Professional Documents

Culture Documents

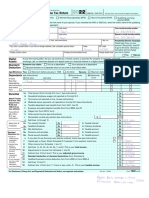

Income Tax Return - MHSO - 2022-23

Income Tax Return - MHSO - 2022-23

Uploaded by

Mahbub SiddiqueOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Return - MHSO - 2022-23

Income Tax Return - MHSO - 2022-23

Uploaded by

Mahbub SiddiqueCopyright:

Available Formats

National Board of Revenue IT-11GA2016

RETURN OF INCOME

For an Individual Assesse

The following schedules shall be the integral part of this return and

must be annexed to return in the following cases:

Schedule 24A if you have income from Salaries photo

Schedule 24B if you have income from house property

Schedule 24C if you have income from business or profession

Schedule 24D if you claim tax rebate

PART I

Basic information

01 Assessment Year: 02 Return submitted under section 82BB? (tick one):

2 0 2 2 - 2 3

Yes √ No

03 Name of the Assessee: Mahbub Hossain Siddique Olesiejuk 04 Gender:

M √ F

05 Twelve-digit TIN: 06 Old TIN:

1 3 9 8 2 4 7 7 0 3 3 8

07 Circle: 317 08 Zone: 15

09 Resident Status (tick one): Resident √ Non-resident

10 Tick on the box(es) below if you are:

10A A gazetted war-wounded 10B A person with disability

N/A N/A

freedom fighter

10C Aged 65 years or more 10D A parent of a person with disability

√ N/A

11 Date of birth (DDMMYYYY) 12 Income Year

2 0 0 6 1 9 7 6 2 0 2 1 - 2 0 2 2

If employed, employer’s name:

Spouse Name: Spouse TIN (if any)

14 15

3 2 9 4 0 6 3 2 1 5 2 8

16 Father’s Name: Late Abu Bakar Siddique 17 Mother’s Name: Late Monija Khatun

18 Present Address: 120/F, Kabi Benezar Bagan, Shahjahanpur, Dhaka 19 Permanent Address: Vill - Daulatpur, Pak Munshir

Hat, Shaduram, Noakhali.

20 Contact Telephone: 01710426483 21 E-mail:

22 National Identification Number 23 Business Identification Numbers

3 7 5 8 2 9 6 5 7 2 N/A

PART II

Particulars of Income and Tax

TIN 1 3 9 8 2 4 7 7 0 3 3 8

Particulars of Total Income Amount ৳

24 Salaries (annex Schedule 24A) S.21 -

25 Interest on securities S.22 283,500

26 Income from house property (annex Schedule 24B) S.24

27 Agricultural income S.26 -

28 Income from business or profession (annex Schedule 24C) S.28 -

29 Capital gains S.31 -

30 Income from other sources S.33 -

31 Share of income from firm or AOP -

32 Income of minor or spouse under section 43(4) S.43 -

33 Foreign income -

34 Total income (aggregate of 24 to 33) 283,500

Tax Computation and Payment Amount ৳

35 Gross tax before tax rebate -

36 Tax rebate (annex Schedule 24D) -

37 Net tax after tax rebate -

38 Minimum tax 28,350

39 Net wealth surcharge -

40 Interest or any other amount under the Ordinance (if any) -

41 Total amount payable 28,350

42 Tax deducted or collected at source (Proof attached) 28,350

43 Advance tax paid (attach proof) -

44 Adjustment of tax refund [mention assessment year(s) of refund] -

45 Amount paid with return (attach proof) -

46 Total amount paid and adjusted (42+43+44+45) 28,350

47 Deficit or excess (refundable) (41-46) -

48 Tax exempted income -

PART III

Instruction, Enclosures and Verification

TIN 1 3 9 8 2 4 7 7 0 3 3 8

49 Instructions

1. Statement of assets, liabilities and expenses (IT-10B2016) and statement of life style expense (IT-10BB2016) must be

furnished with the return unless you are exempted from furnishing such statement(s) under section 80.

2. Proof of payments of tax, including advance tax and withholding tax and the proof of investment for tax rebate must be

provided along with return.

3. Attach account statements and other documents where applicable

50 If you are a parent of a person with disability, has your spouse

Yes No

availed the extended tax exemption threshold? (tick one) √

51 Are you required to submit a statement of assets, liabilities and

Yes No

expenses (IT-10B2016) under section 80(1)? (tick one) √

52 Schedules annexed (tick all that are applicable) 24A 24B 24C 24D

53 Statements annexed (tick all that are applicable) IT-10B2016 IT-10BB2016

54 Other statements, documents, etc. attached (list all): 1 Certificate of interest income

2 Certificate of tax deduction at source

3 Computation of total income and tax

4

5

6

Verification and signature

55 Verification

I solemnly declare that to the best of my knowledge and belief the information given in this return and statements and

documents annexed or attached herewith are correct and complete.

Name: Mahbub Hossain Siddique Olesiejuk Signature:

Date of Signature (DDMMYY) Place of Signature

2 0 2 2 Dhaka, Bangladesh

For official use only

Return Submission Information

Date of Submission (DD– MM –YYYY) Tax Office Entry Number

National Board of Revenue Individual

www.nbr.gov.bd

ACKNOWLEDGEMENT RECEIPT OF

RETURN OF INCOME

Assessment Year Return under section 82BB? (tick one)

2 0 2 2 - 2 3

Yes √ No

Name of the Assesse: Mahbub Hossain Siddique Olesiejuk

Twelve-digit TIN Old TIN

1 3 9 8 2 4 7 7 0 3 3 8

Circle: 317 Taxes Zone: 15

Total income shown (serial 34)

৳ 283,500

Amount payable (serial 41) Amount paid and adjusted (serial 46)

৳ 28,350 ৳ 28,350

Amount of net wealth shown in IT10B2016 Amount of net wealth surcharge paid

৳ - ৳ -

Date of Submission (DD– MM –YYYY) Tax Office Entry Number

2 0 2 2

Signature and seal of the official receiving the return

Date of Signature Contact Number of Tax Office

Mahbub Hossain Siddique Olesiejuk

Computation of total income and taxes thereon

For the income year ended 30 June 2022

Assessment year 2022-2023

Interest income Tk. 283,500

Total Income 283,500

TOTAL INVESTMENT

Shanchaypatra Tk. -

Tk. -

CALCULATION

Tax Rate Amount Payable

i) Tax on 1st slab (Tk.350,000/-) Tk. 283,500 0% Tk. -

ii) Tax on 2nd slab (Next Tk.100,000/-) Tk. - 5% Tk. -

iii) Tax on 3rd slab (Next Tk. 300,000/-) Tk. - 10% Tk. -

iv) Tax on 4th slab (Next Tk. 400,000/-) Tk. - 15% Tk. -

v) Tax on 5th slab (Next Tk. 500,000/-) Tk. - 20% Tk. -

vi) Tax on 6th slab (on remaining balance) Tk. - 25% Tk. -

283,500 -

Calculation of tax liability (i)

Tax leviable on total income Tk. -

Less: Tax credit (As per Annexure-A) Tk. -

Tk. -

Minimum tax liability (ii) Tk. 28,350

(A) Tax liability

higher of (i) and (ii) Tk. 28,350

Calculation of eligible amount (lower of) Annexure-A

20% on total income 70,875

Actual investment -

or Cash 10,000,000

Eligible amount is -

Calculation of tax credit

Eligible amount Tk. - 15% -

- -

(B) Advance tax paid at source

Tax deducted at source u/s 52D Tk. 28,350

Total 28,350

(C) Balance tax payable u/s 74 (A-B) Tk. -

Signature of the Assessee

You might also like

- Managing Filipino Teams by Mike GroganDocument107 pagesManaging Filipino Teams by Mike GroganglycerilkayeNo ratings yet

- 2 Michel Thomas Spanish AdvancedDocument48 pages2 Michel Thomas Spanish Advancedsanjacarica100% (2)

- Mercruiser Service Manual #14 Alpha I Gen II Outdrives 1991-NewerDocument715 pagesMercruiser Service Manual #14 Alpha I Gen II Outdrives 1991-NewerM5Melo100% (10)

- Gymnastic Bodies Fundamentals GuideDocument17 pagesGymnastic Bodies Fundamentals GuideGianniNo ratings yet

- HRBlockDocument7 pagesHRBlocksusu ultra menNo ratings yet

- Victor Benji Wemh Intuit Tax ReturnDocument41 pagesVictor Benji Wemh Intuit Tax ReturnEmo RockstarNo ratings yet

- Detailed Lesson Plan in TLE VIIDocument3 pagesDetailed Lesson Plan in TLE VIIJose Nilo Pastorall70% (10)

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- 2023 Form 1040-SR. U.S. Tax Return For SeniorsDocument4 pages2023 Form 1040-SR. U.S. Tax Return For SeniorspatovoidNo ratings yet

- 2020FTFCS 2022-02-26 1645943726435Document5 pages2020FTFCS 2022-02-26 1645943726435Mark Bagliani100% (1)

- 2023 Tax Return: Prepared ByDocument14 pages2023 Tax Return: Prepared BypatovoidNo ratings yet

- 2023 Tax Return ZaireDocument14 pages2023 Tax Return ZairepatovoidNo ratings yet

- U.S. Individual Income Tax Return: John M Allen 5 2 7 7 3 7 2 3 0Document2 pagesU.S. Individual Income Tax Return: John M Allen 5 2 7 7 3 7 2 3 0marcel100% (1)

- Frantz Raymond TaxDocument1 pageFrantz Raymond Taxjoseph GRAND-PIERRENo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNo ratings yet

- 2022 Amended Tax Return Documents (Operation Vet Fit Inc)Document43 pages2022 Amended Tax Return Documents (Operation Vet Fit Inc)Daniel R. Gaita, MA, LMSWNo ratings yet

- Michael Easley 1040 2017Document2 pagesMichael Easley 1040 2017MichaelNo ratings yet

- Annie Frank Tax Return ProjectDocument10 pagesAnnie Frank Tax Return Projectapi-659042881No ratings yet

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- 2013 Tax Return (Shep-Ty DBA Embrace)Document24 pages2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNo ratings yet

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Document4 pagesCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNo ratings yet

- 2022 Schedule 3 (Form 1040)Document2 pages2022 Schedule 3 (Form 1040)Riley CareNo ratings yet

- FTF 2024-05-11 1715453284246Document4 pagesFTF 2024-05-11 1715453284246Brad Dorsey100% (1)

- 2020 TaxReturnDocument100 pages2020 TaxReturnmonty100% (1)

- 2017 TaxReturnDocument7 pages2017 TaxReturntripsrealplugNo ratings yet

- Beginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Document34 pagesBeginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Nancy GuerraNo ratings yet

- 1099 Form Year 2021Document8 pages1099 Form Year 2021Candy Valentine100% (1)

- NY CA 01-01-1953 9984 TXPRDocument98 pagesNY CA 01-01-1953 9984 TXPRAdmin OfficeNo ratings yet

- Fext 2022-04-17 1650241773772 PDFDocument2 pagesFext 2022-04-17 1650241773772 PDFFera PetersonNo ratings yet

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- FTF 2023-03-20 1679339077907Document15 pagesFTF 2023-03-20 1679339077907ayogbolo100% (1)

- LG FFDocument1 pageLG FFfeem743No ratings yet

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- U.S. Individual Income Tax Return: Standard DeductionDocument26 pagesU.S. Individual Income Tax Return: Standard Deductionnischal.khatri07No ratings yet

- Tax - 2020-2021 PDFDocument2 pagesTax - 2020-2021 PDFShanto ChowdhuryNo ratings yet

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogboloNo ratings yet

- FTFCS 2022-03-23 1648030351701Document15 pagesFTFCS 2022-03-23 1648030351701Charles Goodwin100% (2)

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- Agosto 11Document1 pageAgosto 11dakpi479No ratings yet

- Electronic Filing Instructions For Your 2016 Michigan Tax ReturnDocument4 pagesElectronic Filing Instructions For Your 2016 Michigan Tax Returngrace kruegerNo ratings yet

- Uniform Residential Loan Application: Section 1: Borrower InformationDocument12 pagesUniform Residential Loan Application: Section 1: Borrower InformationJuan C100% (1)

- LIBRO 9 Derecho RomanoDocument30 pagesLIBRO 9 Derecho RomanoDomingo VasquezNo ratings yet

- Sean 2022 Tax ReturnDocument18 pagesSean 2022 Tax Returnaaakinkumi115100% (1)

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- 2020 Donnarumma SH Form 1040 Individual Tax Return - RecordsDocument19 pages2020 Donnarumma SH Form 1040 Individual Tax Return - RecordsandyNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- Tax Return 2019Document26 pagesTax Return 2019Cash AppNo ratings yet

- 2020 Tax Return Documents (DERICK BROOKS A)Document2 pages2020 Tax Return Documents (DERICK BROOKS A)Patricia100% (2)

- 2009 Gibbs D Form 1040 Individual Tax Return Tax2009Document23 pages2009 Gibbs D Form 1040 Individual Tax Return Tax2009Jaqueline LeslieNo ratings yet

- FTF 2022-03-23 1648079099327Document14 pagesFTF 2022-03-23 1648079099327Charles Goodwin100% (1)

- Img 20220411 0006Document1 pageImg 20220411 0006herb flatherNo ratings yet

- 2007 Federal ReturnDocument2 pages2007 Federal ReturnbradybunnellNo ratings yet

- Square 2022 W-2Document2 pagesSquare 2022 W-2Zane CardinalNo ratings yet

- Sarah Paredes 21w2Document2 pagesSarah Paredes 21w2Sarah ParedesNo ratings yet

- Final Return For TARA PDFDocument8 pagesFinal Return For TARA PDFAnonymous NaYWx2vJN100% (1)

- Form PMT ACH Payment 2019: Joyson & Nisha Pekkattil 634-66-1347Document4 pagesForm PMT ACH Payment 2019: Joyson & Nisha Pekkattil 634-66-1347Joy100% (1)

- Tax ReturnDocument16 pagesTax ReturnHasan MahmoodNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- 2022 TaxReturnDocument9 pages2022 TaxReturnmicheelleeex3No ratings yet

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- 2022 23 Sample Return MaleDocument28 pages2022 23 Sample Return Malepk ghosh100% (1)

- To-Do List FormulaDocument1 pageTo-Do List FormulaPre MANo ratings yet

- Law and IT Assignment SEM IXDocument18 pagesLaw and IT Assignment SEM IXrenu tomarNo ratings yet

- University of WorcesterDocument8 pagesUniversity of WorcesterchhaiiNo ratings yet

- PethaDocument4 pagesPethaJeet RajNo ratings yet

- SAS Macro Tutorial ImpDocument27 pagesSAS Macro Tutorial ImpArijit DasNo ratings yet

- Ethiopian Health Systems and PolicyDocument81 pagesEthiopian Health Systems and PolicyFami Mohammed100% (2)

- Final English Presentation - FiskDocument8 pagesFinal English Presentation - FiskMary FreakyNo ratings yet

- Kennel Affix Application: Canine Club, Inc. For The Exclusive Use Ofthe Name ..........................................Document1 pageKennel Affix Application: Canine Club, Inc. For The Exclusive Use Ofthe Name ..........................................Dan GotandaNo ratings yet

- Study of A Housing ProjectDocument6 pagesStudy of A Housing ProjectIshraha100% (1)

- One Paper PS, GK & Islamiat MCQS 04-04-2021Document10 pagesOne Paper PS, GK & Islamiat MCQS 04-04-2021Raja NafeesNo ratings yet

- TheReader 2018-2019 Q1Document127 pagesTheReader 2018-2019 Q1Domitila RamosNo ratings yet

- OB - Lect4 - ch5Document19 pagesOB - Lect4 - ch5Nahed AbduallahNo ratings yet

- UIL Calculator Applications Study ListDocument7 pagesUIL Calculator Applications Study ListRocket FireNo ratings yet

- Formal Register. Consultative Register-Casual Register. Intimate RegisterDocument2 pagesFormal Register. Consultative Register-Casual Register. Intimate RegisterTobio KageyamaNo ratings yet

- Pediatric OrthopaedicDocument66 pagesPediatric OrthopaedicDhito RodriguezNo ratings yet

- Weight Tracking Chartv2 365days WeeklyDocument20 pagesWeight Tracking Chartv2 365days WeeklyozgegizemNo ratings yet

- Ling Jing Five Buddhist TemplesDocument120 pagesLing Jing Five Buddhist Templessrimahakala100% (1)

- Wedding Vows - What Do They Really MeanDocument28 pagesWedding Vows - What Do They Really Meanpsykosomatik0% (1)

- RA 020 Risk Assessment - Risk Assessment - Installation of Cables in Ducts & TrenchesDocument11 pagesRA 020 Risk Assessment - Risk Assessment - Installation of Cables in Ducts & Trenchesthomson100% (2)

- Public Administration - Meaning & Evolution - NotesDocument5 pagesPublic Administration - Meaning & Evolution - NotesSweet tripathiNo ratings yet

- About Fish Farming in GoaDocument5 pagesAbout Fish Farming in Goashashi891965No ratings yet

- Jersey Documentation 1.0.3 User GuideDocument35 pagesJersey Documentation 1.0.3 User Guidenaresh921No ratings yet

- Power Point Presentation About Modalds of Obligations.Document9 pagesPower Point Presentation About Modalds of Obligations.Sebastian Orjuela HerediaNo ratings yet

- SAE-J524, 525, 526, 365 Tubing Pressure RatingDocument1 pageSAE-J524, 525, 526, 365 Tubing Pressure RatingSamuel RochetteNo ratings yet

- Answer: The Measure of The Central Angles of An Equilateral TriangleDocument4 pagesAnswer: The Measure of The Central Angles of An Equilateral Trianglesunil_ibmNo ratings yet