Professional Documents

Culture Documents

1 A. Levy of Gst-Sheet 2-Hw

1 A. Levy of Gst-Sheet 2-Hw

Uploaded by

Naoh HarryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 A. Levy of Gst-Sheet 2-Hw

1 A. Levy of Gst-Sheet 2-Hw

Uploaded by

Naoh HarryCopyright:

Available Formats

GST-LEVY OF TAX-LONG SUM

1] Mr. A of Pune supplied goods for Rs 2,00,000 to Mr. B of Mumbai. GST rate is

18%. (a) Find total price charged by Mr. A (b) Who is liable to pay GST?

2] Mr. B of Mangalore supplied services for Rs 5,00,000 to Mr.C of Hyderabad. GST

rate is 12%. (a) Find total GST payable? (b) Who is liable to pay GST?

The Union Territory GST is applied to union territories of India namely Chandigarh,

Lakshadweep, Daman and Diu, Dadra and Nagar Haveli, Andaman and Nicobar

Islands.

3] Mr. C of Daman & Diu supplied goods worth Rs 3,00,000 to Mr. D of Daman &

Diu. GST rate is 28% (a) Find GST payable? (b) Who is liable to pay GST?

4] Mr. D of Ahmedabad supplied goods for Rs 2,00,000 to Mr. B of Baroda and

Services supplied to Mr. of Ahmedabad worth Rs. 3,00,000. GST rate is 18%.(a) Find

GST payable?(b) Who is liable to pay GST?

5] Mr. E of Orissa supplied services for Rs 5,00,000 to Mr.C of Hyderabad and to Mr.

D of Assam worth Rs 3,50,000. GST rate is 12%. (a) Find total GST payable? (b)

Who is liable to pay GST?

6] Mr. F of Daman & Diu supplied goods worth Rs 3,00,000 to Mr. D of Daman &

Diu and services worth Rs 4,00,000 to Mr. E of Daman. GST rate is 28% (a) Find

GST payable? (b) Who is liable to pay GST?

Input Tax Credit or ITC is the tax that a business pays on a purchase and that it can

use to reduce its tax liability when it makes a sale. In other words, businesses can

reduce their tax liability by claiming credit to the extent of GST paid on purchases.

7] Mr. G of Amravati supplied goods for Rs 4,00,000 to Mr. X of Solapur and

Services supplied to Mr. Y of Pune worth Rs. 5,00,000 Mr. G also purchased goods

from Solapur suppler worth Rs.2,50,000 GST rate is 18%. (a) Find Net GST payable?

(b) Who is liable to pay GST?

8] Mr.H of Jabalpur(MP) supplied services for Rs 670,000 to Mr. P of Porbandar

(Gujarat) and to Mr Q of Assam worth Rs 850,000.

Mr H also purchased goods from Rajasthan suppler worth Rs. 450,000 Gst rate is

12%. (a) Find total GST payable? (b) Who is liable to pay GST?

9] Mr. IX of Andaman & Nicobar Islands supplied goods worth Rs 6,80,000 to Mr.JP

of Andaman and services worth Rs 7,00,000 to Mr. YN of Nicobar.

Mr. IX also purchased goods from supplier of Andaman worth Rs 5,70,000. GST rate

is 28% (a) Find GST payable? (b) Who is liable to pay GST?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Vision Font SentencesDocument1 pageVision Font SentencesNaoh HarryNo ratings yet

- Ser - NO SR - No Team Rank Name V-1 Ser - NO: Sports Shoes Formal Shoes T-Shirts Shorts Lo Wer Jeans TrouserDocument4 pagesSer - NO SR - No Team Rank Name V-1 Ser - NO: Sports Shoes Formal Shoes T-Shirts Shorts Lo Wer Jeans TrouserNaoh HarryNo ratings yet

- Dtax TYBMSDocument2 pagesDtax TYBMSNaoh HarryNo ratings yet

- Legal Status: Simon Chesterman David M MaloneDocument3 pagesLegal Status: Simon Chesterman David M MaloneNaoh HarryNo ratings yet

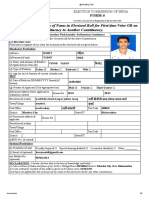

- Application For Inclusion of Name in Electoral Roll For First Time Voter OR On Shifting From One Constituency To Another ConstituencyDocument2 pagesApplication For Inclusion of Name in Electoral Roll For First Time Voter OR On Shifting From One Constituency To Another ConstituencyNaoh HarryNo ratings yet

- Notice-Tentative Exam DatesDocument1 pageNotice-Tentative Exam DatesNaoh HarryNo ratings yet

- 2022 Drik Panchang Hindu Festivals v1.0.0Document11 pages2022 Drik Panchang Hindu Festivals v1.0.0Naoh HarryNo ratings yet

- Starting Your Own Business: The Entrepreneurship AlternativeDocument16 pagesStarting Your Own Business: The Entrepreneurship AlternativeNaoh HarryNo ratings yet

- Lala Lajpatrai College of Commerce & Economics: Nss UnitDocument5 pagesLala Lajpatrai College of Commerce & Economics: Nss UnitNaoh HarryNo ratings yet

- 1610106168communication SkillsDocument23 pages1610106168communication SkillsNaoh HarryNo ratings yet

- Q 5 TOS When Movement of Goods & Payment Is Also InvolvedDocument3 pagesQ 5 TOS When Movement of Goods & Payment Is Also InvolvedNaoh HarryNo ratings yet

- Step 1: Please Visit The Portal Link Given BelowDocument2 pagesStep 1: Please Visit The Portal Link Given BelowNaoh HarryNo ratings yet