Professional Documents

Culture Documents

12 Economics Sp04

12 Economics Sp04

Uploaded by

devilssksokoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Economics Sp04

12 Economics Sp04

Uploaded by

devilssksokoCopyright:

Available Formats

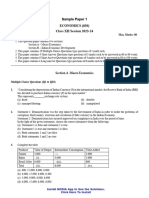

CBSE

Class 12 Economics

Sample Paper 04 (2019-20)

Maximum Marks: 80

Time Allowed: 3 hours

General Instructions:

i. All the questions in both the sections are compulsory. Marks for questions are indicated

against each question.

ii. Question number 1 - 10 and 18 - 27 are very short-answer questions carrying 1 mark

each. They are required to be answered in one word or one sentence each.

iii. Question number 11 - 12 and 28 - 29 are short-answer questions caring 3 marks each.

Answers to them should not normally exceed 60-80 words each.

iv. Question number 13 - 15 and 30 - 32 are also short-answer questions carrying 4 marks

each. Answers to them should not normally exceed 80-100 words each.

v. Question number 16 - 17 and 33 - 34 are long answer questions carrying 6 marks each.

Answers to them should not normally exceed 100-150 words each.

vi. Answer should be brief and to the point and the above word limit be adhered to as far as

possible.

Section A

1. Fill in the blanks: ________ is the difference between total receipts and total

expenditure.

2. What do you mean by injection?

3. What can be the minimum value of the investment multiplier?

a. 0

b. 1.0

c. 2

d. 3

4. Define foreign exchange rate.

Material downloaded from myCBSEguide.com. 1 / 21

OR

What is Nominal Effective Exchange Rate (NEER)?

5. Financing the deficit is

a. Printing more currency notes

b. Taking loans

c. Not paying interest on loans

d. None of them

6. Fill in the blanks:

The maximum value of investment multiplier is ________.

7. Fill in the blanks:

If the saving function is S = - 50 + 0.2Y, then the MPC is ________.

8. State true or false:

In balance of payments, repayment of loans by Indian Government to American

Government will be reflected as debit item.

9. Fill in the blanks:

If borrowings and other liabilities are added to the budget deficit, we get ________.

10. Match the following-:

(a) Fee (i) money offer by people to govt.

(b) Fines (ii) payment to govt. for the services that it renders

(c) Escheat (iii) payment to govt. by law breakers

(d) (iv) transfers the property of a person who has died without heirs to

Donation govt.

11. Distinguish between Direct and Indirect Tax:

12. Find the value of multiplier when

Material downloaded from myCBSEguide.com. 2 / 21

Marginal Propensity to Consume is equal to 1 and Marginal Propensity to Save is

equal to 1.

OR

Explain the distinction between ‘autonomous investment’ and ‘induced investment’.

13. Explain the advancing of loan function of the banks.

14. India’s high current account deficit, given slowing capital inflows, is disturbing.

Further deterioration in the global economic environment could complicate our BoP

situation. - The Economic Times

In the light of the given statement, explain the two BoP situations. Also, explain what

does a deficit in Balance of Trade indicates?

OR

Earlier, the system of closed economy was followed to keep the model simple and

explain the basic macroeconomic mechanisms. In reality, most modern economies

are open. In light of the above statement, explain what is a closed economy and

analyse how the "open economy" has widened the choices?

15. What is meant by foreign exchange rate? Why does a rise in foreign exchange causes

a rise in supply?

16. (i) How will you treat the following while estimating the national income of India?

Give reasons

a. Payment of interest on borrowings by the general government.

b. Increase in prices of the shares of a company.

c. Government expenditure on sanitation.

d. Growing vegetable in a kitchen garden of the house

(ii) From the following about firm ‘Y’, calculate Net Value Added at Market Price by it:

Items In Thousands

(i) Sales 300

Material downloaded from myCBSEguide.com. 3 / 21

(ii) Depreciation 20

(iii) Net indirect taxes 30

(iv) Purchase of intermediate products 150

(v) Closing Stock 200

(vi) Purchase of machinery 100

(vii) Opening Stock 210

OR

From the following data, calculate National Income by:

a. Income Method and

b. Expenditure Method

Items (Rs. in Crore)

Compensation of employees 1200

Net factor income from abroad (-)20

Net indirect taxes 120

Profit 800

Private final consumption expenditure 2000

Net domestic capital formation 770

Consumption of fixed capital 130

Rent 400

Interest 620

Mixed income of self - employed 700

Net exports (-)30

Government final consumption expenditure 1100

17. From the data given below about an economy, calculate

Material downloaded from myCBSEguide.com. 4 / 21

i. Investment expenditure

ii. Consumption expenditure.

Equilibrium level of Income = Rs. 5,000

Autonomous Consumption = Rs. 500

Marginal Propensity to Consume = 0.4.

Section B

18. Privatisation has done more harm than good. Justify your answer.

19. State true or false:

Education cess is levied on state taxes.

20. Match the following:

(a) MRTP Act (i) replace by G.S.T

(b) FERA Act (ii) replace by Competition Act

(c) LQP (iii) replace by FEMA Act

(d) Indirect taxes (iv) replace by LPG

21. When did India adopt social banking and multi-agency approach to meet rural credit

needs?

a. 1991

b. 1969

c. 1965

d. 2001

22. Fill in the blanks:

All those private enterprises which hire less than 10 workers are called ________.

OR

Fill in the blanks:

Material downloaded from myCBSEguide.com. 5 / 21

Infrastructure which provides such facilities which contribute indirectly to economic

activity but directly to the quality of life is called ________.

23. Fill in the blanks:

The growth rate of agriculture has ________ during the reform period.

24. In April 1999 which programme launched

a. SISRY

b. REGP

c. PMRY

d. JGSY

25. Fill in the blanks:

________ refers to the maximum limit within which waste can be assimilated by the

environment without degradation.

26. _____ is the population density the _____ is the pressure of population on land and the

more the economic problems

a. Lower, higher

b. Higher, Lower

c. Higher, Higher

d. Lower, Lower

27. Human Development Index (HDI) include

a. Both

b. Qualitative aspect

c. Quantitative aspect

Material downloaded from myCBSEguide.com. 6 / 21

d. None

28. Why do you think that soil erosion is one of the area which needs to be tackled in

order to preserve the environment?

OR

Do you think regional inequality exists even in health infrastructure in India? Give

reasons for your answer.

29. Why is human capital more important than physical capital?

30. Discuss fiscal policy reforms under New Economic Policy 1991.

31. How does industries help to strengthen the economy of a country?

OR

What are the benefits of globalisation?

32. Answer the questions on the basis of the following data.

i. Which country is having the highest and least rate of poverty?

ii. Suggest some measures that can be taken by India to reduce poverty.

Country Poverty rate(%age of the total population)

India 21.9%

China 3.3%

Pakistan 29.5%

33. Discuss some of the institutional weaknesses in Indian agriculture.

34. Can you give some evidence to prove that health infrastructure has improved in

India?

OR

Explain the various causes of unemployment in India.

Material downloaded from myCBSEguide.com. 7 / 21

CBSE Class 12 Economics

Sample Paper 04 (2019-20)

Solution

Section A

1. Budget deficit

2. It refers to the additions to the circular flow. Injections cause expansion of the

circular flow. Example: Government expenditure, exports and investment.

3. (b) 1.0

Explanation: Referring to the formula of investment multiplier below, if MPS=1, K=1.

It means when consumption is zero or all income is saved, then there is no investment

hence ,no change in income.

4. Foreign exchange rate is the price of a country' currency in terms of another country's

currency. It is the rate at which one currency can be exchanged for the other

currency in foreign exchange market.

OR

It is that type of effective exchange rate which does not account for changes in price

level while measuring average strength of one currency in relation to the others.

5. (b) Taking loans Explanation: Any deficit in the budget is financed by borrowing both

from internal and external sources.

6.

7. 0.8

8. True

9. Fiscal deficit

Material downloaded from myCBSEguide.com. 8 / 21

10. (a) - (ii), (b) - (iii), (c) - (iv), (d) - (i)

11.

Direct Tax Indirect Tax

1. Direct tax is a tax whose liability to 1. The liability to pay and incidence of

pay and incidence lie on the same indirect tax do not lie on the same

person. person.

2. Its incidence can not be shifted to 2. Its incidence can be shifted to some

some other person, i.e. actual burden of other person, i.e. burden of these taxes

taxes cannot be shifted. can be shifted to other.

3. Example : Income Tax, corporation

3. Excise duty, VAT.

tax.

12. i. Given that, Marginal Propensity to Consume (MPC) = 1

We know that Multiplier is given by,

So, here Multiplier (K) = (Infinity).

ii. Given that, Marginal Propensity to save (MPS)=1.

We know that Multiplier is given by, K = 1/1-MPC = 1/MPS = 1/1 = 1. Hence,

Multiplier(K) here is equal to 1.

OR

Differences between autonomous investment and induced investment

Basis Autonomous Investment Induced Investment

Autonomous investment is In simple language, when

that investment which is an increase in investment is due to

Meaning independent of the level of income the increase in the current level of

or profit. Thus, it is not induced by income and production, it is known

any changes in the income. as induced investment.

It is done to promote social

Motive It is driven by a profit motive.

welfare.

Sector It is generally undertaken by the It is generally done by the private

Material downloaded from myCBSEguide.com. 9 / 21

Sector

government sector. sector.

Income It is not affected by the changes in It is affected by the change in the

elasticity income level. income level.

13. Advancing loans is another basic function of the commercial banks. Banks advance

loans mostly for productive purposes. On the basis of the cash deposits of the people,

the banks build their cas reserves. The banks advance loans many times more than

their cash reserves. The deposits received by banks are not allowed to remain idle.

So, after keeping certain cash reserves, the balance is given to needy borrowers and

interest is charged from them, which is the main source of income for these banks.

Banks add to the supply of money in the economy by advancing loans. This is known

as credit creation by the banks.

Different types of loans and advances made by Commercial banks are :

i. Cash Credit: Cash credit refers to a loan given to the borrower against his current

assets like shares, stocks, bonds, etc. A credit limit is sanctioned and the amount is

credited in his account. The borrower may withdraw any amount within his credit

limit and interest is charged on the amount actually withdrawn.

ii. Demand Loans : Demand loans refer to those loans which can be recalled on

demand by the bank at any time. The entire sum of demand loan is credited to the

account and interest is payable on the entire sum.

iii. Short-term Loans : They are given as personal loans against some collateral

security. The money is credited to the account of borrower and the borrower can

withdraw money from his account and interest is payable on the entire sum of

loan granted.

14. The two BoP situations are:

BoP Surplus:

When the receipts of the country on account of autonomous transactions

exceed the payments of a country on account of autonomous transactions, this

difference is termed as BoP surplus.

BoP Surplus = R > P, where R = Receipts of the country, P = Payment of the

Material downloaded from myCBSEguide.com. 10 / 21

country.

BoP Deficit:

When the payments of a country on account of autonomous transactions

exceed the receipts of a country on account of autonomous transactions, this

difference is termed as BoP deficit.

BoP Deficit = Receipts on account of autonomous transactions < Payments on

account of autonomous transactions

Bop Deficit = R<P Where, R = Receipts P = Payments

Deficit:

A deficit in the balance of Trade indicates that the value of exports of goods are less

than the imports of goods for a country.

OR

Closed economy: The economy that does not interact with the rest of the world is

called a closed economy.

Interaction with other economies of the world widens choice in three broad

ways:

i. Consumers and firms have the opportunity to choose between domestic and

foreign goods. This is the product market linkage which occurs through

international trade.

ii. Investors have the opportunity to choose between domestic and foreign assets.

This constitutes the financial market linkage.

iii. Firms can choose where to locate production and workers to choose where to

work.

15. It is the rate at which one currency is exchanged for the other.

Material downloaded from myCBSEguide.com. 11 / 21

An increase in Foreign exchange rate from , means relative fall in

exchange value of domestic currency, which attracts more exports from the country

and implies a greater supply of foreign exchange, i.e., from as shown in

the figure. This is so as purchasing power of a dollar in terms of Indian rupee

increases.

16. (i) Treatment of the following items while estimating the national income of India:

a. It will not be included in national income because it is the non-factor payment as it

is considered that the general government borrows only for consumption

purposes.

b. Not included, because it is capital gain and has nothing to do with production.

c. It will be included because it is the final consumption expenditure by the

government.

d. It is included in the national income because it adds to the production of goods

though it is used for self-consumption.

(ii) Net Value Added at Market Price by Firm Y

= Sales + Change in stock (Closing Stock - Opening Stock) – Purchase of intermediate

products – Consumption of fixed capital

= 300 thousand + (–) 10 thousand (200 thousand - 210 thousand) – 150 thousand – 20

thousand

= 120 thousand Rupees.

OR

a. Income Method:

NDPFC = Compensation of employees + Operating surplus (Rent + Royalty + Interest

Material downloaded from myCBSEguide.com. 12 / 21

+ Profit) + Mixed income

NDPFC = 1200 + (400 + 0 + 620 + 800) + 700

= 1200 + (1820) + 700 = Rs.3720 crore

NNPFC = 1200 + (400 + 0 + 620 + 800) + 700

= 1200 + (1820) + 700 = Rs.3720 crore

NNPFC = NDPFC + NFIA

NNPFC = 3720 + (-20) = Rs.3700 crore

b. Expenditure Method:

GDPMP= Private final consumption expenditure + Government final consumption

expenditure + Gross domestic capital formation + Net exports

2000 + 1100 + (770 + 130) + (-30) = Rs.3970 crore

Gross Domestic Capitall Formation = Net Domestic Capital Formation +

Consumption of Fixed Capital

NNPFC = GDPMP - Depreciation + NFIA - NIT

NNPFC = 3970 - 130 +(-20) + 120

NNPFC = Rs.3700

17. Given,

i. Equilibrium level of Income (Y) = Rs. 5,000.

ii. Autonomous Consumption = Rs. 500.

iii. Marginal Propensity to Consume (MPC or b) = 0.4

i) Calculation of Investment expenditure :

We know that,

Income (Y) = Consumption (C) + Investment (I)

At the equilibrium level, Saving = Investment

5,000 - 2,500 + I or I = 5,000 - 2,500 = 2,500

ii) Calculation of Consumption expenditure :

We also know that,

Material downloaded from myCBSEguide.com. 13 / 21

Consumption (C) = + bY = 500 + [0.4 5,000]

= 500 + 2,000

Consumption (C) = Rs. 2,500

So, Investment Expenditure (I) = Rs. 2,500

Consumption Expenditure (C) = Rs. 2,500

Section B

18. Case for privatisation:

1. It will help in reducing the burden on exchequer.

2. It will help in modernising and diversifying PSUs.

3. It will help in making PSUs more competitive.

4. It will help in improving the quality of decision making of management.

5. It will help in reviving sick units, which are eating away the revenue of

government.

6. It will help in developing capital market and international market.

7. It is argued that a private firm has pressure from shareholders to perform

efficiently. If the firm is inefficient then the firm could be subject to a takeover. A

state-owned firm doesn’t have this pressure and so it is easier for them to be

inefficient. Therefore privatisation increases the efficiency of firms.

Case against privatisation:

1. It will encourage growth of monopoly power in the hands of big business houses.

2. It will increase disparities in income and wealth.

3. Private sector has no interest in buying loss-making and sick enterprises.

4. Privatisation may result in lop-sided development of industries in the country.

5. Private sector may have no interest in long gestation projects, infrastructure

investment and risky projects.

6. Private sector may not have sufficient funds for many vital projects.

7. Unexpectedly, all of the utilities create negative externalities (via pollution,

Material downloaded from myCBSEguide.com. 14 / 21

spoiling the environment, etc.) It can be argued that as public sector companies,

the government can regulate output and make sure that it is at the socially optimal

level (i.e. allow for externalities). In the private sector, maximisation of profit is

the only concern, so a socially damaging level of externalities will occur.

19. False

20. (a) - (ii), (b) - (iii), (c) - (iv), (d) - (i)

21. (b) 1969 Explanation: At the time of independence, moneylenders and traders

exploited the small and marginal farmers and landless laburers by lending to them on

high-interest rates and manipulated them. A major change occurred after 1969 when

India adopted social banking and multi-agency approach to adequately meet the

needs of rural credit.

22. Informal sectors

OR

Social infrastructure

23. Decelerated

24. (d) JGSY

Explanation: Jawahar Gram Samridhi Yojana (JGSY) is the restructured, streamlined

and comprehensive version of the erstwhile Jawahar Rozgar Yojana (JRY). Launched

on 1st April 1999, it has been designed to improve the quality of life of the rural poor

by providing them additional gainful employment.

25. Absorptive capacity

26. (c) Higher, Higher

Explanation: The population density of an area can greatly affect that area's economy and

social conditions.

27. (a) Both

Explanation: The Human Development Index (HDI) is a composite statistic of life

expectancy, education, and per capita income indicators, which are used to rank

Material downloaded from myCBSEguide.com. 15 / 21

countries into four tiers of human development.

28. Soil erosion occurs when rains and floods wash away the surface soil. It needs to be

addressed immediately because as per the estimates soil is being eroded at a rate of

5.3 billion tonnes a year which is in excess of the recharging capacity. A lot of

nutrients are lost due to soil erosion and each year the loss is in the range of 5.8 to 8.4

million tonnes.

OR

The development of health infrastructure is a key area of development in an economy

and all there should be an equitable investment in health infrastructure in both

urban and rural areas. But unfortunately, gender, income and regional bias exist in

the development of this field in India. Rural areas do not have access to or cannot

afford medical care. Even though the majority of population lives in rural areas, only

one-fifth of India’s hospitals are located in rural areas with only half the number of

dispensaries. Out of 6.3 lakh beds, roughly only 30% of them are available in rural

areas. The PHCs in rural areas do not offer basic medical care like X-ray or blood

testing devices. In rural areas, the percentage of people who have no access to proper

aid has risen from 15 in 1986 to 24 in 2003. This is really a very sad state of affairs. On

one hand we are aiming to be the fastest-growing economy and on the other hand, we

cant improve basic healthcare facilities in rural areas. Due to such inequalities, States

like Bihar, Madhya Pradesh, Rajasthan and Uttar Pradesh are relatively lagging

behind in healthcare facilities.

29. Human capital is more important than physical capital because the latter is an effect

of the former.All physical capital that we have today is subject to the acquisition of

human capital.The more qualitative human capital,the more qualitative physical

capital.

30. Fiscal reforms mean increasing the revenue receipts and reducing the public

expenditure of govt. in a manner that production and economic welfare are not

adversely affected. Its main objective was to reduce fiscal deficit which stood at 8.5

percent of GDP in 1990-91. Taxation syatem was made more scientific and rational.

Income tax slabs were reduced upon the recommendations of TRC. The peak rate of

Material downloaded from myCBSEguide.com. 16 / 21

customs duties has been reduced to 15% in budget 2006-07. Excise duty on several

commodities were reduced. Govt. made special efforts to cut public expenditure.

Rationalisation of Tax Systems: To rationalise the indirect tax system at the centre

by removing distortion in the structure there is a need to remove multiplicity of tax

rates of central excise duties on various goods and services. With tax reform initiated

since 1991, this has been now achieved with few exceptions.

Now, there is a single excise duty called CENVAT (which is in the form of value added

tax) on all products which enter a production chain. The argument for a single

CENVAT is that it will remove the distortions in the tax system as a result of

multiplicity of rates of excise duties.

The Fiscal Responsibility and Budget Management Act (FRBMA), 2003 has been

implemented and it emphasises on

a. Revenue led fiscal consolidation

b. Better expenditure outcomes.

c. Rationalisation of tax regime.

31. Industries help to strengthen the economy of a country in the following ways:

i. Industries help in the establishment of the infrastructure of the country such as

dams, railways, etc. Infrastructural development helps in the growth of other

sectors also.

ii. Expansion of capital goods industries pave the way for industrial growth and as a

result, the economy is able to undertake large scale production of goods at low

cost.

iii. Industries help in increasing agricultural productivity by supplying the

agricultural sector with mechanised means of production such as tractors,

threshers, etc and also with fertilisers, insecticides, etc.

iv. Industrialisation helps a country to become self-reliant in the production of

defence goods.

v. Industrialisation brings many more reforms to the places where they got

established. Eg. an increase in local land price, improved transportation and

finally increased revenue.

Material downloaded from myCBSEguide.com. 17 / 21

OR

Globalisation results in the following benefits for the economy

i. It helps the economy to adopt new and flexible methods of production.

ii. It results in raising the productivity of the industrial sector by reducing capital-

output ratio, increasing exports, raising the efficiency of the workforce,

modernising the technology used and increasing capital flow in the country.

iii. It helps in restructuring the production units of the country towards the

production of those goods which the country can produce effectively and

efficiently with the use of the domestically available factors of production.

iv. It helps to increase the flow of foreign capital into the country.

v. It helps to improve the quality of goods produced in the economy.

vi. It helps to address the problem of unemployment.

vii. Advantages from the free movement of labour between countries.

viii. Gains from the sharing of ideas/ skills/ technologies across national borders.

ix. Competitive pressures of globalisation may prompt improved governance and

better labour protections.

x. Encourages producers and consumers to benefit from the deeper division of

labour and economies of scale.

32. i. Pakistan is having the highest and China is having the east rate of poverty.

ii. Various measures that India can take to reduce poverty are:-

labour-intensive method of production

Development of agriculture

stability in the price level

eradication of unemployment

Special focus on backward regions

opportunities for self-employment

33. Some of the institutional weaknesses in Indian agriculture are as follows:

i. We need to involve the small and marginal farmers and the landless labour in

deriving benefits of increased agricultural exports through integrated

co¬operatives like the mother dairy, and other service co-operatives; contract

farming, etc.

Material downloaded from myCBSEguide.com. 18 / 21

ii. Present system of credit does not ensure timely availability of credit. In many

states, land reform remains woefully unfinished and tenancy regimes need urgent

reform.

iii. Indian agricultural credit system is suffering from the problems of subsidised

interest rates, poor recovery of loans, high intermediation costs of cooperatives

and commercial banks and debt write-offs.

iv. We also need to make efforts to develop new technologies for the farming sector

and making it available for small farmers so that they may diversify their

production towards high-value commercial and export commodities.

v. We need to create institutions like trading houses, market intelligence services

and creation of network of information on national and international prices.

vi. We also need infrastructure for processing, marketing and grading of produce,

investment in information etc.

34. There is no doubt about it that health infrastructure in India has improved. It can be

proved from the statistics given below:

Public Health Infrastructure in India

Item 1951 1981 2000

Hospitals 2694 6805 15888

Hospital/ Dispensary Bed 117000 504538 719861

Dispensaries 6600 16745 23065

PHCs 725 9115 22842

Subcenters 84736 137311

CHCs- 761 3043

It is absolutely clear that number of hospitals, dispensaries, PHCs, CHCs all have

increased many times during 1951-2000.

OR

The causes of unemployment in India are given below:

Material downloaded from myCBSEguide.com. 19 / 21

i. Slow Economic Growth: In the Indian economy, the rate of economic growth is

very slow. This slow growth rate fails to provide enough employment

opportunities for the rising population. Supply of labour is much more than the

available employment opportunities.

ii. Low level of Capital Formation: The main reason for India's unemployment is

insufficient capital. We have much less capital in comparison to our labour force.

Our capital structure is weak.

iii. Rapid Growth of Population: Constant increase in population has been a grave

problem of India. It is one of the main causes of unemployment. The number of

unemployed persons has actually increased instead of decreasing during the plan

period.

iv. Unequal distribution of assets: A large portion of the country's assets is

concentrated in a few hands. Because of a lack of assets, the general public cannot

have gainful employment.

v. Faulty Employment Planning: The Five Year Plans in India have not been

designed for employment generation. A frontal attack to solve the problem of

unemployment was missing. In the FYPs, it was assumed that economic growth

will take care of the unemployment problem.

vi. Excessive Use of Foreign Technology: There is a lack of scientific and technical

research in India due to its high cost. This has resulted in excessive use of foreign

technology which has led to technical unemployment in our country

vii. Lack of Financial Resources: The expansion and diversification programme of

agriculture and small scale industries have suffered because of a lack of financial

resources.

viii. The predominance of Agriculture: Agriculture has a predominant place in our

country. In agriculture, people do not find employment for the whole of the year.

This gives rise to seasonal unemployment. Besides this, there is not much scope for

an increase in employment in the agricultural sector.

ix. Agriculture Still a Seasonal Occupation: Even after approximately 70 years of

Independence, agriculture in India still does not have access to adequate irrigation

facilities, rendering it to be a seasonal occupation. Because of this, the workforce

engaged in farming activities remain unemployed for 3-4 months in a year.

x. The decay of Cottage and Small Industries: The cottage and small industries are

Material downloaded from myCBSEguide.com. 20 / 21

labour-intensive and generate a number of employment opportunities. But the

British rule led to their decay and the government of independent India did not

initiate adequate measures for their revival. This compounded the problem of

unemployment.

xi. Low Savings and Investment: In India, a low rate of capital formation prevails

due to low savings and investment. Shortage of capital prevents a business to

expand and grow, thus limiting their power to generate employment.

xii. The mobility of Labour: In India, the mobility of labour is quite low. Because of

family obligations, social constraints, language and cultural barriers, people are

unwilling to move to a new place when offered a job there. This is also a cause for

unemployment in India.

xiii. Wrong development Strategy: In our planning, we have adopted a development

strategy which is capital intensive and heavy industry based. It has proved anti-

employment.

Material downloaded from myCBSEguide.com. 21 / 21

You might also like

- 2021 Economics Solved Guess Paper Set 6Document20 pages2021 Economics Solved Guess Paper Set 6NitikaNo ratings yet

- 12 Economics Sp08Document18 pages12 Economics Sp08devilssksokoNo ratings yet

- 12 Economics Sp09Document19 pages12 Economics Sp09devilssksokoNo ratings yet

- 12 Economics Sp05Document20 pages12 Economics Sp05devilssksokoNo ratings yet

- 12 Economics Sp03Document19 pages12 Economics Sp03devilssksokoNo ratings yet

- 12 Economics Sp10Document20 pages12 Economics Sp10devilssksokoNo ratings yet

- CBSE Class 12 Economics Sample Paper 02 (2019-20)Document19 pagesCBSE Class 12 Economics Sample Paper 02 (2019-20)Anonymous 01HSfZENo ratings yet

- 12 Economics Sp06Document21 pages12 Economics Sp06devilssksokoNo ratings yet

- 12 Economics Sp02Document21 pages12 Economics Sp02devilssksokoNo ratings yet

- Omn XDu 8 Seiqk 1 OWSs XLNDocument20 pagesOmn XDu 8 Seiqk 1 OWSs XLNAnonymous 01HSfZENo ratings yet

- Economics Set I QPDocument4 pagesEconomics Set I QPsaju pkNo ratings yet

- 12 Economcis t2 sp02Document9 pages12 Economcis t2 sp02ShivanshNo ratings yet

- CBSE Class 12 Economics Sample Paper 01 (2019-20)Document21 pagesCBSE Class 12 Economics Sample Paper 01 (2019-20)Anonymous 01HSfZENo ratings yet

- EC Sample Paper 14 UnsolvedDocument7 pagesEC Sample Paper 14 Unsolvedmanjotsingh.000941No ratings yet

- EC Sample Paper 1 UnsolvedDocument8 pagesEC Sample Paper 1 Unsolvedhiruh5396No ratings yet

- Economicsquestionbank2022 23Document33 pagesEconomicsquestionbank2022 23imtidrago artsNo ratings yet

- Economics Set II QPDocument4 pagesEconomics Set II QPVihaan BalotiaNo ratings yet

- Economics Prepboard 1SET - BDocument6 pagesEconomics Prepboard 1SET - Bjainehalll28No ratings yet

- SQP 20 Sets EconomicsDocument160 pagesSQP 20 Sets Economicsmanav18102006No ratings yet

- GR+XII +Chapter++Test +National+IncomeDocument7 pagesGR+XII +Chapter++Test +National+IncomeAkshatNo ratings yet

- Practice Paper Class XII Eco PaperDocument12 pagesPractice Paper Class XII Eco PaperAarush100% (1)

- Ecovisionnaire Must Do QuestionsDocument6 pagesEcovisionnaire Must Do QuestionsAastha VermaNo ratings yet

- EC Sample Paper 20 UnsolvedDocument8 pagesEC Sample Paper 20 Unsolvedmanjotsingh.000941No ratings yet

- Practicepaper 3 Class XIIEconomics EMDocument6 pagesPracticepaper 3 Class XIIEconomics EMAvnish kumarNo ratings yet

- EC Sample Paper 3 UnsolvedDocument8 pagesEC Sample Paper 3 Unsolvedsubasree803No ratings yet

- 12 Economics Sp01Document18 pages12 Economics Sp01devilssksokoNo ratings yet

- 9000 Crores. What Is The Value of Exports?Document3 pages9000 Crores. What Is The Value of Exports?V S VIJITHNo ratings yet

- National Income Review Questions PDFDocument30 pagesNational Income Review Questions PDFseverinmsangi100% (1)

- MycbseguideDocument10 pagesMycbseguideBinoy TrevadiaNo ratings yet

- EconomicsDocument157 pagesEconomicsportableawesomeNo ratings yet

- Pre Board Class XII EconomicsDocument6 pagesPre Board Class XII EconomicsShubhamNo ratings yet

- Eco Mock Test 02 SPCCDocument3 pagesEco Mock Test 02 SPCCsattwikd77No ratings yet

- Eco Set B XiiDocument7 pagesEco Set B XiicarefulamitNo ratings yet

- 12 Economics23 24sp11Document14 pages12 Economics23 24sp11Dr. Anuradha ChugNo ratings yet

- 12 Economics Sp07Document19 pages12 Economics Sp07devilssksokoNo ratings yet

- EconomicsDocument113 pagesEconomicsdevanshsoni4116No ratings yet

- Eco Set A XiiDocument6 pagesEco Set A XiicarefulamitNo ratings yet

- Government Budget QBDocument8 pagesGovernment Budget QBPraneel BhattNo ratings yet

- Cbse Class 12 Economics Sample Paper Set 1 QuestionsDocument6 pagesCbse Class 12 Economics Sample Paper Set 1 QuestionsSaturo GojoNo ratings yet

- Pb23eco02 QPDocument7 pagesPb23eco02 QPAfiya NazimNo ratings yet

- Cbleecpu 12Document8 pagesCbleecpu 12Pubg GokrNo ratings yet

- Sample Paper 3Document8 pagesSample Paper 3scorpiondeathdrop115No ratings yet

- Economics Term TestDocument4 pagesEconomics Term Testniranjankumar jeyaramanNo ratings yet

- EC Sample Paper 16 UnsolvedDocument7 pagesEC Sample Paper 16 UnsolvedMilan TomarNo ratings yet

- Delhi Public School, Hyderabad Class: XII Time: 2hrs Subject: Economics Max. Marks: 50Document2 pagesDelhi Public School, Hyderabad Class: XII Time: 2hrs Subject: Economics Max. Marks: 50Lekhana WesleyNo ratings yet

- 12 EconomicsDocument7 pages12 Economicsshuklajaya349No ratings yet

- This Question Paper Contains Two PartsDocument17 pagesThis Question Paper Contains Two PartsRavikumar BalasubramanianNo ratings yet

- Pre-Board Economics Question Paper PDFDocument6 pagesPre-Board Economics Question Paper PDFmohitNo ratings yet

- Xii Mock TestDocument5 pagesXii Mock Testaryanmadnani50No ratings yet

- MLL For Late Bloomers - Class 12 ECON 2023-24Document59 pagesMLL For Late Bloomers - Class 12 ECON 2023-24nagpalmadhur5No ratings yet

- Exam Paper Class 12 DunlopDocument5 pagesExam Paper Class 12 DunlopPiyush HazraNo ratings yet

- Delhi Public School, Hyderabad Class: XII Time: 1 HR Subject: Economics Max. Marks:30Document2 pagesDelhi Public School, Hyderabad Class: XII Time: 1 HR Subject: Economics Max. Marks:30Lekhana WesleyNo ratings yet

- Cbse Class 12 Economics Sample Paper Set 3 QuestionsDocument6 pagesCbse Class 12 Economics Sample Paper Set 3 QuestionsPhototronixNo ratings yet

- Pre-Board Papers With MS EconomicsDocument160 pagesPre-Board Papers With MS Economicsbksbharatkumar22005No ratings yet

- Eco Practice Booklet Combined File May 2023Document107 pagesEco Practice Booklet Combined File May 2023prince soniNo ratings yet

- Economics 12 2023-1Document31 pagesEconomics 12 2023-1aryantejpal2605No ratings yet

- Economics Board Sample Paper 01 Questions 027c4698e8efdDocument5 pagesEconomics Board Sample Paper 01 Questions 027c4698e8efdaditi22032007No ratings yet

- ISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)Document15 pagesISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)hanaNo ratings yet

- EconomicsDocument9 pagesEconomicsSimha SimhaNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- 12 Economics Sp03Document19 pages12 Economics Sp03devilssksokoNo ratings yet

- 12 Economics Sp05Document20 pages12 Economics Sp05devilssksokoNo ratings yet

- 12 Economics Sp01Document18 pages12 Economics Sp01devilssksokoNo ratings yet

- Same Sex Marriages in IndiaDocument23 pagesSame Sex Marriages in IndiadevilssksokoNo ratings yet

- 12 Economics Sp02Document21 pages12 Economics Sp02devilssksokoNo ratings yet

- 12 Economics Sp07Document19 pages12 Economics Sp07devilssksokoNo ratings yet

- 12 Economics SP 2Document17 pages12 Economics SP 2devilssksokoNo ratings yet

- 12 Economics Sp08Document18 pages12 Economics Sp08devilssksokoNo ratings yet

- 12 Economics SP 1Document13 pages12 Economics SP 1devilssksokoNo ratings yet

- 12 Economics Sp09Document19 pages12 Economics Sp09devilssksokoNo ratings yet

- 12 Economics Sp06Document21 pages12 Economics Sp06devilssksokoNo ratings yet

- 12 Economics Sp10Document20 pages12 Economics Sp10devilssksokoNo ratings yet

- Irrigation Farm Business Plan Plan2farm WorkbookDocument28 pagesIrrigation Farm Business Plan Plan2farm WorkbookKBLMMOSESNo ratings yet

- VisionIAS Research and Analysis February 2024 Modern Indian History (7 Year PYQ Trend Analysis)Document86 pagesVisionIAS Research and Analysis February 2024 Modern Indian History (7 Year PYQ Trend Analysis)me15b042No ratings yet

- Daniel Micheal Okello (Allocative Efficiency)Document19 pagesDaniel Micheal Okello (Allocative Efficiency)Tuấn NgôNo ratings yet

- Income Tax JUNE 2024Document10 pagesIncome Tax JUNE 2024vikas.punjwaniNo ratings yet

- Project in HeleDocument11 pagesProject in HeleNicoleVerosil50% (2)

- Trends of Animal and Agrculture in The Next Five Years in Indonesia or Specially in BanyuwangiDocument2 pagesTrends of Animal and Agrculture in The Next Five Years in Indonesia or Specially in BanyuwangiIrma Rahayu NingrumNo ratings yet

- Lesson PlanDocument10 pagesLesson Planmycoadante09No ratings yet

- 2021 - Malahayati - An Assessment of The Short-TerDocument23 pages2021 - Malahayati - An Assessment of The Short-TerAnand Yamani YupitrikaNo ratings yet

- Agric Tech 2021 (1) .PDF KENNEDYDocument4 pagesAgric Tech 2021 (1) .PDF KENNEDYKennedy PfavayiNo ratings yet

- Case Study - RVDocument3 pagesCase Study - RVKaran WadhawanNo ratings yet

- Geeen PLC Poultry Farm - Project - 2016Document78 pagesGeeen PLC Poultry Farm - Project - 2016abrham astatikeNo ratings yet

- Cover Letter Harvest WorkerDocument2 pagesCover Letter Harvest Workerraisulislamapon42No ratings yet

- Extension Directorate Directory 2019 To 2020Document68 pagesExtension Directorate Directory 2019 To 2020Yared Mesfin FikaduNo ratings yet

- LPP (BM)Document3 pagesLPP (BM)pannu1641No ratings yet

- Ss 2 Agricultural Science Week 9 - 10Document5 pagesSs 2 Agricultural Science Week 9 - 10palmer okiemuteNo ratings yet

- Ahmed Al-Shaikh, Maaden - Argus Europe Fertilizer 2017Document19 pagesAhmed Al-Shaikh, Maaden - Argus Europe Fertilizer 2017vzgscribdNo ratings yet

- PPC - MTCDocument1 pagePPC - MTCNaresh KumarNo ratings yet

- Agropages May 2021 Formulation & Adjuvant TechnologyDocument35 pagesAgropages May 2021 Formulation & Adjuvant TechnologymarianaNo ratings yet

- Yekokeb Berhan NATIONAL Market Assessment Summary Report (Revised July 2012)Document51 pagesYekokeb Berhan NATIONAL Market Assessment Summary Report (Revised July 2012)LambadynaNo ratings yet

- Green House Project ProposalDocument16 pagesGreen House Project ProposalmarkzwikNo ratings yet

- People Empowerment - Making Devolution Work (Guiza & Fernandez, 1996)Document18 pagesPeople Empowerment - Making Devolution Work (Guiza & Fernandez, 1996)VenNo ratings yet

- Auditing and Assurance: Specialized Industries - Agricultural Sector Examination ReviewerDocument7 pagesAuditing and Assurance: Specialized Industries - Agricultural Sector Examination ReviewerHannah SyNo ratings yet

- Curriculum WorkingDocument4 pagesCurriculum WorkingCarmen Arredondo CortezNo ratings yet

- Support Horticultural Crop Works Support Nursery WorksDocument2 pagesSupport Horticultural Crop Works Support Nursery WorksJoanna Claire Dayo - Lumayaga100% (1)

- Cow Magnets-Vet MedicineDocument14 pagesCow Magnets-Vet MedicineAyse Nur ÖksümNo ratings yet

- Profitability and Resource Use Efficiency of Poultry Egg Production in Kuje Area Council Federal Capital Territory NigeriaDocument8 pagesProfitability and Resource Use Efficiency of Poultry Egg Production in Kuje Area Council Federal Capital Territory NigeriaOlateju OmoleNo ratings yet

- Icaesb 2019Document355 pagesIcaesb 2019Oness MushitaNo ratings yet

- Habanos Knowledge Masterfile Part 1Document38 pagesHabanos Knowledge Masterfile Part 1Aurelio TufanoNo ratings yet

- (SWOT Analysis) Blockchain Technology For Sustainable Supply Chains of Agri-Food in VietnamDocument13 pages(SWOT Analysis) Blockchain Technology For Sustainable Supply Chains of Agri-Food in VietnamTrí NghiênNo ratings yet

- Mexico Brazil Cuba Economies Power PointDocument50 pagesMexico Brazil Cuba Economies Power PointLuana SavoretoNo ratings yet