Professional Documents

Culture Documents

Fin Accounting 3-A1-12-2022

Fin Accounting 3-A1-12-2022

Uploaded by

Benjamin BandaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin Accounting 3-A1-12-2022

Fin Accounting 3-A1-12-2022

Uploaded by

Benjamin BandaCopyright:

Available Formats

ZAMBIAN OPEN UNIVERSITY

SCHOOL OF BUSINESS STUDIES

BECHELORS OF BUSINESS ADMINISTRATION

2022- SEMESTER ONE (1)

FINANCIAL ACCOUNTING 3

BBAC 321

Lecturer: Mr F.K.Musweu Mobile Number. 0979106273

Email: fmusweu@webmail.co.za

INSTRUCTIONS

Answer all the questions

Marks will be given for the workings shown

The assignment should be typed and if it is hand written it should be neatly and clearly

written.

NOTE: LATE SUBMISSION WILL NOT BE ENTERTAINED

ASSIGNMENT 1 DUE DATE: 3rd September, 2022.

Question One

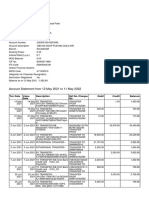

The following Trial Balance was extracted from the books of Hillside Plc at 31st March 2006:

K’000 K’000

K1 000 ordinary shares 200 000

8% K1 000 preference shares 70 000

7% debentures 100 000

Land and buildings: cost 130 000

Accumulated depreciation on buildings on 1st April 2005 30 000

Plant and machinery (K348 million cost) 262 500

Motor vans at cost 140 000

Accumulated depreciation on vans on 1st April 2005 56 800

Profit and loss account b/f 20 000

Share premium account 60 200

Inventory at 1st April 2005 35 000

Sales 344 600

Trade Receivables and Payables 45 000 27 000

Bank 5 800

Purchases 166 100

Distribution costs 18 000

General administration expenses 44 900

Debenture interest 7 000

Interim dividends:

Ordinary 10 000

Preference 2 800

Allowance for doubtful debts 1 500

890 100 890 100

Additional information available:

1. During the year the following transpired in relation to motor vans:

a) A new motor van was purchased on 1st January 2006 on credit for K24 million. The

amount was still due to the supplier on 31st March 2006.

b) A motor van which had cost K16 million four years ago when new was sold for

K6.6 million. The proceeds from the sale had not yet been received on 31st March

2006.

None of the above matters had been recorded in the books of the company.

2. Depreciation on motor vans has been and is to be provided at the rate of 20% per annum on

cost and is charged in full in the year of acquisition and none in the year of disposal.

3. The cost of buildings is K100 million.

4. Depreciation on buildings, and plant and machinery is to be charged as follows:

Buildings 2% on cost

Plant and machinery 10% on cost

5. On 31st March 2006 the company issued bonus shares to the ordinary shareholders on a one

(1) to ten (10) basis. No entry relating to this has yet been made in the books.

6. Inventory at 31st March 2006 was valued at K51 million.

7. A bill for administrative expenses for K150 000 was unsettled as at 31st March 2006.

8. Distribution costs include an insurance premium for delivery vans of K200 000 which relates

to the period 1st July 2005 to 30th June 2006.

9. The allowance for doubtful debts is to be 21/2% of receivables outstanding on 31st March

2006.

10. The directors wish to provide for:

a) A final ordinary dividend of 5%

b) A final preference dividend.

11. Income tax for the year is estimated at K18 million.

Required:

a) Using additional information (1) and (2), prepare the following ledger accounts:

i) Motor van account

ii) Motor van accumulated depreciation account

iii) Motor van disposal account

(8 marks)

b) Prepare the company’s Income Statement for the year ended 31st March 2006.

(12 marks)

c) Prepare the company’s Balance Sheet as at 31st March 2006.

(15 marks)

Total 35 Marks

Question Two

Mupeto Ltd drilled an oil well whose works were completed and production started on 1 March

2016 at a cost of K20, 000. The terms of the license granting permission to drill the oil well are

that Mupeto Ltd will have to ‘return the land to the state it was in before drilling commenced’.

The estimated cost of this in 20 years’ time will be K10, 000. Mupeto Ltd uses a discount rate of

10%.

The discount factor at 10% in year 20 is 0.149

Required:

Calculate the values at which the new oil well will be recognized in the financial statements of

Mupeto Ltd on 28 February 2017, giving explanation for your values. 9 Marks

Question Three

The audit for 2009 for MK Ltd has not yet commenced. The estimated audit fee for the audit of

the 2009 financial statements amounts to K 3, 000. The Finance manager was not sure whether

or not this fee should be provided for in the 2009 financial statement.

Required

Write a memorandum to the directors of MK Ltd explaining the query above. Your answer

should refer to the relevant definitions and the necessary legal and accounting requirements.

6 Marks

Total (50 Marks)

Good Luck

You might also like

- Vault Career Guide To Hedge FundsDocument224 pagesVault Career Guide To Hedge Fundssanfenqiu100% (1)

- Week 2 Tutorial Questions and SolutionsDocument3 pagesWeek 2 Tutorial Questions and Solutionsmuller1234No ratings yet

- Chapter 16Document17 pagesChapter 16Punit SharmaNo ratings yet

- Day 1Document11 pagesDay 1Abdullah EjazNo ratings yet

- The Finance Director of Stenigot Is Concerned About The LaxDocument1 pageThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNo ratings yet

- Lahore School of Economics Financial Management II Assignment 6 Financial Planning & Forecasting - 1Document1 pageLahore School of Economics Financial Management II Assignment 6 Financial Planning & Forecasting - 1AhmedNo ratings yet

- BUSI 353 S18 Assignment 3 All RevenueDocument5 pagesBUSI 353 S18 Assignment 3 All RevenueTanNo ratings yet

- Task - Find Ps As Function ofDocument4 pagesTask - Find Ps As Function ofTinatini BakashviliNo ratings yet

- Week 1 - Problem SetDocument3 pagesWeek 1 - Problem SetIlpram YTNo ratings yet

- Wood Supply and Demand Analysis in PakistanDocument6 pagesWood Supply and Demand Analysis in PakistanMujtaba HaseebNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- 13 Standard CostingDocument32 pages13 Standard CostingMusthari KhanNo ratings yet

- Financial Reporting Final Mock: Barcelona Madrid Non-Current AssetsDocument7 pagesFinancial Reporting Final Mock: Barcelona Madrid Non-Current AssetsMuhammad AsadNo ratings yet

- Nov 06Document24 pagesNov 06Vascilly TerentievNo ratings yet

- Midlands State UniversityDocument11 pagesMidlands State UniversityIsheanesu MutusvaNo ratings yet

- IAS 02: Inventories: Requirement: SolutionDocument2 pagesIAS 02: Inventories: Requirement: SolutionMD Hafizul Islam Hafiz100% (1)

- Sources of Funding For MNC'sDocument22 pagesSources of Funding For MNC'sNeeraj Kumar80% (5)

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- Chapter 13 PDFDocument73 pagesChapter 13 PDFMUKESH KUMARNo ratings yet

- 7 2006 Dec QDocument6 pages7 2006 Dec Qapi-19836745No ratings yet

- CAF-Business Economics PDFDocument40 pagesCAF-Business Economics PDFadnan sheikNo ratings yet

- Question Paper PDFDocument17 pagesQuestion Paper PDFSaianish KommuchikkalaNo ratings yet

- Midterm 5101Document4 pagesMidterm 5101MD Hafizul Islam HafizNo ratings yet

- Absor Pvt. LTDDocument4 pagesAbsor Pvt. LTDsam50% (2)

- November 2006 Examinations: Paper P1 - Management Accounting - Performance EvaluationDocument32 pagesNovember 2006 Examinations: Paper P1 - Management Accounting - Performance EvaluationKamisiro RizeNo ratings yet

- Lesson 9 Problems of Transfer Pricing Practical ExerciseDocument6 pagesLesson 9 Problems of Transfer Pricing Practical ExerciseMadhu kumarNo ratings yet

- December 2003 ACCA Paper 2.5 QuestionsDocument10 pagesDecember 2003 ACCA Paper 2.5 QuestionsUlanda20% (1)

- NN 5 Chap 4 Review of AccountingDocument10 pagesNN 5 Chap 4 Review of AccountingNguyet NguyenNo ratings yet

- Ilovepdf MergedDocument15 pagesIlovepdf MergedRakib KhanNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Working Capital AnalysisDocument9 pagesWorking Capital AnalysisDr Siddharth DarjiNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Individual Assignment Acct 232 Management Accounting 2Document3 pagesIndividual Assignment Acct 232 Management Accounting 2pfungwaNo ratings yet

- Chapter 02 - Basic Financial StatementsDocument139 pagesChapter 02 - Basic Financial StatementsElio BazNo ratings yet

- R175367E Tinashe Mambodza BSFB401 AssignmentDocument8 pagesR175367E Tinashe Mambodza BSFB401 AssignmentTinasheNo ratings yet

- Ratio Analysis of Eastern Bank LTD.: Bus 635 (Managerial Finance)Document19 pagesRatio Analysis of Eastern Bank LTD.: Bus 635 (Managerial Finance)shadmanNo ratings yet

- Soal-Soal Capital Budgeting # 1Document2 pagesSoal-Soal Capital Budgeting # 1Danang0% (2)

- CH 5 Bonds Book QuestionsDocument6 pagesCH 5 Bonds Book QuestionsSavy DhillonNo ratings yet

- 9706 w11 QP 21Document12 pages9706 w11 QP 21Diksha KoossoolNo ratings yet

- Financial Statements: Analysis of Attock Refinery LimitedDocument1 pageFinancial Statements: Analysis of Attock Refinery LimitedHasnain KharNo ratings yet

- Asset Recognition and Operating Assets: Fourth EditionDocument55 pagesAsset Recognition and Operating Assets: Fourth EditionAyush JainNo ratings yet

- Ias 1 & Ias 2-Bact-307-Admin-2019-1Document35 pagesIas 1 & Ias 2-Bact-307-Admin-2019-1Letsah BrightNo ratings yet

- Practice of Ratio Analysis Development of Financial StatementsDocument8 pagesPractice of Ratio Analysis Development of Financial StatementsZarish AzharNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- C.A Cost Acc P.PDocument29 pagesC.A Cost Acc P.PRaja Ubaid100% (1)

- ICAP MSA 1 AdditionalPracticeQuesDocument34 pagesICAP MSA 1 AdditionalPracticeQuesAsad TariqNo ratings yet

- Zica t1 Financial AccountingDocument363 pagesZica t1 Financial Accountinglord100% (2)

- Principles of Accounting PDFDocument2 pagesPrinciples of Accounting PDFfrank mutale0% (1)

- Ebit Eps AnalysisDocument11 pagesEbit Eps Analysismanish9890No ratings yet

- Adams Inc Acquires Clay Corporation On January 1 2012 inDocument1 pageAdams Inc Acquires Clay Corporation On January 1 2012 inMiroslav GegoskiNo ratings yet

- FIN1161 - Introduction To Finance For Business - Report 2Document6 pagesFIN1161 - Introduction To Finance For Business - Report 2thunlagbd230128No ratings yet

- CH 13Document28 pagesCH 13ReneeNo ratings yet

- Journal Entry.Document45 pagesJournal Entry.CHARAK RAYNo ratings yet

- f7 2014 Dec QDocument13 pagesf7 2014 Dec QAshraf ValappilNo ratings yet

- Accounting Principles Chapter OneDocument23 pagesAccounting Principles Chapter OneYyhh100% (1)

- Issues in Corporate GovernanceDocument15 pagesIssues in Corporate GovernanceVandana ŘwţNo ratings yet

- M 2012 June PDFDocument21 pagesM 2012 June PDFMoses LukNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- Poa T - 11Document5 pagesPoa T - 11SHEVENA A/P VIJIANNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- PACRADocument516 pagesPACRABenjamin Banda100% (1)

- Companies and Business Booklet 2021Document65 pagesCompanies and Business Booklet 2021Benjamin BandaNo ratings yet

- Rockview University: School of Humaninities and Social SciencesDocument5 pagesRockview University: School of Humaninities and Social SciencesBenjamin BandaNo ratings yet

- Spe 111 BehaviorDocument3 pagesSpe 111 BehaviorBenjamin BandaNo ratings yet

- David LivingstonDocument4 pagesDavid LivingstonBenjamin BandaNo ratings yet

- Bantu MigrationDocument7 pagesBantu MigrationBenjamin BandaNo ratings yet

- Bureaucracy Is A System of Government in Which Most of The Important Decisions Are Taken by State Officials Rather Than by Elected RepresentativesDocument6 pagesBureaucracy Is A System of Government in Which Most of The Important Decisions Are Taken by State Officials Rather Than by Elected RepresentativesBenjamin BandaNo ratings yet

- Shipping Agents - Freight ForwardersDocument48 pagesShipping Agents - Freight ForwardersKunwar Saigal100% (1)

- A Complete Guide To Volume Price Analysis Read The Book Then Read The Market by Anna Coulling (Z-Lib - Org) (241-273)Document33 pagesA Complete Guide To Volume Price Analysis Read The Book Then Read The Market by Anna Coulling (Z-Lib - Org) (241-273)Getulio José Mattos Do Amaral FilhoNo ratings yet

- Letter To The Mayor and City ManagerDocument2 pagesLetter To The Mayor and City ManagerCincinnatiEnquirerNo ratings yet

- KP Gxie-1Document41 pagesKP Gxie-1Muhammad AswanNo ratings yet

- Trade Expose Final PDFDocument19 pagesTrade Expose Final PDFGhizwaNo ratings yet

- Daniel D. AbshirDocument60 pagesDaniel D. AbshirberiNo ratings yet

- Capitec Fees 2023Document4 pagesCapitec Fees 2023bok kopNo ratings yet

- KPK MRS-2020 PDFDocument411 pagesKPK MRS-2020 PDFKalsoom Khan100% (4)

- Literature Review On Debt FinancingDocument4 pagesLiterature Review On Debt Financingafmzzaadfjygyf100% (1)

- Pref 4 Listening 1 4 Revision Del IntentoDocument2 pagesPref 4 Listening 1 4 Revision Del IntentosdsdsNo ratings yet

- B1-1.MAINPAPER-Steel For Sustainable Development-AdeAjayiDocument7 pagesB1-1.MAINPAPER-Steel For Sustainable Development-AdeAjayiDonald rayNo ratings yet

- GE 3 - Reviewer THE CONTEMPORARY WORLDDocument7 pagesGE 3 - Reviewer THE CONTEMPORARY WORLDKissey EstrellaNo ratings yet

- 03 18 2021 PNL Faelnar, Queenie JoyDocument1 page03 18 2021 PNL Faelnar, Queenie JoyKweeng Tayrus FaelnarNo ratings yet

- GM 06Document3 pagesGM 06ivofimfNo ratings yet

- Handout 3 - 4 - Review Exercises - Questions in TextDocument6 pagesHandout 3 - 4 - Review Exercises - Questions in Text6kb4nm24vjNo ratings yet

- 21-2 ECO 501 - Assignment 1Document3 pages21-2 ECO 501 - Assignment 1Rusab IslamNo ratings yet

- Security Analysis and Portfolio Management by Rohini Singh 2018Document446 pagesSecurity Analysis and Portfolio Management by Rohini Singh 2018Aman Kumar SharanNo ratings yet

- How To Develop A Profitable Trading System PDFDocument3 pagesHow To Develop A Profitable Trading System PDFJoe DNo ratings yet

- Why Engage in International BusinessDocument3 pagesWhy Engage in International Businesslkarpaiya100% (2)

- Đề Thi Thử Tốt Nghiệp THPTDocument108 pagesĐề Thi Thử Tốt Nghiệp THPTMẫn NghiNo ratings yet

- XUIHq MJ Ev Yr BN VFuDocument7 pagesXUIHq MJ Ev Yr BN VFuAbhijit SahaNo ratings yet

- Revolut Business Statement EUR 2 1Document1 pageRevolut Business Statement EUR 2 1JakcNo ratings yet

- ESG World Frameworks Philippines (080822)Document10 pagesESG World Frameworks Philippines (080822)TitoNo ratings yet

- Satılacak Rulman ListesiDocument21 pagesSatılacak Rulman ListesiIbrahim sofiNo ratings yet

- Nielsen PastasDocument31 pagesNielsen PastasGabriela Veronica FranzoniNo ratings yet

- BR Act 1949Document16 pagesBR Act 1949Sanjana SinghNo ratings yet

- Arcelormittal Signs Landmark Agreement With Government of Liberia Signals Commencement of One of The Largest Mining Projects in West AfricaDocument3 pagesArcelormittal Signs Landmark Agreement With Government of Liberia Signals Commencement of One of The Largest Mining Projects in West AfricaDuyan M. PeweeNo ratings yet

- Work AllocationDocument4 pagesWork AllocationNguyen Thanh Duc (FGW HCM)No ratings yet