Professional Documents

Culture Documents

Quess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P M

Quess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P M

Uploaded by

sagar janiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P M

Quess Corp Limited: A U G 2 7 2 0 2 2 3: 1 9 P M

Uploaded by

sagar janiCopyright:

Available Formats

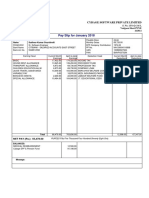

QUESS

CORP LIMITED

HEAD OFFICE 3/3/2, AMBLIPURA, BELLANDUR GATE, SARJAPUR ROAD, BENGALURU, KARNATAKA 560103

PAY SLIP FOR THE MONTH OF JULY 2022

EMPLOYEE ID 2001762179 PAN NO CIXPC4067L

EMPLOYEE NAME CHAVADA SUDHIRKUMAR ESI NO 3713817565

DATE OF JOINING 05/06/2021 FIXED DAYS 31.00

DESIGNATION SEC PRESENT DAYS 29.50

DEPUTED AT SAMSUNG INDIA ELECTRONICS PRIVATE LIMITED BANK NAME RAJKOT NAGRIK SAHAKARI BANK LIMITED

GENDER MALE BANK A/C NO :042003100032223

PF NO PYBOM00463700001224806 INSURANCE NO 35072711

UAN NO 101699515783 LOCATION JETPUR

OFFER ID QS2215472

DESCRIPTION EARNINGS DESCRIPTION DEDUCTIONS

BASIC EMPLOYEE ESI 89.00

HOUSE RENT ALLOWANCE PROVIDENT FUND 1,058.00

STATUTORY_BONUS

PLI+ INCENTIVE

GROSS EARNINGS 11,795.00 TOTAL DEDUCTIONS 1,147.00

TOTAL FIXED SALARY (GE) : 10,648.00 (TEN THOUSAND SIX HUNDRED AND FORTYEIGHT)

INCOME TAX CALCULATION

PARTICULARS CUMULATIVE PROJECTED ANNUAL PERQUISITES

BASIC 35237 74088 109325 ACCOMODATION 0

HOUSE RENT ALLOWANCE 8987 18896 27883 GROSS OTHER INCOME 0

INCENTIVE_IT 1600 0 1600 LOAN 0

OTHER 0

STATUTORY_BONUS 2933 6168 9101

PREVIOUS EMPLOYER INCOME 0

TOTAL 48757 99152 147909 NET PAY 147909

DEDUCTIONS

DEDUCTION U/S 16 (PROFESSIONAL 1800 EDUCATION CESS 0

DEDUCTION U/S 16(IA) (STANDARD 50000 SECTION 87 RELIEF 0

DEDUCTION UNDER CHAPTER VIA 0 SUR CHARGE 0

DEDUCTIONS U/S (10) AND (17) 0 TAX ON INCOME 0

DEDUCTIONS UNDER CHAPTER VI (S 13117 TAX ON INCOME [LESS 87 RELIEF] 0

INCOME / LOSS FROM HOUSE PROPE 0 TAX RECOVERED 0

TAXABLE INCOME (NET SALARY D 82992

TOTAL DEDUCTIONS 64917 TOTAL TAX PAYABLE 0

BALANCE TAX PAYABLE 0

NOTE: THIS IS A COMPUTER GENERATED DOCUMENT DOES NOT REQUIRE ANY SIGNATURE.

FOR ANY QUERY, PLEASE REACH US @ 18005723333 OR WRITE TO HELP@QUESSCORP.COM

AS PER UNION BUDGET 2020 YOU HAVE AN OPTION TO OPT FOR “NEW TAX REGIME” OR TO CONTINUE WITH “OLD TAX REGIME”. INCOME TAX DECLARATION WINDOW WILL BE OPENED IN PORTAL

FROM 21ST MARCH 2022 TO 8TH APRIL 2022

NOTE : PLEASE OPT THE TAX RESUMES CAREFULLY AND SUBMIT, ONCE SUBMITTED THERE IS NO OPTION TO CHANGE TAX REGIME FOR 202223 FY

REF: HTTPS://WWW.INCOMETAXINDIAEFILING.GOV.IN/TAX_CALCULATOR/INDEX.HTML?LANG=ENG

IF NOT DECLARED TAX DEDUCTION WILL BE CONSIDERED AS PER THE OLD TAX REGIME.

A U G 2 7 2 0 2 2 3 : 1 9 P M

You might also like

- Salaryslip YM2023013686 December 2023Document1 pageSalaryslip YM2023013686 December 2023jessypriyadharshini9No ratings yet

- May PayslipDocument1 pageMay Payslipkuna gowthamkumarNo ratings yet

- Nov 2022Document1 pageNov 2022nirmal sridharNo ratings yet

- Axis Bank LTD Payslip For The Month of August - 2019Document3 pagesAxis Bank LTD Payslip For The Month of August - 2019Venkateswarlu KamaniNo ratings yet

- Future Retail Limited: Salary Statement For The Month of MAY-2019Document1 pageFuture Retail Limited: Salary Statement For The Month of MAY-2019Himanshu MalikNo ratings yet

- Godrej One, Pirojshanagar, Eastern Express Highway, Vikhroli (East), Mumbai - 400079Document2 pagesGodrej One, Pirojshanagar, Eastern Express Highway, Vikhroli (East), Mumbai - 400079Shashikant Thakre100% (1)

- Banggawan Answer KeyDocument17 pagesBanggawan Answer Keyvallerie_lumantas73% (44)

- Oct'21Document1 pageOct'21phanindra gaddeNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details: Arrears Current AmountBipuri PavankumarNo ratings yet

- Salary Slips 3Document2 pagesSalary Slips 3Pramod KumarNo ratings yet

- Pay Slip For October 2018: Fare Portal India Private LimitedDocument1 pagePay Slip For October 2018: Fare Portal India Private LimitedManju ChaudharyNo ratings yet

- Pay Slip NewDocument1 pagePay Slip NewSukadev Sahu0% (2)

- Pay Slip For January 2018: Cybage Software Private LimitedDocument1 pagePay Slip For January 2018: Cybage Software Private LimitedSudheer0% (1)

- Geojit Financial Services LTD.,: Pay Slip - July 2019Document1 pageGeojit Financial Services LTD.,: Pay Slip - July 2019sanjit deyNo ratings yet

- Removal/Qualifying ExaminationDocument12 pagesRemoval/Qualifying ExaminationMiljane PerdizoNo ratings yet

- ReportDocument1 pageReportGarima AgrawalNo ratings yet

- Shriram Transport Finance Company Limited: Do Not Circulate Without Authorization Printed On 03/12/2009Document1 pageShriram Transport Finance Company Limited: Do Not Circulate Without Authorization Printed On 03/12/2009Ronald AllenNo ratings yet

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- A356536Document1 pageA356536Er Ravi Kant MishraNo ratings yet

- February 23, 2022selectedReportType Salary - Slip MergedDocument3 pagesFebruary 23, 2022selectedReportType Salary - Slip MergedRoshni ShahaNo ratings yet

- Pay Slip: Salary Slip - APR 2018 (Noida)Document1 pagePay Slip: Salary Slip - APR 2018 (Noida)rahul tyagiNo ratings yet

- IDC Technologies Solutions India Pvt. LTD.: Earnings Deductions Amount AmountDocument1 pageIDC Technologies Solutions India Pvt. LTD.: Earnings Deductions Amount AmountDevipriyaNo ratings yet

- Payslip 8 2022Document1 pagePayslip 8 2022Md SharidNo ratings yet

- Salary SlipDocument1 pageSalary SlipPranav Kumar100% (1)

- Pay Slip - 1421107 - Apr-22Document1 pagePay Slip - 1421107 - Apr-22Sachin ChadhaNo ratings yet

- Salary SlipDocument1 pageSalary SlipSanjay SolankiNo ratings yet

- Cprs Payslip1.jspDocument1 pageCprs Payslip1.jspRakesh KumarNo ratings yet

- Salary Slip SepDocument1 pageSalary Slip SepKhwaja ShaikhNo ratings yet

- Localcube Commerce Private Limited: Payslip For The Month of July 2020Document1 pageLocalcube Commerce Private Limited: Payslip For The Month of July 2020Aswin KumarNo ratings yet

- Pushparaj R PayslipDocument3 pagesPushparaj R PayslipHenry suryaNo ratings yet

- Pay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is RequiredDocument1 pagePay Slip For The Month of February 2021: This Is A Computer Generated Document, Hence No Signature Is Requiredsv netNo ratings yet

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerYashasvi GuptaNo ratings yet

- Payslip 801647 CIN Nov 2021Document1 pagePayslip 801647 CIN Nov 2021mani kandanNo ratings yet

- D114003jul2020 PDFDocument1 pageD114003jul2020 PDFRajarshiRoyNo ratings yet

- SalarySlip 5876095Document1 pageSalarySlip 5876095Larry WackoffNo ratings yet

- Salary Slip June2020Document1 pageSalary Slip June2020rehan siddiquiNo ratings yet

- Pay Slip 201117614Document2 pagesPay Slip 201117614Jeetendra Kumar Chaudhury86% (7)

- PaySlip 11 2023Document1 pagePaySlip 11 2023Sujoy GhoshalNo ratings yet

- Pay Slip - 604316 - Oct-22Document1 pagePay Slip - 604316 - Oct-22ArchanaNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- Salary Slip AugustDocument1 pageSalary Slip AugustRonakJainNo ratings yet

- PaySlip 6 2023...Document1 pagePaySlip 6 2023...Rahul VarmanNo ratings yet

- India Payslip May 2021Document1 pageIndia Payslip May 2021Talla KaseeswarNo ratings yet

- Divi Atchut Kumar - TCL11442 - April - 2021 - Employee - Basic - PayslipDocument1 pageDivi Atchut Kumar - TCL11442 - April - 2021 - Employee - Basic - PayslipDivi AtchutNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Payslip For MarchDocument1 pagePayslip For Marchomkass100% (1)

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- 127961300-Aug Payslip PDFDocument1 page127961300-Aug Payslip PDFAjay Chowdary Ajay ChowdaryNo ratings yet

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- Shiv SlipDocument1 pageShiv SlipRohit raagNo ratings yet

- Form 16 20-21Document2 pagesForm 16 20-21Mohammad AliNo ratings yet

- Intex Technologies (I) LTD.: D-18/2 Okhla Industrial Area, Phase-II, New Delhi-110020Document1 pageIntex Technologies (I) LTD.: D-18/2 Okhla Industrial Area, Phase-II, New Delhi-110020rakeshsingh9811No ratings yet

- Edited VikramDocument1 pageEdited Vikramnaresh0% (1)

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- Quess Corp Limited Head Office 3/3/2, Amblipura, Bellandur Gate, Sarjapur Road, Bengaluru, Karnataka 560103Document1 pageQuess Corp Limited Head Office 3/3/2, Amblipura, Bellandur Gate, Sarjapur Road, Bengaluru, Karnataka 560103AnshumanNo ratings yet

- CG JUL 2022 46134875 PayslipDocument1 pageCG JUL 2022 46134875 PayslipSoniNo ratings yet

- December 2022 CapgeminiDocument1 pageDecember 2022 CapgeminimanojkallemuchikkalNo ratings yet

- April 2022Document1 pageApril 2022Nagendra makamNo ratings yet

- MR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Document1 pageMR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Shaik MansoorhussainNo ratings yet

- Quiz 5 Income TaxDocument9 pagesQuiz 5 Income TaxjohndanielsantosNo ratings yet

- Exercise 18Document2 pagesExercise 18jr centenoNo ratings yet

- Advance Tax Laws ProfessionalDocument1,027 pagesAdvance Tax Laws ProfessionalRADHE GRAPHICSNo ratings yet

- PremiumPaidStatement 2022-2023 LicDocument1 pagePremiumPaidStatement 2022-2023 LicHemant BhoriaNo ratings yet

- CMIE ServicesDocument14 pagesCMIE Servicespuneet7350% (1)

- Lemhar Dayaoen Reading in Philippines History Bsita1Document9 pagesLemhar Dayaoen Reading in Philippines History Bsita1Lemhar DayaoenNo ratings yet

- For DownloadDocument1 pageFor Downloadmaadhavan.r6boNo ratings yet

- Write-Up CITIRA BillDocument3 pagesWrite-Up CITIRA BillMaeJoNo ratings yet

- 01 Notes NPO WA For HasanDocument86 pages01 Notes NPO WA For HasanHassan MasoodNo ratings yet

- Atil 05Document2 pagesAtil 05anon-685406No ratings yet

- Final Income Taxation,: As Amended by Train LawDocument29 pagesFinal Income Taxation,: As Amended by Train LawElle Vernez100% (1)

- Concepts in Federal Taxation 2013 20th Edition Murphy Solutions Manual DownloadDocument102 pagesConcepts in Federal Taxation 2013 20th Edition Murphy Solutions Manual DownloadDavid Clark100% (21)

- Ias 12Document31 pagesIas 12Christian VillagonzaloNo ratings yet

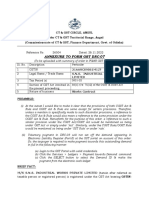

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- Law of Taxation - 3rd SemDocument3 pagesLaw of Taxation - 3rd SemdeepakNo ratings yet

- Taxn03B: Transfer and Business TaxesDocument18 pagesTaxn03B: Transfer and Business TaxesKerby GripoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SEED SEEDNo ratings yet

- Master CTC Calculator & Salary Hike CalculatorDocument6 pagesMaster CTC Calculator & Salary Hike Calculatorvirag_shahsNo ratings yet

- (Understanding TCC) TaxAdministrationDocument2 pages(Understanding TCC) TaxAdministrationhandoutNo ratings yet

- TNTC Form 75CDocument2 pagesTNTC Form 75Cjaiinfo84No ratings yet

- Train Law Updates-Part 5Document23 pagesTrain Law Updates-Part 5Nikki Estores GonzalesNo ratings yet

- طرق قياس النشاط الاقتصادي 1Document7 pagesطرق قياس النشاط الاقتصادي 1MassilNo ratings yet

- New Tax Regime Vs Old Tax RegimeDocument11 pagesNew Tax Regime Vs Old Tax RegimevinishchandraaNo ratings yet

- Chapter1-Taxes and DefinitionsDocument37 pagesChapter1-Taxes and DefinitionsSohael Adel AliNo ratings yet

- Inv 407306401237Document2 pagesInv 407306401237hesima4637 bodeem.comNo ratings yet

- 2020 Yukon Personal Tax Credits Return: Td1YtDocument2 pages2020 Yukon Personal Tax Credits Return: Td1YtBryan WilleyNo ratings yet

- All About E-Ledgers Under GST - E-Cash Ledger, E-Credit Ledger & E-Liability LedgerDocument4 pagesAll About E-Ledgers Under GST - E-Cash Ledger, E-Credit Ledger & E-Liability LedgerDINESH CHANCHALANINo ratings yet