Professional Documents

Culture Documents

Marie SJ Brief

Marie SJ Brief

Uploaded by

Maddie O'DoulCopyright:

Available Formats

You might also like

- Sample Affirmative Defenses and CounterclaimDocument34 pagesSample Affirmative Defenses and Counterclaimraymond_steinbrecher100% (2)

- Wrongful Foreclosure Complaint - GA StateDocument22 pagesWrongful Foreclosure Complaint - GA Statewekesamadzimoyo1100% (5)

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- GA Motion To Set Aside Wrongful Foreclosure SaleDocument30 pagesGA Motion To Set Aside Wrongful Foreclosure Salenilessorrell100% (2)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- .... HOME LOANS at HDFCDocument82 pages.... HOME LOANS at HDFCmoula nawaz33% (3)

- Simple Interest: Math WorksheetsDocument2 pagesSimple Interest: Math WorksheetsRenart LdsNo ratings yet

- Radiowealth Finance Company vs. Spouses Del RosarioDocument2 pagesRadiowealth Finance Company vs. Spouses Del RosarioApril Joy Fano BoreresNo ratings yet

- Malayan Banking BHD V Foo See MoiDocument3 pagesMalayan Banking BHD V Foo See MoizmblNo ratings yet

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- HP MTC Reply Brief (Redacted)Document9 pagesHP MTC Reply Brief (Redacted)Maddie O'DoulNo ratings yet

- Motion To Show CauseDocument8 pagesMotion To Show CauseForeclosure Fraud100% (1)

- Oblicon AssignmentDocument11 pagesOblicon AssignmentEunice EsteraNo ratings yet

- In Re Pigg (Plaintiff's Trial Brief)Document5 pagesIn Re Pigg (Plaintiff's Trial Brief)richdebtNo ratings yet

- Obligations and Contracts HWDocument22 pagesObligations and Contracts HWJessamyn DimalibotNo ratings yet

- Perlas-Bernabe, J.: Atty. Benigno T. Bartolome vs. Atty. Christopher A. BasilioDocument7 pagesPerlas-Bernabe, J.: Atty. Benigno T. Bartolome vs. Atty. Christopher A. BasilioAbi GailNo ratings yet

- Obli (V. F. Novation)Document189 pagesObli (V. F. Novation)Jess EstradaNo ratings yet

- National Union Fire Insurance Company of Pittsburgh, Pa. v. The United States Terre Haute First National BANK, Third PartyDocument6 pagesNational Union Fire Insurance Company of Pittsburgh, Pa. v. The United States Terre Haute First National BANK, Third PartyScribd Government DocsNo ratings yet

- Obli (V. F. Novation)Document189 pagesObli (V. F. Novation)Jess EstradaNo ratings yet

- ObjectionBACHomeLoansClaim 11 12Document3 pagesObjectionBACHomeLoansClaim 11 12GrammaWendyNo ratings yet

- Answer and Affirmative Defenses by GINGO 2Document11 pagesAnswer and Affirmative Defenses by GINGO 2wicholacayoNo ratings yet

- BANA Objection2 4 27 2012Document5 pagesBANA Objection2 4 27 2012GrammaWendy100% (1)

- Bognot vs. RRI Lending - G.R. No. 180144 - September 24, 2014Document16 pagesBognot vs. RRI Lending - G.R. No. 180144 - September 24, 2014Nikki BinsinNo ratings yet

- CA Matlock V JP Morgan ChaseDocument11 pagesCA Matlock V JP Morgan ChaseDonna EversNo ratings yet

- Case Digest Orient FreightDocument5 pagesCase Digest Orient Freightlessej.dimapilisNo ratings yet

- Post Trial OpinionDocument7 pagesPost Trial OpinionSteven SchainNo ratings yet

- Oblicon - 113. Bognot v. Rri Lending, G.R. No. 180144, Sept. 24, 2014Document4 pagesOblicon - 113. Bognot v. Rri Lending, G.R. No. 180144, Sept. 24, 2014Abdullah JulkanainNo ratings yet

- Doble V Deutsche BankDocument14 pagesDoble V Deutsche BankRobert SalzanoNo ratings yet

- Young v. Wells Fargo Bank, 1st Cir. (2013)Document35 pagesYoung v. Wells Fargo Bank, 1st Cir. (2013)Scribd Government DocsNo ratings yet

- Finnegan V Deutsche BankDocument2 pagesFinnegan V Deutsche BankdrattyNo ratings yet

- In Re Fagan Decision Granting Sanction 24 Sep 2007Document10 pagesIn Re Fagan Decision Granting Sanction 24 Sep 2007William A. Roper Jr.No ratings yet

- Cover Letter and Brief To Court For Foreclosure Defense 8-16-11Document3 pagesCover Letter and Brief To Court For Foreclosure Defense 8-16-11jack1929No ratings yet

- StanleymoskDocument9 pagesStanleymoskLEWISNo ratings yet

- Rejoinder AffidavitDocument10 pagesRejoinder AffidavitAntonio de VeraNo ratings yet

- Ong v. Roban Lending Corporation (G.R. No. 172592)Document11 pagesOng v. Roban Lending Corporation (G.R. No. 172592)aitoomuchtvNo ratings yet

- Lewis Wu v. Capital One NA, 3rd Cir. (2015)Document12 pagesLewis Wu v. Capital One NA, 3rd Cir. (2015)Scribd Government DocsNo ratings yet

- I. Payment A) Agner vs. BPI Family Savings Bank, Inc. (D) : Whether or Not There Was AnDocument5 pagesI. Payment A) Agner vs. BPI Family Savings Bank, Inc. (D) : Whether or Not There Was AnFrancis DiazNo ratings yet

- PLS' Resp To Def's MSJDocument178 pagesPLS' Resp To Def's MSJlwzeringueNo ratings yet

- Branch Banking Trust v. Camp, 4th Cir. (2002)Document5 pagesBranch Banking Trust v. Camp, 4th Cir. (2002)Scribd Government DocsNo ratings yet

- Bognot Vs RRI Lending CorporationDocument14 pagesBognot Vs RRI Lending CorporationEl G. Se ChengNo ratings yet

- Colinares and Veloso V CADocument2 pagesColinares and Veloso V CAHans Henly GomezNo ratings yet

- Huge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New CenturyDocument33 pagesHuge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New Century83jjmack0% (1)

- Swagman v. Court of AppealsDocument10 pagesSwagman v. Court of AppealsDayneee PolidarioNo ratings yet

- Title ViiDocument11 pagesTitle ViiELLANo ratings yet

- US Bankruptcy Court ComplaintDocument16 pagesUS Bankruptcy Court ComplaintJames LynchNo ratings yet

- FINAL - TN Porter Pro Se Complaint Against Aurora Loan Services and GMAC Homecomings 10-22-2010 OriginalDocument44 pagesFINAL - TN Porter Pro Se Complaint Against Aurora Loan Services and GMAC Homecomings 10-22-2010 OriginalLin PorterNo ratings yet

- Civil Procedure Digest 3Document10 pagesCivil Procedure Digest 3Neidine Angela FloresNo ratings yet

- Verified Motion To Set Aside The Default and Vacate The Trial Date With Attached Motion To DismissDocument38 pagesVerified Motion To Set Aside The Default and Vacate The Trial Date With Attached Motion To DismissBarry Eskanos100% (1)

- Weintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Document12 pagesWeintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Scribd Government DocsNo ratings yet

- Swagman Hotels and Travel Vs CADocument10 pagesSwagman Hotels and Travel Vs CAlanderNo ratings yet

- 4d11-3098.oplack of Notice AccellerationDocument3 pages4d11-3098.oplack of Notice AccellerationdavidNo ratings yet

- Iten v. County of Los Angeles, No. 22-55480 (9th Cir. Aug. 30, 2023)Document28 pagesIten v. County of Los Angeles, No. 22-55480 (9th Cir. Aug. 30, 2023)RHTNo ratings yet

- Case Digest - Week 3 - Mutuum, Cases 1,2,3,4,5,6,7,8,10Document9 pagesCase Digest - Week 3 - Mutuum, Cases 1,2,3,4,5,6,7,8,10Anonymous b4ycWuoIcNo ratings yet

- Bank Sued For CFPB Regulation E 12 CRF 1005 Provisional Credit Violation + Discovery DemandsDocument30 pagesBank Sued For CFPB Regulation E 12 CRF 1005 Provisional Credit Violation + Discovery Demandschristopher king100% (1)

- Third DivisionDocument3 pagesThird DivisionHank ParkNo ratings yet

- BPI v. CA PDFDocument8 pagesBPI v. CA PDFBLACK mambaNo ratings yet

- Victor YAM and Yek Sun Lent V CA and ManPhil InvestmentDocument2 pagesVictor YAM and Yek Sun Lent V CA and ManPhil InvestmentKenneth Peter MolaveNo ratings yet

- Joint ObligationDocument10 pagesJoint ObligationRigine Pobe MorgadezNo ratings yet

- 1.cebu International V. Ca 316 SCRA 488Document9 pages1.cebu International V. Ca 316 SCRA 488Rhena SaranzaNo ratings yet

- Swagman v. CADocument2 pagesSwagman v. CAAira Marie M. AndalNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- ACS MemoDocument5 pagesACS MemoMaddie O'DoulNo ratings yet

- Titanium Dioxide MemoDocument13 pagesTitanium Dioxide MemoMaddie O'DoulNo ratings yet

- Giles v. Phelan Hallinan & Schmieg and Wells Fargo Bank, N.A., Amended Complaint Filed 12.9.11Document93 pagesGiles v. Phelan Hallinan & Schmieg and Wells Fargo Bank, N.A., Amended Complaint Filed 12.9.11Maddie O'DoulNo ratings yet

- Chocolate Industry MemoDocument17 pagesChocolate Industry MemoMaddie O'DoulNo ratings yet

- WFB Opp 2.20.13 As FiledDocument46 pagesWFB Opp 2.20.13 As FiledMaddie O'DoulNo ratings yet

- MMA Jurisd Briefs I and II (Redacted)Document60 pagesMMA Jurisd Briefs I and II (Redacted)Maddie O'DoulNo ratings yet

- EPDM SJ Opposition (Redacted)Document76 pagesEPDM SJ Opposition (Redacted)Maddie O'DoulNo ratings yet

- Phelan Complaint3.25.09 As FiledDocument30 pagesPhelan Complaint3.25.09 As FiledMaddie O'DoulNo ratings yet

- Sample Phelan Foreclosure Case P.O. BriefDocument11 pagesSample Phelan Foreclosure Case P.O. BriefMaddie O'DoulNo ratings yet

- Settlement Between The United States of America and Steven J. BaumDocument12 pagesSettlement Between The United States of America and Steven J. BaumForeclosure FraudNo ratings yet

- Kamala Harris CA Withdrawal 10.1.11Document4 pagesKamala Harris CA Withdrawal 10.1.11Maddie O'DoulNo ratings yet

- PHS 3rd Cir Brief 12.6.10Document57 pagesPHS 3rd Cir Brief 12.6.10Maddie O'DoulNo ratings yet

- Acuña V VelosoDocument2 pagesAcuña V VelosocharmdelmoNo ratings yet

- Chapter 2 2 Risk Structure and Term Structure of Interest RatesDocument38 pagesChapter 2 2 Risk Structure and Term Structure of Interest RatesLâm BullsNo ratings yet

- Drill 2 - Working Capital & Current Liabilities - ANSWERSDocument7 pagesDrill 2 - Working Capital & Current Liabilities - ANSWERSStanly ChanNo ratings yet

- UntitledDocument2 pagesUntitledElise Smoll (Elise)No ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableDonna ValentinNo ratings yet

- AkuntansiDocument46 pagesAkuntansiRo Untoro ToroNo ratings yet

- FIN 4 Data File - Loan Amortization TableDocument5 pagesFIN 4 Data File - Loan Amortization TableAndyTomasNo ratings yet

- FR Question Paper 1 MAY 2017Document16 pagesFR Question Paper 1 MAY 2017MBaralNo ratings yet

- Agreement Contract Form of MR Pelletier StephaneDocument2 pagesAgreement Contract Form of MR Pelletier StephaneJimmy CaptailNo ratings yet

- Latihan Bahasa Inggris SmaDocument226 pagesLatihan Bahasa Inggris SmaCausalia Sitha100% (1)

- What Does International Fisher EffectDocument3 pagesWhat Does International Fisher EffectGauri JainNo ratings yet

- Fair Value of The Property: Partner's Drawing, DebitDocument12 pagesFair Value of The Property: Partner's Drawing, DebitAera GarcesNo ratings yet

- Sip Report On Punjab National BankDocument75 pagesSip Report On Punjab National BankIshaan YadavNo ratings yet

- Inflation, Perspective Bangladesh: A Trend Analysis Since IndependenceDocument16 pagesInflation, Perspective Bangladesh: A Trend Analysis Since Independencemsuddin76No ratings yet

- Business PlanDocument69 pagesBusiness PlanPolycarp SifunaNo ratings yet

- Pidswp 9302Document37 pagesPidswp 9302cNo ratings yet

- Union of India UOI and Ors Vs MP Trading and InvesSC20150110151128383COM403081Document2 pagesUnion of India UOI and Ors Vs MP Trading and InvesSC20150110151128383COM403081Simone JainNo ratings yet

- Math Reflective Writing - Mortgage LabDocument4 pagesMath Reflective Writing - Mortgage LabJacob AndersonNo ratings yet

- Mock Test 8 Paper 2 PDFDocument21 pagesMock Test 8 Paper 2 PDFHung SarahNo ratings yet

- Financing and Structuring Power Projects in NigeriaDocument62 pagesFinancing and Structuring Power Projects in NigeriapastorgeeNo ratings yet

- Oil Scams Guide PDFDocument46 pagesOil Scams Guide PDFarjunmadan1No ratings yet

- Simple and Compound InterestDocument8 pagesSimple and Compound InterestMari Carreon TulioNo ratings yet

- Draft IM - PAL Onshore Bond-05Jul2020Document99 pagesDraft IM - PAL Onshore Bond-05Jul2020Zahed IbrahimNo ratings yet

- Profitability Analysis of Selected Nationalised Banks in India - March - 2014 - 1598851865 - 05Document5 pagesProfitability Analysis of Selected Nationalised Banks in India - March - 2014 - 1598851865 - 05mukherjeeprity52No ratings yet

- Engineering Economy and AccountingDocument143 pagesEngineering Economy and AccountingDan Mitchelle CanoNo ratings yet

- Simple Interest Formula Excel ExamplesDocument7 pagesSimple Interest Formula Excel ExamplesUmamaheswara ReddyNo ratings yet

- 12 - Squatting and Slum Dwelling in Metropolitan ManilaDocument15 pages12 - Squatting and Slum Dwelling in Metropolitan ManilaArtYSONNo ratings yet

- Monetary Policy and Central Banking in The PhilippinesDocument29 pagesMonetary Policy and Central Banking in The PhilippinesYogun BayonaNo ratings yet

Marie SJ Brief

Marie SJ Brief

Uploaded by

Maddie O'DoulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marie SJ Brief

Marie SJ Brief

Uploaded by

Maddie O'DoulCopyright:

Available Formats

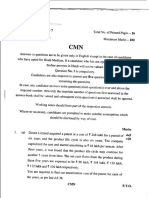

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 1 of 15

UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF PENNSYLVANIA

MARIA V ASSALOTTI aka MARIE MCBRIDE, Plaintiff

FEB 1 7

'- q;

f"\ .,".,

v.

Civil Action No.: 08-5574 WELLS FARGO BANK, N.A. Dba AMERICA'S SERVICING COMPANY Defendant

MEMORANDUM OF LAW OF PLAINTIFF

IN SUPPORT OF HER RESPONSE TO

DEFENDANT'S MOTION FOR SUMMARY JUDGMENT

1.

INTRODUCTION

I became delinquent on my mortgage and foreclosure action was brought against by

Defendant in August 2007. Defendant sent me a letter about workout solutions to avoid foreclosure listing four different optional programs including the loan mod program which was described as adding the delinquent interest, taxes, and/or insurance to the unpaid balance and extending repayment of past due amounts over the remaining loan term. Exhibit A, attached. I was approved for a loan mod. The loan mod package arrived on January 10, 2008 and I signed the agreement and sent the paperwork. and required $S ~ 120.3S "contribution check" back to Defendant immediately so that they could cancel the Sheriff's sale which was scheduled for January 18, 2008. During the time I had waiting to hear from Defendant if a loan mod was possible, I was also consulting a bankruptcy attorney, David Black, Esq. I was struggling financially from my divorce and I was trying to do whatever I could to be able to afford

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 2 of 15

to keep the house for me and my sons. The bankruptcy was filed after I executed the loan mod and the modifications papers were given to the bankruptcy trustee. Bankruptcy for me was personally humiliating and demeaning and was a low point in my life but that combined with an affordable loan mod was the only way that I would be able to keep my house. Defendant ignored the loan mod agreement despite accepting the contribution payment and my first two scheduled monthly payments. In April 2008, Defendant told me I had no loan mod in place and I was delinquent and late fees were continuing to accrue. I then agreed to do another loan mod to take the place of the first one that they had, as they later admitted to, "inadvertently placed on hold". The whole purpose of my agreeing to a loan modification with Defendant was for me to be able to keep my house with a modified payment that I could afford. Included in the terms of the loan mod were monthly amounts for principal, interest, and required escrow payment for a total new monthly payment of$3,019.31. Notably, there was no reference to any other deficient monies that would be addressed or charged at a later time. I signed LM2 on May 22,2008 and mailed the first payment on June 27,2008 in the amount of$3,019.31. On July 8,2008, I received Defendant's mortgage statement which increased my payment to $4,078.08 because they were now charging my for the pre-loan mod delinquent taxes they had represented would be included in the loan mod agreement and which I would have no further obligation on. I could not afford a payment of $4,078.08 and I would never have agreed to that. Defendant sent me a letter dated August 10, 2008 stating that my account was seriously delinquent and sent an Act 91 foreclosure notice dated October 5,2008 stating they intended to foreclose on my house.

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 3 of 15

I retained counsel in November and filed suit against Defendant in December 2008.

II. DISPUTES TO DEFENDANT'S STATEMENT OF MATERIAL FACTS A: Plaintiff's Default on the Mort&aae Loan

1. In 2005, I refinanced my property to cash out some equity to not only repay credit card bills as Defendant states but also to payoff a home equity line of credit that had been used for new siding, windows, and a garage addition to my house. Vassalotti Dep.2S:12-21 with Errata page, Exhibit F, attached. Subsequent to that, I did a no cash out refinance through WMC mortgage to transfer title from my husband and myself to myself at the beginning of my divorce case. This mortgage was at some later point sold to a security trust and was then serviced by Defendant. 2. I began missing payments in 2007 contrary to Defendant's statement that it was shortly after the cash-out refinance that I defaulted on the loan. My finances had become seriously strained after my divorce. Defendant wrongly attempts to paint me in a negative light by stating that I had cashed out a lot of money then immediately defaulted.

B: Plaintiff's First Loan Modification

3. I received a letter from Defendant dated August 21,2007 describing options to resolve my mortgage deficiency including a loan mod program that would add the delinquent interest and taxes into the unpaid balance and extend the repayment ofthe past due amounts over the remaining terms of the loan .. Exhibit A. Defendant's Loan Modification package arrived at my home on January 10, 2008 which included the approval letter stating the specific terms ofthe new loan mod payments which Defendant fails to mention here. Exhibit B, attached. I signed it and had it notarized immediately

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 4 of 15

and mailed it back that same day because Defendant wouldn't cancel the sheriff sale scheduled for January 18, 2008 until they had my signed package and contribution check.

C: Plaintiff's Bankruptcy

4. I had been consulting with my bankruptcy attorney, David Black throughout the process of a workout solution with Defendant. It was to my benefit to obtain a loan mod from Defendant rather than have it go through bankruptcy court because Defendant offered to convert my 9.65% adjustable rate which was due to adjust to 12.65% in January to a fixed 9.65% rate. Mr. Black waited to file the bankruptcy petition until after I sent him a copy of the loan mod agreement I had signed with Defendant. Also, it was our intent to file the petition prior to the Sheriff Sale date of January 18, 2008 in case Defendant had not discontinued that action yet.

D: Plaintiff's Second Loan Modification

5. It was not a result of the bankruptcy that Defendant offered me a second loan mod. It was because of Defendant's breach ofLMI that they offered me LM2. I made timely payments in accordance with LMI and Defendant accepted these payments in March and April 2008. Defendant admits they "inadvertently placed LM 1 on hold" Exhibit E, attached. 6. LM 2 contained terms beyond what Defendant states in their memorandum of law, particularly including a required escrow payment. See Defendant's Memorandum of law, p. 3 #11, p. 3 #12. The terms ofLM 2 were detailed on the approval letter accompanying the loan mod package stating that the new principal and interest payment is $2,691.86 and the required escrow payment is $327.45. Exhibit C, attached. Defendant's letter to me dated November 17,2007 tells me that their loan modification program adds the

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 5 of 15

delinquent interest, taxes, and/or insurance payments to my unpaid balance, Exhibit D, attached. The loan mod did not state that any amounts deficient at the time of the loan mod would be charged after the loan mod was in place.

DI. LEGAL STANDARD

A court should grant summary judgment only where the record shows that there is a genuine issue as to any material fact and the moving party is entitled to judgment as a matter oflaw. Fed. R. Civ. P. 56. A factual dispute is genuine if a reasonable jury could return a verdict for the non-movant, and it is material if, under the substantive law, it would affect the outcome ofthe suit. Anderson v. Liberty Lobby, In.c" 477 U.S. 242,248 (1986). Ideal Dairy Fanns, Inc. v. John Labatt, Ltd., 90 F.3d 737, 743 (3d Cir. 1996). The court must accept as true all well-pleaded facts in the non-moving party's pleadings, as well as admissions on file, giving them the benefit of all reasonable inferences to be drawn there from. Hankin v. Mintz, 276 Pa. Superior Ct. 538,419 A.2d 588 (1980); Ritmanich v Jonnell Enterprises Inc., 219 Pa Superior Ct. 198,280 A 2d 570 (1971). Because material fact disputes preclude the entry of summary judgment against me, Defendant's motion should be denied.

IV. ARGUMENT

A. Defendant is in Breach of Contract The material facts at issue are the essential facts that must be alleged for this action: there was a contract, the Defendant breached it, I performed my contractual duties, and I suffered damages from the breach. Frederico v. Home Depot, 507 F-3d 188, 203 (3d Cir. 2007). Defendant did breach the Loan ModI agreement and later admitted they had "inadvertently put the loan modification on hold". Exhibit E, attached. Further,

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 6 of 15

Defendant erroneously applied monies from my "contribution check" and the first two timely payments to the pre-mod mortgage deficiencies contrary to the loan mod agreement which kept the mortgage in default. Defendant argues I am estopped from asserting a breach of contract claim based on LMI. However, the party asserting estoppel bears the burden of proof on each element of estoppel, International Union v. Skinner Engine Co., 188 F.3d 130 (1990). The Breach of Contract claim in Count II of the Second Amended Complaint was filed by my previous counsel which I incorporated only by reference into the Third Amended Complaint that I filed on January 4, 2010 and which should have stated claims in Breach of Contract on both LMI and LM2. Although the claim against LM2 was omitted, it does not negate the claim against LMI and Summary Judgment should be denied.

B. Defendant is in violation of the Fair Credit Reporting

My claim for Defendant's violation of the Fair Credit Reporting Act claim is based on violation of 15 U.S.C. section 1681s-2B(b). Contrary to Defendant's statement that the Third Amended Complaint contains no allegations that Defendant was contacted by a CRA or furnish information to a CRA, paragraphs 4 and 5 of Count IV of the Third Amended Complain establish:

1. I contacted the CRA's in writing to do an investigation on this dispute. 2. The CRA's responded with the results of their investigation that Defendant had verified the (inaccurate) information. 3. Defendant refused to rectify the disputed charges.

See Exhibit K.

Thus, I have met the required elements to allege Defendant's violation ofFCRA See Jaramillo v. Experian Info. Solutions. 155 F. Supp. 2d 356,362-63 (B.D. Pa. 2001).

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 7 of 15

Defendant further argues that they cannot be held negligent in complying with section 1681s-2(b) in investigating my dispute with the CRAs because their reporting my mortgage loan as "discharged in bankruptcy" is accurate. Both of my loan mods constituted reaffirmation agreements and timely payments on both loan mods were paid by me and accepted by Defendant. The mortgage was never overseen by the trustee nor foreclosed on nor discharged or "forgiven" in the bankruptcy Whereas factual disputes exist, Summary Judgment is inappropriate. See Reeves v. Equiax Info. Serv., LLC, 2010 U.S. Dist. Lexis 5024 (S.D. Miss.May 20,2010). Thus, Summary Judgment should be denied.

C. Defendant is in violation of the Unfair Trade Practice and Consumer

Protection Law.

My claim for Defendant's violation ofUTPCPL is a claim under the "catch all" provision of the Unfair Trade Practices and Consumer Protection Law, 73 P.S. 201 2(4)(xxi) that a person violates the UTPCPL by engaging in any other fraudulent or deceptive conduct which creates a likelihood of confusion or of misunderstanding, that justified reliance was placed on that misrepresentation, and that the reliance caused loss. Hunt v. United States Tobacco Co., 538F.2d 217, 219 (3d Cir.2008). At issue is whether or not the Defendant's letters and the loan mod agreements were deceptive and if I was justified in placing reliance on them to sign the agreements. In fact, the Defendant did engage in fraudulent or deceptive conduct by sending me a specific letter representing their loan mod program as adding the deficient interest and taxes to the new loan and attaching a formal approval letter with the loan mod package itself stating the new terms included a required escrow payment and, further, not

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 8 of 15

disclosing that I would later be obligated on any amounts that were deficient at the time of the loan mod. I relied on those documents to sign the loan mod. These are material omissions and deceptive representations. See Craftmatic Securities Litigation v. Kraftsow, 890 F.2d 628 (3 ed Cir.1990) citing TSC Industries v. Northway, Inc .. 426 US. 438, 449 (1976). My reliance on these documents was justified and Defendant is not, under Pennsylvania law, entitled to summary judgment in Consumer Protection Law action where genuine issue of fact existed in regard to my reliance. See. Toy v. Metro. Life Ins. Co., 593 Pa.20, 928 A.2d 186,208 (Pa.Sup.Ct.2007). Fisher, 320 B.R. 52

(E.D.Pa. 2005) (citing Fav v. Erie Ins Group, 723 A.2d 712, 714 (Pa.Sup. 1999). When Defendant subsequently charged me for a pre-mod tax deficiency contrary to the modified new monthly payment which we had agreed on, I was unable to pay the additional amounts and Defendant called my loan in default and initiated foreclosure proceedings. For the above states reasons, Defendant's motion for summary judgment should be denied. 1. The November 17, 2007 letter was deceptive and my reliance on this letter along with the stated terms on the rormal approval letter was justified. Defendant's statement that their letter to me dated November 17, 2007, Exhibit D, was not deceptive and that my reliance on it to state the terms of my loan modification is completely inaccurate. Defendant misstates when they say "Plaintiff states that she executed LM1 in reliance on the terms of a November 14, 2007 generic letter from Wells Fargo to Plaintiff.". See Defendant's Memorandum of Law p. 11. I relied on that November 17, 2007 letter as a specific description of what Defendant's loan modification program entailed particularly that their loan modification program adds the delinquent

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 9 of 15

taxes to my unpaid balance. My reliance on what the terms of the loan mod were the documents in the actual loan mod package itself stating the terms specifically as the new principal, interest, and escrow payments. Exhibit B. Defendant's assertions that I relied on a "generic" letter is misleading. See Defendant's Memorandum of Law p. 11-12. This letter was not generic. It was specifically addressed to me, included my loan number, and was in response to my contact with Defendant on a workout solution to prevent foreclosure of my home. Further, the letter was accompanied by a financial application with a deadline date for completion of the application. This letter was not generic but rather very specific to me, to my current situation, and to which program I could be approved for pending my financial application. Defendant then wrongly states that I sought to "transform the generic letter into a binding contract". See Defendant's Memorandum of Law p. 12 par. 1. I admitted at my deposition that I did not believe this letter to be a binding contract but rather a description oftheir loan mod program. Vassalotti Dep. 41: 16-22. This letter stated in plain text that the loan mod program" adds the delinquent interest, taxes, and/or insurance payments to your unpaid balance if applicable". Since there were delinquent interest and taxes on my loan as stated in Defendant's foreclosure judgment against me, they were applicable. I filled out their application that was attached with the letter and was subsequently approved for a loan Defendant's assertions regarding the use of the words and/or in the November 17, 2007 are incorrect. See Defendant's Memorandum ofLaw, p. 12 par. 2. The use of "and/or" in the sentence did not establish that ifI met the criteria for a loan mod, the

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 10 of 15

Defendant may capitalize one or more of those delinquent amounts. The words "and/or" refer to delinquent taxes and/or delinquent insurance amounts, whichever or both that were delinquent. My taxes were delinquent. My insurance was not delinquent as Defendant never had advanced any insurance amounts on my behalf Therefore, the word "or" was applicable to me rather than the word "and" meaning that delinquent taxes would be added to the unpaid balance. My reliance on the November 17, 2007 that the Defendant's loan mod program adds the delinquent interest and taxes to the unpaid balance and extend the repayment of the past due amounts over the remaining term of my loan is justified as it was clearly stated in the letter representing its own loan mod program. Therefore, the letter is deceptive and my reliance on it is justified.

2. LM 1 is deceptive and my reliance on the approval letter which accompanied it stating the terms of the loan mod is justified.

Defendant misstates what constituted the loan mod. In their Exhibit G which they purport to be LMI in its entirety, Defendant leaves out the first page of the loan mod package which was the formal approval letter detailing the terms of the loan mod. Defendant now calls this the "transmittal letter" . Defendant then attempts to confuse by stating that "LM 1 does not state the amount of any monthly escrow payments ..". Whereas, in fact, this formal approval letter which was the first stapled page ofthe loan mod package clearly details the terms ofthe loan mod including an escrow payment of $327.45. See Exhibit B. Defendant goes on to wrongfully state that I admitted during my deposition testimony that "the plain text ofLM 1 indicates that Wells Fargo did not waive Plaintiff's escrow deficiency and Plaintiff continued to be liable for repayment escrow amounts advanced

10

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 11 of 15

on her behalf'. First, Defendant never asked me directly about being liable for repayment of escrow amounts advanced. Vassalotti Dep. 52:24-53:1-6. Exhibit F. Defendant's exact question was "This document does not state that Wells Fargo or America's Servicing Company is waiving any amounts that are owed to them, including the escrow amounts that were due?". My exact answer in the deposition was "Correct. It's supposed to include all of them". Vassalotti Dep. 53:5-6. Nowhere in the loan mod did it state that I would have further obligation to pay any amounts that were deficient at the time ofthe loan mod. Since I relied on the clearly stated terms including the required escrow payment and monthly payment to agree to and sign the loan mod, the loan mod was also deceptive. Defendant also states that my claims of relying on the terms written in the loan mod in assuming the escrow deficiency was included in LM 1 (See Third Amended Complaint, par.l3) is incorrect. They argue that the actual terms ofLM 1 are the new monthly principal and interest payment with no stated monthly escrow payment. However, the new escrow payment was clearly stated to be $322.03. They further argue that the paragraph below taken from the loan mod specifically states that I am obligated to repay the escrow deficiency after signing the loan mod: Borrower also will comply with all covenants, agreements, and requirements ofthe security instrument, including without limitation, Borrower's covenant and agreements to make all payments of taxes, insurance premiums, assessments, escrow items, impounds, and all other payments that Borrower is obligated to make under the Security Instrument ...

This paragraph does not state that I am obligated to further pay any escrow deficiency In fact, I believe this paragraph refers to the original security instrument dated December 1,2005 that I signed with WMC mortgage and which the loan mod is amending. Again,

11

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 12 of 15

the tenns of the loan mod were clearly stated in the approval letter that was the first page ofthe loan mod package which included the amount ofthe new monthly escrow payment. Defendant wrongfully argues that additional pages in the package contained all of the tenns including my obligation to repay any escrow deficiency then due. In fact, the words "escrow deficiency" do not appear anywhere in the entire package nor is there any reference to any further obligation on my part to pay an escrow deficiency then due Defendant again states that the approval letter in the loan mod package is a "transmittal letter" and "is not part ofLM1 and merely states certain of its tenns ... ". See Defendant's Memorandum ofLaw p. 14. However, the approval letter accompanying the loan mod package stated all ofthe tenns of my new loan mod payment including the contribution amount required and the new principal, interest, and escrow payments. Thus, I was fully justified in relying on those stated tenns to agree and sign the loan mod. Therefore, for the reasons stated above, LM1 is deceptive and my reliance on the tenns stated on the approval letter is justified.

3. LM2 is deceptive and my reliance on the approval letter accompany it stating the terms of the loan mod is justified.

Defendant attaches as their LM2 exhibit only two pages out of the entire LM2 package that I received yet they admit that "certain of the terms ofLMl are stated on a cover letter included with the loan modification". See Plaintiff's Admissions to Defendant #12, attached as Exhibit J. While Defendant calls this a "transmittal letter", it is the fonnal approval letter, similar to that ofLMl that was the cover letter within the loan mod package. I was justified in relying on the approval letter because it fully outlined all of the tenns of the loan mod including initial contribution amount, new

12

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 13 of 15

principal, interest, and required escrow payment, new rate, modified term, and due date of first payment. Defendant refers to a paragraph within the loan mod stating that "nothing in this Agreement shall be understood or construed to be a satisfaction or release, in whole or in part ofthe Borrower's obligations under the Note or Mortgage". Defendant says this means that my "escrow deficiency remained outstanding". This paragraph, in fact, does not state or refer to my escrow deficiency remaining outstanding. Similar to LM 1, it refers to the covenants in the original security instrument dated December 1, 2005 which the loan mod is amending. Defendant wrongly states that "the proposed monthly payment clearly included only principal and interest and specifically states that is does not include any escrow deposit". See Defendant Memorandum of Law: p. 15. Whereas, the actual terms of the loan mod are stated as follows: 1. 2. 3. 4. 5. 6. Due date of first payment: New principal and interest payment amount: Required escrow payment based on previous analysis: Estimated new net payment: Modified maturity date: Interest rate:

07/01/2008 $2,691.86 $327.45 $3,019.31 12/0112035 9.650%

As with LMl, the terms ofLM2 are clearly stated as to my required escrow payment. Nowhere in LM2 does Defendant state that I have any further obligation to pay any other deficiencies including an escrow deficiency owing at the time ofthe agreement. I signed the Loan Mod on May 22,2008 and mailed the first payment on June 27, 2008 in the amount of $3,019.31. On July 8, 2008, I received Defendant's mortgage statements stating there was an overdue payment owing from 07/01/08 in the amount of $4,078.08 which Defendant admits. Exhibit J: Plaintiff's Request for Admissions #24,

Exhibit H: mortgage statements. This was contrary to the agreement as it increased my

13

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 14 of 15

payment because they were now charging my for the pre-loan mod delinquent taxes they had represented to be included in the loan mod agreement and for which I would have no further obligation. Therefore, LM2 is deceptive. I could not afford a payment of $4,078.08 and I would never have agreed to that. Defendant then sent me a letter dated August 10,2008 stating that my account was seriously delinquent. Exhibit G. In October sent an Act 91 foreclosure notice stating they intended to foreclose on my house. Exhibit I, attached. Defendant next argues that because it is dated May 10, 2008 and I signed the agreement on May 22, 2008 that it was not part ofthe loan mod package. See Defendant's Memorandum of Law p. 15. Defendant separates it from the loan mod in their exhibit, whereas, in fact, similar to loan LM 1, the approval letter was the first stapled page ofthe entire loan mod package and did not arrive under separate cover. Defendant continues to call this document a "transmittal letter" , whereas, this document reads "This letter will confirm the formal approval of a loan modification/restructure of your mortgage loan". My reliance on this approval letter detailing the terms of my new payment amounts and not disclosing any further obligation on any other deficient monies owing is fully justified. Therefore, LM 2 is deceptive and I relied on it along with the Defendant's description of its loan mod program to sign the agreement. Thus, for these reasons as well as the reasons discussed above, Defendant is in violation of my claims under UTPCPL because they engaged in deceptive conduct which created a likelihood of confusion or misunderstanding and I justifiably relied on the alleged deceptive conduct to my detriment. Therefore, Summary Judgment should be denied.

14

Case 2:08-cv-05574-AB Document 60-1

Filed 02/17/11 Page 15 of 15

v.

CONCLUSION

For the foregoing reasons, material facts are disputed on all counts and Plaintiff requests the Court to deny Defendant's Motion for Summary Judgment on all counts.

Respectfully submitted, Dated: February 15, 2011

Marie Vassalotti 521 Paxon Hollow Road Broomall, P A 19008 610-353-3904 Pro Se Plaintiff

You might also like

- Sample Affirmative Defenses and CounterclaimDocument34 pagesSample Affirmative Defenses and Counterclaimraymond_steinbrecher100% (2)

- Wrongful Foreclosure Complaint - GA StateDocument22 pagesWrongful Foreclosure Complaint - GA Statewekesamadzimoyo1100% (5)

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- GA Motion To Set Aside Wrongful Foreclosure SaleDocument30 pagesGA Motion To Set Aside Wrongful Foreclosure Salenilessorrell100% (2)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- .... HOME LOANS at HDFCDocument82 pages.... HOME LOANS at HDFCmoula nawaz33% (3)

- Simple Interest: Math WorksheetsDocument2 pagesSimple Interest: Math WorksheetsRenart LdsNo ratings yet

- Radiowealth Finance Company vs. Spouses Del RosarioDocument2 pagesRadiowealth Finance Company vs. Spouses Del RosarioApril Joy Fano BoreresNo ratings yet

- Malayan Banking BHD V Foo See MoiDocument3 pagesMalayan Banking BHD V Foo See MoizmblNo ratings yet

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- HP MTC Reply Brief (Redacted)Document9 pagesHP MTC Reply Brief (Redacted)Maddie O'DoulNo ratings yet

- Motion To Show CauseDocument8 pagesMotion To Show CauseForeclosure Fraud100% (1)

- Oblicon AssignmentDocument11 pagesOblicon AssignmentEunice EsteraNo ratings yet

- In Re Pigg (Plaintiff's Trial Brief)Document5 pagesIn Re Pigg (Plaintiff's Trial Brief)richdebtNo ratings yet

- Obligations and Contracts HWDocument22 pagesObligations and Contracts HWJessamyn DimalibotNo ratings yet

- Perlas-Bernabe, J.: Atty. Benigno T. Bartolome vs. Atty. Christopher A. BasilioDocument7 pagesPerlas-Bernabe, J.: Atty. Benigno T. Bartolome vs. Atty. Christopher A. BasilioAbi GailNo ratings yet

- Obli (V. F. Novation)Document189 pagesObli (V. F. Novation)Jess EstradaNo ratings yet

- National Union Fire Insurance Company of Pittsburgh, Pa. v. The United States Terre Haute First National BANK, Third PartyDocument6 pagesNational Union Fire Insurance Company of Pittsburgh, Pa. v. The United States Terre Haute First National BANK, Third PartyScribd Government DocsNo ratings yet

- Obli (V. F. Novation)Document189 pagesObli (V. F. Novation)Jess EstradaNo ratings yet

- ObjectionBACHomeLoansClaim 11 12Document3 pagesObjectionBACHomeLoansClaim 11 12GrammaWendyNo ratings yet

- Answer and Affirmative Defenses by GINGO 2Document11 pagesAnswer and Affirmative Defenses by GINGO 2wicholacayoNo ratings yet

- BANA Objection2 4 27 2012Document5 pagesBANA Objection2 4 27 2012GrammaWendy100% (1)

- Bognot vs. RRI Lending - G.R. No. 180144 - September 24, 2014Document16 pagesBognot vs. RRI Lending - G.R. No. 180144 - September 24, 2014Nikki BinsinNo ratings yet

- CA Matlock V JP Morgan ChaseDocument11 pagesCA Matlock V JP Morgan ChaseDonna EversNo ratings yet

- Case Digest Orient FreightDocument5 pagesCase Digest Orient Freightlessej.dimapilisNo ratings yet

- Post Trial OpinionDocument7 pagesPost Trial OpinionSteven SchainNo ratings yet

- Oblicon - 113. Bognot v. Rri Lending, G.R. No. 180144, Sept. 24, 2014Document4 pagesOblicon - 113. Bognot v. Rri Lending, G.R. No. 180144, Sept. 24, 2014Abdullah JulkanainNo ratings yet

- Doble V Deutsche BankDocument14 pagesDoble V Deutsche BankRobert SalzanoNo ratings yet

- Young v. Wells Fargo Bank, 1st Cir. (2013)Document35 pagesYoung v. Wells Fargo Bank, 1st Cir. (2013)Scribd Government DocsNo ratings yet

- Finnegan V Deutsche BankDocument2 pagesFinnegan V Deutsche BankdrattyNo ratings yet

- In Re Fagan Decision Granting Sanction 24 Sep 2007Document10 pagesIn Re Fagan Decision Granting Sanction 24 Sep 2007William A. Roper Jr.No ratings yet

- Cover Letter and Brief To Court For Foreclosure Defense 8-16-11Document3 pagesCover Letter and Brief To Court For Foreclosure Defense 8-16-11jack1929No ratings yet

- StanleymoskDocument9 pagesStanleymoskLEWISNo ratings yet

- Rejoinder AffidavitDocument10 pagesRejoinder AffidavitAntonio de VeraNo ratings yet

- Ong v. Roban Lending Corporation (G.R. No. 172592)Document11 pagesOng v. Roban Lending Corporation (G.R. No. 172592)aitoomuchtvNo ratings yet

- Lewis Wu v. Capital One NA, 3rd Cir. (2015)Document12 pagesLewis Wu v. Capital One NA, 3rd Cir. (2015)Scribd Government DocsNo ratings yet

- I. Payment A) Agner vs. BPI Family Savings Bank, Inc. (D) : Whether or Not There Was AnDocument5 pagesI. Payment A) Agner vs. BPI Family Savings Bank, Inc. (D) : Whether or Not There Was AnFrancis DiazNo ratings yet

- PLS' Resp To Def's MSJDocument178 pagesPLS' Resp To Def's MSJlwzeringueNo ratings yet

- Branch Banking Trust v. Camp, 4th Cir. (2002)Document5 pagesBranch Banking Trust v. Camp, 4th Cir. (2002)Scribd Government DocsNo ratings yet

- Bognot Vs RRI Lending CorporationDocument14 pagesBognot Vs RRI Lending CorporationEl G. Se ChengNo ratings yet

- Colinares and Veloso V CADocument2 pagesColinares and Veloso V CAHans Henly GomezNo ratings yet

- Huge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New CenturyDocument33 pagesHuge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New Century83jjmack0% (1)

- Swagman v. Court of AppealsDocument10 pagesSwagman v. Court of AppealsDayneee PolidarioNo ratings yet

- Title ViiDocument11 pagesTitle ViiELLANo ratings yet

- US Bankruptcy Court ComplaintDocument16 pagesUS Bankruptcy Court ComplaintJames LynchNo ratings yet

- FINAL - TN Porter Pro Se Complaint Against Aurora Loan Services and GMAC Homecomings 10-22-2010 OriginalDocument44 pagesFINAL - TN Porter Pro Se Complaint Against Aurora Loan Services and GMAC Homecomings 10-22-2010 OriginalLin PorterNo ratings yet

- Civil Procedure Digest 3Document10 pagesCivil Procedure Digest 3Neidine Angela FloresNo ratings yet

- Verified Motion To Set Aside The Default and Vacate The Trial Date With Attached Motion To DismissDocument38 pagesVerified Motion To Set Aside The Default and Vacate The Trial Date With Attached Motion To DismissBarry Eskanos100% (1)

- Weintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Document12 pagesWeintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Scribd Government DocsNo ratings yet

- Swagman Hotels and Travel Vs CADocument10 pagesSwagman Hotels and Travel Vs CAlanderNo ratings yet

- 4d11-3098.oplack of Notice AccellerationDocument3 pages4d11-3098.oplack of Notice AccellerationdavidNo ratings yet

- Iten v. County of Los Angeles, No. 22-55480 (9th Cir. Aug. 30, 2023)Document28 pagesIten v. County of Los Angeles, No. 22-55480 (9th Cir. Aug. 30, 2023)RHTNo ratings yet

- Case Digest - Week 3 - Mutuum, Cases 1,2,3,4,5,6,7,8,10Document9 pagesCase Digest - Week 3 - Mutuum, Cases 1,2,3,4,5,6,7,8,10Anonymous b4ycWuoIcNo ratings yet

- Bank Sued For CFPB Regulation E 12 CRF 1005 Provisional Credit Violation + Discovery DemandsDocument30 pagesBank Sued For CFPB Regulation E 12 CRF 1005 Provisional Credit Violation + Discovery Demandschristopher king100% (1)

- Third DivisionDocument3 pagesThird DivisionHank ParkNo ratings yet

- BPI v. CA PDFDocument8 pagesBPI v. CA PDFBLACK mambaNo ratings yet

- Victor YAM and Yek Sun Lent V CA and ManPhil InvestmentDocument2 pagesVictor YAM and Yek Sun Lent V CA and ManPhil InvestmentKenneth Peter MolaveNo ratings yet

- Joint ObligationDocument10 pagesJoint ObligationRigine Pobe MorgadezNo ratings yet

- 1.cebu International V. Ca 316 SCRA 488Document9 pages1.cebu International V. Ca 316 SCRA 488Rhena SaranzaNo ratings yet

- Swagman v. CADocument2 pagesSwagman v. CAAira Marie M. AndalNo ratings yet

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)From EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)No ratings yet

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- ACS MemoDocument5 pagesACS MemoMaddie O'DoulNo ratings yet

- Titanium Dioxide MemoDocument13 pagesTitanium Dioxide MemoMaddie O'DoulNo ratings yet

- Giles v. Phelan Hallinan & Schmieg and Wells Fargo Bank, N.A., Amended Complaint Filed 12.9.11Document93 pagesGiles v. Phelan Hallinan & Schmieg and Wells Fargo Bank, N.A., Amended Complaint Filed 12.9.11Maddie O'DoulNo ratings yet

- Chocolate Industry MemoDocument17 pagesChocolate Industry MemoMaddie O'DoulNo ratings yet

- WFB Opp 2.20.13 As FiledDocument46 pagesWFB Opp 2.20.13 As FiledMaddie O'DoulNo ratings yet

- MMA Jurisd Briefs I and II (Redacted)Document60 pagesMMA Jurisd Briefs I and II (Redacted)Maddie O'DoulNo ratings yet

- EPDM SJ Opposition (Redacted)Document76 pagesEPDM SJ Opposition (Redacted)Maddie O'DoulNo ratings yet

- Phelan Complaint3.25.09 As FiledDocument30 pagesPhelan Complaint3.25.09 As FiledMaddie O'DoulNo ratings yet

- Sample Phelan Foreclosure Case P.O. BriefDocument11 pagesSample Phelan Foreclosure Case P.O. BriefMaddie O'DoulNo ratings yet

- Settlement Between The United States of America and Steven J. BaumDocument12 pagesSettlement Between The United States of America and Steven J. BaumForeclosure FraudNo ratings yet

- Kamala Harris CA Withdrawal 10.1.11Document4 pagesKamala Harris CA Withdrawal 10.1.11Maddie O'DoulNo ratings yet

- PHS 3rd Cir Brief 12.6.10Document57 pagesPHS 3rd Cir Brief 12.6.10Maddie O'DoulNo ratings yet

- Acuña V VelosoDocument2 pagesAcuña V VelosocharmdelmoNo ratings yet

- Chapter 2 2 Risk Structure and Term Structure of Interest RatesDocument38 pagesChapter 2 2 Risk Structure and Term Structure of Interest RatesLâm BullsNo ratings yet

- Drill 2 - Working Capital & Current Liabilities - ANSWERSDocument7 pagesDrill 2 - Working Capital & Current Liabilities - ANSWERSStanly ChanNo ratings yet

- UntitledDocument2 pagesUntitledElise Smoll (Elise)No ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableDonna ValentinNo ratings yet

- AkuntansiDocument46 pagesAkuntansiRo Untoro ToroNo ratings yet

- FIN 4 Data File - Loan Amortization TableDocument5 pagesFIN 4 Data File - Loan Amortization TableAndyTomasNo ratings yet

- FR Question Paper 1 MAY 2017Document16 pagesFR Question Paper 1 MAY 2017MBaralNo ratings yet

- Agreement Contract Form of MR Pelletier StephaneDocument2 pagesAgreement Contract Form of MR Pelletier StephaneJimmy CaptailNo ratings yet

- Latihan Bahasa Inggris SmaDocument226 pagesLatihan Bahasa Inggris SmaCausalia Sitha100% (1)

- What Does International Fisher EffectDocument3 pagesWhat Does International Fisher EffectGauri JainNo ratings yet

- Fair Value of The Property: Partner's Drawing, DebitDocument12 pagesFair Value of The Property: Partner's Drawing, DebitAera GarcesNo ratings yet

- Sip Report On Punjab National BankDocument75 pagesSip Report On Punjab National BankIshaan YadavNo ratings yet

- Inflation, Perspective Bangladesh: A Trend Analysis Since IndependenceDocument16 pagesInflation, Perspective Bangladesh: A Trend Analysis Since Independencemsuddin76No ratings yet

- Business PlanDocument69 pagesBusiness PlanPolycarp SifunaNo ratings yet

- Pidswp 9302Document37 pagesPidswp 9302cNo ratings yet

- Union of India UOI and Ors Vs MP Trading and InvesSC20150110151128383COM403081Document2 pagesUnion of India UOI and Ors Vs MP Trading and InvesSC20150110151128383COM403081Simone JainNo ratings yet

- Math Reflective Writing - Mortgage LabDocument4 pagesMath Reflective Writing - Mortgage LabJacob AndersonNo ratings yet

- Mock Test 8 Paper 2 PDFDocument21 pagesMock Test 8 Paper 2 PDFHung SarahNo ratings yet

- Financing and Structuring Power Projects in NigeriaDocument62 pagesFinancing and Structuring Power Projects in NigeriapastorgeeNo ratings yet

- Oil Scams Guide PDFDocument46 pagesOil Scams Guide PDFarjunmadan1No ratings yet

- Simple and Compound InterestDocument8 pagesSimple and Compound InterestMari Carreon TulioNo ratings yet

- Draft IM - PAL Onshore Bond-05Jul2020Document99 pagesDraft IM - PAL Onshore Bond-05Jul2020Zahed IbrahimNo ratings yet

- Profitability Analysis of Selected Nationalised Banks in India - March - 2014 - 1598851865 - 05Document5 pagesProfitability Analysis of Selected Nationalised Banks in India - March - 2014 - 1598851865 - 05mukherjeeprity52No ratings yet

- Engineering Economy and AccountingDocument143 pagesEngineering Economy and AccountingDan Mitchelle CanoNo ratings yet

- Simple Interest Formula Excel ExamplesDocument7 pagesSimple Interest Formula Excel ExamplesUmamaheswara ReddyNo ratings yet

- 12 - Squatting and Slum Dwelling in Metropolitan ManilaDocument15 pages12 - Squatting and Slum Dwelling in Metropolitan ManilaArtYSONNo ratings yet

- Monetary Policy and Central Banking in The PhilippinesDocument29 pagesMonetary Policy and Central Banking in The PhilippinesYogun BayonaNo ratings yet