Professional Documents

Culture Documents

Mini-Case 1 Answer

Mini-Case 1 Answer

Uploaded by

Kazak KhardaeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mini-Case 1 Answer

Mini-Case 1 Answer

Uploaded by

Kazak KhardaeCopyright:

Available Formats

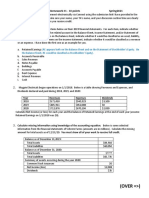

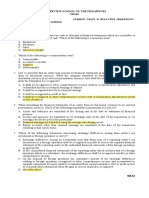

ACC 502 FT – FINANCIAL ACCOUNTING

Use EDGAR or the company’s website to download the latest 10-K of Southwest Airlines Co.

(LUV) (fiscal year ending December 31, 2021).

1. What is Southwest’s Balance Sheet Equation on December 31, 2021?

ANSWER (in millions)

Balance Sheet Equation:

Assets = Liabilities + Equity; $36,320 = 25,906 + 10,414;

2. What is Southwest’s Net Income and Basic EPS (Earnings Per Share) for the fiscal year

ending December 31, 2021?

ANSWER (in millions)

Net Income = $977

Basic EPS (Earnings Per Share) = $1,65

3. Did Southwest retain most of its Net Income from the fiscal year 2021, or did the

company declare some of it as dividends?

ANSWER

Southwest Airlines Co. retained all profit. No dividends

4. What is Southwest’s Net Operating Cash Flow for the fiscal year 2021?

ANSWER (in millions)

Net Operating Cash Flow = $2,322

5. Did Southwest’s Net Income for the year 2021 equal its Net Operating Cash Flow for that

fiscal year? Explain why.

ANSWER

No, Net Income for the year 2021 is not equal its Net Operating Cash Flow because these

are two different financial categories that are calculated differently. Net Cash Flow from

operating activities is calculated as the sum of Net Income, adjustments for Non-Cash

Expenses, and changes in working capital.

6. How much cash and cash equivalents did Southwest have on hand on December 31,

2021? On December 31, 2020?

ANSWER (in millions)

Cash and cash equivalents on December 31, 2021 = $12,480

Cash and cash equivalents on December 31, 2020 = $11,063

7. Out of Southwest’s main activities (operating, investing, and financing), which

activity(ies) provided a net inflow of cash and which activity(ies) provided a net outflow

of cash during the fiscal year 2021?

ANSWER (in millions)

Inflow: Operating = $2,322

Financing = $359

Outflow: Investing = $1,264

8. What is Southwest’s book value (of equity) and market value (of equity) on December

31, 2021? Did Southwest’s book value equal its market value on December 31, 2021?

What is Southwest’s market-to-book ratio? What does this market-to-book ratio indicate?

[Hint: The book value can be found on the company’s financial statements. For the

market value, you will need the company’s i) number of common shares outstanding on

December 31, 2021 (not the weighted number over the year), and ii) stock price on

December 31, 2021 (look up on the Internet, use the “closing” price as of December 31,

2021 adjusted for splits or adjusted for both splits and dividends)]

ANSWER (in millions)

Book value (of equity) = $10,414

Market value (of equity) = $25,366

Southwest’s book value is not equal its market value on December 31, 2021

Market-to-book ratio = 2.44

Market-to-book ratio indicate how much equity investors are paying for each dollar in net

assets;

You might also like

- Group Assignment 3 - Fall 2021 - Ashwin BaluDocument16 pagesGroup Assignment 3 - Fall 2021 - Ashwin Baluhalelz69No ratings yet

- Accounting FinalsDocument10 pagesAccounting FinalsrixaNo ratings yet

- 6th Ed Module 1 Selected Homework AnswersDocument7 pages6th Ed Module 1 Selected Homework AnswersjoshNo ratings yet

- (OVER ) : ACCY 201 - Friday Discussion (FD) Homework #1 - 10 Points Spring2021 DeadlineDocument3 pages(OVER ) : ACCY 201 - Friday Discussion (FD) Homework #1 - 10 Points Spring2021 DeadlineXiao ZidanNo ratings yet

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- ch02 Financial Statement, Cash Flows and TaxesDocument30 pagesch02 Financial Statement, Cash Flows and TaxesAffan AhmedNo ratings yet

- Solved 1 The Petty Cash Fund of The Brooks Agency Is PDFDocument1 pageSolved 1 The Petty Cash Fund of The Brooks Agency Is PDFAnbu jaromiaNo ratings yet

- Midterm Test - Code 37 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 37 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- ACC For Stock IssuesDocument9 pagesACC For Stock IssuesJasonSpringNo ratings yet

- For The Period Ended 31/03/2011: Income StatementDocument7 pagesFor The Period Ended 31/03/2011: Income StatementMuostapha FikryNo ratings yet

- FAR T123 ASM-2-1-3 CaseStudy v3.1Document4 pagesFAR T123 ASM-2-1-3 CaseStudy v3.1fgbonaNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementRobert MunyaradziNo ratings yet

- Fall 2023 Final ExamDocument24 pagesFall 2023 Final Examjoey131413141314No ratings yet

- 2012 Audit ReportDocument10 pages2012 Audit ReportSpace Frontier FoundationNo ratings yet

- Chapter 8 Financial Planning and ForecastingDocument24 pagesChapter 8 Financial Planning and Forecastingsekolah futsalNo ratings yet

- CF MBA S23 Ch2 (B2) QsDocument6 pagesCF MBA S23 Ch2 (B2) QsWaris 3478-FBAS/BSCS/F16No ratings yet

- 7 Tcsap LLC March 2022Document8 pages7 Tcsap LLC March 2022Saurabh AggarwalNo ratings yet

- Preparation and Analysis of Financial Statements (Assessment)Document6 pagesPreparation and Analysis of Financial Statements (Assessment)Talisha JosephNo ratings yet

- Financial Statement AnalysisDocument87 pagesFinancial Statement AnalysisNessan Jane50% (2)

- hw4 (Answers) R2Document6 pageshw4 (Answers) R2Arslan HafeezNo ratings yet

- AFR Mid TermDocument8 pagesAFR Mid TermRizviNo ratings yet

- Indicate Which of These Items Would Typically Be Reported As Inventory in The Financial StatementsDocument5 pagesIndicate Which of These Items Would Typically Be Reported As Inventory in The Financial StatementsBONNo ratings yet

- Marsh MC Lennan 2021-57-60Document4 pagesMarsh MC Lennan 2021-57-60socialsim07No ratings yet

- IFA s2 2Document17 pagesIFA s2 2Ксения НиколоваNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument36 pagesFinancial Statements, Cash Flow, and TaxesHussainNo ratings yet

- Foreign Currency TranslationDocument3 pagesForeign Currency TranslationGround ZeroNo ratings yet

- HKMU BAFS 2022 P2A Question EngDocument11 pagesHKMU BAFS 2022 P2A Question EngJaeeeNo ratings yet

- Assignment 2 Tesla Inc.Document12 pagesAssignment 2 Tesla Inc.Amel BarghutiNo ratings yet

- LBA TemplatesDocument14 pagesLBA Templatesibs56225No ratings yet

- Chapter 3-4 Lab Problems 9.14.2021Document1 pageChapter 3-4 Lab Problems 9.14.2021Abdullah alhamaadNo ratings yet

- Ch02 - Introduction To Published Accounts - v2Document16 pagesCh02 - Introduction To Published Accounts - v2Davy KHSCNo ratings yet

- Gannett Co. IncDocument13 pagesGannett Co. IncNikita VithlaniNo ratings yet

- Midterm Test - Code 1 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 1 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- AssignmentsDocument3 pagesAssignmentsVikin JainNo ratings yet

- Accounts Finance - AssignmentDocument16 pagesAccounts Finance - AssignmentvellithodiresmiNo ratings yet

- FS AnalysisDocument51 pagesFS AnalysisJecelyn PaganaNo ratings yet

- F2 Sept 2013 QPDocument20 pagesF2 Sept 2013 QPFahadNo ratings yet

- Afar FC 2Document5 pagesAfar FC 2Ann MagsipocNo ratings yet

- Kering CaseDocument29 pagesKering Caseadelaida.cerveraestebanNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- Ratio Analysis: The Balance Sheet For FinancialDocument10 pagesRatio Analysis: The Balance Sheet For FinancialWahidul Islam 222-14-522No ratings yet

- Learnie Inc Annual Financial Statements Review Report - FinalDocument13 pagesLearnie Inc Annual Financial Statements Review Report - FinalThuy Duong HoangNo ratings yet

- Module 1, Chapter 1 Handout Introduction To Financial StatementsDocument5 pagesModule 1, Chapter 1 Handout Introduction To Financial StatementssdfsdfuignbcbbdfbNo ratings yet

- THPS 1 - Summer 2023Document9 pagesTHPS 1 - Summer 2023Ruth KatakaNo ratings yet

- Midterm Test - Code 40 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 40 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- CH 05Document50 pagesCH 05Gaurav KarkiNo ratings yet

- Glacier Reports Second Quarter 2021 ResultsDocument3 pagesGlacier Reports Second Quarter 2021 ResultsriditoppoNo ratings yet

- 9022 - Financial Statements TranslationDocument3 pages9022 - Financial Statements TranslationAljur SalamedaNo ratings yet

- BBA 201 All AssignmentsDocument17 pagesBBA 201 All Assignmentssiambangladesh2020No ratings yet

- E5-4 Assessing Receivable and Inventory Turnover Aicpa AdaptedDocument6 pagesE5-4 Assessing Receivable and Inventory Turnover Aicpa AdaptedDylan AdrianNo ratings yet

- CHP 23Document19 pagesCHP 23lena cpaNo ratings yet

- Finance Report2Document8 pagesFinance Report2Sadman Sharar 1931037030No ratings yet

- Iefinmt Reviewer For Quiz (#1) : I. Definition of TermsDocument11 pagesIefinmt Reviewer For Quiz (#1) : I. Definition of TermspppppNo ratings yet

- Financial Report - EditedDocument7 pagesFinancial Report - EditedMaina PeterNo ratings yet

- ACF - Audited-Financials-2021Document23 pagesACF - Audited-Financials-2021ejazahmad5No ratings yet

- Financial Strategies For Business Development Assignment 1Document4 pagesFinancial Strategies For Business Development Assignment 1Amel BarghutiNo ratings yet

- Midterm Test - Code 4 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 4 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- NOPAT NOPAT2011 - NOPAT20010 (Note ' MeansDocument5 pagesNOPAT NOPAT2011 - NOPAT20010 (Note ' MeansBryan LluismaNo ratings yet

- Ausenco 2012 Preliminary Final ReportDocument101 pagesAusenco 2012 Preliminary Final ReportMuhammad SalmanNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Beams10e Ch01 Business CombinationsDocument39 pagesBeams10e Ch01 Business CombinationsmegaangginaNo ratings yet

- RB Ar17Document183 pagesRB Ar17Tehan SamarasinhaNo ratings yet

- Trial Balance MyobDocument1 pageTrial Balance MyobAdam Al MukhaffiNo ratings yet

- ch19 Accounting Income TaxesDocument102 pagesch19 Accounting Income TaxesIndah SariwatiNo ratings yet

- Lecture 7 - Managing Retailer's FinancesDocument36 pagesLecture 7 - Managing Retailer's Financesjefribasiuni1517No ratings yet

- ACC Plus - Ch.9 - Reversing EntriesDocument8 pagesACC Plus - Ch.9 - Reversing EntriesJeffrey Jazz BugashNo ratings yet

- Chapter 1 Joint Arrangements & PEDocument36 pagesChapter 1 Joint Arrangements & PEMati MeseretNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Assignment #3 Financial Distress and RestructuringDocument6 pagesAssignment #3 Financial Distress and Restructuringcharlie simo100% (2)

- Fundamentals of Capital MarketDocument24 pagesFundamentals of Capital MarketBharat TailorNo ratings yet

- Financial Statements Analysis Management Accounting Review /rcroqueDocument12 pagesFinancial Statements Analysis Management Accounting Review /rcroqueJemNo ratings yet

- K01274 - 20211101102721 - Topic 2 - Business OwnershipDocument23 pagesK01274 - 20211101102721 - Topic 2 - Business OwnershipBe UniqueNo ratings yet

- Fundamental Financial Accounting Concepts 10th Edition Edmonds Test BankDocument44 pagesFundamental Financial Accounting Concepts 10th Edition Edmonds Test Bankpropelomnifi.cw3100% (27)

- Items That May Be Reclassified Subsequently To The Profit or LossDocument4 pagesItems That May Be Reclassified Subsequently To The Profit or LossEugene Khoo Sheng ChuanNo ratings yet

- Financial MarketsDocument7 pagesFinancial MarketsBlade BNo ratings yet

- Jun18l1-Ep05 QaDocument26 pagesJun18l1-Ep05 QajuanNo ratings yet

- Chapter Six: Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDocument32 pagesChapter Six: Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsLeenNo ratings yet

- Mathematics of Finance: Intended Learning OutcomesDocument38 pagesMathematics of Finance: Intended Learning OutcomesRabena, Vinny Emmanuel T.No ratings yet

- IPO Valuation 3E TemplateDocument3 pagesIPO Valuation 3E TemplateLohith Kumar ReddyNo ratings yet

- Liquidation of CompanyDocument8 pagesLiquidation of CompanySeban Ks0% (2)

- Foundations in Accounting: Maintaining Financial RecordsDocument33 pagesFoundations in Accounting: Maintaining Financial RecordsKewish JhanjhanNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 10 TrialDocument22 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 10 TrialMantejNo ratings yet

- Financial Accounting P3Document4 pagesFinancial Accounting P3amiNo ratings yet

- Reading 22 InventoriesDocument36 pagesReading 22 InventoriesAmineNo ratings yet

- Practice Homework Chapter 4 (25 Ed)Document4 pagesPractice Homework Chapter 4 (25 Ed)Thomas TermoteNo ratings yet

- خطوات المراجعة الخارجية مترجمDocument34 pagesخطوات المراجعة الخارجية مترجمAbduh AfifNo ratings yet

- Financial Modeling: It'S Easier To Save Paper Than Planting TreesDocument8 pagesFinancial Modeling: It'S Easier To Save Paper Than Planting TreesAbhishek GuptaNo ratings yet

- 14 034 Transfer Pricing Intra Group Financing Final WebDocument48 pages14 034 Transfer Pricing Intra Group Financing Final Webshahista Imran0% (1)

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet