Professional Documents

Culture Documents

107-134 Compressed

107-134 Compressed

Uploaded by

Febriati Rusyda0 ratings0% found this document useful (0 votes)

10 views28 pagesRAZEE CHAPTER 4

Original Title

107-134_compressed

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRAZEE CHAPTER 4

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

10 views28 pages107-134 Compressed

107-134 Compressed

Uploaded by

Febriati RusydaRAZEE CHAPTER 4

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 28

Chapter 4

Board of Directors’ Roles

and Responsibilities

INTRODUCTION

ROLE OF THE BOARD OF DIRECTORS

FIDUCIARY DUTIES OF THE BOARD OF DIRECTORS

BOARD COMMITTE

BOARD MODELS

BOARD CHARACTERISTICS

BOARD SELECTION

DIRECTOR EDUCATION AND EVALUATION

BOARD ACCOUNTABILITY

EFFECTIVE CORPORATE BOARDS

DIRECTOR LIABILITY

SUMMARY

KEY TERMS

REVIEW QUESTIONS

DISCUSSION QUESTIONS

NOTES

INTRODUCTION

Boards of directors are elected by shareholders to oversee the managerial function, The-

oretically, boards of directors exist to resolve the agency problems associated with the

separation of a company’s ownership controls from decision controls, Intuitively, although

directors are elected to align management's interests with those of shareholders, their close

association with the company’s senior executives can create conflicts of interest within the

boardroom. Senior executives, particularly CEOs, are motivated to take over the board by

influencing the election of directors and controlling their compensation, whereas directors,

89

90

Chapter 4 Board of Directors’ Roles and Responsibilities

have the fiduciary duty to maintain their independence, monitor the CEO, and discipline the

CEO for poor performance. This chapter discusses the roles and responsibilities of the board

of directors in advising management on its strategic decisions without micromanaging and

overseeing its actions and performan

Primary Objectives

‘The primary objectives of this chapter are to

+ Identify the difference between decision management and decision control.

+ Understand the role of the board of directors with regard to decision control and

fiduciary duties.

‘+ Understand that the board of directors is ul

its affairs,

imately responsible for the business and

+ Provide an overview of what the oversight function entails.

+ Identify and explain the fiduciary duties of the board of directors.

+ Gain awareness of the variety of board models recommended in global corporate

governance reforms.

+ Idemtify the board attributes that affect the quality of monitoring and oversight func-

tions performed by the company's board,

+ Illustrate the importance of an independent board of directors.

‘+ Become familiar with the best practices of determining directors’ compensation.

+ Idemtify and describe the determinants of an effective board of directors.

+ Become familiar with board accountability, evaluation, and the legal obligations and

liabilities fa

ing outside directors of public companies.

ROLE OF THE BOARD OF DIRECTORS

Separation of ownership and control in public companies and resulting agency problems

ead to the division of decision management and decision control. Decision management,

which consists of initiation and implementation of strategies, is viewed as the manage-

‘ment’s responsibility, whereas decision control, which entails the ratification and monitor-

ing of strategies, is viewed as the board of directors’ fiduciary duty performed on behalf

Of the shareholders. In performing their oversight function, boards of directors should not

involve themselves in managerial and operational decisions through micromanaging. They

should oversee managerial strategies but not implement them. In today's ever-changing and

challenging business environment, the traditional model of the board of directors in just

overseeing financial activities and reporting may not be adequate as directors get involved

more in corporate governance functions of ensuring their company is prepared to meet,

future challenges

‘The board of directors is ultimately responsible for the company’s business affairs and

governance on, the

bylaws, and shareholder agreements, Many state laws require corporations to form a board

stated in its governing documents, including the articles of incorporat

Role of the Board of Directors. 91

of directors to represent shareholders and make decisions on their behalf. The Delaware

General Corporation Law Code states

The business and affairs of every corporation organized under this chapter shall be managed

by or under the direction of a board of ditectors, except as may be otherwise provided in this

chapter or in its certificate of incorporation. (Emphasis added.)

Almost all states have a similar statute authorizing and empowering the board of directors

to direct, oversee, and control a company’s business affairs, and to govern its activities.

Shareholders have statutory rights to elect directors, to replace them, and in many states to

approve major decisions or transactions such as mergers and acquisitions, the sale of major

assets, or dissolution of the company. A vigilant board of directors proactively participates

in strategic decisions; asks management tough questions; oversees management's plan:

decisions, and actions; and monitors management's ethical conduct, financial reporting,

and legal compliance. The primary oversight function of the board is the appointment of the

CEO and concurrence with the CEO's selection of other senior executives to run the com-

pany. Corporationsare legally required to have a board of directors, and many not-for-profit

organizations (¢.g., churches, universities) have a similar governing board. The success

of the board of directors depends on the composition, structure, resources, diligence, and

authority of the entire board, as well as their working relationships with other participants

of corporate governance, including management, external auditors, intemal auditors, legal

counsel, professional advisors, regulators, standard-setting bodies, and investors. Tradition-

ally, many companies” boardrooms are viewed as “gentleman's clubs” characterized by a

tendency and desire to please the CEO and rubber-stamp the CEO's decisions rather than

being the place for challenge and inquiry that adds value to corporate governance. ‘The

board, in overseeing management, should be able to influence the company’s vision, mis-

sion, strategies, and goals as well as management's plans, decisions, and actions to achieve

these goals without micromanaging.

‘The board may delegate its decision-making authority to the company’s top man-

agement team, but it is still responsible and accountable for running the company.

Boards of directors must realize that they not only are representing shareholders, but

also all stakeholders who have direct or indirect human or physical capital interests

in their corporations. ‘This does not necessarily mean that all major stakeholders (in-

vestors, employers, suppliers, govemment, customers, creditors) must have representa-

tive or so-called constituency directors on the boards. Instead, both inside (executive)

and outside (nonexecutive) directors must represent all stakeholders and protect their

interests,

‘The board of directors is the comerstone of the company’s corporate governance struc~

ture with the primary role of safeguarding interests of shareholders and other stakeholders.

In summary, roles and responsibilities of boards of directors are to

1, Represent shareholders and create shareholder value,

2. Align the interests of management with those of shareholders while protecting the

interests of other stakeholders (customers, creditors, suppliers).

3. Define the company’s mission and goals.

4, Establish or approve strai

plans and decisions to achieve these goals.

92 Chapter4 Board of Directors’ Roles and Responsibilities

5. Appoint senior executives to manage the company in accordance with the estab-

lished strategies, plans, policies, and procedures.

6. Oversee the company’s performance by setting objectives, establishing short-term

‘and Long-term strategies to achieve these objectives, and assessing the performance

of senior executives in fulfilling their responsibilities without micromanaging

7. Approve major business transactions and corporate plans, decisions, and actions

according to the bylaws.

8. Develop and approve executive compensation, pension, postretirement benefits

plan, and other long-term benefits, including stock ownership and stock options.

9. Review financial reports, including audited annual financial statements, quarterly

reviewed financial statements, and other important financial disclosures such as

‘management discussion and analysis (MD&A) eamings releases and reports filed

with regulators (SEC) or disseminated to the public

10, Review management's report on the effectiveness of internal control over financial

reporting,

11, Provide counsel to the company’s senior executives, especially the CEO, on ma-

terial strategic decisions and risk management.

12, Ensure the company's compliance with applicable laws, rules, and regulations,

13. Approve the company's major operating, investing, and financial activities.

14, Set the tone at the top by promoting legal and ethical conduct throughout the

company.

15. Evaluate the performance of the board, its committees (¢.g., audit, compensation,

and nominating), and the members of each committee.

16. Hold the board, its committees, and directors accountable for the fulfillment of the

assigned fiduciary duties and oversight functions.

17. Approve dividends, financing, capital changes, and other extraordinary corporate

matters.

18. Oversee the sustainability of the company in ere:

and protecting interests of other stakeholders,

1g long-term shareholder value

‘Table 4.1 compares roles and responsibilities of directors before and after corporate

governance reforms. Boards of directors have experienced unprecedented challenges in

the post-SOX era, and some still struggle to find the right balance between engaging in

strategic decisions of directors advising management and monitoring its managerial deci-

sions and actions. This is particularly important in light of landmark settlements by former

directors of Enron and WorldCom agreeing to pay damages ($31 million) from their own

pockets for their company’s failures. Corporate boards are now undet extensive scrutiny,

and directors are concerned about their personal liability for questionable governance prac-

tices. One way to influence directors’ ethical conduct is to hold them accountable and

liable for poor performance and business misconduct. It is expected that boards of direc-

tors will engage more proactively in the oversight function in facing increasing business

challenges.

Fiduciary Duties of the Board of Directors 93

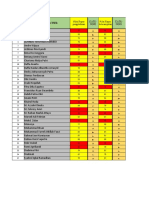

Table 4.1 Compatiéon of Destine (Pit and Postcorpotnte Gavemanés Refit)

Prerefonms Postreforms

+ Personal ties to company + Oversight ofthe sustainability ofthe company in

management

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NURUL DESTU ARAFAH X AKL 3 (Tugas 2)Document1 pageNURUL DESTU ARAFAH X AKL 3 (Tugas 2)Febriati RusydaNo ratings yet

- Kelompok 4 Part2Document2 pagesKelompok 4 Part2Febriati RusydaNo ratings yet

- Purbawangsa 2019Document17 pagesPurbawangsa 2019Febriati RusydaNo ratings yet

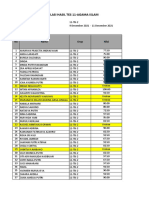

- Leger Nilai Rapor Kelas 10 AKL 2Document9 pagesLeger Nilai Rapor Kelas 10 AKL 2Febriati RusydaNo ratings yet

- Leger Nilai Rapor Kelas 10 AKL 1Document5 pagesLeger Nilai Rapor Kelas 10 AKL 1Febriati RusydaNo ratings yet

- Nilai Kls 12Document4 pagesNilai Kls 12Febriati RusydaNo ratings yet

- Kelompok 5 DK - SSDocument2 pagesKelompok 5 DK - SSFebriati RusydaNo ratings yet

- 710-Article Text-1407-1-10-20210930Document23 pages710-Article Text-1407-1-10-20210930Febriati RusydaNo ratings yet

- Leger Nilai Rapor Kelas 11 DKV 1Document4 pagesLeger Nilai Rapor Kelas 11 DKV 1Febriati RusydaNo ratings yet

- Leger Nilai Rapor Kelas 10 AKL 2Document6 pagesLeger Nilai Rapor Kelas 10 AKL 2Febriati RusydaNo ratings yet

- Leger Nilai Rapor Kelas 11 DKV 1Document4 pagesLeger Nilai Rapor Kelas 11 DKV 1Febriati RusydaNo ratings yet

- jrfm-13-00215 en IdDocument20 pagesjrfm-13-00215 en IdFebriati RusydaNo ratings yet

- Leger Nilai Rapor Kelas 11 AKL 1Document5 pagesLeger Nilai Rapor Kelas 11 AKL 1Febriati RusydaNo ratings yet

- Leger Nilai Rapor Kelas 11 AKL 1Document5 pagesLeger Nilai Rapor Kelas 11 AKL 1Febriati RusydaNo ratings yet

- Leger Nilai Rapor Kelas 11 AKL 2Document5 pagesLeger Nilai Rapor Kelas 11 AKL 2Febriati RusydaNo ratings yet

- Leger Nilai Rapor Kelas 10 AKL 1Document6 pagesLeger Nilai Rapor Kelas 10 AKL 1Febriati RusydaNo ratings yet

- 107-134 Compressed CompressedDocument28 pages107-134 Compressed CompressedFebriati RusydaNo ratings yet

- Mallin Corporate Governance PDFDocument28 pagesMallin Corporate Governance PDFFebriati RusydaNo ratings yet

- Blank Quiz (Jawaban)Document24 pagesBlank Quiz (Jawaban)Febriati RusydaNo ratings yet

- The Internal Auditors On Occupational Fraud: An Integrative Literature ReviewDocument16 pagesThe Internal Auditors On Occupational Fraud: An Integrative Literature ReviewFebriati RusydaNo ratings yet

- Data Rekap Hasil Tes - 11-TB-1Document3 pagesData Rekap Hasil Tes - 11-TB-1Febriati RusydaNo ratings yet

- Toefl Preparation Program:: STRUCTURE Questions: Understanding Subject and VerbDocument19 pagesToefl Preparation Program:: STRUCTURE Questions: Understanding Subject and VerbFebriati RusydaNo ratings yet

- Data Rekap Hasil Tes - 11-TB-2Document2 pagesData Rekap Hasil Tes - 11-TB-2Febriati RusydaNo ratings yet

- Data Rekap Hasil Tes - 11-TKJ-2Document5 pagesData Rekap Hasil Tes - 11-TKJ-2Febriati RusydaNo ratings yet