Professional Documents

Culture Documents

IFRS 15 - Revenue From Contracts With Customers

IFRS 15 - Revenue From Contracts With Customers

Uploaded by

KRABBYPATTY PHCopyright:

Available Formats

You might also like

- Answer-Assignment DMBA104 MBA1 2 Set-1 and 2 Sep 2023Document13 pagesAnswer-Assignment DMBA104 MBA1 2 Set-1 and 2 Sep 2023Sabari Nathan100% (1)

- Private Equity Case Study 2Document10 pagesPrivate Equity Case Study 2AmineBekkalNo ratings yet

- Accounting Practice SetDocument33 pagesAccounting Practice SetANDAYA SHERLYN67% (3)

- Ilovepdf MergedDocument100 pagesIlovepdf MergedVinny AujlaNo ratings yet

- Captură de Ecran Din 2022-01-18 La 18.26.19Document9 pagesCaptură de Ecran Din 2022-01-18 La 18.26.19Liliana MilitaruNo ratings yet

- Basic Accounting Reviewer Step 1 To 3Document12 pagesBasic Accounting Reviewer Step 1 To 3Mary Gleyne100% (1)

- How to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.From EverandHow to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.Rating: 5 out of 5 stars5/5 (1)

- RetroFitness Business ModelDocument20 pagesRetroFitness Business ModelBúp Cassie50% (2)

- Latourneau Company (Cost Classification) PDFDocument3 pagesLatourneau Company (Cost Classification) PDFCeline Versace100% (3)

- Topic 5 - Mfrs15_revenue From Contract With CustomersDocument64 pagesTopic 5 - Mfrs15_revenue From Contract With CustomersADAM SUFFIAN BIN HAMZAH MoeNo ratings yet

- FAR Part-1.6 DistributableDocument8 pagesFAR Part-1.6 DistributablepritishNo ratings yet

- Construction Accounting-Contract With CustomersDocument72 pagesConstruction Accounting-Contract With CustomersChristine Joyce MagoteNo ratings yet

- Chapter 6 Brief ExercisesDocument8 pagesChapter 6 Brief ExercisesPatrick YazbeckNo ratings yet

- Notes On Revenue RecognitionDocument4 pagesNotes On Revenue Recognitiony48591773No ratings yet

- Day 18 Class Notes CompleteDocument5 pagesDay 18 Class Notes Completekk sdfNo ratings yet

- Unit II A Accounts ReceivablesDocument12 pagesUnit II A Accounts ReceivablesJulie Ann TolinNo ratings yet

- Module4 AccountsReceivablePartIDocument6 pagesModule4 AccountsReceivablePartIGab OdonioNo ratings yet

- As 9 Revenue RecognitionDocument6 pagesAs 9 Revenue Recognitionhealthylifestyle21tipsNo ratings yet

- A10 PFRS 15 Part 2Document16 pagesA10 PFRS 15 Part 2john leo ambuyocNo ratings yet

- Chapter 4.2 Accounts ReceivableDocument7 pagesChapter 4.2 Accounts Receivable2021315379No ratings yet

- Chapter 3 Prob 3 4 Key AnswerDocument7 pagesChapter 3 Prob 3 4 Key AnswerShang LajerbaNo ratings yet

- AffDocument69 pagesAffdishanialahakoonNo ratings yet

- Revenue From Contracts With Customers: (IFRS 15)Document34 pagesRevenue From Contracts With Customers: (IFRS 15)yonas alemuNo ratings yet

- SBR Class NotesDocument228 pagesSBR Class NotesAzeem Ali ShahNo ratings yet

- ACC2001 Lecture 2Document42 pagesACC2001 Lecture 2michael krueseiNo ratings yet

- Additional Questions On Financial Statements and Cash BookDocument5 pagesAdditional Questions On Financial Statements and Cash BookBoi NonoNo ratings yet

- 13) IFRS-15 RevenueDocument34 pages13) IFRS-15 Revenuemanvi jainNo ratings yet

- 6.1 Revenue From Contract - RecognitionDocument3 pages6.1 Revenue From Contract - RecognitionTKTGNo ratings yet

- ACCOUNTS RECEIVABLE Final AtaDocument8 pagesACCOUNTS RECEIVABLE Final AtaFranshen ElopreNo ratings yet

- ACCOUNT Tally Busy PDDDocument60 pagesACCOUNT Tally Busy PDDanime75031No ratings yet

- Basic Accounting Practice - Adjusting Entries-3Document34 pagesBasic Accounting Practice - Adjusting Entries-3randel10caneteNo ratings yet

- DAY 1_ Getting to Know the Accounting Equation and Classification of Accounts (1) 4Document9 pagesDAY 1_ Getting to Know the Accounting Equation and Classification of Accounts (1) 4ZOEZEL ANNLEIH LAYONGNo ratings yet

- Consignment Accounts - Part 1 - Entries in The Books of The ConsignorDocument17 pagesConsignment Accounts - Part 1 - Entries in The Books of The ConsignorSanzida Rahman AshaNo ratings yet

- Accounting Non-Accountants Part 2Document37 pagesAccounting Non-Accountants Part 2Vanessa Gapas0% (1)

- MAA AssignmentDocument8 pagesMAA AssignmentRaghavendra R BelurNo ratings yet

- Module 1.2 PFRS 15 Revenue From Customers - Other IssuesDocument16 pagesModule 1.2 PFRS 15 Revenue From Customers - Other IssuesNCTNo ratings yet

- Ind AS 115Document21 pagesInd AS 115Vrinda KNo ratings yet

- Accounting EquationDocument3 pagesAccounting EquationRowena DizonNo ratings yet

- 1 InventoriesDocument4 pages1 InventoriesJamie MarizNo ratings yet

- BAC 223 Topic TwoDocument39 pagesBAC 223 Topic TwoGABRIEL KAMAU KUNG'UNo ratings yet

- Session 2 Revenue Recognition AR InventoryDocument41 pagesSession 2 Revenue Recognition AR InventoryNANo ratings yet

- Chapter 11Document59 pagesChapter 11patriquembeleonokokoNo ratings yet

- Topic 1 - The Accounting EquationDocument10 pagesTopic 1 - The Accounting Equationgabriellemorgan714No ratings yet

- Chapter 12 - Accounting For Revenue - 2020 LMSDocument38 pagesChapter 12 - Accounting For Revenue - 2020 LMSMenaka KulathungaNo ratings yet

- BU8101 - Lecture 3Document67 pagesBU8101 - Lecture 3Mohammad FaizalNo ratings yet

- Unit 2 Slides - BAEDocument25 pagesUnit 2 Slides - BAEdessibiancaNo ratings yet

- Unit II Lesson 5 and 6 ADJUSTING ENTRIES and FSDocument25 pagesUnit II Lesson 5 and 6 ADJUSTING ENTRIES and FSAlezandra SantelicesNo ratings yet

- Summary Notes Installment Sales and Consignment SalesDocument11 pagesSummary Notes Installment Sales and Consignment SalesJaycel OngyNo ratings yet

- Lecture 4 Accounting EquationDocument60 pagesLecture 4 Accounting EquationDevyansh GuptaNo ratings yet

- Lecture-6 Adjusted Trial BalanceDocument22 pagesLecture-6 Adjusted Trial BalanceWajiha NadeemNo ratings yet

- Boss Naik Accounti NG Series: ReceivablesDocument8 pagesBoss Naik Accounti NG Series: ReceivablesKian BarredoNo ratings yet

- The Accounting Equation: Assets Liabilities + EquityDocument4 pagesThe Accounting Equation: Assets Liabilities + EquityRegine CariñoNo ratings yet

- Lesson 3b Adjusting The AccountsDocument3 pagesLesson 3b Adjusting The AccountsBenedict CladoNo ratings yet

- Exercise Accruals Adjusting EntriesDocument3 pagesExercise Accruals Adjusting EntriesNatalie Irish VillanuevaNo ratings yet

- Purpose of Adjusting Entries: Depreciation Expense Depreciable Value Estimated Useful LifeDocument7 pagesPurpose of Adjusting Entries: Depreciation Expense Depreciable Value Estimated Useful LifeJhon Robert Belando100% (1)

- ACN101M NotesDocument30 pagesACN101M NotesArfan Mehmood/Admim/CSONNo ratings yet

- Session 1 Introduction To Financial AccountingDocument26 pagesSession 1 Introduction To Financial AccountingTSNo ratings yet

- Revenue From Contracts With Customers Application of Basic ConceptsDocument6 pagesRevenue From Contracts With Customers Application of Basic ConceptsSharon AnchetaNo ratings yet

- Class 11 Accountancy Chapter-3 Revision NotesDocument11 pagesClass 11 Accountancy Chapter-3 Revision NotesMohd. Khushmeen KhanNo ratings yet

- Purchase & Sales of Inventory - Answer Key: Purchasing Inventory Either With Cash or On-AccountDocument8 pagesPurchase & Sales of Inventory - Answer Key: Purchasing Inventory Either With Cash or On-AccountShihab AldhawiNo ratings yet

- 2023 COALA1 Week 5 Transfer Procedures & Correspondent AccountsDocument44 pages2023 COALA1 Week 5 Transfer Procedures & Correspondent Accountsnandinhlapo96No ratings yet

- Chapter 7 ReceivablesDocument87 pagesChapter 7 ReceivablesLEE WEI LONGNo ratings yet

- ACYASR1 Reflection PaperDocument3 pagesACYASR1 Reflection PaperKRABBYPATTY PHNo ratings yet

- ACYFMG1 Unit IV Formula (2022.04.04)Document5 pagesACYFMG1 Unit IV Formula (2022.04.04)KRABBYPATTY PHNo ratings yet

- FranchisingDocument10 pagesFranchisingKRABBYPATTY PHNo ratings yet

- CHAPTER 1 - The Goals and Activities of Financial ManagementDocument5 pagesCHAPTER 1 - The Goals and Activities of Financial ManagementKRABBYPATTY PHNo ratings yet

- Long-Term Construction ContractsDocument3 pagesLong-Term Construction ContractsKRABBYPATTY PHNo ratings yet

- Subsequent To Date of AcquisitionDocument10 pagesSubsequent To Date of AcquisitionKRABBYPATTY PHNo ratings yet

- Home Office and Branch AccountingDocument27 pagesHome Office and Branch AccountingKRABBYPATTY PHNo ratings yet

- Business CombinationsDocument14 pagesBusiness CombinationsKRABBYPATTY PHNo ratings yet

- Unit 1 - PartnershipDocument3 pagesUnit 1 - PartnershipKRABBYPATTY PHNo ratings yet

- AFAR - Mastery Class Batch 2Document5 pagesAFAR - Mastery Class Batch 2Antonette Eve CelomineNo ratings yet

- Int. Business SlidesDocument219 pagesInt. Business SlidesAfnan A.S.No ratings yet

- Chapter 23 28Document104 pagesChapter 23 28Xander Clock50% (2)

- MNGT 222nDocument2 pagesMNGT 222nGet BurnNo ratings yet

- Revenue Recognition and Franchise TestbankDocument43 pagesRevenue Recognition and Franchise TestbankBusiness MatterNo ratings yet

- Mushak-6.3 Practise Sales InvoiceDocument6 pagesMushak-6.3 Practise Sales InvoiceArnold Roger CurryNo ratings yet

- Test Chap 1 2Document8 pagesTest Chap 1 2Nhi Nguyễn Thị NgânNo ratings yet

- ZomatoDocument15 pagesZomatoJaydev ozaNo ratings yet

- Hire - Purchase AgreementDocument7 pagesHire - Purchase AgreementHarshit MalviyaNo ratings yet

- Unit 1Document80 pagesUnit 1udaywal.nandiniNo ratings yet

- How To Make Money Online With Print On DemandDocument4 pagesHow To Make Money Online With Print On Demanddawe sNo ratings yet

- The Product Life CycleDocument10 pagesThe Product Life CyclePheobelyn Ending100% (1)

- Carrin Byk Real Estate Agent in Clarkston, Michigan Earns SRS (Seller Representative Specialist) Designation and Takes Her Career To The Next LevelDocument2 pagesCarrin Byk Real Estate Agent in Clarkston, Michigan Earns SRS (Seller Representative Specialist) Designation and Takes Her Career To The Next LevelPR.comNo ratings yet

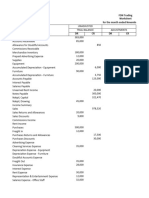

- FDNACCT Group Project FDN TradingDocument9 pagesFDNACCT Group Project FDN Tradingcyka blyatNo ratings yet

- A Business OrganizationDocument19 pagesA Business OrganizationNilusha Wijesooriya100% (1)

- The Economics of Valentines Day Siddhartha Pillutla 2224058Document4 pagesThe Economics of Valentines Day Siddhartha Pillutla 2224058Siddhartha SspNo ratings yet

- Kalyan Pharma LTD.: Presented by - Group 5Document11 pagesKalyan Pharma LTD.: Presented by - Group 5Saumitra NandaNo ratings yet

- Achieving Customer Satisfaction Through Sustainable Marketing Strategies: A Qualitative Analysis of Three Bread Industries in Abakaliki Ebonyi State, NigeriaDocument7 pagesAchieving Customer Satisfaction Through Sustainable Marketing Strategies: A Qualitative Analysis of Three Bread Industries in Abakaliki Ebonyi State, NigeriaajmrdNo ratings yet

- Arens Auditing16e SM 16Document32 pagesArens Auditing16e SM 16Jesslyn AgnesNo ratings yet

- Gita Fitri - Staff FinanceDocument1 pageGita Fitri - Staff Financehendra gunawanNo ratings yet

- Invoice 1 Jun 22 03 40 54 119Document9 pagesInvoice 1 Jun 22 03 40 54 119Rolando Jr. SantosNo ratings yet

- Etsy Investor-Presentation-1Q20 - Final-VersionDocument47 pagesEtsy Investor-Presentation-1Q20 - Final-VersionOleksandr YaroshenkoNo ratings yet

- Ebook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFDocument67 pagesEbook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFjohn.gallardo475100% (35)

- Mock Questions On l4m5Document12 pagesMock Questions On l4m5pearl100% (1)

- Receivable Financing: Quick Review!Document9 pagesReceivable Financing: Quick Review!Barbie BleuNo ratings yet

- Proforma Invoice For LibyaDocument2 pagesProforma Invoice For LibyaFantania BerryNo ratings yet

IFRS 15 - Revenue From Contracts With Customers

IFRS 15 - Revenue From Contracts With Customers

Uploaded by

KRABBYPATTY PHOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFRS 15 - Revenue From Contracts With Customers

IFRS 15 - Revenue From Contracts With Customers

Uploaded by

KRABBYPATTY PHCopyright:

Available Formats

IFRS 15: Revenue from Contracts with Customers

● IFRS 15 = a five step method in recognizing revenue

= accounts superseded by this Standard are obsolete:

➔ IAS 11 (Construction Contracts)

➔ IAS 18 (Revenue)

➔ IFRIC 13 (Customer Loyalty Programmes)

➔ IFRC 15 (Agreements for Construction of Real Estate)

➔ IFRIC 18 (Transfers of Assets from Customers)

➔ SIC 31 (Revenue-Barter Transactions Involving Advertising

Services)

Step 1: Identify the contract

● Contract = an agreement between two or more parties that created unenforceable rights

(right to collect) and obligations (settle debts)

○ Rights = Assets

○ Obligations = Liabilities

● Criteria for Contracts

1. Contract has commercial substance (w/ relative fair value)

2. Entity can identify the payment methods

3. The parties to the contract have approved the contract (mutual consent)

4. The entity can identify each party’s rights regarding regarding goods or services

to be rendered

5. It is probable that the entity will collect the consideration to which it is entitled

● NOTE:

1. Performance of either party gives rise to a contract asset or liability.

2. If a customer pays or the entity has an amount of consideration before the entity

transfers goods or services to the customer, the entity shall recognize

contract liability.

3. If the entity performs before the customer pays consideration or before

payment is due, the entity shall recognize contract asset, excluding any

amount presented as receivable

4. Entity may use alternative descriptions other than contract asset or liability

Contract Asset vs Receivable

● Contract Asset = entity’s right to consideration in exchange for goods or services

transferred to a customer

○ “Basta may trinansfer ka sa customer, may contract asset ka na kahit hindi mo

pa pinepeform yung obligation mo”

○ Example: You have the obligation to transfer 10,000 units of TV sets.You have

already transferred 5,000 units.

■ Do you already have a contract asset? YES, pertaining to that 5,000

units transferred to the customer.

■ Can you consider that a receivable? NO, since the agreed number is

10,000 units but only 5,000 units have only been transferred. There is still

a condition needed to fulfill (the 5,000 units)

■ Once the remaining 5,000 units have been transferred, that is when it will

be part of receivables (unconditional)

● Receivable = entity’s right to consideration that is unconditional

Situation: On January 1, 2021, X Company is obligated to deliver the goods to Company Z

through a contract amounting to 400,000 pesos with a cost of 250,000.

1. What if on January 30, X delivered the goods to Z. Z paid on February 28 for the

delivered goods.

Jan 30 Contract Asset/ Accounts Receivable* 400,000

Sales 400,000

Cost of Sales 250,000

Merchandise Inventory 250,000

Feb 28 Cash 400,000

Contract Asset/Accounts Receivable 400,00

*Either CA or AR can be used since you only have one obligation (deliver the goods).

Since the obligation has been fulfilled, you now have the right to collect payment from

customer (AR)

2. What if on January 20, Z paid X in advance for goods to be delivered. On January 30, X

delivered the goods to Z.

Jan 20 Cash 400,000

Contract Liability/ DR/ UI* 400,000

Jan 30 Contract Liability/ DR/ UI 400,000

Sales 400,00

Cost of Sales 250,000

Merchandise Inventory 250,000

*As per note 4, entities may use alternative descriptions.

● DR = Deferred Revenue

● UI = Unearned Income

Situation: On January 1, 2021, X Company is obligated to deliver 100,000 items of goods to

Company Z through a contract amounting to 400,000 with a cost of 250,000.

1. On January 30, X delivered 50,000 items to Z. On February 10, X delivered the

remaining 50,000 items. On February 28, Z paid X for the delivery of goods.

Jan 30 Contract Asset 200,000

Sales 200,000

Cost of Sales 125,000

Merchandise Inventory 125,000

*No AR debited yet since there is still an obligation.

* 200,000 = (400,000/100,000)*50,000

* 125,000 = (250,000/100,000)*50,000

Feb 10 Accounts Receivable 400,000

Sales 200,000

Contract Asset 200,000

*Eliminate contract asset and debit accounts receivable.

Cost of Sales 125,000

Merchandise Inventory 125,000

Feb 28 Cash 400,000

Accounts Receivable 400,000

Step 2: Identify the separate performances of obligations

● Whether obligations are:

○ Distinct = two obligations

■ Example: Delivering chairs and tables

○ Not distinct

■ Example: Delivering chairs and tables in one package

Step 3: Determination of transaction price

● Consider the effects of the following

1. Variable considerations

➔ Occurs when part of the contract depends on the outcome of a future

event (example: set expenses for 50 pax but 66 people came; additional

expenses)

➔ The entity shall estimate the amount of variable consideration

➔ Methods of estimating variable consideration:

◆ Expected Value Approach

● Used if an entity has a large number of contracts with

similar characteristics

● Applied when more than two possible amount is available

(problem is silent)

◆ Most likely amount approach

● Appropriate if the contract has only two possible outcomes

● Higher chance or probability of happening

* Check Illustrative Problem 1 and 2

2. Existence of a significant financing component

➔ Consider the time value of money (money diminishes purchasing power)

➔ Transaction price order of priority:

1. Cash price equivalent

2. PV of Future Net Cash Inflows

3. Non-cash considerations

➔ Transaction price is equal to the FV of non-cash considerations received

4. Consideration payable to customer

➔ Customer at some point is also your supplier

➔ If consideration paid is greater than its fair value, the difference is

deducted from the transaction price

➔ If consideration paid is less than or equal to its fair value, there is no

accounting problem (IGNORE)

➔ If fair value is 0, the whole consideration paid is deducted from the

transaction price

Step 4: Allocate transaction price to the separate performance obligation

● Does not apply to contracts with single performance obligations.

● Allocation basis relative fair value or stand-alone selling price of each performance

obligation.

● If the stand-alone selling price is not directly observable, an entity shall estimate the

stand-alone selling price.

● Methods of estimating stand-alone selling price:

○ Adjusted market assessment approach = looks at market price of fellow

competitors in the market (market value, average selling price in market)

○ Cost plus a margin approach (cost is always 100% the add the margin)

○ Residual approach

Step 5: Recognize revenue when each performance of obligation is satisfied

● Ways on satisfying performance obligations:

○ Satisfaction over the period of time = more than one obligation, all obligations

must be satisfied before recognizing revenue

○ Satisfaction at a point of time = “isang bagsakan ng pagsatisfy/perform ng

performance obligation”

You might also like

- Answer-Assignment DMBA104 MBA1 2 Set-1 and 2 Sep 2023Document13 pagesAnswer-Assignment DMBA104 MBA1 2 Set-1 and 2 Sep 2023Sabari Nathan100% (1)

- Private Equity Case Study 2Document10 pagesPrivate Equity Case Study 2AmineBekkalNo ratings yet

- Accounting Practice SetDocument33 pagesAccounting Practice SetANDAYA SHERLYN67% (3)

- Ilovepdf MergedDocument100 pagesIlovepdf MergedVinny AujlaNo ratings yet

- Captură de Ecran Din 2022-01-18 La 18.26.19Document9 pagesCaptură de Ecran Din 2022-01-18 La 18.26.19Liliana MilitaruNo ratings yet

- Basic Accounting Reviewer Step 1 To 3Document12 pagesBasic Accounting Reviewer Step 1 To 3Mary Gleyne100% (1)

- How to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.From EverandHow to have a Brilliant Career in Estate Agency: The ultimate guide to success in the property industry.Rating: 5 out of 5 stars5/5 (1)

- RetroFitness Business ModelDocument20 pagesRetroFitness Business ModelBúp Cassie50% (2)

- Latourneau Company (Cost Classification) PDFDocument3 pagesLatourneau Company (Cost Classification) PDFCeline Versace100% (3)

- Topic 5 - Mfrs15_revenue From Contract With CustomersDocument64 pagesTopic 5 - Mfrs15_revenue From Contract With CustomersADAM SUFFIAN BIN HAMZAH MoeNo ratings yet

- FAR Part-1.6 DistributableDocument8 pagesFAR Part-1.6 DistributablepritishNo ratings yet

- Construction Accounting-Contract With CustomersDocument72 pagesConstruction Accounting-Contract With CustomersChristine Joyce MagoteNo ratings yet

- Chapter 6 Brief ExercisesDocument8 pagesChapter 6 Brief ExercisesPatrick YazbeckNo ratings yet

- Notes On Revenue RecognitionDocument4 pagesNotes On Revenue Recognitiony48591773No ratings yet

- Day 18 Class Notes CompleteDocument5 pagesDay 18 Class Notes Completekk sdfNo ratings yet

- Unit II A Accounts ReceivablesDocument12 pagesUnit II A Accounts ReceivablesJulie Ann TolinNo ratings yet

- Module4 AccountsReceivablePartIDocument6 pagesModule4 AccountsReceivablePartIGab OdonioNo ratings yet

- As 9 Revenue RecognitionDocument6 pagesAs 9 Revenue Recognitionhealthylifestyle21tipsNo ratings yet

- A10 PFRS 15 Part 2Document16 pagesA10 PFRS 15 Part 2john leo ambuyocNo ratings yet

- Chapter 4.2 Accounts ReceivableDocument7 pagesChapter 4.2 Accounts Receivable2021315379No ratings yet

- Chapter 3 Prob 3 4 Key AnswerDocument7 pagesChapter 3 Prob 3 4 Key AnswerShang LajerbaNo ratings yet

- AffDocument69 pagesAffdishanialahakoonNo ratings yet

- Revenue From Contracts With Customers: (IFRS 15)Document34 pagesRevenue From Contracts With Customers: (IFRS 15)yonas alemuNo ratings yet

- SBR Class NotesDocument228 pagesSBR Class NotesAzeem Ali ShahNo ratings yet

- ACC2001 Lecture 2Document42 pagesACC2001 Lecture 2michael krueseiNo ratings yet

- Additional Questions On Financial Statements and Cash BookDocument5 pagesAdditional Questions On Financial Statements and Cash BookBoi NonoNo ratings yet

- 13) IFRS-15 RevenueDocument34 pages13) IFRS-15 Revenuemanvi jainNo ratings yet

- 6.1 Revenue From Contract - RecognitionDocument3 pages6.1 Revenue From Contract - RecognitionTKTGNo ratings yet

- ACCOUNTS RECEIVABLE Final AtaDocument8 pagesACCOUNTS RECEIVABLE Final AtaFranshen ElopreNo ratings yet

- ACCOUNT Tally Busy PDDDocument60 pagesACCOUNT Tally Busy PDDanime75031No ratings yet

- Basic Accounting Practice - Adjusting Entries-3Document34 pagesBasic Accounting Practice - Adjusting Entries-3randel10caneteNo ratings yet

- DAY 1_ Getting to Know the Accounting Equation and Classification of Accounts (1) 4Document9 pagesDAY 1_ Getting to Know the Accounting Equation and Classification of Accounts (1) 4ZOEZEL ANNLEIH LAYONGNo ratings yet

- Consignment Accounts - Part 1 - Entries in The Books of The ConsignorDocument17 pagesConsignment Accounts - Part 1 - Entries in The Books of The ConsignorSanzida Rahman AshaNo ratings yet

- Accounting Non-Accountants Part 2Document37 pagesAccounting Non-Accountants Part 2Vanessa Gapas0% (1)

- MAA AssignmentDocument8 pagesMAA AssignmentRaghavendra R BelurNo ratings yet

- Module 1.2 PFRS 15 Revenue From Customers - Other IssuesDocument16 pagesModule 1.2 PFRS 15 Revenue From Customers - Other IssuesNCTNo ratings yet

- Ind AS 115Document21 pagesInd AS 115Vrinda KNo ratings yet

- Accounting EquationDocument3 pagesAccounting EquationRowena DizonNo ratings yet

- 1 InventoriesDocument4 pages1 InventoriesJamie MarizNo ratings yet

- BAC 223 Topic TwoDocument39 pagesBAC 223 Topic TwoGABRIEL KAMAU KUNG'UNo ratings yet

- Session 2 Revenue Recognition AR InventoryDocument41 pagesSession 2 Revenue Recognition AR InventoryNANo ratings yet

- Chapter 11Document59 pagesChapter 11patriquembeleonokokoNo ratings yet

- Topic 1 - The Accounting EquationDocument10 pagesTopic 1 - The Accounting Equationgabriellemorgan714No ratings yet

- Chapter 12 - Accounting For Revenue - 2020 LMSDocument38 pagesChapter 12 - Accounting For Revenue - 2020 LMSMenaka KulathungaNo ratings yet

- BU8101 - Lecture 3Document67 pagesBU8101 - Lecture 3Mohammad FaizalNo ratings yet

- Unit 2 Slides - BAEDocument25 pagesUnit 2 Slides - BAEdessibiancaNo ratings yet

- Unit II Lesson 5 and 6 ADJUSTING ENTRIES and FSDocument25 pagesUnit II Lesson 5 and 6 ADJUSTING ENTRIES and FSAlezandra SantelicesNo ratings yet

- Summary Notes Installment Sales and Consignment SalesDocument11 pagesSummary Notes Installment Sales and Consignment SalesJaycel OngyNo ratings yet

- Lecture 4 Accounting EquationDocument60 pagesLecture 4 Accounting EquationDevyansh GuptaNo ratings yet

- Lecture-6 Adjusted Trial BalanceDocument22 pagesLecture-6 Adjusted Trial BalanceWajiha NadeemNo ratings yet

- Boss Naik Accounti NG Series: ReceivablesDocument8 pagesBoss Naik Accounti NG Series: ReceivablesKian BarredoNo ratings yet

- The Accounting Equation: Assets Liabilities + EquityDocument4 pagesThe Accounting Equation: Assets Liabilities + EquityRegine CariñoNo ratings yet

- Lesson 3b Adjusting The AccountsDocument3 pagesLesson 3b Adjusting The AccountsBenedict CladoNo ratings yet

- Exercise Accruals Adjusting EntriesDocument3 pagesExercise Accruals Adjusting EntriesNatalie Irish VillanuevaNo ratings yet

- Purpose of Adjusting Entries: Depreciation Expense Depreciable Value Estimated Useful LifeDocument7 pagesPurpose of Adjusting Entries: Depreciation Expense Depreciable Value Estimated Useful LifeJhon Robert Belando100% (1)

- ACN101M NotesDocument30 pagesACN101M NotesArfan Mehmood/Admim/CSONNo ratings yet

- Session 1 Introduction To Financial AccountingDocument26 pagesSession 1 Introduction To Financial AccountingTSNo ratings yet

- Revenue From Contracts With Customers Application of Basic ConceptsDocument6 pagesRevenue From Contracts With Customers Application of Basic ConceptsSharon AnchetaNo ratings yet

- Class 11 Accountancy Chapter-3 Revision NotesDocument11 pagesClass 11 Accountancy Chapter-3 Revision NotesMohd. Khushmeen KhanNo ratings yet

- Purchase & Sales of Inventory - Answer Key: Purchasing Inventory Either With Cash or On-AccountDocument8 pagesPurchase & Sales of Inventory - Answer Key: Purchasing Inventory Either With Cash or On-AccountShihab AldhawiNo ratings yet

- 2023 COALA1 Week 5 Transfer Procedures & Correspondent AccountsDocument44 pages2023 COALA1 Week 5 Transfer Procedures & Correspondent Accountsnandinhlapo96No ratings yet

- Chapter 7 ReceivablesDocument87 pagesChapter 7 ReceivablesLEE WEI LONGNo ratings yet

- ACYASR1 Reflection PaperDocument3 pagesACYASR1 Reflection PaperKRABBYPATTY PHNo ratings yet

- ACYFMG1 Unit IV Formula (2022.04.04)Document5 pagesACYFMG1 Unit IV Formula (2022.04.04)KRABBYPATTY PHNo ratings yet

- FranchisingDocument10 pagesFranchisingKRABBYPATTY PHNo ratings yet

- CHAPTER 1 - The Goals and Activities of Financial ManagementDocument5 pagesCHAPTER 1 - The Goals and Activities of Financial ManagementKRABBYPATTY PHNo ratings yet

- Long-Term Construction ContractsDocument3 pagesLong-Term Construction ContractsKRABBYPATTY PHNo ratings yet

- Subsequent To Date of AcquisitionDocument10 pagesSubsequent To Date of AcquisitionKRABBYPATTY PHNo ratings yet

- Home Office and Branch AccountingDocument27 pagesHome Office and Branch AccountingKRABBYPATTY PHNo ratings yet

- Business CombinationsDocument14 pagesBusiness CombinationsKRABBYPATTY PHNo ratings yet

- Unit 1 - PartnershipDocument3 pagesUnit 1 - PartnershipKRABBYPATTY PHNo ratings yet

- AFAR - Mastery Class Batch 2Document5 pagesAFAR - Mastery Class Batch 2Antonette Eve CelomineNo ratings yet

- Int. Business SlidesDocument219 pagesInt. Business SlidesAfnan A.S.No ratings yet

- Chapter 23 28Document104 pagesChapter 23 28Xander Clock50% (2)

- MNGT 222nDocument2 pagesMNGT 222nGet BurnNo ratings yet

- Revenue Recognition and Franchise TestbankDocument43 pagesRevenue Recognition and Franchise TestbankBusiness MatterNo ratings yet

- Mushak-6.3 Practise Sales InvoiceDocument6 pagesMushak-6.3 Practise Sales InvoiceArnold Roger CurryNo ratings yet

- Test Chap 1 2Document8 pagesTest Chap 1 2Nhi Nguyễn Thị NgânNo ratings yet

- ZomatoDocument15 pagesZomatoJaydev ozaNo ratings yet

- Hire - Purchase AgreementDocument7 pagesHire - Purchase AgreementHarshit MalviyaNo ratings yet

- Unit 1Document80 pagesUnit 1udaywal.nandiniNo ratings yet

- How To Make Money Online With Print On DemandDocument4 pagesHow To Make Money Online With Print On Demanddawe sNo ratings yet

- The Product Life CycleDocument10 pagesThe Product Life CyclePheobelyn Ending100% (1)

- Carrin Byk Real Estate Agent in Clarkston, Michigan Earns SRS (Seller Representative Specialist) Designation and Takes Her Career To The Next LevelDocument2 pagesCarrin Byk Real Estate Agent in Clarkston, Michigan Earns SRS (Seller Representative Specialist) Designation and Takes Her Career To The Next LevelPR.comNo ratings yet

- FDNACCT Group Project FDN TradingDocument9 pagesFDNACCT Group Project FDN Tradingcyka blyatNo ratings yet

- A Business OrganizationDocument19 pagesA Business OrganizationNilusha Wijesooriya100% (1)

- The Economics of Valentines Day Siddhartha Pillutla 2224058Document4 pagesThe Economics of Valentines Day Siddhartha Pillutla 2224058Siddhartha SspNo ratings yet

- Kalyan Pharma LTD.: Presented by - Group 5Document11 pagesKalyan Pharma LTD.: Presented by - Group 5Saumitra NandaNo ratings yet

- Achieving Customer Satisfaction Through Sustainable Marketing Strategies: A Qualitative Analysis of Three Bread Industries in Abakaliki Ebonyi State, NigeriaDocument7 pagesAchieving Customer Satisfaction Through Sustainable Marketing Strategies: A Qualitative Analysis of Three Bread Industries in Abakaliki Ebonyi State, NigeriaajmrdNo ratings yet

- Arens Auditing16e SM 16Document32 pagesArens Auditing16e SM 16Jesslyn AgnesNo ratings yet

- Gita Fitri - Staff FinanceDocument1 pageGita Fitri - Staff Financehendra gunawanNo ratings yet

- Invoice 1 Jun 22 03 40 54 119Document9 pagesInvoice 1 Jun 22 03 40 54 119Rolando Jr. SantosNo ratings yet

- Etsy Investor-Presentation-1Q20 - Final-VersionDocument47 pagesEtsy Investor-Presentation-1Q20 - Final-VersionOleksandr YaroshenkoNo ratings yet

- Ebook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFDocument67 pagesEbook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFjohn.gallardo475100% (35)

- Mock Questions On l4m5Document12 pagesMock Questions On l4m5pearl100% (1)

- Receivable Financing: Quick Review!Document9 pagesReceivable Financing: Quick Review!Barbie BleuNo ratings yet

- Proforma Invoice For LibyaDocument2 pagesProforma Invoice For LibyaFantania BerryNo ratings yet