Professional Documents

Culture Documents

Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022

Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022

Uploaded by

Meg CruzCopyright:

Available Formats

You might also like

- Craig's Design and Landscaping Services: Profit and Loss % of Total IncomeDocument2 pagesCraig's Design and Landscaping Services: Profit and Loss % of Total Incomeapi-528502931No ratings yet

- Conceptual Framework Qualitative CharacteristicDocument99 pagesConceptual Framework Qualitative CharacteristicXander Clock0% (1)

- Managerial Economics Center of Gravity: TH TH THDocument1 pageManagerial Economics Center of Gravity: TH TH THReginald ValenciaNo ratings yet

- KPMG Technical Terms Commercial Accounting and Tax LawDocument44 pagesKPMG Technical Terms Commercial Accounting and Tax LawIosias100% (3)

- Financial Statements Practice ProblemsDocument5 pagesFinancial Statements Practice ProblemsnajascjNo ratings yet

- Assignment 2465 - 02 PDFDocument2 pagesAssignment 2465 - 02 PDFAhsan KamranNo ratings yet

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- C. Inclusions and Exclusions From Gross IncomeDocument10 pagesC. Inclusions and Exclusions From Gross IncomeGreggy BoyNo ratings yet

- ACTIVITY 06 Accounting For A Service Provider Additional ExercisesDocument3 pagesACTIVITY 06 Accounting For A Service Provider Additional Exercises이시연No ratings yet

- Business Law and Regulations Departmental Exam ReviewerDocument29 pagesBusiness Law and Regulations Departmental Exam ReviewerGraciela InacayNo ratings yet

- Ia1 Posttest3 - Inventories (Questionnaire)Document8 pagesIa1 Posttest3 - Inventories (Questionnaire)Chris JacksonNo ratings yet

- Special Allowable Itemized DeductionsDocument13 pagesSpecial Allowable Itemized DeductionsSandia EspejoNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Magna Carta For Residential Electricity ConsumersDocument56 pagesMagna Carta For Residential Electricity ConsumersVanvan BitonNo ratings yet

- Confras Transes Module 1 and 2Document16 pagesConfras Transes Module 1 and 2Cielo MINDANAONo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- 2019 Level 1 CFASDocument8 pages2019 Level 1 CFASMary Angeline LopezNo ratings yet

- PROBLEM SOLVING (4 Items X 5 Points) : Expected Utilization RatesDocument3 pagesPROBLEM SOLVING (4 Items X 5 Points) : Expected Utilization RatesSnapShop by AJNo ratings yet

- IA3 - REVIEWER - Internediate 3Document38 pagesIA3 - REVIEWER - Internediate 3Mujahad QuirinoNo ratings yet

- Name: Section: Date:: Angel SantaDocument5 pagesName: Section: Date:: Angel SantaJoebet DebuyanNo ratings yet

- Financial Accounting Reviewer - Chapter 65Document11 pagesFinancial Accounting Reviewer - Chapter 65Coursehero PremiumNo ratings yet

- AP - A05 Audit of LiabilitiesDocument7 pagesAP - A05 Audit of LiabilitiesJane DizonNo ratings yet

- Porter's Five Forces Analysis of Technology SectorDocument6 pagesPorter's Five Forces Analysis of Technology SectorRAVI KUMARNo ratings yet

- Chapter 9 - Regular Income Tax: Inclusions in Gross IncomeDocument4 pagesChapter 9 - Regular Income Tax: Inclusions in Gross IncomejellNo ratings yet

- Risk and Return: Sample ProblemsDocument14 pagesRisk and Return: Sample ProblemsRynette FloresNo ratings yet

- Problem With Solution For Intermediate Accounting 3Document1 pageProblem With Solution For Intermediate Accounting 3Luxx LawlietNo ratings yet

- 01 Problem Solving 1Document3 pages01 Problem Solving 1Millania ThanaNo ratings yet

- EXAM-223 1 To 3Document9 pagesEXAM-223 1 To 3Nicole KimNo ratings yet

- Origin and Development of Operation ResearchDocument11 pagesOrigin and Development of Operation ResearchJaspreet SinghNo ratings yet

- Hasselback Company Acquired A Plant Asset at The Beginning of PDFDocument1 pageHasselback Company Acquired A Plant Asset at The Beginning of PDFAnbu jaromiaNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Job Order Costing: Cost Accounting: Foundations and Evolutions, 8eDocument34 pagesJob Order Costing: Cost Accounting: Foundations and Evolutions, 8eFrl RizalNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- MAS Bobadilla-Product Quality and Productivity Total Quality Management PDFDocument5 pagesMAS Bobadilla-Product Quality and Productivity Total Quality Management PDFrandyNo ratings yet

- Session 2Document8 pagesSession 2Muhammad Haris100% (1)

- Tax - First Preboard QuestionnaireDocument14 pagesTax - First Preboard QuestionnairewithyouidkNo ratings yet

- ACCCOB3Document87 pagesACCCOB3Lexy SungaNo ratings yet

- SolMan (Advanced Accounting)Document190 pagesSolMan (Advanced Accounting)Jinx Cyrus RodilloNo ratings yet

- #5 NCA Held For SaleDocument3 pages#5 NCA Held For SaleMakoy BixenmanNo ratings yet

- 6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument2 pages6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- Stracos Module 1 Quiz Cost ConceptsDocument12 pagesStracos Module 1 Quiz Cost ConceptsGemNo ratings yet

- Lupisan-Baysa PDFDocument206 pagesLupisan-Baysa PDFRicart Von LauretaNo ratings yet

- Chapter 13a - Ordinary Allowable Itemized DeductionsDocument9 pagesChapter 13a - Ordinary Allowable Itemized DeductionsprestinejanepanganNo ratings yet

- Statement of Comprehensive Income - ExerciseDocument2 pagesStatement of Comprehensive Income - ExerciseMary Kate OrobiaNo ratings yet

- Solution 2Document5 pagesSolution 2Alexandria SomethingNo ratings yet

- FM 1 Assignment 1Document3 pagesFM 1 Assignment 1Jelly Ann AndresNo ratings yet

- Team PRTC 1stPB May 2024 - TAXDocument7 pagesTeam PRTC 1stPB May 2024 - TAXAnne Marie SositoNo ratings yet

- Executive SummaryDocument20 pagesExecutive SummarySamNo ratings yet

- Franchise AccountingDocument16 pagesFranchise AccountingJi YuNo ratings yet

- Chapter 14 Assignment Exercise 1: Department 1 2 4 TotalDocument18 pagesChapter 14 Assignment Exercise 1: Department 1 2 4 TotalAna Leah DelfinNo ratings yet

- Part 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Document66 pagesPart 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Alyssa PilapilNo ratings yet

- Chapter 13 - Principles of DeductionsDocument13 pagesChapter 13 - Principles of DeductionsjellNo ratings yet

- SAP Workbook 03Document53 pagesSAP Workbook 03Morphy GamingNo ratings yet

- 06 Activity 1 Renion-SenaDocument2 pages06 Activity 1 Renion-SenaGoose ChanNo ratings yet

- Civil SocietyDocument6 pagesCivil SocietyBethel DizonNo ratings yet

- Problem 36 14Document18 pagesProblem 36 14Janna rae BionganNo ratings yet

- Quiz Chapter-2 Partnership-Operations 2020-EditionDocument7 pagesQuiz Chapter-2 Partnership-Operations 2020-EditionShaz NagaNo ratings yet

- 09 Task PerformanceDocument5 pages09 Task PerformanceAngel Joy CalingasanNo ratings yet

- San Beda University: Department of Accountancy and TaxationDocument11 pagesSan Beda University: Department of Accountancy and TaxationOG FAMNo ratings yet

- Preparation of Income Tax Return IndividualDocument2 pagesPreparation of Income Tax Return IndividualFRAULIEN GLINKA FANUGAONo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Quiz On Tax On CompensationDocument3 pagesQuiz On Tax On CompensationMaster GTNo ratings yet

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- Answer Key Quiz On Graduated Income Tax 1 PDFDocument3 pagesAnswer Key Quiz On Graduated Income Tax 1 PDFMeg CruzNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Pre-Feasib Atos Cabacungan Cruz, Meghan Durian Mabuyo MacawadibDocument8 pagesPre-Feasib Atos Cabacungan Cruz, Meghan Durian Mabuyo MacawadibMeg CruzNo ratings yet

- Module 1 Project Feasbility Study NotesDocument7 pagesModule 1 Project Feasbility Study NotesMeg CruzNo ratings yet

- Module 3 Financial Ratios Practice ProblemsDocument2 pagesModule 3 Financial Ratios Practice ProblemsMeg CruzNo ratings yet

- Operating SegmentsDocument10 pagesOperating SegmentsUdit JindalNo ratings yet

- Douglas A. Chandler v. Commissioner of Internal Revenue, 226 F.2d 467, 1st Cir. (1955)Document6 pagesDouglas A. Chandler v. Commissioner of Internal Revenue, 226 F.2d 467, 1st Cir. (1955)Scribd Government DocsNo ratings yet

- PAYE Scheme (Chapter XIV of The Inland Revenue Act No 10 of 2006)Document12 pagesPAYE Scheme (Chapter XIV of The Inland Revenue Act No 10 of 2006)Audithya KahawattaNo ratings yet

- Quiz 2nd YearDocument4 pagesQuiz 2nd YearJeryco Quijano BrionesNo ratings yet

- Academy Trust External Audit Preparation ChecklistDocument8 pagesAcademy Trust External Audit Preparation ChecklistAyşe BalamirNo ratings yet

- Port Pricing PDFDocument86 pagesPort Pricing PDFMw. MustolihNo ratings yet

- EastGate at GreyHawk Analysis 3.20.17Document11 pagesEastGate at GreyHawk Analysis 3.20.17vobhoNo ratings yet

- Capital Budgeting 2Document3 pagesCapital Budgeting 2mlexarNo ratings yet

- Chapter 2Document51 pagesChapter 2prathibakb0% (1)

- Lease Accounting IFRS 16Document6 pagesLease Accounting IFRS 16rqpNo ratings yet

- Individual Income Tax ComputationsDocument13 pagesIndividual Income Tax ComputationsclarizaNo ratings yet

- Jntuh Financial Management Model PaperDocument2 pagesJntuh Financial Management Model Papervijay kumarNo ratings yet

- MbaprojectDocument60 pagesMbaprojectJayanthiNo ratings yet

- Module 5 Intacc SoluDocument13 pagesModule 5 Intacc SoluMiks EnriquezNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)haroonsaeed12No ratings yet

- Assignment: 1. What Are Your Expectations From MBA (Power Management) From Npti?Document5 pagesAssignment: 1. What Are Your Expectations From MBA (Power Management) From Npti?Amit SinghNo ratings yet

- Immunization StrategiesDocument20 pagesImmunization StrategiesnehasoninsNo ratings yet

- Chapter 2 - Sustainable Development: Definitions, Measures and DeterminantsDocument54 pagesChapter 2 - Sustainable Development: Definitions, Measures and Determinantsvignesh mnsNo ratings yet

- Sample Question On SQLDocument3 pagesSample Question On SQLoptimuz primeNo ratings yet

- Non-Financial Liabilities HomeworDocument6 pagesNon-Financial Liabilities HomeworIsabelle Guillena60% (5)

- Accounts Chapter 8Document10 pagesAccounts Chapter 8R.mNo ratings yet

- SPSD Case StudiesDocument4 pagesSPSD Case Studiessohanlon07No ratings yet

- Aznar Vs CtaDocument2 pagesAznar Vs CtarobbyNo ratings yet

- FSM Dec 19 - Answers - With Working NotesDocument20 pagesFSM Dec 19 - Answers - With Working NotesmadhaviNo ratings yet

- Princess Dress ShopDocument13 pagesPrincess Dress ShopKram Olegna Anagerg75% (4)

- WS-Percentage Problems 1Document1 pageWS-Percentage Problems 1mysteriousm333No ratings yet

Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022

Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022

Uploaded by

Meg CruzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022

Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022

Uploaded by

Meg CruzCopyright:

Available Formats

Department of Accountancy and Taxation

COLLEGE OF ARTS AND SCIENCES

San Beda University

Manila

FINAL DEPARTMENTAL EXAMINATION

SUBJECT CODE/ TITLE: TXINCME -Philippine Tax System

Instructions:

1. Answer these problems on a separate paper by your own handwriting.

2. Provide solutions and double rule your final answers. No solution, no credit.

3. Take a picture of your answers and send them individually to my Messenger account.

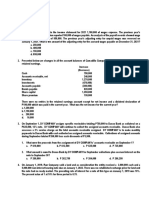

1. Through the information given by Albert Rivers, a Canadian rock star promoting an upcoming concert

in the Philippines, the BIR was able to collect/recover unpaid taxes of a Chinese Tax evader amounting

to P1,400,000. How much is Albert entitled to receive as a reward, net of tax?

a. P900,000

b. P126,000

c. P1,260,000

d. P0

For Numbers 2-5:

Polka Cilla is a rank and file employee in an Advertising Firm in Makati. In the year 2019, he had the following

compensation record:

Basic Pay P500,000.00

Overtime Pay 200,000.00

13th Month & Other Benefits:

13th Month 20,000.00

14th Month 20,000.00

15th Month 20,000.00

Christmas Bonus 10,000.00

Creditable Withholding Tax 156,000.00

De Minimis Benefits:

Christmas and Anniversary Gifts 3,000.00

Laundry Allowance 2,600.00

Employee Achievement Award in kind 12,000.00

Actual Medical Assistance 5,000.00

Rice Subsidy 22,000.00

Medical Cash Allowance To Employee Dependents 2,500.00

Uniform and Clothing Allowance 5,000.00

Productivity Incentive Allowance 18,000.00

Persons Living with and Dependent on the Taxpayer :

3 Illegitimate Children (Aged 22, 23 and 25)

1 Minor Adopted Child

Senior Citizen Father

1 Foster Child

2. Polka’s Total Compensation Income is:

a. P699,000

b. P700,000

c. P650,000

d. P649,000

3. Polka’s Taxable De Minimis Benefits amount to:

a. P11,200

b. P10,000

c. P3,800

d. none

MENTORING THE BEDAN CPA

TAX01-Philippine Tax System 2nd Semester, AY2021-2022

Final Examination Page |2

4. Polka’s Tax Payable/(Refundable) for the year is:

a. P105,000

b. (P51,000)

c. P26,920

d. P56,000

5. Polka’s Total De Minimis Benefits exempt by law:

a. P70,100

b. P80,100

c. P60,100

d. P0

6. Benjamin, a resident Filipino, married but legally separated, supporting his mother, has the following

transactions for the year 2020:

Sales P2, 000,000

Cost of Sales 1, 150,000

Operating expenses 560, 000

Interest income from BDO 10, 000

Interest Expense 20, 000

Other transactions:

Sale of office equipment held for 5 years:

Selling price 100, 000

Cost 120, 000

Accumulated depreciation 80, 000

Sale of family van-bus held for 3 years:

Selling price 300, 000

Cost 210, 000

Sale of family car held for 18 months:

Selling price 480, 000

Cost 500, 000

Taxpayer will report a taxable income of:

a. P365,000

b. P385,000

c. P368,300

d. P318,300

7. PP & Co., a partnership engaged in the practice of accounting, had a gross income of 220,000 and

expenses of 85,000 during the year 2020:

Ping Pong

Share in P/L ration 75% 25%

Income from other business 125,000 325,000

Expenses 80,000 190,000

Status Married Unmarried

Dependent children none 2

What is the income tax payable of the partnership?

a. Zero c.75,000

b. 40,500 d. 47,250

8. Using the preceding number, what is the taxable income of Ping and Pong?

a. P96,250; P68,750 c. P146,250; P118,750

b. P146,250; P168,750 d. P96,250; P168,750

9. Following the preceding problem, how much is the income tax payable/(refundable) of Ping and Pong?

a. P18,100; P28,700 c. (P10,125): (P3,375)

b. 0;0 d. P29,250;P P33,750

10. Assuming, PP & Co., a partnership engaged in the practice of law, had a gross income of 2,200,000 and

expenses of 200,000 during the year 2020:

Ping Pong

Share in P/L ration 50% 50%

Income from other business 125,000 325,000

Expenses 80,000 190,000

Status Married Unmarried

Dependent children none 2

THAT IN ALL THINGS GOD MAY BE GLORIFIED

TAX01-Philippine Tax System 2nd Semester, AY2021-2022

Final Examination Page |3

How much is the income tax payable/refundable of Ping and Pong?

a. P203,500; P230,500 c. P230,500;P203,500

b. P53,500; P80,500 d. P80,500; P53,500

11. Using No. 12, assuming PP & Co. is a general partnership, how much is the taxable income of Ping and

Pong?

a. P45,000; P135,000 c. P1,045,000; P1,135,000

b. (P5,000); P35,000 d. P995,000; P1,035,000

12. Usang Boltahe, a national athlete, received the following during 2020:

Ramon Magsaysay award P 50,000.00

Athlete of the year award 100,000.00

Prize – Jollibee raffle 5,000.00

Prize for winning the silver Olympic medal 500,000.00

Cash award from Mr. Alfred Lim 250,000.00

Cash from Nissan as a gift 1,000,000.00

Winnings – Philippine sweepstake 100,000.00

Gambling winnings 5,000,000.00

The total winnings/awards and prizes not subject to income tax is:

a. P2,505,000

b. P2,000,000

c. P1,905,000

d. P1,900,000

For Numbers 13 to 16

PolVi Cecilia, a Non-resident Citizen, received the following from sources within the Philippines during the year

2020:

Interest income from PNBank savings account, net of final tax P 16,000.00

Interest income from a Tax-free Covenant Bond 8,000.00

Interest income on long-term deposits, pre-terminated on the 4th year 12,000.00

Interest Income from Notes Receivable 23,000.00

Interest Income from FCDU maintained with PNBank (P45:$1) $ 5,000.00

Capital gains on sale of shares of stock, not listed or traded through a local stock exchange P 180,000.00

Capital loss on sale of shares of stock, not listed or traded through a local stock exchange 60,000.00

Capital gains on sale of shares of stock, not listed or traded through a local stock exchange 120,000.00

Sold residential lot located in the Philippines, held as capital asset (Appraised value by an P 580,000.00

Independent Appraiser – P800,000.00; Assessed Value – P700,000.00; Zonal value –

P680,000.00). The proceeds were used to build his principal residence amounting to

P1,000,000.00.

Dividends received from a Resident Foreign Corporation 8,000.00

Dividends received from a Domestic Corporation 6,000.00

Royalties from musical composition 14,000.00

Winnings (25% of which came from PCSO winnings) 12,000.00

Prize received from Essay contest 1,500.00

Prize received from Bowling Tournament 10,000.00

Prize received from being an outstanding Resident of their barangay 20,000.00

Indemnity for Moral Damages from Libel suit filed 500,000.00

Appreciation in the value of his real property due to a road – widening project by the 300,000.00

Government

Separation pay received due to company retrenchment program 150,000.00

Rental Income from 4-door apartment inherited from his deceased Father 80,000.00

Income from Services rendered as a professional mortician 60,000.00

13. Final Tax withheld on Interest Income is:

a. P6,400

b. P8,800

c. P7,000

d. P12,340

14. At the end of the year, the sale of shares of stock will result in Annual:

a. Capital Gains Tax Refundable of P1,000

THAT IN ALL THINGS GOD MAY BE GLORIFIED

TAX01-Philippine Tax System 2nd Semester, AY2021-2022

Final Examination Page |4

b. Capital Gains Tax Payable of P1,000

c. Capital Gains Tax Payable of P9,000

d. Capital Gains Tax Refundable of P9,000

15. The Capital Gains Tax on the sale of real property is:

a. P0

b. P42,000

c. P48,000

d. P40,800

16. Total Final Tax Due on Dividends, Royalties, Winning and Prizes is:

a. P3,800

b. P5,800

c. P6,100

d. P5,200

17. The Aidsiah, Inc., an insurance company, had the following data for the taxable year 2022:

Sales P5,000,000

Cost of Goods Sold 2,000,000

General, Selling and Administrative Expenses 500,000

Interest Income/yield from trust funds 100,000

Rental Income (net of 5% withholding tax) 190,000

Dividend Income: From domestic corporation 60,000

From foreign corporation 50,000

Winnings from charity sweepstakes 1,000,000

Capital gains from sale of domestic share of stocks not traded in the PSE, sold 75,000

directly to buyer

Dividend declared and paid during the year 500,000

Retained earnings, beg. of the year (subjected to IAE tax last year) 1,000,000

Paid-up Capital, inclusive of Share Premium amounting to P300,000 800,000

Note: The board of directors approved a resolution reserving P1,500,000 of its net profit for the year for plant

expansion.

How much is the Improperly Accumulated Earnings Tax?

a. P142,875 c. P162,875

b. P62,875 d. none

18. A real estate investment trust (REIT) is a stock corporation established principally for the purpose of

owning income-generating real estate assets such as apartment buildings, office buildings, medical

facilities, hospitals, hotels, resorts, highways, warehouses, shopping centers, railroads, among others. It is

a type of investment instrument that provides a return to investors derived from rental income of the

underlying real estate asset. It has essential requirements to avail of the tax incentives. Which of the

following is NOT a requirement?

a. It must be registered with the SEC as a stock corporation with a minimum paid-up capital of P300

million.

b. It must be listed with an Exchange and, upon listing, have at least 1,000 Public shareholders each

owning at the minimum 500 shares and which, in the aggregate, own at least1/3 of the outstanding capital

stock of the REIT.

c. The independent directors in the REIT must be composed of at least one-third or two, whichever is

higher, of the board of directors.

d. A REIT must appoint an independent Fund Manager and Property Manager who must qualify under the

fit and proper rule.

19. Miss Darrelle Joe is a self-published author. She established a printing press and a marketing distribution

business for her books which sells wildly hot like chili-flavored pizza. She does not know anything about

taxation so she consulted you about what type of income tax she will pay.

What advice would you give her?

a. You are subject to regular tax not to final tax so file three quarterly income tax returns every 60 days

following the end of the first three quarters and file an annual consolidated income tax return on or before

April 15 of the following year.

b. You are subject to final tax on your book royalties. There is no need to file regular tax returns.

c. You should pay regular income tax on your net income and 10% final tax on your royalties from your

books to avoid hassle with the tax authorities.

THAT IN ALL THINGS GOD MAY BE GLORIFIED

TAX01-Philippine Tax System 2nd Semester, AY2021-2022

Final Examination Page |5

d. You are subject to regular tax. You shall file three quarterly income tax returns on or before April 15,

August 15, and November 15 respectively and file a consolidated annual income tax return on or before

April 15 of the following year.

20. San Miguel Corporation is a resident corporation having the following data in 2020:

Selling price, at fair market value, on a direct sale

to a buyer, of shares of stock of a domestic corporation,

not traded in the Philippine Stock Exchange, held as capital asset 3,500,000

Sales Discount 15,000

Expenses on sales 30,000

Cost of the shares of stock 1,850,000

Holding period of the asset 24 months

What is the capital gains tax?

a. 240,000 c. 155,500

b. 240,750 d. 160,000

21. Jalex Rosales, an entrepreneur, met an accident and was able to claim the following damages:

Actual damages for unrealized profit P100,000

Actual damages for lost products 200,000

Exemplary damages due to injuries 50,000

Moral damages due to injuries 50,000

Interest on nontaxable damages 20,000

Attorney’s fee 80,000

How much damages are taxable and not taxable?

Taxable Nontaxable

a. P380,000 P120,000

b. P300,000 P200,000

c. P200,000 P300,000

d. P120,000 P380,000

22. Ms. Vandish, a manager of Burn, Inc., received the following fringe benefits during the taxable year

2020:

Cash travel allowance ---------------------------------------------- P 34, 000

House and lot- ownership of real property is transferred to

Ms Vandish, (FMV, P544,000) cost ------------------------------ 476,000

Car-ownership was transferred to Ms. Vandish.

The car has a 10-year estimated useful life, but

already 1 year in use at date of transfer --------------------------- 680,000

The grossed-up monetary value of the fringe benefits would be

a. P 850,000 c. P 1,750,000

b. P 950,000 d. P 1,830,769

For questions 23 and 24, use the following information:

The following data pertains to a domestic corporation which was incorporated in 2010 but was registered

with the BIR on 2011:

2014 2015 2016 2017 2018 2019

Gross Income 1,000,000 1,800,000 2,200,000 2,600,000 3,000,000 3,500,000

Allowable 800,000 1,700,000 2,300,000 2,800,000 2,600,000 3,000,000

Deduction

23. What is the income tax payable in 2017?

a. P330,000 c. P300,000

b. P52,000 d. P0

24. What is the income tax payable in 2019?

a. P150,000 c. P12,000

b. P18,000 d. P24,000

For numbers 25-30, use the following data:

Wilchon, a resident citizen, has the following income for the year 2019:

Gross income from business of poultry (net of Cost of Sale: 200,000)..... P1,500,000

Gross income from business of piggery(net of Cost of Sale: 100,000)...... 900,000

THAT IN ALL THINGS GOD MAY BE GLORIFIED

TAX01-Philippine Tax System 2nd Semester, AY2021-2022

Final Examination Page |6

Dividend from domestic corporation...................................................... 10,000

Dividend from resident corporation...................................................... 50,000

Interest on bank deposit……… ………………………........................... 15,000

Monetary benefit from Deposit Substitute .............................................. 25,000

Sale of common shares held as capital asset from SMART, Inc, not

listed and traded thru Philippine Stock exchange:

Fair Market Value P 1,000,000

Selling Price 500,000

Acquisition Cost 200,000

Sale of common shares held as capital asset from

GLOBE, Inc, listed and traded thru Philippine

Stock exchange:

Fair Market Value P 2,000,000

Selling Price 1,000,000

Acquisition Cost 200,000

Sale of real property not used in trade or business

located in Tondo, Manila:

Assessed Value P 5,000,000

Zonal Value 6,000,000

Selling Price 4,000,000

Acquisition Cost 7,000,000

Sale of real property not used in trade or business

located in Kazakhstan:

Assessed Value P 500,000

Zonal Value 600,000

Selling Price 400,000

Acquisition Cost 350,000

Interest under Expanded Foreign Currency Deposit System 500,000

Won 1st prize: Montero Sport, in a raffle draw worth 3,000,000

Won winnings from Barangay Basketball League 11,000

Won winnings from Barangay Volleyball League 9,000

Interest from P1,000,000 individual trust funds

(Term: 5 years)......................................................................... 100,000

Royalties from cinematographic films………......................... 50,000

Interest from P3,000,000 investment management accounts

(Term: 5 years) After one year and one month, he pre-

terminated the investment account..................... 200,000

Business expenses from poultry business................................... 720,000

Business expenses from piggery business................................... 900,000

An amount paid out for betterments made to increase

the value of the land.................................................................... 80,000

Amount paid in restoring the real property located in

Tondo, Manila ............................................................................ 120,000

25. Assuming Wilchon signified in his first quarter return his intention to avail of the 8% preferential tax rate,

how much is his income tax due for the year 2019?

a.P224,720 c. P204,720

b.P200,720 d. P196,720

26. Assuming Wilchon failed to file his Quarterly Tax Return in the First Quarter, how much is his income

tax due and business tax, if any for the year 2019?

a. P156,700; P81,000 c. P231,700; P81,000

b. P246,700; P84,270 d. P231,700;P82,770

27. Assuming Wilchon is also employed in Meralco earning a total compensation income per annum of

P1,500,000, which of the following is correct?

a. Wilchon cannot avail of the 8% preferential tax rate because his total income from his business and

employment exceeds P3Million

b. Wilchon may avail of the 8% preferential tax rate for his entire income because it is provided for under

the TRAIN Law

c. Wilchon may avail of the 8% preferential tax rate on his income earned from business and other non-

operating income, but his compensation income shall be taxable by graduated income tax rates.

THAT IN ALL THINGS GOD MAY BE GLORIFIED

TAX01-Philippine Tax System 2nd Semester, AY2021-2022

Final Examination Page |7

d. Wilchon may avail of the 8% preferential tax rate on his income earned from business and other non-

operating income, but his compensation income shall be taxable by graduated income tax rates plus

3%OPT.

28. Using the facts stated above, but the businesses of Wilchon involves cockpits and cabarets, which of the

following is correct?

a. Wilchon may avail of the 8% preferential tax rate but without the benefit of the P250,000 exemption.

b. Wilchon may avail of the 8% preferential tax rate with the benefit of the P250,000 exemption

c. Wilchon’s business income is subject to graduated income tax

d. Wilchon may be imprisoned because of these illegal businesses

29. Assuming Wilchon, a purely self-employed income earner, signified in his first quarter return his

intention to avail of the OSD, how much is his income tax due?

a. P408,700 c. P107,250

b. P266,020 d. P318,700

30. Assuming that Wilson is a mixed income earner where he also earned a total compensation income of

P1,500,000, net of exclusions, and availed of the OSD for his business income from the start of the year

2019, how much is his total income tax due?

a. P658,700 c. P883,280

b. P606,020 d. P748,700

31. Mr. Panchito, a lawyer by profession, had the following income and donations during the year 2020:

Professional fees…………………………………….. P1,500,000

Expenses related to practice of profession………….. 400,000

Facilitation fees……………………………………… 200,000

Donations to government priority activities……………..100,000

Donations to pursuant to treaties………………………….30,000

Donations to accredited charitable institutions…………....50,000

Donations to the government for public purpose………….80,000

Donations to non-accredited charitable institutions……….60,000

Donations to a foreign charitable institution………………40,000

Donations to street beggars………………………………..50,000

How much is the total deductible contribution expense?

a. P290,000 c. P370,000

b. P270,000 d. P320,000

32. Burn Inc. leases its lot to Sta. Barbara for 15 years with an annual rental of P50,000. They have agreed

that Sta. Barbara shall construct a building thereon with a stipulation that at the end of the lease term, the

ownership of the building will go to Burn Inc. The building has a fair market value of P1,200,000 with an

estimated life of 20 years. On the 10th year of the lease, the building was destroyed by tornado. A part of

it was saved with an estimated amount of P40,000 and the same was covered by insurance amounting to

P100,000. How much is the loss on the building?

a. P160,000 c. P60,000

b. P40,000 d. P50,000

33. Alibaba Corp. is engaged in the business of bakery and providing parlor services with net sales and

revenue of P6,000,000 and P4,000,000, respectively. The actual entertainment, amusement and recreation

expenses for the taxable year totaled P100,000. For income tax purposes, how much is the total deductible

entertainment, amusement and recreation expenses for each business, respectively?

a. P60,000;P40,000 c. P60,000;P20,000

b. P30,000;P40,000 d. P50,000; P50,000

34. The running of the Statute of Limitations provided in Sections 203 and 222 of the NIRC on the making of

assessment and the beginning of distraint or levy a proceeding in court for collection, in respect of any

deficiency, shall be suspended on the following instances, EXCEPT:

a. taxpayer requests for a motion for reinvestigation which is granted by the Commissioner

b. taxpayer requests for a motion for reconsideration which is granted by the Commissioner

c. taxpayer cannot be located in the address given by him in the return filed upon which a tax is being

assessed or collected

d. when the warrant of distraint or levy is duly served upon the taxpayer

35. Statement 1: The Court of Tax Appeals has an exclusive original jurisdiction to review the inaction by the

Commissioner of Internal Revenue (CIR) in cases involving disputed assessments, refunds of internal

revenue taxes, fees or other charges, penalties in relations thereto, or other matters arising under the

National Internal Revenue Code or other laws administered by the Bureau of Internal Revenue.

Statement 2: Based on the preceding paragraph, the inaction of the CIR shall be deemed a denial.

a. Both statements are true

b. Both statements are false

THAT IN ALL THINGS GOD MAY BE GLORIFIED

TAX01-Philippine Tax System 2nd Semester, AY2021-2022

Final Examination Page |8

c. Only Statement 1 is true

d. Only Statement 2 is true

36. Statement 1: Pursuant to the life blood doctrine, as a rule, no court shall grant an injunction to restrain the

collection of any national revenue tax, fee or charge imposed by the NIRC.

Statement 2: The “No injunction rule” is subject to the exception that when the decision of the

Commissioner is pending appeal before the Court of Tax Appeals (CTA), the CTA may enjoin the

collection of taxes if such collection will jeopardize the interest of the government and/or the taxpayer

a. Both statements are true

b. Both statements are false

c. Only Statement 1 is true

d. Only Statement 2 is true

37. Statement 1: The taxpayers shall be informed in writing of the law and the facts on which the assessment

is made; otherwise, the assessment shall be void

Statement 2: If the protest is denied in whole or in part, or is not acted upon within one hundred eighty

(180) days from submission of documents, the taxpayer adversely affected by the decision or inaction

may appeal to the Court of Appeals within thirty (30) days from receipt of the said decision, or from the

lapse of one hundred eighty (180)-day period

a. Both statements are true

b. Both statements are false

c. Only Statement 1 is true

d. Only Statement 2 is true

38. Pre-assessment notice shall not be required in the following cases, EXCEPT:

a. When the finding for any deficiency tax is the result of mathematical error in the computation of the tax

as appearing on the face of the return

b. When a discrepancy has been determined between the tax withheld and the amount actually remitted by

the withholding agent

c. When a taxpayer who opted to claim a refund or tax credit of excess creditable withholding tax for a

taxable period was determined to have carried over and automatically applied the same amount claimed

against the estimated tax liabilities for the taxable quarter or quarters of the succeeding taxable year

d. When the income tax due on excisable articles has not been paid

39. Statement 1: The Court of Tax Appeals has an exclusive appellate jurisdiction to review decisions, orders

or resolutions of the Regional Trial Courts in local tax cases originally decided or resolved by them in the

exercise of their original or appellate jurisdiction

Statement 2: The Court of Appeals has an exclusive original jurisdiction to review Decisions of the

Commissioner of Customs in cases involving liability for customs duties, fees or other money charges,

seizure, detention or release of property affected, fines, forfeitures or other penalties in relation thereto, or

other matters arising under the Customs Law or other laws administered by the Bureau of Customs

a. Both statements are true

b. Both statements are false

c. Only Statement 1 is true

d. Only Statement 2 is true

40. Statement 1: For cases of financial incapacity, a minimum compromise rate equivalent to forty percent

(40%) of the basic assessed tax shall be allowed by the Commissioner

Statement 2: In case of reasonable doubt as to the validity of the claim against the taxpayer, a minimum

compromise rate equivalent to ten percent (10%) of the basic assessed tax shall be allowed by the

Commissioner

a. Both statements are true

b. Both statements are false

c. Only Statement 1 is true

d. Only Statement 2 is true

41. Statement 1: On March 15, 2019, Ping Guerrero filed an Income Tax Return which is due on April 15,

2019, with which the income declared is understated by 30% of the actual income he could have declared.

The BIR has 3 years from March 15, 2019 to assess Ping’s tax liability.

Statement 2: The taxpayer may file an administrative protest against an assessment within 30 days from

receipt of the assessment.

a. Both statements are true

b. Both statements are false

c. Only Statement 1 is true

d. Only Statement 2 is true

42. If there is showing that expenses have been incurred but the exact amount thereof cannot be ascertained

due to absence of documentary evidence, it is the duty of the BIR to make an estimate of deduction that

THAT IN ALL THINGS GOD MAY BE GLORIFIED

TAX01-Philippine Tax System 2nd Semester, AY2021-2022

Final Examination Page |9

may be allowable in computing the taxpayer’s taxable income, which estimate may be based on 50% of

the taxpayer’s claimed deduction. This is called

a. Cohan Rule c. Cojan Rule

b. Johan Rule d. Trojan Rule

43. Which of the following is not a fundamental principle of the Local Government Taxation?

a. Uniformity

b. Equitability

c. Collection of taxes is solely for the benefit of the national and local government

d. Progressive

44. A Province cannot impose the following, EXCEPT:

a. DST c. Taxes on premiums paid by way of reinsurance or retrocession

b. VAT d. RPT

45. Statement 1: Manufacturers, assemblers, contractors, producers, and exporters with factories, project

offices, plants, and plantations in the pursuit of their business shall allocate their sales in the their

principal office in which 70% will be taxable by the city/municipality where the principal office is

located, and 30% shall be taxable by the city/municipality where the factory, project office, plant, or

plantation is located

Statement 2: Light Rail Transit Authority is exempt from real property tax

a. Both statements are correct c. Only statement 1 is correct

b. Both statements are incorrect d. Only statement 2 is correct

46. Which is not a ground to suspend the running of prescription to assess a local tax?

a. The treasurer is legally prevented from making the assessment of collection

b. The taxpayer requests re-investigation and executes a waiver in writing before expiration of the period

within which to assess or collect

c. The taxpayer is out of the country or otherwise cannot be located

d. The taxpayer requests for reconsideration

47. Statement 1: The City Treasurer’s denial of protest of the taxpayer is appealable to Local Board of

Assessment Appeals within 30 days from receipt of denial.

Statement 2: Payment under protest is not a pre-requisite to make a protest in a local tax dispute.

a. Both statements are correct c. Only statement 1 is correct

b. Both statements are incorrect d. Only statement 2 is correct

48. Statement 1: If the assessment of basic RPT or any other tax levied is found to be ILLEGAL or

ERRONEOUS and the tax is reduced or adjusted, the taxpayer may file a petition for refund or credit for

taxes and interests with the City Assessors Office within 2 years from the date the taxpayer is entitled to

such reduction or adjustment.

Statement 2: In assailing the validity of RPT, deposit is jurisdictional and must be complied with only if

the real property is tax delinquent.

a. Both statements are correct c. Only statement 1 is correct

b. Both statements are incorrect d. Only statement 2 is correct

49. Statement 1: The Secretary of Finance has the authority to issue an injunction order if the collection of

taxes will jeopardize the interest of the taxpayer

Statement 2: An LGU can impose amusement taxes on cabarets.

a. Both statements are correct c. Only statement 1 is correct

b. Both statements are incorrect d. Only statement 2 is correct

50. The following entities retained their tax exemption privileges given by the Local Government Code.

Which of the following is not included?

a. Local Water District

b. Cooperatives.

c. Non-stock Non Profit Educational Institutions

d. Religious sectors

THAT IN ALL THINGS GOD MAY BE GLORIFIED

You might also like

- Craig's Design and Landscaping Services: Profit and Loss % of Total IncomeDocument2 pagesCraig's Design and Landscaping Services: Profit and Loss % of Total Incomeapi-528502931No ratings yet

- Conceptual Framework Qualitative CharacteristicDocument99 pagesConceptual Framework Qualitative CharacteristicXander Clock0% (1)

- Managerial Economics Center of Gravity: TH TH THDocument1 pageManagerial Economics Center of Gravity: TH TH THReginald ValenciaNo ratings yet

- KPMG Technical Terms Commercial Accounting and Tax LawDocument44 pagesKPMG Technical Terms Commercial Accounting and Tax LawIosias100% (3)

- Financial Statements Practice ProblemsDocument5 pagesFinancial Statements Practice ProblemsnajascjNo ratings yet

- Assignment 2465 - 02 PDFDocument2 pagesAssignment 2465 - 02 PDFAhsan KamranNo ratings yet

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- C. Inclusions and Exclusions From Gross IncomeDocument10 pagesC. Inclusions and Exclusions From Gross IncomeGreggy BoyNo ratings yet

- ACTIVITY 06 Accounting For A Service Provider Additional ExercisesDocument3 pagesACTIVITY 06 Accounting For A Service Provider Additional Exercises이시연No ratings yet

- Business Law and Regulations Departmental Exam ReviewerDocument29 pagesBusiness Law and Regulations Departmental Exam ReviewerGraciela InacayNo ratings yet

- Ia1 Posttest3 - Inventories (Questionnaire)Document8 pagesIa1 Posttest3 - Inventories (Questionnaire)Chris JacksonNo ratings yet

- Special Allowable Itemized DeductionsDocument13 pagesSpecial Allowable Itemized DeductionsSandia EspejoNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Magna Carta For Residential Electricity ConsumersDocument56 pagesMagna Carta For Residential Electricity ConsumersVanvan BitonNo ratings yet

- Confras Transes Module 1 and 2Document16 pagesConfras Transes Module 1 and 2Cielo MINDANAONo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- 2019 Level 1 CFASDocument8 pages2019 Level 1 CFASMary Angeline LopezNo ratings yet

- PROBLEM SOLVING (4 Items X 5 Points) : Expected Utilization RatesDocument3 pagesPROBLEM SOLVING (4 Items X 5 Points) : Expected Utilization RatesSnapShop by AJNo ratings yet

- IA3 - REVIEWER - Internediate 3Document38 pagesIA3 - REVIEWER - Internediate 3Mujahad QuirinoNo ratings yet

- Name: Section: Date:: Angel SantaDocument5 pagesName: Section: Date:: Angel SantaJoebet DebuyanNo ratings yet

- Financial Accounting Reviewer - Chapter 65Document11 pagesFinancial Accounting Reviewer - Chapter 65Coursehero PremiumNo ratings yet

- AP - A05 Audit of LiabilitiesDocument7 pagesAP - A05 Audit of LiabilitiesJane DizonNo ratings yet

- Porter's Five Forces Analysis of Technology SectorDocument6 pagesPorter's Five Forces Analysis of Technology SectorRAVI KUMARNo ratings yet

- Chapter 9 - Regular Income Tax: Inclusions in Gross IncomeDocument4 pagesChapter 9 - Regular Income Tax: Inclusions in Gross IncomejellNo ratings yet

- Risk and Return: Sample ProblemsDocument14 pagesRisk and Return: Sample ProblemsRynette FloresNo ratings yet

- Problem With Solution For Intermediate Accounting 3Document1 pageProblem With Solution For Intermediate Accounting 3Luxx LawlietNo ratings yet

- 01 Problem Solving 1Document3 pages01 Problem Solving 1Millania ThanaNo ratings yet

- EXAM-223 1 To 3Document9 pagesEXAM-223 1 To 3Nicole KimNo ratings yet

- Origin and Development of Operation ResearchDocument11 pagesOrigin and Development of Operation ResearchJaspreet SinghNo ratings yet

- Hasselback Company Acquired A Plant Asset at The Beginning of PDFDocument1 pageHasselback Company Acquired A Plant Asset at The Beginning of PDFAnbu jaromiaNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Job Order Costing: Cost Accounting: Foundations and Evolutions, 8eDocument34 pagesJob Order Costing: Cost Accounting: Foundations and Evolutions, 8eFrl RizalNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- MAS Bobadilla-Product Quality and Productivity Total Quality Management PDFDocument5 pagesMAS Bobadilla-Product Quality and Productivity Total Quality Management PDFrandyNo ratings yet

- Session 2Document8 pagesSession 2Muhammad Haris100% (1)

- Tax - First Preboard QuestionnaireDocument14 pagesTax - First Preboard QuestionnairewithyouidkNo ratings yet

- ACCCOB3Document87 pagesACCCOB3Lexy SungaNo ratings yet

- SolMan (Advanced Accounting)Document190 pagesSolMan (Advanced Accounting)Jinx Cyrus RodilloNo ratings yet

- #5 NCA Held For SaleDocument3 pages#5 NCA Held For SaleMakoy BixenmanNo ratings yet

- 6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument2 pages6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- Stracos Module 1 Quiz Cost ConceptsDocument12 pagesStracos Module 1 Quiz Cost ConceptsGemNo ratings yet

- Lupisan-Baysa PDFDocument206 pagesLupisan-Baysa PDFRicart Von LauretaNo ratings yet

- Chapter 13a - Ordinary Allowable Itemized DeductionsDocument9 pagesChapter 13a - Ordinary Allowable Itemized DeductionsprestinejanepanganNo ratings yet

- Statement of Comprehensive Income - ExerciseDocument2 pagesStatement of Comprehensive Income - ExerciseMary Kate OrobiaNo ratings yet

- Solution 2Document5 pagesSolution 2Alexandria SomethingNo ratings yet

- FM 1 Assignment 1Document3 pagesFM 1 Assignment 1Jelly Ann AndresNo ratings yet

- Team PRTC 1stPB May 2024 - TAXDocument7 pagesTeam PRTC 1stPB May 2024 - TAXAnne Marie SositoNo ratings yet

- Executive SummaryDocument20 pagesExecutive SummarySamNo ratings yet

- Franchise AccountingDocument16 pagesFranchise AccountingJi YuNo ratings yet

- Chapter 14 Assignment Exercise 1: Department 1 2 4 TotalDocument18 pagesChapter 14 Assignment Exercise 1: Department 1 2 4 TotalAna Leah DelfinNo ratings yet

- Part 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Document66 pagesPart 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Alyssa PilapilNo ratings yet

- Chapter 13 - Principles of DeductionsDocument13 pagesChapter 13 - Principles of DeductionsjellNo ratings yet

- SAP Workbook 03Document53 pagesSAP Workbook 03Morphy GamingNo ratings yet

- 06 Activity 1 Renion-SenaDocument2 pages06 Activity 1 Renion-SenaGoose ChanNo ratings yet

- Civil SocietyDocument6 pagesCivil SocietyBethel DizonNo ratings yet

- Problem 36 14Document18 pagesProblem 36 14Janna rae BionganNo ratings yet

- Quiz Chapter-2 Partnership-Operations 2020-EditionDocument7 pagesQuiz Chapter-2 Partnership-Operations 2020-EditionShaz NagaNo ratings yet

- 09 Task PerformanceDocument5 pages09 Task PerformanceAngel Joy CalingasanNo ratings yet

- San Beda University: Department of Accountancy and TaxationDocument11 pagesSan Beda University: Department of Accountancy and TaxationOG FAMNo ratings yet

- Preparation of Income Tax Return IndividualDocument2 pagesPreparation of Income Tax Return IndividualFRAULIEN GLINKA FANUGAONo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Quiz On Tax On CompensationDocument3 pagesQuiz On Tax On CompensationMaster GTNo ratings yet

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- Answer Key Quiz On Graduated Income Tax 1 PDFDocument3 pagesAnswer Key Quiz On Graduated Income Tax 1 PDFMeg CruzNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Pre-Feasib Atos Cabacungan Cruz, Meghan Durian Mabuyo MacawadibDocument8 pagesPre-Feasib Atos Cabacungan Cruz, Meghan Durian Mabuyo MacawadibMeg CruzNo ratings yet

- Module 1 Project Feasbility Study NotesDocument7 pagesModule 1 Project Feasbility Study NotesMeg CruzNo ratings yet

- Module 3 Financial Ratios Practice ProblemsDocument2 pagesModule 3 Financial Ratios Practice ProblemsMeg CruzNo ratings yet

- Operating SegmentsDocument10 pagesOperating SegmentsUdit JindalNo ratings yet

- Douglas A. Chandler v. Commissioner of Internal Revenue, 226 F.2d 467, 1st Cir. (1955)Document6 pagesDouglas A. Chandler v. Commissioner of Internal Revenue, 226 F.2d 467, 1st Cir. (1955)Scribd Government DocsNo ratings yet

- PAYE Scheme (Chapter XIV of The Inland Revenue Act No 10 of 2006)Document12 pagesPAYE Scheme (Chapter XIV of The Inland Revenue Act No 10 of 2006)Audithya KahawattaNo ratings yet

- Quiz 2nd YearDocument4 pagesQuiz 2nd YearJeryco Quijano BrionesNo ratings yet

- Academy Trust External Audit Preparation ChecklistDocument8 pagesAcademy Trust External Audit Preparation ChecklistAyşe BalamirNo ratings yet

- Port Pricing PDFDocument86 pagesPort Pricing PDFMw. MustolihNo ratings yet

- EastGate at GreyHawk Analysis 3.20.17Document11 pagesEastGate at GreyHawk Analysis 3.20.17vobhoNo ratings yet

- Capital Budgeting 2Document3 pagesCapital Budgeting 2mlexarNo ratings yet

- Chapter 2Document51 pagesChapter 2prathibakb0% (1)

- Lease Accounting IFRS 16Document6 pagesLease Accounting IFRS 16rqpNo ratings yet

- Individual Income Tax ComputationsDocument13 pagesIndividual Income Tax ComputationsclarizaNo ratings yet

- Jntuh Financial Management Model PaperDocument2 pagesJntuh Financial Management Model Papervijay kumarNo ratings yet

- MbaprojectDocument60 pagesMbaprojectJayanthiNo ratings yet

- Module 5 Intacc SoluDocument13 pagesModule 5 Intacc SoluMiks EnriquezNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)haroonsaeed12No ratings yet

- Assignment: 1. What Are Your Expectations From MBA (Power Management) From Npti?Document5 pagesAssignment: 1. What Are Your Expectations From MBA (Power Management) From Npti?Amit SinghNo ratings yet

- Immunization StrategiesDocument20 pagesImmunization StrategiesnehasoninsNo ratings yet

- Chapter 2 - Sustainable Development: Definitions, Measures and DeterminantsDocument54 pagesChapter 2 - Sustainable Development: Definitions, Measures and Determinantsvignesh mnsNo ratings yet

- Sample Question On SQLDocument3 pagesSample Question On SQLoptimuz primeNo ratings yet

- Non-Financial Liabilities HomeworDocument6 pagesNon-Financial Liabilities HomeworIsabelle Guillena60% (5)

- Accounts Chapter 8Document10 pagesAccounts Chapter 8R.mNo ratings yet

- SPSD Case StudiesDocument4 pagesSPSD Case Studiessohanlon07No ratings yet

- Aznar Vs CtaDocument2 pagesAznar Vs CtarobbyNo ratings yet

- FSM Dec 19 - Answers - With Working NotesDocument20 pagesFSM Dec 19 - Answers - With Working NotesmadhaviNo ratings yet

- Princess Dress ShopDocument13 pagesPrincess Dress ShopKram Olegna Anagerg75% (4)

- WS-Percentage Problems 1Document1 pageWS-Percentage Problems 1mysteriousm333No ratings yet