Professional Documents

Culture Documents

wk35 Sep2022mktwatch

wk35 Sep2022mktwatch

Uploaded by

craftersxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

wk35 Sep2022mktwatch

wk35 Sep2022mktwatch

Uploaded by

craftersxCopyright:

Available Formats

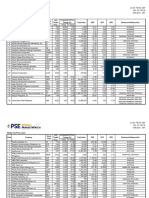

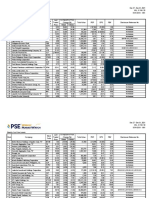

Aug 29 - Sep 02, 2022

VOL. XII NO. 35

ISSN 2013 - 1351

Weekly Top Price Gainers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Berjaya Philippines, Inc. BCOR 8.00 26.98 33.33 769,045 35.97 0.22 3.56 No Disclosure

2 Megawide Construction Corporation MWIDE 5.31 21.23 24.94 40,443,800 (26.30) (0.20) 0.65 C06703-2022, C06704-2022

3 PXP Energy Corporation PXP 6.20 15.24 14.81 40,287,862 (7.10) (0.87) 7.23 No Disclosure

4 Waterfront Philippines, Incorporated WPI 0.51 9.68 13.33 21,589,025 2.14 0.24 0.15 No Disclosure

5 ACE Enexor, Inc. ACEX 18.48 9.09 15.64 35,484,410 (164.15) (0.11) 2,919.00 No Disclosure

5 Oriental Petroleum and Minerals Corporation "B" OPMB 0.012 9.09 - 27,400 32.39 0.0004 0.51 No Disclosure

7 Pacific Online Systems Corporation LOTO 1.48 8.03 7.25 17,670 (11.41) (0.13) 1.79 No Disclosure

8 AbaCore Capital Holdings, Inc. ABA 2.36 6.79 11.32 599,502,950 2.15 1.10 0.65 No Disclosure

9 8990 Holdings, Inc. HOUSE 10.30 6.30 7.29 947,761 7.31 1.41 1.15 No Disclosure

C06595-2022, CR05869-2022,

10 Union Bank of the Philippines UBP 85.00 6.25 8.97 180,782,618 17.54 4.85 1.74 CR05873-2022

C06628-2022, CR05872-2022,

11 Primex Corporation PRMX 2.62 6.07 15.93 13,167,320 408.46 0.01 2.11 C06672-2022, CR05886-2022,

C06689-2022, CR05895-2022

12 Medco Holdings, Inc. MED 0.275 5.77 3.77 2,750 (139.74) (0.002) 26.08 No Disclosure

13 Bank of Commerce BNCOM 10.00 5.49 18.48 1,237,038 9.87 1.01 0.53 No Disclosure

14 Citystate Savings Bank, Inc. CSB 8.43 5.38 5.38 843 80.96 0.10 1.09 No Disclosure

15 Vulcan Industrial & Mining Corporation VUL 1.01 5.21 20.24 32,094,520 (656.50) (0.002) (378.98) No Disclosure

16 Filinvest REIT Corp. FILRT 6.60 5.10 (2.80) 53,680,768 20.20 0.33 5.55 CR05890-2022

17 ATN Holdings, Inc. "B" ATNB 0.420 5.00 6.33 92,650 1,111.95 0.0004 1.34 No Disclosure

18 First Abacus Financial Holdings Corp. FAF 0.66 4.76 6.45 56,100 (10.14) (0.07) 0.75 No Disclosure

19 PetroEnergy Resources Corporation PERC 4.90 4.03 - 74,029 7.03 0.70 0.48 No Disclosure

20 Pryce Corporation PPC 5.45 3.81 3.02 435,285 5.97 0.91 0.75 No Disclosure

21 Jollibee Foods Corporation JFC 245.80 3.71 14.43 640,751,268 33.59 7.32 4.71 No Disclosure

22 Centro Escolar University CEU 6.86 3.63 - 2,744 16.75 0.41 0.56 C06602-2022, C06605-2022

23 Vivant Corporation VVT 15.00 3.45 (4.46) 7,500 9.19 1.63 0.90 CR05902-2022, C06708-2022

C06589-2022, C06590-2022, C06591-2022,

24 Raslag Corp. ASLAG 2.12 3.41 22.54 41,354,240 27.36 0.08 2.29 C06636-2022, C06649-2022, C06650-2022,

C06679-2022, C06693-2022

25 AyalaLand Logistics Holdings Corp. ALLHC 3.77 3.29 15.29 15,179,120 29.07 0.13 1.96 No Disclosure

26 GT Capital Holdings, Inc. GTCAP 510.00 3.24 12.88 338,120,710 9.74 52.36 0.57 No Disclosure

27 Eagle Cement Corporation EAGLE 14.64 3.10 2.23 4,039,832 12.26 1.19 1.67 C06681-2022

28 Figaro Coffee Group Inc. FCG 0.68 3.03 7.94 57,636,630 9.24 0.07 2.02 No Disclosure

29 Asian Terminals, Inc. ATI 13.90 2.96 2.51 39,512 12.22 1.14 1.30 CR05860-2022, CR05882-2022

30 Medilines Distributors Incorporated MEDIC 0.72 2.86 (4.00) 2,443,590 10.42 0.07 1.01 No Disclosure

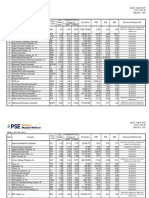

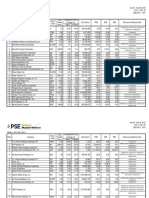

Aug 29 - Sep 02, 2022

VOL. XII NO. 35

ISSN 2013 - 1351

Weekly Top Price Losers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 MJC Investments Corporation MJIC 0.74 (27.45) (21.28) 3,700 (2.67) (0.28) (1.93) No Disclosure

2 Prime Media Holdings, Inc. PRIM 1.79 (24.47) (11.82) 10,529,590 (605.33) (0.003) (8.58) C06582-2022, C06583-2022, C06584-2022

C06662-2022, C06663-2022, C06664-2022,

3 ABS-CBN Corporation ABS 9.15 (19.60) (10.29) 16,497,302 (1.63) (5.62) 0.65 C06665-2022, C06677-2022, C06678-2022

4 SOCResources, Inc. SOC 0.50 (18.03) (18.03) 500 46.04 0.01 0.27 No Disclosure

5 Manila Jockey Club, Inc. MJC 1.32 (12.00) (11.41) 1,320 (11.47) (0.12) 1.01 No Disclosure

6 Central Azucarera de Tarlac, Inc. CAT 10.16 (11.50) 1.20 7,112 45.13 0.23 0.76 No Disclosure

7 Roxas Holdings, Inc. ROX 1.09 (11.38) (7.63) 130,650 (1.98) (0.55) 0.36 No Disclosure

8 Manila Bulletin Publishing Corporation MB 0.345 (9.21) (2.82) 10,350 53.46 0.01 0.33 No Disclosure

9 Manulife Financial Corporation MFC 920.00 (8.73) (0.54) 13,800 4.73 194.31 0.75 No Disclosure

10 Bright Kindle Resources & Investments Inc. BKR 1.60 (8.05) (10.61) 894,690 15.05 0.11 2.11 C06578-2022, C06579-2022

11 Cemex Holdings Philippines, Inc. CHP 0.72 (7.69) 2.86 11,028,250 12.43 0.06 0.22 CR05888-2022, C06682-2022

12 Philippine Business Bank PBB 7.48 (7.65) 16.88 358,179 3.65 2.05 0.34 No Disclosure

13 EEI Corporation EEI 3.45 (7.51) 3.29 21,529,440 6.33 0.54 0.27 CR05904-2022

14 A Brown Company, Inc. BRN 0.78 (7.14) 5.41 305,200 4.95 0.16 0.30 No Disclosure

Atlas Consolidated Mining and

15 AT 4.22 (7.05) (9.83) 10,845,990 3.22 1.31 0.37 CR05887-2022

Development Corporation

16 Concepcion Industrial Corporation CIC 17.20 (7.03) (6.42) 39,679,270 80.86 0.21 1.44 No Disclosure

17 City & Land Developers, Incorporated LAND 0.93 (7.00) 35.63 3,626,680 6.00 0.15 0.57 No Disclosure

18 San Miguel Food and Beverage, Inc. FB 43.00 (6.32) (6.42) 60,893,960 13.09 3.28 2.61 No Disclosure

19 Balai ni Fruitas Inc. BALAI 0.94 (6.00) 30.56 161,684,760 164.53 0.01 8.53 No Disclosure

20 Integrated Micro-Electronics, Inc. IMI 6.83 (5.66) (3.53) 2,859,664 (20.80) (0.33) 0.74 No Disclosure

21 Dizon Copper-Silver Mines, Inc. DIZ 4.60 (5.54) 21.05 9,200 320.52 0.01 9.16 C06671-2022

22 LT Group, Inc. LTG 8.76 (5.30) 3.06 143,880,503 4.67 1.87 0.49 C06700-2022

23 Top Frontier Investment Holdings, Inc. TFHI 108.00 (5.26) (6.09) 173,352 (24.56) (4.40) 0.22 No Disclosure

24 Cirtek Holdings Philippines Corporation TECH 2.77 (5.14) (10.36) 24,383,600 5.82 0.48 0.16 No Disclosure

25 ACEN CORPORATION ACEN 7.64 (4.98) (13.77) 978,016,052 69.09 0.11 3.02 CR05856-2022, C06603-2022

26 Premiere Horizon Alliance Corporation PHA 0.385 (4.94) (2.53) 6,939,650 (22.76) (0.02) 1.38 No Disclosure

27 Philex Mining Corporation PX 3.14 (4.85) (0.95) 107,519,460 7.09 0.44 0.67 No Disclosure

28 MerryMart Consumer Corp. MM 1.39 (4.79) 12.10 8,445,190 295.10 0.005 5.39 No Disclosure

29 Ever-Gotesco Resources and Holdings, Inc. EVER 0.300 (4.76) - 21,617,900 0.70 0.43 0.61 No Disclosure

29 Ionics, Inc. ION 0.60 (4.76) (13.04) 393,780 3.35 0.18 0.17 No Disclosure

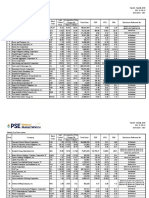

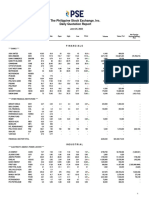

Aug 29 - Sep 02, 2022

VOL. XII NO. 35

ISSN 2013 - 1351

Weekly Market Statistics

(In pesos) August 22 - August 26 August 29 - September 02 Year-to-Date

Total Market Capitalization 17,100,166,308,501.00 16,823,385,497,412.40 16,823,385,497,412.40

Domestic Market Capitalization 13,739,451,819,067.60 13,629,987,746,354.10 13,629,987,746,354.10

Total Value Traded 29,362,723,130.23 24,434,566,539.15 1,207,097,152,457.59

Ave. Daily Value Traded 5,872,544,626.05 6,108,641,634.79 7,228,126,661.42

Foreign Buying 11,840,661,720.61 12,644,654,667.14 484,190,020,422.31

Foreign Selling 13,060,468,127.69 12,771,545,592.23 538,025,952,333.93

Net Foreign Buying/ (Selling) (1,219,806,407.08) (126,890,925.10) (53,835,931,911.61)

% of Foreign to Total 42% 52% 42%

Number of Issues (Common shares):

78 - 154 - 18 77 - 142 - 28 75 - 196 - 3

Gainers - Losers - Unchanged

Weekly Index Performance

Comparative Change (%) YTD Change

Close PER

1 Week 4 Weeks (%)

PSEi 6,692.65 (0.89) 4.48 (6.04) 17.45

All Shares Index 3,548.53 (0.81) 3.39 (7.06) 11.32

Financials Index 1,612.17 (1.50) 6.02 0.37 9.57

Industrial Index 9,926.40 0.52 3.47 (4.59) 17.69

Holding Firms Index 6,458.51 (0.50) 6.36 (5.12) 15.10

Property Index 2,984.96 (1.20) 4.44 (7.29) 18.57

Services Index 1,692.03 (1.77) 1.09 (14.82) 21.61

Mining and Oil Index 11,643.81 (1.45) 1.79 21.27 7.19

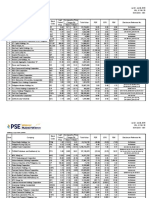

Notes:

- Top price gainers and losers only cover common shares.

- EPS (Earnings per Share) is computed as: Net Income

Outstanding Shares

PER (Price-Earnings Ratio) is computed as: Last Traded Price per Share

Earnings per Share

PBV (Price to Book Value Ratio) is computed as: Company Market Capitalization

Company Stockholders Equity (end of period)

EPS, PER and PBV use four-quarter trailing financial data.

- Total Value in Top

29Gainers and Losers tables refers to total value traded in the regular market.

- The disclosures cover those made from 3:31 pm, Friday of the previous week to 3:30 pm, Friday of the covered week. Information and disclosures made by the companies, as itemized in this report, may be

viewed by clicking on the links above. These may also be viewed in the “Disclosure” page of the company at the PSE website (www.pse.com.ph). To access the disclosure page, enter the stock symbol in the symbol

lookup field located at the upper right portion of the PSE website. The public is encouraged to regularly monitor subsequent developments as may be disclosed by the company in succeeding weeks.

- Current week’s foreign transactions data are subject to amendments allowed until t+2. Previous week’s foreign transactions data have been adjusted accordingly for amendments.

- Domestic Market capitalization excludes the market capitalization of foreign domiciled companies.

The data contained in this file is collated by the Market Data Department of the Philippine Stock Exchange. The PSE does not make any representations or warranties, express or implied, on matters such as, but not limited to, the accuracy, timeliness, completeness, non-infringement, validity, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE assumes no liability and

responsibility for any loss or damage suffered as a consequence of any errors or omissions in this file, or any decision made or action taken in reliance upon information contained herein. This document is for information purposes only, and does not constitute legal, financial or investment advice, nor intended to influence investment decisions. Independent assessment should be undertaken, and advice from a securities professional is

strongly recommended. For inquiries or suggestions on the PSE Weekly MarketWatch, you may call (632) 8876-4888, send a message through fax no. (632) 8876-4553 or email info@pse.com.ph.

You might also like

- JAWABAN UAS FINANCING AC010 (Elang SAP-AC10 Dua Jawatengah Bandung)Document16 pagesJAWABAN UAS FINANCING AC010 (Elang SAP-AC10 Dua Jawatengah Bandung)REG.A/0117101094/SITI SOBARIAH67% (9)

- wk05 Jan2024mktwatchDocument3 pageswk05 Jan2024mktwatchMacxie Baldonado QuibuyenNo ratings yet

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxNo ratings yet

- wk39 Sep2022mktwatchDocument3 pageswk39 Sep2022mktwatchcraftersxNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- QuarterlyTop50 1Q 2008Document5 pagesQuarterlyTop50 1Q 2008Franz Carla NavarroNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Nylinad Calubayan EstrellaNo ratings yet

- NLI Securities Limited: Direct Trading AccountDocument12 pagesNLI Securities Limited: Direct Trading AccountSaiful IslamNo ratings yet

- QuarterlyTop50 4Q 2009Document5 pagesQuarterlyTop50 4Q 2009Franz Carla NavarroNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- NYSE & NASDAQ New 52 Week Highs and Lows - 20220506Document30 pagesNYSE & NASDAQ New 52 Week Highs and Lows - 20220506matrixitNo ratings yet

- Daily Stock Market Report: IndicesDocument1 pageDaily Stock Market Report: IndicesMuhammad Shahid AshrafNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)AlexHunterNo ratings yet

- Nifty 50Document3 pagesNifty 50Arjun BhatnagarNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- DailystockmktDocument1 pageDailystockmktArbab Muhammad Ali KhanNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Fintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesFintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Dlix StrandNo ratings yet

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVcraftersxNo ratings yet

- InnovationDocument2 pagesInnovationmikiNo ratings yet

- Fintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesFintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)nelsonNo ratings yet

- Ark InnovationDocument2 pagesArk InnovationmikiNo ratings yet

- Lab 110609Document6 pagesLab 110609Andre SetiawanNo ratings yet

- CFD - November 6th 2009Document3 pagesCFD - November 6th 2009Andre SetiawanNo ratings yet

- Yapi Kredi Portföy Yönetimi A.Ş. (Yay) Yapi Kredi Portfoy Yabanci Teknoloji Sektoru Hisse Senedi Fonu NİSAN 2024Document7 pagesYapi Kredi Portföy Yönetimi A.Ş. (Yay) Yapi Kredi Portfoy Yabanci Teknoloji Sektoru Hisse Senedi Fonu NİSAN 2024ozanooz001No ratings yet

- Next Generation InterneDocument2 pagesNext Generation InternemikiNo ratings yet

- Fintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesFintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)hkm_gmat4849No ratings yet

- Ranking PageDocument1 pageRanking PageRomon YangNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarNo ratings yet

- Closingrates 202431janDocument21 pagesClosingrates 202431janmdcat466No ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoNo ratings yet

- CFD - November 5th 2009Document3 pagesCFD - November 5th 2009Andre SetiawanNo ratings yet

- Ind Oil Gas EV Metrics - AllDocument1 pageInd Oil Gas EV Metrics - AllPo_PimpNo ratings yet

- CFD - October 30th 2009Document3 pagesCFD - October 30th 2009Andre SetiawanNo ratings yet

- Rank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCADocument6 pagesRank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCA0000000000000000No ratings yet

- New 52 Week Highs and LowsDocument4 pagesNew 52 Week Highs and LowsMohammad SiddiquiNo ratings yet

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)hkm_gmat4849No ratings yet

- SCBS Investment Recommendations: Underperform UnderperformDocument4 pagesSCBS Investment Recommendations: Underperform UnderperformHappybabyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarNo ratings yet

- Eb Finance - Os Review PPT - SalemDocument7 pagesEb Finance - Os Review PPT - SalemCAO TR SALEMNo ratings yet

- Top Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupDocument4 pagesTop Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupkristineNo ratings yet

- Top Stories:: FRI 27 AUG 2021Document7 pagesTop Stories:: FRI 27 AUG 2021Elcano MirandaNo ratings yet

- Ark Next Generation Internet Etf Arkw HoldingsDocument2 pagesArk Next Generation Internet Etf Arkw HoldingsCheah ChenNo ratings yet

- Ark Next Generation Internet Etf (Arkw) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Next Generation Internet Etf (Arkw) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- wk38 Sep2022mktwatchDocument3 pageswk38 Sep2022mktwatchcraftersxNo ratings yet

- wk39 Sep2022mktwatchDocument3 pageswk39 Sep2022mktwatchcraftersxNo ratings yet

- Manila Jockey Club, Inc. - SEC Form 17-Q (2nd QTR 2022) - 23 Aug 2022Document75 pagesManila Jockey Club, Inc. - SEC Form 17-Q (2nd QTR 2022) - 23 Aug 2022craftersxNo ratings yet

- 2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastroDocument5 pages2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastrocraftersxNo ratings yet

- September 29, 2022-EODDocument13 pagesSeptember 29, 2022-EODcraftersxNo ratings yet

- Form 23-B 8-23Document5 pagesForm 23-B 8-23craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation ReportDocument12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation ReportcraftersxNo ratings yet

- SMIC - Acquisition of Shares of AIC Group of Companies Holding Corp (August 24, 2022)Document3 pagesSMIC - Acquisition of Shares of AIC Group of Companies Holding Corp (August 24, 2022)craftersxNo ratings yet

- SEC Form 17-C - Setting of BC Virtual ASMDocument3 pagesSEC Form 17-C - Setting of BC Virtual ASMcraftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022Document12 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: June 24, 2022craftersxNo ratings yet

- The Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022Document11 pagesThe Philippine Stock Exchange, Inc. Daily Quotation Report: February 09, 2022craftersxNo ratings yet

- Dilg Memocircular 2022428 D68ad9acb2Document13 pagesDilg Memocircular 2022428 D68ad9acb2craftersxNo ratings yet

- Maf551 PricingDocument4 pagesMaf551 Pricinghanisfarhanah17No ratings yet

- Accounting Ratio Formula Excel TemplateDocument4 pagesAccounting Ratio Formula Excel TemplatenazninNo ratings yet

- 2023 - 01 Brochure About Us 1Document20 pages2023 - 01 Brochure About Us 1Kss selvaNo ratings yet

- Analysis of Past and Present PerformanceDocument9 pagesAnalysis of Past and Present Performancerazelle anne saplotNo ratings yet

- MODULE 5 - Construction AccountingDocument8 pagesMODULE 5 - Construction AccountingEdison Salgado CastigadorNo ratings yet

- Data Analysis and Interpretation: Table.1 Age of The RespondentDocument24 pagesData Analysis and Interpretation: Table.1 Age of The RespondentESWARAN SANTHOSHNo ratings yet

- Salam and Parallel SalamDocument3 pagesSalam and Parallel SalamMuhammad SalmanNo ratings yet

- Bramer Listing Particlars Bookletpg Whole DocDocument32 pagesBramer Listing Particlars Bookletpg Whole DocRavi KureemunNo ratings yet

- 2.2016 Syllabus Paper-16-Jan2021 Direct Tax Laws and International Taxation Study NotesDocument514 pages2.2016 Syllabus Paper-16-Jan2021 Direct Tax Laws and International Taxation Study NotesRadhakrishnaraja RameshNo ratings yet

- BSNL Employees Superannuation Pension Trust Rules RulesDocument15 pagesBSNL Employees Superannuation Pension Trust Rules RulesswapanNo ratings yet

- China Mobile SolutionDocument11 pagesChina Mobile SolutionWildan RadistaNo ratings yet

- LECTURE Jan. 3 2023Document17 pagesLECTURE Jan. 3 2023lheamaecayabyab4No ratings yet

- Ar5 PDFDocument164 pagesAr5 PDFBhavna Devi BhoodunNo ratings yet

- The Impact of Country-Level and Fund-Level Factors On Mutual Fund Performance in VietnamDocument15 pagesThe Impact of Country-Level and Fund-Level Factors On Mutual Fund Performance in VietnamCitra MurtiNo ratings yet

- Aml Kyc Notice PDFDocument4 pagesAml Kyc Notice PDFabhishek50% (2)

- ACCCOB2-Chapter 3 - RECEIVABLESDocument43 pagesACCCOB2-Chapter 3 - RECEIVABLESVan TisbeNo ratings yet

- Caterpillar - Analyst CoverageDocument3 pagesCaterpillar - Analyst CoverageThe-InsiderNo ratings yet

- Akzo Nobel India LTD, August 2023Document24 pagesAkzo Nobel India LTD, August 2023bhuvaneshNo ratings yet

- A Strategic Analysis of Tune GroupDocument7 pagesA Strategic Analysis of Tune Groupchristinenyamoita2019No ratings yet

- Oracle R12 General LedgerDocument40 pagesOracle R12 General LedgerCA Vara ReddyNo ratings yet

- Residential Parking Permit ApplicationDocument2 pagesResidential Parking Permit ApplicationdanielwilloughbyNo ratings yet

- PA Chapter 2Document15 pagesPA Chapter 2Judelyn TolozaNo ratings yet

- Fundraising PresentationDocument18 pagesFundraising Presentationpushkar royNo ratings yet

- Current Acct Statement - XX0388 - 12092023Document10 pagesCurrent Acct Statement - XX0388 - 12092023Ashwani KumarNo ratings yet

- M011-Consumer Mathematics (Taxation)Document5 pagesM011-Consumer Mathematics (Taxation)Tan Jun YouNo ratings yet

- Investments, Chapter 4: Answers To Selected ProblemsDocument5 pagesInvestments, Chapter 4: Answers To Selected ProblemsRadwan MagicienNo ratings yet

- CNHA Investor Fact SheetDocument2 pagesCNHA Investor Fact SheetMattNo ratings yet

- Module 1 - Overview of Cost AccountingDocument7 pagesModule 1 - Overview of Cost AccountingMae JessaNo ratings yet

- Chapter 7 - Risks of Financial Inter MediationDocument69 pagesChapter 7 - Risks of Financial Inter MediationVu Duy AnhNo ratings yet