Professional Documents

Culture Documents

Definition of INCOME Under Income Tax (Section 2 (24) )

Definition of INCOME Under Income Tax (Section 2 (24) )

Uploaded by

deepak sharma0 ratings0% found this document useful (0 votes)

48 views7 pagesSection 5 and Section 6 of the Income Tax Act of 1961 define the scope of income and the criteria for determining residential status in India for income tax purposes. Section 5 states that the total income of a person includes all income received or deemed to be received in India, as well as income that accrues or arises in India. Section 6 provides the criteria for determining if an individual is considered a resident of India, including the number of days spent in India within a year or over a four year period. Refunds due are addressed under Sections 237-245, including the form of refund claims, limitation periods, interest due on delayed refunds, and adjustment of refunds against outstanding tax demands.

Original Description:

impo topic

Original Title

Income Tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSection 5 and Section 6 of the Income Tax Act of 1961 define the scope of income and the criteria for determining residential status in India for income tax purposes. Section 5 states that the total income of a person includes all income received or deemed to be received in India, as well as income that accrues or arises in India. Section 6 provides the criteria for determining if an individual is considered a resident of India, including the number of days spent in India within a year or over a four year period. Refunds due are addressed under Sections 237-245, including the form of refund claims, limitation periods, interest due on delayed refunds, and adjustment of refunds against outstanding tax demands.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

48 views7 pagesDefinition of INCOME Under Income Tax (Section 2 (24) )

Definition of INCOME Under Income Tax (Section 2 (24) )

Uploaded by

deepak sharmaSection 5 and Section 6 of the Income Tax Act of 1961 define the scope of income and the criteria for determining residential status in India for income tax purposes. Section 5 states that the total income of a person includes all income received or deemed to be received in India, as well as income that accrues or arises in India. Section 6 provides the criteria for determining if an individual is considered a resident of India, including the number of days spent in India within a year or over a four year period. Refunds due are addressed under Sections 237-245, including the form of refund claims, limitation periods, interest due on delayed refunds, and adjustment of refunds against outstanding tax demands.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

Definition of INCOME Section 2(7) in The

under Income Tax Income- Tax Act, 1995--

[Section 2(24)]-- The (7) " assessee" means a

definition given u/s person by whom 3 any

2(24) is inclusive and not tax] or any other sum of

exhaustive. According to money is payable under

English dictionary, the this Act, and includes-

term income means (a) every person in

“periodical receipts from respect of whom any

one ‘s business, land, proceeding under this

work, investments etc. Act has been taken for

The term income simply the assessment of his

means something which income or of the income

comes in. It is a of any other person in

periodical return with respect of which he is

regularity or expected assessable, or of the loss

regularity. It’s nowhere sustained by him or by

mentioned that income such other person, or of

refers to only monetary the amount of refund

return. It includes value due to him or to such

of benefits and other person;

perquisites. Any thing (b) every person who is

which can reasonably deemed to be an

and properly be assessee under any

described as income is provision of this Act;

taxable under this Act (c) every person who is

unless specifically deemed to be an

exempted under the assessee in default

various provisions of this under any provision of

Act.”Income includes :1 this Act

Profits and gains 2 What is Section 2 22

Dividend 3Voluntary of income tax?Income

Contributions received Tax Act's Section 2(22)e.

by a trust. 4 Any sum As per Section 2(22)e,

chargeable to tax u/s 28 when a closely held

(iiia) 5 Any sum company, gives a loan

chargeable to tax u/s or extends an advance

28(iiib) 6 Any sum to the respective

chargeable to tax u/s 28 personnel: A

(iiic) 7 The value of any shareholder who holds a

benefit or perquisite minimum of 10 per cent

taxable under section 28 of the voting rights, and

(iv) 8 Any capital gain is the beneficial owner

taxable under section 45 of shares. Sec (22) "

dividend" includes-

(a) any distribution by a

company of

accumulated profits,

(b) any distribution to its

shareholders by a

company of

debentures(c) any

distribution made to the

shareholders of a

company on its

liquidation(d) any

distribution to its

shareholders by a

company on the

reduction of its

capital(e) any payment

by a company

under S.2(23) of the Section 56 in The

Income Tax Act: Income- Tax Act, 1995

Meaning of the terms 56. Income from other

‘Partner’, ‘Partnership’ & sources 1

‘Firm’ a) Definition of (1) Income of every kind

‘Firm’ – S.2(23)(i) Income which is not to be

Tax--As per S.2(23)(i) of excluded from the total

the Income Tax Act, income under this Act

1961, unless the context shall be chargeable to

otherwise requires, the income- tax under the

term “firm” shall have head" Income from

the meaning assigned to other sources", if it is

it in the Indian not chargeable to

Partnership Act, 1932 (9 income- tax under any

of 1932), and shall of the heads specified in

include a limited liability section 14, items A to E.

partnership as defined in (2) In particular, and

the Limited Liability without prejudice to the

Partnership Act, 2008 (6 generality of the

of 2009). provisions of sub-

b) Definition of ‘Partner’ section (1), the

– S.2(23)(ii) Income Tax following income shall

As per S.2(23)(ii) of be chargeable to

Income Tax Act, 1961, income- tax under the

unless the context head" Income from

otherwise requires, the other sources", namely:-

term “partner” c) (i) dividends; (ii) income

Definition of Partnership from machinery, plant

– S.2(23)(iii) Income Tax or furniture belonging

As per S.2(23)(iii) of to the assessee and let

Income Tax Act, 1961, on hire

unless the context

otherwise requires, the

term “partnership

Section 6- Residence in Section 5- Scope of

India – Income Tax Act, income – Income Tax

1961 6. [1] An individual Act, 1961 5. [1] the total

is said to be resident in income of any previous

India in any previous year of a person who is

year, if he— [a] is in a resident includes all

India in that year for a income from whatever

period or periods source derived which—

amounting in all to one [a] is received or is

hundred and eighty-two deemed to be received

days or more ; or [b] in India in such year by

having within the four or on behalf of such

years preceding that person ; or [b] accrues

year been in India for a or arises or is deemed to

period or periods accrue or arise to him in

amounting in all to three India during such year ;

hundred and sixty-five or [c] accrues or arises

days or more, AND is in to him outside India

India for a period or during such year :

periods amounting in all Provided that, in the

to sixty days or more in case of a person not

that year. ordinarily resident in

India within the

Refunds Person entitled meaning of sub-section

to claim refund in [6] of section 6, the

certain special cases and income which accrues or

Form of claim for refund arises to him outside

and limitation are India shall not be so

defined under section included unless it is

237, 238 and 239 of derived from a business

Income Tax Act 1961. controlled in or a

Provisions under these profession set up in

Sections are :Section 237 India

of Income Tax Act

"Refunds"--- 237. If any

person satisfies the 240 "Refund on appeal,

Assessing Officer that etc" Where, as a result

the amount of tax paid of any order passed in

by him or on his behalf appeal or other

or treated as paid by him proceeding under this

or on his behalf for any Act, refund of any

assessment year exceeds amount becomes due to

the amount with which the assessee

he is properly 242 "Correctness of

chargeable under this assessment not to be

Act for that year, he questioned"

shall be entitled to a 243 of Income Tax Act

refund of the excess. "Interest on delayed

238. "Person entitled to refunds"--243. (1) If the

claim refund in certain Assessing Officer does

special cases (1) Where not grant the refund,-

the income of one 244A(1)(a), an assessee

person is included under is entitled to receive

any provision of this Act interest on refund out of

in the total income of any tax collected at

any other person, the source, t ax deducted at

latter alone shall be source or advance tax

entitled to a refund paid from the 1st day of

under this Chapter in April of the assessment

respect of such income year to the date on

239. Form of claim for which the refund is

refund and limitation granted

(1) Every claim for 245 of the Income Tax

refund under this Act empowers the

Chapter shall be assessing officer (AO) to

made 3[by adjust the refund (or a

furnishing return in part of the refund)

against any tax demand

accordance with the that is outstanding from

provisions of the taxpayer. In simple

section 139] words, the IT

13A: SPECIAL PROVISION department wants to

RELATING TO INCOMES adjust the refund due

OF POLITICAL PARTIES against a demand due

Any income of a political from you.

party which is Section 10 of Income

chargeable under the Tax Act, 1961 includes

head “Income from such income that does

house property” or not form part of the

“Income from other total income while

sources” or “Capital calculating the total tax

Gains” or “any income liability of any person

by way of voluntary The agricultural

contributions” received income is exempt from

by a political party from tax under section 10(1)

any person shall '10A. Special provision

in respect of newly

established industrial

undertakings in free

trade zones

You might also like

- Construction Kickoff Meeting AgendaDocument3 pagesConstruction Kickoff Meeting AgendaTrajce StojanovNo ratings yet

- UCO Reporter 2022, March Edition, February 27, 2022Document44 pagesUCO Reporter 2022, March Edition, February 27, 2022ucopresidentNo ratings yet

- Keyman Insurance Policy-White PaperDocument12 pagesKeyman Insurance Policy-White PaperbeingviswaNo ratings yet

- Basic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, DsnluDocument47 pagesBasic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliNo ratings yet

- Tax Treatment of Dividend ReceivedDocument8 pagesTax Treatment of Dividend ReceivedAnanth DivakaruniNo ratings yet

- Taxs Law ExamDocument15 pagesTaxs Law ExamSaif AliNo ratings yet

- 2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveDocument24 pages2 (9) of The Income Tax Act, 1961, Unless The Context Otherwise Requires, The Term 'Assessment Year' Means The Period of TwelveAlezNo ratings yet

- Law of Taxation NotesDocument49 pagesLaw of Taxation NotesBhoomika SinghNo ratings yet

- LAPD IntR in 2012 09 Arc 11 IN9 Issue 4 Archived On 14 October 2009Document17 pagesLAPD IntR in 2012 09 Arc 11 IN9 Issue 4 Archived On 14 October 2009sibiyazukiswa27No ratings yet

- Income Form Other Sources-9Document10 pagesIncome Form Other Sources-9s4sahith50% (2)

- The Diploma in International Taxation - Relevant Treaty ArticlesDocument20 pagesThe Diploma in International Taxation - Relevant Treaty ArticlesMAHESH JAINNo ratings yet

- UntitledDocument92 pagesUntitledPawandeep SinghNo ratings yet

- Basic Concepts of TaxDocument6 pagesBasic Concepts of TaxAshutosh Dubey AshuNo ratings yet

- LLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsDocument133 pagesLLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsTahaNo ratings yet

- 52640bosfinal p6c Maynov19 Cp2Document120 pages52640bosfinal p6c Maynov19 Cp2SHASWAT DROLIANo ratings yet

- Basic Concepts of Income Tax ActDocument14 pagesBasic Concepts of Income Tax ActRaghu CkNo ratings yet

- Unit-1: Basic Concepts and Framework of Income Tax Act, 1961Document40 pagesUnit-1: Basic Concepts and Framework of Income Tax Act, 1961Saurab JainNo ratings yet

- Income Tax NotesDocument37 pagesIncome Tax Notesgeegostral chhabraNo ratings yet

- Topic 1 IncomeDocument17 pagesTopic 1 IncomeVikram VermaNo ratings yet

- Defination 2 (1-67)Document4 pagesDefination 2 (1-67)AtiaTahiraNo ratings yet

- Week - 3Document6 pagesWeek - 3Vijayant DalalNo ratings yet

- Income Tax: V SemesterDocument17 pagesIncome Tax: V SemesterAnzum anzumNo ratings yet

- Tax 2Document8 pagesTax 2arshithgowda01No ratings yet

- Dr. P. Sree Sudha, Associate Professor, DsnluDocument47 pagesDr. P. Sree Sudha, Associate Professor, Dsnluammu arellaNo ratings yet

- Non Resident Taxation: After Studying This Chapter, You Will Be Able ToDocument136 pagesNon Resident Taxation: After Studying This Chapter, You Will Be Able ToAtul AgrawalNo ratings yet

- DT 4Document29 pagesDT 4Charu JagetiaNo ratings yet

- Index: Income From Other SourcesDocument41 pagesIndex: Income From Other Sourcesnaveed30No ratings yet

- Return of IncomeDocument18 pagesReturn of IncomeTania SharmaNo ratings yet

- Lecture Synopsis-2 For Overall Discussion On Principles of TaxationDocument8 pagesLecture Synopsis-2 For Overall Discussion On Principles of TaxationProgga MehnazNo ratings yet

- Adobe Scan 09-Nov-2023Document5 pagesAdobe Scan 09-Nov-2023james17stevensNo ratings yet

- Section-10: Income Exempt From TaxDocument21 pagesSection-10: Income Exempt From TaxJitendra VernekarNo ratings yet

- Tax Credits 61. Charitable Donations.Document15 pagesTax Credits 61. Charitable Donations.Siddiqui Muhammad AshfaqueNo ratings yet

- 49.income From Other SourcesDocument11 pages49.income From Other Sourcespratapnirbhay0551No ratings yet

- Taxguru - in-TaxGuru Consultancy Amp Online Publication LLPDocument30 pagesTaxguru - in-TaxGuru Consultancy Amp Online Publication LLPPrathamesh PawarNo ratings yet

- INCOMEDocument12 pagesINCOMEaviralmittuNo ratings yet

- Section-10: Income Exempt From TaxDocument21 pagesSection-10: Income Exempt From TaxRakesh SharmaNo ratings yet

- Topic - 1 - Taxation - Notes by Legal Lab OfficialDocument16 pagesTopic - 1 - Taxation - Notes by Legal Lab OfficialGourav KumarNo ratings yet

- Introduction To BD Income TaxDocument34 pagesIntroduction To BD Income TaxShajid HassanNo ratings yet

- Income Exempt From TaxDocument20 pagesIncome Exempt From TaxSaad AliNo ratings yet

- Declaration and Payment On DividendDocument12 pagesDeclaration and Payment On DividendChiranjeev RoutrayNo ratings yet

- Section - 36Document5 pagesSection - 36adipawar2824No ratings yet

- GST Weekly Update - 45 - 2023-24Document5 pagesGST Weekly Update - 45 - 2023-24guptaharshit2204No ratings yet

- Income Tax Act, 2010Document160 pagesIncome Tax Act, 2010ils2006No ratings yet

- A Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingDocument12 pagesA Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingSipoy SatishNo ratings yet

- 2.11 Relevant Statutory Definations and Important ConceftsDocument4 pages2.11 Relevant Statutory Definations and Important Conceftsavi dottoNo ratings yet

- Bonus Act 65Document14 pagesBonus Act 65Ayush BankarNo ratings yet

- Section 40Document4 pagesSection 40Anil MathewNo ratings yet

- Additional Reading For Franking AccountDocument9 pagesAdditional Reading For Franking Accountfuturepatent20No ratings yet

- An Act To Consolidate and Amend The Law Relating To Income-Tax and Super-TaxDocument20 pagesAn Act To Consolidate and Amend The Law Relating To Income-Tax and Super-TaxdravayNo ratings yet

- Chapter 10Document8 pagesChapter 10Faizan razaNo ratings yet

- S - Viii: Bba - LL.B (Hons) Corporate LawsDocument20 pagesS - Viii: Bba - LL.B (Hons) Corporate LawsSalonee NayakNo ratings yet

- Payment of Bonus Act, 1965Document17 pagesPayment of Bonus Act, 1965Milani NarulaNo ratings yet

- G R KartikeyanDocument8 pagesG R KartikeyanAnkitaSinghNo ratings yet

- Income Tax AmendmentsDocument15 pagesIncome Tax AmendmentsHitarth shahNo ratings yet

- In Come Tax 1979Document247 pagesIn Come Tax 1979Salman MalikNo ratings yet

- Unit 1Document35 pagesUnit 1Monika SaxenaNo ratings yet

- Corporate Law Dividend CSRDocument8 pagesCorporate Law Dividend CSRGulshan KashyapNo ratings yet

- Liquidation of Companies PDFDocument8 pagesLiquidation of Companies PDFTippanna GodiNo ratings yet

- Prof Ca S P Desai Important Definitions: Assessee (Section 2 (7) )Document10 pagesProf Ca S P Desai Important Definitions: Assessee (Section 2 (7) )Jay SangoiNo ratings yet

- Taxation Ions B1Document8 pagesTaxation Ions B1Saurabh SanjayNo ratings yet

- Interpretation OF STATUTEDocument35 pagesInterpretation OF STATUTEdeepak sharmaNo ratings yet

- Public International LawDocument13 pagesPublic International Lawdeepak sharmaNo ratings yet

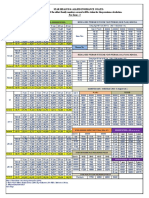

- Zone - 3 Rate With Tax 18 (Rev 1Document1 pageZone - 3 Rate With Tax 18 (Rev 1deepak sharmaNo ratings yet

- Common - Proposal Form Health Policy StarDocument4 pagesCommon - Proposal Form Health Policy Stardeepak sharmaNo ratings yet

- Product Detail Sheet: 3/4" Palnut Type LocknutDocument3 pagesProduct Detail Sheet: 3/4" Palnut Type LocknutthorenNo ratings yet

- DHL Strategy ModelDocument59 pagesDHL Strategy Modelfssankar100% (12)

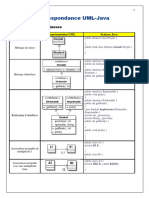

- 8 - Correspondance UML-JAVADocument3 pages8 - Correspondance UML-JAVAoussama sfiriNo ratings yet

- Input Data Required For Pipe Stress AnalysisDocument4 pagesInput Data Required For Pipe Stress Analysisnor azman ab aziz100% (1)

- Dynamic Simulation of A Crude Oil DistillationDocument14 pagesDynamic Simulation of A Crude Oil DistillationAL-JABERI SADEQ AMEEN ABDO / UPMNo ratings yet

- 3 Odometer DisclosureDocument1 page3 Odometer DisclosureJuan Carlos MartinezNo ratings yet

- Turbine Blade Shop-Block 3 BhelDocument40 pagesTurbine Blade Shop-Block 3 Bheldeepak GuptaNo ratings yet

- 3 Simpson Wickelgren (2007) Naked Exclusion Efficient Breach and Downstream Competition1Document10 pages3 Simpson Wickelgren (2007) Naked Exclusion Efficient Breach and Downstream Competition1211257No ratings yet

- Business Plan DETAILDocument4 pagesBusiness Plan DETAILAnnabelle Poniente HertezNo ratings yet

- Brochure E-Catalogue Afias (Temporer)Document2 pagesBrochure E-Catalogue Afias (Temporer)Pandu Satriyo NegoroNo ratings yet

- Service Quality, Customer Satisfaction, and Behavioral Intentions in Fast-Food RestaurantsDocument19 pagesService Quality, Customer Satisfaction, and Behavioral Intentions in Fast-Food RestaurantsFelisitas AgnesNo ratings yet

- Artikel Sardi SantosaDocument18 pagesArtikel Sardi SantosaSardi Santosa NastahNo ratings yet

- Ruwanpura Expressway Design ProjectDocument5 pagesRuwanpura Expressway Design ProjectMuhammadh MANo ratings yet

- SDL 11Document14 pagesSDL 11Sharmila BalaNo ratings yet

- 001 2012 4 b-3Document114 pages001 2012 4 b-3dikahunguNo ratings yet

- IMS JRDocument4 pagesIMS JRRyoNo ratings yet

- AC ResidentialDocument18 pagesAC ResidentialHiten VadkareNo ratings yet

- Guidelines - In-Hospital ResuscitationDocument18 pagesGuidelines - In-Hospital ResuscitationparuNo ratings yet

- Mr. Anil Wanarse PatilDocument29 pagesMr. Anil Wanarse PatilANIL INTERAVIONNo ratings yet

- Anaesthetic Considerations in Polytrauma PatientsDocument8 pagesAnaesthetic Considerations in Polytrauma PatientsMileidys LopezNo ratings yet

- Data Communication and Networking Prelims ExamDocument7 pagesData Communication and Networking Prelims ExamSagarAnchalkarNo ratings yet

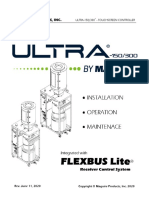

- Ultra 150 300 Ts FileDocument136 pagesUltra 150 300 Ts FileEmanuel GutierrezNo ratings yet

- Government Led Joint Assessment in Conflict Affected Districts of Xarardheere & Ceel DheerDocument9 pagesGovernment Led Joint Assessment in Conflict Affected Districts of Xarardheere & Ceel DheerBarre Moulid ShuqulNo ratings yet

- 3l/epublit of Tbe Bilippine9': Supreme !courtDocument15 pages3l/epublit of Tbe Bilippine9': Supreme !courtCesar ValeraNo ratings yet

- Dr. N.P SheteDocument28 pagesDr. N.P SheteMD Noyon IslamNo ratings yet

- Code On Wages 2019, 2Document9 pagesCode On Wages 2019, 2Saxena M.No ratings yet

- Profile: NR Technoserve Pvt. Ltd. 2016 - PresentDocument2 pagesProfile: NR Technoserve Pvt. Ltd. 2016 - PresentSuvam MohapatraNo ratings yet

- Math ResearchDocument4 pagesMath ResearchRaja AliNo ratings yet