Professional Documents

Culture Documents

Royal Cargo Inc (Philipine) BVD 11 - 08 - 2022 13 - 43

Royal Cargo Inc (Philipine) BVD 11 - 08 - 2022 13 - 43

Uploaded by

harryxwjOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Royal Cargo Inc (Philipine) BVD 11 - 08 - 2022 13 - 43

Royal Cargo Inc (Philipine) BVD 11 - 08 - 2022 13 - 43

Uploaded by

harryxwjCopyright:

Available Formats

ROYAL

CARGO, INC.

Philippines

Active Private

BvD ID: PHA199712529 Orbis ID: 037508115 The Global Ultimate Owner of this controlled subsidiary is MRS LENY

RAEUBER

Free chapter

ROYAL CARGO BLDG., NO.4 STA. AGUEDA AVE., Legal form: Corporation

PASCOR DR., BRGY. STO. NINO Activity: Corporate, Transport, Freight

1704 & Storage

Philippines Date of incorporation: 1997

Phone: +63 2 3333000

Website: www.royalcargo.com

Most recent accounts: 2020 Ownership News stories since last year

Available in Orbis since: 03/2022

Types of account: Unconsolidated 9 shareholders 0 negative stories

Available for: 10 years 5 subsidiaries 0 stories in total

7 companies in the corporate

group

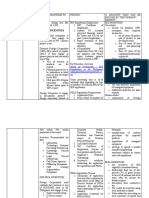

Total assets Operating revenue (Turnover)

140 90

120 80

70

100

60

80 50

60 40

30

40

20

20 10

0 0

2011 2014 2016 2018 2020 2011 2014 2016 2018 2020

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 1

© Bureau van Dijk 2022

P/L before tax P/L [=Net Income]

14 8

12

6

10

8 4

6

2

4

2 0

0

-2

-2

-4 -4

2011 2014 2016 2018 2020 2011 2014 2016 2018 2020

Cash flow

12

10

2011 2014 2016 2018 2020

Activity

BvD major sector:

Transport

US SIC Core code:

Arrangement of transportation of freight and cargo (473)

NACE Rev. 2 Core code:

Other transportation support activities (5229)

NAICS 2012 Core code:

Freight Transportation Arrangement (4885)

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 2

© Bureau van Dijk 2022

Key information

ROYAL CARGO BLDG., NO.4 STA. AGUEDA AVE., Legal form: Corporation

PASCOR DR., BRGY. STO. NINO Activity: Corporate, Transport, Freight &

1704 Storage

Philippines Date of incorporation: 1997

Phone: +63 2 3333000

Website: www.royalcargo.com

Operating revenue P/L [=Net Income] for 2020

(Turnover) for 2020

$ 1.72 m

$ 65.9 m -7.3%

Ownership PEPs and sanctions

9 shareholders This company is notthe same

5 subsidiaries or similar to a risk relevant

7 companies in the corporate name

group

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 3

© Bureau van Dijk 2022

Financial profile

Unconsolidated, Local registry filing

31/12/2020 31/12/2019 31/12/2018 31/12/2017 31/12/2016

th USD th USD th USD th USD th USD

12 months 12 months 12 months 12 months 12 months

Local Local Local Local Local

GAAP GAAP GAAP GAAP GAAP

Exchange rate: PHP/USD 0.02082 0.01971 0.01897 0.02003 0.02008

Operating revenue 65,906 71,059 76,944 85,921 75,819

(Turnover)

P/L before tax 5,142 -2,307 8,295 11,350 12,029

P/L for period [=Net 1,722 -3,926 2,485 6,175 6,330

income]

Cash flow 11,323 4,522 6,778 10,953 9,588

Total assets 121,359 116,420 102,002 98,033 57,507

Shareholders funds 47,070 42,069 39,849 37,978 31,236

Current ratio (x) 1.02 0.86 0.84 1.11 1.24

Profit margin (%) 7.80 -3.25 10.78 13.21 15.87

ROE using P/L before tax 10.93 -5.48 20.82 29.89 38.51

(%)

ROCE using P/L before 10.09 1.60 13.79 17.49 32.23

tax (%)

Solvency ratio (Asset 38.79 36.14 39.07 38.74 54.32

based) (%)

Management News stories since last year

Mr Gregg P Laquiores 0 negative stories

Mr Rodolfo R Pomaris 0 stories in total

+ 14 more

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 4

© Bureau van Dijk 2022

Financial strength summary

Financial Reputational Environmental

High Quantitative Qualitative and effect

risk compliance

Low

risk

Falcon CRIF VadRisk WVB Albatross Compass RepRisk Trucost

4 767 2 B- 323 1.35

2020 2020 2020 2020 28/02/22 2020

Financial risk review summary

Financial

High Quantitative Qualitative

risk

Low

risk

MORE Reactive Qualitative

BB BB B

2020 11/07/22 26/07/22

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 5

© Bureau van Dijk 2022

Contact

Contact information

ROYAL CARGO BLDG., NO.4 STA. AGUEDA AVE., ISO territory code PH

PASCOR DR., BRGY. STO. NINO

1704 Region National Capital Region (NCR)

Philippines

District Southern Manila District (Pasay)

Phone: +63 2 3333000

Website: www.royalcargo.com

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 6

© Bureau van Dijk 2022

Industry & activities

Type of entity: Corporate

BvD sector: Transport, Freight & Storage

NACE Rev. 2 main section: H - Transportation and storage

Products & services: Transportation and handling of cargo [source: Bureau van Dijk]

Filipino SIC 2010 code(s)

Primary code(s): 52291 Freight forwarding services

NACE Rev. 2 code(s) {derived from Filipino SIC 2010 codes}

Core code: 5229 Other transportation support activities

Primary code(s): 5229 Other transportation support activities

NAICS 2017 code(s) {derived from Filipino SIC 2010 codes}

Core code: 4885 Freight Transportation Arrangement

Primary code(s): 488510 Freight Transportation Arrangement

US SIC code(s) {derived from Filipino SIC 2010 codes}

Core code: 473 Arrangement of transportation of freight and cargo

Primary code(s): 4731 Arrangement of transportation of freight and cargo

Trade description

Freight forwarding services

Trade description in original language (Unknown)

Freight forwarding services

This company is primarily engaged in the transportation and handling of cargo. It provides specialized logistics in the fields

offreight forwarding, contract logistics, warehousing and distribution, cold storage and project and heavylift services -

withowned equipment and facilities. Its services include international freight forwarding, warehousing and distribution,

projectsand heavylifts, trucking, customs brokerage, moving and storage, freeport logistics, ecozone logistics, liquid solutions,

andshipping agency. The company's head office is located in Paranaque City, Philippines. Its Vision: To be a world-class

totallogistics provider offering specialized, high quality and cost efficient logistics solutions promptly, effectively and

professionallyat all times, anywhere. Its Mission: It is committed to its customers, its partners in a mutual journey of growth

and success; itaims to grow and profit with the knowledge that each customer it serves is fully satisfied; it adheres to the

concept ofreliability, competence, competitiveness and integrity; it is committed to being up-to-date with the latest technology

to keep upwith the demands of the global market; and it cares for the welfare of its employees, its community, and its

environment. The

company has other local offices located in Pampanga, Laguna, Subic, Cavite, Cebu, Alabang and Sucat. It also

hasinternational offices in Vietnam, Hong Kong, Cambodia, Singapore, Germany and the United Kingdom.

Active in 5 country(ies) or region(s), 1 strategic alliance(s)

Primary business line: Engaged in the transportation and handling of cargo

Main activity: Services

Main products and services: Transportation and handling of cargo

Strategy, organization and policy: To be a world-class total logistics provider offering specialized, high quality and cost

efficient logistics solutions promptly, effectively and professionally at all times, anywhere

Main domestic country: Philippines

Main foreign countries or regions: Vietnam; Hong Kong; Cambodia; Singapore; Germany and the United Kingdom

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 7

© Bureau van Dijk 2022

Identifiers

BvD ID number PHA199712529

BvD account number PHA199712529U

Orbis ID number 037508115

SEC registration number (Trade register number) A199712529

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 8

© Bureau van Dijk 2022

Legal information

Active(updated in Orbis on 04/02/2022) PEPs and sanctions

Status history This company is notthe same or similar to a

risk relevant name

History Status date Updated

in Orbis

Active 04/02/2022

Status unknown 21/01/2022

Active 12/06/2019

Status unknown 12/04/2017

Active

Corporation

Incorporated in 1997

Corporate

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 9

© Bureau van Dijk 2022

Accounting information

Information for this record is provided by CIBI Information, Inc. (last delivery: 25/07/2022)

Most recent accounts: 2020 Accounts published in: PHP

Available in Orbis since: 03/2022 Closing date: 31/12/2020

Types of account: Unconsolidated Filing type: Local registry filing

Available for: 10 years Accounting template: Corporate

Available account

31/12/2020 Unconsolidated, Local registry filing

Key indicators based on Unconsolidated, Local registry filing

Operating revenue

(Turnover) for 2020

$ 65.9 m -7.3%

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 10

© Bureau van Dijk 2022

Country profile

Philippines

General information

Series name 2025F 2024F 2023F 2022F

Population (m.) 114.2 112.9 111.6 110.2

GDP at constant $ rate (bil. USD) n.a. n.a. n.a. n.a.

GDP real growth rate (%) n.a. n.a. n.a. n.a.

GDP per head at constant $ rate (USD) n.a. n.a. n.a. n.a.

Inflation rate (%) n.a. n.a. 2.0 4.0

Budget balance (% of GDP) n.a. n.a. n.a. n.a.

Public debt (% of GDP) n.a. n.a. n.a. n.a.

Unemployment (% of labour force) n.a. n.a. n.a. 8.0

Current account balance (% of GDP) n.a. n.a. n.a. n.a.

Trade balance (% of GDP) n.a. n.a. n.a. n.a.

International reserves (bil. USD) n.a. n.a. n.a. 109

Forecast period

Source: Moody's Analytics

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 11

© Bureau van Dijk 2022

2021 2020 2019 2018 2017

108.8 107.3 105.8 104.2 102.5

358 396 373 351 328

n.a. 6.0 6.0 7.0 7.0

3,270 3,665 3,501 3,338 3,168

2.0 2.0 5.0 3.0 1.0

n.a. n.a. n.a. n.a. n.a.

n.a. 37.0 37.0 38.0 37.0

9.0 n.a. n.a. n.a. n.a.

n.a. 0.0 -3.0 -1.0 0.0

n.a. -12.0 -12.0 -9.0 -9.0

110 88 79 82 81

Additional information

Population (m.) Vital statistics: Projected population - Both sexes - All ages; (#)

Source: Philippine Statistics Authority: Mid-Year Population Based on 2015

POPCEN

GDP at constant $ rate (bil. World Development Indicators: GDP; (constant 2015 USD)

USD)

GDP real growth rate (%) World Development Indicators: GDP; (constant 2015 USD)

Source: The World Bank: World Development Indicators [NY.GDP.MKTP.KD]

GDP per head at constant $ World Development Indicators: GDP per capita; (constant 2015 USD)

rate (USD)

Inflation rate (%) Consumer price index: All items; (Index 2018=100; NSA)

Source: Philippine Statistics Authority: Table 1 - Monthly Consumer Price Index

[PCOICOP]; Moody's Analytics Estimated [Extended prior to JAN2018 using

CPITT_12UM.IPHL; CPITT_06UM.IPHL; and IMFIFSIPCPIUM.IPHL]

Budget balance (% of GDP)

Public debt (% of GDP) Global Debt Database: General government - Share of GDP; (%)

Source: International Monetary Fund (IMF): Global Debt Database

Unemployment (% of labour Labor: Unemployment rate; (%; NSA)

force)

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 12

© Bureau van Dijk 2022

Unemployment (% of labour Source: Philippine Statistics Authority: Employment Situation

force)

Current account balance (% of World Development Indicators: Current account balance; (% of GDP)

GDP) Source: The World Bank: World Development Indicators [BN.CAB.XOKA.GD.ZS]

Trade balance (% of GDP) World Development Indicators: External balance on goods and services; (% of

GDP)

International reserves (bil. International Financial Statistics: International reserves - Official reserve assets;

USD) (USD)

Source: International Monetary Fund (IMF): International Financial Statistics (IFS)

[RAFA_USD]

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 13

© Bureau van Dijk 2022

Key financials & employees

Unconsolidated, Local registry filing

31/12/2020 31/12/2019 31/12/2018 31/12/2017 31/12/2016 31/12/2012

th USD th USD th USD th USD th USD th USD

12 months 12 months 12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02082 0.01971 0.01897 0.02003 0.02008 0.02428

∟ Operating revenue 65,906 71,059 76,944 85,921 75,819 34,304

(Turnover)

∟ P/L before tax 5,142 -2,307 8,295 11,350 12,029 4,025

∟ P/L for period [=Net 1,722 -3,926 2,485 6,175 6,330 2,449

income]

∟ Cash flow 11,323 4,522 6,778 10,953 9,588 4,472

∟ Total assets 121,359 116,420 102,002 98,033 57,507 36,244

∟ Shareholders funds 47,070 42,069 39,849 37,978 31,236 12,365

∟ Current ratio (x) 1.02 0.86 0.84 1.11 1.24 1.07

∟ Profit margin (%) 7.80 -3.25 10.78 13.21 15.87 11.74

∟ ROE using P/L before 10.93 -5.48 20.82 29.89 38.51 32.56

tax (%)

∟ ROCE using P/L 10.09 1.60 13.79 17.49 32.23 23.89

before tax (%)

∟ Solvency ratio (Asset 38.79 36.14 39.07 38.74 54.32 34.12

based) (%)

∟ Number of employees n.a. n.a. n.a. n.a. n.a. n.a.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 14

© Bureau van Dijk 2022

31/12/2011 31/12/2010 31/12/2009 31/12/2008

th USD th USD th USD th USD

12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02276 0.02279 0.02157 0.02106

∟ Operating revenue 23,368 14,628 11,979 10,637

(Turnover)

∟ P/L before tax 2,557 1,216 1,119 750

∟ P/L for period [=Net 1,878 905 922 518

income]

∟ Cash flow 3,309 1,775 1,425 918

∟ Total assets 25,719 17,640 13,352 8,778

∟ Shareholders funds 8,809 6,761 5,419 2,709

∟ Current ratio (x) 1.14 1.29 0.85 1.01

∟ Profit margin (%) 10.94 8.31 9.34 7.05

∟ ROE using P/L before 29.02 17.98 20.66 27.69

tax (%)

∟ ROCE using P/L 21.53 13.51 18.10 21.84

before tax (%)

∟ Solvency ratio (Asset 34.25 38.33 40.59 30.86

based) (%)

∟ Number of employees n.a. n.a. n.a. n.a.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 15

© Bureau van Dijk 2022

Global standard format

Unconsolidated, Local registry filing

31/12/2020 31/12/2019 31/12/2018 31/12/2017 31/12/2016 31/12/2012

th USD th USD th USD th USD th USD th USD

12 months 12 months 12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02082 0.01971 0.01897 0.02003 0.02008 0.02428

Balance sheet

Assets

Fixed assets 80,849 82,154 75,246 65,562 33,426 19,042

∟ Intangible fixed assets 5,143 102 123 48 28 0

∟ Tangible fixed assets 56,900 66,006 59,060 49,281 25,186 14,885

∟ Other fixed assets 18,806 16,045 16,063 16,233 8,212 4,157

Current assets 40,510 34,266 26,756 32,471 24,081 17,202

∟ Stock 0 0 0 0 0 0

∟ Debtors 17,757 19,862 16,594 26,753 19,920 9,733

∟ Other current assets 22,753 14,404 10,162 5,718 4,161 7,469

∟ Cash & cash 7,944 2,263 2,784 1,878 2,040 1,627

equivalent

Total assets 121,359 116,420 102,002 98,033 57,507 36,244

Liabilities & equity

Shareholders funds 47,070 42,069 39,849 37,978 31,236 12,365

∟ Capital 20,839 19,727 18,986 20,051 20,095 7,075

∟ Other shareholders 26,232 22,343 20,863 17,927 11,141 5,290

funds

Non-current liabilities 34,714 34,617 30,330 30,916 6,765 7,730

∟ Long term debt 32,560 34,427 29,325 29,554 5,434 5,863

∟ Other non-current 2,154 190 1,006 1,362 1,331 1,867

liabilities

∟ Provisions 0 0 0 0 0 0

Current liabilities 39,574 39,733 31,823 29,140 19,506 16,150

∟ Loans 27,583 25,251 14,155 8,809 4,855 8,272

∟ Creditors 11,809 6,354 8,823 9,674 7,856 3,846

∟ Other current liabilities 183 8,128 8,844 10,656 6,795 4,032

Total shareh. funds & 121,359 116,420 102,002 98,033 57,507 36,244

liab.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 16

© Bureau van Dijk 2022

31/12/2011 31/12/2010 31/12/2009 31/12/2008

th USD th USD th USD th USD

12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02276 0.02279 0.02157 0.02106

Balance sheet

Assets

Fixed assets 13,906 9,879 8,064 4,241

∟ Intangible fixed assets 0 0 0 4

∟ Tangible fixed assets 10,547 7,151 5,753 1,480

∟ Other fixed assets 3,359 2,728 2,311 2,758

Current assets 11,813 7,761 5,288 4,537

∟ Stock 0 0 0 0

∟ Debtors 7,359 4,747 3,430 3,372

∟ Other current assets 4,454 3,014 1,857 1,165

∟ Cash & cash 899 207 1,330 400

equivalent

Total assets 25,719 17,640 13,352 8,778

Liabilities & equity

Shareholders funds 8,809 6,761 5,419 2,709

∟ Capital 5,705 5,710 5,406 3,593

∟ Other shareholders 3,104 1,050 13 -884

funds

Non-current liabilities 6,498 4,866 1,672 1,593

∟ Long term debt 4,381 2,844 428 228

∟ Other non-current 2,117 2,021 1,245 1,365

liabilities

∟ Provisions 0 0 0 0

Current liabilities 10,412 6,013 6,261 4,476

∟ Loans 2,473 2,233 2,508 881

∟ Creditors 3,200 1,704 1,264 1,557

∟ Other current liabilities 4,738 2,077 2,489 2,038

Total shareh. funds & 25,719 17,640 13,352 8,778

liab.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 17

© Bureau van Dijk 2022

31/12/2020 31/12/2019 31/12/2018 31/12/2017 31/12/2016 31/12/2012

th USD th USD th USD th USD th USD th USD

12 months 12 months 12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02082 0.01971 0.01897 0.02003 0.02008 0.02428

Memo lines

∟ Working capital 5,948 13,508 7,771 17,079 12,064 5,888

∟ Net current assets 936 -5,467 -5,067 3,332 4,575 1,053

∟ Enterprise value n.a. n.a. n.a. n.a. n.a. n.a.

∟ Number of employees n.a. n.a. n.a. n.a. n.a. n.a.

Profit & loss account

∟ Operating revenue 65,906 71,059 76,944 85,921 75,819 34,304

(Turnover)

∟ Sales 65,906 71,059 76,944 85,921 75,819 34,304

∟ Costs of goods sold 49,988 58,492 61,015 68,099 58,499 26,731

∟ Gross profit 15,918 12,567 15,929 17,823 17,319 7,573

∟ Other operating 7,128 7,136 5,899 5,698 5,025 2,766

expenses

∟ Operating P/L [=EBIT] 8,791 5,432 10,030 12,125 12,295 4,807

∟ Financial P/L -3,648 -7,739 -1,735 -775 -265 -782

∟ Financial revenue -95 -212 -352 -79 -49 -6

∟ Financial expenses 3,553 7,527 1,383 697 216 776

∟ P/L before tax 5,142 -2,307 8,295 11,350 12,029 4,025

∟ Taxation 1,240 -327 2,096 3,818 3,596 800

∟ P/L after tax 3,902 -1,980 6,199 7,531 8,433 3,226

∟ Extr. and other P/L -2,180 -1,946 -3,714 -1,357 -2,104 -777

∟ Extr. and other -501 -1,946 -1,267 -1,320 -1,069 -51

revenue

∟ Extr. and other 1,679 0 2,447 36 1,034 726

expenses

∟ P/L for period [=Net 1,722 -3,926 2,485 6,175 6,330 2,449

income]

Memo lines

∟ Export revenue n.a. n.a. n.a. n.a. n.a. n.a.

∟ Material costs n.a. n.a. n.a. n.a. n.a. n.a.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 18

© Bureau van Dijk 2022

31/12/2011 31/12/2010 31/12/2009 31/12/2008

th USD th USD th USD th USD

12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02276 0.02279 0.02157 0.02106

Memo lines

∟ Working capital 4,159 3,043 2,166 1,815

∟ Net current assets 1,401 1,747 -973 61

∟ Enterprise value n.a. n.a. n.a. n.a.

∟ Number of employees n.a. n.a. n.a. n.a.

Profit & loss account

∟ Operating revenue 23,368 14,628 11,979 10,637

(Turnover)

∟ Sales 23,368 14,628 11,979 10,637

∟ Costs of goods sold 18,164 11,141 9,063 8,406

∟ Gross profit 5,204 3,488 2,916 2,231

∟ Other operating 1,903 1,863 1,634 1,311

expenses

∟ Operating P/L [=EBIT] 3,301 1,625 1,281 921

∟ Financial P/L -744 -409 -162 -170

∟ Financial revenue -5 -5 2 19

∟ Financial expenses 739 404 164 189

∟ P/L before tax 2,557 1,216 1,119 750

∟ Taxation 603 260 317 377

∟ P/L after tax 1,954 955 802 373

∟ Extr. and other P/L -76 -51 120 144

∟ Extr. and other -76 -51 138 167

revenue

∟ Extr. and other 0 0 18 23

expenses

∟ P/L for period [=Net 1,878 905 922 518

income]

Memo lines

∟ Export revenue n.a. n.a. n.a. n.a.

∟ Material costs n.a. n.a. n.a. n.a.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 19

© Bureau van Dijk 2022

31/12/2020 31/12/2019 31/12/2018 31/12/2017 31/12/2016 31/12/2012

th USD th USD th USD th USD th USD th USD

12 months 12 months 12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02082 0.01971 0.01897 0.02003 0.02008 0.02428

∟ Costs of employees n.a. n.a. n.a. n.a. n.a. n.a.

∟ Depreciation & 9,601 8,448 4,293 4,778 3,258 2,022

Amortization

∟ Other operating items n.a. n.a. n.a. n.a. n.a. n.a.

∟ Interest paid 3,110 3,538 1,383 697 216 776

∟ Research & n.a. n.a. n.a. n.a. n.a. n.a.

Development expenses

∟ Cash flow 11,323 4,522 6,778 10,953 9,588 4,472

∟ Added value 15,673 7,732 10,257 15,467 13,400 6,047

∟ EBITDA 18,392 13,880 14,322 16,902 15,553 6,829

31/12/2011 31/12/2010 31/12/2009 31/12/2008

th USD th USD th USD th USD

12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02276 0.02279 0.02157 0.02106

∟ Costs of employees n.a. n.a. n.a. n.a.

∟ Depreciation & 1,431 870 503 400

Amortization

∟ Other operating items n.a. n.a. n.a. n.a.

∟ Interest paid 739 356 164 189

∟ Research & n.a. n.a. n.a. n.a.

Development expenses

∟ Cash flow 3,309 1,775 1,425 918

∟ Added value n.a. n.a. n.a. n.a.

∟ EBITDA 4,732 2,495 1,784 1,321

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 20

© Bureau van Dijk 2022

Global ratios

Unconsolidated, Local registry filing

31/12/2020 31/12/2019 31/12/2018 31/12/2017 31/12/2016 31/12/2012

th USD th USD th USD th USD th USD th USD

12 months 12 months 12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02082 0.01971 0.01897 0.02003 0.02008 0.02428

Profitability ratios

∟ ROE using P/L before 10.93 -5.48 20.82 29.89 38.51 32.56

tax (%)

∟ ROCE using P/L 10.09 1.60 13.79 17.49 32.23 23.89

before tax (%)

∟ ROA using P/L before 4.24 -1.98 8.13 11.58 20.92 11.11

tax (%)

∟ ROE using Net 3.66 -9.33 6.24 16.26 20.26 19.81

income (%)

∟ ROCE using Net 5.91 -0.51 5.51 9.97 17.23 16.05

income (%)

∟ ROA using Net 1.42 -3.37 2.44 6.30 11.01 6.76

income (%)

∟ Profit margin (%) 7.80 -3.25 10.78 13.21 15.87 11.74

∟ Gross margin (%) 24.15 17.69 20.70 20.74 22.84 22.08

∟ EBITDA margin (%) 27.91 19.53 18.61 19.67 20.51 19.91

∟ EBIT margin (%) 13.34 7.64 13.04 14.11 16.22 14.01

∟ Cash flow / Operating 17.18 6.36 8.81 12.75 12.65 13.04

revenue (%)

∟ Enterprise value / n.a. n.a. n.a. n.a. n.a. n.a.

EBITDA (x)

∟ Market cap / Cash n.a. n.a. n.a. n.a. n.a. n.a.

flow from operations (x)

Operational ratios

∟ Net assets turnover 0.81 0.93 1.10 1.25 2.00 1.71

(x)

∟ Interest cover (x) 2.83 1.54 7.25 17.41 56.81 6.20

∟ Stock turnover (x) n.s. n.s. n.s. n.s. n.s. n.s.

∟ Collection period 97 101 78 112 95 102

(days)

∟ Credit period (days) 65 32 41 41 37 40

∟ Export revenue / n.a. n.a. n.a. n.a. n.a. n.a.

Operating revenue (%)

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 21

© Bureau van Dijk 2022

31/12/2011 31/12/2010 31/12/2009 31/12/2008

th USD th USD th USD th USD

12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02276 0.02279 0.02157 0.02106

Profitability ratios

∟ ROE using P/L before 29.02 17.98 20.66 27.69

tax (%)

∟ ROCE using P/L 21.53 13.51 18.10 21.84

before tax (%)

∟ ROA using P/L before 9.94 6.89 8.38 8.54

tax (%)

∟ ROE using Net 21.32 13.38 17.02 19.11

income (%)

∟ ROCE using Net 17.10 10.84 15.31 16.44

income (%)

∟ ROA using Net 7.30 5.13 6.91 5.90

income (%)

∟ Profit margin (%) 10.94 8.31 9.34 7.05

∟ Gross margin (%) 22.27 23.84 24.34 20.98

∟ EBITDA margin (%) 20.25 17.06 14.89 12.42

∟ EBIT margin (%) 14.13 11.11 10.70 8.65

∟ Cash flow / Operating 14.16 12.13 11.89 8.63

revenue (%)

∟ Enterprise value / n.a. n.a. n.a. n.a.

EBITDA (x)

∟ Market cap / Cash n.a. n.a. n.a. n.a.

flow from operations (x)

Operational ratios

∟ Net assets turnover 1.53 1.26 1.69 2.47

(x)

∟ Interest cover (x) 4.47 4.57 7.82 4.86

∟ Stock turnover (x) n.s. n.s. n.s. n.s.

∟ Collection period 113 117 103 114

(days)

∟ Credit period (days) 49 42 38 53

∟ Export revenue / n.a. n.a. n.a. n.a.

Operating revenue (%)

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 22

© Bureau van Dijk 2022

31/12/2020 31/12/2019 31/12/2018 31/12/2017 31/12/2016 31/12/2012

th USD th USD th USD th USD th USD th USD

12 months 12 months 12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02082 0.01971 0.01897 0.02003 0.02008 0.02428

∟ R&D expenses / n.a. n.a. n.a. n.a. n.a. n.a.

Operating revenue (%)

Structure ratios

∟ Current ratio (x) 1.02 0.86 0.84 1.11 1.24 1.07

∟ Liquidity ratio (x) 1.02 0.86 0.84 1.11 1.24 1.07

∟ Shareholders liquidity 1.36 1.22 1.31 1.23 4.62 1.60

ratio (x)

∟ Solvency ratio (Asset 38.79 36.14 39.07 38.74 54.32 34.12

based) (%)

∟ Solvency ratio 63.36 56.58 64.11 63.24 n.s. 51.78

(Liability based) (%)

∟ Gearing (%) 132.35 142.31 111.64 104.60 37.20 129.41

Per employee ratios

∟ Profit per employee n.a. n.a. n.a. n.a. n.a. n.a.

(th)

∟ Operating revenue per n.a. n.a. n.a. n.a. n.a. n.a.

employee (th)

∟ Costs of employees / n.a. n.a. n.a. n.a. n.a. n.a.

Operating revenue (%)

∟ Average cost of n.a. n.a. n.a. n.a. n.a. n.a.

employee (th)

∟ Shareholders funds n.a. n.a. n.a. n.a. n.a. n.a.

per employee (th)

∟ Working capital per n.a. n.a. n.a. n.a. n.a. n.a.

employee (th)

∟ Total assets per n.a. n.a. n.a. n.a. n.a. n.a.

employee (th)

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 23

© Bureau van Dijk 2022

31/12/2011 31/12/2010 31/12/2009 31/12/2008

th USD th USD th USD th USD

12 months 12 months 12 months 12 months

Local GAAP Local GAAP Local GAAP Local GAAP

Exchange rate: PHP/USD 0.02276 0.02279 0.02157 0.02106

∟ R&D expenses / n.a. n.a. n.a. n.a.

Operating revenue (%)

Structure ratios

∟ Current ratio (x) 1.14 1.29 0.85 1.01

∟ Liquidity ratio (x) 1.14 1.29 0.85 1.01

∟ Shareholders liquidity 1.36 1.39 3.24 1.70

ratio (x)

∟ Solvency ratio (Asset 34.25 38.33 40.59 30.86

based) (%)

∟ Solvency ratio 52.09 62.14 68.31 44.63

(Liability based) (%)

∟ Gearing (%) 101.84 105.00 77.14 91.32

Per employee ratios

∟ Profit per employee n.a. n.a. n.a. n.a.

(th)

∟ Operating revenue per n.a. n.a. n.a. n.a.

employee (th)

∟ Costs of employees / n.a. n.a. n.a. n.a.

Operating revenue (%)

∟ Average cost of n.a. n.a. n.a. n.a.

employee (th)

∟ Shareholders funds n.a. n.a. n.a. n.a.

per employee (th)

∟ Working capital per n.a. n.a. n.a. n.a.

employee (th)

∟ Total assets per n.a. n.a. n.a. n.a.

employee (th)

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 24

© Bureau van Dijk 2022

Graph - Value over time

90,000 ● Operating revenue

(Turnover) (th USD)

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

th USD

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 25

© Bureau van Dijk 2022

Graph - Indices of several values over time

Base: 2008

1,800

Operating revenue (Turnover) (m USD) 10.6

1,600 P/L before tax (th USD) 750

1,400 P/L for period [=Net income] (th USD) 518

1,200 Cash flow (th USD) 918

Total assets (m USD) 8.78

1,000

800

600

400

200

0

2008 2011 2014 2017 2020

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 26

© Bureau van Dijk 2022

Peer comparison

Year Operating revenue P/L before tax

Accounting year: Peer group year

(Turnover)

th USD th USD

Median 65,906 3,309

Standard deviation 213 1,881

Average 65,875 2,882

ABREU - CARGA E TRANSITOS, LDA 2020 65,929 5 2,269 6

SIAM NISTRANS CO LTD 2020 65,554 11 3,343 4

TMF OPERATING 2020 66,198 1 1,467 7

MOLD TRANS SL 2020 66,176 2 290 8

HONOLD CONTRACT LOGISTICS GMBH 2020 65,970 4 4,289 3

ROYAL CARGO, INC. 2020 65,906 6 5,142 2

SUZHOU LOGISTICS CENTER CO., LTD. 2020 65,755 7 n.a.

JILIN ANGUANG LOGISTICS CO.,LTD 2020 65,702 8 3,309 5

HEILONGJIANG JINGU LOGISTICS CO., LTD. 2020 65,689 9 5,676 1

PUTIAN SHUNFENGSUYUN CO.,LTD 2020 65,635 10 n.a.

O EMU SHI, KD 2020 66,108 3 152 9

Year P/L for period [=Net Total assets

Accounting year: Peer group year

income]

th USD th USD

Median 2,412 38,253

Standard deviation 5,433 85,010

Average 4,191 68,778

ABREU - CARGA E TRANSITOS, LDA 2020 1,699 8 34,541 7

SIAM NISTRANS CO LTD 2020 2,567 5 43,887 4

TMF OPERATING 2020 1,215 9 42,429 5

MOLD TRANS SL 2020 197 10 23,817 10

HONOLD CONTRACT LOGISTICS GMBH 2020 2,885 4 32,631 9

ROYAL CARGO, INC. 2020 1,722 7 121,359 2

SUZHOU LOGISTICS CENTER CO., LTD. 2020 19,542 1 324,538 1

JILIN ANGUANG LOGISTICS CO.,LTD 2020 2,412 6 45,408 3

HEILONGJIANG JINGU LOGISTICS CO., LTD. 2020 4,268 3 38,253 6

PUTIAN SHUNFENGSUYUN CO.,LTD 2020 9,470 2 33,898 8

O EMU SHI, KD 2020 125 11 15,795 11

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 27

© Bureau van Dijk 2022

Year Shareholders funds Number of employees

Accounting year: Peer group year

th USD

Median 24,412 127

Standard deviation 61,975 319

Average 38,880 239

ABREU - CARGA E TRANSITOS, LDA 2020 13,413 7 177 4

SIAM NISTRANS CO LTD 2020 32,101 3 n.a.

TMF OPERATING 2020 8,538 9 n.a.

MOLD TRANS SL 2020 4,098 10 201 3

HONOLD CONTRACT LOGISTICS GMBH 2020 25,891 5 336 2

ROYAL CARGO, INC. 2020 47,070 2 n.a.

SUZHOU LOGISTICS CENTER CO., LTD. 2020 230,613 1 77 5

JILIN ANGUANG LOGISTICS CO.,LTD 2020 10,895 8 51 6

HEILONGJIANG JINGU LOGISTICS CO., LTD. 2020 28,077 4 22 7

PUTIAN SHUNFENGSUYUN CO.,LTD 2020 24,412 6 1,039 1

O EMU SHI, KD 2020 2,572 11 9 8

Peer group definition

Closest 10 international companies according to the Operating revenue (Turnover) of the subject company for the last

available year (2020) amongst the standard peer group.

The standard peer group is based on NACE Rev. 2 industry classification: 5229 - Other transportation support activities.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 28

© Bureau van Dijk 2022

Company ratings

No data available for this company

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 29

© Bureau van Dijk 2022

Country ratings

No data available for this company

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 30

© Bureau van Dijk 2022

Financial strength summary

Financial strength summary

Financial Reputational Environmental

High Quantitative Qualitative and effect

risk compliance

Low

risk

Falcon CRIF VadRisk WVB Albatross Compass RepRisk Trucost

4 767 2 B- 323 1.35

2020 2020 2020 2020 28/02/22 2020

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 31

© Bureau van Dijk 2022

Falcon counterparty risk score by Zanders

Probability of default: 1.61%

Credit limit: 1,141,202 $

Industry: Transportation and storage

10 1

4 - Sufficient

for 2020

Evolution over time

High risk 1

2

3

4

5

6

7

8

9

Low risk 10

2011 2017 2018 2019 2020

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 32

© Bureau van Dijk 2022

Evolution over time (Tabular view)

2011 2017 2018 2019 2020

Counterparty Risk Score (CRS) 6 6 5 3 4

Probability of default (%) 0.66 0.66 1.01 2.75 1.61

Falcon credit limit (th $) 401 n.a. n.a. n.a. 1,141

Observations

2020 Original currency is not EUR

2019 Data is older than 2 years

Original currency is not EUR

2018 Data is older than 2 years

Original currency is not EUR

2017 Data is older than 2 years

Original currency is not EUR

2011 Original currency is not EUR

Falcon influencing ratios

2011 2017 2018 2019 2020

Operations and Liquidity

Turnover growth 9 3 2 2 1

Return on sales 9 9 7 0 6

Current ratio 4 4 3 3 4

Debtor days 2 2 2 2 2

Debt services

Interest coverage ratio 8 9 9 6 7

Debt/EBITDA 1 0 0 0 0

Capital structure

Gearing 4 4 3 2 2

Solvency 5 6 6 5 5

Tangible net worth 8 10 10 10 10

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 33

© Bureau van Dijk 2022

Financial stability score by CRIF Decision Solutions Ltd

Key influencing factor Asset management efficiency

Scores for peer group 245 Minimum

586 Average

795 Maximum

1000 1

Industry Other transportation support activities

767

for 2020

Evolution over time

High risk 1

100

200

300

400

500

600

700

800

900

Low risk 1000

2012 2017 2018 2019 2020

Legend

Peer group reference value (only average in graph)

Evolution over time (Tabular view)

2012 2017 2018 2019 2020

Company 777 767 787 564 767

- Financial leverage - Financial leverage - Financial leverage - Profitability - Asset

Key factors - Asset - Asset management

management management efficiency

efficiency efficiency

- Financial leverage

Peer group

Minimum 245 267 267 267 265

Average 586 576 575 587 583

Maximum 795 795 795 795 795

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 34

© Bureau van Dijk 2022

Predictive indicators by Vadis

Propensity of bankruptcy Key influencing factors:

Evolution of taxation

Extraordinary revenue

Evolution of credit period (company's group financials)

Shareholders funds / total shareholders funds

1 9 Company's age

Risk of bankruptcy lower than

national average

for 2020

Propensity to be sold

A5 A1

n.a.

Evolution over time

High risk 9

8

7

6

5

4

3

2

Low risk 1

2012 2017 2018 2019 2020

Evolution over time (Tabular view)

2012 2017 2018 2019 2020

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 35

© Bureau van Dijk 2022

Propensity of bankruptcy 2 3 3 2 2

Evolution of Evolution of Evolution of Evolution of Evolution of

Key influencing factors gross margin interest paid taxation taxation taxation

Extraordinary (company's Extraordinary Extraordinary Extraordinary

revenue group revenue revenue revenue

Legal form financials) Shareholders Shareholders Evolution of

Evolution of funds / total funds / total credit period

Shareholders

taxation shareholders shareholders (company's

funds / total

shareholders Extraordinary funds funds group

funds revenue Company's age Company's age financials)

Shareholders Shareholders

Evolution of Evolution of Evolution of

funds / total funds / total

cash flow / extraordinary export turnover

shareholders shareholders

operating expenses (company's

funds funds

revenue sector

Company's age financials) Company's age

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 36

© Bureau van Dijk 2022

Global score by WVB

A D

B- - Medium &

vulnerable

for 2020

Evolution over time

High risk D

C

B-

B

B+

Low risk A

2011 2012 2018 2019 2020

Evolution over time (Tabular view)

2011 2012 2018 2019 2020

WVB Global score C C B- B- B-

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 37

© Bureau van Dijk 2022

Compass score merchant risk by G2

Key influencing factors:

- Monitored without incident for less than 1 year, last monitored between 4 and 12

months ago

- No risk indicators found for this merchant

1 1000

323

on 28/02/2022

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 38

© Bureau van Dijk 2022

Environmental score by Trucost

1

0% ≥ 100%

0.5

1.35%

for 2020

Legend

Greenhouse Waste Land & water pollutants

gases

Air pollutants Natural resources used

Water

Subject company values

Sector average values

Industry: Support activities for transportation

Evolution over time

High risk 100

90

80

70

60

50

40

30

20

10

Low risk 0

2018 2019 2020

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 39

© Bureau van Dijk 2022

Evolution over time (Tabular view)

2018 2019 2020

Environmental score (%) 1.96 2.09 1.35

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 40

© Bureau van Dijk 2022

Financial risk review summary

Financial risk review summary

Financial

High Quantitative Qualitative

risk

Low

risk

MORE Reactive Qualitative

BB BB B

2020 11/07/22 26/07/22

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 41

© Bureau van Dijk 2022

MORE credit risk score by modeFinance

Probability of default: 2.30%

Credit limit: 1,030,763 $

Industry: Services

AAA D

BB - Adequate

for 2020

Confidence level: 100%

Evolution over time

High risk D

C

CC

CCC

B

BB

BBB

A

AA

Low risk AAA

2016 2017 2018 2019 2020

Legend

MORE comparison peer group

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 42

© Bureau van Dijk 2022

Evolution over time (Tabular view)

2016 2017 2018 2019 2020

Score

Company A BB BB B BB

Peer group BB BBB BB BB BBB

Probability of default (%)

Company 0.20 0.95 1.10 5.30 2.30

Peer group 1.10 0.60 1.00 0.85 0.45

Confidence level (%)

Company 100 100 100 100 100

Credit limit (th $)

Company n.a. n.a. n.a. 876 1,031

MORE influencing ratios

2016 2017 2018 2019 2020

Solvency ratios

Leverage ratio AA B B B B

Assets to debt AAA A A A A

Liquidity ratios

Current ratio BBB BB BB BB BB

Quick ratio BBB BBB BB BB BB

Cash conversion cycle (CCC) B CCC A B B

Profitability and economic ratios

Return on investment (ROI) AA BBB BB B BB

Return on equity (ROE) BBB BBB B D B

Asset turnover A BB BB B B

Profit margin CCC CCC CCC CCC CCC

Interest coverage ratio

Interest paid coverage A BBB BB B B

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 43

© Bureau van Dijk 2022

Reactive MORE credit risk score by modeFinance

Reactive probability of default: 1.10%

Reactive credit limit: 887,773 $

AAA D Scenario: Moderately negative

Country impact: Moderately positive

BB - Adequate

Sector impact: Extremely negative

on 11/07/2022

Size impact: No scenario change

Reactive confidence level:

50%

Evolution over time

High risk D

C

CC

CCC

B

BB

BBB

A

AA

Low risk AAA

Mar Apr May Jun Jul

2022

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 44

© Bureau van Dijk 2022

Evolution over time (Tabular view)

March April May June July

2022 2022 2022 2022 2022

Reactive score

Company BB BB BB BB BB

Reactive probability of default (%)

Company 1.20 2.30 1.10 1.10 1.10

Reactive confidence level (%)

Company 100 50 50 50 50

Reactive credit limit (th $)

Company 918 886 911 911 888

Reactive MORE influencing ratios

March April May June July

2022 2022 2022 2022 2022

Reactive solvency ratios

Leverage ratio (reactive) AA AA AA AA AA

Financial leverage ratio (reactive) B B B B B

Assets to debt (reactive) AA AA AA AA AA

Reactive liquidity ratios

Current ratio (reactive) BB BB BB BB BB

Quick ratio (reactive) BBB BBB BBB BBB BBB

Cash conversion cycle (CCC) (reactive) CCC B B B B

Reactive profitability and economic ratios

Return on investment (ROI) (reactive) BB BB BB BB BB

Return on equity (ROE) (reactive) B BB BB BB BB

Asset turnover (reactive) BB BB BB BB BB

EBITDA sales ratio (reactive) BB BB BB BB BB

Reactive interest coverage ratio

EBIT interest paid coverage (reactive) B BB BB BB BB

EBITDA interest paid coverage (reactive) BB BB BB BB BB

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 45

© Bureau van Dijk 2022

Qualitative score by modeFinance

Credit limit: n.a.

No Qualitative credit limit has been calculated

because a recent MORE credit limit is available for

this company.

A E

Key influencing factors: B - GUO MORE score / status

B - Satisfactory B - Subsidiaries average MORE score / status

A - Size of the GUO

on 26/07/2022

Industry score: C

Confidence level: 66.0%

Evolution over time

High risk E

Low risk A

2018 2019 2020 2021 2022

Legend

Industry score

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 46

© Bureau van Dijk 2022

Evolution over time (Tabular view)

2018 2019 2020 2021 26/07/2022

Qualitative score B B B C B

Confidence level (%) 65 65 66 66 66

Credit limit

Industry score C C C C C

Credit limit annotations

26/07/2022 No Qualitative credit limit has been calculated because a recent MORE credit

limit is available for this company.

2021 No Qualitative credit limit has been calculated because a recent MORE credit

limit is available for this company.

2020 No Qualitative credit limit has been calculated because a recent MORE credit

limit is available for this company.

2019 No Qualitative credit limit has been calculated because a recent MORE credit

limit is available for this company.

2018 No Qualitative credit limit has been calculated because a recent MORE credit

limit is available for this company.

2017 No Qualitative credit limit has been calculated because a recent MORE credit

limit is available for this company.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 47

© Bureau van Dijk 2022

Managed funds

There is no available data for this entity set

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 48

© Bureau van Dijk 2022

Funds overview

There is no available data for this entity.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 49

© Bureau van Dijk 2022

Current directors & managers

Boards & committees 16 | 1

Boards of directors 1

MR GREGG P LAQUIORES

BI

Chairman and Chief Executive Officer

MR RODOLFO R POMARIS

BI

Chairman and Chief Executive Officer

MR ROBERTO J TEODOSIO

Chairman BI

+ 2 other roles

MS VERONICA V TEODOSIO

BI

Chairman

MS VIRGINIA V YUTUC

Chairman BI

+ 1 other role

MS SHARON T FUENTEBELLA

BI

Director

MR WARLITO P LAQUIORES

BI

President / Director

MS RAQUEL L LAQUIORES

BI

Director

MR ALEJO EDMINEIL FORMANTES NAPENAS

BI

Director

MS EMILIANA D POMARIS

BI

President / Director

MR CHRISTIAN K RAEUBER

Director BI

Also shareholder

MR SEBASTIAN K RAEUBER

Director BI

Also shareholder

MS LENY U RAEUBER

Director BI

Also shareholder

MR ROBERTO MARI TEODOSIO

BI

Director

MS BIANCA MARIE V TEODOSIO

President / Director BI

+ 1 other role

MS VERONICA TEODOSIO

BI

Director

Management & staff 16 | 1

Senior Management 1

MR GREGG P LAQUIORES

Chairman and Chief Executive Officer BI

+ 1 other role

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 50

© Bureau van Dijk 2022

MR RODOLFO R POMARIS

BI

Chairman and Chief Executive Officer

MR MICHAEL K RAEUBER

Group Chief Executive Officer BI

Also shareholder

MR WARLITO P LAQUIORES

BI

President / Director

MS EMILIANA D POMARIS

President / Director BI

+ 1 other role

MR ELMER FRANCISCO U SARMIENTO

President BI

Also shareholder

MR ROBERTO J TEODOSIO

President / Director BI

+ 1 other role

MS BIANCA MARIE V TEODOSIO

President / Director BI

+ 2 other roles

MS VIRGINIA V YUTUC

President / Director BI

+ 1 other role

MS RAQUEL L LAQUIORES

BI

Corporate Secretary

ROVILLE C SUNGA

BI

Corporate Secretary

MR ROBERTO MARI TEODOSIO

BI

Corporate Secretary

MR RODOLFO E POMARIS

BI

Treasurer

Finance & Accounting

MR ANDREW K RAEUBER

Dep. COO / Treasurer BI

Also shareholder

MS VERONICA V TEODOSIO

BI

COO and Treasurer

Operations &

Production & Mfg

MARK BOSCO PETER N KHAMBATTA

BI

Chief Operating Officer

Legend

There are names that are the same, or similar to, a risk relevant name

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 51

© Bureau van Dijk 2022

Source

BI:CIBI Information

Filters

Formal sources

Bodies & departments

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 52

© Bureau van Dijk 2022

Current auditors, bankers & other advisors

Auditors

SYCIP GORRES VELAYO & CO.

BI

Auditor

Source

BI:CIBI Information

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 53

© Bureau van Dijk 2022

Previous auditors, bankers & other advisors

No data available for this company

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 54

© Bureau van Dijk 2022

Ownership structure

Graph : Shareholders

MR Elmer Francisco U.

MR Michael K. Raeuber MRS Leny Raeuber MRS EVA de Leon Sunga Loida F. Tasis MR Andrew K Raeuber MR Christian K. Raeuber MR Cesar B. Ambalada JR. MR Sebastian K. Raeuber

Sarmiento

PH PH PH PH PH PH PH PH PH

25.00/n.a. 30.50/n.a. 0.50/n.a. 2.50/n.a. 10.00/n.a. 10.00/n.a. 1.00/n.a.

10.50/n.a. 10.00/n.a.

Royal Cargo, Inc.

PH

All 9 shareholders and the controlling shareholder path are represented.

Legend

Company Node Direct / Total ownership %

Controlling shareholder x/x Direct / Total ownership %

↔

BR Branch

An individual

CQP1 50% + 1 Share

Beneficial Owner CTP Calculated total percentage

DM Director / Manager

Global Ultimate Owner

FC Foreign company

There are names that are the same, or GP General partner

similar to, a risk relevant name JO Jointly owned, = 50 %

MO Majority owned, > 50%

Entity type n.a. Not available

NG Negligible, <= 0.01%

A Insurance company.

REG Beneficial Owner from register, = 100%

B Bank.

T Sole trader, = 100 %

C Corporate.

VE Vessel

D Unnamed private

shareholders, aggregated. WO Wholly owned, >= 98%

E Mutual & Pension

Fund/Nominee/Trust/Trustee.

F Financial company.

H Self ownership.

I One or more named

individuals or families.

J Foundation/Research

Institute.

L Other unnamed

shareholders, aggregated.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 55

© Bureau van Dijk 2022

M Employees/Managers/Directors.

P Private Equity firm.

Q Branch.

S Public authority, State,

Government.

V Venture capital.

W Marine Vessel.

Y Hedge fund.

Z Public (publicly listed

companies).

Ultimate Owner definition

The path from the company to its Ultimate Owner is minimum 25.01%

I consider a company the Ultimate Owner if there are no identified shareholders or if the shareholder percentage is not

known.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 56

© Bureau van Dijk 2022

Geographic footprint

Number of companies in the corporate group per country

The map represents the geographic location of the companies in the corporate group

All 7 companies in the corporate group are represented

Legend

Number of entities by country Country of both the company and the GUO

■ More than 1

■ Less than 1

Ultimate Owner definition

The path from the company to its Ultimate Owner is minimum 25.01%

I consider a company the Ultimate Owner if there are no identified shareholders or if the shareholder percentage is not

known.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 57

© Bureau van Dijk 2022

Corporate group

There are 7 companies in the corporate group

Ownership Level of Info

Name Country

Direct % Total % own. Source

Global Ultimate Owner

MRS LENY RAEUBER PH

Ultimately owned subsidiaries

ROYAL CARGO, INC. PH 30.50 n.a. 1 WW

LIMA LOGISTICS CORPORATION PH - NG 1 BI

Name

Date

Global Ultimate Owner

MRS LENY RAEUBER

Ultimately owned subsidiaries

ROYAL CARGO, INC. 05/2022

LIMA LOGISTICS CORPORATION 06/2018

Legend

NG = Negligible (< 0.01%)

Ultimate Owner definition

The path from the company to its Ultimate Owner is minimum 25.01%

I consider a company the Ultimate Owner if there are no identified shareholders or if the shareholder percentage is not

known.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 58

© Bureau van Dijk 2022

Beneficial Owners

Beneficial Owners (6)

MR ANDREW K RAEUBER

Philippines Distance: 1

Name Country Ownership Ownership Source

Direct % Total %

MR ANDREW K RAEUBER PH 10.00 n.a. WW 05/2022

ROYAL CARGO, INC. PH

MR CHRISTIAN K. RAEUBER

Philippines Distance: 1

Name Country Ownership Ownership Source

Direct % Total %

MR CHRISTIAN K. RAEUBER PH 10.00 n.a. WW 05/2022

ROYAL CARGO, INC. PH

MR ELMER FRANCISCO U. SARMIENTO

Philippines Distance: 1

Name Country Ownership Ownership Source

Direct % Total %

MR ELMER FRANCISCO U. SARMIENTO PH 10.50 n.a. WW 05/2022

ROYAL CARGO, INC. PH

MR MICHAEL K. RAEUBER

Philippines Distance: 1

Name Country Ownership Ownership Source

Direct % Total %

MR MICHAEL K. RAEUBER PH 25.00 n.a. WW 05/2022

ROYAL CARGO, INC. PH

MR SEBASTIAN K. RAEUBER

Philippines Distance: 1

Name Country Ownership Ownership Source

Direct % Total %

MR SEBASTIAN K. RAEUBER PH 10.00 n.a. WW 05/2022

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 59

© Bureau van Dijk 2022

ROYAL CARGO, INC. PH

MRS LENY RAEUBER

Philippines Distance: 1

Name Country Ownership Ownership Source

Direct % Total %

MRS LENY RAEUBER PH 30.50 n.a. WW 05/2022

ROYAL CARGO, INC. PH

Other Ultimate Beneficiary (0)

This company has no Other Ultimate Beneficiaries.

Beneficial Owner from register (0)

There is no register available for this country

Legend

Also a manager There are names that are the same, or similar to, a risk

relevant name

Beneficial Owner definition

The minimum percentage of ownership at first level is 10.00%, the minimum percentage at further levels is 10.00%.

I also consider any individual at the top of a path who has an unknown percentage of ownership (% such as ‘>x%’ are

considered unknown)

I also consider any individual at the top of a path who has a percentage of minimum 10.00% (with the requested 10.00% at

all other levels).

Beneficial Owners from register are not subject to the defined thresholds.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 60

© Bureau van Dijk 2022

Controlling shareholders

BvD independence indicator

B C B - No majority ownership

Has no identified shareholder with over 50% ownership, but at least one with

A D over 25%

Confidence level: high

Ownership Info Op. Rev.

Name Country Type

Direct % Total % Source Date (m USD)

MRS LENY RAEUBER PH I 30.50 n.a. WW 05/2022 -

ROYAL CARGO, INC. PH C 66

No of

Name

employees

MRS LENY RAEUBER -

ROYAL CARGO, INC. n.a.

Legend

Also a manager I = One or more named individuals or families

C = Corporate

Ultimate Owner definition

The path from the company to its Ultimate Owner is minimum 25.01%

I consider a company the Ultimate Owner if there are no identified shareholders or if the shareholder percentage is not

known.

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 61

© Bureau van Dijk 2022

Current shareholders

Ownership Info Op. Rev.

Name Country Type

Direct % Total % Source Date (m USD)

MRS LENY RAEUBER PH I 30.50 n.a. WW 05/2022 -

MR MICHAEL K. RAEUBER PH I 25.00 n.a. WW 05/2022 -

MR ELMER FRANCISCO U. SARMIENTO PH I 10.50 n.a. WW 05/2022 -

MR ANDREW K RAEUBER PH I 10.00 n.a. WW 05/2022 -

MR CHRISTIAN K. RAEUBER PH I 10.00 n.a. WW 05/2022 -

MR SEBASTIAN K. RAEUBER PH I 10.00 n.a. WW 05/2022 -

LOIDA F. TASIS PH I 2.50 n.a. WW 05/2022 -

MR CESAR B. AMBALADA JR. PH I 1.00 n.a. WW 05/2022 -

MRS EVA DE LEON SUNGA PH I 0.50 n.a. WW 05/2022 -

No of

Name

employees

MRS LENY RAEUBER -

MR MICHAEL K. RAEUBER -

MR ELMER FRANCISCO U. SARMIENTO -

MR ANDREW K RAEUBER -

MR CHRISTIAN K. RAEUBER -

MR SEBASTIAN K. RAEUBER -

LOIDA F. TASIS -

MR CESAR B. AMBALADA JR. -

MRS EVA DE LEON SUNGA -

Legend

There are names Also a manager I = One or more named individuals or

that are the same, or families

similar to, a risk

relevant name

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 62

© Bureau van Dijk 2022

Shareholders history

Current shareholders

Ownership Info Op. Rev. No of

Name Country Type

Direct % Total % Source Date (m USD) employees

MRS LENY RAEUBER PH I 30.50 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

MR MICHAEL K. RAEUBER PH I 25.00 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

MR ELMER FRANCISCO U. SARMIENTO PH I 10.50 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

MR ANDREW K RAEUBER PH I 10.00 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

MR CHRISTIAN K. RAEUBER PH I 10.00 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

MR SEBASTIAN K. RAEUBER PH I 10.00 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

LOIDA F. TASIS PH I 2.50 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

MR CESAR B. AMBALADA JR. PH I 1.00 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

MRS EVA DE LEON SUNGA PH I 0.50 n.a. WW 05/2022 - -

- n.a. BI 10/2018

- n.a. BI 10/2017

- n.a. BI 03/2016

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 63

© Bureau van Dijk 2022

Legend

There are names Also a manager I = One or more named individuals or

that are the same, or families

similar to, a risk

relevant name

Previous shareholders

Ownership Info Op. Rev.

Name Country Type

Direct % Total % Source Date (m USD)

MRS SARAH C. MENDOZA PH I - n.a. BI 10/2017 -

- n.a. BI 03/2016

GEODIS INTERNATIONAL FR E 29.00 n.a. SC 03/2011 0

29.00 n.a. SC 02/2011

29.00 n.a. SC 11/2009

29.00 n.a. SC 06/2009

29.00 n.a. SC 05/2008

29.00 n.a. SC 06/2007

No of

Name

employees

MRS SARAH C. MENDOZA -

GEODIS INTERNATIONAL n.a.

Legend

I = One or more named individuals or families

E = Mutual and pension fund, nominee, trust, trustee

Filters

Shareholders: All

All information since 01/2002

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 64

© Bureau van Dijk 2022

Current subsidiaries

Ownership Info Op. Rev.

Name Country Type Status

Direct % Total % Source Date (m USD)

ROYAL CARGO SINGAPORE PTE. LTD. SG C 94.39 94.39 - BZ 05/2022 0

IRIS LOGISTICS INC PH C MO n.a. - HS 07/2022 7

LIMA LOGISTICS CORPORATION PH C MO n.a. - WW 10/2018 4

ROYAL GLOBAL SERVICES, INC. PH C - MO n.a. - WW 10/2018 2

TMW WORLDWIDE EXPRESS INC PH C - MO n.a. - WW 10/2018 1

No of

Name

employees

ROYAL CARGO SINGAPORE PTE. LTD. n.a.

IRIS LOGISTICS INC n.a.

LIMA LOGISTICS CORPORATION n.a.

ROYAL GLOBAL SERVICES, INC. n.a.

TMW WORLDWIDE EXPRESS INC n.a.

Legend

There are names that are the same, or C = Corporate

similar to, a risk relevant name MO = Majority owned

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 65

© Bureau van Dijk 2022

Research

Company profiles

Filters:

Moody's Investors Service, Moody’s Analytics Capital Markets, MarketLine, Morningstar, GlobalData

No data available for this company

Industry profiles

No data available for this company

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 66

© Bureau van Dijk 2022

kompany

You currently have no kompany document

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 67

© Bureau van Dijk 2022

My variables

Unconsolidated, Local registry filing

No data available for this company

Appendix – Omitted chapters

The chapters listed below have been omitted because they have no data for this company, or the data cannot be represented

in the PDF

Legal events

Detailed format

Cash flow statement

Segment data - Business lines

Segment data - Geographic segments

Graph - company ratings over time

Albatross score by Zanders

RepRisk indicators by RepRisk

National scores

Stock profile

Annual stock data

Annual stock valuation

Pricing series

Beta and price volatility

Earnings estimates

Credit default swaps

Previous directors & managers

Branches

Royalties agreements

Company and market news

Mergers & acquisitions

Crossborder investments

Liquidity events & potential beneficiaries

Local registry documents

aRMadillo

Global reports

EOL SEC filings

Data Update 325,003 (09/08/2022) 11/08/2022 - Page 68

© Bureau van Dijk 2022

You might also like

- 300D 310D and 315D Backhoe Loader IntroductionDocument7 pages300D 310D and 315D Backhoe Loader Introductionhenry ibañez100% (1)

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDocument9 pages1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNo ratings yet

- Monthly: Old Taxation TablesDocument2 pagesMonthly: Old Taxation TablesBai NiloNo ratings yet

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- Robert Montoya Inc PDFDocument4 pagesRobert Montoya Inc PDFLui BaardeNo ratings yet

- Financial Statement Analysis 2Document21 pagesFinancial Statement Analysis 2San Juan EzthieNo ratings yet

- Afar 2 - Summative Test (Consolidated) Theories: Realized in The Second Year From Upstream Sales Made in Both YearsDocument23 pagesAfar 2 - Summative Test (Consolidated) Theories: Realized in The Second Year From Upstream Sales Made in Both YearsVon Andrei Medina100% (1)

- Percentage TaxDocument34 pagesPercentage TaxKyla Joy T. SanchezNo ratings yet

- Maize Liquid Glocuse Manufacturing Feasibility StudyDocument73 pagesMaize Liquid Glocuse Manufacturing Feasibility StudyDglNo ratings yet

- Production of Probiotic Drink Made With Kefir Grains (Water Kefir) in Barangay Santiago Baraz, RizalDocument1 pageProduction of Probiotic Drink Made With Kefir Grains (Water Kefir) in Barangay Santiago Baraz, RizalcyrusbatayanNo ratings yet

- Hospitality Industry and Lodging or Real EstateDocument17 pagesHospitality Industry and Lodging or Real EstateRommel VinluanNo ratings yet

- Rights and Remedies of The Government Under The NIRC: I. Power of The Bir To Obtain Information and Make An AssessmentDocument24 pagesRights and Remedies of The Government Under The NIRC: I. Power of The Bir To Obtain Information and Make An AssessmentPau SaulNo ratings yet

- About LexmarkDocument6 pagesAbout Lexmarkche_valerieNo ratings yet

- Local Media9055451308065624461Document73 pagesLocal Media9055451308065624461DigiTime Trading ShopNo ratings yet

- ZONCR Advisory No 2020-039 - PEZA MC 2020-049 Extension of Work From Home ArrangementsDocument4 pagesZONCR Advisory No 2020-039 - PEZA MC 2020-049 Extension of Work From Home ArrangementsAsterNo ratings yet

- Cpale 2022Document3 pagesCpale 2022Mario ErazoNo ratings yet

- Feasibility Study - Marketing Aspect SampleDocument2 pagesFeasibility Study - Marketing Aspect SampleJaden RiveraNo ratings yet

- Application For Registration: Republic of The Philippines BIR Form NoDocument6 pagesApplication For Registration: Republic of The Philippines BIR Form Nomarlon anzanoNo ratings yet

- Illustrative Problems IntangiblesDocument4 pagesIllustrative Problems IntangiblesJulian CheezeNo ratings yet

- Lyster Duzar - Home Activity #2Document5 pagesLyster Duzar - Home Activity #2ICT AKONo ratings yet

- SocioDocument3 pagesSocioAime BacolodNo ratings yet

- Partnershipsjoint Venture CoownershipDocument4 pagesPartnershipsjoint Venture CoownershipJane TuazonNo ratings yet

- Step AnalysisDocument13 pagesStep AnalysisLow El LaNo ratings yet

- ConsultancyDocument4 pagesConsultancyRicher Lee Bartolome GangosoNo ratings yet

- For Boi IncentivesDocument7 pagesFor Boi Incentiveskimberly fanoNo ratings yet

- AST QE (Suggested)Document8 pagesAST QE (Suggested)JamesNo ratings yet

- ARTS CPA Review ARTS CPA ReviewDocument28 pagesARTS CPA Review ARTS CPA ReviewAG VenturesNo ratings yet

- Quiz Finman WCDocument3 pagesQuiz Finman WCZoey Alvin EstarejaNo ratings yet

- Business Plan Chapter 2Document47 pagesBusiness Plan Chapter 2Kyle BagaygayNo ratings yet

- Financial Statement Analysis & Their Implication To ManagementDocument23 pagesFinancial Statement Analysis & Their Implication To ManagementCharmNo ratings yet

- Chapte R: Short-Term Finance and PlanningDocument57 pagesChapte R: Short-Term Finance and PlanningMohammad Salim HossainNo ratings yet

- Solution - IntangiblesDocument9 pagesSolution - IntangiblesjhobsNo ratings yet

- Unit VIII Accounting For Long Term Construction ContractsDocument8 pagesUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveNo ratings yet

- Feasibility On ShirtsDocument33 pagesFeasibility On ShirtsAna Imbuido BaldonNo ratings yet

- Case Study Analysis Using MS Word and MS Excel: Laboratory ExerciseDocument3 pagesCase Study Analysis Using MS Word and MS Excel: Laboratory ExerciseAbbegail CalinaoNo ratings yet

- RS1Document43 pagesRS1abigailNo ratings yet

- Smartbooks Lea Victoria PronuevoDocument72 pagesSmartbooks Lea Victoria PronuevoLEA VICTORIA PRONUEVONo ratings yet

- Tax CompilationDocument175 pagesTax Compilationomer 2 gerdNo ratings yet

- Hart Nike Case ADocument19 pagesHart Nike Case Atanmay786No ratings yet

- ResearchDocument9 pagesResearchJuan FrivaldoNo ratings yet

- Chapter 2 - Feasibility Surf & Safe Hotel N' ResortDocument8 pagesChapter 2 - Feasibility Surf & Safe Hotel N' ResortBlue Anton CruzNo ratings yet

- Final Na Tikaharani Ha KamatuoranDocument54 pagesFinal Na Tikaharani Ha Kamatuoranᜄᜒ ᜇᜌᜒNo ratings yet

- 2.1. Property Plant and Equipment IAS 16Document7 pages2.1. Property Plant and Equipment IAS 16Priya Satheesh100% (1)

- The Review of The Performance and Challenges of Universal Robina Corporation's Coffee BusinessDocument9 pagesThe Review of The Performance and Challenges of Universal Robina Corporation's Coffee BusinessJosefina CadizNo ratings yet

- Components of VMDocument15 pagesComponents of VMNadine YbascoNo ratings yet

- Ayala Corporation SEC17Q June 2019 PDFDocument78 pagesAyala Corporation SEC17Q June 2019 PDFKeziah YpilNo ratings yet

- Specialized IndustryDocument9 pagesSpecialized IndustryPhilip Jhon BayoNo ratings yet

- B. Industry and Competitor Analysis B.1 Industry AnalysisDocument42 pagesB. Industry and Competitor Analysis B.1 Industry AnalysisAngelica Sanchez de VeraNo ratings yet

- BAM 031 P2 ExamDocument8 pagesBAM 031 P2 ExamAngel Frolen B. RacinezNo ratings yet

- Case Sample 1Document3 pagesCase Sample 1Shivam AroraNo ratings yet

- Nueva Eicja University of Science and Technology: Tel. No. (044) 464-5298Document26 pagesNueva Eicja University of Science and Technology: Tel. No. (044) 464-5298JonnaLyn Marquez PerezNo ratings yet

- Demand and Supply Analysis 1Document5 pagesDemand and Supply Analysis 1Casiño B ACNo ratings yet

- RDO No. 98 - Cagayan de Oro City, Misamis OrientalDocument1,638 pagesRDO No. 98 - Cagayan de Oro City, Misamis OrientalJoan Plete-KoNo ratings yet

- Rem 7-5Document31 pagesRem 7-5Kevin JugaoNo ratings yet

- Local Media3594291794869200412Document9 pagesLocal Media3594291794869200412WenjunNo ratings yet

- FM Unit 7 Lecture Notes - Cost of CapitalDocument2 pagesFM Unit 7 Lecture Notes - Cost of CapitalDebbie DebzNo ratings yet

- Buss Law II Quiz Compilation 1Document10 pagesBuss Law II Quiz Compilation 1Asiza BatarNo ratings yet

- Empleo Robles SolMan Non-Financial LiabilitiesDocument6 pagesEmpleo Robles SolMan Non-Financial LiabilitiesJohanna Raissa CapadaNo ratings yet

- Asiabest Group International Inc. - 17A - 10may2022Document97 pagesAsiabest Group International Inc. - 17A - 10may2022Ming MaoNo ratings yet

- ONLINE QUIZ Pledge Morgage and AntichresisDocument2 pagesONLINE QUIZ Pledge Morgage and AntichresisSophia PerezNo ratings yet

- W1 Module 1 The Environment For Financial Accounting and ReportingDocument6 pagesW1 Module 1 The Environment For Financial Accounting and Reportingleare ruazaNo ratings yet

- CES (Chip Eng Seng) Salcon PTE LTD BVD 23 - 08 - 2022 13 - 31Document75 pagesCES (Chip Eng Seng) Salcon PTE LTD BVD 23 - 08 - 2022 13 - 31harryxwjNo ratings yet

- CES (Chip Eng Seng) Salcon PTE LTD BVD 23 - 08 - 2022 13 - 31Document75 pagesCES (Chip Eng Seng) Salcon PTE LTD BVD 23 - 08 - 2022 13 - 31harryxwjNo ratings yet

- Aneka Gas Industri (Parent of Dwi Setia Gas) BVD 12-08-2022 11 - 02Document123 pagesAneka Gas Industri (Parent of Dwi Setia Gas) BVD 12-08-2022 11 - 02harryxwjNo ratings yet

- PT Multipanel Intermitra Mandiri (MIM HO JKT) BVD Export 24 - 08 - 2022 03 - 38Document28 pagesPT Multipanel Intermitra Mandiri (MIM HO JKT) BVD Export 24 - 08 - 2022 03 - 38harryxwjNo ratings yet

- Kurnia Safety Supplies PT BVD 16 - 08 - 2022 08 - 45Document33 pagesKurnia Safety Supplies PT BVD 16 - 08 - 2022 08 - 45harryxwjNo ratings yet

- PT Daekyung IHI Cilegon BVD 22 - 08 - 2022 11 - 47Document31 pagesPT Daekyung IHI Cilegon BVD 22 - 08 - 2022 11 - 47harryxwjNo ratings yet

- PT Daekyung IHI (HO) Jaksel 22 - 08 - 2022 11 - 53Document29 pagesPT Daekyung IHI (HO) Jaksel 22 - 08 - 2022 11 - 53harryxwjNo ratings yet

- Themelis Ulloa LandfillDocument15 pagesThemelis Ulloa LandfillHenry Bagus WicaksonoNo ratings yet

- Building 7Document1 pageBuilding 7Arshad AlamNo ratings yet

- Lesson Plan: I've Got Two SistersDocument5 pagesLesson Plan: I've Got Two SistersBianca BybyNo ratings yet

- IIA IPPF PG - Quality Assurance and Improvement Program March 2012Document29 pagesIIA IPPF PG - Quality Assurance and Improvement Program March 2012Denilson MadaugyNo ratings yet

- Fs Tco Battery Diesel Delivery Trucks Jun2022Document3 pagesFs Tco Battery Diesel Delivery Trucks Jun2022The International Council on Clean TransportationNo ratings yet

- September 23, Infer The Purpose of The Poem Listened ToDocument4 pagesSeptember 23, Infer The Purpose of The Poem Listened ToLouelle GonzalesNo ratings yet

- Toward The Efficient Impact Frontier: FeaturesDocument6 pagesToward The Efficient Impact Frontier: Featuresguramios chukhrukidzeNo ratings yet

- InnerFiles Current Year PDF 2023Document687 pagesInnerFiles Current Year PDF 2023shravanibagul04No ratings yet

- Department of Mechanical Engineering: Final Year Mini Project PresentationDocument22 pagesDepartment of Mechanical Engineering: Final Year Mini Project PresentationNaresh DamaNo ratings yet

- Elrc 4507 Unit PlanDocument4 pagesElrc 4507 Unit Planapi-284973023No ratings yet

- Jackson - Chimu Sculptures of Huaca TaycanamoDocument27 pagesJackson - Chimu Sculptures of Huaca TaycanamoJose David Nuñez UrviolaNo ratings yet

- GDPR ReportDocument84 pagesGDPR ReportKingPlaysNo ratings yet

- Measurement of Thermal Conductivity: Engineering Properties of Biological Materials and Food Quality 3 (2+1)Document17 pagesMeasurement of Thermal Conductivity: Engineering Properties of Biological Materials and Food Quality 3 (2+1)Mel CapalunganNo ratings yet

- Getting The Most From Lube Oil AnalysisDocument16 pagesGetting The Most From Lube Oil AnalysisGuru Raja Ragavendran Nagarajan100% (2)

- Sip 2019-2022Document4 pagesSip 2019-2022jein_am97% (29)

- Emmanuel Levinas - God, Death, and TimeDocument308 pagesEmmanuel Levinas - God, Death, and Timeissamagician100% (3)

- Synchronous Alternators: Three-Phase BrushlessDocument5 pagesSynchronous Alternators: Three-Phase BrushlessĐại DươngNo ratings yet

- Ccc221coalpowerR MDocument58 pagesCcc221coalpowerR Mmfhaleem@pgesco.comNo ratings yet

- Drama Bahasa InggrisDocument24 pagesDrama Bahasa InggrisCahyo Yang bahagiaNo ratings yet

- MAD Practical 6Document15 pagesMAD Practical 6DIVYESH PATELNo ratings yet

- Assignment 5 - Profile and Cross Section LevelingDocument3 pagesAssignment 5 - Profile and Cross Section LevelingKeanna Marie TorresNo ratings yet

- Forms PensionersDocument15 pagesForms PensionersAnimesh DasNo ratings yet

- Tivoli Storage Manager Operational Reporting Installation, Configuration and CustomizationDocument53 pagesTivoli Storage Manager Operational Reporting Installation, Configuration and CustomizationSABRINE KHNo ratings yet

- DorkDocument5 pagesDorkJeremy Sisto ManurungNo ratings yet

- Biophilic Design: ARC407 DissertationDocument4 pagesBiophilic Design: ARC407 DissertationAaryan JainNo ratings yet

- Acute Gynaecological Emergencies-1Document14 pagesAcute Gynaecological Emergencies-1Anivasa Kabir100% (1)

- StatementOfAccount 6316692309 21072023 222045Document17 pagesStatementOfAccount 6316692309 21072023 222045Asekar AlagarsamyNo ratings yet

- EEET423L Final ProjectDocument7 pagesEEET423L Final ProjectAlan ReyesNo ratings yet