Professional Documents

Culture Documents

Taxation Paper EMBA 16042022

Taxation Paper EMBA 16042022

Uploaded by

Rohit B .S. Prabhu VerlekarCopyright:

Available Formats

You might also like

- Test Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 7th Edition Wahlen, Baginski, BradshawDocument33 pagesTest Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 7th Edition Wahlen, Baginski, Bradshawa415878694No ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Tax Laws Letures (13-07-2021 To 17-07-2021)Document28 pagesTax Laws Letures (13-07-2021 To 17-07-2021)shanmukvardhanNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- Tax Mock Test PaperDocument17 pagesTax Mock Test Papermanyagoyall20No ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- Semester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesSemester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksAnshu kumarNo ratings yet

- CS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaDocument269 pagesCS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaParitoshNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- Vol 1 31032019 PDFDocument9 pagesVol 1 31032019 PDFPradeep KattimaniNo ratings yet

- 2 - House Property Problems 22-23Document5 pages2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Ifos WorksheetDocument7 pagesIfos WorksheetjaoceelectricalNo ratings yet

- iNCOME TAX MODEL Q.PDocument3 pagesiNCOME TAX MODEL Q.PAndalNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- QP 1Document7 pagesQP 1Shankar ReddyNo ratings yet

- 4) TaxationDocument21 pages4) TaxationKrushna MateNo ratings yet

- MTP 1Document7 pagesMTP 1Aman VithlaniNo ratings yet

- Sa 1 DT NovDocument10 pagesSa 1 DT NovRishabh GargNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- Capital Gain 2Document11 pagesCapital Gain 2Aishwarya SundararajNo ratings yet

- Sem - IV Taxation - I Sample Paper-1Document5 pagesSem - IV Taxation - I Sample Paper-1yadavkari497No ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- House Propery QuestionsDocument6 pagesHouse Propery QuestionsTauseef AzharNo ratings yet

- Tybms Sem5 DT Nov19Document5 pagesTybms Sem5 DT Nov19omsantoshbhosale01No ratings yet

- DT Test 1Document3 pagesDT Test 1D. NEERAJ kumarNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- tax qpDocument6 pagestax qpAashish kumarNo ratings yet

- Assessment 1Document4 pagesAssessment 1lalshahbaz57No ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Document11 pagesAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- Income Tax Quesion BankDocument22 pagesIncome Tax Quesion BankPaatrickNo ratings yet

- SAHODAYAModel Question Acc SET 2Document9 pagesSAHODAYAModel Question Acc SET 2aamiralishiasbackup1No ratings yet

- TAXQDocument7 pagesTAXQcashubhamkelaNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- May 2024 Full Length DT Test 2Document6 pagesMay 2024 Full Length DT Test 2Jyoti ManwaniNo ratings yet

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocument8 pagesBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Document36 pagesCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNo ratings yet

- Question BankDocument146 pagesQuestion BankSanskriti JainNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- f7sgp 2009 Dec QDocument9 pagesf7sgp 2009 Dec Q10 SPACENo ratings yet

- Frontline Estimate Bid 01Document17 pagesFrontline Estimate Bid 01richard mcGrawNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

- Project GADocument20 pagesProject GABeza AbrNo ratings yet

- Principles of AccountsDocument23 pagesPrinciples of Accountsmohamed sobahNo ratings yet

- 14 Bbma3203 T10 PDFDocument27 pages14 Bbma3203 T10 PDFHarianti HattaNo ratings yet

- Numericals On MAT-115JBDocument2 pagesNumericals On MAT-115JBReema Laser100% (1)

- Accounting Grade 11 Revision Term 1 - 2023Document15 pagesAccounting Grade 11 Revision Term 1 - 2023sihlemooi3No ratings yet

- UBL Interim Financial Statements March 2023 ConsolidatedDocument37 pagesUBL Interim Financial Statements March 2023 Consolidatedabdullahazaim55No ratings yet

- V Guard StabilisersDocument25 pagesV Guard Stabilisersmoondonoo7No ratings yet

- Notes On Ppe GG BC Wa IaDocument12 pagesNotes On Ppe GG BC Wa IaCleo GreyNo ratings yet

- Notes On Accounting of Insurance CompanyDocument6 pagesNotes On Accounting of Insurance Companysneha pathakNo ratings yet

- Faculty of Commerce & Management: Semester Subject: Management Accounting Subject Code: BCH 302 Dr. R. S. BisariyaDocument29 pagesFaculty of Commerce & Management: Semester Subject: Management Accounting Subject Code: BCH 302 Dr. R. S. BisariyaMd Imran Hossain KhanNo ratings yet

- Solutions Unit 2,8,9,10,11,16,19Document58 pagesSolutions Unit 2,8,9,10,11,16,19Thảo TrangNo ratings yet

- Fixed Asset Register NotesDocument9 pagesFixed Asset Register NotesNeema EzekielNo ratings yet

- Discussion QuestionsDocument22 pagesDiscussion QuestionsAndhikaa Nesansa NNo ratings yet

- Aznar V CTADocument22 pagesAznar V CTAJuris PasionNo ratings yet

- Annual Financial Statements of Volkswagen AG As of December 31 2023Document294 pagesAnnual Financial Statements of Volkswagen AG As of December 31 2023Bacon PancakesNo ratings yet

- Chapter - 3 Accounting For Public Sector & Civil SocietyDocument88 pagesChapter - 3 Accounting For Public Sector & Civil Societyfekadegebretsadik478729No ratings yet

- Fundamentals of Accounting mgt-205Document2 pagesFundamentals of Accounting mgt-205Kuch B100% (1)

- CeramicGlazedTiles ProjectDocument18 pagesCeramicGlazedTiles ProjectSiddharth AryaNo ratings yet

- Fixed Asset Flexfields in Oracle Assets EBS R12Document2 pagesFixed Asset Flexfields in Oracle Assets EBS R12naveenravellaNo ratings yet

- This Study Resource Was Shared Via: Property, Plant and EquipmentDocument4 pagesThis Study Resource Was Shared Via: Property, Plant and EquipmentStefanie FerminNo ratings yet

- (17 18) Depreciation and TaxesDocument40 pages(17 18) Depreciation and TaxesOwen FrancisNo ratings yet

- Ppe Different Modes of Acquisition Comprehensive ProblemsDocument3 pagesPpe Different Modes of Acquisition Comprehensive ProblemsedrianclydeNo ratings yet

- TB 03Document65 pagesTB 03chowchow123No ratings yet

- 4 Accounting Concepts and ConventionsDocument20 pages4 Accounting Concepts and ConventionsHislord BrakohNo ratings yet

- Screening Capital Investment ProposalsDocument13 pagesScreening Capital Investment ProposalsSandia EspejoNo ratings yet

- ENGM401-LectureSlides 03a Income StatementsDocument34 pagesENGM401-LectureSlides 03a Income StatementsThedudeNo ratings yet

Taxation Paper EMBA 16042022

Taxation Paper EMBA 16042022

Uploaded by

Rohit B .S. Prabhu VerlekarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Paper EMBA 16042022

Taxation Paper EMBA 16042022

Uploaded by

Rohit B .S. Prabhu VerlekarCopyright:

Available Formats

TAXATION SEA PAPER

Duration: 60 Min

Answer Any Three from following questions (from 1 to 5)

(7 marks)

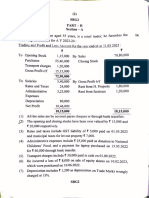

1. Mr. Aditya is a proprietor of Star Stores having 2 units. On 1.4.2020, he has transferred

Unit 2, which he started in 2003-04, by way of slump sale for a total consideration of

INR 18 lakhs. The professional fees & brokerage paid for this transfer are Rs. 78,000.

His Balance Sheet as on 31-03-2020 is as under:

Liabilities Rs Assets Unit 1 Unit 2 Total

(Rs) (Rs)

Own Capital 20,50,000 Land 12,75,000 7,50,000 20,25,000

Revaluation 2,50,000 Furniture 2,00,000 5,00,000 7,00,000

reserve

Bank Loan (70% 8,50,000 Debtors 2,00,000 3,50,000 5,50,000

for Unit 1)

Trade Creditors 4,50,000 Patents - 7,25,000 7,25,000

(20% for Unit 2)

Unsecured Loan 4,00,000

(30% for Unit 2)

40,00,000 16,75,000 23,25,000 40,00,000

Other Information:

a. Land of Unit 2 was purchased at Rs.5,00,000 in the year 2003 and revalued at

Rs.7,50,000 as on 31.3.2020.No individual value of any asset is considered in the

transfer deed.

b. Patents were acquired on 01-12-2018 on which no depreciation has been

provided.

c. Furniture of Unit 2 of Rs.5,00,000 were purchased on 01-12-2019 on which no

depreciation has been provided.

d. Fair market value of capital asset transferred by way of slump sale of Unit 2 is

Rs. 18,10,000.

Compute the capital gain for A.Y. 2021-22.

(7 marks)

2. From the following particulars of income furnished by Mr. Ashutosh, aged 65

years, pertaining to year ended 31.03.2021, show the working for computation of

total income for the A.Y. 2021-22 and tax thereon, if he is a Resident and

ordinarily resident.

Sr. No Particulars Amount

(in Rs)

(i) Long term Capital gain on sale of land in Jaipur to Mr. 15,00,000

Ramesh, a non- resident, outside India. The consideration is

also received outside India in foreign currency

(ii) Rent from property in Delhi, let out to a branch of a foreign 2,20,000

company. The rent agreement is entered outside India.

Monthly rent is also received outside India

(iii) Agricultural income from a land situated in Nepal, received in 55,000

Nepal

(iv) FD Interest on bank deposit in UCO Bank, Delhi 18,000

(v) Gift received from his daughter on his birthday 55,000

(vi) Past foreign taxed income brought to India 37,000

(7 marks)

3. What is agricultural income? How is agricultural income taxed in the hands of

assessee? Give two examples of agricultural income.

(7 marks)

4. Poorna has one house property at Indira Nagar in Bangalore. She stays with her

family in the house. The rent of similar property in the neighborhood is

Rs. 25,000 p.m. The municipal valuation is Rs. 2,80,000 p.a. Municipal taxes

paid are Rs. 8,000. The house construction began in April 2014 with a loan of

Rs. 20,00,000 taken from SBI Housing Finance Ltd. @9% p.a. on 1.4.2014. The

construction was completed on 30.11.2016. The accumulated interest up to

31.3.2016 is Rs. 3,60,000. On 31.3.2021, Poorna paid Rs. 2,40,000 which

included Rs. 1,80,000 as interest. There was no principal repayment prior to this

date. Compute Poorna’s income from house property for A.Y. 2021-22.

(7 marks)

5. Mr. Kunal (age 33 years) an associate director of Transaction Square Limited

submits following information relevant for AY 2021-22:

a. Basic Salary Rs. 14,56,000, Entertainment allowance 1,06,000, Bonus 7,50,000,

income tax penalty paid by employer Rs 9,500, LTC Rs 1,00,000 (actual

expenditure on fare is more than 1,00,000) ,

b. Free residential telephone Rs 18,000, Reimbursement of gas bills Rs 8,500,

Professional tax paid by Mr. Kunal Rs 3,650.

c. House rent allowance 35,000, Monthly Rent paid by him 27,000.

d. Arrears of bonus not taxed earlier Rs, 52,000, payment of delegation fee to FICCI

for attending all India conference for corporate managers Rs 3000,

e. Dividend from Infosys Ltd an Indian company Rs 57,880 and agricultural income

from Bhutan Rs 1,39,000.

f. During the year Mr. Kunal makes the following contribution and expenditure:

Contribution towards recognized provident fund Rs 80,000

Insurance premium for policy of his wife Rs 5,200 (sum assured 90,000)

Deposit in 10 year account under post office savings bank Rs 2,400

Payment of school fees of 2 children Rs 19,200 for each child

Calculate tax liability for AY 2021-22 assuming he resides in Mumbai.

Answer any one question from 6 & 7

(4 marks)

6. Mr. Vikas received a gold ring worth Rs. 60,000 on the occasion of his daughter’s

wedding from his best friend Mr. Vishnu. Mr. Vishnu also gifted a gold chain to

Kavya, daughter of Mr. Vikas, worth Rs. 80,000 on the said occasion. Compute

taxable income in the hands of Mr. Vikas and Ms. Kavya with reasoning for

same.

(4 marks)

7. What benefits are offered under presumptive scheme of taxation for medical

professionals? What are the conditions for availing presumptive taxation scheme?

You might also like

- Test Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 7th Edition Wahlen, Baginski, BradshawDocument33 pagesTest Bank For Financial Reporting Financial Statement Analysis and Valuation A Strategic Perspective 7th Edition Wahlen, Baginski, Bradshawa415878694No ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Tax Laws Letures (13-07-2021 To 17-07-2021)Document28 pagesTax Laws Letures (13-07-2021 To 17-07-2021)shanmukvardhanNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- Tax Mock Test PaperDocument17 pagesTax Mock Test Papermanyagoyall20No ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- DT 1 QDocument23 pagesDT 1 QG INo ratings yet

- Semester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesSemester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksAnshu kumarNo ratings yet

- CS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaDocument269 pagesCS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaParitoshNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- Vol 1 31032019 PDFDocument9 pagesVol 1 31032019 PDFPradeep KattimaniNo ratings yet

- 2 - House Property Problems 22-23Document5 pages2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Ifos WorksheetDocument7 pagesIfos WorksheetjaoceelectricalNo ratings yet

- iNCOME TAX MODEL Q.PDocument3 pagesiNCOME TAX MODEL Q.PAndalNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- QP 1Document7 pagesQP 1Shankar ReddyNo ratings yet

- 4) TaxationDocument21 pages4) TaxationKrushna MateNo ratings yet

- MTP 1Document7 pagesMTP 1Aman VithlaniNo ratings yet

- Sa 1 DT NovDocument10 pagesSa 1 DT NovRishabh GargNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- Capital Gain 2Document11 pagesCapital Gain 2Aishwarya SundararajNo ratings yet

- Sem - IV Taxation - I Sample Paper-1Document5 pagesSem - IV Taxation - I Sample Paper-1yadavkari497No ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- House Propery QuestionsDocument6 pagesHouse Propery QuestionsTauseef AzharNo ratings yet

- Tybms Sem5 DT Nov19Document5 pagesTybms Sem5 DT Nov19omsantoshbhosale01No ratings yet

- DT Test 1Document3 pagesDT Test 1D. NEERAJ kumarNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- tax qpDocument6 pagestax qpAashish kumarNo ratings yet

- Assessment 1Document4 pagesAssessment 1lalshahbaz57No ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Document11 pagesAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- Income Tax Quesion BankDocument22 pagesIncome Tax Quesion BankPaatrickNo ratings yet

- SAHODAYAModel Question Acc SET 2Document9 pagesSAHODAYAModel Question Acc SET 2aamiralishiasbackup1No ratings yet

- TAXQDocument7 pagesTAXQcashubhamkelaNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- May 2024 Full Length DT Test 2Document6 pagesMay 2024 Full Length DT Test 2Jyoti ManwaniNo ratings yet

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocument8 pagesBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Document36 pagesCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNo ratings yet

- Question BankDocument146 pagesQuestion BankSanskriti JainNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- f7sgp 2009 Dec QDocument9 pagesf7sgp 2009 Dec Q10 SPACENo ratings yet

- Frontline Estimate Bid 01Document17 pagesFrontline Estimate Bid 01richard mcGrawNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

- Project GADocument20 pagesProject GABeza AbrNo ratings yet

- Principles of AccountsDocument23 pagesPrinciples of Accountsmohamed sobahNo ratings yet

- 14 Bbma3203 T10 PDFDocument27 pages14 Bbma3203 T10 PDFHarianti HattaNo ratings yet

- Numericals On MAT-115JBDocument2 pagesNumericals On MAT-115JBReema Laser100% (1)

- Accounting Grade 11 Revision Term 1 - 2023Document15 pagesAccounting Grade 11 Revision Term 1 - 2023sihlemooi3No ratings yet

- UBL Interim Financial Statements March 2023 ConsolidatedDocument37 pagesUBL Interim Financial Statements March 2023 Consolidatedabdullahazaim55No ratings yet

- V Guard StabilisersDocument25 pagesV Guard Stabilisersmoondonoo7No ratings yet

- Notes On Ppe GG BC Wa IaDocument12 pagesNotes On Ppe GG BC Wa IaCleo GreyNo ratings yet

- Notes On Accounting of Insurance CompanyDocument6 pagesNotes On Accounting of Insurance Companysneha pathakNo ratings yet

- Faculty of Commerce & Management: Semester Subject: Management Accounting Subject Code: BCH 302 Dr. R. S. BisariyaDocument29 pagesFaculty of Commerce & Management: Semester Subject: Management Accounting Subject Code: BCH 302 Dr. R. S. BisariyaMd Imran Hossain KhanNo ratings yet

- Solutions Unit 2,8,9,10,11,16,19Document58 pagesSolutions Unit 2,8,9,10,11,16,19Thảo TrangNo ratings yet

- Fixed Asset Register NotesDocument9 pagesFixed Asset Register NotesNeema EzekielNo ratings yet

- Discussion QuestionsDocument22 pagesDiscussion QuestionsAndhikaa Nesansa NNo ratings yet

- Aznar V CTADocument22 pagesAznar V CTAJuris PasionNo ratings yet

- Annual Financial Statements of Volkswagen AG As of December 31 2023Document294 pagesAnnual Financial Statements of Volkswagen AG As of December 31 2023Bacon PancakesNo ratings yet

- Chapter - 3 Accounting For Public Sector & Civil SocietyDocument88 pagesChapter - 3 Accounting For Public Sector & Civil Societyfekadegebretsadik478729No ratings yet

- Fundamentals of Accounting mgt-205Document2 pagesFundamentals of Accounting mgt-205Kuch B100% (1)

- CeramicGlazedTiles ProjectDocument18 pagesCeramicGlazedTiles ProjectSiddharth AryaNo ratings yet

- Fixed Asset Flexfields in Oracle Assets EBS R12Document2 pagesFixed Asset Flexfields in Oracle Assets EBS R12naveenravellaNo ratings yet

- This Study Resource Was Shared Via: Property, Plant and EquipmentDocument4 pagesThis Study Resource Was Shared Via: Property, Plant and EquipmentStefanie FerminNo ratings yet

- (17 18) Depreciation and TaxesDocument40 pages(17 18) Depreciation and TaxesOwen FrancisNo ratings yet

- Ppe Different Modes of Acquisition Comprehensive ProblemsDocument3 pagesPpe Different Modes of Acquisition Comprehensive ProblemsedrianclydeNo ratings yet

- TB 03Document65 pagesTB 03chowchow123No ratings yet

- 4 Accounting Concepts and ConventionsDocument20 pages4 Accounting Concepts and ConventionsHislord BrakohNo ratings yet

- Screening Capital Investment ProposalsDocument13 pagesScreening Capital Investment ProposalsSandia EspejoNo ratings yet

- ENGM401-LectureSlides 03a Income StatementsDocument34 pagesENGM401-LectureSlides 03a Income StatementsThedudeNo ratings yet