISSER MA Thesis - Ishmael Hammond - Prof-Fosu-review - Jan-2023Document93 pagesISSER MA Thesis - Ishmael Hammond - Prof-Fosu-review - Jan-2023Afful Frank OseiNo ratings yet

- CCA Notice - December 2022Document1 pageCCA Notice - December 2022Wews WebStaffNo ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- Test 1 Question PaperDocument12 pagesTest 1 Question PaperNaveen R HegadeNo ratings yet

- S6 E Working FinalDocument9 pagesS6 E Working FinalROHIT PANDEYNo ratings yet

- Starbucks FsaDocument9 pagesStarbucks Fsanori.victoriaNo ratings yet

- Akuntansi - Week 3Document9 pagesAkuntansi - Week 3joddy lintar002No ratings yet

- b2 AnsDocument13 pagesb2 AnsRashid AbeidNo ratings yet

- Introduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualDocument42 pagesIntroduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualberthaNo ratings yet

- Purchase of Immovable Property (NIN01)Document4 pagesPurchase of Immovable Property (NIN01)Phil MatizNo ratings yet

- Bayag 1Document41 pagesBayag 1Jan Angelo MagnoNo ratings yet

- Hardeep Singh ITR 2023Document1 pageHardeep Singh ITR 2023parwindersingh9066No ratings yet

- 1701 - ITR For 2022 SampleDocument1 page1701 - ITR For 2022 SampleKaixeR 0125No ratings yet

- Accounting Principles and ConceptDocument50 pagesAccounting Principles and ConceptmengistuNo ratings yet

- Far570 Group ProjectDocument4 pagesFar570 Group ProjectN FrzanahNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearFMG PATELNo ratings yet

- MS 3605 Variable and Absorption CostingDocument5 pagesMS 3605 Variable and Absorption Costingrichshielanghag627No ratings yet

- Mean Median Mode and RangeDocument2 pagesMean Median Mode and Rangeharry potterNo ratings yet

- Cup 2 (Far)Document8 pagesCup 2 (Far)Chan DagaleNo ratings yet

- Application QuestionsDocument8 pagesApplication QuestionsAbdelnasir HaiderNo ratings yet

- Income From Other SourcesDocument3 pagesIncome From Other SourcesAnu KNo ratings yet

- 06-Exercise 2 - Appropriation, Recording and ReportingDocument10 pages06-Exercise 2 - Appropriation, Recording and ReportingGie Bernal CamachoNo ratings yet

- E.I.Du Pont CaseDocument26 pagesE.I.Du Pont CaseChip choiNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJheza Mae PitogoNo ratings yet

Final Reviewer 2ndmid BM

Final Reviewer 2ndmid BM

Uploaded by

Rawr rawr0 ratings0% found this document useful (0 votes)

10 views1 pageThis document discusses various types of employee compensation and benefits. It defines salary earners, wage earners, and piece-rate earners. It also covers gross and net earnings, standard deductions from earnings, overtime and night shift pay rates, premium pay rates, retirement benefits, maternity leave benefits, and taxable versus non-taxable benefits. Key benefits discussed include retirement pay, 13th month pay, laundry allowance, unused leave payouts, uniform allowance, and medical assistance.

Original Description:

Original Title

final-reviewer-2ndmid-BM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses various types of employee compensation and benefits. It defines salary earners, wage earners, and piece-rate earners. It also covers gross and net earnings, standard deductions from earnings, overtime and night shift pay rates, premium pay rates, retirement benefits, maternity leave benefits, and taxable versus non-taxable benefits. Key benefits discussed include retirement pay, 13th month pay, laundry allowance, unused leave payouts, uniform allowance, and medical assistance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageFinal Reviewer 2ndmid BM

Final Reviewer 2ndmid BM

Uploaded by

Rawr rawrThis document discusses various types of employee compensation and benefits. It defines salary earners, wage earners, and piece-rate earners. It also covers gross and net earnings, standard deductions from earnings, overtime and night shift pay rates, premium pay rates, retirement benefits, maternity leave benefits, and taxable versus non-taxable benefits. Key benefits discussed include retirement pay, 13th month pay, laundry allowance, unused leave payouts, uniform allowance, and medical assistance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

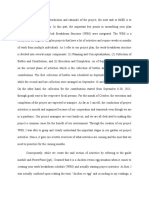

REVIEWER IN BUSINESS MATHEMATICS BENEFITS OF AN EMPLOYEE

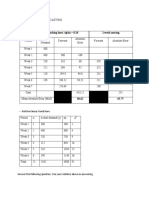

SECOND MID-QUARTER RETIREMENT PAY = 22.5 x P x T

SALARY AND WAGES P = daily income

T = no. of years served

GROSS AND NET EARNINGS

MATERNITY LEAVE

OVERTIME AND NIGHT SHIFT Normal Delivery = 2x

PREMIUM PAY Caesarian = 2.6x

BENEFITS OF AN EMPLOYEE x = Monthly Income

TAXABLE AND NON-TAXABLE 13 MONTH PAY = Annual Income/12

th

BENEFITS Note: if an employee has not been in the

company, at least a year of service, he/she is entitled

SALARY AND WAGES only a portion of the 13th month pay

SALARY EARNERS – An employee who earns

a fix amount of income TAXABLE AND NOT-TAXABLE BENEFITS

WAGE EARNERS – An employee who gets paid “Stated in the Revenue Regulation No. 5-2011”

on an hourly rate The following are Not-taxable benefits

PIECE-RATE EARNERS – An employee who 1) Laundry allowance of 300 per month

gets paid per piece of work done 2) Monetized unused vacation leave credits of

private employees not exceeding to 10 days

EX. A lantern maker is paid 100 pesos for every

3) Monetized value of vacation and sick leave

lantern he makes. How much would be his gross

credits paid to government official and

earnings for making 36 lanterns? employees.

Gross = 100 x 36 = PHP 3,600 4) Uniform and clothing allowance not exceeding

PHP 4,000 per annum

Given the Annual Income (AI) 5) Rice subsidy amounting not more than PHP

Monthly = AI/12 1,500 a month

Bi-monthly = AI/24 6) Employees achievement awards in the form of

Weekly = AI/52 tangible personal property, other than cash, with

Bi-weekly = AI/104 annual monetary value not exceeding to PHP

Daily = AI/365 10,000

7) Gifts given during Christmas or major

GROSS AND NET EARNINGS anniversary celebration not exceeding PHP

GROSS EARNINGS – the total earnings 5,000 per annum

accumulated by a worker in a span of time 8) Medical cash allowance to dependents of

NET EARNINGS - The difference between employees, not exceeding PHP 125 per month.

gross earnings and all deductions 9) Actual Medical Assistance not exceeding to

STANDARD DEDUCTIONS PHP 10,000 per annum

• Withholding tax 10) Meal allowance for overtime of work or night

• Philhealth shift not exceeding to 25% of employee’s daily

wage

• PAG_IBIG/ SSS Loan

TAX PAYABLE: amount that exceeds in the maximum

• Charges/ Miscellaneous

required amount of the benefit typically computed

• SSS Premium

annually.

• PAG IBIG

• Retirement Fund PREMIUM PAY RATES

REGULAR HOLIDAY = 2

NET EARNINGS = GROSS – DEDUCTION REST DAY = 1.3

OVERTIME AND NIGHT SHIFT SPECIAL HOLIDAY = 1.3

OVERTIME = 1.25 x hourly rate DOUBLE HOLIDAY = 3

NIGHT SHIFT = 1.1 x hourly rate REST DAY + SPECIAL HOLIDAY = 1.5

Overtime – beyond 8 hours REST DAY + REGULAR HOLIDAY = 2.6

Night shift – 10pm – 6am OVERTIME ON PREMIUM PAY = 1.3

You might also like

- Chapter 10-Compensation Income: True or FalseDocument15 pagesChapter 10-Compensation Income: True or FalseJarren Basilan57% (7)

- Financial Management ReviewerDocument59 pagesFinancial Management Reviewerkristoffer88% (8)

- Bus Math-Module 5.4 Gross and Net EarningDocument51 pagesBus Math-Module 5.4 Gross and Net Earningaibee patatagNo ratings yet

- APICS - CPIM - 2019 - PT 2 - Mod 1 - SecFDocument23 pagesAPICS - CPIM - 2019 - PT 2 - Mod 1 - SecFS.DNo ratings yet

- Income Tax Banggawan Chapter 10Document18 pagesIncome Tax Banggawan Chapter 10Earth Pirapat100% (5)

- Business Math Lesson1 Week 4Document6 pagesBusiness Math Lesson1 Week 4REBECCA BRIONESNo ratings yet

- BJZPP3740D Partb 2021-22Document3 pagesBJZPP3740D Partb 2021-22sagar lovzNo ratings yet

- Business Math - W4 - W5 - Wage EarnersDocument7 pagesBusiness Math - W4 - W5 - Wage Earnerscj100% (4)

- FABM2 Q2W5 TaxationDocument8 pagesFABM2 Q2W5 TaxationDanielle SocoralNo ratings yet

- Business Math Q2 Week 3Document9 pagesBusiness Math Q2 Week 3john100% (1)

- Salaries and WagesDocument2 pagesSalaries and WagesMisha Dela Cruz CallaNo ratings yet

- Busmath Reviewer 2ND Quarter 2022 2023Document1 pageBusmath Reviewer 2ND Quarter 2022 2023Nikko BautistaNo ratings yet

- Gross Net IncomeDocument14 pagesGross Net IncomeRisalyn MitraNo ratings yet

- Salary, Wage and IncomeDocument6 pagesSalary, Wage and Incomevyhmwqcqn8No ratings yet

- Lesson 2 Wk10 4th Fundamental Operations of Mathematics As Applied in Salaries and Wages StudentDocument11 pagesLesson 2 Wk10 4th Fundamental Operations of Mathematics As Applied in Salaries and Wages StudentFrancine Arielle Bernales100% (1)

- Math ReviewerFinalsDocument17 pagesMath ReviewerFinalssamgyupNo ratings yet

- ModuleDocument6 pagesModuleGe Ne VieveNo ratings yet

- Compensation Income (Notes)Document6 pagesCompensation Income (Notes)Anonymous LC5kFdtc100% (1)

- Tax RatesDocument37 pagesTax RatesMelanie OngNo ratings yet

- CHAPTER 11 Compensation IncomeDocument15 pagesCHAPTER 11 Compensation IncomeGIRLNo ratings yet

- Business Math Q2Document9 pagesBusiness Math Q2Cezter AbutinNo ratings yet

- Bus Math-Module 5.3 Benefits of A Wage EarnerDocument60 pagesBus Math-Module 5.3 Benefits of A Wage Earneraibee patatagNo ratings yet

- Introduction To Salaries Wages Income and BenefitsDocument14 pagesIntroduction To Salaries Wages Income and BenefitsYAHIKOヤヒコYUICHIゆいちNo ratings yet

- BM Module 3 4 Q2W3 4 For PDFDocument5 pagesBM Module 3 4 Q2W3 4 For PDFDanica De veraNo ratings yet

- Ruy Lopez Main LineDocument8 pagesRuy Lopez Main Linekurtdelacruz102No ratings yet

- BUSINESS MATHEMATICS Lesson 5 IONDocument9 pagesBUSINESS MATHEMATICS Lesson 5 IONPurple. Queen95100% (2)

- IncomeTax Banggawan2019 Ch10Document10 pagesIncomeTax Banggawan2019 Ch10Noreen Ledda100% (1)

- Unit 3 Accounting For Labour CostsDocument54 pagesUnit 3 Accounting For Labour Costsjoseswartzsr31No ratings yet

- My report-WPS OfficeDocument4 pagesMy report-WPS OfficeMichaela PingolNo ratings yet

- Chapter 3Document14 pagesChapter 3fhagos003No ratings yet

- Week 3 - Salary, WageDocument21 pagesWeek 3 - Salary, WageKristiane Joie MicoNo ratings yet

- Presentation of Business DataDocument3 pagesPresentation of Business DataSheilaMarieAnnMagcalasNo ratings yet

- BUS. MATH Q2 - Week3Document4 pagesBUS. MATH Q2 - Week3DARLENE MARTINNo ratings yet

- BUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONDocument14 pagesBUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONJASON DAVID AMARILANo ratings yet

- Chapter 3Document14 pagesChapter 3fhagos003No ratings yet

- SalaryDocument25 pagesSalaryKylee NathanielNo ratings yet

- Salary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesDocument9 pagesSalary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesAlmirah H. AliNo ratings yet

- Business Math 12Document9 pagesBusiness Math 12Scottie James Martin FaderangaNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- Lesson 4 and 5Document7 pagesLesson 4 and 5Fatima Elsan OrillanNo ratings yet

- Payroll Accounting: Chapter Two Payroll CalculationsDocument20 pagesPayroll Accounting: Chapter Two Payroll Calculations409005091No ratings yet

- 4.03 Key Terms For Preparing PayrollDocument21 pages4.03 Key Terms For Preparing Payrollapi-262218593No ratings yet

- Compensation IncomeDocument5 pagesCompensation IncomePaula Mae Dacanay100% (1)

- Acca Accounting For LabourDocument54 pagesAcca Accounting For LabourKiri chrisNo ratings yet

- Salaries and Wages: Prepared By: Ms. Jaeneth D. SimondoDocument47 pagesSalaries and Wages: Prepared By: Ms. Jaeneth D. SimondoJenny Stypay100% (1)

- Benefits and Services-HrmDocument27 pagesBenefits and Services-Hrmrizalleneangiela44No ratings yet

- Employee Compensation Refers ToDocument10 pagesEmployee Compensation Refers ToDaniiNo ratings yet

- Business Math SLHT 3Document7 pagesBusiness Math SLHT 3Zia Belle Bedro - LuardoNo ratings yet

- Compensation Income and Fringe BenefitsDocument3 pagesCompensation Income and Fringe BenefitsAbigail VergaraNo ratings yet

- Non Taxable Employee BenefitsDocument7 pagesNon Taxable Employee BenefitsGeomari D. BigalbalNo ratings yet

- Tax On Compensation Income: Activi TY SheetDocument14 pagesTax On Compensation Income: Activi TY SheetJudylyn SakitoNo ratings yet

- BUS. MATH Q2 - Week4Document5 pagesBUS. MATH Q2 - Week4DARLENE MARTIN100% (1)

- Module - 2 Incomes From Salary and Income From House PropertyDocument7 pagesModule - 2 Incomes From Salary and Income From House PropertyNikitha AlpetNo ratings yet

- Salary Wage Income BenefitsDocument23 pagesSalary Wage Income BenefitsIan SumastreNo ratings yet

- Business Math Report WEEK 1Document25 pagesBusiness Math Report WEEK 1HOney Mae Alecida OteroNo ratings yet

- Whichever Is Lower: A) DeductionsDocument3 pagesWhichever Is Lower: A) Deductions8151 KATALE PRIYANKANo ratings yet

- Labor EducationDocument37 pagesLabor EducationEd FeranilNo ratings yet

- CH 2 - Pay FudDocument21 pagesCH 2 - Pay FudbavanthinilNo ratings yet

- Tax43-013-Compensation IncomeDocument22 pagesTax43-013-Compensation Incomelowi shooNo ratings yet

- Salaries and WagesDocument61 pagesSalaries and WagesSnow WhiteNo ratings yet

- SKI Presentation Final YKDocument34 pagesSKI Presentation Final YKbosskaeNo ratings yet

- Business Mathematics Benefits of Wage EarnersDocument6 pagesBusiness Mathematics Benefits of Wage EarnersZeus Malicdem100% (1)

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- HumRes Assignment 4Document2 pagesHumRes Assignment 4Rawr rawrNo ratings yet

- A Specialized Industry Is A Distinct Market That Has A Unique Way of Accounting For Transactions and Reporting Its Financial ResultsDocument1 pageA Specialized Industry Is A Distinct Market That Has A Unique Way of Accounting For Transactions and Reporting Its Financial ResultsRawr rawrNo ratings yet

- Assignment 4Document3 pagesAssignment 4Rawr rawrNo ratings yet

- DIT and OC ProblemDocument1 pageDIT and OC ProblemRawr rawrNo ratings yet

- RFBT AssignmentDocument1 pageRFBT AssignmentRawr rawrNo ratings yet

- Audit Theo LectureDocument2 pagesAudit Theo LectureRawr rawrNo ratings yet

- Materials JITDocument5 pagesMaterials JITRawr rawrNo ratings yet

- Assignment 7Document3 pagesAssignment 7Rawr rawrNo ratings yet

- EssayDocument1 pageEssayRawr rawrNo ratings yet

- HumRes Assignment 1Document3 pagesHumRes Assignment 1Rawr rawrNo ratings yet

- HumRes Assignment 5Document2 pagesHumRes Assignment 5Rawr rawrNo ratings yet

- Assignment 8Document2 pagesAssignment 8Rawr rawrNo ratings yet

- Assignment 5Document3 pagesAssignment 5Rawr rawrNo ratings yet

- PRM Assignment 5Document3 pagesPRM Assignment 5Rawr rawrNo ratings yet

- Operations Assignment 2Document3 pagesOperations Assignment 2Rawr rawrNo ratings yet

- PM Assignment 3Document4 pagesPM Assignment 3Rawr rawrNo ratings yet

- Universal Robina Corporation:: Holy Angel UniversityDocument5 pagesUniversal Robina Corporation:: Holy Angel UniversityRawr rawrNo ratings yet

- PRM Assignment 6Document2 pagesPRM Assignment 6Rawr rawrNo ratings yet

- Operations Assignment 7Document5 pagesOperations Assignment 7Rawr rawrNo ratings yet

- Operations Assignment 1Document3 pagesOperations Assignment 1Rawr rawrNo ratings yet

- Ope Assignment 5Document4 pagesOpe Assignment 5Rawr rawrNo ratings yet

- Operations Reflection 1Document3 pagesOperations Reflection 1Rawr rawrNo ratings yet

- GB ReflectionDocument1 pageGB ReflectionRawr rawrNo ratings yet

- Tax DiscussionDocument4 pagesTax DiscussionRawr rawrNo ratings yet

- Management Assignment 7Document3 pagesManagement Assignment 7Rawr rawrNo ratings yet

- PM Assignment 1Document3 pagesPM Assignment 1Rawr rawrNo ratings yet

- Stratax Online DiscussionDocument8 pagesStratax Online DiscussionRawr rawrNo ratings yet

- Ethics Quiz 2Document3 pagesEthics Quiz 2Rawr rawrNo ratings yet

- Reflection On Job AnalysisDocument2 pagesReflection On Job AnalysisRawr rawrNo ratings yet

- Dividend Decision: HTET, UPTET Qualified)Document42 pagesDividend Decision: HTET, UPTET Qualified)KumarNo ratings yet

- Maths Lit p1 Gr12 QP June 2022 - EnglishDocument13 pagesMaths Lit p1 Gr12 QP June 2022 - Englishnombusoz608No ratings yet

- Income Tax - DEA-1Document83 pagesIncome Tax - DEA-1Crick CompactNo ratings yet

- ISSER MA Thesis - Ishmael Hammond - Prof-Fosu-review - Jan-2023Document93 pagesISSER MA Thesis - Ishmael Hammond - Prof-Fosu-review - Jan-2023Afful Frank OseiNo ratings yet

- CCA Notice - December 2022Document1 pageCCA Notice - December 2022Wews WebStaffNo ratings yet

- Common Questions TaxationDocument5 pagesCommon Questions TaxationChris TineNo ratings yet

- Test 1 Question PaperDocument12 pagesTest 1 Question PaperNaveen R HegadeNo ratings yet

- S6 E Working FinalDocument9 pagesS6 E Working FinalROHIT PANDEYNo ratings yet

- Starbucks FsaDocument9 pagesStarbucks Fsanori.victoriaNo ratings yet

- Akuntansi - Week 3Document9 pagesAkuntansi - Week 3joddy lintar002No ratings yet

- b2 AnsDocument13 pagesb2 AnsRashid AbeidNo ratings yet

- Introduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualDocument42 pagesIntroduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualberthaNo ratings yet

- Purchase of Immovable Property (NIN01)Document4 pagesPurchase of Immovable Property (NIN01)Phil MatizNo ratings yet

- Bayag 1Document41 pagesBayag 1Jan Angelo MagnoNo ratings yet

- Hardeep Singh ITR 2023Document1 pageHardeep Singh ITR 2023parwindersingh9066No ratings yet

- 1701 - ITR For 2022 SampleDocument1 page1701 - ITR For 2022 SampleKaixeR 0125No ratings yet

- Accounting Principles and ConceptDocument50 pagesAccounting Principles and ConceptmengistuNo ratings yet

- Far570 Group ProjectDocument4 pagesFar570 Group ProjectN FrzanahNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearFMG PATELNo ratings yet

- MS 3605 Variable and Absorption CostingDocument5 pagesMS 3605 Variable and Absorption Costingrichshielanghag627No ratings yet

- Mean Median Mode and RangeDocument2 pagesMean Median Mode and Rangeharry potterNo ratings yet

- Cup 2 (Far)Document8 pagesCup 2 (Far)Chan DagaleNo ratings yet

- Application QuestionsDocument8 pagesApplication QuestionsAbdelnasir HaiderNo ratings yet

- Income From Other SourcesDocument3 pagesIncome From Other SourcesAnu KNo ratings yet

- 06-Exercise 2 - Appropriation, Recording and ReportingDocument10 pages06-Exercise 2 - Appropriation, Recording and ReportingGie Bernal CamachoNo ratings yet

- E.I.Du Pont CaseDocument26 pagesE.I.Du Pont CaseChip choiNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJheza Mae PitogoNo ratings yet