Professional Documents

Culture Documents

Ca55efc4 492774 10

Ca55efc4 492774 10

Uploaded by

aryamahaCopyright:

Available Formats

You might also like

- Black List International Data ProviderDocument14 pagesBlack List International Data ProvideraryayuriemNo ratings yet

- E PassbookDocument9 pagesE PassbookAdnan QureshiNo ratings yet

- Banking PPT Group 1 - Structure of Indian Banking SystemDocument53 pagesBanking PPT Group 1 - Structure of Indian Banking Systemrohit75% (4)

- Ed - 11-08-2023Document1 pageEd - 11-08-2023Avinash Chandra RanaNo ratings yet

- Monetary Policy ReviewDocument4 pagesMonetary Policy ReviewiesmcrcNo ratings yet

- Article On Monetary PolicyDocument3 pagesArticle On Monetary PolicyMahi YadavNo ratings yet

- 7e8cd0bb 582694 8Document1 page7e8cd0bb 582694 8ThejaswiniNo ratings yet

- CPI Inflation View: Prepare For A Downside Surprise: Treasury Research 1 October 2021Document4 pagesCPI Inflation View: Prepare For A Downside Surprise: Treasury Research 1 October 2021sharman mohiteNo ratings yet

- Monetary Policy - April 2015Document4 pagesMonetary Policy - April 2015Deepak SharmaNo ratings yet

- IN: Inflation and Shifting Policy Dynamics: EconomicsDocument5 pagesIN: Inflation and Shifting Policy Dynamics: EconomicsgirishrajsNo ratings yet

- CPI InflationDocument3 pagesCPI InflationKabilanNo ratings yet

- RBI Monetary Policy Statement - Must Read For The Class Now and TodayDocument4 pagesRBI Monetary Policy Statement - Must Read For The Class Now and TodayAnanya SharmaNo ratings yet

- FinSights - RBI Monetary Policy Statement Dec 2020Document2 pagesFinSights - RBI Monetary Policy Statement Dec 2020speedenquiryNo ratings yet

- RBI MPC StatementDocument3 pagesRBI MPC StatementLAKHAN TRIVEDINo ratings yet

- Report On Rate CutDocument2 pagesReport On Rate CutAman GuptaNo ratings yet

- Assignment 3Document5 pagesAssignment 3SuprityNo ratings yet

- Monetary Policy StatementDocument3 pagesMonetary Policy Statementvipulpandey005No ratings yet

- Elevated Inflation Threatens To Slow PH Recovery, Says Amro: News ValueDocument3 pagesElevated Inflation Threatens To Slow PH Recovery, Says Amro: News ValueMaria Rizza IlaganNo ratings yet

- Calibrated Normalisation: Monetary PolicyDocument4 pagesCalibrated Normalisation: Monetary Policyvikash singhNo ratings yet

- RBI Raised Interest Rates How This Impacts You!Document5 pagesRBI Raised Interest Rates How This Impacts You!Aishwarya ShettyNo ratings yet

- BSP Monetary Policy February 2023Document2 pagesBSP Monetary Policy February 2023Durdle DurdlerNo ratings yet

- FinShiksha - RBI Monetary Policy ReviewDocument5 pagesFinShiksha - RBI Monetary Policy ReviewTheMoneyMitraNo ratings yet

- Australia and New ZealandDocument11 pagesAustralia and New ZealandedgarmerchanNo ratings yet

- Impt. For AsignmentDocument4 pagesImpt. For AsignmentPranshu_Priyad_8742No ratings yet

- BSP MonetaryPolicySummary August2022 QuizDocument2 pagesBSP MonetaryPolicySummary August2022 Quizcjpadin09No ratings yet

- Macro Economics and Business Environment Assignment: Submitted To: Dr. C.S. AdhikariDocument8 pagesMacro Economics and Business Environment Assignment: Submitted To: Dr. C.S. Adhikarigaurav880No ratings yet

- Monetary PolicyDocument6 pagesMonetary PolicyVishalNo ratings yet

- 2011-06-02 DBS Daily Breakfast SpreadDocument7 pages2011-06-02 DBS Daily Breakfast SpreadkjlaqiNo ratings yet

- RBI Monetary Review of 2014Document2 pagesRBI Monetary Review of 2014Niranjan YpNo ratings yet

- Expectations From Credit Policy - September 2015Document4 pagesExpectations From Credit Policy - September 2015Deepak SharmaNo ratings yet

- 10 Feb 2023_MPC_Finance CADocument13 pages10 Feb 2023_MPC_Finance CAsdmarijit99No ratings yet

- Untitled Document - Edited - 2024-06-09T202151.521Document4 pagesUntitled Document - Edited - 2024-06-09T202151.521kimberlyarileyNo ratings yet

- Ed - 16-08-2023Document1 pageEd - 16-08-2023Avinash Chandra RanaNo ratings yet

- EconomyDocument4 pagesEconomypremidbi2008No ratings yet

- MPS Nov 2019 Eng PDFDocument2 pagesMPS Nov 2019 Eng PDF21augustNo ratings yet

- RBI BulletinDocument118 pagesRBI Bulletintheresa.painter100% (1)

- March 2021Document15 pagesMarch 2021RajugupatiNo ratings yet

- Why RBI Raised Rates How This Impacts You!Document12 pagesWhy RBI Raised Rates How This Impacts You!Avinash2458No ratings yet

- RBI Monetary Policy Review - 20240405Document8 pagesRBI Monetary Policy Review - 20240405niteshNo ratings yet

- India RBI AI Apr19Document7 pagesIndia RBI AI Apr19Aman GuptaNo ratings yet

- MonetaryPolicySummary February2024Document2 pagesMonetaryPolicySummary February2024Kier TabzNo ratings yet

- Subbarao StunsDocument2 pagesSubbarao Stunssachdev_prateekNo ratings yet

- Statement of The Monetary Policy CommitteeDocument10 pagesStatement of The Monetary Policy CommitteeFadia SalieNo ratings yet

- Rbi Monetary Policy December 2021Document3 pagesRbi Monetary Policy December 2021Josep CorbynNo ratings yet

- Monetary Policy ReviewDocument4 pagesMonetary Policy ReviewVishal KanojiaNo ratings yet

- Interest Rate: Wholesale Inflation Drops On Back of Softer Oil PricesDocument9 pagesInterest Rate: Wholesale Inflation Drops On Back of Softer Oil PricesRoshni BhatiaNo ratings yet

- Subbarao Puts Onus On Govt: Slash in CRR May Be RBI's Curtain-Raiser To Rate CutsDocument3 pagesSubbarao Puts Onus On Govt: Slash in CRR May Be RBI's Curtain-Raiser To Rate CutsfinscholarNo ratings yet

- Monetary PolicyDocument2 pagesMonetary PolicyFuture Leaders of the PhilippinesNo ratings yet

- Monetary Policy ReviewDocument3 pagesMonetary Policy ReviewNikhil DambalNo ratings yet

- Nedbank Se Rentekoers-Barometer November 2016Document4 pagesNedbank Se Rentekoers-Barometer November 2016Netwerk24SakeNo ratings yet

- Rbi Monetary Policy Review Further Cuts LikelyDocument6 pagesRbi Monetary Policy Review Further Cuts LikelyTaransh ANo ratings yet

- Playing The Debt MarketDocument1 pagePlaying The Debt MarketChandan PreetNo ratings yet

- Monetary Policy Review 301007Document3 pagesMonetary Policy Review 301007pranjal92pandeyNo ratings yet

- Slide - 1: 2009. Between March 2010 and October 2011 The Reserve Bank Raised Its Policy RepoDocument3 pagesSlide - 1: 2009. Between March 2010 and October 2011 The Reserve Bank Raised Its Policy RepoGarrima ParakhNo ratings yet

- Premia Insights Feb2020 PDFDocument6 pagesPremia Insights Feb2020 PDFMuskan mahajanNo ratings yet

- MPC Statement November 20 FinalDocument11 pagesMPC Statement November 20 FinalMatthewLeCordeurNo ratings yet

- MPS Apr 2024 EngDocument2 pagesMPS Apr 2024 EngsuhailhansNo ratings yet

- Statement of The Monetary Policy Committee - 24 January 2017Document10 pagesStatement of The Monetary Policy Committee - 24 January 2017Tiso Blackstar GroupNo ratings yet

- Review of Monetary Policy Statement H2'24 by EBLSLDocument7 pagesReview of Monetary Policy Statement H2'24 by EBLSLAnika Nawar ChowdhuryNo ratings yet

- Anatomy of 12 Rate Hikes in 19 MonthsDocument6 pagesAnatomy of 12 Rate Hikes in 19 Monthsjp6451No ratings yet

- Fundamental AnalysisDocument15 pagesFundamental AnalysissuppishikhaNo ratings yet

- Asian Development Outlook 2015: Financing Asia’s Future GrowthFrom EverandAsian Development Outlook 2015: Financing Asia’s Future GrowthNo ratings yet

- TH 2021 06 21 CNI Chennai TH 5 - 06 UxzDocument1 pageTH 2021 06 21 CNI Chennai TH 5 - 06 UxzaryamahaNo ratings yet

- The Labour Codes Will Only Better India's Ease of Doing Business' Ranking Instead of Improving Conditions of EmploymentDocument1 pageThe Labour Codes Will Only Better India's Ease of Doing Business' Ranking Instead of Improving Conditions of EmploymentaryamahaNo ratings yet

- Bfd80eef 491529 7Document1 pageBfd80eef 491529 7aryamahaNo ratings yet

- H54 Euq Jufn M0 OSEGDocument10 pagesH54 Euq Jufn M0 OSEGaryamahaNo ratings yet

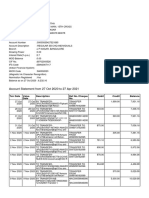

- Account Statement From 1 Apr 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancearyamahaNo ratings yet

- Bahmani and Vijayanagar Kingdoms: Learning ObjectivesDocument68 pagesBahmani and Vijayanagar Kingdoms: Learning ObjectivesaryamahaNo ratings yet

- Is One Language Enough?Document1 pageIs One Language Enough?aryamahaNo ratings yet

- Objectives:-Following Are The Products and Services Od State Bank of IndiaDocument2 pagesObjectives:-Following Are The Products and Services Od State Bank of IndiaDorothy PriceNo ratings yet

- MACD Bearish or Bullish Crossover, Technical Analysis ScannerDocument2 pagesMACD Bearish or Bullish Crossover, Technical Analysis ScannerfixemiNo ratings yet

- ICICI Bank by Jayanta Kumar DasDocument34 pagesICICI Bank by Jayanta Kumar DasAnindya SahaNo ratings yet

- Bin ItaliaDocument18 pagesBin ItaliaXxxMOvieDominicana PcNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNARENDER AINGHNo ratings yet

- Federal Bank: Your Perfect Banking PartnerDocument11 pagesFederal Bank: Your Perfect Banking PartnerJijin RoxNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVarun ChandruNo ratings yet

- Growth Strategy of ICICI BankDocument2 pagesGrowth Strategy of ICICI Banksonu1aNo ratings yet

- FINMAN 104 Module IIIDocument29 pagesFINMAN 104 Module IIIAlma Teresa NipaNo ratings yet

- Maiden Lane III Portfolio - RevisedDocument4 pagesMaiden Lane III Portfolio - Revisedoctothorpe2294No ratings yet

- CS Global Money Notes 2Document26 pagesCS Global Money Notes 2rockstarliveNo ratings yet

- Analyzing Data of Pradhan Mantri Jan Dhan YojanaDocument44 pagesAnalyzing Data of Pradhan Mantri Jan Dhan YojanaShifa FatimaNo ratings yet

- Activity 8 Financial Market Is LM GarcesleeyasonDocument14 pagesActivity 8 Financial Market Is LM GarcesleeyasonCheska Lee100% (1)

- Acct Statement - XX6097 - 06042023Document5 pagesAcct Statement - XX6097 - 06042023SAGAR STATIONERYNo ratings yet

- OpTransactionHistory03 11 2021Document62 pagesOpTransactionHistory03 11 2021Samar ChaudharyNo ratings yet

- Vwap 20131113Document0 pagesVwap 20131113Kevin HeahNo ratings yet

- 2021年财富报告Document88 pages2021年财富报告Marco WongNo ratings yet

- PLI Wise Unit Wise CLCSS Data As On September 30 2014Document1,089 pagesPLI Wise Unit Wise CLCSS Data As On September 30 2014Neeraj AgarwalNo ratings yet

- HSBC Brief HistoryDocument40 pagesHSBC Brief HistoryvivekchikkalaNo ratings yet

- TORTS Cases 3B For Digest and RecitationDocument3 pagesTORTS Cases 3B For Digest and RecitationKiana AbellaNo ratings yet

- African Banks: The Race To TransformDocument30 pagesAfrican Banks: The Race To TransformshankarmondalNo ratings yet

- Exchange 2023 06 22Document1 pageExchange 2023 06 22Md Mintu MiahNo ratings yet

- Classification of Commercial BanksDocument2 pagesClassification of Commercial BanksPrakash KrishnanNo ratings yet

- Principles and Practices of BankingDocument63 pagesPrinciples and Practices of BankingbasuNo ratings yet

- SRD - Challan-IDBIDocument2 pagesSRD - Challan-IDBISudhir ShanklaNo ratings yet

- 0814 A 7 e 698 e 2Document23 pages0814 A 7 e 698 e 2esperanzasantanaka59No ratings yet

- 1580740668762Document26 pages1580740668762A.E.PNo ratings yet

Ca55efc4 492774 10

Ca55efc4 492774 10

Uploaded by

aryamahaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ca55efc4 492774 10

Ca55efc4 492774 10

Uploaded by

aryamahaCopyright:

Available Formats

Tenuous tack

The MPC’s policy of prioritising growth over

price stability is clearly fraught with risks

F

riday’s decision by the Monetary Policy Commit-

tee (MPC) of the Reserve Bank of India to main-

tain status quo on benchmark interest rates and

continue with an accommodative policy stance for “as

long as necessary” has been widely welcomed as being

‘pro-growth’. With the MPC noting that the signs of eco-

nomic recovery were still far from broad-based, the pa-

nel asserted that it was incumbent on policymakers to

support a durable rebound. The MPC also fl�agged its ex-

pectation that infl�ation would continue to “remain ele-

vated” through the coming months to average 6.3% —

well above the 6% upper bound of its target range —

through the second half of the current fi�scal. The RBI,

which in October estimated retail infl�ation to range bet-

ween 4.5% and 5.4% in the six-month period, has in just

two months raised its projection for price gains by at

least close to one percentage point. Seen in this light,

the MPC’s decision shows that the RBI is clearly priori-

tising growth over price stability for now. While the

compulsion to ensure that monetary policy remains

broadly supportive of an economy that is in recession

as a fallout of the COVID-19 pandemic and accompany-

ing lockdowns is understandable, the rate setting pa-

nel’s readiness to shrug off� both persistently high infl�a-

tion and its own outlook on prices is cause for concern.

Recent increases in the prices of iron ore, steel and

transportation fuels also add to the worries that cost

pressures are continuing to accumulate at a time when

the economy is still well under water. The RBI has also,

surprisingly, raised its GDP forecast for the full year.

The central bank now expects the economy to shrink

by only 7.5% in the 12 months ending in March, a full 2

percentage points shallower than the 9.5% contraction

it had projected in October. The forecast is predicated

on a return to growth of 0.1% in Q3 and 0.7% in Q4. It is

this ostensibly sanguine outlook on the economy that is

hard to square with the RBI’s stand according primacy

to growth over price stability. With the central bank

prognosticating that, save some possible continued sof-

tening in the prices of cereals and transient easing of ve-

getable costs through the winter, other food prices

would persistently remain at elevated levels, the MPC’s

policy approach is clearly fraught with risks. By laying

the onus on supply disruptions, profi�teering and taxes

for the infl�ation spiral, the RBI is abdicating its primary

mandate.

You might also like

- Black List International Data ProviderDocument14 pagesBlack List International Data ProvideraryayuriemNo ratings yet

- E PassbookDocument9 pagesE PassbookAdnan QureshiNo ratings yet

- Banking PPT Group 1 - Structure of Indian Banking SystemDocument53 pagesBanking PPT Group 1 - Structure of Indian Banking Systemrohit75% (4)

- Ed - 11-08-2023Document1 pageEd - 11-08-2023Avinash Chandra RanaNo ratings yet

- Monetary Policy ReviewDocument4 pagesMonetary Policy ReviewiesmcrcNo ratings yet

- Article On Monetary PolicyDocument3 pagesArticle On Monetary PolicyMahi YadavNo ratings yet

- 7e8cd0bb 582694 8Document1 page7e8cd0bb 582694 8ThejaswiniNo ratings yet

- CPI Inflation View: Prepare For A Downside Surprise: Treasury Research 1 October 2021Document4 pagesCPI Inflation View: Prepare For A Downside Surprise: Treasury Research 1 October 2021sharman mohiteNo ratings yet

- Monetary Policy - April 2015Document4 pagesMonetary Policy - April 2015Deepak SharmaNo ratings yet

- IN: Inflation and Shifting Policy Dynamics: EconomicsDocument5 pagesIN: Inflation and Shifting Policy Dynamics: EconomicsgirishrajsNo ratings yet

- CPI InflationDocument3 pagesCPI InflationKabilanNo ratings yet

- RBI Monetary Policy Statement - Must Read For The Class Now and TodayDocument4 pagesRBI Monetary Policy Statement - Must Read For The Class Now and TodayAnanya SharmaNo ratings yet

- FinSights - RBI Monetary Policy Statement Dec 2020Document2 pagesFinSights - RBI Monetary Policy Statement Dec 2020speedenquiryNo ratings yet

- RBI MPC StatementDocument3 pagesRBI MPC StatementLAKHAN TRIVEDINo ratings yet

- Report On Rate CutDocument2 pagesReport On Rate CutAman GuptaNo ratings yet

- Assignment 3Document5 pagesAssignment 3SuprityNo ratings yet

- Monetary Policy StatementDocument3 pagesMonetary Policy Statementvipulpandey005No ratings yet

- Elevated Inflation Threatens To Slow PH Recovery, Says Amro: News ValueDocument3 pagesElevated Inflation Threatens To Slow PH Recovery, Says Amro: News ValueMaria Rizza IlaganNo ratings yet

- Calibrated Normalisation: Monetary PolicyDocument4 pagesCalibrated Normalisation: Monetary Policyvikash singhNo ratings yet

- RBI Raised Interest Rates How This Impacts You!Document5 pagesRBI Raised Interest Rates How This Impacts You!Aishwarya ShettyNo ratings yet

- BSP Monetary Policy February 2023Document2 pagesBSP Monetary Policy February 2023Durdle DurdlerNo ratings yet

- FinShiksha - RBI Monetary Policy ReviewDocument5 pagesFinShiksha - RBI Monetary Policy ReviewTheMoneyMitraNo ratings yet

- Australia and New ZealandDocument11 pagesAustralia and New ZealandedgarmerchanNo ratings yet

- Impt. For AsignmentDocument4 pagesImpt. For AsignmentPranshu_Priyad_8742No ratings yet

- BSP MonetaryPolicySummary August2022 QuizDocument2 pagesBSP MonetaryPolicySummary August2022 Quizcjpadin09No ratings yet

- Macro Economics and Business Environment Assignment: Submitted To: Dr. C.S. AdhikariDocument8 pagesMacro Economics and Business Environment Assignment: Submitted To: Dr. C.S. Adhikarigaurav880No ratings yet

- Monetary PolicyDocument6 pagesMonetary PolicyVishalNo ratings yet

- 2011-06-02 DBS Daily Breakfast SpreadDocument7 pages2011-06-02 DBS Daily Breakfast SpreadkjlaqiNo ratings yet

- RBI Monetary Review of 2014Document2 pagesRBI Monetary Review of 2014Niranjan YpNo ratings yet

- Expectations From Credit Policy - September 2015Document4 pagesExpectations From Credit Policy - September 2015Deepak SharmaNo ratings yet

- 10 Feb 2023_MPC_Finance CADocument13 pages10 Feb 2023_MPC_Finance CAsdmarijit99No ratings yet

- Untitled Document - Edited - 2024-06-09T202151.521Document4 pagesUntitled Document - Edited - 2024-06-09T202151.521kimberlyarileyNo ratings yet

- Ed - 16-08-2023Document1 pageEd - 16-08-2023Avinash Chandra RanaNo ratings yet

- EconomyDocument4 pagesEconomypremidbi2008No ratings yet

- MPS Nov 2019 Eng PDFDocument2 pagesMPS Nov 2019 Eng PDF21augustNo ratings yet

- RBI BulletinDocument118 pagesRBI Bulletintheresa.painter100% (1)

- March 2021Document15 pagesMarch 2021RajugupatiNo ratings yet

- Why RBI Raised Rates How This Impacts You!Document12 pagesWhy RBI Raised Rates How This Impacts You!Avinash2458No ratings yet

- RBI Monetary Policy Review - 20240405Document8 pagesRBI Monetary Policy Review - 20240405niteshNo ratings yet

- India RBI AI Apr19Document7 pagesIndia RBI AI Apr19Aman GuptaNo ratings yet

- MonetaryPolicySummary February2024Document2 pagesMonetaryPolicySummary February2024Kier TabzNo ratings yet

- Subbarao StunsDocument2 pagesSubbarao Stunssachdev_prateekNo ratings yet

- Statement of The Monetary Policy CommitteeDocument10 pagesStatement of The Monetary Policy CommitteeFadia SalieNo ratings yet

- Rbi Monetary Policy December 2021Document3 pagesRbi Monetary Policy December 2021Josep CorbynNo ratings yet

- Monetary Policy ReviewDocument4 pagesMonetary Policy ReviewVishal KanojiaNo ratings yet

- Interest Rate: Wholesale Inflation Drops On Back of Softer Oil PricesDocument9 pagesInterest Rate: Wholesale Inflation Drops On Back of Softer Oil PricesRoshni BhatiaNo ratings yet

- Subbarao Puts Onus On Govt: Slash in CRR May Be RBI's Curtain-Raiser To Rate CutsDocument3 pagesSubbarao Puts Onus On Govt: Slash in CRR May Be RBI's Curtain-Raiser To Rate CutsfinscholarNo ratings yet

- Monetary PolicyDocument2 pagesMonetary PolicyFuture Leaders of the PhilippinesNo ratings yet

- Monetary Policy ReviewDocument3 pagesMonetary Policy ReviewNikhil DambalNo ratings yet

- Nedbank Se Rentekoers-Barometer November 2016Document4 pagesNedbank Se Rentekoers-Barometer November 2016Netwerk24SakeNo ratings yet

- Rbi Monetary Policy Review Further Cuts LikelyDocument6 pagesRbi Monetary Policy Review Further Cuts LikelyTaransh ANo ratings yet

- Playing The Debt MarketDocument1 pagePlaying The Debt MarketChandan PreetNo ratings yet

- Monetary Policy Review 301007Document3 pagesMonetary Policy Review 301007pranjal92pandeyNo ratings yet

- Slide - 1: 2009. Between March 2010 and October 2011 The Reserve Bank Raised Its Policy RepoDocument3 pagesSlide - 1: 2009. Between March 2010 and October 2011 The Reserve Bank Raised Its Policy RepoGarrima ParakhNo ratings yet

- Premia Insights Feb2020 PDFDocument6 pagesPremia Insights Feb2020 PDFMuskan mahajanNo ratings yet

- MPC Statement November 20 FinalDocument11 pagesMPC Statement November 20 FinalMatthewLeCordeurNo ratings yet

- MPS Apr 2024 EngDocument2 pagesMPS Apr 2024 EngsuhailhansNo ratings yet

- Statement of The Monetary Policy Committee - 24 January 2017Document10 pagesStatement of The Monetary Policy Committee - 24 January 2017Tiso Blackstar GroupNo ratings yet

- Review of Monetary Policy Statement H2'24 by EBLSLDocument7 pagesReview of Monetary Policy Statement H2'24 by EBLSLAnika Nawar ChowdhuryNo ratings yet

- Anatomy of 12 Rate Hikes in 19 MonthsDocument6 pagesAnatomy of 12 Rate Hikes in 19 Monthsjp6451No ratings yet

- Fundamental AnalysisDocument15 pagesFundamental AnalysissuppishikhaNo ratings yet

- Asian Development Outlook 2015: Financing Asia’s Future GrowthFrom EverandAsian Development Outlook 2015: Financing Asia’s Future GrowthNo ratings yet

- TH 2021 06 21 CNI Chennai TH 5 - 06 UxzDocument1 pageTH 2021 06 21 CNI Chennai TH 5 - 06 UxzaryamahaNo ratings yet

- The Labour Codes Will Only Better India's Ease of Doing Business' Ranking Instead of Improving Conditions of EmploymentDocument1 pageThe Labour Codes Will Only Better India's Ease of Doing Business' Ranking Instead of Improving Conditions of EmploymentaryamahaNo ratings yet

- Bfd80eef 491529 7Document1 pageBfd80eef 491529 7aryamahaNo ratings yet

- H54 Euq Jufn M0 OSEGDocument10 pagesH54 Euq Jufn M0 OSEGaryamahaNo ratings yet

- Account Statement From 1 Apr 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2021 To 30 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancearyamahaNo ratings yet

- Bahmani and Vijayanagar Kingdoms: Learning ObjectivesDocument68 pagesBahmani and Vijayanagar Kingdoms: Learning ObjectivesaryamahaNo ratings yet

- Is One Language Enough?Document1 pageIs One Language Enough?aryamahaNo ratings yet

- Objectives:-Following Are The Products and Services Od State Bank of IndiaDocument2 pagesObjectives:-Following Are The Products and Services Od State Bank of IndiaDorothy PriceNo ratings yet

- MACD Bearish or Bullish Crossover, Technical Analysis ScannerDocument2 pagesMACD Bearish or Bullish Crossover, Technical Analysis ScannerfixemiNo ratings yet

- ICICI Bank by Jayanta Kumar DasDocument34 pagesICICI Bank by Jayanta Kumar DasAnindya SahaNo ratings yet

- Bin ItaliaDocument18 pagesBin ItaliaXxxMOvieDominicana PcNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNARENDER AINGHNo ratings yet

- Federal Bank: Your Perfect Banking PartnerDocument11 pagesFederal Bank: Your Perfect Banking PartnerJijin RoxNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVarun ChandruNo ratings yet

- Growth Strategy of ICICI BankDocument2 pagesGrowth Strategy of ICICI Banksonu1aNo ratings yet

- FINMAN 104 Module IIIDocument29 pagesFINMAN 104 Module IIIAlma Teresa NipaNo ratings yet

- Maiden Lane III Portfolio - RevisedDocument4 pagesMaiden Lane III Portfolio - Revisedoctothorpe2294No ratings yet

- CS Global Money Notes 2Document26 pagesCS Global Money Notes 2rockstarliveNo ratings yet

- Analyzing Data of Pradhan Mantri Jan Dhan YojanaDocument44 pagesAnalyzing Data of Pradhan Mantri Jan Dhan YojanaShifa FatimaNo ratings yet

- Activity 8 Financial Market Is LM GarcesleeyasonDocument14 pagesActivity 8 Financial Market Is LM GarcesleeyasonCheska Lee100% (1)

- Acct Statement - XX6097 - 06042023Document5 pagesAcct Statement - XX6097 - 06042023SAGAR STATIONERYNo ratings yet

- OpTransactionHistory03 11 2021Document62 pagesOpTransactionHistory03 11 2021Samar ChaudharyNo ratings yet

- Vwap 20131113Document0 pagesVwap 20131113Kevin HeahNo ratings yet

- 2021年财富报告Document88 pages2021年财富报告Marco WongNo ratings yet

- PLI Wise Unit Wise CLCSS Data As On September 30 2014Document1,089 pagesPLI Wise Unit Wise CLCSS Data As On September 30 2014Neeraj AgarwalNo ratings yet

- HSBC Brief HistoryDocument40 pagesHSBC Brief HistoryvivekchikkalaNo ratings yet

- TORTS Cases 3B For Digest and RecitationDocument3 pagesTORTS Cases 3B For Digest and RecitationKiana AbellaNo ratings yet

- African Banks: The Race To TransformDocument30 pagesAfrican Banks: The Race To TransformshankarmondalNo ratings yet

- Exchange 2023 06 22Document1 pageExchange 2023 06 22Md Mintu MiahNo ratings yet

- Classification of Commercial BanksDocument2 pagesClassification of Commercial BanksPrakash KrishnanNo ratings yet

- Principles and Practices of BankingDocument63 pagesPrinciples and Practices of BankingbasuNo ratings yet

- SRD - Challan-IDBIDocument2 pagesSRD - Challan-IDBISudhir ShanklaNo ratings yet

- 0814 A 7 e 698 e 2Document23 pages0814 A 7 e 698 e 2esperanzasantanaka59No ratings yet

- 1580740668762Document26 pages1580740668762A.E.PNo ratings yet