Professional Documents

Culture Documents

Profit Loss Account - ZSQIW - 2021-2022

Profit Loss Account - ZSQIW - 2021-2022

Uploaded by

Chhaya JainCopyright:

Available Formats

You might also like

- W EMTRqdn K7 A1 B5 LFDocument2 pagesW EMTRqdn K7 A1 B5 LFAnup YadavNo ratings yet

- Statement: Branch Details Your Current Details Period 2020 To 202Document6 pagesStatement: Branch Details Your Current Details Period 2020 To 202xxalias100% (1)

- Cust 1-247694200538 20210901Document2 pagesCust 1-247694200538 20210901Rogers Gift100% (1)

- Statement: Branch Details Your Current Details PeriodDocument2 pagesStatement: Branch Details Your Current Details Periodxxalias100% (2)

- Ciia Final Exam I March11 - Qe-OriginalDocument12 pagesCiia Final Exam I March11 - Qe-OriginalAdedeji AjadiNo ratings yet

- Kotak securities-PandL 2022-23 RRGDocument5 pagesKotak securities-PandL 2022-23 RRGRg RrgNo ratings yet

- Kotak securities-PandL 2021-22 RRGDocument3 pagesKotak securities-PandL 2021-22 RRGRg RrgNo ratings yet

- Transaction - History - Permata - Paging - 2022-09-21T162705.715Document1 pageTransaction - History - Permata - Paging - 2022-09-21T162705.715Devi Yolanda SamosirNo ratings yet

- Adobe Scan Feb 24, 2022Document4 pagesAdobe Scan Feb 24, 2022R.Navaneetha KrishnanNo ratings yet

- Park View Enclave (PVT) Limited.: Account StatementDocument1 pagePark View Enclave (PVT) Limited.: Account Statementamirali.bme4527No ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAPPLE MARINENo ratings yet

- HISTORI_TRANSAKSI_1718553575849Document2 pagesHISTORI_TRANSAKSI_1718553575849karwatinini99No ratings yet

- RDInstallment Report 19!05!2023Document6 pagesRDInstallment Report 19!05!2023Javed SNo ratings yet

- Check & CVDocument304 pagesCheck & CVjardinlyzylNo ratings yet

- Loan Ledger - LIC HFL - Customer Portal PDFDocument1 pageLoan Ledger - LIC HFL - Customer Portal PDFShisArquamNo ratings yet

- Histori TransaksiDocument1 pageHistori TransaksiyortaniosabangNo ratings yet

- Journal Part 1Document1 pageJournal Part 1Chaudhry M. BurairNo ratings yet

- 11 10 22 20:10:48Document1 page11 10 22 20:10:48nhimvidavorn8181No ratings yet

- Diduction Tva 17072024Document2 pagesDiduction Tva 17072024ayman KaciMiNo ratings yet

- Diduction Tva 17072024Document2 pagesDiduction Tva 17072024ayman KaciMiNo ratings yet

- Design PDFDocument4 pagesDesign PDFAJAY SHINDENo ratings yet

- COUNTER EXERCISES (Version 1)Document20 pagesCOUNTER EXERCISES (Version 1)ScribdTranslationsNo ratings yet

- Histori TransaksiDocument3 pagesHistori TransaksiAwwalul Khair FatwaNo ratings yet

- Computer Orientation AssignmentDocument18 pagesComputer Orientation AssignmentTaha AhmedNo ratings yet

- Miss Candice T Mazibuko Thabisile 347 MOTSU Tembisa 1632: Transactions in RAND (ZAR) Accrued Bank ChargesDocument2 pagesMiss Candice T Mazibuko Thabisile 347 MOTSU Tembisa 1632: Transactions in RAND (ZAR) Accrued Bank ChargestoksbchNo ratings yet

- Zuze FungaiDocument1 pageZuze FungaiLainoNo ratings yet

- DailyReport - 2022-11-16T104612.200Document1 pageDailyReport - 2022-11-16T104612.200Sreenath SNo ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMohamed RafihNo ratings yet

- RP Statement Feb2024 02032024092428 PDFDocument3 pagesRP Statement Feb2024 02032024092428 PDFGani SyamNo ratings yet

- Statement of Account For The Period From To Is Furnished Below 01-SEP-20 30-SEP-20Document1 pageStatement of Account For The Period From To Is Furnished Below 01-SEP-20 30-SEP-20Chandramohan GNo ratings yet

- Estado de CuentaDocument1 pageEstado de CuentaDjTwistfly24No ratings yet

- FeesReceipt - 19-22-004838 - College Fees - Semester 7Document1 pageFeesReceipt - 19-22-004838 - College Fees - Semester 7Nevil GajeraNo ratings yet

- Invoice: Gross Invoice Total Minus Outstanding AmountDocument2 pagesInvoice: Gross Invoice Total Minus Outstanding AmountMadz Alcoy BautistaNo ratings yet

- Cestrum BS-Mar 23 ConsolDocument35 pagesCestrum BS-Mar 23 Consolprimestuff09No ratings yet

- CreditCardStatement2801868 - 2085 - 27-Oct-20Document1 pageCreditCardStatement2801868 - 2085 - 27-Oct-20Abdul AleemNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2020.10.27 14:31:13 UTCDocument3 pagesCash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2020.10.27 14:31:13 UTCSANDEEP GAWANDENo ratings yet

- Shiv Shrushti Ledger 21 - 22Document1 pageShiv Shrushti Ledger 21 - 22shrushtianitaNo ratings yet

- Account Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancearchitrohida.officialNo ratings yet

- Usha Com PDFDocument2 pagesUsha Com PDFMukesh MishraNo ratings yet

- Account Statement: Total Search Results: 16Document1 pageAccount Statement: Total Search Results: 16Sales BzugNo ratings yet

- Project ADVANCE FINANCIAL MANAGEMENTDocument11 pagesProject ADVANCE FINANCIAL MANAGEMENTBilal KhalidNo ratings yet

- LCB250422 Government of Saint Lucia 91-Day Treasury Bill ReportDocument6 pagesLCB250422 Government of Saint Lucia 91-Day Treasury Bill ReportShiloh FrederickNo ratings yet

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAmishaNo ratings yet

- Liberty OnlineDocument1 pageLiberty OnlineKhushi AgarwalNo ratings yet

- Histori TransaksiDocument2 pagesHistori Transaksiradenmister05No ratings yet

- Tva Ihsane OpticDocument17 pagesTva Ihsane Opticnourdine ouhammouNo ratings yet

- Toyota Financial Services India Ltd. Account StatementDocument4 pagesToyota Financial Services India Ltd. Account StatementaliNo ratings yet

- TRX - Inquiry - 1810000666116 - 16 July 2020-28 July 2020 - 202007280805 PDFDocument2 pagesTRX - Inquiry - 1810000666116 - 16 July 2020-28 July 2020 - 202007280805 PDFWyllmar PasangkaNo ratings yet

- Hema May 1 To Dec 9Document5 pagesHema May 1 To Dec 9Rajesh pvkNo ratings yet

- Part 2 JournalDocument1 pagePart 2 JournalChaudhry M. BurairNo ratings yet

- 03 March 2022Document19 pages03 March 2022John Louie LagunaNo ratings yet

- Canara1st Apr 2022 To 21march 2023Document110 pagesCanara1st Apr 2022 To 21march 2023JAWED MOHAMMADNo ratings yet

- Dhanshreeenterprises 13122182347Document3 pagesDhanshreeenterprises 13122182347Team Nanda GurjarNo ratings yet

- Fin P&LDocument14 pagesFin P&LBotiyoNo ratings yet

- FINNIFTY - 3 Min - PCR Intraday Trend Based On Options Data - Binary TraderDocument10 pagesFINNIFTY - 3 Min - PCR Intraday Trend Based On Options Data - Binary Traderpol sujatasNo ratings yet

- Statement 25-FEB-21 AC 23995070Document3 pagesStatement 25-FEB-21 AC 23995070Doris Zhao100% (1)

- Ledger Jun 30 2020 Jul 31 2020Document1 pageLedger Jun 30 2020 Jul 31 2020Jack SaravananNo ratings yet

- Daily Derivative Overview 20122023Document10 pagesDaily Derivative Overview 20122023riddhi SalviNo ratings yet

- Comparative Analysis of Three Asset Management Companies PDFDocument103 pagesComparative Analysis of Three Asset Management Companies PDFAayushi PatelNo ratings yet

- Tbla 2016 PDFDocument281 pagesTbla 2016 PDFNanda Julyantie RatmanaNo ratings yet

- FABM 1 Week 3 4Document20 pagesFABM 1 Week 3 4RD Suarez67% (6)

- CFA Level1 2018 Curriculum UpdatesDocument13 pagesCFA Level1 2018 Curriculum UpdatesTeddy Jain100% (1)

- COMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24Document350 pagesCOMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24http://secwatch.comNo ratings yet

- Principles of Financial Accounting PDFDocument318 pagesPrinciples of Financial Accounting PDFRalph Aries Almeyda Alvarez100% (2)

- 2018-1383 Samsona, Melanie S.Document8 pages2018-1383 Samsona, Melanie S.Melanie SamsonaNo ratings yet

- YPAS - Annual Report - 2017 (Rugi) PDFDocument164 pagesYPAS - Annual Report - 2017 (Rugi) PDFbuwat donlotNo ratings yet

- Director of Global BenefitsDocument2 pagesDirector of Global Benefitsapi-79047316No ratings yet

- Ch13 The Stock MarketDocument34 pagesCh13 The Stock MarketAya OuldelgaoudNo ratings yet

- MCQ - Change in PSR (Class XII)Document4 pagesMCQ - Change in PSR (Class XII)WHY NOT YOU ??No ratings yet

- Lesson 2 Business LawDocument3 pagesLesson 2 Business LawAshok ReddyNo ratings yet

- ICM Text Book UpdateDocument78 pagesICM Text Book UpdatemariposaNo ratings yet

- FCFF and Fcfe of CVDocument2 pagesFCFF and Fcfe of CVmuktaNo ratings yet

- Introduction To AccountingDocument14 pagesIntroduction To AccountingMylene SalvadorNo ratings yet

- RA 10846 PDIC Law ExcerptsDocument11 pagesRA 10846 PDIC Law ExcerptsMohammad Allem AlegreNo ratings yet

- Company Registration in Nepal (2080) Process of RegistrationDocument11 pagesCompany Registration in Nepal (2080) Process of RegistrationPrabin XhresthaNo ratings yet

- Profit. Planning and ControlDocument16 pagesProfit. Planning and ControlNischal LawojuNo ratings yet

- AuditDocument9 pagesAuditrahul422No ratings yet

- Audit of PpeDocument5 pagesAudit of PpeCathleen VillalvitoNo ratings yet

- Module 1 Conceptual FrameworkDocument8 pagesModule 1 Conceptual FrameworkHeart Erica AbagNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Audit Fot Liability Problem #14Document2 pagesAudit Fot Liability Problem #14Ma Teresa B. CerezoNo ratings yet

- WRK IFRS SMEsDocument109 pagesWRK IFRS SMEsMazhar Ali JoyoNo ratings yet

- Problem 2Document5 pagesProblem 2Rommel RoyceNo ratings yet

- Difference Between Partnership & Pvt. LTDDocument4 pagesDifference Between Partnership & Pvt. LTDpiudeva100% (3)

- Enter The Data Only in The Yellow Cells.: Agg Plan - LevelDocument7 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - LevelJason RobillardNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- 2023 CFA Level 1 Curriculum Changes Summary (300hours)Document2 pages2023 CFA Level 1 Curriculum Changes Summary (300hours)johnNo ratings yet

Profit Loss Account - ZSQIW - 2021-2022

Profit Loss Account - ZSQIW - 2021-2022

Uploaded by

Chhaya JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit Loss Account - ZSQIW - 2021-2022

Profit Loss Account - ZSQIW - 2021-2022

Uploaded by

Chhaya JainCopyright:

Available Formats

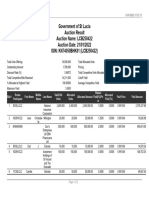

Realised Profit Loss Account for the Financial Year : 2021-2022

Client

: ZSQIW

Code

Client

: BRIJESH JAISWAL

Name

Securities Details Profit and Loss

Security Name Qty Cost Basis Procceds Square Off < 1 yr. #> 1 yr. Total

Equity

ICICI Prudential Gold ETF 11.0000 455.86 459.04 0.00 6.88 -3.71 3.17

Indian Oil Corporation Ltd. 25.0000 2533.80 2663.90 0.00 130.10 0.00 130.10

Macrotech Developers Ltd. 30.0000 14580.00 17852.87 0.00 3272.87 0.00 3272.87

Reliance Capital Ltd. 50.0000 679.49 1027.67 0.00 348.18 0.00 348.18

Axis Bank Ltd. 1.0000 747.45 778.36 0.00 30.91 0.00 30.91

Total Equity: 0 3788.94 -3.71 3785.23

Derivative Details

Scrip Code Instrument Type - Scrip Name ExpDate DrvType Strike Price Profit Loss

Options

BANKNIFTY BANKNIFTY 03NOV2021 Put Option 38400 513.93

BANKNIFTY BANKNIFTY 03NOV2021 Put Option 38500 851.68

BANKNIFTY BANKNIFTY 10FEB2022 Call Option 39000 -554.45

BANKNIFTY BANKNIFTY 10FEB2022 Call Option 39100 254.79

BANKNIFTY BANKNIFTY 10FEB2022 Call Option 39200 -223.55

BANKNIFTY BANKNIFTY 10FEB2022 Put Option 36900 146.08

BANKNIFTY BANKNIFTY 10FEB2022 Put Option 39100 404.74

BANKNIFTY BANKNIFTY 17FEB2022 Call Option 37800 145.36

BANKNIFTY BANKNIFTY 17FEB2022 Call Option 38200 330.98

BANKNIFTY BANKNIFTY 17FEB2022 Call Option 38300 166.11

BANKNIFTY BANKNIFTY 17FEB2022 Call Option 38800 -1396.29

BANKNIFTY BANKNIFTY 17FEB2022 Call Option 39500 -83.21

BANKNIFTY BANKNIFTY 17FEB2022 Put Option 35000 -542.10

BANKNIFTY BANKNIFTY 17FEB2022 Put Option 35500 -141.30

BANKNIFTY BANKNIFTY 17FEB2022 Put Option 36000 406.81

BANKNIFTY BANKNIFTY 17FEB2022 Put Option 36200 798.79

BANKNIFTY BANKNIFTY 17FEB2022 Put Option 37100 537.76

BANKNIFTY BANKNIFTY 17FEB2022 Put Option 37200 -374.19

BANKNIFTY BANKNIFTY 17FEB2022 Put Option 37500 208.11

CRUDEOIL CRUDEOIL 16FEB2022 Put Option 7000 68.99

NIFTY NIFTY 03NOV2021 Call Option 18000 1845.47

NIFTY NIFTY 03NOV2021 Call Option 18200 -1184.80

NIFTY NIFTY 10FEB2022 Call Option 17500 -115.71

NIFTY NIFTY 10FEB2022 Put Option 17500 -475.43

NIFTY NIFTY 17FEB2022 Call Option 17500 -355.55

NIFTY NIFTY 17FEB2022 Call Option 17800 487.52

NIFTY NIFTY 17FEB2022 Put Option 16200 489.85

NIFTY NIFTY 17FEB2022 Put Option 17050 390.88

NIFTY NIFTY 23SEP2021 Call Option 17700 1398.19

NIFTY NIFTY 24FEB2022 Call Option 17800 -404.05

NIFTY NIFTY 24FEB2022 Call Option 18050 -1742.35

NIFTY NIFTY 29APR2021 Call Option 15000 -369.25

NIFTY NIFTY 29APR2021 Put Option 13900 -746.36

NIFTY NIFTY 29APR2021 Put Option 14100 -7631.52

NIFTY NIFTY 29APR2021 Put Option 14300 -6423.39

NIFTY NIFTY 29APR2021 Put Option 14400 -491.00

NIFTY NIFTY 30SEP2021 Call Option 17700 1473.96

Total : -12334.5

***End of Report***

#: Gain amount has been calculated as per the new Income Tax rules for calculation of Long Term Capital Gain tax post grand

fathering.

Disclaimer:

This report has been provided based on the Depository and Trading transactions executed by you with Kotak Securities Limited (KSL)

and is provided for your personal reference and ease only. This report does not cover STT charges, other ledger debits such as DP

Charges, delayed payment charges, penalties and corporate actions, off market transactions, IPOs etc. which may affect the

correctness of this report. This report shall not be used for the purpose of calculation of your income tax liability and / or any

other purpose. You are advised to take help of professional Tax advisor and to refer the contract notes, demat transaction

statements and ledger statement for arriving at your actual Profit and Loss. KSL, its directors and employees shall not be held

responsible for erroneous Gain/Loss Calculations and shall not be answerable / liable for any action, losses, claims, cost,

damages, charges, penalties etc initiated by any authority basis this report.

You might also like

- W EMTRqdn K7 A1 B5 LFDocument2 pagesW EMTRqdn K7 A1 B5 LFAnup YadavNo ratings yet

- Statement: Branch Details Your Current Details Period 2020 To 202Document6 pagesStatement: Branch Details Your Current Details Period 2020 To 202xxalias100% (1)

- Cust 1-247694200538 20210901Document2 pagesCust 1-247694200538 20210901Rogers Gift100% (1)

- Statement: Branch Details Your Current Details PeriodDocument2 pagesStatement: Branch Details Your Current Details Periodxxalias100% (2)

- Ciia Final Exam I March11 - Qe-OriginalDocument12 pagesCiia Final Exam I March11 - Qe-OriginalAdedeji AjadiNo ratings yet

- Kotak securities-PandL 2022-23 RRGDocument5 pagesKotak securities-PandL 2022-23 RRGRg RrgNo ratings yet

- Kotak securities-PandL 2021-22 RRGDocument3 pagesKotak securities-PandL 2021-22 RRGRg RrgNo ratings yet

- Transaction - History - Permata - Paging - 2022-09-21T162705.715Document1 pageTransaction - History - Permata - Paging - 2022-09-21T162705.715Devi Yolanda SamosirNo ratings yet

- Adobe Scan Feb 24, 2022Document4 pagesAdobe Scan Feb 24, 2022R.Navaneetha KrishnanNo ratings yet

- Park View Enclave (PVT) Limited.: Account StatementDocument1 pagePark View Enclave (PVT) Limited.: Account Statementamirali.bme4527No ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAPPLE MARINENo ratings yet

- HISTORI_TRANSAKSI_1718553575849Document2 pagesHISTORI_TRANSAKSI_1718553575849karwatinini99No ratings yet

- RDInstallment Report 19!05!2023Document6 pagesRDInstallment Report 19!05!2023Javed SNo ratings yet

- Check & CVDocument304 pagesCheck & CVjardinlyzylNo ratings yet

- Loan Ledger - LIC HFL - Customer Portal PDFDocument1 pageLoan Ledger - LIC HFL - Customer Portal PDFShisArquamNo ratings yet

- Histori TransaksiDocument1 pageHistori TransaksiyortaniosabangNo ratings yet

- Journal Part 1Document1 pageJournal Part 1Chaudhry M. BurairNo ratings yet

- 11 10 22 20:10:48Document1 page11 10 22 20:10:48nhimvidavorn8181No ratings yet

- Diduction Tva 17072024Document2 pagesDiduction Tva 17072024ayman KaciMiNo ratings yet

- Diduction Tva 17072024Document2 pagesDiduction Tva 17072024ayman KaciMiNo ratings yet

- Design PDFDocument4 pagesDesign PDFAJAY SHINDENo ratings yet

- COUNTER EXERCISES (Version 1)Document20 pagesCOUNTER EXERCISES (Version 1)ScribdTranslationsNo ratings yet

- Histori TransaksiDocument3 pagesHistori TransaksiAwwalul Khair FatwaNo ratings yet

- Computer Orientation AssignmentDocument18 pagesComputer Orientation AssignmentTaha AhmedNo ratings yet

- Miss Candice T Mazibuko Thabisile 347 MOTSU Tembisa 1632: Transactions in RAND (ZAR) Accrued Bank ChargesDocument2 pagesMiss Candice T Mazibuko Thabisile 347 MOTSU Tembisa 1632: Transactions in RAND (ZAR) Accrued Bank ChargestoksbchNo ratings yet

- Zuze FungaiDocument1 pageZuze FungaiLainoNo ratings yet

- DailyReport - 2022-11-16T104612.200Document1 pageDailyReport - 2022-11-16T104612.200Sreenath SNo ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMohamed RafihNo ratings yet

- RP Statement Feb2024 02032024092428 PDFDocument3 pagesRP Statement Feb2024 02032024092428 PDFGani SyamNo ratings yet

- Statement of Account For The Period From To Is Furnished Below 01-SEP-20 30-SEP-20Document1 pageStatement of Account For The Period From To Is Furnished Below 01-SEP-20 30-SEP-20Chandramohan GNo ratings yet

- Estado de CuentaDocument1 pageEstado de CuentaDjTwistfly24No ratings yet

- FeesReceipt - 19-22-004838 - College Fees - Semester 7Document1 pageFeesReceipt - 19-22-004838 - College Fees - Semester 7Nevil GajeraNo ratings yet

- Invoice: Gross Invoice Total Minus Outstanding AmountDocument2 pagesInvoice: Gross Invoice Total Minus Outstanding AmountMadz Alcoy BautistaNo ratings yet

- Cestrum BS-Mar 23 ConsolDocument35 pagesCestrum BS-Mar 23 Consolprimestuff09No ratings yet

- CreditCardStatement2801868 - 2085 - 27-Oct-20Document1 pageCreditCardStatement2801868 - 2085 - 27-Oct-20Abdul AleemNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2020.10.27 14:31:13 UTCDocument3 pagesCash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2020.10.27 14:31:13 UTCSANDEEP GAWANDENo ratings yet

- Shiv Shrushti Ledger 21 - 22Document1 pageShiv Shrushti Ledger 21 - 22shrushtianitaNo ratings yet

- Account Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2022 To 31 Mar 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancearchitrohida.officialNo ratings yet

- Usha Com PDFDocument2 pagesUsha Com PDFMukesh MishraNo ratings yet

- Account Statement: Total Search Results: 16Document1 pageAccount Statement: Total Search Results: 16Sales BzugNo ratings yet

- Project ADVANCE FINANCIAL MANAGEMENTDocument11 pagesProject ADVANCE FINANCIAL MANAGEMENTBilal KhalidNo ratings yet

- LCB250422 Government of Saint Lucia 91-Day Treasury Bill ReportDocument6 pagesLCB250422 Government of Saint Lucia 91-Day Treasury Bill ReportShiloh FrederickNo ratings yet

- Accountancy & Auditing-IDocument4 pagesAccountancy & Auditing-Izaman virkNo ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAmishaNo ratings yet

- Liberty OnlineDocument1 pageLiberty OnlineKhushi AgarwalNo ratings yet

- Histori TransaksiDocument2 pagesHistori Transaksiradenmister05No ratings yet

- Tva Ihsane OpticDocument17 pagesTva Ihsane Opticnourdine ouhammouNo ratings yet

- Toyota Financial Services India Ltd. Account StatementDocument4 pagesToyota Financial Services India Ltd. Account StatementaliNo ratings yet

- TRX - Inquiry - 1810000666116 - 16 July 2020-28 July 2020 - 202007280805 PDFDocument2 pagesTRX - Inquiry - 1810000666116 - 16 July 2020-28 July 2020 - 202007280805 PDFWyllmar PasangkaNo ratings yet

- Hema May 1 To Dec 9Document5 pagesHema May 1 To Dec 9Rajesh pvkNo ratings yet

- Part 2 JournalDocument1 pagePart 2 JournalChaudhry M. BurairNo ratings yet

- 03 March 2022Document19 pages03 March 2022John Louie LagunaNo ratings yet

- Canara1st Apr 2022 To 21march 2023Document110 pagesCanara1st Apr 2022 To 21march 2023JAWED MOHAMMADNo ratings yet

- Dhanshreeenterprises 13122182347Document3 pagesDhanshreeenterprises 13122182347Team Nanda GurjarNo ratings yet

- Fin P&LDocument14 pagesFin P&LBotiyoNo ratings yet

- FINNIFTY - 3 Min - PCR Intraday Trend Based On Options Data - Binary TraderDocument10 pagesFINNIFTY - 3 Min - PCR Intraday Trend Based On Options Data - Binary Traderpol sujatasNo ratings yet

- Statement 25-FEB-21 AC 23995070Document3 pagesStatement 25-FEB-21 AC 23995070Doris Zhao100% (1)

- Ledger Jun 30 2020 Jul 31 2020Document1 pageLedger Jun 30 2020 Jul 31 2020Jack SaravananNo ratings yet

- Daily Derivative Overview 20122023Document10 pagesDaily Derivative Overview 20122023riddhi SalviNo ratings yet

- Comparative Analysis of Three Asset Management Companies PDFDocument103 pagesComparative Analysis of Three Asset Management Companies PDFAayushi PatelNo ratings yet

- Tbla 2016 PDFDocument281 pagesTbla 2016 PDFNanda Julyantie RatmanaNo ratings yet

- FABM 1 Week 3 4Document20 pagesFABM 1 Week 3 4RD Suarez67% (6)

- CFA Level1 2018 Curriculum UpdatesDocument13 pagesCFA Level1 2018 Curriculum UpdatesTeddy Jain100% (1)

- COMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24Document350 pagesCOMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24http://secwatch.comNo ratings yet

- Principles of Financial Accounting PDFDocument318 pagesPrinciples of Financial Accounting PDFRalph Aries Almeyda Alvarez100% (2)

- 2018-1383 Samsona, Melanie S.Document8 pages2018-1383 Samsona, Melanie S.Melanie SamsonaNo ratings yet

- YPAS - Annual Report - 2017 (Rugi) PDFDocument164 pagesYPAS - Annual Report - 2017 (Rugi) PDFbuwat donlotNo ratings yet

- Director of Global BenefitsDocument2 pagesDirector of Global Benefitsapi-79047316No ratings yet

- Ch13 The Stock MarketDocument34 pagesCh13 The Stock MarketAya OuldelgaoudNo ratings yet

- MCQ - Change in PSR (Class XII)Document4 pagesMCQ - Change in PSR (Class XII)WHY NOT YOU ??No ratings yet

- Lesson 2 Business LawDocument3 pagesLesson 2 Business LawAshok ReddyNo ratings yet

- ICM Text Book UpdateDocument78 pagesICM Text Book UpdatemariposaNo ratings yet

- FCFF and Fcfe of CVDocument2 pagesFCFF and Fcfe of CVmuktaNo ratings yet

- Introduction To AccountingDocument14 pagesIntroduction To AccountingMylene SalvadorNo ratings yet

- RA 10846 PDIC Law ExcerptsDocument11 pagesRA 10846 PDIC Law ExcerptsMohammad Allem AlegreNo ratings yet

- Company Registration in Nepal (2080) Process of RegistrationDocument11 pagesCompany Registration in Nepal (2080) Process of RegistrationPrabin XhresthaNo ratings yet

- Profit. Planning and ControlDocument16 pagesProfit. Planning and ControlNischal LawojuNo ratings yet

- AuditDocument9 pagesAuditrahul422No ratings yet

- Audit of PpeDocument5 pagesAudit of PpeCathleen VillalvitoNo ratings yet

- Module 1 Conceptual FrameworkDocument8 pagesModule 1 Conceptual FrameworkHeart Erica AbagNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Audit Fot Liability Problem #14Document2 pagesAudit Fot Liability Problem #14Ma Teresa B. CerezoNo ratings yet

- WRK IFRS SMEsDocument109 pagesWRK IFRS SMEsMazhar Ali JoyoNo ratings yet

- Problem 2Document5 pagesProblem 2Rommel RoyceNo ratings yet

- Difference Between Partnership & Pvt. LTDDocument4 pagesDifference Between Partnership & Pvt. LTDpiudeva100% (3)

- Enter The Data Only in The Yellow Cells.: Agg Plan - LevelDocument7 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - LevelJason RobillardNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- 2023 CFA Level 1 Curriculum Changes Summary (300hours)Document2 pages2023 CFA Level 1 Curriculum Changes Summary (300hours)johnNo ratings yet