Professional Documents

Culture Documents

Graycliff Presentation Exploration Season 2022

Graycliff Presentation Exploration Season 2022

Uploaded by

James HudsonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Graycliff Presentation Exploration Season 2022

Graycliff Presentation Exploration Season 2022

Uploaded by

James HudsonCopyright:

Available Formats

GRAYCLIFFEXPLORATION.

COM

INVESTOR PRESENTATION

SPRING 2022

GRAY CSE GRYCF OTCQB GE0 FSE

Investment Highlights

• Shakespeare Gold Project: Exploring for

high-grade gold in the “shadow” of a headframe

• Phase 3 drilling completed in Feb 2022;

Phase 4 underway – VG idenitified

• Over 10,000 metres drilled as of June 2022

• Mineralized zone: open in all directions,

over 115 m NE-SW, over 120 m NW-SE,

and to a depth of greater than 250 m

• Baldwin Project: 1,500 hectares that are adjacent and with

similar geology to Shakespeare, field exploration underway,

drilling to begin soon

• The makings of a new Ontario gold camp

• All-Star Technical Team: Credited with major Ontario mining

discoveries

• Tight capital structure and fully funded for 2022 exploration

2 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

SHAKESPEARE PROJECT

SU D BU RY, O N TAR IO

3 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Shakespeare Project

Ontario, Canada

• Located 88 km west of Sudbury, Ontario

• Project is located in a well-known geology on the

prolific Canadian Shield at the contact between the

Archean, Southern and Superior geological provinces

• Excellent Infrastructure

• Just off the Trans-Canada Highway

• Power, water and road access at site

• Property consists of one (1) crown patented lease, two (2)

crown leases, and 40 mineral claims covering 1,025 ha in

one contiguous block

• Shakespeare Mine was in operation from 1903-1907

• 2,959 oz of Au were produced from six underground areas

• Over 10,000 metres of core drilling completed to date

• Mineralized zone extended in all directions and multiple high-grade,

significant-width gold intersections reported

4 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Shakespeare Project Geology

Potential for

Significant Mineralization

• Major north-east trending faults

cross through the area

• A series of quartz veins and stock works of

quartz veins containing sulphides has been

identified on

the property

• Quartz veins identified a

considerable distance to the northeast of

the former mine site suggest a regional

structure

• Potential for other gold discoveries

along the prospective Shakespeare

gold-bearing horizon of over 6 km

5 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Shakespeare Project Overview

Property’s Massive Potential Starting to Get

Uncovered

• The Shakespeare mine operated from 1903 to 1907 and produced 2,959 oz of

gold, when gold was US$19 per oz.

• Limited historical exploration and drilling had been carried out until 2014, when

a new strategy was developed and partially tested.

• Our team reviewed numerous historical reports and

initiated our initial exploration and drilling program in Q3 2020.

• Graycliff intends to re-open the adit into the 3rd level of the former mine (the

“#3 Adit”) to carry out exploration and drilling from underground upon the

receipt of permits.

• Airborne geophysics completed - results pending.

Phase 2 drilling core: visible gold identified

6 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Shakespeare Project High-Grade Au in the Shadow of Historical Headframe

>10,000 metres drilled. Mineralized zone extended and open in ALL directions.

High-grade gold mineralization identified. VG in 4 of 11 holes in Phase 4.

• J-7: 5.5 m of 8.59 g/t Au at depth of 68.5 m, incl.

• 1.0 m of 43.6 g/t Au & 1.0 m of 1.8 g/t Au

• J-8: 16 m of 16.37 g/t Au at a depth of 89 m, incl.

• 10.5 m of 6.5 g/t Au, 3.0 m of 67.0 g/t Au,

0.7 m of 90.1 g/t Au and 1.0 m of 137.0 g/t Au

• J-9: 16 m of 13.32 g/t Au at a depth of 104 m, incl.

• 1.0 m of 3.1 g/t Au and 4.0 m of 52.1 g/t Au

• J-21: 4.2 m of 19.38 g/t Au at a depth of 138 m, incl.

• 1.0 m of 13.1 g/t Au and 0.6 m of 112.0 g/t Au

• J-22: 2.7 m of 46.2 g/t Au at a depth of 167 m

and 4.8 m of 46.0 g/t Au at a depth of 190 m

• J-31: 2.0 m of 20.52 g/t Au at a depth of 204 m, incl.

• 1.0 m of 39.0 g/t Au

• J-36: 5.0 m of 6.23 g/t Au at a depth of 105 m, incl.

• 1.0 m of 14.3 g/t Au

7 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Shakespeare Project Surface Channel Sampling

Highlighted results include:

• 137.0 g/t Au over 0.71 m

• 54.20 g/t Au over 0.56 m

• 15.30 g/t Au over 0.49 m

The channel samples were located proximal to the

historic Miller Shaft and the boundaries of the

mineralized zone identified throughout drilling.

Results prove that the mineralized zone extends

from surface down to at least 250 metres below

surface.

Further surface channel sampling will be carried out

as part of summer 2022 exploration program.

The goal is to expand the mineralized footprint at

surface to identify new zones for future drilling.

8 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Shakespeare Project 2022 Exploration Plan

Phase 3 core - looking at VG: President & CEO James Macintosh

Completed Phase Three drilling

• >7,000 m total completed – average hole lengths of approximately 150 m

Phase Four drilling commenced in Q1 2022

• 11 holes drilled and over 2,500 m of a minimum of 5,000 m drilled

3D modelling (ongoing)

• Comprehensive, including historic mine workings,

field sampling, all phases of drilling and structural

modelling (Q3)

Prospecting along trend (ongoing)

• Identify new exploration targets along identified mineralized trend

Airborne geophysical interpretation – New drill targets (Q2)

9 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

BALDWIN PROJECT

SU D BU RY, O N TAR IO

10 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

The Baldwin Project

1,500 Hectares

with Similar Geology

• The Baldwin Project is comprised of three

mining blocks totalling 68 mining claims,

which are located to the east of the

Shakespeare Project property boundaries.

• The Baldwin project doubles Graycliff’s

exposure in the vicinity of the Murray

Fault and covers a major splay off the

Murray Fault.

• Initial due diligence suggests that

both projects share similar geological

features that the Company’s technical

team identified during its first two drill programs at the Shakespeare Gold Project.

• Regional field sampling underway. Ground geophysics and initial drilling planned for Q2-Q4 2022.

• Together with Shakespeare this could be the beginning of a new Ontario Gold Camp.

11 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

COMPANY

G R AYC L IFF T EAM & ST R U C T U R E

12 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Management and Board

James Macintosh – President & Director

• Over 35 years of experience in mineral exploration, mining research analysis, corporate finance and management of private and public

resources companies

• Current President, CEO and Director of Kingsview Minerals Ltd, a junior exploration company (CSE : KVM)

• Lead Director of Carlisle Goldfields prior to sale to Alamos Gold and Seed Investor and Director of Circuitmeter Inc.

• B.Sc. (Geology) and Member of Queen’s University Geology Council

Julio DiGirolamo, CPA, CA – CFO & Director

• Chartered Professional Accountant with over 24 years of senior-level public company experience, 14 years of it in the mining sector

• Current CFO and Director of Monterey Minerals Inc.

• Key areas of experience include corporate governance and regulatory matters

• CFO of Carlisle Goldfields prior to sale to Alamos Gold

David Lees – Director and Non-Executive Chairman

• Director of Peninsula Investments (WA) Pty Ltd from 2007 to present

• Managing Director of Casey Lees International Pty Ltd from 2017 to present

• Non-Executive Director of Sultan Resources Ltd from March 2019 to present

13 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Management and Board

Nicholas Konkin – Director

• Over a decade of experience developing successful private and public resource and technology start-ups

• Strong background in wealth management and investor relations

• Currently Director, Capital Markets for Grove Corporate Services

Technical Advisors

Bruce Durham

• Credited with the discovery of several significant economic mineral deposits including: the David Bell Mine (Hemlo),

the Golden Giant Mine (Hemlo), the Redstone Nickel Mine (Timmins) and the Bell Creek Mine (Timmins)

Don McKinnon Jr.

• Very experienced prospector specializing in Ontario, who has been involved in managing all aspects of exploration from property

acquisition and grass-roots exploration to seeing projects through to development

14 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Capital Structure

GRAY

Trading on the CSE

GRYCF

Trading on the OTCQB 30.00 M

Shares

GE0

Trading on FSE

(WKN:A2QAW2)

2.77 M

37.16 M Options

Fully Diluted $0.15-$0.85

2024-2026

~30% 4.39 M

Management Warrants

and Strategic

$0.30- $1.00

Investors

Jan-Dec 2023

Ownership

15 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Investment Highlights

• Shakespeare Gold Project: Exploring for

high-grade gold in the “shadow” of a headframe

• Phase 3 drilling completed in Feb 2022;

Phase 4 drilling underway – VG identified

• Over 10,000 metres drilled as of April 2022

• Mineralized zone: open in all directions,

over 115 m NE-SW, over 120 m NW-SE,

and to a depth of greater than 250 m

• Baldwin Project: 1,500 hectares that are adjacent and with

similar geology to Shakespeare, field exploration underway,

drilling to begin soon

• The makings of a new Ontario gold camp

• All-Star Technical Team: Credited with major Ontario mining

discoveries

• Tight capital structure and fully funded for 2022 exploration

16 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

GRAYCLIFFEXPLORATION.COM

GRAY CSE GRYCF OTCQB GE0 FSE

For More Information

investors@graycliffexploration.com

Forward-Looking Statements

This presentation contains “forward-looking information” within the meaning of applicable Canadian securities legislation, and “forward-looking statements”

within the meaning of applicable United States securities legislation (collectively referred to as “forward-looking information” ("FLI")). All statements, other

than statements of historical fact, are FLI and can be identified by the use of statements that include words such as "anticipates", "plans", "continues",

"estimates", "expects", "may", "will", "projects", "predicts", “proposes”, "potential", "target", "implement", “scheduled”, "intends", "could", "might", "should",

"believe" and similar words or expressions. FLI in this presentation includes, but is not limited to: exploration of the Shakespeare and Baldwin projects,

including expected costs of drilling and timing to achieve certain milestones, including timing for completion of drilling programs; the Company’s ability to

successfully fund, or remain fully funded for exploration of any of the Projects (including with any potential strategic partners); any anticipated impacts of

COVID-19 on the Projects, the Company's financial position or operations, and the expected timing of announcements in this regard;

FLI involves known and unknown risks, assumptions and other factors that may cause actual results or performance to differ materially. This FLI reflects

the Company’s current views about future events, and while considered reasonable by the Company at this time, are inherently subject to significant

uncertainties and contingencies. Accordingly, there can be no certainty that they will accurately reflect actual results. Assumptions upon which such FLI is

based include, without limitation: current technological trends; the business relationship between the Company and its business partners and vendors;

ability to fund, advance and develop each of the Projects, including results therefrom and timing thereof; the ability to operate in a safe and effective

manner; uncertainties related to receiving and maintaining exploration, environmental and other permits or approvals in the respective jurisdictions; any

unforeseen impacts of COVID-19; demand for gold, silver and base metals; impact of increasing competition in the mineral exploration business, including

the Company’s competitive position in the industry; general economic conditions, including in relation to currency controls and interest rate fluctuations;

Graycliff’s actual results, programs and financial position could differ materially from those anticipated in such FLI as a result of numerous factors, risks and

uncertainties, many of which are beyond Graycliff’s control. These include, but are not limited to: neither of the Projects may be explored or developed as

planned; uncertainty as to whether cost-overruns; market prices affecting development of the Projects; the availability and ability to secure adequate

financing and on favourable terms; risks to the growth of the gold markets; inability to obtain required governmental permits; any limitations on operations

imposed by governments in the jurisdictions where we operate; technology risk; inability to achieve and manage expected growth; political risk associated

with foreign operations; changes in government regulations, including currency controls; changes in environmental requirements; failure to obtain or

maintain necessary licenses, permits or approvals; risks associated with COVID-19; insurance risk; litigation risk;

18 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

Forward-Looking Statements

receipt and security of mineral property titles and mineral tenure risk; changes in project parameters; uncertainties associated with estimating mineral

resources and mineral reserves, including uncertainties regarding assumptions underlying such estimates; whether mineral resources will ever be

converted into mineral reserves; opposition to development of either of the Projects; surface access risk; geological, technical, drilling or processing

problems; health and safety risks; unanticipated results; unpredictable weather; unanticipated delays; reduction in demand for minerals; intellectual

property risks; dependency on key personnel; workforce and equipment availability; currency and interest rate fluctuations; and volatility in general market

and industry conditions. The foregoing list of risks, assumptions and uncertainties associated with FLI is not exhaustive.

Management has provided this information as of the date of this presentation in order to assist readers to better understand the expected results and

impact of Graycliff’s operations. There can be no assurance that FLI will prove to be accurate, as actual results and future events could differ materially

from those anticipated in such information. As such, readers are cautioned not to place undue reliance on this information, and that this information may

not be appropriate for any other purpose, including investment purposes. Readers are further cautioned to review the full description of risks, uncertainties

and management’s assumptions in Graycliff’s most recent Annual Information Form and interim and annual Management’s Discussion and Analysis

available on SEDAR at www.sedar.com. Graycliff expressly disclaims any obligation to update FLI as a result of new information, future events or

otherwise, except as and to the extent required by applicable securities laws.

Forward-looking financial information also constitutes FLI within the context of applicable securities laws and as such, is subject to the same risks,

uncertainties and assumptions as are set out in the cautionary note above. Currency All figures presented are in Canadian Dollars unless otherwise noted.

CAUTIONARY STATEMENT CSE: GRAY OTCQB: GRYCF Spring 2022

Disclaimer

Information provided in this presentation is summarized and may not contain all available material information. Accordingly, readers are cautioned to review

Graycliff’s public disclosure record in full. The Company expressly disclaims any responsibility for readers' reliance on this presentation. This presentation

is provided for informational purposes only, and shall not form the basis of any commitment or offering. Any commitment or offering will only be made by

binding written agreement containing customary terms for transactions of such nature, and which is in compliance with applicable laws, including securities

laws of Canada and the United States. This presentation is the property of Graycliff Exploration Ltd.

19 GRAYCLIFFE XPLORAT ION .C OM GRAY CSE GRYCF OTCQB GE0 FSE

You might also like

- An Order Creating The Water Quality Monitoring Unit of The Municipality of MalapatanDocument3 pagesAn Order Creating The Water Quality Monitoring Unit of The Municipality of MalapatanJoey Coliao92% (12)

- Grade 8 History Learners Book Unit 2 Term 2Document18 pagesGrade 8 History Learners Book Unit 2 Term 2Zelda Juffrou Snyman100% (1)

- Sample California Motion For Judgment On The Pleadings For PlaintiffDocument5 pagesSample California Motion For Judgment On The Pleadings For PlaintiffStan Burman100% (1)

- Company Security Operations ManualDocument32 pagesCompany Security Operations ManualJayson Malero100% (3)

- US Hemp Market Landscape - Hemp Business JournalDocument52 pagesUS Hemp Market Landscape - Hemp Business JournalJames Hudson100% (1)

- NEW Graycliff Exploration - Presentation 2022 WinterDocument17 pagesNEW Graycliff Exploration - Presentation 2022 WinterJames HudsonNo ratings yet

- CSE: GRAY Graycliff Presentation Spring 2021Document13 pagesCSE: GRAY Graycliff Presentation Spring 2021James HudsonNo ratings yet

- Huckleberry Summary PosterDocument1 pageHuckleberry Summary PosterGregGillstromNo ratings yet

- Wealth Letter: West Mining Corp Analyst Report - March 2021Document9 pagesWealth Letter: West Mining Corp Analyst Report - March 2021James HudsonNo ratings yet

- Interim Report 22 Dec 06Document12 pagesInterim Report 22 Dec 06sum0n3No ratings yet

- Mineral, Geothermal and Petroleum Potential of Ethiopia - March - 29 - 2023Document26 pagesMineral, Geothermal and Petroleum Potential of Ethiopia - March - 29 - 2023Sun FengfengNo ratings yet

- Orogenic Gold PresentationDocument21 pagesOrogenic Gold PresentationBORIS FONYUYNo ratings yet

- Diversified Aggressive Well-Positioned For A Vibrant Copper MarketDocument20 pagesDiversified Aggressive Well-Positioned For A Vibrant Copper MarketeredekoppNo ratings yet

- H H H Highlights Ighlights Ighlights IghlightsDocument15 pagesH H H Highlights Ighlights Ighlights IghlightsFadili ElhafedNo ratings yet

- 19 Karouni Gold Mine DevelopmentDocument56 pages19 Karouni Gold Mine Developmentprimo_techNo ratings yet

- VanDerBorgh High Grade Gold Deposits Cortona - High Grade Gold Deposits in A Re-Emerging Goldfield in Southeastern Lachlan Orogen Mines & Wines 2010Document25 pagesVanDerBorgh High Grade Gold Deposits Cortona - High Grade Gold Deposits in A Re-Emerging Goldfield in Southeastern Lachlan Orogen Mines & Wines 2010Danton JohannesNo ratings yet

- RCG Corporate Presentation October 2016 2Document31 pagesRCG Corporate Presentation October 2016 2kaiselkNo ratings yet

- When North Gold Project Seeking Investors To Develop in ZimbabweDocument20 pagesWhen North Gold Project Seeking Investors To Develop in ZimbabweMauled ResourcesNo ratings yet

- Malagasy Aquires Karlawinda Gold Project: HighlightsDocument7 pagesMalagasy Aquires Karlawinda Gold Project: HighlightsOwm Close CorporationNo ratings yet

- RV Investor FactsheetDocument2 pagesRV Investor FactsheetMattNo ratings yet

- March 2018 Quarterly Report To Shareholders: GBM Gold LimitedDocument15 pagesMarch 2018 Quarterly Report To Shareholders: GBM Gold LimitedWill EdwardioNo ratings yet

- BTR Investor PresentationDocument28 pagesBTR Investor PresentationkaiselkNo ratings yet

- nwgn17 Confbook Cascabel (01 10)Document10 pagesnwgn17 Confbook Cascabel (01 10)Lenin SánchezNo ratings yet

- Cote D'Ivoire: Geochemical Results Highlight New Gold SystemsDocument11 pagesCote D'Ivoire: Geochemical Results Highlight New Gold Systemssedjou ernestNo ratings yet

- Colibri Fact Sheet-ProofDocument2 pagesColibri Fact Sheet-ProofkaiselkNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Cordoba Presentation Feb 2017Document19 pagesCordoba Presentation Feb 2017kaiselkNo ratings yet

- C SEDAR FILINGS Annual-ReportDocument36 pagesC SEDAR FILINGS Annual-Reportcarlos arroyo huaracaNo ratings yet

- Revolution Resources Investor FactsheetDocument2 pagesRevolution Resources Investor FactsheetMattNo ratings yet

- San Juan GoldDocument37 pagesSan Juan GoldHugo Luis HuamaníNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- ALTURAS Callejones Feb2009 PDFDocument2 pagesALTURAS Callejones Feb2009 PDFPedro Luis Trujillo HermitañoNo ratings yet

- RTR Canada OptionDocument16 pagesRTR Canada OptionPeteNo ratings yet

- Click Here For Ni 43-101 Technical Report On The Coasa Gold ProjectDocument7 pagesClick Here For Ni 43-101 Technical Report On The Coasa Gold ProjectMarcelino Vargas QueaNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- ADN Company Presentation SM PDFDocument30 pagesADN Company Presentation SM PDFakmal_gundooNo ratings yet

- Graycliff Exploration Ltd. (CSE:GRAY) - As You Like It: Exploring For High-Grade Au Near SudburyDocument14 pagesGraycliff Exploration Ltd. (CSE:GRAY) - As You Like It: Exploring For High-Grade Au Near SudburyJames HudsonNo ratings yet

- J Lithos 2004 03 052Document11 pagesJ Lithos 2004 03 052Warwick HastieNo ratings yet

- 279-286 RhodesDocument8 pages279-286 Rhodes约翰No ratings yet

- About Silver One: SVE SLVRF Brk1Document2 pagesAbout Silver One: SVE SLVRF Brk1kaiselkNo ratings yet

- 2015-04-22 Press Release (Logo)Document3 pages2015-04-22 Press Release (Logo)Annemette JorgensenNo ratings yet

- Geopacific Resources NL - ASX Annual Report FYE Dec 2007 - Nabila Gold ProjectDocument71 pagesGeopacific Resources NL - ASX Annual Report FYE Dec 2007 - Nabila Gold ProjectIntelligentsiya HqNo ratings yet

- Corporate PresentationDocument14 pagesCorporate PresentationEdison SantillanaNo ratings yet

- Tipos de ExplosivosDocument18 pagesTipos de ExplosivosFernando GuerreroNo ratings yet

- Report On Sarir Oil Field: Well Intervention Workover and Stimulation Techniques (PTE-432)Document9 pagesReport On Sarir Oil Field: Well Intervention Workover and Stimulation Techniques (PTE-432)adityamduttaNo ratings yet

- 2 - Historic Overview - UploadDocument54 pages2 - Historic Overview - Uploadusman nawazNo ratings yet

- Further High-Grade Gold Targets at The Loch Tay Project - With MapsDocument8 pagesFurther High-Grade Gold Targets at The Loch Tay Project - With MapsNiall Mc DermottNo ratings yet

- TienkoDocument2 pagesTienkoFreNo ratings yet

- Visit To Hutti Gold Mines and National Seminar On Gold Mining at KGFDocument14 pagesVisit To Hutti Gold Mines and National Seminar On Gold Mining at KGFbhupenderNo ratings yet

- Kodiak Forges AheadDocument2 pagesKodiak Forges AheaddouglashadfieldNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Revolution Resources FactsheetDocument2 pagesRevolution Resources FactsheetMattNo ratings yet

- 44 H 2 QH 0 NBJ 9 KXXDocument16 pages44 H 2 QH 0 NBJ 9 KXXAzrunnas ZakariaNo ratings yet

- A Permian Cu - Mo Porphyry North - ChileDocument14 pagesA Permian Cu - Mo Porphyry North - ChileAlexanderNo ratings yet

- ALTURAS Pampa Colorada Feb2009 PDFDocument2 pagesALTURAS Pampa Colorada Feb2009 PDFPedro Luis Trujillo HermitañoNo ratings yet

- Exploring Frontiers: GoldenDocument17 pagesExploring Frontiers: Goldenjenny smithNo ratings yet

- May 2011 Corporate Presentation For Kiska MetalsDocument27 pagesMay 2011 Corporate Presentation For Kiska MetalsgjervisNo ratings yet

- Hollister Project Steve Konieczki Chief Engineer Great Basin Gold, LTDDocument18 pagesHollister Project Steve Konieczki Chief Engineer Great Basin Gold, LTDBisto MasiloNo ratings yet

- AnualReport2006 PDFDocument56 pagesAnualReport2006 PDFLuis Jordan LoboNo ratings yet

- Trans Canada Gold Corp.: News ReleaseDocument4 pagesTrans Canada Gold Corp.: News ReleaseTrans Canada Gold Corp. (TSX-V: TTG)No ratings yet

- Pasofino Drilling Update FinalDocument5 pagesPasofino Drilling Update Finaldolosayeb3No ratings yet

- Quarterly Activities Report For The Period Ending 30 September 2019Document9 pagesQuarterly Activities Report For The Period Ending 30 September 2019AlexNo ratings yet

- Gold Mining Adventures: A Step-by-Step Guide to Unveil TreasuresFrom EverandGold Mining Adventures: A Step-by-Step Guide to Unveil TreasuresNo ratings yet

- Jay Taylor Hotline-2023-08-18 Goliath - 230820 - 101329Document5 pagesJay Taylor Hotline-2023-08-18 Goliath - 230820 - 101329James HudsonNo ratings yet

- Avila - FactSheet - October 2022Document2 pagesAvila - FactSheet - October 2022James HudsonNo ratings yet

- Avila Energy - September 2022 - 09.12.22 - OptDocument45 pagesAvila Energy - September 2022 - 09.12.22 - OptJames HudsonNo ratings yet

- Avila Energy Fact Sheet - July 27 2022Document5 pagesAvila Energy Fact Sheet - July 27 2022James HudsonNo ratings yet

- Graycliff Exploration Ltd. (CSE:GRAY) - As You Like It: Exploring For High-Grade Au Near SudburyDocument14 pagesGraycliff Exploration Ltd. (CSE:GRAY) - As You Like It: Exploring For High-Grade Au Near SudburyJames HudsonNo ratings yet

- NEW Graycliff Exploration - Presentation 2022 WinterDocument17 pagesNEW Graycliff Exploration - Presentation 2022 WinterJames HudsonNo ratings yet

- Trillion Energy International $TCF $TCFF Investor Deck Feb 2021 1Document17 pagesTrillion Energy International $TCF $TCFF Investor Deck Feb 2021 1James HudsonNo ratings yet

- Finlay Minerals Investor Presentation November 2021Document21 pagesFinlay Minerals Investor Presentation November 2021James HudsonNo ratings yet

- Avila Energy: Established and DiversifiedDocument23 pagesAvila Energy: Established and DiversifiedJames HudsonNo ratings yet

- CSE: GRAY Graycliff Presentation Spring 2021Document13 pagesCSE: GRAY Graycliff Presentation Spring 2021James HudsonNo ratings yet

- Global Hemp Group $GHG $GBHPF Developing A Green Community in Hayden, Co.Document23 pagesGlobal Hemp Group $GHG $GBHPF Developing A Green Community in Hayden, Co.James HudsonNo ratings yet

- DCS Investment Deck Aug 2021Document25 pagesDCS Investment Deck Aug 2021James HudsonNo ratings yet

- Wealth Letter: West Mining Corp Analyst Report - March 2021Document9 pagesWealth Letter: West Mining Corp Analyst Report - March 2021James HudsonNo ratings yet

- Wealth Letter Analyst Report First Energy Metals March 25 2021Document8 pagesWealth Letter Analyst Report First Energy Metals March 25 2021James HudsonNo ratings yet

- SAG-AFTRA Negotiation DocumentDocument12 pagesSAG-AFTRA Negotiation DocumentGMG EditorialNo ratings yet

- Florida International University Pedestrian Bridge Collapse: Analysis of The NTSB Report RecommendationsDocument21 pagesFlorida International University Pedestrian Bridge Collapse: Analysis of The NTSB Report RecommendationsDe'Von JNo ratings yet

- Mark E. Wildermuth (Auth.) - Gender, Science Fiction Television, and The American Security State - 1958-Present-Palgrave Macmillan US (2014)Document237 pagesMark E. Wildermuth (Auth.) - Gender, Science Fiction Television, and The American Security State - 1958-Present-Palgrave Macmillan US (2014)Valquiria JohnNo ratings yet

- 3rd Periodical Exam in English 10Document1 page3rd Periodical Exam in English 10iren deferia100% (2)

- FEDERICO YLARDE and ADELAIDA DORONIODocument2 pagesFEDERICO YLARDE and ADELAIDA DORONIOphgmbNo ratings yet

- Gayo vs. VercelesDocument2 pagesGayo vs. VercelesJessamine OrioqueNo ratings yet

- CASE ANALYSIS Final NKDocument4 pagesCASE ANALYSIS Final NKNikhil KalyanNo ratings yet

- Law of Torts Paper 1Document18 pagesLaw of Torts Paper 1Purva KharbikarNo ratings yet

- Delimitation of ConstituenciesDocument5 pagesDelimitation of ConstituenciesDhawal VasavadaNo ratings yet

- Algebraic Manipulation 4.8: Click To Enter Your AnswerDocument1 pageAlgebraic Manipulation 4.8: Click To Enter Your AnswerArshad KhanNo ratings yet

- Petitioner Vs Vs Respondents Buñag Kapunan Migallos & Perez Arturo D. Vallar and Antonio C. Pesigan Reloj Law OfficeDocument11 pagesPetitioner Vs Vs Respondents Buñag Kapunan Migallos & Perez Arturo D. Vallar and Antonio C. Pesigan Reloj Law OfficeaifapnglnnNo ratings yet

- Rule 39Document62 pagesRule 39Anonymous Q0KzFR2iNo ratings yet

- Convention On The Elimination of All Forms of Discrimination Against WomenDocument26 pagesConvention On The Elimination of All Forms of Discrimination Against WomenDaud DilNo ratings yet

- Kami Export - Annotated-RU DateableDocument2 pagesKami Export - Annotated-RU Dateableshahid choudhuryNo ratings yet

- Show Temp - PLDocument7 pagesShow Temp - PLWVLT NewsNo ratings yet

- Suny App WorksheetDocument6 pagesSuny App Worksheetapi-615224443No ratings yet

- Aws A2-4 1998Document118 pagesAws A2-4 1998muhammedNo ratings yet

- Who I Am in The Cyber World (Digital Self)Document16 pagesWho I Am in The Cyber World (Digital Self)Mary BloodyNo ratings yet

- BpmpaDocument19 pagesBpmparupakhiltdNo ratings yet

- Atr D 1-21 EnglDocument6 pagesAtr D 1-21 EnglFernando Enrique Lobo SierraNo ratings yet

- Case Study 2022-23Document7 pagesCase Study 2022-23Lumina RajasekeranNo ratings yet

- Fish Grading DeviceDocument7 pagesFish Grading DeviceLiladhar Ganesh DhobleNo ratings yet

- Quarter 2 Lesson 02 ICT As Platform For Change SY2022 2023Document66 pagesQuarter 2 Lesson 02 ICT As Platform For Change SY2022 2023itsameayuanNo ratings yet

- CWScholarship ApplicationDocument3 pagesCWScholarship ApplicationAbhishek SinghNo ratings yet

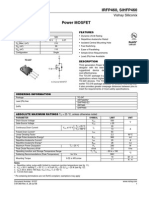

- Irfp460, Sihfp460: Vishay SiliconixDocument9 pagesIrfp460, Sihfp460: Vishay Siliconixcelo81No ratings yet

- Apollo LairbenosDocument25 pagesApollo Lairbenosfevzisahin79No ratings yet

- Illegal Gambling Ring ComplaintDocument48 pagesIllegal Gambling Ring ComplaintTyler DiedrichNo ratings yet