Professional Documents

Culture Documents

Quota-Based Compensation Plans For Multi-Territory Heterogeneous Sales-Forces

Quota-Based Compensation Plans For Multi-Territory Heterogeneous Sales-Forces

Uploaded by

Maria Paula Robles BulaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quota-Based Compensation Plans For Multi-Territory Heterogeneous Sales-Forces

Quota-Based Compensation Plans For Multi-Territory Heterogeneous Sales-Forces

Uploaded by

Maria Paula Robles BulaCopyright:

Available Formats

QUOPLAN: A System for Optimizing Sales Quota-Bonus Plans

Author(s): Rene Y. Darmon

Source: The Journal of the Operational Research Society , Dec., 1987, Vol. 38, No. 12

(Dec., 1987), pp. 1121-1132

Published by: Palgrave Macmillan Journals on behalf of the Operational Research

Society

Stable URL: http://www.jstor.com/stable/2582749

REFERENCES

Linked references are available on JSTOR for this article:

http://www.jstor.com/stable/2582749?seq=1&cid=pdf-

reference#references_tab_contents

You may need to log in to JSTOR to access the linked references.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

Operational Research Society and Palgrave Macmillan Journals are collaborating with JSTOR to

digitize, preserve and extend access to The Journal of the Operational Research Society

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

J. Opl Res. Soc. Vol. 38, No. 12, pp. 1121-1132, 1987 0160-5682/87 $3.00 + 0.00

Printed in Great Britain. All rights reserved Copyright ? 1987 Operational Research Society Ltd

QUOPLAN: A System for Optimizing

Sales Quota-Bonus Plans

RENE Y. DARMON

Faculty of Management, McGill University, Montreal, Canada

This paper describes an IBM-PC menu-driven and user-friendly procedure which can help sales

management in setting up optimal quota-bonus plans. For a given sales force, the resulting quota-

bonus plan maximizes the firm's current profits subject to (1) keeping every individual sales-force

member at least at his/her current level of satisfaction (or eventually, increasing this level), and (2) being

consistent and harmonious across sales representatives. The QUOPLAN system is composed of two

submodels. The first submodel is used by salespersons for eliciting their own utility functions, and

is essentially based upon the principles of conjoint analysis. The second submodel is used by manage-

ment for reconciling all the individuals' judgements and the company's objectives into a consistent

quota-bonus plan.

Key words: bonus, marketing, optimization, sales quotas

Controlling sales-force activities is a major sales-management task. It is also a difficult task because,

very often, salespeople work away from their home office for long periods of time. Two main

theoretical and empirical research streams have typically been followed to address the sales-force

control problem: setting up (1) decentralized or (2) centralized controls. Decentralized control

research attempts to find conditions under which a salesperson behaving according to his/her best

interest optimizes the firm's objectives at the same time. The jointly optimal sales-force compen-

sation literature has typically followed this route (see, for instance, Berger,1 2 Farley,3 Tapiero and

Farley,4 Weinberg5'6). In order to find such jointly optimal conditions, a set of restrictive

assumptions about salespeople's motives, goals and behaviour is often needed. In addition, this

approach has had some success at devising conditions of sales-force effort allocation, but it has been

less successful at controlling a salesperson's activity level.7'9

This is the reason why a centralized sales-force control approach is often warranted. Centralized

control systems derive guidelines and norms enforced by sales management in order to induce sales

representatives to behave in such a way as to contribute optimally to the firm's own objectives.

The sales-force quota literature typically follows such an approach (see, for instance, Darmon,'0

Davis and Farley,"1 Farley and Weinberg,'2 Winer"3).

The application described in this paper is essentially concerned with the control of salespersons'

activity levels, and hence will follow a centralized approach. The model, QUOPLAN, has been

implemented on the IBM-PC, and can help management design sales-force quota-bonus plans.

These plans will maximize a firm's current profits, subject to keeping all individual salespersons

at their present satisfaction level and to providing an overall consistent and harmonious plan across

salespeople. Salespersons are assumed to have heterogeneous preferences, motives and behaviour.

In addition, short of rationality, no other assumption is needed about individual salespersons'

behaviour.14

This paper is organized as follows: first, the quota setting problem is discussed; second, a formal

model is proposed; finally, the QUOPLAN computer system is described.

PROBLEM-SETTING

Sales quotas are typically used as standards and guidelines to direct salespeople's selling

activities. As a result, they are also convenient control and evaluation devices of salespersons'

performance.5 To be effective, sales quotas must be perceived by salespeople as being attainable

O.RS. 38/12-B 1 121

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

Journal of the Operational Research Society Vol. 38, No. 12

and desirable goals. Otherwise, they are unlikely to raise a salesperson's level of aspiration. Because

meeting quotas is likely to be a desirable objective for a salesperson only if quotas are linked to

some kind of reward/sanction system, quota achievement is generally rewarded, and subquota

performance is sanctioned. Rewards for quota achievement may include financial gains (e.g. a

bonus) or non-financial benefits (e.g. sales-club membership). Sanctions against subquota per-

formers may range from the mere absence of reward to dismissal for recurrent failures to meet

quotas. In this application, a financial bonus is used as a reward, although other forms of financial

or non-financial incentives could have been used as well. The complete absence of bonus is the

sanction for failing to achieve the quota.

Because of the effects of this reward/sanction system on sales-force morale, the importance of

setting 'right' quotas should be underscored. However, setting proper quotas is no easy task, for

at least two reasons.

1. Quotas should be set high enough to bring profits to the company and challenge salespeople.

However, they should be set low enough to be judged attainable and worth the extra effort

by a salesperson. Finding the correct balance is fraught with difficulty. Setting quotas implies

that a sales manager knows the sales response-functions to salespeople's time with some

certainty. Needless to say that this is hardly the case. The response functions depend on such

factors as territory sales-potentials and the responsiveness of the territory to personal selling

activities, as well as on a salesperson's competence level."5

2. Reward for quota achievement should be set high enough to motivate a salesperson to make

the necessary effort to meet quotas, but low enough to keep selling costs under control. Here

again, the balance is not easy to find. The difficulty arises in this case mainly because setting

the proper reward level implies (1) some knowledge about each salesperson's utility functions,

as generally salespeople will find some satisfying compromise between their utility for the

reward and the disutility associated with the effort involved in getting it, and (2) some

knowledge about the attitudes of each salesperson toward risk; for instance, a higher risk must

be borne by a salesperson assigned a high quota and a large reward than by a salesperson

assigned a low quota and a small reward.1"

A theoretical framework, as well as an operational procedure based on conjoint analysis,

has already been proposed for dealing with this problem (see Darmon10 for details). It has

been shown that when a salesperson expresses preferences for various combinations of quota

and bonus levels for their own territories, these preference judgements are likely to take into

account (1) their utility function with respect to reward, (2) their disutility function with respect

to additional work, (3) their perceptions of the territory sales response-function to their own

selling effort, and (4) their attitudes towards risk. However, this procedure had two major

limitations.

First, the procedure only applied to individual salespersons and not to the sales force. Because

of this, there was no guarantee that all the individual optimal quota-bonus solutions were

consistent and compatible with one another. For instance, it may happen that certain salespersons

should be granted much larger bonus amounts for smaller quota increases in comparison with other

sales representatives. If a sales manager were profit maximizing in an 'ideal' world where

salespeople would not communicate among themselves, he/she could use such a personalized

bonus-quota plan without further adjustment. However, this 'optimal' plan might seem unfair to

the second group of salespeople because their low utility for leisure would result in low

compensation. In this instance, the sales manager could cope with this inconsistency by granting

the second group much smaller quotas than suggested by the procedure, but still achieve a

performance level slightly higher than at present. In these cases, the additional bonus to keep these

salespeople at their present satisfaction level is rather small, and could be consistent with the high

bonus increases of the first group. These adjustments can be made by judgement. However, this

could prove to be a tedious and difficult task if many salespeople are involved. A more systematic

and optimal method should prove to have a definite advantage.

Second, the original procedure was difficult to use and apply, because it did not provide a unified

and integrated system for convenient managerial implementation. The QUOPLAN system has been

designed to address these important issues.

1122

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

R. Y. Darmon-QUOPLAN

MODEL DESCRIPTION

Overview of the model structure

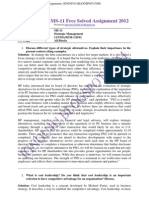

In addition to a preliminary step required for inputting necessary application and basic territory

data by a sales manager and/or by individual sales representatives, QUOPLAN is made of two

submodels: a salesperson's and a manager's submodels (see Figure 1).

The salesperson's submodel is designed to interact with every individual salesperson. Its purpose

is to determine every sales representative's profit-maximizing quota-bonus levels, taking into

account his/her preferences for various combinations of quota and bonus levels.

START

Management/ Inputs = Number of territories (N), Maximum

Salesperson quota -bonus values (a, a, fl

For each salesperson i : sales level (5,),

potential (PF) product mix margin (mj)

Step 1 - QUOPLAN

o Determines the relevant set of quota-bonus options for

salesperson i

Ste2 - SALESPERSON i

o Interacts with QUOPLAN and indicates preferences among

= 3 + selected sets of quota-bonus options

Step 3 - QUOPLAN

o Finds quota/bonus utilities for salesperson i

o Computes salesperson i's indifference-curve parameters

o Finds the optimal plan (0,, B,,) for salesperson i

No

/ iN? >

Yes

Step 4 - QUOPLAN

o Computes overall consistent quota-bonus plan and provides

for each salesperson i Oj, B ,f, Oj, BP , 11, AO!, ABj., AJ1

o Computes overall salesforce expected results:

* * B * I0 B0 0, A0,AB,^g.

Is management Yes

satisfied ?

Step 5 - MANAGEMENT provides weights (ac) for every sales-

personi

FIG. 1. Flow chart of the QUOPLAN system.

1123

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

Journal of the Operational Research Society Vol. 38, No. 12

This submodel includes three steps:.

Step 1. Given some basic territory-characteristic data (sales, potential, product-mix margin), the

system determines the meaningful levels of bonus and quotas that will be used in the various

fictitious quota-bonus plans to be used at step 2.

Step 2. Selected subsets of possible combinations of quota and bonus levels are proposed to the

salesperson in charge of the territory. For every selection, the salesperson must indicate which one

is preferred. Depending upon preceding answers, the system selects the next set of quota-bonus

options proposed to the salesperson.

Step 3. The system determines the underlying utilities of the salesperson for the various quota

and bonus levels. Then it specifies the parameters of the utility functions best fitting these data

points. Finally, the system determines the profit-maximizing quota-bonus combination which

leaves this salesperson at his/her present utility level.

The second submodel is essentially an interactive dialogue between the system and the sales

manager. This dialogue should take place only after all individual salespeople have indicated their

preferences to the system through the preceding submodel. The second submodel includes two

additional steps:

Step 4. Taking into account all the individual optimal solutions at the end of step 3, the system

determines an overall consistent plan across salespeople. To do so, all the individual quota-bonus

solutions must be related by a logical monotonic function (to be selected by management). The

parameters of this function are selected so as minimally to move each salesperson's optimal

compromise along his/her indifference curve (so as to keep the same utility level). The output of

step 4 provides a comparison between the optimal solution and the collectively consistent solution,

for each salesperson and for the whole sales force. Thus, the cost of a specific consistency function

can be assessed (and eventually changed).

Step 5. After a sales manager has examined the solution, he may accept or reject it. The

solution may be changed by assigning unequal weights to the various sales representatives. These

weights may reflect the level of confidence the manager has that various salespeople will

actually achieve their optimal quota, or reflect other subjective judgements about each

salesperson/territory. A new quota-bonus plan will be computed with the new set of weights. Thus,

steps 4 and 5 can be repeated an infinite number of times until management is satisfied with the

final solution.

The salesperson submodel

Setting the range and levels of the quota and bonus options (step 1). Because sales potentials and

sales penetrations may widely vary among territories, and are known to be determinants of sales,15

quota comparisons among territories are expressed as proportions of untapped potential. Thus,

the minimum yearly quota to be given to a salesperson i is defined (for instance) as his/her present

yearly sales level Si. The maximum yearly quota Qi is defined as:

Qi = Si + (Pi-Si)qh, O- S1, (1)

where:

Pi = yearly sales potential of territory i;

qi = maximum proportion of the untapped potenti

of (1) a maximum realistic proportion a, or (2) the maximum realistic sales increase over

last year, i.e. flSi/(Pi - Si). In other words, the maximum quota Qi is equal to the lowest

value of Si + (Pi - Si) and (1 + i3)Si.

Five equidistant levels are selected within the quota range, i.e. q1 = 0, q12 = i/4, qi3 =qi

q4= qi/4 and qi5 = h

In the same way, a maximum conceivable bonus for a very high performer is selected by a

manager to be B. Four equidistant bonus levels are selected as: B11 = 0, B12 = B /3, Bi3 = 2B

1124

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

R. Y. Darmon-QUOPLAN

Bi, = B. Consequently, there are 20 possible combinations of quota-bonus

j E 1, 5 and k E 1, 4.

This step sets up quota-bonus options which are likely to be meaningful for a specific salesperson

and a specific territory.

Salesperson's preference judgements (step 2). Obviously, plan (Qi5, Bil) is the least preferred,

since it offers the smallest bonus with the largest possible quota. Conversely, plan (Qil, Bi4) must

be the most liked. Other than that, the system must ask the salesperson to rank order the

remaining quota-bonus options. Because it would be tedious for a salesperson to compare all

the remaining 18 options at once, the system capitalizes on a few logical assumptions about

the salesperson's preferences for making this task easier. First, a higher bonus should always

be preferred over a lower bonus given the same quota level, and a lower quota should

always be preferred over a high quota for the same bonus level. Mathematically, this can be

expressed as:

U(Qyj, Bi,k+ 1) >U(Qij, Bik) with 1 j < 5 and 1 < k 3 (2)

U(Qi,j+ 1, Bik) < U(Qij, Bik) with 1 sj < 4 and 1 < k < 4 (3)

In other words, it is assumed that sales representatives' utilities are monotonically increasing as

the bonus size increases and monotonically decreasing as the quota levels increase. In addition,

past experience has shown that salespersons' utilities for quotas decrease at an increasing rate as

quotas are increased.10 This reflects the fact that each additional quota increase requires increasing

marginal efforts from salespeople. Mathematically, this is expressed by:

If

U(Qij, Bik) < U(Qij,, Bik'), (4

then

U(Qi,j+ 1, Bik) < U(Qi,j, + 1, Bik')

with

j'<j; k <k' and j,k,j',k',

in the relevant ranges.

Because these two assumptions are built into the system, the program does not ask sales

representatives redundant information. Typically, a sales representative will be asked between 10

and 15 times to indicate the most preferred plan in sets of 2 to 4 options. These numbers are not

constant but depend on the answers supplied by each sales representative. After all these choices

have been input into the system, the system can associate to each plan a number which reflects

a strict rank order of the 20 options, from 20 for the most preferred to one for the least preferred

option.

Individual salespersons' optimal quota-bonus (step 3). Conjoint analysis is used to estimate

utilities."6 The principle of the technique is to ask a salesperson to rank, by increasing order of

preference various combinations of quota and bonus amounts, set according to a factorial design.

These ordinal data can be treated by an algorithm like MONANOVA17 to yield interval-scaled

utilities associated with each quota and bonus level. The additive combination of the utility

numbers associated with the various quota and bonus levels is as close as possible to the input

ordinal data up to a monotonic transformation. The utility scales for bonus and quotas are

asymptotically expressed in the same unit. More details of this conjoint analysis application, as well

as illustrative examples, are provided in Darmon.10

Although the MONANOVA or monotone regression18 algorithms could be used, this model

simply estimates the utilities through multiple regression analysis, with the preference ranks as the

dependent variable. Empirical results by Green19 and Hauser and Urban20 have demonstrated

that regression yields results which are very close to those of the more complex procedures. Thus,

four utility part-worths Uik(k = 1, 4) are associated with the four bonus levels, and five utility

part-worths Wij(j = 1, 5) are associated with the five quota levels.

1125

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

Journal of the Operational Research Society Vol. 38, No. 12

Now continuous curves are fitted to these data points. This procedure has been shown to be more

accurate than piecewise interpolations.21 Past experience with this procedures has shown that the

bonus utilities can be adequately represented by a positive linear function of the bonus levels, and

the quota utilities by a decreasing quadratic function of quota levels. In other words, the following

functional forms are used by the model:

Ui=ai+biBi, bi>O (5)

and

Wi = ci + diqf + e-qi, ei < 0 and di < 0. (6)

The coefficients ai, bi, ci, di and ei are computed through linea

the least-squares method. Currently, the sales representative i has a utility level of ai + ci (i.e. no

additional quota, no bonus). If quota is increased to a certain value qi, quota utility will drop from

ci to ui = ci + diqi + eiq, i.e. this utility will decrease by - (di qi +eiq). In order to keep this

salesperson at his/her original utility level (ai + ci), this drop must be compensated by a certain

bonus Bi:

-(diqi+ eiq4) = biBi. (7)

In other words,

Bi = fiqi + giq4 (0 < qi <, i), (8)

with

fi = -dibi and gi =-ei/bi.

Equation (8) represents a salesperson's iso-preference curve. In other words, this salesperson

should display the same preference level for all the points (or quota-bonus combinations) on this

curve.

The next step is to find the additional quota proportion q* and the bonus B* that will

maximize profits subject to the constraint that the new plan remains on the sales represen-

tative's iso-preference curve. The additional profits Ani generated by the additional quota are

given by:

Ani= mi(Pi - Si)qi - Bi, (9)

where mi = profit margin of this sales r

Bi by its value in (8) leads to:

Ani = [mi(Pi - Si) - fi]qi - gii (10)

Consequently, the optimal additional quota that will maximize additional profits is characterized

by the proportion q* of untapped potential:

dA~ri/dq =0 = mi(Pi - Si) - f -2giq (11)

or

q*= [mi(Pi-Si)-f]/2gi, with 0 <qi* <hi (12)

and

BI= Jiqi*+giqi (13)

These values of qi*, Bi* and A

later computations.

The sales manager 's submodel

Finding a consistent quota-bonus plan (step 4). Although once all the sales representatives

have interacted with the system, an optimal quota-bonus plan has been determined for each of

1126

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

R. Y. Darmon-QUOPLAN

them, there is no guarantee that the different solutions will follow a consistent pattern. In

most cases, management would like to have a logical and consistent pattern between additional

quotas and bonuses. This principle will be illustrated here with a simple linear relationship,

although any monotonically increasing pattern may be used. In QUOPLAN, a sales manager

has the option to select any functional form of the type: Bi = Cqx( > 0), and a specific

value for a. If 0 < a < 1, the function displays decreasing marginal returns; if a > 1, it displays

increasing marginal returns; if a = 1, the function is linear. For instance, management may

wish to see that all the quota-bonuses (qi, Bi) given to the salespersons follow the linear

relationship:

B? = Cq?, Vi, (14)

where C is a constant. Because generally (Q?, B?) will be different from (Q*, Br), management

will change the optimal plan but will want to keep the salesperson at the same utility level.

Consequently,

B?? = fiq? + giq?', Vi. (15)

Replacing B? by its value in (14) and solving for q? and B? gives:

q0 = (C-f)lgi and B? = C(C-fi)lgi. (16)

The additional profits given by this (less than optimal) solution are:

A = mi(Pi - Si)q - B?, (17)

and replacing q? and B? by their values in (16) gives:

An= (C -f)[(Pi- Si)mi- C]/gi. (18)

Consequently, selecting the consistent plan (Q ?, B?) instead of the optimal plan (Q *, B*) results

in a drop of additional profits of equation (10) less equation (18), or:

dAiti = [(Pi- Si)mi-f ]qi -giqi2 mi(Pi- S)(C -f)/gi + C(C -f)/ggi (19)

Optimally, C should be selected so as to minimize this drop in additional profits. Formally:

Minimize IdAlHi, with respect to C. (20)

Because the solutions q??, B?? must be constrained in the feasible ranges (0, hi), an an

tion is not used. The optimal C* value is found by an iterative procedure: each salespersons's

optimal solution is found, and for a given C value, opportunity cost of the plan is assessed. C is

varied by successive increments in its feasible range, and the C* value which minimizes opportunity

costs is found.

Using this optimal C value, it is easy to compute each consistent quota-bonus for every

salesperson, using equation (16).

Adjusting the quota-bonus plan (step 5). If a sales manager wishes to change the proposed

plan by assigning differential weights yfito each salesperson with 0Cy* 1,Vi, the C value

is reassessed after weighting the profit contribution of each salesperson accordingly.

Analytically:

Minimize yi dA sle with respect to C. (21)

The weights can be changed any number of times until the sales manager is satisfied with the

proposed plan.

1127

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

Journal of the Operational Research Society Vol. 38, No. 12

THE QUOPLAN COMPUTER SYSTEM

QUOPLAN is a completely interactive menu-driven program. Through a system of passwords,

salespeople and managers can access all or only parts of the system. For instance, a salesperson

can only access his/her own territory's data, while management can access all data, except sales-

persons' preference judgements. For the sales manager's and the sales representatives' subsystems,

one part of the dialogue leads to finding a new quota-bonus plan. Another part is designed to

manage territory data (i.e. list, modify data on territories, change data about an application, add

or delete territories, etc.).

The salesperson's subsystem

The typical salesperson dialogue with QUOPLAN is given in Appendix 1, and is essentially

self-explanatory.

The sales manager's subsystem

After all the sales representatives have interacted with the system, the sales manager

dialogues with QUOPLAN in order to work out a consistent quota-bonus plan. The typical

dialogue is shown in Appendix 2, and is essentially self-explanatory, except perhaps for the

following remarks.

On the first screen, the two asterisks (**) next to a sales representative's name indicate

that he/she has already interacted with QUOPLAN and that his/her preferences will there-

fore enter into the computations. The dashes (-) mean that the sales representative has not

indicated his/her preferences to QUOPLAN yet, and that QUOPLAN will therefore ignore

them in its computations. This listing of sales representatives is provided so that a manager can

have a good idea, ahead of time, of who exactly has or has not yet interacted with QUOPLAN.

After a few seconds of computing, QUOPLAN prints out the quota-bonus plan it has just

worked out, starting with a list of totals (screen 2). The optimal amounts contained in the

left-most column indicate the amounts that would be obtained if each sales representative

followed the optimal quota-bonus plan that was determined when each individual sales repre-

sentative interacted with QUOPLAN. The second column indicates the figures that are

reached when the constraint of a consistent quota-bonus plan over all sales representatives is

added.

Once these totals have been examined, the manager can get a more precise picture of the plan

by pressing the space bar and getting the details of proposed quotas, bonuses and resulting profits

for each individual sales-force member (screen 3). At the same time, the manager can change the

weight from 1.0 to any value between 0 and 1.0 for each salesperson. After the review, a new plan

will be computed taking the new weights into account.

CONCLUSIONS

The basic theoretical principles and the conjoint analysis procedure to elicit salespeople's

judgements have already been tested and have proved to be quite valuable (see Darmon10).

However, because the procedure was not easy to implement at the sales-force level, the procedure

could not be used as a routine management tool. This paper has presented a completely

menu-driven computerized procedure which is extremely user-friendly and which should remove

most of the obstacles to using these concepts for the practice of sales-force controls. More

specifically, through QUOPLAN, each salesperson can now provide his/her preferences for various

quota and bonus options through a simple and short dialogue with the system. Then QUOPLAN

can provide the sales manager with a quota-bonus plan which is consistent across salespeople. In

addition, QUOPLAN can take into account a manager's judgemental inputs. This ensures that the

sales manager keeps in control of the system, and will eventually reach a solution that is acceptable

to management.

1128

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

R. Y. Darmon QUOPLAN

APPENDIX 1

Typical dialogue between a salesperson and QUOPLAN

SCREEN 1

SALES REPRESENTATIVES' MENU

1/ MANAGE DATA ON TERRITORY

Use this option to list and modify data on your sales territory.

2/ DIALOGUE WITH QUOPLAN

Use this option to dialogue with QUOPLAN. You will be asked to

indicate your preferences with regard to different quota-bonus plans. These

preferences will be taken into account in setting up the quota-bonus plan

for next period.

Esc/ EXIT FROM MENU

Please select the desired option (1, 2 or [Esc])...

[If the salesperson types: '2', SCREEN 2 appears. If '1' is typed, SCREEN 4

appears.]

SCREEN 2

SALES REPRESENTATIVES' PREFERENCES

Assume that you are given the choice between these two plans.

Which one would you prefer? (from 1 to 2):

PLAN NO. 1 PLAN NO. 2

QUOTA ($): 124900 110000

BONUS ($): 7000 2300

[The salesperson types '2' (for instance).]

1129

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

Journal of the Operational Research Society Vol. 38, No. 12

SCREEN 3

SALES REPRESENTATIVES' PREFERENCES

Assume that you are given the choice between these three plans.

Which one would you prefer? (from 1 to 3):

PLAN NO. 1 PLAN NO. 2 PLAN NO. 3

QUOTA ($): 139700 124900 110000

BONUS ($): 7000 4700 2300

[This process continues between 10 and 15 times. Then, the salesperson is thanked

for his/her co-operation.]

SCREEN 4

DATA ON TERRITORY NO. 1: ALABAMA

(A) Sales representative: JOHNSON | (C) Sales ($) 110000

(B) Sales territory: ALABAMA | (D) Potential ($:300000

HISTORICAL DATA

1 1980 2 1981 3 1982 4 1983

1 POTENTIAL ($) 250000 270000 290000 295000

2 QUOTA ($) 80000* 95000 105000* 110000*

3 SALES ($) 82500 91000 107239 110923

4 BONUS ($) 7500* 8000 8000* 9000*

* = Quota was met/bonus received.

You have interacted with QUOPLAN and your preferences will be taken

into account.

ENTER NO. OF INFORMATION TO CHANGE (Esc TO EXIT)...

1130

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

R. Y. Darmon QUOPLAN

APPENDIX 2

Typical dialogue between a sales manager and QUOPLAN

SCREEN 1

DIALOGUE

1 JOHNSON ** 17 WEBSTER

2 SMITH ** 18 CLAIRBORNE

3 BROWN ** 19 WILLIAM

4 JAMISON 20 McKINLEY

5 SIMON : 21 KENNEDY

6 WATT : 22 LEWIS

7 NICHOLSON 23 GARFIELD

8 COOLIDGE : 23 CARSON

9 SCOFIELD : 25 WHITE

10 PUNBAR : 26 LUKE

11 SANDERS : 27 ROTCHEL

12 JACKSON : 28 DARMON

13 BOWEN : 29 BYRNE

14 PARKER : 30 SCOWCROFT

15 CONALLY : 31 MAILER

16 LONG : 32 CLARK

Please press space bar to continue...

[After all territories have been listed, QUOPLAN will print out the quota-bonus

plan it has just worked out, starting with a list of totals, as shown below.]

SCREEN 2

QUOTA-BONUS PLAN

* * * * * TOTALS * * * * *

INDIVIDUAL PLANS CONSISTENT PLAN DIFFERENCE

QUOTA (in $) 953500 953500 0

BONUS (in $) 22670 22763 -93

PROFIT (in $) 17965 17872 93

The total profit from this plan will be: 17872

[The manager presses the space bar.]

1131

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

Journal of the Operational Research Society Vol. 38, No. 12

SCREEN 3

QUOTA-BONUS PLAN

No: 3 TERRITORY: CALIFORNIA SALES REP: BROWN

INDIVIDUAL PLANS CONSISTENT PLAN DIFFERENCE

QUOTA (in $) 310300 310300 0

BONUS (in $) 11335 11381 -47

PROFIT (in $) 7629 7582 47

Weight assigned to this sales representative: 1.0000

Now, you may enter a new weight a (0 < a < 1), or a territory number,

('N' for next territory, 'P' for preceding, '0' to compute new plan, space bar

for totals). Press the Esc key to exit.

[This process continues until the manager is satisfied with the quota-bonus plan.]

Acknowledgement-The author gratefully acknowledges the programming assistance of Henri R. Darmon.

REFERENCES

1. P. D. BERGER (1972) On setting optimal sales commissions. Opi Res. Q. 23, 213-215.

2. P. D. BERGER (1975) Optimal compensation plans: the effects of uncertainty and attitude towards risk on the salesman

effort allocation decision. In Proceedings of the 1975 Marketing Educators' Conference (E. MAZZE, Ed.). American

Marketing Association, Chicago, Ill.

3. J. U. FARLEY (1964) Optimal plan for salesmen's compensation. J. marking Res. 1, 39-43.

4. C. S. TAPIERO and J. U. FARLEY (1975) Optimal control of sales force effort in time. Mgmt Sci. 21, 976-985.

5. C. B. WEINBERG (1975) An optimal commission plan for salesmen's control over prices. Mgmt Sci. 21, 937-943.

6. C. B. WEINBERG (1978) Jointly optimal sales force commissions for non-income maximizing sales forces. Mgmt Sci.

24, 1252-1258.

7. R. Y. DARMON (1981) Optimal compensation plans for salesmen who trade-off leisure time against income. J. Opl Res.

Soc. 32, 381-390.

8. R. Y. DARMON (1983) A partial theory of sales force response to compensation changes. In Proceedings of the 12th

Annual Conference of the European Marketing Academy, Grenoble, France.

9. V. SRINIVASAN (1981) An investigation of the equal commission rate policy for a multi-product sales force. Mgmt Sci.

27, 731-756.

10. R. Y. DARMON (1979) Setting sales quotas with conjoint analysis. J. marking Res. 15, 133-140.

11. 0. A. DAVIS and J. U. FARLEY (1971) Allocating sales force effort with commissions and quotas. Mgmt Sci. 18, 55-63.

12. J. U. FARLEY and C. B. WEINBERG (1975) Inferential optimization: an algorithm for determining optimal sales

commissions in multi-product sales forces. Opi Res. Q. 25, 413-418.

13. L. WINER (1973) The effect of product sales quotas on sales force productivity. J. marking Res. 10, 180-183.

14. R. Y. DARMON (1974) Salesmen's response to financial incentives: an empirical study. J. marking Res. 11, 418-426.

15. H. C. LUCAS, C. B. WEINBERG and K. CLOWES (1975) Sales response as a function of territory potential and sales

representative workload. J. marking Res. 12, 298-305.

16. P. E. GREEN and V. SRINIVASAN (1978) Conjoint analysis in consumer research: issues and outlook. J. Cons. Res. 5,

103-123.

17. J. B. KRUSKAL and F. CARMONE (undated) Use and theory of MONANOVA, a program to analyze factorial

experiments by estimating monotone transformations of the data. Unpublished paper.

18. R. M. JOHNSON (1975) A simple method for pairwise monotone regression. Psychometrika 40, 163-168.

19. P. E. GREEN (1975) Marketing applications of MDS: assessment and outlook. J. Marktng 39, 24-31.

20. J. R. HAUSER and G. L. URBAN (1977) A normative methodology for modeling consumer response to innovation. Opns

Res. 25, 579-619.

21. D. PEKELMAN and S. K. SEN (1977) Measurement and estimation of conjoint utility functions. J. Cons. Res. 5,

263-271.

1132

This content downloaded from

200.3.152.96 on Fri, 19 Aug 2022 03:55:53 UTC

All use subject to https://about.jstor.org/terms

You might also like

- Patty Brennan Homeopathic GuideDocument54 pagesPatty Brennan Homeopathic Guidepawajee50% (2)

- Astm C 423Document12 pagesAstm C 423Abhinav AcharyaNo ratings yet

- anthonyIM 23Document25 pagesanthonyIM 23ceojiNo ratings yet

- Project Management For Information Systems by James Cadle and Donald Yeates End of Chapter Questions and Answers Chapter 1 Managing ChangeDocument35 pagesProject Management For Information Systems by James Cadle and Donald Yeates End of Chapter Questions and Answers Chapter 1 Managing ChangeAbhishek RanaNo ratings yet

- Chap 023Document23 pagesChap 023Neetu RajaramanNo ratings yet

- Editing Coding and Tabulation of Data-Marketing ResearchDocument16 pagesEditing Coding and Tabulation of Data-Marketing ResearchArivanandan Get Going100% (1)

- Y8 Textiles WorkbookDocument68 pagesY8 Textiles WorkbookCharlene Joy100% (1)

- Attitude Toward The Advertising MusicDocument9 pagesAttitude Toward The Advertising MusicAlexandra CiarnauNo ratings yet

- Palgrave Jors 2601292Document10 pagesPalgrave Jors 2601292Hạnh HồngNo ratings yet

- Pricing Decision Support SystemsDocument19 pagesPricing Decision Support SystemsYasemin OzcanNo ratings yet

- Day, G. S and Wensley, R (1988) Assessing Advantage A Framework For Diagnosing Competitive SuperiorityDocument21 pagesDay, G. S and Wensley, R (1988) Assessing Advantage A Framework For Diagnosing Competitive SuperiorityElvis CamdessusNo ratings yet

- Taguig City University: College of Business Management Pricing and CostingDocument27 pagesTaguig City University: College of Business Management Pricing and CostingLeigh MarianoNo ratings yet

- Jariatu MGMT AssignDocument10 pagesJariatu MGMT AssignHenry Bobson SesayNo ratings yet

- 1986 Freedman - How To Develop A Sales Compensation PlanDocument9 pages1986 Freedman - How To Develop A Sales Compensation Plankeku091No ratings yet

- A Practical Approach To Sales Compensation: What Do We Know Now? What Should We Know in The Future?Document56 pagesA Practical Approach To Sales Compensation: What Do We Know Now? What Should We Know in The Future?anitayadavNo ratings yet

- MBA 540 Final - ExamDocument4 pagesMBA 540 Final - ExamJoeNo ratings yet

- Price Execution How To Get Pricing Power Into Your Sales ForceDocument4 pagesPrice Execution How To Get Pricing Power Into Your Sales ForceasaadNo ratings yet

- Sales Manage Ment FinalDocument9 pagesSales Manage Ment FinalVinisha MantriNo ratings yet

- Different Types of Sales Incentive Payout Curves Explained - Aurochs SolutionsDocument1 pageDifferent Types of Sales Incentive Payout Curves Explained - Aurochs SolutionsReeteyNo ratings yet

- Playing Offense During A Downturn - by Gokul Rajaram - MediumDocument6 pagesPlaying Offense During A Downturn - by Gokul Rajaram - MediumRavi BhoguNo ratings yet

- Compensation PlanDocument44 pagesCompensation PlanSneha SharmaNo ratings yet

- DSS CaseStudyDocument33 pagesDSS CaseStudysomeoneLovesBlackNo ratings yet

- Jari Managerial Accounting AssignmentDocument8 pagesJari Managerial Accounting AssignmentHenry Bobson SesayNo ratings yet

- HR Chapter 12Document4 pagesHR Chapter 12Gwenn PosoNo ratings yet

- Assessing Advantage - Day PDFDocument28 pagesAssessing Advantage - Day PDFAmirah AliNo ratings yet

- Company Valuation ThesisDocument4 pagesCompany Valuation Thesisangelaweberolathe100% (1)

- SMU A S: Sales Distribution & Supply Chain ManagementDocument27 pagesSMU A S: Sales Distribution & Supply Chain ManagementGYANENDRA KUMAR MISHRANo ratings yet

- Effective Sales Comp Plans Q 42004Document11 pagesEffective Sales Comp Plans Q 42004Preeti SadhwaniNo ratings yet

- Ch01 McGuiganDocument31 pagesCh01 McGuiganJonathan WatersNo ratings yet

- Allocating Sales Effort and QuotaDocument23 pagesAllocating Sales Effort and QuotaPrashant DubeyNo ratings yet

- Sales Quotas, Budgeting & ControlDocument12 pagesSales Quotas, Budgeting & ControlAbhishek SisodiaNo ratings yet

- Objectives of FirmDocument20 pagesObjectives of Firmdranita@yahoo.comNo ratings yet

- Operational Decision MakingDocument9 pagesOperational Decision MakingyudaNo ratings yet

- Eoc AnsDocument35 pagesEoc AnsMahesh SriniNo ratings yet

- Industrial TwoDocument16 pagesIndustrial TwoSitra AbduNo ratings yet

- Strategic Pricing Secret Sauce Executives 106561Document13 pagesStrategic Pricing Secret Sauce Executives 106561ricardo navarreteNo ratings yet

- This Team Could Be Staffed With Full-Or Part-Time: Process Center of ExcellenceDocument11 pagesThis Team Could Be Staffed With Full-Or Part-Time: Process Center of ExcellencevinodjayakeerthiNo ratings yet

- Holmstrom Milgrom 1991Document30 pagesHolmstrom Milgrom 1991faqeveaNo ratings yet

- Financial Management by SaumyaDocument59 pagesFinancial Management by Saumyasaumyaranjanbiswal92No ratings yet

- Using Performance Measures To Drive Maintenance Improvement: Sandy Dunn Asseti V Ity Pty LTDDocument14 pagesUsing Performance Measures To Drive Maintenance Improvement: Sandy Dunn Asseti V Ity Pty LTDSteevenNicolasQuijadaReyesNo ratings yet

- MK0001 Set 1Document6 pagesMK0001 Set 1RK SinghNo ratings yet

- Anaplan Navigating Change Ebook v2Document8 pagesAnaplan Navigating Change Ebook v2Gopii GopiNo ratings yet

- Compensation ManagementDocument10 pagesCompensation ManagementRadhika SinhaNo ratings yet

- MGT603 SOLVED Finalterm SubjectiveDocument10 pagesMGT603 SOLVED Finalterm SubjectiveAbdul JabbarNo ratings yet

- Chapter 6 Performance Objectives of Operations ManagementDocument17 pagesChapter 6 Performance Objectives of Operations ManagementJimmy Ong Ah Huat100% (2)

- IGNOU MBS MS-11 Free Solved Assignment 2012: Presented byDocument4 pagesIGNOU MBS MS-11 Free Solved Assignment 2012: Presented byroshdan23No ratings yet

- Master of Business Administration-MBA Semester 3 ' Supply Chain" Specialization SC0009-Supply Chain Cost Management - 4 Credits Assignment (60 Marks)Document8 pagesMaster of Business Administration-MBA Semester 3 ' Supply Chain" Specialization SC0009-Supply Chain Cost Management - 4 Credits Assignment (60 Marks)mreenal kalitaNo ratings yet

- Material de Lectura - Tema 05 - World at Work - BroadbandingDocument5 pagesMaterial de Lectura - Tema 05 - World at Work - BroadbandingFather McKenzieNo ratings yet

- 603 Current SubjectiveDocument11 pages603 Current SubjectiveMehak MalikNo ratings yet

- Material No. 3Document9 pagesMaterial No. 3rhbqztqbzyNo ratings yet

- Ili Cue See Model PaperDocument8 pagesIli Cue See Model PaperaustinfruNo ratings yet

- Notes Chapter WiseDocument55 pagesNotes Chapter WiseBitan SahaNo ratings yet

- Importance of ProbabilityDocument5 pagesImportance of ProbabilityShadab HasanNo ratings yet

- TEST MKT623.editedDocument7 pagesTEST MKT623.editedNur RaihanahNo ratings yet

- CH-5 Analysis of Firm StructureDocument15 pagesCH-5 Analysis of Firm StructureRoba AbeyuNo ratings yet

- Sale Organization StructureDocument24 pagesSale Organization StructurejasmineNo ratings yet

- GraceDocument3 pagesGraceguruNo ratings yet

- 2.sales Compesnation PlanDocument8 pages2.sales Compesnation Planhimmathayer52671No ratings yet

- Total Quality Management/ Total Quality Leadership in Sales: Policy ForumDocument4 pagesTotal Quality Management/ Total Quality Leadership in Sales: Policy Forumthor7527No ratings yet

- H#3 Objectives of Business FirmDocument2 pagesH#3 Objectives of Business FirmMd. Didarul AlamNo ratings yet

- Delivering Desired Outcomes Efficiently:: The Creative Key T O Competitive StrategyDocument19 pagesDelivering Desired Outcomes Efficiently:: The Creative Key T O Competitive StrategyOrlando RamosNo ratings yet

- Commercial Excellence: Slide 1 - Title SlideDocument8 pagesCommercial Excellence: Slide 1 - Title SlideMridul DekaNo ratings yet

- CH02Document19 pagesCH02Min WilsNo ratings yet

- Cut Costs, Grow Stronger : A Strategic Approach to What to Cut and What to KeepFrom EverandCut Costs, Grow Stronger : A Strategic Approach to What to Cut and What to KeepRating: 5 out of 5 stars5/5 (1)

- Salesforce Compensation - An Analytical and Empirical Examination of The Agency Theoretic ApproachDocument17 pagesSalesforce Compensation - An Analytical and Empirical Examination of The Agency Theoretic ApproachMaria Paula Robles BulaNo ratings yet

- Contratos Homogéneos para Agentes Heterogéneos - Alineación de La Composición y Compensación de La Fuerza de VentasDocument23 pagesContratos Homogéneos para Agentes Heterogéneos - Alineación de La Composición y Compensación de La Fuerza de VentasMaria Paula Robles BulaNo ratings yet

- The 'Ratchet Principle' and Performance IncentivesDocument8 pagesThe 'Ratchet Principle' and Performance IncentivesMaria Paula Robles BulaNo ratings yet

- Perspectives On Behavior-Based Versus Outcome-Based Salesforce Control SystemsDocument14 pagesPerspectives On Behavior-Based Versus Outcome-Based Salesforce Control SystemsMaria Paula Robles BulaNo ratings yet

- Comfort ZoneDocument4 pagesComfort Zonesigal ardanNo ratings yet

- Drawing Using Cad SoftwareDocument21 pagesDrawing Using Cad SoftwareChris HeydenrychNo ratings yet

- CyberbullyingDocument8 pagesCyberbullyingapi-433558817No ratings yet

- 3700 S 24 Rev 0 ENDocument3 pages3700 S 24 Rev 0 ENJoão CorrêaNo ratings yet

- LG+47ln5700 47ln570t 47ln570y 47ln5710 Chassis lb33bDocument119 pagesLG+47ln5700 47ln570t 47ln570y 47ln5710 Chassis lb33bmidominguez0% (1)

- Tle 7-1st Periodic TestDocument2 pagesTle 7-1st Periodic TestReymart TumanguilNo ratings yet

- Unit 1 - Task 3 - Reader Guru Adventure! - Evaluation Quiz - Revisión Del IntentoDocument7 pagesUnit 1 - Task 3 - Reader Guru Adventure! - Evaluation Quiz - Revisión Del IntentoNelson AbrilNo ratings yet

- Form 137Document2 pagesForm 137Raymund BondeNo ratings yet

- Reflection Paper On "Legal Research, Legal Writing, and Legal Analysis: Putting Law School Into Practice" by Suzanne RoweDocument2 pagesReflection Paper On "Legal Research, Legal Writing, and Legal Analysis: Putting Law School Into Practice" by Suzanne RoweRobert Jay Regz Pastrana IINo ratings yet

- Infosys-Broadcom E2E Continuous Testing Platform Business Process Automation SolutionDocument16 pagesInfosys-Broadcom E2E Continuous Testing Platform Business Process Automation Solutioncharu.hitechrobot2889No ratings yet

- Linx Enterprise: Getting Results GuideDocument56 pagesLinx Enterprise: Getting Results GuideSaadullah SiddiquiNo ratings yet

- Biophilic Design: ARC407 DissertationDocument4 pagesBiophilic Design: ARC407 DissertationAaryan JainNo ratings yet

- Oma TS MLP V3 - 2 20110719 ADocument128 pagesOma TS MLP V3 - 2 20110719 AkennychanklNo ratings yet

- Relatorio Mano JulioDocument7 pagesRelatorio Mano JulioProGeo Projetos AmbientaisNo ratings yet

- Rikki Tikki Tavi Story Lesson PlanDocument3 pagesRikki Tikki Tavi Story Lesson Planapi-248341220No ratings yet

- Biogas ProductionDocument7 pagesBiogas ProductionFagbohungbe MichaelNo ratings yet

- SummaryDocument2 pagesSummaryRosida IdaNo ratings yet

- Research PaperDocument7 pagesResearch PaperHazirah AmniNo ratings yet

- Module - 1 IntroductionDocument33 pagesModule - 1 IntroductionIffat SiddiqueNo ratings yet

- US Gasification DatabaseDocument9 pagesUS Gasification DatabaseAhmad DaoodNo ratings yet

- ManualeDelphi IngleseDocument86 pagesManualeDelphi IngleseoxooxooxoNo ratings yet

- Turnaround Strategies Vol IDocument7 pagesTurnaround Strategies Vol INeeraj SethiNo ratings yet

- The Radiology Assistant - Fleischner 2017 GuidelineDocument11 pagesThe Radiology Assistant - Fleischner 2017 GuidelineHenry J. Hernández L.No ratings yet

- CaneToadsKakadu 2Document3 pagesCaneToadsKakadu 2Matheesha RajapakseNo ratings yet

- SBAS35029500001ENED002Document20 pagesSBAS35029500001ENED002unklekoNo ratings yet

- Alameda Investments - Alameda InvestmentsDocument9 pagesAlameda Investments - Alameda InvestmentsLuisNo ratings yet