Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsCMA - Omprakash Sahu

CMA - Omprakash Sahu

Uploaded by

CA Pallav SinghaniaThe document provides an assessment of the working capital requirements for M/s Omprakash Sahu from 2021-2025. It includes projections for the company's profit and loss statement and balance sheet over this period, showing estimated sales growth and costs. The projections estimate the company will require Rs. 3 lacs in short-term bank borrowings starting in 2023 to fund operations and working capital needs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- CMA - Event Management 21.05.2019Document22 pagesCMA - Event Management 21.05.2019madhukar sahayNo ratings yet

- Project Report - Petrol PumpDocument33 pagesProject Report - Petrol PumpNITESH JAISINGHANINo ratings yet

- Latihan Soal Cash FlowDocument2 pagesLatihan Soal Cash FlowRuth AngeliaNo ratings yet

- Padma TractorsDocument35 pagesPadma TractorsArun KumarNo ratings yet

- CMA FormatDocument7 pagesCMA FormatRamakrishnan NatarajanNo ratings yet

- CMA DataDocument19 pagesCMA Dataca.vitalconsultantsNo ratings yet

- Assesment of Working Capital RequirementsDocument19 pagesAssesment of Working Capital RequirementsLokeswar Tandi (Lokesh)No ratings yet

- RAJMISHRA - CMA ReportDocument7 pagesRAJMISHRA - CMA ReportAbhay NandaNo ratings yet

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- Project Stone CrusherDocument34 pagesProject Stone CrusherManjari AgrawalNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik PolymersDocument17 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik Polymersamit22505No ratings yet

- Cma Sat GuruDocument25 pagesCma Sat GuruSohom NagNo ratings yet

- Cma Data FormatDocument5 pagesCma Data FormatSoumik Parua0% (1)

- ITC Report and Accounts 2023 185Document1 pageITC Report and Accounts 2023 185Nishith RanjanNo ratings yet

- CMA - BlankDocument84 pagesCMA - Blankeakwalansari4No ratings yet

- ITC-Profit-Loss 2017 PDFDocument1 pageITC-Profit-Loss 2017 PDFShristi GutgutiaNo ratings yet

- CMA NewDocument7 pagesCMA NewKrishna MohanNo ratings yet

- 4th Floor - Cma1Document39 pages4th Floor - Cma1Giri SukumarNo ratings yet

- Integrated Report and Annual Accounts 2016-17-175 175Document1 pageIntegrated Report and Annual Accounts 2016-17-175 175Sanju VisuNo ratings yet

- Air India: Statement of Profit and Loss For The Year Ended 31St March 2018Document1 pageAir India: Statement of Profit and Loss For The Year Ended 31St March 2018Rutuja shindeNo ratings yet

- Wovensacks Projections in ExcelDocument57 pagesWovensacks Projections in ExcelPradeep TlNo ratings yet

- Figure in Lakh Prepared by - Ca. Shivam GuptaDocument11 pagesFigure in Lakh Prepared by - Ca. Shivam GuptaAayush LohanaNo ratings yet

- Cma & DSCRDocument10 pagesCma & DSCRSaranNo ratings yet

- Balance Sheet As at 30th Fu.t: SeptemberDocument3 pagesBalance Sheet As at 30th Fu.t: SeptemberDHANU DANGINo ratings yet

- Statement of Profit and Loss: Particulars Note NoDocument3 pagesStatement of Profit and Loss: Particulars Note NosqxxsnnfdgNo ratings yet

- Bal SheetDocument4 pagesBal SheetVishal JainNo ratings yet

- Standalone Balance Sheet: As at 31 March, 2021 (All Amounts in Crores, Unless Otherwise Stated)Document4 pagesStandalone Balance Sheet: As at 31 March, 2021 (All Amounts in Crores, Unless Otherwise Stated)gitanjali srivastavNo ratings yet

- Essar Bulk Terminal Paradip LimitedDocument33 pagesEssar Bulk Terminal Paradip LimitedMudit KediaNo ratings yet

- Annual Report 2020 21 261 PDFDocument1 pageAnnual Report 2020 21 261 PDFAnand GovindanNo ratings yet

- 4 Financial-InformationDocument154 pages4 Financial-InformationDIVEY KocharNo ratings yet

- 23MB0026 FAR AssignmentDocument14 pages23MB0026 FAR Assignmenthimanshu011623No ratings yet

- Statement Profit Loss StandaloneDocument1 pageStatement Profit Loss Standalonesubham not a nameNo ratings yet

- Balance Sheet of RINL For The FY 2020-21: Particulars 31-Mar-21 31-Mar-20Document8 pagesBalance Sheet of RINL For The FY 2020-21: Particulars 31-Mar-21 31-Mar-20javoleNo ratings yet

- Statemnt of Profit and LossDocument1 pageStatemnt of Profit and LossRutuja shindeNo ratings yet

- 747WC Model-UnsolvedDocument7 pages747WC Model-UnsolvedGokul BansalNo ratings yet

- Financial Statements Kodak Q3 2022Document3 pagesFinancial Statements Kodak Q3 2022GARCÍA GUTIERREZ NOEMINo ratings yet

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006No ratings yet

- 9M 2023 Reviewed Financial StatementsDocument64 pages9M 2023 Reviewed Financial StatementsZain RehmanNo ratings yet

- Statement of Profit and Loss For The Year Ended 31St March 2017Document1 pageStatement of Profit and Loss For The Year Ended 31St March 2017Himanshu DuttaNo ratings yet

- Voith PDFDocument2 pagesVoith PDFABHAY KUMAR SINGHNo ratings yet

- Standalone Balance Sheet: Financial Statements Dabur India LimitedDocument1 pageStandalone Balance Sheet: Financial Statements Dabur India LimitedYagika JagnaniNo ratings yet

- Elgi Gulf (Fze) Balance Sheet As at 31St March 2015Document7 pagesElgi Gulf (Fze) Balance Sheet As at 31St March 2015SnehaNo ratings yet

- ACAPL - Outcome of BM - Finnancials - Asset Cover CertificateDocument23 pagesACAPL - Outcome of BM - Finnancials - Asset Cover CertificateShashi Bhushan PrinceNo ratings yet

- Quarter AnnualDocument8 pagesQuarter AnnualNeetu JainNo ratings yet

- Abridged StatementDocument7 pagesAbridged StatementAnkit BankaNo ratings yet

- Annexure-Finacial Balance Sheet RCFDocument8 pagesAnnexure-Finacial Balance Sheet RCFkishorejayapalNo ratings yet

- Cma Data Template1Document19 pagesCma Data Template1farman aliNo ratings yet

- Assessment of Working Capital Requirement: Sheet 1Document13 pagesAssessment of Working Capital Requirement: Sheet 1Arjun YemulNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677No ratings yet

- BHAGYALAKSMI CMA LOAN BHBHJDocument15 pagesBHAGYALAKSMI CMA LOAN BHBHJbal balreddyNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalNo ratings yet

- Standalone Balance Sheet As at March 31, 2019Document4 pagesStandalone Balance Sheet As at March 31, 2019Umang KaushikNo ratings yet

- Ice Make Refrigeration LimitedDocument8 pagesIce Make Refrigeration LimitedPositive ThinkerNo ratings yet

- CMA Statement of Trading ActivityDocument17 pagesCMA Statement of Trading ActivitySubrato MukherjeeNo ratings yet

- CMA Case StudyDocument15 pagesCMA Case Studyyajur_nagiNo ratings yet

- Balance Sheet: I. Assets (1) Non-Current AssetsDocument1 pageBalance Sheet: I. Assets (1) Non-Current Assetsharshit abrolNo ratings yet

- Standalone Balance Sheet Standalone Statement of Profit and LossDocument3 pagesStandalone Balance Sheet Standalone Statement of Profit and LosssqxxsnnfdgNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Shivam Roller Flour Mills Pvt. LTD Amounts in Rs. LacsDocument14 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Shivam Roller Flour Mills Pvt. LTD Amounts in Rs. LacsAKHI9No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- RTM 2 Pa 1Document3 pagesRTM 2 Pa 1Mega UrjuwanNo ratings yet

- Credit Analyst in Spandana Sphoorty Financial Limited Ha The Several Responsibility Those Can Be Explain Under 2 Major Points Those Are As FollowsDocument8 pagesCredit Analyst in Spandana Sphoorty Financial Limited Ha The Several Responsibility Those Can Be Explain Under 2 Major Points Those Are As FollowsNithinNo ratings yet

- Se2cal Notice 1208160011799234Document2 pagesSe2cal Notice 1208160011799234Jyotsana SharmaNo ratings yet

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- Scams in IndiaDocument19 pagesScams in IndiaNirbhay SinghNo ratings yet

- Chapter 3. Solution Exercises Income StatementDocument13 pagesChapter 3. Solution Exercises Income StatementHECTOR ORTEGANo ratings yet

- Final Project Axis BankDocument69 pagesFinal Project Axis BankJagjit SinghNo ratings yet

- Bank Reconciliation Statement.Document4 pagesBank Reconciliation Statement.priyanshubohra3No ratings yet

- Uploaded in Moodle As A Guide To Complete Your Assignment Apart From Your Other Sources.)Document6 pagesUploaded in Moodle As A Guide To Complete Your Assignment Apart From Your Other Sources.)Derek GawiNo ratings yet

- Asset Quality & Risk Management Practices - An Analysis On Yes BankDocument10 pagesAsset Quality & Risk Management Practices - An Analysis On Yes BankParth Hemant PurandareNo ratings yet

- Session4 ICFDocument12 pagesSession4 ICFSomyata RastogiNo ratings yet

- SFM Express Notes by Archana Kaithan Ma'AmDocument124 pagesSFM Express Notes by Archana Kaithan Ma'AmNishu DasNo ratings yet

- The Morgan StanleyDocument7 pagesThe Morgan Stanleysarav3387No ratings yet

- Canadian Preferred Shares Yield TablesDocument29 pagesCanadian Preferred Shares Yield TablesrblaisNo ratings yet

- GFF2023 - Agenda Hallwise For WebsiteDocument67 pagesGFF2023 - Agenda Hallwise For WebsiteAmit ANo ratings yet

- Bader Al Hussain (CV) PDFDocument3 pagesBader Al Hussain (CV) PDFBaderalhussain0No ratings yet

- Chapter 1. Presentation of ContentsDocument8 pagesChapter 1. Presentation of ContentsJason MablesNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- M&A Conference - Global Markets and MacroeconomicsDocument20 pagesM&A Conference - Global Markets and Macroeconomicsjm petit100% (1)

- The Basic Accounting Equation: Assets Liabilities + EquityDocument16 pagesThe Basic Accounting Equation: Assets Liabilities + EquityangeliNo ratings yet

- Sponsorship Proposal For Axis BankDocument7 pagesSponsorship Proposal For Axis BankMayank JoshiNo ratings yet

- E Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Document1 pageE Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Abhishek KulkarniNo ratings yet

- HDFC SL CrestDocument1 pageHDFC SL Crestk_kishan288No ratings yet

- Notice: Sanctions Blocked Persons, Specifically Designated Nationals, Terrorists, Narcotics Traffickers, and Foreign Terrorist Organizations: Narcotics-Related Blocked Persons Additional DesignationsDocument3 pagesNotice: Sanctions Blocked Persons, Specifically Designated Nationals, Terrorists, Narcotics Traffickers, and Foreign Terrorist Organizations: Narcotics-Related Blocked Persons Additional DesignationsJustia.comNo ratings yet

- FABM 2 Lesson 1Document38 pagesFABM 2 Lesson 1Trisha ElecerioNo ratings yet

- Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Document17 pagesChapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Portia AbestanoNo ratings yet

- Ceres Gardening - Case (1) ProfesorDocument1 pageCeres Gardening - Case (1) Profesorpeta8805No ratings yet

- Topic 2 Interest Rates & The Role of A Central BankDocument26 pagesTopic 2 Interest Rates & The Role of A Central BankSarifah SaidsaripudinNo ratings yet

- iBT TOEFL Listening 단숨에 따라잡기: Part 1: 강의Document7 pagesiBT TOEFL Listening 단숨에 따라잡기: Part 1: 강의green1458No ratings yet

CMA - Omprakash Sahu

CMA - Omprakash Sahu

Uploaded by

CA Pallav Singhania0 ratings0% found this document useful (0 votes)

10 views7 pagesThe document provides an assessment of the working capital requirements for M/s Omprakash Sahu from 2021-2025. It includes projections for the company's profit and loss statement and balance sheet over this period, showing estimated sales growth and costs. The projections estimate the company will require Rs. 3 lacs in short-term bank borrowings starting in 2023 to fund operations and working capital needs.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an assessment of the working capital requirements for M/s Omprakash Sahu from 2021-2025. It includes projections for the company's profit and loss statement and balance sheet over this period, showing estimated sales growth and costs. The projections estimate the company will require Rs. 3 lacs in short-term bank borrowings starting in 2023 to fund operations and working capital needs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views7 pagesCMA - Omprakash Sahu

CMA - Omprakash Sahu

Uploaded by

CA Pallav SinghaniaThe document provides an assessment of the working capital requirements for M/s Omprakash Sahu from 2021-2025. It includes projections for the company's profit and loss statement and balance sheet over this period, showing estimated sales growth and costs. The projections estimate the company will require Rs. 3 lacs in short-term bank borrowings starting in 2023 to fund operations and working capital needs.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

Credit Monitoring Arrangement

Of

M/s Omprakash Sahu

(Prop. Omprakash Sahu)

Gandhi Chowk

Tilda Neora (C.G.)

PALLAV SINGHANIA & CO.

CHARTERED ACCOUNTANTS

Beside Canara Bank, Shri Sharda Business Park

Kharora Road, Tilda Neora 493114

Mob: +91-7000689421

Email: CaPallavSinghania@gmail.com

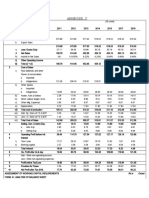

ASSESMENT OF WORKING CAPITAL REQUIREMENTS

FORM II

AS PER PROFIT & LOSS ACCOUNT (ACTUAL / ESTIMATES) FOR THE YEAR ENDED

M/S Omprakash Sahu

(Rs in Lac)

Year 2021 2022 2023 2024 2025

Non -Audited Non -Audited Estimated Projected Projected

1 Gross Receipts

(i) -Sales Receipts 18.26 18.86 21.69 24.94 28.68

(ii) -Other Income 0.75 0.77 0.81 0.95 1.05

Total 19.01 19.63 22.50 25.89 29.73

2 Less : Excise Duty - - - - -

Less: Other Items - - - - -

3 Net Sales (1-2) 19.01 19.63 22.50 25.89 29.73

4 % age rise (+) or fall (-) in net sales as compared to

0.00% 3.26% 14.62% 15.08% 14.82%

previous yr

5 Cost of Sales

(i) Purchases 13.18 11.23 13.14 14.56 16.74

(ii) Power and Fuel 1.78 1.85 2.13 2.45 2.81

(ii) Rent - - - - -

(iii) Transportation charges - - - - -

(iv) Salary & Wages 1.80 1.96 2.25 2.59 2.98

(v) Repair and Maintanence - - - - -

(vi) Administrative Expenses - - - - -

(vii) Depreciation - - - - -

(viii) GROSS TOTAL 16.76 15.04 17.52 19.60 22.54

(viii) Add: Opening Stock in Process - - - - -

Sub-total 16.76 15.04 17.52 19.60 22.54

(ix) Deduct: Closing Stock in Process - - - - -

(x) COST OF PRODUCTION 16.76 15.04 17.52 19.60 22.54

(xi) Add: Opening Stock of Finished Goods - 2.25 2.39 2.65 2.83

Sub-total 16.76 17.29 19.91 22.25 25.37

(xii) Less : Closing Stock of Finished Goods 2.25 2.39 2.65 2.83 3.12

(xiii) TOTAL COST OF SALES 14.51 14.90 17.26 19.42 22.25

Gross Profit 4.50 4.73 5.24 6.47 7.48

23.67% 24.10% 23.28% 25.01% 25.17%

6 Selling General & Admin.expenses - - - - -

7 SUB TOTAL (5+6) 14.51 14.90 17.26 19.42 22.25

8 Operating Profit Before Interest (3-7) 4.50 4.73 5.24 6.47 7.48

9 Interest - - 0.30 0.30 0.30

10 Operating Profit After Interest 4.50 4.73 4.94 6.17 7.18

11(i) Add : Other Non Operating Income - - - -

Interest / Discount Received - - -

Sundry Balances Written Back - - - - -

Miscellaneous 0.00 - - - -

Previous Year Adjustments - - - - -

Sub-total - - - - -

(ii) Deduct : Other Non Operating expenses -

Miscellaneous - - -

Other Expenses - - - - -

Sub-total - - - - -

Net of Non Operating Income / Expenses - - - - -

12 Profit / (Loss) Before Tax 4.50 4.73 4.94 6.17 7.18

13 Provision For Taxes - - - - -

Prior Period Adjustments - - - - -

14 Net Profit / (Loss) After Tax 4.50 4.73 4.94 6.17 7.18

15 Dividend / Directors remuneration - - - - -

Defferred Taxes - - - - -

16 Retained Profit 4.50 4.73 4.94 6.17 7.18

17 Cash Accruals 4.50 4.73 4.94 6.17 7.18

FORM - III (Continued)

ANALYSIS OF BALANCE SHEET

M/S Omprakash Sahu As per Balance sheet as at

LIABILITIES 2021 2022 2023 2024 2025

(Rs in Lac) Non -Audited Non -Audited Estimated Projected Projected

CURRENT LIABILITIES

1 Short-term borrowings from banks(incld.bills purchased

discounted & excess borrwoing placed on repayment

basis)

(i) From applicant bank - - 3.00 3.00 3.00

(ii) From other banks - - - - -

(iii) (of which BP & BD)

Sub Total - - 3.00 3.00 3.00

2 Short term borrowing from others - - - - -

3 Sundry creditors (Trade) 1.76 1.87 1.96 2.11 2.32

4 Advance payments from customers / dep. From dealer

- - - -

5 Provision - - - - -

6 Dividend payable - - - - -

7 Other statutory liabilities (due within one year) -

8 Deposits / Instalments of term loans/DPGs/Debenture

-

(due within one year)

9 Other current liabilities & provisions (due in 1yrs.)

- -

(Specify major items)

a TDS payable - - - - -

b Creditor for Expenses - - - - -

c Other current liabilities - - - - -

Other Current Liabilities [Sub-total (B)] 1.76 1.87 1.96 2.11 2.32

10 Total Current Liabilities ( total of 1 to 9 excl (iii)) 1.76 1.87 4.96 5.11 5.32

TERM LIABILITIES

11 Debentures (not maturing within 1yrs.) - - - - -

12 Prefrence shares (redeemable after 1yrs.) - - - - -

13 Term loans (excld instalments payable within 1yrs.) - -

14 Deferred Payment Credit excluding inst. due within 1yrs

- - - - -

15 Unsecured Loans (repayable after 1year) - - - - -

16 Other term liabilities - - - -

17 TOTAL TERM LIABILITIES - - - - -

17.a Inter Unit Balance - - - - -

18 Total Outside Liabilities (item 10 + 17) 1.76 1.87 4.96 5.11 5.32

NET WORTH

19 Partner's capital 9.03 11.11 11.90 12.59 13.28

20 Introduced Capital - - - -

21 Withdrawl 2.42 3.94 4.25 5.48 6.76

22 Other reserves(excluding provisions) - - - - -

23 Surplus(+) or deficit(-) in P&L account 4.50 4.73 4.94 6.17 7.18

23.a Capital Reserve - - - - -

23.b Investment Allowance Reserve - - - - -

23.c Deferred Tax Liability - - - - -

24 NET WORTH 11.11 11.90 12.59 13.28 13.70

25 TOTAL LIABILITIES 12.87 13.77 17.55 18.39 19.02

FORM - III (Continued)

ANALYSIS OF BALANCE SHEET

M/S Omprakash Sahu As per Balance sheet as at

ASSETS

2021 2022 2023 2024 2025

(Rs in Lac) Non -Audited Non -Audited Estimated Projected Projected

CURRENT ASSETS

26 Cash and bank balances 5.27 6.00 4.92 5.57 5.35

27 Investments (other than long term investments) - - - - -

(i) Fixed Deposits (LC, BG, Margin) -

(ii) Other Fixed deposits with bank - - - - -

28(i) Receivables other than defered & export (export

1.35 1.38 5.98 5.99 6.55

including bills purchased and discounted by bank)

(ii) Export receivables (incld bills purchased & dis. By 1) - - - - -

29 Installments of deferred receivables (due with in 1 year)

- - - - -

30 Inventory: 2.25 2.39 2.65 2.83 3.12

(i) Raw materials(including stores & other items used in the

- - - - -

process of manufacture)

a Imported - - - - -

b Indigenous - - - - -

(ii) Stock-in-process - - - - -

(iii) Finished goods 2.25 2.39 2.65 2.83 3.12

(iv) Other consumable spares - - - - -

a Imported - - - - -

b Indigenous - - - - -

31 Advances to suppliers of Finished Goods 4.00 4.00 4.00 4.00 4.00

32 Advance payment of taxes - - - - -

33 Other current assets - - - - -

Deposits - - - -

Others - - - - -

34 TOTAL CURRENT ASSETS (total of 26 to 33)

12.87 13.77 17.55 18.39 19.02

FIXED ASSETS

35 Gross Block (land & building, machinery, work-in-

- - - - -

procees)

36 Depreciation to date - - - - -

37 NET BLOCK (35-36) - - - - -

OTHER NON-CURRENT ASSETS

38 Investments/book debts/adv./deposits which are not

- - - - -

Current Assets

(i)a Investments in subsidiary companies / affiliates - - - - -

b Others (amount earmarked for future expansions) - - -

(ii) Loan & Advances - - - - -

(iii) Inter unit A/C - - - - -

(iv) Others-Debtors>6 months - - - - -

-Security deposit - - - - -

-Any other Non-Current deposits - - - - -

39 Loan & Advances - - - - -

40 Other non-current assets incl. Dues from directors - - - - -

41 TOTAL OTHER NON-CURRENT ASSETS - - - - -

42 Intangible assets (patents,goodwill, prelim.exp.

- - - - -

Bad/doubtful expenses not provided for, etc.)

43 TOTAL ASSETS (34+37+41+42) 12.87 13.77 17.55 18.39 19.02

44 TANGIBLE NET WORTH (24-42) 11.11 11.90 12.59 13.28 13.70

45 NET WORKING CAPITAL (17+24)-(37+41+42) 11.11 11.90 12.59 13.28 13.70

46 Current Ratio 7.31 7.36 3.54 3.60 3.58

46 a Current Ratio [Excluding Term Loan Installment] 7.31 7.36 3.54 3.60 3.58

47 Total Outside Liabilities/Tangible Net Worth 0.16 0.16 0.39 0.38 0.39

48 Total Term Liabilities/Tangible Net Worth - - - - -

- - (0.00) 0.00 0.00

FORM - IV

Comparative statement of Current assets & Current Liabilities

M/S Omprakash Sahu

I. CURRENT ASSETS

Year 2021 2022 2023 2024 2025

(Rs in Lac) Non -Audited Non -Audited Estimated Projected Projected

1 Raw materials including stores & other items used in the

process of manufacturing

(a) Imported : Amount - - - - -

: Month's consumption - - - - -

(b) Indigenous : Amount - - - - -

: Month's consumption - - - - -

2 Other consumable spares, excldg.those included in(1)

above - - - - -

(a) Imported : Amount - - - - -

: Month's consumption - - - - -

(b) Indigenous : Amount - - - - -

: Month's consumption - - - - -

3 Stock-in-process: Amont - - - - -

: Month's cost of production - - - - -

4 Finished goods : Amount 2.25 2.39 2.65 2.83 3.12

: Month's cost of Sales (0.78) (1.92) (1.84) (1.75) (1.68)

5 Receivables other than export & defered receivables

(Incldg. Bill purchased & discounted by bank) : Amount 1.35 1.38 5.98 5.99 6.55

: Month's Domestic Sales( includg.

(0.36) (0.84) (3.19) (2.78) (2.64)

defered payment sales)

6 Export receivables (incldg. Bills purchased & disc.)

: Amount - - - - -

: Month's export Sales - - - - -

7 Advance to suppliers of materials & stores / spares,etc.

- - - - -

- - - - -

8 Other current assets includg. Cash & bank balances

receivables due within one year (speciy major items) 5.27 6.00 4.92 5.57 5.35

Cash & bank balances 5.27 6.00 4.92 5.57 5.35

Investment except long-term investment of def. - - - - -

Others - - - - -

9 TOTAL CURRENT ASSETS 8.87 9.77 13.55 14.39 15.02

II. CURRENT LIABILITIES

(Other than bank borrowing for working capital) - - - - -

- - - - -

10 Creditors for purchase of raw materials, stores & - - - - -

consumable

Spares : Amount 1.76 1.87 1.96 2.11 2.32

: Month's purchase (1.41) (1.70) (1.53) (1.48) (1.41)

11 Advance from customers - - - - -

12 Statutory liabilities - - - - -

13 Other current liabilities-specify major items

a) S T borrowing-others - - - - -

b) Dividend payable - - - - -

c) Instalments of TL, DPS & public deposits - - - - -

d) Other current liabilities & provisions - - - - -

14 TOTAL 1.76 1.87 1.96 2.11 2.32

FORM - V

Computation of Assessed Bank Finance for Working Capital

M/S Omprakash Sahu

(Rs in Lac)

Year 2021 2022 2023 2024 2025

Non -Audited Non -Audited Estimated Projected Projected

ASSESSED BANK FINANCE

1 Total current assets 12.87 13.77 17.55 18.39 19.02

2 Other current liabilities(other than bank borrowing) 1.76 1.87 1.96 2.11 2.32

3 Working capital gap 11.11 11.90 15.59 16.28 16.70

4 Net working capital 11.11 11.90 12.59 13.28 13.70

5 Assessed bank finance - - 3.00 3.00 3.00

6 NWC to Total Current Assets% 86.32 86.42 71.74 72.21 72.03

7 Bank Finance to TCA % - - 17.09 16.31 15.77

8 Sundry Creditors to TCA % 13.68 13.58 11.17 11.47 12.20

9 Other current Liabilities to Total Current assets % - - - - -

10 Inventory to Net Sales (Days) 10.80 11.11 42.99 39.89 38.31

11 Receivables to Gross Sales (Days) 6.48 6.41 24.25 21.11 80.42

12 Sundry Creditors to Purchases (Days) 48.74 60.78 54.45 44.90 42.93

FORM - VI FUND STATEMENT

M/S Omprakash Sahu

(Rs in Lac)

Year 2021 2022 2023 2024 2025

Non -Audited Non -Audited Estimated Projected

1 SOURCES

a) Net profit (after tax) 4.50 4.73 4.94 6.17 7.18

b) Depreciation - - - - -

c) Increase in capital - 2.08 0.79 0.69 0.69

d) Increase in term liabilities,including public deposit - - - - -

e) Decrease in :

(i) Fixed assets - - - - -

(ii) Other non-current assets - - - - -

f) Others - - - - -

g) TOTAL 4.50 6.81 5.73 6.86 7.88

2 USES

a) Net loss

b) Decrease in term liabilities,including public deposits - - - -

c) Increase in:

(i) Fixed assets - - - -

(ii) Depreciation adjustment - - - -

(iii) Other non-current assets - - - -

d) Dividend payment - - - -

e) Others 6.02 5.04 6.17 7.45

f) TOTAL 6.02 5.04 6.17 7.45

3 Long term surplus / deficit 0.79 0.69 0.69 0.42

4 Increase / Decrease in current assets (as per details given

4.90 7.78 0.84 0.63

below)

5 Increase / Decrease in current liabilities other than bank

0.11 0.09 0.15 0.21

borrowings

6 Increase / Decrease in working capital gap 4.79 7.69 0.69 0.42

7 Net surplus (+) / deficit(-) (4.00) (7.00) 0.00 0.00

8 Increase / Decrease in Bank borrowings - 3.00 - -

INCREASE / DECREASE IN NET SALES 2.87 3.39 3.84 #REF!

*Break-up of (4) (4.00) (4.00) 0.00 0.00

(i) Increase / decrease in Raw materials - - - -

(ii) Increase / decrease in Stock - in - process - - - -

(iii) Increase / decrease in Finished goods 0.14 0.26 0.18 0.29

(iv) Increase / decrease in Receivables (a) Domestic 0.03 4.60 0.01 0.56

(b) Export - - - -

(v) Increase / decrease in Stores & spares - - - -

(vi) Increase / decrease in Other current assets 4.73 2.92 0.65 (0.22)

4.90 7.78 0.84 0.63

Assesment of Working Capital Requirements

Financial Indicators

M/S Omprakash Sahu

Year 2021 2022 2023 2024 2025

(Rs in Lac) Non -Audited Non -Audited Estimated Projected Projected

1 Net Sales 19.01 19.63 22.50 25.89 29.73

1.a Operating Profit 4.50 4.73 5.24 6.47 7.48

2 Profit Before Tax 4.50 4.73 4.94 6.17 7.18

2.a PBT / Net sales(%) 23.67 24.10 21.95 23.85 24.16

3 Profit After Tax 4.50 4.73 4.94 6.17 7.18

4 Paid Up Capital 9.03 11.11 11.90 12.59 13.28

4.a Cash Accruals 4.50 4.73 4.94 6.17 7.18

5 Tangible Net Worth 11.11 11.90 12.59 13.28 13.70

6 Total Outside Liability 1.76 1.87 4.96 5.11 5.32

7 TOL / TNW 0.16 0.16 0.39 0.38 0.39

7.a Adjusted TNW 11.11 11.90 12.59 13.28 13.70

7.b TOL / Adj. TNW 0.16 0.16 0.39 0.38 0.39

8 Total Current Assets 12.87 13.77 17.55 18.39 19.02

8.a Total Tangible Assets 12.87 13.77 17.55 18.39 19.02

9 PBT / TTA(%) 34.97% 34.35% 28.14% 33.58% 37.76%

10 Operating Expenses 14.51 14.90 17.26 19.42 22.25

11 Operating Expenses / Net Sales (%) 76.33% 75.90% 76.72% 74.99% 74.83%

12 Cost of Sales / Net sales (%) 76.33% 75.90% 76.72% 74.99% 74.83%

13 Depretiation - - - - -

14 Interest - - 0.30 0.30 0.30

15 Net Working Capital 11.11 11.90 12.59 13.28 13.70

16 Inventory + Receivables 3.60 3.77 8.63 8.82 9.67

17 Assessed Bank Finance - - 3.00 3.00 3.00

18 PBDIT 4.50 4.73 5.24 6.47 7.48

19 PBDIT / Intt. #DIV/0! #DIV/0! 17.46 21.58 24.94

20 PBDIT / TTA 34.97 34.35 29.85 35.21 39.33

21 Purchases 13.18 11.23 13.14 17.15 19.72

22 Sundry Creditors 1.76 1.87 1.96 2.11 2.32

23 TOL / TNW 0.16 0.16 0.39 0.38 0.39

24 CA / CL 7.31 7.36 3.54 3.60 3.58

25 Bank Finance / TCA (%) - - 17.09 16.31 15.77

26 Gross Sales / Total Current Assets 1.48 1.43 1.28 1.41 1.56

27 Operating Profit / TTA (%) 34.97 34.35 29.85 35.21 39.33

28 Operating Profit / TNW (%) 40.50 39.75 41.61 48.74 54.59

29 Operating Profit / Gross Fixed Assets(%) #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

EFFICIENCY RATIOS

1 Net Sales to TTA (times) 1.48 1.43 1.28 1.41 1.56

2 PBT to TTA (%) 34.97 34.35 28.14 33.58 37.76

3 Operating costs to sales (%) 76.33 75.90 76.72 74.99 74.83

4 Bank Finance / TCA (%) - - 17.09 16.31 15.77

5 (Inv./Net Sales) + (Receivables / Gross Sales) days 17.28 17.52 140.00 124.33 118.73

A Assessed Bank Finance - - 3.00 3.00 3.00

B CA / CL 7.31 7.36 3.54 3.60 3.58

C TOL / TNW 0.16 0.16 0.39 0.38 0.39

D PBDIT / Intt. #DIV/0! #DIV/0! 17.46 21.58 24.94

E Net Profit / Net Sales (%) 23.67 24.10 21.95 23.85 24.16

F (PBDIT / TTA) ROCE 139.86 137.40 29.85 35.21 39.33

G (Inv./Net Sales) + (Receivables / Gross Sales) days 17.28 17.52 140.00 124.33 118.73

Prepared by - CA Pallav Singhania & Co.

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- CMA - Event Management 21.05.2019Document22 pagesCMA - Event Management 21.05.2019madhukar sahayNo ratings yet

- Project Report - Petrol PumpDocument33 pagesProject Report - Petrol PumpNITESH JAISINGHANINo ratings yet

- Latihan Soal Cash FlowDocument2 pagesLatihan Soal Cash FlowRuth AngeliaNo ratings yet

- Padma TractorsDocument35 pagesPadma TractorsArun KumarNo ratings yet

- CMA FormatDocument7 pagesCMA FormatRamakrishnan NatarajanNo ratings yet

- CMA DataDocument19 pagesCMA Dataca.vitalconsultantsNo ratings yet

- Assesment of Working Capital RequirementsDocument19 pagesAssesment of Working Capital RequirementsLokeswar Tandi (Lokesh)No ratings yet

- RAJMISHRA - CMA ReportDocument7 pagesRAJMISHRA - CMA ReportAbhay NandaNo ratings yet

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- Project Stone CrusherDocument34 pagesProject Stone CrusherManjari AgrawalNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik PolymersDocument17 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik Polymersamit22505No ratings yet

- Cma Sat GuruDocument25 pagesCma Sat GuruSohom NagNo ratings yet

- Cma Data FormatDocument5 pagesCma Data FormatSoumik Parua0% (1)

- ITC Report and Accounts 2023 185Document1 pageITC Report and Accounts 2023 185Nishith RanjanNo ratings yet

- CMA - BlankDocument84 pagesCMA - Blankeakwalansari4No ratings yet

- ITC-Profit-Loss 2017 PDFDocument1 pageITC-Profit-Loss 2017 PDFShristi GutgutiaNo ratings yet

- CMA NewDocument7 pagesCMA NewKrishna MohanNo ratings yet

- 4th Floor - Cma1Document39 pages4th Floor - Cma1Giri SukumarNo ratings yet

- Integrated Report and Annual Accounts 2016-17-175 175Document1 pageIntegrated Report and Annual Accounts 2016-17-175 175Sanju VisuNo ratings yet

- Air India: Statement of Profit and Loss For The Year Ended 31St March 2018Document1 pageAir India: Statement of Profit and Loss For The Year Ended 31St March 2018Rutuja shindeNo ratings yet

- Wovensacks Projections in ExcelDocument57 pagesWovensacks Projections in ExcelPradeep TlNo ratings yet

- Figure in Lakh Prepared by - Ca. Shivam GuptaDocument11 pagesFigure in Lakh Prepared by - Ca. Shivam GuptaAayush LohanaNo ratings yet

- Cma & DSCRDocument10 pagesCma & DSCRSaranNo ratings yet

- Balance Sheet As at 30th Fu.t: SeptemberDocument3 pagesBalance Sheet As at 30th Fu.t: SeptemberDHANU DANGINo ratings yet

- Statement of Profit and Loss: Particulars Note NoDocument3 pagesStatement of Profit and Loss: Particulars Note NosqxxsnnfdgNo ratings yet

- Bal SheetDocument4 pagesBal SheetVishal JainNo ratings yet

- Standalone Balance Sheet: As at 31 March, 2021 (All Amounts in Crores, Unless Otherwise Stated)Document4 pagesStandalone Balance Sheet: As at 31 March, 2021 (All Amounts in Crores, Unless Otherwise Stated)gitanjali srivastavNo ratings yet

- Essar Bulk Terminal Paradip LimitedDocument33 pagesEssar Bulk Terminal Paradip LimitedMudit KediaNo ratings yet

- Annual Report 2020 21 261 PDFDocument1 pageAnnual Report 2020 21 261 PDFAnand GovindanNo ratings yet

- 4 Financial-InformationDocument154 pages4 Financial-InformationDIVEY KocharNo ratings yet

- 23MB0026 FAR AssignmentDocument14 pages23MB0026 FAR Assignmenthimanshu011623No ratings yet

- Statement Profit Loss StandaloneDocument1 pageStatement Profit Loss Standalonesubham not a nameNo ratings yet

- Balance Sheet of RINL For The FY 2020-21: Particulars 31-Mar-21 31-Mar-20Document8 pagesBalance Sheet of RINL For The FY 2020-21: Particulars 31-Mar-21 31-Mar-20javoleNo ratings yet

- Statemnt of Profit and LossDocument1 pageStatemnt of Profit and LossRutuja shindeNo ratings yet

- 747WC Model-UnsolvedDocument7 pages747WC Model-UnsolvedGokul BansalNo ratings yet

- Financial Statements Kodak Q3 2022Document3 pagesFinancial Statements Kodak Q3 2022GARCÍA GUTIERREZ NOEMINo ratings yet

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006No ratings yet

- 9M 2023 Reviewed Financial StatementsDocument64 pages9M 2023 Reviewed Financial StatementsZain RehmanNo ratings yet

- Statement of Profit and Loss For The Year Ended 31St March 2017Document1 pageStatement of Profit and Loss For The Year Ended 31St March 2017Himanshu DuttaNo ratings yet

- Voith PDFDocument2 pagesVoith PDFABHAY KUMAR SINGHNo ratings yet

- Standalone Balance Sheet: Financial Statements Dabur India LimitedDocument1 pageStandalone Balance Sheet: Financial Statements Dabur India LimitedYagika JagnaniNo ratings yet

- Elgi Gulf (Fze) Balance Sheet As at 31St March 2015Document7 pagesElgi Gulf (Fze) Balance Sheet As at 31St March 2015SnehaNo ratings yet

- ACAPL - Outcome of BM - Finnancials - Asset Cover CertificateDocument23 pagesACAPL - Outcome of BM - Finnancials - Asset Cover CertificateShashi Bhushan PrinceNo ratings yet

- Quarter AnnualDocument8 pagesQuarter AnnualNeetu JainNo ratings yet

- Abridged StatementDocument7 pagesAbridged StatementAnkit BankaNo ratings yet

- Annexure-Finacial Balance Sheet RCFDocument8 pagesAnnexure-Finacial Balance Sheet RCFkishorejayapalNo ratings yet

- Cma Data Template1Document19 pagesCma Data Template1farman aliNo ratings yet

- Assessment of Working Capital Requirement: Sheet 1Document13 pagesAssessment of Working Capital Requirement: Sheet 1Arjun YemulNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677No ratings yet

- BHAGYALAKSMI CMA LOAN BHBHJDocument15 pagesBHAGYALAKSMI CMA LOAN BHBHJbal balreddyNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalNo ratings yet

- Standalone Balance Sheet As at March 31, 2019Document4 pagesStandalone Balance Sheet As at March 31, 2019Umang KaushikNo ratings yet

- Ice Make Refrigeration LimitedDocument8 pagesIce Make Refrigeration LimitedPositive ThinkerNo ratings yet

- CMA Statement of Trading ActivityDocument17 pagesCMA Statement of Trading ActivitySubrato MukherjeeNo ratings yet

- CMA Case StudyDocument15 pagesCMA Case Studyyajur_nagiNo ratings yet

- Balance Sheet: I. Assets (1) Non-Current AssetsDocument1 pageBalance Sheet: I. Assets (1) Non-Current Assetsharshit abrolNo ratings yet

- Standalone Balance Sheet Standalone Statement of Profit and LossDocument3 pagesStandalone Balance Sheet Standalone Statement of Profit and LosssqxxsnnfdgNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Shivam Roller Flour Mills Pvt. LTD Amounts in Rs. LacsDocument14 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Shivam Roller Flour Mills Pvt. LTD Amounts in Rs. LacsAKHI9No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- RTM 2 Pa 1Document3 pagesRTM 2 Pa 1Mega UrjuwanNo ratings yet

- Credit Analyst in Spandana Sphoorty Financial Limited Ha The Several Responsibility Those Can Be Explain Under 2 Major Points Those Are As FollowsDocument8 pagesCredit Analyst in Spandana Sphoorty Financial Limited Ha The Several Responsibility Those Can Be Explain Under 2 Major Points Those Are As FollowsNithinNo ratings yet

- Se2cal Notice 1208160011799234Document2 pagesSe2cal Notice 1208160011799234Jyotsana SharmaNo ratings yet

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- Scams in IndiaDocument19 pagesScams in IndiaNirbhay SinghNo ratings yet

- Chapter 3. Solution Exercises Income StatementDocument13 pagesChapter 3. Solution Exercises Income StatementHECTOR ORTEGANo ratings yet

- Final Project Axis BankDocument69 pagesFinal Project Axis BankJagjit SinghNo ratings yet

- Bank Reconciliation Statement.Document4 pagesBank Reconciliation Statement.priyanshubohra3No ratings yet

- Uploaded in Moodle As A Guide To Complete Your Assignment Apart From Your Other Sources.)Document6 pagesUploaded in Moodle As A Guide To Complete Your Assignment Apart From Your Other Sources.)Derek GawiNo ratings yet

- Asset Quality & Risk Management Practices - An Analysis On Yes BankDocument10 pagesAsset Quality & Risk Management Practices - An Analysis On Yes BankParth Hemant PurandareNo ratings yet

- Session4 ICFDocument12 pagesSession4 ICFSomyata RastogiNo ratings yet

- SFM Express Notes by Archana Kaithan Ma'AmDocument124 pagesSFM Express Notes by Archana Kaithan Ma'AmNishu DasNo ratings yet

- The Morgan StanleyDocument7 pagesThe Morgan Stanleysarav3387No ratings yet

- Canadian Preferred Shares Yield TablesDocument29 pagesCanadian Preferred Shares Yield TablesrblaisNo ratings yet

- GFF2023 - Agenda Hallwise For WebsiteDocument67 pagesGFF2023 - Agenda Hallwise For WebsiteAmit ANo ratings yet

- Bader Al Hussain (CV) PDFDocument3 pagesBader Al Hussain (CV) PDFBaderalhussain0No ratings yet

- Chapter 1. Presentation of ContentsDocument8 pagesChapter 1. Presentation of ContentsJason MablesNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- M&A Conference - Global Markets and MacroeconomicsDocument20 pagesM&A Conference - Global Markets and Macroeconomicsjm petit100% (1)

- The Basic Accounting Equation: Assets Liabilities + EquityDocument16 pagesThe Basic Accounting Equation: Assets Liabilities + EquityangeliNo ratings yet

- Sponsorship Proposal For Axis BankDocument7 pagesSponsorship Proposal For Axis BankMayank JoshiNo ratings yet

- E Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Document1 pageE Receipt For State Bank Collect Payment: 13731 Suryansh .Tiwari Ug GN Mme Btech Hall3 156 Suryansh@Iitk - Ac.In 55890 0Abhishek KulkarniNo ratings yet

- HDFC SL CrestDocument1 pageHDFC SL Crestk_kishan288No ratings yet

- Notice: Sanctions Blocked Persons, Specifically Designated Nationals, Terrorists, Narcotics Traffickers, and Foreign Terrorist Organizations: Narcotics-Related Blocked Persons Additional DesignationsDocument3 pagesNotice: Sanctions Blocked Persons, Specifically Designated Nationals, Terrorists, Narcotics Traffickers, and Foreign Terrorist Organizations: Narcotics-Related Blocked Persons Additional DesignationsJustia.comNo ratings yet

- FABM 2 Lesson 1Document38 pagesFABM 2 Lesson 1Trisha ElecerioNo ratings yet

- Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Document17 pagesChapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Portia AbestanoNo ratings yet

- Ceres Gardening - Case (1) ProfesorDocument1 pageCeres Gardening - Case (1) Profesorpeta8805No ratings yet

- Topic 2 Interest Rates & The Role of A Central BankDocument26 pagesTopic 2 Interest Rates & The Role of A Central BankSarifah SaidsaripudinNo ratings yet

- iBT TOEFL Listening 단숨에 따라잡기: Part 1: 강의Document7 pagesiBT TOEFL Listening 단숨에 따라잡기: Part 1: 강의green1458No ratings yet