Professional Documents

Culture Documents

Alfa MLG (Audit Report) 2019-20

Alfa MLG (Audit Report) 2019-20

Uploaded by

Harsh Punmiya0 ratings0% found this document useful (0 votes)

5 views41 pagesOriginal Title

12. ALFA MLG (AUDIT REPORT) 2019-20

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

5 views41 pagesAlfa MLG (Audit Report) 2019-20

Alfa MLG (Audit Report) 2019-20

Uploaded by

Harsh PunmiyaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 41

ALFA BOILERS PVT. LTD.

ANNUAL REPORT

F.Y, 2019-20

ALFA BOILERS PRIVATE LIMITED.

dependent Auditor's Report

TO THE MEMBERS OF

ALFA BOILERS PRIVATE LIMITED

Report on the Financial Statements

We have audited accompanying financial statements of ALFA BOILERS PRIVATE LIMITED which

comprise the Balance Sheet as at March 31, 2020, the Statement of Profit and Loss and Cash Flow

Statement for the year then ended, and a summary of significant accounting policies and other

explanatory information.

Management's Responsibility for the Financial Statements

The Company's Management is responsible for the preparation of these financial statements that

Give @ true and fair view of the financial position, financial performance and cash flows of the

Company in accordance with the Accounting Standards notified under the Companies Act, 1956 (“the

Act”) (which continue to be applicable in respect of Section 133 of the Companies Act, 2013 in terms

of General Circular 15/2023 dated 13th September, 2013 of the Ministry of Corporate Affairs) and in

accordance with the accounting principles generally accepted in India. This responsibilty includes the

Gesign, implementation and maintenance of intemal control relevant to the preparation and

Presentation of the financial statements that give a true and fair view and are free from material

misstatement, whether due to fraud or error,

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We

Conducted our audit in accordance with the Standards on Auditing issued by the Institute of

Chartered Accountants of india. Those Standards require that we comply with ethical requirements

and plan and perform the audit to obtain reasonable assurance about whether the financial

statements are free from material misstatement.

An audit Involves performing procedures to obtain audit evidence about the amounts and

disclosures in the financial statements. The procedures selected depend on the auditor’s judgment,

including the assessment of the tisks of material misstatement of the financial statements, whether

due to fraud or error. in making those risk assessments, the auditor considers internal control

relevant to the Company's preparation and falr presentation of the financial statements in order to

Gesign audit procedures that are dppropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the Company's internal control. An audit also includes

evaluating the appropriateness of accounting policies used and the reasonableness ofthe accounting

estimates made by management, as well as evaluating the overall presentation of the financial

statements, We believe that the audit evidence we have obtained is sufficient and appropriate to

provide a basis for our audit opinion.

Opinion

{nour opinion and to the best of our information and according to the explanations given to us, the

aforesaid financial statements give the information required by the Act in the manner so required

and give a true and fair view in conformity with the accounting principles generally accepted in india:

{a} Im.the case of the Balance Sheet, of the state of affairs of the Company as at March 31,

(b) In the case of the Statement of Profit and Loss, of the profit of the Company for the year

‘ended on that date; and

{c) In the case of the Cash Flow Statement, of the cash flows of the Company for the year

‘ended on that date,

Report On Other Legal And Regulatory Requirements

As required by the Companies (Auditor's Report) Order, 2016 ("the Order") issued by the Central

Government of India in terms of sub-section (11) of section 143 of the Act, we give in the

“annexure A", a statement on the matters specified in the paragraph 3 and 4 of the order.

As required by Bection 143(3) of the Act, we further report that:

1. We have sought and obtained all the information and explanations, which to the best of our

knowledge and belief were necessary for the purpose of our Audit.

2. In our opinion proper books of Accounts as required by law have been kept by the Company 50

{far as appears from our examination of the books.

3. The Balance Sheet, the Statement of Profit and Loss, and the Cash Flow Statement dealt with

by this Report are in agreement with the books of account.

4, tn our opinion, the Balance Sheet, the Statement of Profit and Loss, and the Cash Flow

Statement comply with Accounting Standards specified under Section 133 of the Act, read with

Rule 7 of the Companies (Accounts) Rules, 2014.

On the basis of the written representations received from the directors as on March 31, 220,

taken on record by the Board of Directors, none of the directors is disqualified as on March 31,

71120, from being appointed 2s a director in terms of Section 164(2} of the Act.

6. With respect to the adequacy of the internal financial controls over financial reporting of the

Company and the operating effectiveness of such controls, refer to our separate report in

“ase B

For- UPENDRA MEHTA & ASSOCIATES

‘Chartered Accountants

'

/ ssi Nb

SEY ca UPENORAT.TAEHTA

Tiatvenon J! partner

fe (Mi, NO.38883

(Firm Regn. No.: 107393W) a

MALEGAON,

NOVEMBER, 2020

Annexure A to the Auditors’ Report

The Annexure referred to in Independent Auditors’ Report to the members of the Company

on the financial statements for the year ended 31 March 2020, we report that:

4. a) The Company has maintained proper records showing full particulars including quantitative

details and situation of fixed assets.

5) AS explained to us, the fited assets have been physically verified by the management during

the Year. We are informed that the management on such verification has noticed ne

material discrepancies as compared to the aforesaid records of the Fixed Assets,

¢} According to the information and explanations given to us and on the basis of our

parnination of the records of the Company, the title deeds of immovable properties are

held in the name of the Company.

2. a) As explained to us the inventory has been physically verified by the management at

reasonable intervals during the year.

4) In our opinion the frequency of verification is reasonable. According to the information &

explanation given to us in our opinion, the procedures of physical verification of stocks

followed by management are reasonable & adequate in relation to the size of the business of

the company.

©} As informed & certified by the management , the discrepancies noticed on verification

between the physical stock and the book records were not materiel and have been

appropriately dealt with in the books of accounts

4) nour opinion & on the basis of our examinations of records the valuation Of closing stock is,

fair & proper and In accordance with the normally accepted accounting principles,

3. In respect of the Loans , secured or unsecured , granted or taken by the Company to \ from

ComPanies , firms or other parties covered in the register maintained under section 189 of the

Companies Act 2023, in our opinion the Rate of Interest, in other terms & conditions of such

loans granted \ taken, are prima-facie, not prejudicial to the interest of the company. The

borrowers have been regular in the payment of the principal and interest as stipulated, There are

no averdue amounts in respect of the loan granted to partes listed in the register maintained

under section 189 of the Act.

4. In our opinion and according to the information and explanations given to us, the Company has

complied with the provisions of section 185 and 186 of the Act, with respect to the leane and

investments made.

5. In our opinion and according to the information and explanation given to us the company has

[Rot accepted any deposit from public during the year within the meaning of the directives leeued

by the Reserve Bank of India and the provisions of sections 73 to 76 of any other relevent

Provisions of the Companies Act, 2013 and the rules framed there under.

8. The Central Government has not prescribed the maintenance of cost records under section

148(1) of the Act, for the year under review.

7. According to the information and explanations given to us and the records of the Company

Cxamined by us there are no undisputed amounts payable in respect of Income-Tax Sales Tax.

Custom duty, Excise duty, Cess and any other statutory dues with the appropriate authority,

which were outstanding as on 34st March 2016 for the Period of more than 6 months from the

date they become payable. During the period under consideration we are informed that the

Provisions of employee's provident fund and ESIC fund are properly complied with,

&. In our opinion and according to the information and explanations given by the management, we

are of the opinion that, the Company has not defaulted in repayment of dues tera financial

institution, bank or debenture holders, as applicable to the company,

9 The Company did not raise any money by way of initial public offer or further public offer

{cluding debt instruments) and term loans during the year. Accordingly, paragraph 38 (ix) of the

Order is not applicable.

10. According to the information and explanations given to us, no material fraud by the Company or

on the Company by its officers or employees has been noticed or reported during the course of

our audit,

11. According to the information and explanations give to us and based on our ‘examination of the

records of the Company, the Company has paid/provided for managerial remuneration oy

actordance with the requisite approvals mandated by the provisions of section 197 reed win

Schedule V to the Act.

12. In our opinion and according to the information and explanations given to us, the Company is

nota nidhi company. Accordingly, paragraph 3(xi) of the Order is not applicable,

13. According to the information and explanations given to us and based on our examination of the

tecords of the Company, transactions with the related parties are in compliance with sections

177 and 188 of the Act where applicable and details of such transactions have been disclosed in

the financial statements as required by the applicable accounting standards,

14. According to the information and explanations give to us and based on our examination of the

records of the Company, the Company has not made any preferential allotment ur Private

Placement of shares or fully or partly convertible debentures during the year

15. According to the information and explanations given to us and based on our examination of the

records of the Company, the Company has not entered into non-cash transactions with directors

OF Persons connected with him. Accordingly, paragraph 3(xv) of the Order is not applicable.

16, The Company is not required to be registered under section 45-IA of the Reserve Bank of India

Act 1934,

Annexure - B to the Auditors’ Report

Report on the internal Financial Controls under Clause (i) of Sub-section 3 of Section 143 of

the Companies Act, 2013 (“the Act”)

{te have audited the internal financial controls over financial reporting of Alfa Boilers Private Limited

("the Company”) as of 31 March 2020 in conjunction with our audit of the financial statements of

the Company for the year ended on that date.

Management's Responsibility for Internal Financial Controls

The Company's management is responsible for establishing and maintaining internal financial

controls based on the intemal control over financial reporting criteria estabished by the Company

considering the essential components of internal control stated in the Guldance Note on Audit x

Internal Financial Controls over Financial Reporting issued by the Institute of Chartered Accountoree

of india (‘CAI’). These responsibilities include the design, implementation and maintenones of

adequate internal financial controls that were operating effectively for encuting the orderly and

efficient conduct of its business, including adherence to company’s polices, the safeguarding of its

assets, the prevention and detection of frauds and errors, the accuracy and completeness of the

Accounting records, and the timely preparation of reliable financial information, as required under

the Companies Act, 2013,

Auditors’ Responsibility

Sur responsibility I to express an opinion on the Company's internal financial controls over financial

reporting based on our audit. We conducted our audit in accordance with the Guidance Note on

Audit of Internal Financial Controls over Financial Reporting (the “Guidance Note”) and the Standards

on Auditing, issued by ICAI and deemed to be prescribed under section 143(i0) of the Companies

Act, 2023, to the extent applicable to an audit of internal financial controls, both applicable to an

audit of internal Financial Controls and, both issued by the Institute of Chartered Accountants of

India, Those Standards end the Guidance Note require that we comply with ethical requirements and

plan and perform the audit to obtain reasonable assurance about whether adequate internal

Financial controls over financial reporting was established and maintained and if such controls

operated effectively in all material respects.

Our audit Involves performing procedures to obtain audit evidence about the adequacy of the

internal financial controls system over financial reporting and their operating effectiveness, Our

audit of internal financial controls over financial reporting included obtaining an understanding of

intérnal financial controls over financial reporting, assessing the risk that a material weakness exists,

and! testing and evaluating the design and operating effectiveness of internal control based on the

assessed risk, The procedures selected depend on the auditor's judgment, including the assessment

of the risks of material misstatement of the financial statements, whether due to fraud or error

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis,

for our audit opinion on the Company's internal financial controls system over financial reporting,

Meaning of internal Financial Controls over Financial Reporting

A company’s Internal financial control over financial reporting is a process designed to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial

Statements for external purposes in accordance with generally accepted accounting principles. A

company's internal financial control over financial reporting includes those policies and procedures

that (2) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect

the transactions and dispositions of the assets of the company; (2) provide reasonable ascurance

that transactions are recorded as necessary to permit preparation of financial statements in

accordance with generally accepted accounting principles, and that receipts and expenditures of the

company are being made only in accordance with authorisations of management and directors of

the company; and (3) provide reasonable assurance regarding prevention or timely detection of

unauthorised acquisition, use, or disposition of the company’s assets that could have a material

‘effect on the financial statements.

Inherent Limitations of internal Financial Controls Over Financial Reporting

Because of the inherent limitations of

jernal financial controls over financial reporting, including

the possibility of collusion or improper management override of controls, material misstatements

due to error gf fraud may occur and not be detected. Also, projections of any evaluation of the

internal financial controls over financial reporting to future periods are subject to the risk that the

internal financial control over financial reporting may become inadequate because of changes in

conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Opinion

In our opinion, the Company has, in all material respects, an adequate internal financial

controls system over financial reporting and such internal financial controls over financial

reporting were operating effectively as at 31 March 2020, based on the internal control over

financial reporting criteria established by the Company considering the essential

components of internal control stated in the Guidance Note on Audit of Internal Financial

Controls Over Financial Reporting issued by the Institute of Chartered Accountants of India,

For- UPENDRA MEHTA & ASSOCIATES

Chartered Accountants

7 CA UPENDRAV. MEHTA

[0 Proprietor

M.No.38883

‘ (Firm Regn, tho.: 1073930)

MALEGAON,

" NOVEMBER, 2020

ALFA BOILERS PRIVATE LIMITED

DIRECTORS’ REPORT

To

The Members,

The Board of Directors have pleasure in presenting the Annual Report together with the audited

statement of Accounts for the financial year ended on 31st March 2020.

ancial Results

| Particutars Het FY. 2019-20 | Fy.2018-19 |

SPH Rs.Iniakhs | Rs. In lakhs

Profit \(Loss) before Tax 2451 23.22

Provision for Tax 6.37 5.98

Net Profit \(Loss) for the Year 18.14 17.24

Balance Brought Forward from

ae 116.78 $8.80

Appropriation & Prior period (0.61) (0.75)

adjustments s :

Balance Cartied Forward to Balance ay en

sheet See EEE eee er el eee eee

Operations

The Company is engaged in Job work of repairs & maintenance of Pressure Vessels, Boilers etc. &

‘manufacturing & dealers of boiler Spares & Components.

Fixed Deposit

The company has not accepted any fixed deposits from the public during the year,

Dividend

{In view of the inadequate distributable surplus , the Directors have considered it financially prudent

in the tong term interest of the Company to reinvest the surplus into the business of the Company to

build the strong reserve base and grow the business of the Company. No dividend is therefore

recommend for the year ended on 31st March 2020.

Auditors oe

Upendra Mehta & Associates, Chartered Accountants, who are, Yhe- statutory ‘auditors of the

Company, hold office until the conclusion of the ensuing AGM and are’ élgibieYor, re-appointment.

Members of the Company at the AGM held on 30 September, 2015 had approved the appointment

of Upendra Mehta & Associates (formerly known as Parakh Mehta & Associ les Jas the Statutory

Auditors for a period of five financial years i.e. up to 31 March, 2020. As required by the provisions of

the Companies Act, 2013, their appointment should be ratified by members each year at the AGM.

Accordingly, requisite resolution forms part of the notice convening the AGM.

Directors responsibility Statement

Pursuant to the provision of sub-section (3)(c) of Section 134 of the Companies Act 2013, the

Directors:confirm

That in the preparation of annual accounts, the applicable accounting standards had been

followed along with proper explanation relating to material departure.

b. That the Directors had selected such accounting policies and applied them consistently and

made judgements and estimates that are reasonable and prudent so as to give a true and

fair View of the state of affairs of the company at the end of the financial year and of the

profit or loss of the company for that period .

© That the Directors had taken proper and sufficient care for the maintenance of adequate

accounting records in accordance with the provisions of Act for safeguarding the assets of

the Company and for preventing and detecting fraud and other irregularities,

4. That the Directors had prepared the annual accounts on a going concern basis.

© That the Directors had devised proper system to ensure compliance with the provisions of

all applicable iaws and that such systems were adequate and operating effectively.

Personnel,

No information Is required to be furnished in terms of the provisions of Section 197(12) of the

Companies Act 2013, read with Rule 5(1) of Companies (Appointments & Remuneration of

Managerial Personnel) Rules 2014, since the Company has not employed during the period any

Employee drawing the remuneration in excess ofthe limits prescribed under the relevant provisions

of the Act and the Rules.

Auditors Repor

The Auditor's Report is unqualified. Notes to and forming part of the Financial Statements referred

{0 in the Auditor’s Report are self explanatory and therefore do not call for any further clarification

under Sec. 134 (3)(f) of the Companies Act, 2013,

For & on Behalf of the Board of Directors of,

ALFA BOILERS PVT. LTD.

fis” fis

Farooque b. — Quadir D. Hamdulay

Director Director

MALEGAON,

25" NOVEMBER, 2020

‘ALFA BOILERS PVT. LTD.

FY-2039-20

BALANCE SHEET AS AT 38st MARCH, 2020 .

TateNa, | _sia32000 | s05 2019

JeauirvaNoUABiES

I shareholder's ands

Shor Capt 2 9735000) 975,000

reserves and Sure 3 ratais7a| 1367855

2.66579] 26,13 855

It shareappcation money pending allotment : -

1 NoreCrrt abiies

pong erm borrntngs 4 raso9oe1) —2a3aaan2

other Long term abies ; -

760508 | zaRa a

IV Current Liabilities:

Shor om borrowings 5 aansia22| sszo1a8e

Trade payables 6 se0s06ss| 64077669

other cuentas 7 20,86 278536

Shorter prosions 2 regan | —_s297322

: Ea7as7a8| 02563822

Tota a.saoa,00| —a2a6.2 399

asers

1 Nocurent assets

Fed sets

Tangible arts 2 2asaseo7| 3070213

Cop werkn-gropres 10 :

Non cutentnvestmerts n ; :

other norecrent sete 2 ; .

7a a5657| — Ba7 ORAS

1 coment ast

rvenores 3 3os7aseo] —aananaio

Trae recsiabes Py aasszae| —a6anasi

Cosh and cen equaers 1s 2sosssea] 23.1883

Shor ern oa and advances 16 7323007| 2633802

othercurant sets 0 saassor| 5137651

3.09.46 701] 2909986

Tota iaagnaee| —32362,350

summary of Scant Acourting Pcie 1

Noles refered to above form an integral part of the balance sheet

In Terms of our Report attached

For UPENDRA MEHTA & ASSOCIATES

Chartered Accountants

7

CA, UPENDRA. Ta

Proprietor

M, No. 38883

(Firm Regn No.: 107393)

MALEGAON —_—_UDIN - 20038883AQAAEA9830

25-11-2020

For

ALFA BOILERS PVT. LTD.

(ol

Director

4

teal

Director

ALFA BOILERS PVT. LTD. EY-2019-20

STATEMENT OF PROFIT AND LOSS _FOR THE YEAR ENDED 31st MARCH, 2020

Note | 31-03-2020 31-03-2019

No.

INCOME

Revenue from operations 18 26,29,62,322 | 21,26,37,183

Other Income 19 17,72,151 59,10,311

Total Revenue 26,07,34,474 | _23,85,47,494

EXPENSES 7

Cost of materials consumed 20 13,99,60,624 | 12,87,45,094 :

Other Operating Expenses an 7,72,42,306 6,39,77,678

‘Changes in inventories 22 84,27,514 (94,45,475)|

Employee benefit expenses 2B 1,36,40,868 1,09,96,516

Financial costs 24 28,28,169, 39,448,777

Depreciation and amortization expense 5 43,63,630 44,52,875

Other expenses 26 1,58,19,700 1,35,54,251

Total Expenses 26,22,82,814 | _21,62,25,716

[Profit before exceptional and extraordinary items and tax. 24,51,663 23,214,778

Exceptional Items -

Profit before extraordinary items and tax 24,51,663 23,21,778

Extraordinary Items - -

Profit before tax 24,51,663 23,21,778

itax expense: .

Current tax 637,432 597,864

Deferred Tax

Profit/(Loss) for the period 18,14,231 17,23,914

Earning per equity share:

Basic 16.64 v7.

Diluted 18.64 71

[Summary of Significant Accounting Policies 1

‘Notes refered to above form an integral part of the statement of Profit and loss Statement

In Terms of our Report Attached

For- UPENDRA MEHTA & ASSOCIATES For- ALFA BOILERS PVT. LTD.

Chartered Accountants

(Firm Regn No.: 107393W)

'

CA. UPENDI m Director Director

Pariner

M. No. 38883

MALEGAON DIN - 20038883AAAAEA9830

25-11-2020

ALFA BOILERS PVT. LTD.

Fy-2019-20

Notes to and forming part of the Financial Statements

Notes on Balance Sheet

[Note - 2___ Share Capital

31-03-2020 31-03-2019

Particulars Nos.ofshare| Amount | Nos. ofshare_| Amount

[authorised

Equity Shares of Rs.f00/- each 3,00,000 | 1,00,00,000 3,00,000 | _1,00,00,000

Total 3,00,000 | 1,00,00,000 4,00,000 | _1,00,00,000

Jssued, Subscribed & Paid Up

Equity Shares of Rs.100/- each 97,350 | _ 97,35,000 97,350| __97,35,000

L Total 97,350| _97,35,000 97,350 | _ 97,35,000

Refer Notes (i) to (iv) below

Not

(i) Right of Equity Shareholders

The Company has only one class of Equity Shares having a par value of Rs. 100/- each, Each holder of shares is

entitled to one vote per share. In the event of liqudation of the Company, the holder of equity shares will be

entitled to receive any of the remaining assets of the company, after distribution of all preferential amount to

various stakeholders of the company.

(ii) Reconciliation of,the equity shares outstanding at the beginning and at the end of the year

31-03-2020 31-03-2019

Particulars Nos. ofshare] Amount | Nos.ofshare | Amount

[At the beginning ofthe year 97,350] 97,35,000 97,350| —97,35,000

Issued during the year : _

loutstanding at the end of the year 97,350| _97.35,000 97,350.00] _97,35,000

(li) Details of shares held by each shareholder holding more than 5% of shares:

Equity Shares

! 31-03-2020 31.03-2019

| ‘Nos. of share Nos. of share

lame of Shareholder held __ | %of Holding held % of Holding

Farooque 0. Hamdulay 8,750 8.99% 3750 + 8.99%

Hajuddin D. Hamdulay 8,750 8.99% 8,750 8.99%

Khalid 0. Hamdulay * 8,000 8.22%) 8,000 8.22%

{Quadir 0. Hamaualy 8,000 8.22% 8,000 8.22%

Jakbar K. Hamdulay 6,000 6.1656 6,000 6.16%

Bilal K, Harndulay 6,000 6.1656 6,000 6.165%

lunaid @. Hamdulay 6,000 6.16%) 6,000 6.1686

{Ismail T. Hamdulay 6,000 6.16% 6,000 6.16%

JAyesha D. Hamdulay 8,000 8.22% 8,000 8.22%

HTarique D. Hamdulay 7,350 7.55% 7,350 7.55%

(iv) The Company is standatone coinpany and does not have any holding company.

Note ~ 3___ Reserves & Surplus

Particulars 31.03-2020| 31-03-2019

Profit & Loss Account

opening Balance B/F 1,16,78,465 | 98,79,886

hoa! Profit for the Current Year 38,14,231] 17,23,914

Excoss Brovision for IT Wrriten back : 74,665

1,34,92,696 | 1,16,78,465

Less- Short provision of IT for earlier years 61,117 -

Prior Period Adjustments :

61417 :

Total 13431579 | 1,16,78,465

Note - 4 Long Term Borrowings

particulars 31-03-2020] 31-03-2019

(a) Term loans from Banks :

secured 547,498) 7.26577

A 3,47,498| 7.26577

(b) Loans & Advancés from Directors & related Parties

Secured :

Unsecured 1,10,61,583 | _2,06,17,534

8 4,30,61,583 | 2,06,17,534

(b) Loans & Advances from Others

secured 7 i

Unsecured 7 :

c 7 z

Total (A¥8+C) 11609081] 2,13,44,112

Notes

(i) Details of Securities & terms of repayment for Secured long-term borrowings from Banks & Others

Particulars ‘Amount as] Securities \ Guarantees Terms of Repayment

or Repayment Rate df interest

fare: Schedule

HOFCCartoan Hyp. of Motor Car 36 Months 11%

Note = 3

|Particutars 31-03-2020] 31-03-2019]

[Cash Credit from Banks , repayable on demand - 7

Secured 2,41,64,822 | 1,52,01,384

Unsecured - 7

{otal 2,41,64,822 | _1,52,01,384

Directors of the company in their individual capacity.

Note - Cash Credit \Working capital Loan from Banks are secured by hypothecation of Raw material, Finished

goods, WIP, and book debts by way of first charge in favour of Dena Bank . The Limits are guarnteed by all the

Note Trade Payables

Particulars 32-03-2020] 31-03-2019

Sundry Creditors for goods 3,79,47,336 | 2,63,14,467

Sundry Creditors for Expenses & Others 72,52,019 | 2,18,56,631

customers Credit Balances 3,28,51,334| 2,59,06,571

[rotat 5,80,50,688 | _6,40,77,669

Note - 7 ___ Other Current Liabilities

Particulars 31-03-2020] _ 31-03-2019]

[Employees Providend Fund Dues sora] 26,071

ESIC Dues 3,024 6402

Profession Tax payable 5,600 8,145

lest Payable 6,03,899 :

[10s Payable iH 1,79,049 237918

Total 8,22,386 2,78,536

INote- 8 __ Short Term Provisions

Particulars 31-03-2020| 31-03-2039

Salaries Payable 7,70,784 6,99,369

Wages Payable 241,918

Telephone Exp. Payable 23,708 .

nent Payable 5,000

lprovison for income Tax 637,432 5,97,864

Hrotal 16,78,842| 12.97,233

INote - 9 Tangible Assets

Particulars . 31-03-2020| 31-03-2029]

JGross Block 6,37,75,905 | 6,15,68,991

Less Accumulated Depreciation 3,52,30,208 | _3,08,66,578

et Block 2,85,45,697 | _3,07,02,413

For Details , Refer Annexure to Note No, 9 - Tangible Fixed Assets

Note - 10___Capital Work in Progress

Particulars 31.03-2020| 31-03-2019]

Hotat - :

INote - 11__ Investments

particulars 31.03-2020| 31-03-2019]

Shares ( Unquoted)} af Co-op. Banks :

Total 7 z

Note - 12__Othernon-current assets

Particulars 31.03-2020| 31-03-2019]

wit 7 :

Total i i

Note - 13 Inventories

Particulars 31.03-2020| 31-03-2019)

Rav Material 1,55,10,494 | 1,75,88,710

Work in Process 151,68,185 | _2,35,95,700

Total 3,06,78,680 | _4,11,84,410

Note - Stock of raw materials valued at cost. Stock of Finished goods , Packing Material & WIP is valued at

cost or net relisable Value which ever is lower.

Note-__18__Trade Receivables

Particulars 31-03-2020] 31-03-2019

lunsecured, considered good (unless otherwise stated.)

Joutstanding for @ period exceeding 6 months fram the date

Ithey are due for payment - 5181100] 69,72,711

lother Receivables 1,63,71,734 | _1,26,62.140

frotat 2,1552,834| 1,95,34,851

Note~ 35 Cash & Cash Equivalents 98,898.00

particulars 31.03.2020] 31-03-2019]

Balance with Scheduled Banks :

'n Current accounts 27,092,829 | _1,08,13,306

In Fix Deposit Accounts 2,04,48,099 | 1,19,34,085

[cash on hand 19,19,655 | _21,14,112

Total 2,50,66,583 | _2,43,61,483

Note 16 _Short Term Loans & Advances

Particulars 31-03-2020] 31-03-2019]

Unsecured , considered good {unless otherwise stated.)

Advances to suppliers of goods & services, 76,06,428| — 26,13,592

Other Advances 2,165,569 :

otal 7923097 | _26,11,592

Note - 17__ Other Current Assets :

Particulars 31-03-2020] 31-03-2019

Unsecured , considered good (unless otherwise stated:

security & earnest Deposits 13,16,780 | 12,38,930

staff & Labour Loan 8,000 9,000

IMVATRefund Due FY 2013-14 - 597,350

MVAT Refund Due F.¥.2016-17 10,39,807| 10,39,807

service Tax Appeal Dues - 50,589

last mput Creat 61,370 73,005

Income Tax Refund Claimed 32,00,230 | 4,23,173

[rcs Credit ( income tax) 38,909

{05 Credit (Income tax) 21,993,320 | __16,46,868

Hrotal 58.25,507| _51,17,651

ALFA BOILERS PVT. LTD. FY- 2019-20

Notes to and forming part of the Financial Statements

Notes on Profit & Loss Statement

Note - 18 Revenue from Operations

Particulars 3103-2020] _31-03°2019]

ISales of Products

Sales - Obmestic sales. 17,94,61,958 | 16,21,25,528

Sales - Export sales - -

sale of Services

Sales - Domestic sales 8,35,00,264 | 5,05,11,656

Sales “Export sales

[Totat 26,29,62,322 | 21,26,37,183

Note - 19 Other Income.

Particul: 31-03-2020| 31-03-2019]

[Other Operating Revenue

[Discount & Rebate on sales (65,953) 6,78,910,

lRecoveries on Debis Wioff : 105,177

leackibng & Forwarding recovered 3,26,832 7

ITranspor Charges recovered 1,07,700

credit Balances of Customers Written OFF E 43,73,233

368,579 | __51,57,320

Other Receipts

Interest Accrude on Bank Deposits 12,2561 782,991

interest on IT Refund 15,442

lother misc. Receipts 1,62,520

14,03,573, 752,931

[Total i721] 59,1031)

Note 20 Cost of Material Consumed

Particulars 31-03-2020] 31-03-2019]

lOp. Stock of Raw Material 1,75,88,710 | 1,49,94,475

Purchases of Raw Material 13,78,82,408 | 13,13,39,329

Less Closing Stock of Raw Material 1,55,10,494 | _1,75,88,710

[Total Cost of Material Consumed 13,99,60,624 | 12,87,48,094

1

Note - 21 Other Operating Expenses

Particulars 31-03-2020] 31-03-2019]

[Outsourcing Charges (Job Work } 6,57,36,069 | _ 4,90,20575

Repairs & maintenance | Machineries & Others ) 26,98,410 | 20,15,080

Repairs & maintenance ( Building } 3,05,372} 20,358,986

Power & Fuel 24,29,307| — 28,46,822

Transport & Freight 6018149 | _80,59,217

[Total 7,72,42,306 [| _6,39,77,678

(Gale

Note 22___ Changes in inventories of finished goods, work-in-progress and stock-in-trade

Particulars 31-03-2020| 31-03-2019]

inventories at the end of the year

Finished Goods -

Work in process 1,51,68,186 | 2,35,95,700

Total A 7,51,68,186 | 2,35,95,700

inventories at the beginning of the year

Finished Goods -

Work in process 2,35,95,700 | 4,41,50,225

Total B 2,35,95,700 | 1,41,50,225

|Cinerease )\ Decrease in Inventories (AB) 84,27,514| _ (94,45,475)

Note 723__ Employees Benefit Expenses :

Particulars 31-03-2020] _31-03-2019|

[Salaries & Wages 94,08,070] —71,51,452

Staff & Labour Welfare Expenses 18,06,331| 17,91,514

[contribution to Employee PF 4,94,250 402,415,

|contribution to ESIC 230,915, 2,11,139

Incentive & Ex-Gratia to Workers & Staff 2,61,302

Directors Remuneration 14,40,000 |__14,40,000

[rotal 1,36,40,868 | _1,09,96,516

[Note - 24 Finance Cost

[Particulars 31-03-2020[ _31-03-2019|

[Bank Charges & Commission 71,749) 911,222

interest

interest on Bank Cash Credit 13,35,038 | 15,30,266

interest on Bank Term Loan 63,021 446,927

[Other interest 7,18,361| _ 10,56,362

[Total v 28,28,169| 39,448,777

Note~ 25 Depreciation & Amortisation of Expenses

Particulars 31-03-2020] 31-03-2019)

[Depreciation { refer Note -9 Tangible Assets ) 43,63,630 ——_44,52,875

[Total 43,63,630] —_44,52,875

Note - 26 __ Other Expenses

Particulars 31-03-2020 31-03-2019]

Entertainment & Hospitality 3,02,767 3,66,587

Insurance 2,79,234 1,18,193

Rates & Taxes 7,45,812 456,422

Sales Promotion Exp, 10,74,518 1,28,781

Traveling xp 15,01,265| —15,59,424

Professional, Consutancy & Technical Fees 38,30,516| — §3,03,998,

Hrelephane Exe. 1 3,23,235 4,33,819

lHote!, Lodging & Boarding 548,564 5,55,046

Iconveyance 46,125 45,631

ladvertisement 1,30,268 1,08,928

lauditors Remuneration as auditors 65,000 50,000

Legal expenses | \BR Fees ) 31,47,37| — 24,50,484

lkent 3,31,403 431,372

hrrecoverable Ocbts Wott 17,25,145

Icommission on sales, 2,80,314 7,37,082

lOther Administrative Exp. 988,157 212,514

[Total 188,19,700 | 1,35,54,251

In authentication of Notes to and forming part of Financial Statements

For- UPENDRA MEHTA & ASSOCIATES For- ALFA BOILERS PVT. LTD.

Chartered Accountants

cA Director Director

MALEGAON. Partner

25-11-2020 M. No, 03883,

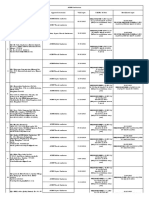

Etv'zo'4o’e | TéR'c0'ew'z_| 8¢5°99'80"E Sca'7s'py | £0L'ET'e9'Z 166'89'ST'9 000'8T oos'ro'sr | £19'09‘E9 vLS'TZ'L0'S 22a, SNOWAAY|

ses'sw'se'z_| eww'zo'se's_| soz'or'zs'e ors'es'ey |acs'ss'e0'e |sos'scce's | - | ese'ss'er | ose'ev's | ros‘ax'sr’s awi04

vev'ed'T sT6'E9'7 Lor'es'tZ = zer'st'T seg'ec'oz Tee'z9'E7 BBL'De E09LE'ET suaandwo5|

Bebe TZ TWe6'Ls'sz Ees‘6r'or 28o'es'e Svt'99're 990°pz'0L 990'rz'OL s2piyan)

sein

re'60'at ogs's0'0z 616'69'ET BE0'10 T16'99'Tt T6e'6e'TE 008'e T6y'SL'Te oR aunwny)

swvowdinby

races Best 885'7 00s‘vE oos've a0}

Trouper

g96‘o6'e9't_| t9s'zz‘ox't_| Ofv‘06'98'T Tze'seee _| 60L'pT'6s'T S6E'TS'OS‘E Eiverais g90'07'8 oLs'Le‘62'E Bela]

020'99'6L EETTS'8S Tre's?'ts. err'se's ect epee T92‘v6'09'T T9z'6'09'T saupiing|

ozoz-eo-te | ctoz-v0-fo | ozoz-eore | * erozvo-10 | ozoz-e0-te stepost> [ steposte | 6toz-vo-to

usunsnipy svaysuen.

wesy sesy wesy | sano [seehamsos| aesv resy__|\sesodsig suonpy wesy

2po1g 3oN wonepesdea spore 019 sseynonieg

or-sror- As

(sressy egies )

SS Paxid ‘6 "ON 210N 0} sunxsUUY

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

NOTES TO AND FORMING PART OF TUE FINANCIAL STATEMENTS

[Note Wo: Signfcant Accounting Poies ~~~

+ Basis Of Preparation OF Financial Statements - The accounts are prepared under historical

cost conventions & in accordance with the applicable accounting standards & with the

Senerally accepted accounting principles & the provisions of the Companies Act 1956 as

adopted consistently by the company. The Concern generally follows mercantile (accrval)

system of accounting and recognises significant items of income & expenditure on accrual

basis. Accounting Policies not specifically referred to otherwise are consistent and in

consonance with generally accepted accounting principles There is no change from the

Accounting Policies adopted in the immediately preceding year . In view of the same, there

ie.h2 deviation in the Income computed as per the financial statements and that as per

leps-1

2 Use OF Estimates - The preparation of the financial statements with the generally accepted

accounting principles requires the Management to make estimates and assumptions

considered in the reported amount of assets & liabilities on the date of the financial

Statements & the reported revenues & expenses during the reporting period. Management

believes that the estimates & assumptions used in preparation of financial statements are

prudent & reasonable, Future results could differ from these estimates.

3. Inventories Valuation - The Inventories are valued “at cost or net realizable value ,

whichever is lower” . There is no change from the method of valuation of inventories

aropted in the immediately preceding year . Inventories are as per physically taken, verified,

valued & certified by the Board.

Revenue Recognition - In preparing the Financial Statements , “revenue” falling within the

scope of ICDS IV , are recognized when there is reasonable certainty of its ultimate

collection. As regards to transaction involving sale of goods & services , there is no amount

which Is not recognized as revenue during the previous year due to lack of reasonably

certainty of its ultimate collection along with nature of uncertainty . Mercantile (accrual)

system of accounting is followed for recording all revenues & expenses having regard to

‘materiality of the transaction and size & nature of business of the Company.

5+ Tangible Fixed Assets - Fixed assets are stated at historical cost of acquisition including any

Cost attributable for bringing the assets to its working conditions , less accumulated

Gepreciation. Attributable interest and expenses , if any, of bringing the respective assets to

working condition for their intended use are capitalised, In preparing the Financial

Statements, the treatment of Tangible Fixed Assets is made as envisaged in ICDS V regarding

Tangible Fixed Asset, As regards to the disclosures required to be made under ICDS V, Note

on Fixed Assets annexed to Financial Statements may be referred .

6. Depreciation & Amortisation - Depreciation on assets is provided on written down velue

‘method at the rates prescribed under Income Tax Rules, 1962,

7. Investments - There are no investments during the year .

8. Borrowing Cost - Borrowing costs that are attributable to the acquisition or construction of

the qualifying assets are capitalized as part of the cost of such assets, The amount of

borrowing cost capitalized during the year is NIL.

8. In the opinion of the Board, the current assets loans and advances, are approximately of the

value stated if realised in the ordinary course of the business, The provisions for all known

10.

1

13.

. Figures

liabilities is adequate and not in excess of the

contingent liability.

amount reasonably necessary and there is no

Balances of accounts payables & receivables, loans & advances are subject to confirmations

from the respective parties,

‘There is no contingent liability .

respect of the previous year are re

confirm to the current year’s classification.

Earnings Per Share - Basic and Diluted Earnin

‘grouped & rearranged wherever necessary to

'gS per Share are computed in accordance with

‘Accounting Standard (AS) -20— Earning Per Share.

Page | of 1

'e:

£ ©-FILING anyuiere Arytine

cae ses ieone at depuinen Govinda

g

ACKNOWLEDGEMENT OF RECEIPT OF FORM (Other Than ITR)

ALFA BOILERS PRIVATE ie

Name LIMITED PAN AAECA7332E,

Form N 3CA Sisessment 070.01

ee Year

e-Filing Acknowledgement i" Date of e- :

Number 77362550101 1220 Filing 01/12/2020

For andon behalf of

e-Filing Administrator

(This is a computer generated Acknowledgment Receipt and needs no signature)

Skee] oR

http://127.0.0.1:81/PData/CompuBal/201: 9/A05-01/Other_Acknowledgment_A0S-01_..

01/12/2020

Upendra Mehta & Associates

Chartered Accountants

CTS 101 to 109 Vishal Markel Tilak Road Gulshanabad MALEGAON MAHARASHTRA 429208

Ph 8372722266 2554-230678

e-mail: UPENDRAMG@REDIFFMAIL COM

FORM NO. 3CA

[See rule 6G(1)(a)]

Audit report under section 44AB of the Income-tax Act, 1961, in a case where the accounts of

the business or profession of a person have beon audited under any other law

41. We repor thatthe statutory audit of

Ms, ALFA BOILERS PRIVATE LIMITED

84/3,PLOT NO. 2,3,4,5,0LD AGRA ROAD ISLAMPURA WARD, MALEGAON DIST-NASIK

PAN AAECA7332E

was conducted by us UPENDRA V MEHTA in pursuance of the provisions of the INCOME TAX ACT Act, and we annex

hereto a copy of cur audit report dated 25-Nov-2020 along with @ copy each of -

(2) the auaited Profit and Loss Account forthe period beginning from 1-APR-2019 to ending on 31-Mar-2020

(©) the audited Balance Sheet as at 31-Mar-2020; and

(©) documents declared by the said Act to be part of, o annexed fo, the Proil'and Loss Account and Balance Sheet.

2, The statement of particulars required to be furnished under section 44AB is annexed herewith in Form No, 36D.

3. In our opinion and to the best of our information and according to examination of books of account including other

relevant documents and explanations given to us, the particulars given in the said Form No. 3CD are true and correct,

‘Subject to the following observations/quaitfications, If any:

SH Gualiication Type Observations/Gualifications

1 | Records produced for veriicaton of paymonts |The asseseae has not mado any poymonts excoeding We

trough account payee cheque were not sufiiont [limit in section 40A(}269SS/209" in Cosh, However tie

not possible forus to verity whether the payments in excess

the specified limit in section 40A(3) /269SS/26eT have been

made otherwise than by account payee cheque or account

bayee bank drat, asthe necessary evidence are nt in

possession of he assossen. |

oihers TAs explained os ,in view ofthe nature of aclvity of the

company, numerous tems in ferent measurement uit

are purchased & consumed, In view ofthe same not

possible to quantify the quanilative etal of raw rnatrial &

finshed goots |

For Upendra Mehta & Associates

Chartered Accountants

(Upendra Va

Place :MALEGAON Partner

Date : 25/11/2020 Membership No: 038883,

UDIN : 20038883AAAAEAQ830

FORM NO. 3CD

[See rule 6G(2)]

Statement of particulars required to be furnished under

‘section 44AB of the Income-tax Act, 1961

the books of accounts are kept. (In case books of account are

maintained in a computer system, mention the books of

Jaccount generated by such computer system. If the books of|

‘accounts are not kept at one location, please fuish the

Jaddresses of locations along with the delails of books of|

‘accounts maintained at each location. )

PartA

OF [Ram ate asvesaoe [ALFA BOILERS PRIVATE TIMTED

02 |Ahess Ba. PLOTWG.

ROAD ISLAM

WARO MALEGAON DIST-NASIK

5 | Pima Aunt Wabar PAN) RAECATSSIE

OF |e ie asses Table To pay Taal ahs wide ay Yes

Service tax, sles tay, good and sevice taceustans auto

Ye, pease tush the rogstraton number oe GST humber ay

her Weneaton nue alte fre sone =

Tame oA State oie ogitalen Wo Basen pioray

Goods and service tax [MAHARASHTRA 2TAAECATS32E12x [

State eampany

06 [Previous yar From T-APRROT a 3 Mar2020

O7 [Assessment year ce 2020-21 ana

15 [neat he relevant clause f Secon #@AB Uhder whch re aol etovant aie of sso GAAB Wier WVGH TS

hasbeen coated ud oe bee concued

Clause 44RBy- Toa saleshurnovelgoas

__}roceptsnbuslnesa exceeding spetoee nie

Beal Whenor he aamaiae Was opted Tor tovalon unr malas]

PNGB SoMa tonne 2 =

PartB

09 /@)/if firm or “association of persons, indicate names of] ‘Name ~ | Profit sharing

arnersnembers and el ra shorn race rato

Wa

'b) If there is any change in the partners or members or in ther|No- fo

pratt shxing rato since he fast date ofthe poceang yea

fhe pacdrs of such change

Name of — | Date afchangé | Type change OW pail | Newwrowt] —~— Rena

pateniceer | wate | Sa

rato’ | “Rate

10 | a) /Nature of business or profession (if more than one business or|

broesson i eared en dung tho proviccs year saa ol

every businsa or poteason

Secor Sab Secor Tele

WANUFACTORING Oterfianatacturing nee: Gad

'b) |If there is any change in the nature of business or profession, |No

he partuars of ueh change

Business Sector ‘Sub Sector Code] Remarks ifany

11 | 2) |Whether books of account are prescribed under section 440A, |Bank Book, Cash Book, Journai, Ledger,

ites, nto hooks co pesca! Purchases Reiser, Ssioe Rogitor

11 |b) /List of books of account maintained and the address al which |84/3,, PLOT NO. [Bank Book, Cash Book,

2.3.4.5 ,, OLD AGRA

ROAD, ISLAMPURA

WARD, MALEGAON,

MAHARASHTRA,

423203,

Journal, Ledger,

Purchases Register,

Sales Register

(Computerized)

©) [Uist of books of account and nature of relevant documents|

[Bank Book, Cash Book, Journal, Ledger,

jexamined.

Purchases Register, Sales Register

2

12

[Whether the profit end foss account includes any profits and gains|No

‘assessable on presumptive basisif yes, indicate the amount and)

|the, relevant section (44AD, 44ADA, 44AE, 44AF, 448, 4488,

448BA, 448BB,Chapler XII-G, First Schedule or any other

{relevant section !

Section ‘Amount

Remarks any;

a

|b) |Whether there had Been any change in the method of| No

jaccounting omployed vis-a-vis the method employed in the|

immediately preceding previous year.

'8) [Method of accounting employed in the Previous year Mercantile system

| d) Whether ony adjustment is required to be made to The profits]No

6) If answer to (b) above is in the affirmative, give delalls of auch

[change, and the effect thereof on the profi or loss.

Particulars: Increase in profit (Rs.)

1 Decrease in Remarks ifany:

proft(Rs,)

Jor toss for complying with the provisions of income!

‘Computation and disclosure standards nolfied under section|

14502)

€) | answer to (@) above isin the afirmative, give detalls of sucht

adjustments

Rs) proft(Rs)

Particulars increase in proht] Decrease in | Nat Effect(Rs,)

[Disclosure as par ICDS alae

TDs

Disclosure

ICDS 1- Accounting Policies |As per accounting poli

ies & notes to financial statements

ICDS Ii-Valuation of inventories __|As per accounting polici

ies & notes to financial statements:

ICDS lil Construction Contracts [NA

ICDS IV - Revenue Recognition [AS per accounting policies & notes to financial statements

ICDS V- Tangible Fixed Assets ‘As per Fixed Assets and Depreciation Chart annexed in FORM CD.

ICDS Vii - Governments Grants NA SEE +e

ICDS IX - Borrowing Costs [As per accounting policies & notes to financial statements

Total

|ICDS X - Provisions, Contingent | Provision, Contingent Liablitios and.

Feat tee and Contingent Assets way of notes in the notes on accounts, frequiesd,

‘Assets have beon disclosed by

%

2) | Method of vaiuallon of lasing stock employed In he Previous [Raw Material

year, |Whichever

lower

id Finished Goods Cost or NRV

In case of deviation fiom the melhed of valuation proserbed|No

lunder section 145A, and the effect thereat on the profit or loss,

please furnish:

profs.)

Particulars increase in profit (R3)] Decrease in 4 Remarks ifany:

(Give the following particulars of the capiial asset converled Into] NA

stock in-trade:-

Description of Date of Gost of | Amount at

Capital Assets | Acquisition | Acquisition |” which

capital

assets

‘converted

into stock

6

‘Amounts not credited fo the profit and loss account, baing, >

1a) [the items falling within the scope of section 28; Nil

Description Amount

Remarks Wany:

») the proforma credits, drawbacks, refunds of daly of customs or] Nit

excise or service tax or refunds of sales tax or value added lax|

or Goods & Service Taxwhere such credits, drawbacks or

[#efunds are admitted as due by the authorities concerned;

I Description Amount

3

Remarks irany,

©) [eseslaion aims ascopled daring the previous year

Daseintion [Amount Renae anys

4) | any other item aFincome,

Description ‘Amount |

Remarks frany:

| ©) |eapital receipt eny.

Description ‘Amount Remarks Wfany:

WF [hers any Tend or bulding or both Te Wanstened Guine We|We

Previous year for a consderation less than value adented

assessed or assessabie by any authoriy of a State Govonmont

feferred to in section 43CA or SOG. please furnish, ES

| | Deias of | Considerai] Value] Remarks 7 ‘Adtiess | Aaaress|— Cyr — Stale | Prccas

Property |onreceived| adopted or} any: | ‘Linet” | ‘tinea” | aur

or accrued | assessed Distt

°F

assessable is |

! pee l a

"8 |Panloulas oF depredaon allonable as per te Income ax Ral [Ae Pov Aamaaive

{964 in respect of each asset or block of essels ashe cave oy

bein the folowing form =

a) |Description of assetbiock of assets.

+b) [Rate of depreciation.

6) [Adal cost or willen down Value, 05 We tas Thay Be

Adjustment made fo te writen down value under section

11SBAA (or assessment year 2020°21 ony)

| eb|Aajustod writen down vatue

1) [Cental Value Added Tax creat eaimed and alowed indy

he Central Excise Rules, 1044, in respect of ascets|

acquited on or afer 1st March, 1984,

[i [enange in rate of exchange of currency, and

‘id Subsidy or grant or reimbursement, by whatever narie|

called.

| [© [Depreciation aliowabie. L i

') [Written down value ai the end of the year

19 [Amounts admissible under sections

Seclion [Amount debited to | Amount aanisabie ae Remarks any

Pal per he provisions of

the Income-tax A

1961

20/2) Any sum paid to an employee as bonus or commision tor] Ni

services rendered, where such sum was othenvise payable to

{hrm as profits or dividend, Section 36(1)(9] a

| Description ‘Amount Remarks any:

0) [Details Of contributions received trom employeas Tor various

funds as referred to in section 36(1)iva)

Name of Fund ‘Amount | ~Ralual Dale] — ue Data |The aca]

{amount paid

i J

2a eae ueh We deals of amounts Gebed To the OT and oss ACCT, boing ae ale capa personal

advertisement expenditure ete

1 [expenditure of capital nature Nir

Particulars ‘Amountin Rs, | Remarks irany:

i

[expenditure of personal nature;

Particulars

‘Amount in Re,

Remarks Wany;

Particulars

jexpenditure on advertisement in any souvenir, brochure, [NIT

fact, pamphlet or the ike, published by a pollical party.

‘Amount Ta Re,

Remarks any:

‘Expenditure incurred at clubs being enivar

subscriptions

ince Tees and [NIT

Particulars

and faciitias used

[L_ Anountin

‘Expenditure incurred ai clubs being coat for cub senvicea] NIT

Remarks if any,

tt

Pariculars

‘Amount in Rs.

Remarks Fany:

| [7 |espenaiire by way oF any

Expenditure by way of penally or fine for vic

law for the time being force

lation oF any]

Particulars

‘Amount a Re,

Remarks Wany:

{covered above

other penaliy oF fe not Ni

Particulars

“Amountin RS:

‘under section 200(1)

has not been paid during the previous year or in the|

Subsequent year before the expiry ot time prescribed

8 | Expeniure tneurred Yor ay purpose which is an ofaice IT ce al

lot which is prohibited by law co oe

Particulars Amountin Rs. | Remarks if any:

'b) [Amounts inadmissible under section 40(a)= Hae

| [a8 payment to non-resident referred to in sub-clause fi) ooo

/[Delails of payment on which ix snot deducted: fi 1

| pale of | Ameunt ]Naiute of Name of | PAN of | Address | Address | Gly at] Pnosds | Remare

payment] of | payment| the | the | Line?) | Lines’ | om, itany

payment payee | payee Distt

it feptionap | _

2) Details of payment on whieh Tax has Deon deduced but [NIT ——

5

Date of | Amount | Nature [Name of] PAN of [Adivoa [Adress] iy or | Phcods | Taunt [Romane

payment] of of | the | the | Line? | Line2 | Town or oftax | ifany;

ayment| payment! payee | payee Dit eaucte

(@piona d

)

[as payment fo resdent refered toh sub-clause [ay

[Delis of payment on which taxis not deducted: Ri

|_| | Bale ot | Amount [Nature off Name of | PANT | Aaaress | Adress | Gly ar] Finale | Ronee

payment | of | payment | the | tte | tinet | noes irany

payment payee | payee

(optional)

| Poa

| Deals of payment on which tax Ras boon deduced bul Ni

|has not been paid on or before the due date epected i

sub-section () of section 199,

Date of [Amoun] Nature | Namo [PAN of Addres [Adare | Cy or [Pod [Amun | Amount] REMSr

payment) vot | of | ofthe | the |'sLine | stine | Tow |e |raron | mount | Rema

Payme | payme | payer | Payer 4 2 or deduct} (VI) any:

nt nt (option District ed | deposited|

al) ifany.

{

iii Jas payment referred to in sub-clause (ib)

A] Details of payment on which levy is not deducted: [Nir

Nature of | Name of

payment | the

payee

[ Date oF

| | | payment

“Amount

of

payment

PAN OF

the

payee

(eptional |

Aadross

Ling

Address

Line 2

Pincode [Remarks |

itany:

Gily or

Town or

District

et

e

Details of payment on which levy has been deducted]

but has not been paid on or before the due date

| pected in sub- section (1) ef secton 120

Date of [Amoun | Nature | Name | PAN of

payment of | ofthe | the

payme| payer | Payer

at | {option

{ | al)

‘Addres

shine

1

[Addres | City or

‘Line

2

‘Amoun] Amount

toftax | “outof

deduct) (Vi)

ed |deposited|

itany

]Pincoa Remar

Town |e

or

District

any:

| ao

Fringe benef tax under sub-clause (c)

Weaith fax under sub-clause (ia)

(| Royall, Tcense feo, service fee ele. under sub-Gause Gd]

| Salary payable outside Indialto a non resident without TDS

Jote. under sub-clause (li)

Zele

PAN of

the payee

(optional)

Date of | Amount | Name of

payment | of | the payee

[ payment

Address Line

1

‘Address Line] Giiy or

Pineods | Rematks

2 Town or any:

District

Payment to PFfother fund etc, under sub-clause (v) |

| ix [Tax paid by employer for parqulsies under subdaise Wy

o

|Arounts debited to prot and ls account being seep

salary, bonus, commission or emunetaton naameebie ek

secon 400)/40(t) and computation tev

NA

Particulars | Section Amount

debited to Pi.

AC

Description

‘Amount ]

admissible

‘Amount

inadmissible

a

Disallowanceldeemed income under section 40A@)>

‘A ]On the tasis of the examination of books of account and]

other relevant documents/evidence, whether the

Jexpentiture covered under section 40A(3) read vith rule

SDD were made by account payee cheque dravn on a

bank or account payee bank draft. Ifnot, please furnish the

details:

L

Name ofthe

payee

Date of

payment

Nature of payment | Amount

PAN OF

the payee.

(optional)

Remarks any:

‘On the basis of the examination of books of aecounl and

other relevant documenis/evidence, whether the payment

referred to in section 40A(3A) read with rule 6DD were

Jmade by account payee cheque drawn on a bank or!

/account payee bank draft if not, please furnish the details

Jof amount deemed to be the profits and gains of business|

lor profession under section 40A(3A);,

Date of | Nature of payment | Amount

payment

Name ofthe

payee

the payoe|

PAN of Remarks any:

optional)

)

[provision for

ayant of ally not afowabe under See]

40A(7);

9

[any sum pald by the assessee as

lunder section 404(9)

‘an employer not allowable’

Nir

9

Particulars of any liabilly of a contingent nature;

i

Nature of Liability “Amount

Remarks irany:

Ay

‘amount of deduction inadmissible in terms of section 144

fespect of the expenditure incurred in relation to income which

does not form part of the total income;

i

Particuiars| “Amount

Remarks i any:

1) Jemount inadmissible under the proviso lo

Nil

22 |Amount of inlerest inadmissible under section 23 of the ‘Micro, [Nil

‘Small and Medium Enterprises Development Act, 2008.

|4082)(b).

23 |Parliculars of payments made to persons specified undar section AS PF ‘Annexure "

[Section [Desc

24 |Armounts deomed to be profs and Gans under Sécion SIAC oF]

|S2AD or 3948 or 334BA or 33AG

ion

[__ Amount

Remarks irany:

{computation thereof.

25 |Any amount of profit chargeable to tax under section 41 and] Nil

Name of Party

‘Amount of [Section Description of | Computation | Remarks W any: |

Income

transaction ‘any

Se I ae eet

26 | i [in respect of any sum referred to in clause (@)(O)(@).(@)(e).W) or @) aT eackon 435. he Tiabily Tor which

year and was,

‘A [pre-exisied on the frst day of the previous year but was]

‘not allowed in the assessment of any

¥y preceding previous

| Nature of iabiity

B) | pald daring te

9) [paid during the pravious year, Ni

Remarks W any: ~ Section

previous year Ni EE

Nature of Uabiity Remarks any. [___Seation

3 incurred in the previous year and was

paid on or before the dle date for furnishing the retum| Ae Par Annex

income of the previous year under section 139(1);

‘not paid on or before the aforesaid dale. Nir

Naiure of Liabiliy

| Amount Remark Fan: Seaton

[passed through the profits

“T'|Slate whether sales tax.goods & service Tax custome ‘duty, [No

| [excise duty or any other indirect taxlevy,cess,impost etc.is|

and ioss account.

utilised during the previous

[Amount of Central Value Addec

36 Tax credits availed of er|No

Year and its treatment in the profit

fand loss account and treatment of outstanding Central Value

|Added Tax credits in the accounts.

Particulars

Capital [input (Re) Trealment

Goods

(Rs)

1coma or expenditure of prior period credited or]NA

; |debited to the profit and loss account

Type

Particulars

| Ameunt Prior period fo which | ~ Remarks Wany:

itrelates(¥ear in

es yow-yy forma)

28 /Whether during the previous year the assesses has received any|No

property, being share of a company not being a

the public are substantially interested, without consideration or for

‘inadequate consideration as referred to in sect

‘company in which

ion 56(2)(via), if

yes, please furnish the details of the same.

Name ofthe || PAN of | "Name ofthe [Ci afthe| No.of [Amount ef] Far] Raman any:

person from {the person} company whose | company | Shares |considerat| Market

which shares | (optional) | shares are Received | ‘ion paid | value of

received received the shares

ae l

29 [Whether during the previous year the asceasce Tecoived any] No

lConsideration for issue of shares which exceeds the fair market

Value of the shares as referred to in section 86(2)(vib), if yes,

|please fumish the details of the same,

Name of the person from [PAN ofthe | No.of [Amountof] Fair Remarks any:

whom consideration {person (oplionel)| Shares | consideral| Market

received for issue of shares issued |” ion | valuaof

received | the shares

2

‘A Whether any amount is to be included as Income Chargeable [NA

junder the head income from other sources as referred {o in|

[clause (x of sub section 2 of section 56

‘Nature of Income “Amount

Remarks ifany:

Fa

'B |Whether any amount is fo be included ae income chargeable [NA

lunder the head Income from other sources as referred to in|

[clause (x of sub section 2 of section 86

Nature of Income ‘Amount

Remarks any

30

Details of any amount borrowed on hundi or any amount due|No

thereon (including interest on the amount borrowed) repaid,

otherwise than through en account payee cheque. [Section 690]

Name | Amount /Remark | PAN of Address | Address] City or | Slate |Pincode] Date of [Amount |Amou] Date

ofthe |borowe|sifany:| the | Line 1 | Line 2 |Town or Borrow | duo |nt | of

person} d person Distt ng} includin repai | Repa

‘rom (ptiona a | @ |ymen

whom » interest t

| amount

borrowe |

dor

repaid

on | |

unc }

]

30 [A | Whether primary adjusiments to transfer price, a8 refered 10|NA

in sub section (1) of section 92CE, has been made during the

previous year?

‘Clause under which of fAmountin Rs | Whether the | Whether | Amounl(Re) of [Expected] Remarks Fanyr

Sub section(t) of | ofprimary | excessmoney | the impuied | Date

92CE primary | adjustment | available with | Excess | interest income |

‘adjustments is made associated | _money on such excess

enterprise is | has been | money which

required tobe |repatiated) has not been

fepatrated to | within the | repatriated

India as perthe [prescribed] withinthe |

provision ofsub | time | prescribed time

section 2) of

Section S2CE

30,/B Whether the assessee fas incurred expenditure during the|NA

Previous year by way of interest or of similar nature exceeding]

Jone crore rupees as referred to in sub section (1) of section

948

‘Amounifin |” Eamings “| Amount (In ] Ass Vear of | Amount of | Ass Year af | Amountot | Remarks Fanys

Roof | before Rs)of | interest | interest | interest | interest

interest or | interest, | expenditure | expenditure | expenditure | expenditure | expenditure

similar |taxdepreciat| byway of | brought | brought | caved | carried

nature | jonand | interest of | fonvard as | forward as | forward | forward

incurred Jamortzation(| similar | persub | persud | carried | canied

EBITDA) | nature as_| section (4) off section (4) of forward as | forward as

during the | per() above | section 948 | section 948 | per sub | por sub

previous |" which section (4) of section (4) of

year (ins) | exceeds section 94-8 | section 94.8

30% of

EBITDA as 87's lwo

per (i) above ee!

30 /C|Whelher the assessee has entered info an impermissible [NA

| avoidance arrangement, as referred to in section 96 during the|

Provious year (This Clause is kept in abeyance til 31st

March 2021)

Nature ofthe impermissibie avoidance | Amount (n Rs) of tax Remarks Fany:

| ‘arrangement benefit in the previous

year arising, in

aggregate, to all

Parties to the

arrangement

a

3) [Parficuars of each foan or deposttin an amount exceeding Os]

[tim specified in section 2698S taken or accepted during the

[previous year

Paricula's of each specified sum In an amount exceeding the

iit spocied in section 2698S taken or accepted during the

previous year.

[As Por Annexure *D™

Ni

Name ofthe person om [Adress of te Name oth parson] FAN othe Naive | AriounTat ~[Wreiaris] Ts case We

‘wham specified sumis | fom whom specied sum i received |of he person trom| spectted sum | spectig | “yaacaxt

Toeeived whom speciied |“ takener” | sumvas | somwes

sumis receives | accepted | takenor | taken or

(optional) accepted by | accepted by

‘cheque or | cheque or

bank after) bank dra,

Use of | vihether the

lection | Same was

dearing. | ‘taken ot

system | accepted by

twrough » | Sn aocount

| | tank | “payee

seccin | eat

payee bank

rah

[Paticulars Gf each receipt in an amount exceeding the] Nil

mit specified in section 268ST, in aggregate from a

jperson in a day or in respect of @ single transaction or in|

espect of transactions relating to one event of occasion

[tom a person , during the previous year, where such

eceipt is otherwise than by a cheque of bank drat or use|

of electronic clearing systom through a bank account a

‘Name of fie payor ‘Address ofthe payer] PAN ofthe payer | — Nature of Amount | Date of

ane (eptenay | tansacton_| “receipt | tecoist

|

b Jb) |Pariculars of each receipt in an amount exceeding the] Nil

limit specified in section 26987, in aggregate from a

Person in a day or in respect of ‘single transaction of in

Tespect of transaction relating to one event of occasion

{from a person, received by cheque or bank draft, not being

fan account payee cheque or an account payee bank drat

during the previous year

Name ofthe payer ‘areas OTe payer PAN ofthe payer (optional ‘Aout ar eseipt

[¢) |Pariculars of each payment made in an amount excooding NT

the limit specified in section 269ST, in aggregate to a

Person in a day or in respect ofa single transaction or in|

espect relating to one event or occasion to a person,

jothenmise than by a cheque or bank draft or use of|

{electronic clearing system through a bank account during

the previous year as

‘Name ofthe Payes ‘Aairase Oe Payee] PAN ofthe Payee] Nature of | Amant a | bale of

(optiona) | wansaeton_| “payment _| payment

b/@) [Particulars of each payment in an amount exceeding the]NI

limit specified in section 269ST, in aggregate to a person

in a day or in respect of single trensaction or in respect

rolling to one event or occasion to a person, made by a

cheque or bank drat, not being the an account payee

Jcheque or an account payee bank draf, during the

[previous year :

‘Name of the Payee Raeiess te Payee PAN af the Payee (optional) | Amount of payment

©) |Partculars of each repayment of lean or deposit or any

specified advance in an amount exceeding the limit specified

in section 2697 made during the previous year:

[As Per Annexure "E™

4) [Particulars of repayment of loan or deposit or any specifed|

jadvance in an amount exceeding the limit specified in section

}269T received otherwise than by a cheque or bank draft or

Juse of electronic clearing system through a bank account

Nir

during the previous year

[Wa ofthe payer ‘Raaiess OTe payer PAN of payer | _Ananter

| (oiona) | repaymentot ean

| Sapo or any

spocted savance

received oeree

than by acheaue

or bank dro or uso,

ofeectonc

clean system

through a bane

account curing the

| Hees "previous year |

) |Pariculars OF repayment of ioan or deposi or any specifed| NI

advance in an amount exceeding the limit specified in secton|

2897 received by @ cheque or bank draft which is not an.

‘account payee cheque or account payee bank draft during the

previous year ee ee

‘Name of tie payer ‘Adaress OT he payer PAN of tie payer

(optional) | repayment of oan

‘or depositor any

specited advance

teoeived by a

cheque or a bank

draft which is net

‘an account payee

| cheque or account

ie payee bank aft

during the previous

po oe _ year

82 | a) [Details of brought forward loss oF deprecaiion alowance, inp 7

the following manner, to the extent avaiable : |

‘Serial No | Assessme | Nature of [Amountas| All | Amount as ‘Amount as assessed Remarks

mtYear | loss/ | returned | losses/allo| adjusted | (give reference to

Depreciati wances | by televant order)

on ‘not | withdrawal

allowance allowed | of

under | additional

section | depreciatio

145BAA | non

‘account of

‘opting for

| taxation

under

section

A1SBAA

‘Amount | Order US

HEE Eee and date

') | Whether @ change in shareholding of the company has Texen|No

Place in the previous year due to which the losses incured

prior to the previous year cannot be allowed to be carried

onward in terms of section 78, Eee

©) | Whether the assesse_ has incurred any speculation Tose —|No

referred oin secon 73 during the previous year, tyes,

please furnish the detais of the same aes

‘) | Wiether the assesse has incurred any Toss referred on |No

section 73A in respect of any specified business during the

previous year, ifyes, please fumish details ofthe sams,

@]]In case ofs company, please state that whether the company [No

is deemed to be carrying on a speculation business as,

eferred in explanation 0 section 73, if yes, please furnish the

| details of speculation loss if any incurred during the previous

year.

38 |Section-wise delais of deductions, any, admissible undev/ NIT

‘Chapter VIA or Chapter ill (Section 10A, Section 10A),

Section “Amount Remarks Wany.

4 |a) [Whether the assessee Is fequired to deduct or collect tax as] As Per Annexure"

per the provisions of Chapter XVII-B or Chapter XVILBB, ifyes|

Please furnish;

10

[5 | Whetter the asseese is required to fuiich the Satement af] Yes

|\ax deducted or tax collected Ifyes please fumsh tn dota

Fax deduction and] Type ofForm | Oue dale for) Date oF "Wrek, pleaso nish iat a

| calectonAezoun| furnishing statement ot | deiaistransactions which

Number (TAN) taxdeducted | ~ “are not reported

or collected

Contains

information

| about ait

| transactions

| ich ae |

required tobe |

crt _| repented ase

NSKADSOs6F — [26a siaraove — |asTurz07e [ves I

[NSKAO3036F 260 31-Oct-2019” [29-Oct-2019 Yes

NSKAO3036F——126Q ssJan-2020_ [28-Jan-2020 [Ves

| nSKA03036F {26a [34-Jul-2020 [25-Jun-2020 [Yes —

| [O)]whether the asseasee Is Table To ay interest under seclion|No

!201(1A) or section 206C(7).fyes, louse furnish, cit

Taxdeduelon | Amountof Amount paid | dale oT Remarks any

andcolecion | Interest under | cut of column | payment

Account section @)

Number (TAN) |201(1A)/206¢(7 |

| Dis payable cere Bete

36 a [in he case ofa rading concen, cve quanlatvedetals of pindpal ems of Goods Waded

tiem Name Unt] 9pening Tpurehases curing] sales during tie | cosa Soak] ahovageT

stock” |the previous year| previous year excess, i

| cet et an

WR 4

oor ese 8 manufacturing concern, Gve quantlaWve Glas Of Whe pincpal Tami of Taw malelake Wahod

[products and by-products, a a

‘\]Raw Materials =

Nem Name]"“Unit pening [purchas [eonsum | sales] -Gosing | "yaaa? “shortage

stock | es | pion | during | ‘stock’ | tnishee excess,

ating | during | “the producls itany

the | “the” | previous

Previous previous) * year

——_Lvear “year He

z

“emNaie [Uni “openiig—Y prehases | guanlly yeaa aura] chang —|-shataye7

Stock” | dung the |marufactred|the previous ‘atose | Sokeley

previous |"euringthe | your ay

at__| previous yoar

NA

C [ey products:

Tem Name Unit ‘opening “| purchases |” ~quantity | sales during ‘closing [shortage

Stock | during the |manuactured| tie prevows| ‘stock’ | ereneSy

previous |""donngthe. | year any

tt year | prevows year

WA

36 [In the case-of a domeatic company, details of x on distibulod] Ni

profits under section 115-0 in the following form :-

(2) Total” amount of eduction as | (b) Total | (Date of Paymonls wih Remarks Wany:

amount of | ‘referredtoin section | tax paid “Amount

distibuied thereon

profits

THEO) | TIE-OGIAY Dales of | “Ariount

0 i payment

{

[A Jeter the assessee has received any amount in The nalure]NA

of dividends as referred to in sub-Clause (€) of clause(22) of

section 2

“Arcut Reeivedva RY] Dats ofrasant T Rar any

[cost auditor,

| 87 |Whethor any cost audit was cariied out, F yes, give tha datails, #]No

‘any, of disqualification or disagreement on any

| matteritem/value/quantity as may be reportedidentified by the

38 |Whether any audit

1944, if yes, give the details, if any, of disqualification or

disagreement on any matteritemivalueiquantity as may. be

Teportediidentiied by the auditor.

was conducted under the Central Exelse Ack [Ne

‘39 |Whether any audit was conducted under section 72A of The|No

Finance Act,1994 in relation to valuation of taxable services, if

'yes, give the details, if any, of disqualification or disagreement on

any matteritem/value/quantity a8 may be reportedjideniiied by

Lie auctor SNS fee

40 [Details tegarcing umover, grove profi, ef, forthe previous year]

and preceding previous year __ a