Professional Documents

Culture Documents

Grain Workshop 1

Grain Workshop 1

Uploaded by

AbhazOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Grain Workshop 1

Grain Workshop 1

Uploaded by

AbhazCopyright:

Available Formats

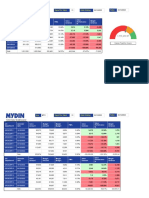

AMIS Market Monitor No.

99 June 2022 3

World supply-demand outlook

FAO-AMIS USDA IGC

WHEAT production in 2022 is forecast to decline for the first time in

Wheat

2021/22 2022/23 2021/22 2022/23 2020/21 2021/22

four years, down 0.8 percent from the 2021 record, mostly reflecting est f'cast est f'cast est f'cast

lower expected outputs in Australia, India, Morocco, and Ukraine. 2 Jun 12 May 19 May

Utilization is seen falling in 2022/23, down 0.4 percent from 2021/22, 776.8 770.8 779.3 774.8 774.3 781.2

Stocks Trade Utiliz. Supply Prod.

T O N N E S

led by a decline in feed use, as a result of high prices, and, to a lesser 639.9 634.0 642.3 639.8 640.0 644.1

extent, industrial use. 1068.2 1067.4 1070.5 1054.5 1049.5 1059.7

Trade in 2022/23 (July/June) is set to contract from the 2021/22 record, 800.9 796.7 789.4 777.6 786.2 795.5

mainly reflecting lower exports from Ukraine, due to conflict disruptions, 771.7 768.6 790.8 787.5 770.9 777.6

M I L L I O N

as well as Argentina, Australia, and India, stemming from lower 628.9 630.9 642.8 643.5 625.0 636.8

production, on top of an export ban in India.

192.1 188.9 201.6 205.3 190.3 193.6

Stocks (ending in 2023) forecast to rise marginally above opening levels, 182.6 181.1 191.9 195.8 179.3 184.0

with increases mostly in China, Russia, and Ukraine outweighing

296.5 297.8 279.7 267.0 278.5 282.1

anticipated stock drawdowns in several countries in Africa and Asia.

I N

162.8 157.2 137.8 125.5 150.2 149.1

FAO-AMIS USDA IGC

MAIZE production in 2022 is forecast to decline, down 1.6 percent

Maize

2021/22 2022/23 2021/22 2022/23 2020/21 2021/22

from the 2021 record, led by smaller outputs in Ukraine and in the US. est f'cast est f'cast est f'cast

Utilization in 2022/23 set to contract by 0.4 percent, almost entirely 2 Jun 12 May 19 May

reflecting lower feed use, especially in Canada, the EU, and the US. 1206.7 1187.8 1215.6 1180.7 1131.5 1213.8

Stocks Trade Utiliz. Supply Prod.

T O N N E S

934.2 914.8 943.1 909.7 870.8 941.2

Trade is forecast to fall in 2022/23 (July/June), driven by an expected

steep fall in exports from Ukraine, as well as lower export availability in 1493.8 1491.5 1508.8 1490.1 1429.4 1492.7

Argentina and the US. On the importer side, smaller purchases are 1067.1 1062.7 1030.5 1008.9 976.9 1025.8

projected for Canada, China, and the EU. 1194.8 1189.7 1199.4 1185.0 1150.6 1207.5

M I L L I O N

Stocks (ending 2023) are forecast to decline, down 1.1 percent below 902.9 893.3 908.4 890.0 862.7 908.8

opening levels. While the largest drawdowns are expected in China and 180.8 174.2 190.5 183.2 188.1 174.2

the US, stocks are seen falling at the regional level in Asia, Northern 157.3 154.2 167.5 165.2 158.3 154.2

America, Africa, Central America, and Europe.

303.7 300.3 309.4 305.1 278.9 285.2

I N

147.9 147.9 99.2 100.9 84.5 97.0

FAO-AMIS USDA IGC

RICE production in 2022 forecast to be just short of the 2021 2021/22 2022/23 2021/22 2022/23 2020/21 2021/22

Rice

all-time high, as another abundant Asian harvest, as well as larger crops est f'cast est f'cast est f'cast

in Africa and Australia, largely compensate for shortfalls elsewhere. 2 Jun 12 May 19 May

520.8 519.5 512.9 514.6 510.2 514.4

Stocks Trade Utiliz. Supply Prod.

Utilization in 2022/23 seen little changed from the 2021/22 peak, as

T O N N E S

continued growth in food intake is largely counterbalanced by a cut in 375.0 373.4 363.9 365.6 361.9 365.0

non-food uses. 712.3 711.8 700.7 704.7 691.1 696.0

Trade in 2022 and 2023 predicted to remain on an expansionary trend, 463.4 465.1 435.2 442.7 432.7 439.4

although reduced import demand from the Far East to decelerate 521.0 522.0 510.6 518.4 509.6 514.8

M I L L I O N

growth. 369.5 374.3 355.2 361.8 355.9 360.9

Stocks (2022/23 carry-out) seen at their second highest on record, as 53.1 53.9 52.6 54.3 50.6 51.2

expected drawdowns, notably in Brazil, Myanmar and Thailand, are 48.2 49.4 47.4 48.3 46.0 46.2

mostly offset by accumulations in China and India.

192.4 191.6 190.1 186.3 181.6 181.2

I N

91.8 90.4 77.1 77.3 72.2 73.5

FAO-AMIS USDA IGC

SOYBEAN 2022/23 production could rise to a record high, mainly

Soybean

2021/22 2022/23 2021/22 2022/23 2020/21 2021/22

tied to a sharp rebound in productivity levels in Argentina, Brazil and est f'cast est f'cast est f'cast

Paraguay, as well as area expansions in China and the US. 2 Jun 12 May 19 May

348.8 390.4 349.4 394.7 368.5 348.6

Stocks Trade Utiliz. Supply Prod.

Utilization in 2022/23 to recover moderately from an exceptional

T O N N E S

contraction estimated for 2021/22, underpinned by a steady 332.4 371.0 333.0 377.2 348.9 332.2

consumption growth in China and uptake recoveries in South American 399.6 430.2 449.3 479.9 421.7 403.8

countries. 359.7 391.7 401.7 431.7 371.9 356.0

Trade in 2022/23 (Oct/Sep) likely to rebound markedly, largely driven by 365.9 377.8 362.9 377.4 366.5 358.4

M I L L I O N

a forecasted import recovery in China, while major South American 253.1 261.3 254.2 261.8 253.2 247.3

exporters are expected to regain market shares.

155.2 166.7 155.6 170.0 160.2 154.3

Stocks (2022/23 carry-out) to replenish from multi-year lows estimated 63.2 67.5 63.6 71.0 65.2 62.3

for 2021/22, although the global stocks-to-use ratio would remain

39.8 51.0 85.2 99.6 55.2 45.4

below the 5-year average.

I N

20.8 30.0 54.5 68.0 23.7 16.7

+i World Balances

Data shown in the second rows refer to world aggregates without China; world trade data refer to exports; and world trade without China excludes exports to China.

To review and compare data, by country and commodity, across three main sources, go to https://app.amis-outlook.org/#/market-database/compare-sources

Estimates and forecasts may differ across sources for many reasons, including different methodologies. For more information see Explanatory notes on the last

page of this report.

You might also like

- Infographic of Vinamilk Channel MapDocument1 pageInfographic of Vinamilk Channel MapGiang ĐặngNo ratings yet

- Gradual Increase in Rice Production Area and Reduction of Post-Harvest LossesDocument4 pagesGradual Increase in Rice Production Area and Reduction of Post-Harvest LossesDodong MelencionNo ratings yet

- Cash - Cost - EBITDA 2017-2022 FVDocument7 pagesCash - Cost - EBITDA 2017-2022 FVJulian Brescia2No ratings yet

- Rice Outlook Monthly Tables February 2020Document12 pagesRice Outlook Monthly Tables February 2020Akash NeupaneNo ratings yet

- 2024 OIV April PressConference PPTDocument26 pages2024 OIV April PressConference PPTllglion78No ratings yet

- 04 - 2024 April Appendix TablesDocument14 pages04 - 2024 April Appendix Tablesdjindal9999No ratings yet

- Rice Outlook Monthly Tables November 2021Document13 pagesRice Outlook Monthly Tables November 2021jun njkNo ratings yet

- Indian Economy Prognosis FY24Document25 pagesIndian Economy Prognosis FY24Tejaswi KarriNo ratings yet

- 2023.04.28 Press Release - ICSG Copper Market Forecast 2023-2024Document2 pages2023.04.28 Press Release - ICSG Copper Market Forecast 2023-2024Pedro Jose Cardenas PyastolovNo ratings yet

- Tomates en California PDFDocument2 pagesTomates en California PDFOliver ReaNo ratings yet

- USDA Export Sales Report - Current and Recent HistoryDocument2 pagesUSDA Export Sales Report - Current and Recent HistoryPhương NguyễnNo ratings yet

- Chapter IDocument15 pagesChapter Imohsin.usafzai932No ratings yet

- Factsheets Fy2022Document13 pagesFactsheets Fy2022akiko1550No ratings yet

- Canada's Oil Extraction Industry: Key IssuesDocument12 pagesCanada's Oil Extraction Industry: Key Issuesderailedcapitalism.comNo ratings yet

- EU Cereals MarketDocument29 pagesEU Cereals MarketCatalin PlatonNo ratings yet

- HSL - Commodities Pack Report - 2021-202108182348310059173Document16 pagesHSL - Commodities Pack Report - 2021-202108182348310059173SHAIK AHMEDNo ratings yet

- I. Economic Environment (1) O: The Dominican Republic WT/TPR/S/207/Rev.1Document15 pagesI. Economic Environment (1) O: The Dominican Republic WT/TPR/S/207/Rev.1Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Site Daily Dashboard: Today Report For Week Site Week EndingDocument19 pagesSite Daily Dashboard: Today Report For Week Site Week EndingSHIEVANESAAN RAVEENo ratings yet

- 2009-08-10 - Trade Policy Review - Report by The Secretariat On Guyana Rev1 PART1 (WTTPRS218R1-01)Document11 pages2009-08-10 - Trade Policy Review - Report by The Secretariat On Guyana Rev1 PART1 (WTTPRS218R1-01)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Nepal Economic Survey 2009-10 - TablesDocument209 pagesNepal Economic Survey 2009-10 - TablesChandan SapkotaNo ratings yet

- Financial StudyDocument20 pagesFinancial StudyROSAL ARRAYNo ratings yet

- ITC Quarterly Result Presentation Q3 FY2021Document46 pagesITC Quarterly Result Presentation Q3 FY2021Vineet UttamNo ratings yet

- Secretary General Federation of Indian Chambers of Commerce and Industry (FICCI)Document24 pagesSecretary General Federation of Indian Chambers of Commerce and Industry (FICCI)surajjain2012yahooNo ratings yet

- Market Review - March 2024 (Yearly Update)Document9 pagesMarket Review - March 2024 (Yearly Update)Akshay ChaudhryNo ratings yet

- Malaysia:: Macro Economic Key DataDocument58 pagesMalaysia:: Macro Economic Key DataWong Kai WenNo ratings yet

- Gross National Income (Gni) and Gross Domestic Product by Industrial OriginDocument1 pageGross National Income (Gni) and Gross Domestic Product by Industrial OriginLerry FernandezNo ratings yet

- Tea Industry Performance Report 2023Document10 pagesTea Industry Performance Report 2023valoruroNo ratings yet

- Crisil Economy First Cut Cutting GDP Growth To 6point3percent in Fiscal 2020Document8 pagesCrisil Economy First Cut Cutting GDP Growth To 6point3percent in Fiscal 2020VibWho R EahNo ratings yet

- Weekly Economic Update 37 - 2019Document4 pagesWeekly Economic Update 37 - 2019jyl12No ratings yet

- Automobiles Q2FY24Review17Nov23 ResearchDocument6 pagesAutomobiles Q2FY24Review17Nov23 Researchkrishna_buntyNo ratings yet

- Growth Rate and Composition of Real GDPDocument27 pagesGrowth Rate and Composition of Real GDPpallavi jhanjiNo ratings yet

- 2023-06 2022 Phil Eco PerformanceDocument2 pages2023-06 2022 Phil Eco PerformanceDaincy Pearl MarianoNo ratings yet

- ITMGDocument17 pagesITMGIrwan SukmaNo ratings yet

- Hossain Ahmmed Fahad-KGL-25034719Document11 pagesHossain Ahmmed Fahad-KGL-25034719MONJURUL KARIMNo ratings yet

- Fullreport Aes2009Document174 pagesFullreport Aes2009thyquynh285No ratings yet

- Annual T and A Industry Report-2021Document47 pagesAnnual T and A Industry Report-2021pavithra nirmalaNo ratings yet

- Chap-1 3Document6 pagesChap-1 3Irfan AnwerNo ratings yet

- 1) Sectorial Composition of GDP of Pakistan.1Document7 pages1) Sectorial Composition of GDP of Pakistan.1Syed Ashar ShahidNo ratings yet

- The Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Document5 pagesThe Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Rohit AggarwalNo ratings yet

- Frost&Sullivan EMDS ReportDocument11 pagesFrost&Sullivan EMDS ReportzehratmuzaffarNo ratings yet

- Indonesia Palm Oil: Sector BriefingDocument40 pagesIndonesia Palm Oil: Sector BriefingatanmasriNo ratings yet

- Tabchart 7Document19 pagesTabchart 7Sahana SNo ratings yet

- Story: You May E-Mail Dale Jewett atDocument1 pageStory: You May E-Mail Dale Jewett atGlen YNo ratings yet

- BNI Sekuritas 08102021Document14 pagesBNI Sekuritas 08102021Quartantyo WijanarkoNo ratings yet

- 2Q23 Consolidated ChartsDocument26 pages2Q23 Consolidated ChartsSANDRO LUIS GUEVARA CONDENo ratings yet

- Growth and Stabilization: : at Average Exchange Rate P: ProvisionalDocument17 pagesGrowth and Stabilization: : at Average Exchange Rate P: ProvisionalWaqas TayyabNo ratings yet

- 2015 - REP ERA Grid Analysis ReportDocument57 pages2015 - REP ERA Grid Analysis ReportsedianpoNo ratings yet

- Equity Reserch Coal IndiaDocument42 pagesEquity Reserch Coal IndiaPrajwal nayakNo ratings yet

- SEPO - Macroeconomic and Fiscal Assumptions of The Proposed 2023 Budget - 12september2022Document25 pagesSEPO - Macroeconomic and Fiscal Assumptions of The Proposed 2023 Budget - 12september2022Rivera T DariNo ratings yet

- F3117 Domestic Price of Wheat Feed BED ReportDocument4 pagesF3117 Domestic Price of Wheat Feed BED ReportZhang YiNo ratings yet

- BONDS RITEL - Harga BRIefx - 2022-09-23Document1 pageBONDS RITEL - Harga BRIefx - 2022-09-23upinNo ratings yet

- WPIC Platinum Essentials May 2024Document16 pagesWPIC Platinum Essentials May 2024Alexandr LaputinNo ratings yet

- Trimegah CF 20220715 ADMR - Long Term Gain Will Offset The ST PainDocument8 pagesTrimegah CF 20220715 ADMR - Long Term Gain Will Offset The ST PainHeryadi IndrakusumaNo ratings yet

- Economic Spotlight - Nuvama ReportDocument8 pagesEconomic Spotlight - Nuvama Reportsonika.arora1417No ratings yet

- Petroleum-Energy To A Growing WorldDocument47 pagesPetroleum-Energy To A Growing WorldNBNo ratings yet

- TABLE 1.1 Gross National Product at Constant Basic Prices of 2005-06Document12 pagesTABLE 1.1 Gross National Product at Constant Basic Prices of 2005-06sidraNo ratings yet

- FullReport AES2022Document100 pagesFullReport AES2022Slimey DogiesNo ratings yet

- I. Economic Environment (1) I: Brunei Darussalam WT/TPR/S/196/Rev.1Document17 pagesI. Economic Environment (1) I: Brunei Darussalam WT/TPR/S/196/Rev.1hakseng lyNo ratings yet

- 06huawei NE Series Enterprise RoutersDocument93 pages06huawei NE Series Enterprise RoutersJonas Suarin100% (1)

- Godrej Agrovet - MOSL - RU - 2022Document14 pagesGodrej Agrovet - MOSL - RU - 2022Raghu KuchiNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Grain Workshop 3Document1 pageGrain Workshop 3AbhazNo ratings yet

- Workshop On Positive ResponsesDocument1 pageWorkshop On Positive ResponsesAbhazNo ratings yet

- Writing Exercises 3.1 - 3.7: 3.1 Identifying The Main Features: Writing Task LDocument1 pageWriting Exercises 3.1 - 3.7: 3.1 Identifying The Main Features: Writing Task LAbhazNo ratings yet

- Vocabulary Workshop 5Document1 pageVocabulary Workshop 5AbhazNo ratings yet

- WRITING TASK 1 - Model AnswerDocument1 pageWRITING TASK 1 - Model AnswerAbhazNo ratings yet

- 3.4 INTRODUCTION: Writing Task 2:: A University Lecturer Has Asked You To Write An Essay On The Following TopicDocument1 page3.4 INTRODUCTION: Writing Task 2:: A University Lecturer Has Asked You To Write An Essay On The Following TopicAbhazNo ratings yet

- 202 Useful Exercises For BELTS: (Answers On Page 117)Document1 page202 Useful Exercises For BELTS: (Answers On Page 117)AbhazNo ratings yet

- 3.8 MATCHING SENTENCE HALVES: Refer To The Text in Exercise 3.3 and Match The Halves of The Given Sentences TogetherDocument1 page3.8 MATCHING SENTENCE HALVES: Refer To The Text in Exercise 3.3 and Match The Halves of The Given Sentences TogetherAbhazNo ratings yet

- Grammar - Classroom Notes - Verbals30Document1 pageGrammar - Classroom Notes - Verbals30AbhazNo ratings yet

- Grammar - Classroom Notes - Verbals24Document1 pageGrammar - Classroom Notes - Verbals24AbhazNo ratings yet

- Shipment Note: TCNU1150169 EU15736274Document1 pageShipment Note: TCNU1150169 EU15736274AbhazNo ratings yet

- GRS Certified PCR, PIR GranulesDocument4 pagesGRS Certified PCR, PIR GranulesDhananjay VishwakarmaNo ratings yet

- Toefl Exercise 1Document1 pageToefl Exercise 1Aswin MuhammadNo ratings yet

- 5-6 - Storage Dan Warehousing - 1Document34 pages5-6 - Storage Dan Warehousing - 1SITI WATSIQOHNo ratings yet

- Constraints and Opportunities of Raw Jute Production: A Household Level Analysis in BangladeshDocument9 pagesConstraints and Opportunities of Raw Jute Production: A Household Level Analysis in BangladeshVictor ChicaizaNo ratings yet

- Maitri BrochureDocument4 pagesMaitri BrochuresunilkumarchaudharyNo ratings yet

- Indian Agriculture After IndependenceDocument26 pagesIndian Agriculture After IndependenceSameer BaswanaNo ratings yet

- Freeze Drying Vs Spray DryingDocument4 pagesFreeze Drying Vs Spray DryingADVOCATE ASHUTOSH SHARMANo ratings yet

- Kolin - Solid Waste Manifest Form - KolinDocument2 pagesKolin - Solid Waste Manifest Form - Kolinkhrayzie bhoneNo ratings yet

- MBA Retail - 1Document28 pagesMBA Retail - 1Siana GurungNo ratings yet

- Travel MarketDocument9 pagesTravel MarketStefanee Dhel Tricia S. PanesNo ratings yet

- OrganicAgriculture v2Document15 pagesOrganicAgriculture v2Joesery Padasas Tuma-obNo ratings yet

- PolymersDocument3 pagesPolymersYash SonalekarNo ratings yet

- Bisphenol Grade FKM DaikinDocument5 pagesBisphenol Grade FKM DaikinBudi Sapto AjiNo ratings yet

- Power For All - ToolsDocument6 pagesPower For All - Toolsdan marchisNo ratings yet

- Hospital Waste Management - CMDocument25 pagesHospital Waste Management - CMSara KaleemNo ratings yet

- 1415 - S1 - Food Problem - Unit 2.5&2.6 - AnsDocument7 pages1415 - S1 - Food Problem - Unit 2.5&2.6 - AnsLouisa LauNo ratings yet

- GPP Monitoring ToolDocument3 pagesGPP Monitoring ToolLaish Christle CapiendoNo ratings yet

- Gpi HRDocument30 pagesGpi HRBionics EnvirotechNo ratings yet

- The Story of Village Palampur PDFDocument23 pagesThe Story of Village Palampur PDFBhavi sriNo ratings yet

- Budget ProposalDocument7 pagesBudget ProposalJB B. SegarraNo ratings yet

- Mikro Ransum MineralnyaDocument9 pagesMikro Ransum Mineralnyaaditya mahardika pradanaNo ratings yet

- Tejas Kush Investigatory Hard Plastic ExperimentDocument18 pagesTejas Kush Investigatory Hard Plastic ExperimentTejas KushNo ratings yet

- Invoice Ext FileDocument336 pagesInvoice Ext FileChef Shane0% (1)

- Science-5 - Quarter-1-Module-5-Week-5Document6 pagesScience-5 - Quarter-1-Module-5-Week-5Vhacie TorresNo ratings yet

- Noida Ceo Cto MD Data SampleDocument3 pagesNoida Ceo Cto MD Data SampleAayat ChoudharyNo ratings yet

- 9 Soil Physics - FINALDocument4 pages9 Soil Physics - FINALChikondi KanamaNo ratings yet

- Company Profile Adyabina PutramasDocument6 pagesCompany Profile Adyabina PutramasFAUSANo ratings yet

- VTDPT E CLDocument55 pagesVTDPT E CLTrâm TrầnNo ratings yet

- Tooy 2022 IOP Conf. Ser. Earth Environ. Sci. 977 012068Document8 pagesTooy 2022 IOP Conf. Ser. Earth Environ. Sci. 977 012068jasajustine04No ratings yet