Professional Documents

Culture Documents

Assignment 2 Sample II

Assignment 2 Sample II

Uploaded by

mechanical singhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 2 Sample II

Assignment 2 Sample II

Uploaded by

mechanical singhCopyright:

Available Formats

ANNUAL REPORT FOR 2017-18 COMPANY: CIPLA LTD.

1. Please state the summarized income statement equation for the last two years from the latest given company

annual report with all figures in Rs. Cr.

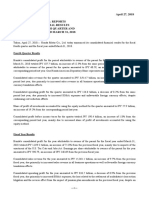

The summarized income statement equation is:

(Retained Earnings during a period) = (Revenue) - (Expenses + Dividends)

Retained

Revenue-

Earnings

Particulars Revenue Expenses Dividends (Expenses+

during the

Dividends)

period

=

[R] [E] [D] [X] = [R]-[E+D] [X]

Year ended 31st March 2018 11779.69 10311.17 189.27 1279.25 1279.25

Year ended 31st March 2017 11104.43 10129.49 193.58 781.36 781.36

Total revenue is more or less same in both the years (2017 and 2018), but there is 63.72 % increase in the Retained

earnings for 2018 as profit for the year has gone up from Rs. 974.97 Cr. in 2017 to Rs. 1468.52 Cr. in 2018.

The impairment of investment cost became nil in 2018 from Rs. 251.41 Cr. in 2017. It is mentioned that the Company’s

wholly owned subsidiary Cipla BioTec Pvt. Ltd. Had decided to reposition the Biotechnology business to explore new

business development opportunities including in-licensing to de-risk future investments in the segment without solely

relying on in-house development. Accordingly, the Company had re-assessed the carrying value of investment in Cipla

BioTec Pvt. Ltd. and recorded impairment charge of Rs. 251.41 Cr. during the previous year ended 31st March, 2017.

2. Mention three biggest items as part of the “sales / revenue / income” and “expenses / dividends / deductions”

(along with their proportions) as mentioned in the annual report (to the extent available) for last two years

Sr Clause Sub Clause Amount Amount % of % Comments

N. 2018 (In Cr.) 2017 (In total Change

Cr.) (Mar-18) wrt. 2017

1 Revenue Revenue from Sale 11004.44 10637.08 93.42% 3.45% Of total revenue, revenue from sales is

of Product significantly high. There is a slight

increase in the revenue compared to

previous year.

2 Expenses Finance cost 11.90 39.20 0.40% -69.64% Interest and borrowing expenses have

come down in 2018.

3 Expenses Change in -212.05 56.27 0.57% -476.84% The WIP inventory has become negative

inventories in ’18 as WIP goods that have been

(Finished Goods), completed during ’17 are credited to

WIP and SIT the WIP inv. account and debited to the

finished goods inv. account.

4 Reserves and Earning per equity 18.22 12.11 - 50.45% Earnings per share has increased by

Surplus share 50.45% as profit increased from

974.94Cr. to 1468.52 Cr. in 2018.

3. Referring to the format given to you, mention one item that is missing and mention one item that you have found

interesting in the income statement.

MISSING ITEMS:

Extraordinary Items: No extraordinary items are mentioned in the statement as company has not accounted for

unforeseen and atypical events.

Dividend: The dividend is not mentioned in the statement. However in the annual report it is mentioned that The Board of

Directors of the Company at its meeting held on 22nd May 2018 has recommended a final dividend of Rs. 3.00 per equity share

for the financial year ended 31st March 2018. is subject to approval at the ensuing Annual General Meeting of the Company,

and hence not recognized as liability.

INTERESTING ITEMS:

Remeasurement of Post Post-retirement benefits obligation has dropped to 2.71Cr in 2018 from 10.60 Cr.

in 2017 which may be due to life insurance and medical plans, or premiums for such benefits, as well as deferred-compensation

arrangements etc.

Other Income has become 334.88 Cr. in 2018 which was 129.85 Cr. in 2017, mainly because of divided income from

subsidiaries- carried at amortized cost.

You might also like

- Financial Position and Performance of FirstGroup PLC.Document17 pagesFinancial Position and Performance of FirstGroup PLC.Mohammad MollaNo ratings yet

- Management Accounts SampleDocument13 pagesManagement Accounts SampleJoe Magero100% (1)

- Bullying, Stalking and ExtortionDocument17 pagesBullying, Stalking and ExtortionJLafge83% (6)

- Cinderella by Roald DahlDocument5 pagesCinderella by Roald DahlRaquel Gonzalez33% (3)

- List of Documents NBA PfilesDocument48 pagesList of Documents NBA PfilesDr. A. Pathanjali Sastri100% (1)

- Fy18 Press ReleaseDocument28 pagesFy18 Press ReleaseElena AitoNo ratings yet

- Statutory Reports 201819Document45 pagesStatutory Reports 201819Mahek KhanNo ratings yet

- April 27, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal Fourth Quarter and The Fiscal Year Ended March 31, 2018Document22 pagesApril 27, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal Fourth Quarter and The Fiscal Year Ended March 31, 2018Le NovoNo ratings yet

- KDDL LTD DDocument10 pagesKDDL LTD Ds jNo ratings yet

- July 31, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal First Quarter ENDED JUNE 30, 2018Document17 pagesJuly 31, 2018 Honda Motor Co., Ltd. Reports Consolidated Financial Results For The Fiscal First Quarter ENDED JUNE 30, 2018Black Star11No ratings yet

- FA Assignment#4 Statement of Changes in Equity Company Name: Deepak NitriteDocument2 pagesFA Assignment#4 Statement of Changes in Equity Company Name: Deepak NitriteBhaktaNo ratings yet

- Unit 5 Income Statement.Document9 pagesUnit 5 Income Statement.castarmuiz5No ratings yet

- CGI Financial Analysis-AmmendmentsDocument13 pagesCGI Financial Analysis-AmmendmentsmosesNo ratings yet

- FinolexDocument171 pagesFinolexAkash Nil ChatterjeeNo ratings yet

- KMAMC Annual Report FY 18-19Document88 pagesKMAMC Annual Report FY 18-19World EntertainmentNo ratings yet

- Module 3 Problems On Income StatementDocument8 pagesModule 3 Problems On Income StatementShruthi PNo ratings yet

- Lloyds Bank PLC Q1 2018 Interim Management Statement 25 April 2018Document5 pagesLloyds Bank PLC Q1 2018 Interim Management Statement 25 April 2018saxobobNo ratings yet

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaNo ratings yet

- FSA Burgos Cababat Codilla Garrote Original ZanoriaDocument13 pagesFSA Burgos Cababat Codilla Garrote Original ZanoriaChristine Joy OriginalNo ratings yet

- Jindal Saw-AR-2017-18-NET PDFDocument274 pagesJindal Saw-AR-2017-18-NET PDFshahavNo ratings yet

- 2 RK Chapter 3-SolutionDocument10 pages2 RK Chapter 3-SolutionNancyNo ratings yet

- Assignment # 4Document2 pagesAssignment # 4Anil VermaNo ratings yet

- Board'S Report: Summarised Financial ResultsDocument15 pagesBoard'S Report: Summarised Financial Resultsirisha guptaNo ratings yet

- Module - 4 Credit Risk - Financial Statement Analysis: Prof. R. KannanDocument70 pagesModule - 4 Credit Risk - Financial Statement Analysis: Prof. R. Kannangopalswaminathan iyerNo ratings yet

- Britannia Annual Report 2006Document72 pagesBritannia Annual Report 2006akash_metNo ratings yet

- Intermediate: AccountingDocument76 pagesIntermediate: AccountingDieu NguyenNo ratings yet

- 2016-03-31 00 - 00 - 00 - AA1 - Diro - Note PDFDocument25 pages2016-03-31 00 - 00 - 00 - AA1 - Diro - Note PDFkirtan patelNo ratings yet

- Radico Ar PDFDocument186 pagesRadico Ar PDFSriharsha ReddyNo ratings yet

- Glainier Industríal CorporationDocument43 pagesGlainier Industríal CorporationGraceila CalopeNo ratings yet

- Board's ReportDocument37 pagesBoard's ReportSanil FernandesNo ratings yet

- RATIO ANALYSIS ProjectDocument14 pagesRATIO ANALYSIS ProjectwwvaibNo ratings yet

- P20 PDFDocument12 pagesP20 PDFlahari kadimicherlaNo ratings yet

- Balance Sheet - Variance Analysis AssetsDocument9 pagesBalance Sheet - Variance Analysis AssetsAndriaNo ratings yet

- 6-Month Report Final 2018Document2 pages6-Month Report Final 2018BernewsAdminNo ratings yet

- IP June 17Document31 pagesIP June 17tarun lahotiNo ratings yet

- Prudential PLC Ar 2020Document404 pagesPrudential PLC Ar 2020Lim KaixianNo ratings yet

- Financial Statements Analysis: Liabilities Which Both Increased, Accrued Liability Increased by $157,000,000 and OtherDocument11 pagesFinancial Statements Analysis: Liabilities Which Both Increased, Accrued Liability Increased by $157,000,000 and OtherAnonymous sXBdCyo8kNo ratings yet

- مادة الدراساتSlides No.2Document39 pagesمادة الدراساتSlides No.2gehad ahmedNo ratings yet

- Furnmart Ltd. (FURNMART-BW) - Interim Report For Period End 31-Jan-2018 (English) PDFDocument1 pageFurnmart Ltd. (FURNMART-BW) - Interim Report For Period End 31-Jan-2018 (English) PDFmisterbeNo ratings yet

- Assignment FinalDocument10 pagesAssignment FinalJamal AbbasNo ratings yet

- Inventories With Lower Cost, Without Sacrificing Its QualityDocument4 pagesInventories With Lower Cost, Without Sacrificing Its QualityMark Lyndon YmataNo ratings yet

- Analyses and Comment About The Profitability of Top GloveDocument3 pagesAnalyses and Comment About The Profitability of Top GloveAishvini ShanNo ratings yet

- Bajaj Directors' ReportDocument10 pagesBajaj Directors' ReporthotalamNo ratings yet

- Camposol Holding PLC: Fourth Quarter and Preliminary Full Year 2018 ReportDocument24 pagesCamposol Holding PLC: Fourth Quarter and Preliminary Full Year 2018 Reportkaren ramosNo ratings yet

- q4 Fy20 EarningsDocument20 pagesq4 Fy20 EarningsKJ HiramotoNo ratings yet

- Pertemuan 2 Dan 3 MKDocument62 pagesPertemuan 2 Dan 3 MKAnisa Zahra SabilaNo ratings yet

- Directors ReportDocument51 pagesDirectors ReportEllis ElliseusNo ratings yet

- Ratio and Interpretaion With GraphsDocument12 pagesRatio and Interpretaion With GraphsShilpiNo ratings yet

- Financial Accounting and Reporting: Subject Code - MFT4CCEF02Document9 pagesFinancial Accounting and Reporting: Subject Code - MFT4CCEF02Varun RathoreNo ratings yet

- Annual Report and Accounts 2017Document192 pagesAnnual Report and Accounts 2017Ali WaqasNo ratings yet

- Lecture 3 - Assignment - Jaimin PandyaDocument10 pagesLecture 3 - Assignment - Jaimin PandyajaiminNo ratings yet

- Annual Report 2017-18Document190 pagesAnnual Report 2017-1823321gauravNo ratings yet

- Accounting in Organisations & Society: Group Report Part ADocument11 pagesAccounting in Organisations & Society: Group Report Part ALinh Giang HàNo ratings yet

- 2017NufarmHYReport PDFDocument32 pages2017NufarmHYReport PDFWilliam WatterstonNo ratings yet

- Gannett Earnings 2022Document19 pagesGannett Earnings 2022the kingfishNo ratings yet

- Assignment # 1: Saphire Textile Mills Limited (PVT) Analysis of Financial Position (2017-2018)Document4 pagesAssignment # 1: Saphire Textile Mills Limited (PVT) Analysis of Financial Position (2017-2018)F190308 Faiza AmanNo ratings yet

- Nestle Group Alternative Performance Measures February 2020 enDocument12 pagesNestle Group Alternative Performance Measures February 2020 enMehdi Ben ahmedNo ratings yet

- Amal Annual Report 2017 18Document104 pagesAmal Annual Report 2017 18Kumar RajputNo ratings yet

- Centrica Ar2020Document228 pagesCentrica Ar2020Mustafa BaigNo ratings yet

- Three Years Management Plan: FY2022 To FY2024Document47 pagesThree Years Management Plan: FY2022 To FY2024Shashank ShekharNo ratings yet

- Statement of Comprehensive IncomeDocument2 pagesStatement of Comprehensive IncomeRandom AcNo ratings yet

- Company Fundamentals - Income StatementDocument28 pagesCompany Fundamentals - Income StatementThắm TrầnNo ratings yet

- Human Rights in IslamDocument22 pagesHuman Rights in IslamNoor AliNo ratings yet

- Power Point Skripsi UmarDocument12 pagesPower Point Skripsi UmarMuchamad Umar Chatab NasserieNo ratings yet

- User Manual of CUBOIDDocument50 pagesUser Manual of CUBOIDshahinur rahmanNo ratings yet

- Realme Buds Q2s With AI ENC & Fast Charging Bluetooth HeadsetDocument2 pagesRealme Buds Q2s With AI ENC & Fast Charging Bluetooth HeadsetKhuni FreefireNo ratings yet

- Diagnostic Exam 2Document5 pagesDiagnostic Exam 2Tomzki Cornelio50% (2)

- Week 1 - The Swamp LessonDocument2 pagesWeek 1 - The Swamp LessonEccentricEdwardsNo ratings yet

- Greece Education Foundation Courses and Gces 10 2010Document6 pagesGreece Education Foundation Courses and Gces 10 2010Stamatios KarapournosNo ratings yet

- Intro To ForsciDocument16 pagesIntro To ForsciChloe MaciasNo ratings yet

- Dermatology TreatmentsDocument6 pagesDermatology TreatmentsMayar MostafaNo ratings yet

- Installation Manual: Enclosed Type Switching Power Supply (Families: G3, NE, LRS, SE, PFC, HSP, SPV, USP, RST, G5, MSP)Document2 pagesInstallation Manual: Enclosed Type Switching Power Supply (Families: G3, NE, LRS, SE, PFC, HSP, SPV, USP, RST, G5, MSP)Aicky IkrackNo ratings yet

- Electric Circuits - M. Navhi and J. A. Edminister PDFDocument113 pagesElectric Circuits - M. Navhi and J. A. Edminister PDFNamratha ThataNo ratings yet

- Republic of Rhetoric by Abhinav ChandrachudDocument356 pagesRepublic of Rhetoric by Abhinav ChandrachudVinayak Gupta100% (1)

- Care of Terminally IllDocument34 pagesCare of Terminally Illbemina jaNo ratings yet

- State of The Handloom Industry of BangladeshDocument8 pagesState of The Handloom Industry of BangladeshNoshin NawarNo ratings yet

- M HealthDocument81 pagesM HealthAbebe ChekolNo ratings yet

- Comprehension Toolkit 1Document3 pagesComprehension Toolkit 1api-510893209No ratings yet

- Female Genital Organ AnomaliesDocument83 pagesFemale Genital Organ AnomalieszulinassirNo ratings yet

- SPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLADocument2 pagesSPOUSES SALVADOR ABELLA v. SPOUSES ROMEO ABELLAAlia Arnz-Dragon100% (1)

- Fped 07 00310Document6 pagesFped 07 00310Fariz HidayatNo ratings yet

- 5 He-Man Vs Skeletor Their Final BattleDocument9 pages5 He-Man Vs Skeletor Their Final BattleRodrigo Sorokin100% (2)

- Drill #1 With RationaleDocument12 pagesDrill #1 With RationaleRellie CastroNo ratings yet

- Practical Research 2: Sampling and Probability SamplingDocument11 pagesPractical Research 2: Sampling and Probability SamplingJohn Joseph JalandoniNo ratings yet

- Influence of Cooling Rate On The Structure and Formation of Oxide Scale in LowDocument7 pagesInfluence of Cooling Rate On The Structure and Formation of Oxide Scale in LowVarun MangaloreNo ratings yet

- 'Deus Caritas Est' - Pope Benedict and 'God Is Love'Document5 pages'Deus Caritas Est' - Pope Benedict and 'God Is Love'Kym JonesNo ratings yet

- Ordinary People Summary ChartDocument2 pagesOrdinary People Summary Chartangela_cristiniNo ratings yet

- Birinci Pozisyon Notalar Ve IsimleriDocument3 pagesBirinci Pozisyon Notalar Ve IsimleriEmre KözNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011473No ratings yet