Professional Documents

Culture Documents

12 Economics Sp08

12 Economics Sp08

Uploaded by

devilssksokoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Economics Sp08

12 Economics Sp08

Uploaded by

devilssksokoCopyright:

Available Formats

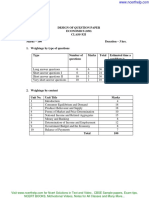

CBSE

Class 12 Economics

Sample Paper 08 (2019-20)

Maximum Marks: 80

Time Allowed: 3 hours

General Instructions:

i. All the questions in both the sections are compulsory. Marks for questions are indicated

against each question.

ii. Question number 1 - 10 and 18 - 27 are very short-answer questions carrying 1 mark

each. They are required to be answered in one word or one sentence each.

iii. Question number 11 - 12 and 28 - 29 are short-answer questions caring 3 marks each.

Answers to them should not normally exceed 60-80 words each.

iv. Question number 13 - 15 and 30 - 32 are also short-answer questions carrying 4 marks

each. Answers to them should not normally exceed 80-100 words each.

v. Question number 16 - 17 and 33 - 34 are long answer questions carrying 6 marks each.

Answers to them should not normally exceed 100-150 words each.

vi. Answer should be brief and to the point and the above word limit be adhered to as far as

possible.

Section A

1. Fill in the blanks:

_________ refers to the excess of revenue expenditure of the government over its

revenue receipts.

2. Define stocks.

3. The important factor influencing the propensity to save in an economy is

a. The level of savings

b. The level of investment

c. The level of consumption

d. The level of income (Y)

Material downloaded from myCBSEguide.com. 1 / 18

4. What is the meaning of deficit in Balance of Payments?

OR

The balance of trade shows a deficit of Rs.300 crore. The value of exports is Rs. 500

crore. What is the value of imports?

5. Fiscal Policy refers to a policy of :

a. Money lenders

b. Monetary authority

c. Commercial banks

d. Government Finance

6. Fill in the blanks:

________ is the rate at which the central bank (RBI) borrows money from commercial

bank.

7. Fill in the blanks:

The expenditure and revenue policy taken by the general government to accomplish

the desired goals is known as ________.

8. State true or false:

In spot market sale and purchase of foreign currency is settled on a specified future

date.

9. Fill in the blanks:

A vicious circle set wherein the government takes more loans to repay earlier loans,

which is called ________.

10. Match the following-:

(a) Direct tax (i) Escheat

Material downloaded from myCBSEguide.com. 2 / 18

(b) Indirect tax (ii) Recovery of loan

(c) Non tax receipt (iii) Income tax

(d) Capital receipt (iv) G.S.T

11. What is disinvestment? Does it refer to revenue receipt or capital receipt of

the government? Give an example.

12. Suppose that consumption equals C = 100 + 0.75Y, and investment equals 1 = ₹50 and

Y = C + I. Find

(i) The equilibrium level of income

(ii) The level of consumption at equilibrium, and

(iii) The level of saving at equilibrium.

OR

Find consumption expenditure from the following.

Autonomous consumption = Rs. 100

Marginal Propensity to Consume = 0.70

National Income = Rs. 1,000.

13. What are open market operations? What is their effect on availability of credit?

14. Distinguish between the current account and capital account of balance of payments

account. Is import of machinery recorded in current account or capital account? Give

reasons for your answer.

OR

A surplus current account means that the nation is a lender to other countries and a

deficit current account means that the nation is a borrower from other countries.

With respect to the given statement, analyze the components of Balance on Current

Account.

15. Tax rates on higher-income group have been increased. Which economic value does it

reflect? Explain.

16. Why are exports included in the estimation of Domestic Product by the

Material downloaded from myCBSEguide.com. 3 / 18

expenditure method? Can the gross domestic product be greater than the Gross

National Product? Explain.

OR

Calculate Gross National Product at Factor Cost from the following data by

i. Income method and

ii. Expenditure method.

S.no. Contents (Rs. in crores)

(i) Private Final Consumption Expenditure 1,000

(ii) Net Domestic Capita! Formation 200

(iii) Profits 400

(iv) Compensation of Employees 800

(v) Rent 250

(vi) Government Final Consumption Expenditure 500

(vii) Consumption of Fixed Capital 60

(viii) Interest 150

(ix) Net Current Transfer from Rest of the World (-) 80

(x) Net Factor Income from Abroad (-) 10

(xi) Net Exports (-) 20

(xii) Net Indirect Taxes 80

17. i. Distinguish between autonomous investment and induced investment,

ii. On the basis of the following information about an economy calculate its

equilibrium level of income.

Autonomous consumption = Rs 100

Marginal Propensity to Consume = 0.75

Investment = Rs 5,000

Material downloaded from myCBSEguide.com. 4 / 18

Section B

18. Discuss the impact of fiscal sector reforms.

19. State true or false:

A teacher's salary is higher than a rickshaw puller because of education.

20. Match the following:

(a) Fifth plan (i) generation of employment opportunity

(b) Sixth plan (ii) focus on weaker section of society

(c) Seventh plan (iii) strengthening of infrastructure

(d) Eighth plan (iv) removal of poverty

21. Development of rural marketing relates to

a. All of these

b. Regulated market

c. Storage

d. Transportation

22. Fill in the blanks:

The process of moving from self-employment and regular salaried employment to

casual wage work is known as ________ of the workforce.

OR

Fill in the blanks:

________ refers to overseas patients visiting India for their medical treatment.

23. Fill in the blanks:

_________ is a production system that sustains the health of soils, ecosystem, and

Material downloaded from myCBSEguide.com. 5 / 18

people.

24. ____ it is a cut-off point on the line of distribution which divides the population into

poor and non-poor

a. Poverty line

b. Poverty distribution

c. Poverty

d. Poverty cut off

25. Fill in the blanks:

An increase in earth's temperature results in an increase in the volume of water

which contributes to a rise in the sea level is called ________.

26. Which of the following country is growing mainly due to manufacturing sector?

a. China

b. Pakistan

c. None.

d. India

27. Which of the following is not the parameter of human development

a. Adult mortality rate

b. Life expectancy

c. Population below poverty line

d. Infant mortality rate

28. Is environmental crisis a recent phenomenon? If so, why?

OR

Material downloaded from myCBSEguide.com. 6 / 18

Do you think India’s installed capacity to generate electricity is sufficient?

29. A skilled worker like software professional generates more income than an unskilled

worker. Why?

30. Explain the changing role of state in Indian economy since introduction of reforms.

31. What is subsidy? What is its objective?

OR

What was the impact of reforms on growth and employment in India?

32. Compare India and China in the context of various social indicators by studying the

following data.

Social sector indicators 2012-15

Description India China

Gross enrolment ratio in primary school 2013(%) 100.1 116

Expenditure on research and development as % of GDP (2005-12) 0.8 2

adult literacy ratio 2013 (%) 62.8 95.1

Health expenditure (%GDP) (2014) 5.05 10.43

Doctor after one thousand population (2017) 0.7 1.6

33. What do you mean by organic farming. Why should we adopt organic farming?

34. Highlight important features of the infrastructure sector.

OR

What should be the main elements of ‘employment policy’ in India in the present

context?

Material downloaded from myCBSEguide.com. 7 / 18

CBSE Class 12 Economics

Sample Paper 08 (2019-20)

Solution

Section A

1. Revenue deficit

2. Stock variables are defined as any quantity measured at a particular point of time e.g.

number of machines in a plant on 31st March, the amount in the bank account on 1st

July. National wealth, money supply is a stock variable. Stock variables are not time

dimensional.

3. (d) The level of income (Y) Explanation: Saving is a function of income.

S=f(Y).

So, APS=S/Y=f(Y)/Y.

4. Deficit in BOP refers to a situation when receipts of the country arising out of

autonomous transactions are less than the corresponding payments to the rest of the

world during the period of an accounting year. Suppose, the receipts of the domestic

country is Rs. 200 crore, whereas payments are Rs. 220 crore. Then BOP deficit will be

= 220 - 200 crore = Rs. 20 crore

OR

BOT = Exports - Imports

= - Rs. 300 crore

Imports = Exports - BOT (Deficit)

= Rs. 500 - (- Rs.300 crore)

= Rs. 800 crore.

5. (d) Government Finance

Explanation: Government Finance

6. Reverse repo rate

Material downloaded from myCBSEguide.com. 8 / 18

7. Fiscal policy

8. False

9. Debt Trap

10. (a)-(iii) , (b)-(iv) , (c)-(i) , (d)-(ii)

11. Disinvestment refers to the withdrawal of existing investment. For Example, The

government of India is undertaking disinvestment by selling its shares in the Maruti

Udyog. It is a capital receipt of the government as it reduces assets of the government.

12. i) Y = C + I

Y = 100 + 0.75Y + 50

Y – 0.75y = 150

=₹600

(ii) C = 100 + 0.75* 600 = ₹550

(iii) S = Y – C = 600 – 550 = ₹50

OR

Here we have Autonomous consumption ( ) = Rs.100,

Marginal Propensity to Consume (b) = 0.70 and Income (Y) = Rs. 1,000.

Now we have to find Consumption Expenditure which is given by the following

equation,

(C) = + bY

= 100 + 0.7 1,000

= 100 + 700= Rs. 800. Therefore Consumption Expenditure is equal to Rs 800.

13. Open market operations refer to buying and selling of government securities by the

central bank from/to the public and commercial banks.

Sale of securities by central bank reduces the reserves of the commercial banks. This

adverselty affects the bank's ability to create credit and this decreases the money

supply in the economy. Purchase of securities by central bank increases the reserves

and raises the bank's ability to give credit.

Material downloaded from myCBSEguide.com. 9 / 18

14. (i) Current account: Current account is that account which records imports and

exports of goods and services and unilateral transfers, income and transfer payments

during a year.

(ii) Capital account: Capital account is that account which records all such transaction

between residents of a country and rest of the world which cause a change in the

asset or lability status of the residents of a country or its government.

(iii) Import of machinery is an import item. So, it will be included or recorded under

the current account.

OR

Balance on Current Account has two components:

Balance of Trade or Trade Balance

Balance on Invisibles

Balance of trade is the difference between the value of exports and value of imports

of goods of a country in a given period of time. Export of goods is entered as a credit

item in BOT, whereas import of goods is entered as a debit item in BOT. It is also

known as Trade Balance.

Net Invisibles is the difference between the value of exports and value of imports of

invisibles of a country in a given period of time. Invisibles include services, transfers

and flows of income that take place between different countries. Services trade

includes both factor and non-factor income. Factor income includes net international

earnings on factors of production (like labour, land and capital). Non-factor income is

net sale of service products like shipping, banking, tourism, software services, etc.

15. The economic value that is reflected in the rise in the tax rate for higher-income

group is 'Equality and Social Welfare'.Individual welfare is availed by people

themselves provided they have higher income but, welfare to all other people is not

availed by individuals as they have no incentive to do that. Since the government

aims at welfare rather than profit, it frames policies for economic equality and social

welfare. The main objective of the budgetary policy of the government is to reduce

inequalities of income and wealth in the country. Even distribution of wealth and

social welfare remains the main objective of budgetary policy. Inequality arises when

Material downloaded from myCBSEguide.com. 10 / 18

the income of one group is greater than the other group. The government uses

progressive taxation policy to reduce the inequalities of income and wealth in the

country. The government imposes high tax rates on higher-income group and a low

tax rate on lower-income group. People with income below a certain level are not

levied any direct tax altogether. All this is done so that the wealth is smoothly

distributed among all classes of society.

16. The expenditure method estimates expenditure on domestic product i.e., expenditure

on final goods and services produced within the economic territory of the country. It

includes expenditure incurred by residents and non-residents both. Exports though

purchased by non-residents are produced within the economic territory and therefore

a part of domestic product.

Domestic Product = National Product + Net factor income from abroad.

i.e Domestic Product = National Product + (Net factor income received from abroad-

Net factor income paid to abroad).

So for Domestic product to be greater than National Product, Net Factor income

received from abroad should be negative and this will be possible when Net factor

income paid to rest of the world is greater than the Net factor income received from

the rest of the world.

So we can conclude that Domestic product would be less than National product only

when Net factor income received from rest of world is Negative.

OR

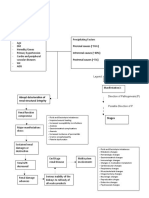

Calculation of Gross National Product at Factor Cost :

By Income Method By Expenditure Method

GNPFC = Private Final Consumption Expenditure +

GNPFC = Compensation of

Government Final Consumption Expenditure + Net

Employees + Profits + Rent +

Domestic Capital Formation + Consumption of Fixed

Interest + Consumption of

Capital + Net Exports - Net Indirect Taxes + Net

Fixed Capital + Net Factor

Factor Income from Abroad

Material downloaded from myCBSEguide.com. 11 / 18

Income from Abroad

= 800 + 400 + 250 + 150 + 60 + = 1,000 + 500 + 200 + 60 + (- 20) - 80 + (- 10)

(-10) = 1,760 - 110

= Rs. 1,650 crores = Rs. 1,650 crores

17. i. Differences between autonomous investment and induced investment

SR.

Basis Autonomous Investment Induced Investment

No.

To promote social welfare, Induced Investment is

1. Motive

Autonomous Investment is done driven by profit motive.

It is generally undertaken by the It is generally done by

2. Sector

government sector. the private sector.

Income It is not affected by the changes in It is affected by the change

3.

elasticity income level. in the income level.

ii. Calculation of equilibrium level of income:

Given,

i. Autonomous consumption = Rs 100

ii. Marginal Propensity to Consume = 0.75

iii. Investment = Rs 5,000

Since at the equilibrium level, Saving = Investment

Income (Y) = Consumption (C) + Investment (I),

Also, Consumption Expenditure

Where, = Autonomous consumption, b = Marginal Propensity to Consume, and Y

= Income

So, from the above two relations, we get

Y = 100 + 0.75Y + 5000

Y - 0.75Y = 5100

Material downloaded from myCBSEguide.com. 12 / 18

0.25Y = 5100

The equilibrium level of income = Rs 20,400

Section B

18. Fiscal sector reforms had not produced desirable results. Reducing tax rates have not

led to increase in government revenue. Reform policies like tariff reduction have

reduced the scope of increasing government revenue. Tax incentives offered to attract

MNCs has further reduced scope of increasing government revenue. However fiscal

sector reforms have helped to raise the rate of savings and investments in India,

which to some extent have further enhanced the productivity of public expenditure.

19. True

20. (a) - (ii), (b) - (iv), (c) - (i), (d) - (iii)

21. (a) All of these

Explanation: Agricultural marketing includes all these processes between harvesting

and final sale of the produce by the farmers.

22. Casualisation

OR

Medical Tourism

23. Organic farming

24. (a) Poverty line

Explanation: A minimum income level used as an official standard for determining

the proportion of a population living in poverty is called poverty line.

25. Global warming

26. (a) China

Explanation: Sectoral Share of Employment and GDP (%)

Contribution to GDP (2003) Distribution of WorkForce

Sector

Material downloaded from myCBSEguide.com. 13 / 18

India China Pakistan India(2000) China(1997) Pakistan(2000)

Agriculture 23 15 23 60 54 49

Industry 26 53 23 16 27 18

Service 51 32 54 24 19 37

Total 100 100 100 100 100 100

27. (a) Adult mortality rate

Explanation: Development Index (HDI) combines three dimensions: A long and

healthy life: Life expectancy at birth, Education index: Mean years of schooling and

Expected years of schooling, A decent standard of living: GNI per capita.

28. Yes, the environmental crisis is a very recent phenomenon. The sparks of such crisis

were never visible in the past. In recent years, the population has increased. It has

increased demand for natural resources while the supply of natural resources is

fixed. It creates excess demand and exerts pressure on natural resources.

Consequently, the mounting pressure on the carrying capacity of the environment is

paving the way for environmental crises.

OR

India’s installed capacity to generate electricity is not sufficient to feed an annual

economic growth of 7-8%. In order to meet the growing demand for electricity,

between 2000 and 2012, India needs to add 100000 MW of new capacity, whereas at

present India is able to add only 20000 MW a year. The role of private sector power

generators and foreign investors has been limited. The thermal power sector is facing

a shortage of raw material and coal supplies.

29. A skilled worker generates more income than an unskilled worker. The productivity

of an educated and skilled person is higher than an unskilled one. Skilled workers

often refer to a line of work that requires technical skills or specialized training. So

there is a great demand for skilled workers. Due to this fact, a skilled worker also

commands higher earnings and gainful employment and they cannot be substituted

easily because it takes years to generate manpower which is skilled in a particular

field. On the other hand, unskilled labor occupations typically don’t require workers

Material downloaded from myCBSEguide.com. 14 / 18

to have any kind of special training or skills, For e.g. an unskilled worker like a

rickshaw puller can be easily substituted and such workers easily compromise on

their earnings.

30. The changing role of state is reflected in the eighth five-year plan which mentioned

that the planning in India will be indicative increasingly. In order to give some

correctness to the changing role of state the eighth five-year plan has identified the

principles governing public sector. These are :

1. The public sector must withdraw from the areas where no public sector is served

by its presence.

2. State should make investments only in those areas where investment is of main

infrastructural nature where private sector is not likely to come forth to an adequate

extent within a reasonable time perspective.

After that we saw a major shift in the Indian economy and the role of state has been

changing from a controller, regulator and participator to that of a facilitator, observer

and guide. The changes that took place in the role of state since 1991 are as under:

a. Before economic reforms, government had its share in all sectors of the economy.

It was producing bread, butter, biscuits, milk, running hotels and many of these

were actually not required to be in public sector. Government withdrew herself

from these sectors through delicensing, deregulation and disinvestment.

b. As a regulator, during 1947-1990, Government regulated all activities with the

laws and acts. But after 1991, except some basic and strategic goods and services,

decisions were made to be market-driven. For this purpose, regulatory authorities

were set up for different sectors.

c. Since 1991, Government has focused its attention on development of social sector

like education, health, defence, law and order.

Overall, we can say that the role of state has changed from producer to production

facilitator.

31. A subsidy is a benefit given by the government to the producers as an incentive to

produce. To farmers a subsidy is given to lower the cost of inputs. It is given on

Material downloaded from myCBSEguide.com. 15 / 18

electricity to the producers to lower cost of production and it is given to consumers

especially those living below poverty line on necessities to make basic needs

affordable for them.

The objective of subsidy is to bolster the welfare of the society. It is a part of non-plan

expenditure of the government. Major subsidies in India are petroleum subsidy,

fertiliser subsidy, food subsidy, interest subsidy, etc.

OR

The study reveals that economic growth which started after independence took

momentum after economic reforms were introduced in the economy. Now India is

recognized as second fast-growing country after china and is emerging as a

superpower in the years to come. Although there has been an increase in the growth

rates during reform period, however scholars point out that growth has not led to

creation of employment opportunities. Private-sector job growth increased but

couldn't keep pace with the annual increase in labour force and pace of job losses in

the public sector. As a consequence number of people working in the organised sector

in India as a percentage of total labour force has decreased. This failure of private

sector to generate enough jobs to compensate for the shrinking public sector is partly

to do with India's terrible educational outcome and the rigidity in the labour market

regulation. Moreover, economic reforms had not led to growth of all the sectors

equally.

32. With impressive achievements in the economic sphere, China has also fared better in

terms of the social sector. The table shows that the enrolment ratio in primary school

is higher in China than that of India. So, the adult literacy ratio is far greater in China

as compared to India. Moreover, health expenditure in China is double in comparison

to India. Education has been given special importance in the social indicator.

The level of education is known by the comparison of the mean year of schooling of

both the countries i.e, India and China. It indicates that the position of China (7.8) is

better in comparison to India (6.4).

33. It is a whole system of farming that restores, maintains and enhances the ecological

balance.

Material downloaded from myCBSEguide.com. 16 / 18

Organic agriculture offers a means to substitute costlier agricultural inputs (such as

HYV seeds, chemical fertilizers, pesticides etc.) with locally produced organic inputs

that are cheaper and thereby generate good returns on investment. Organic

agriculture also generates income through exports as the demand for organically

grown crops is on a rise. Studies across countries have shown that organically grown

food has more nutritional value than chemical farming thus providing us with

healthy foods. Since organic farming requires more labour input than conventional

farming, India will find organic farming an attractive proposition. Finally, the

produce is pesticide-free and produced in an environmentally sustainable way.

34. Following are the important features of infrastructure:

1. Public Goods: Most of the physical infrastructure services have some elements of

public good in them i.e. it is not always possible to exclude those consumers who

chose not to pay for them.

2. Externalities: The social benefit of the infrastructure services is more than the cost

involved in their generation. It makes it difficult to price them economically.

3. Monopolies: Monopolies are more prevalent in infrastructure.

4. Public Sector Domination: Public sector dominates in supply of infrastructure due

to above-mentioned features.

5. Lumpy Investment: Infrastructure projects are such that any expenditure on a

part of the project is not useful until the whole project is ready for operations.

6. Indivisibilities: It means one can not divide and sub-divide such projects in small

parts and activate them.

OR

Following should be the main elements of employment policy in India in the present

context:

i. The employment policy should emphasise on both complete and more productive

employment.

ii. Employment policy must have the objective of a higher rate of capital formation.

iii. Employment should be generated in the normal process of development.

iv. There should be an effective reform of the educational system. Emphasis should

be on vocational and technical knowledge.

Material downloaded from myCBSEguide.com. 17 / 18

v. Emergence of destabilising factors in the economy should be avoided through

greater efficiency in planning.

vi. Measures should be taken to increase employment opportunities for women.

vii. Employment policy should give more emphasis to self-employment.

viii. Cottage industry should be promoted to reduce seasonal unemployment.

Material downloaded from myCBSEguide.com. 18 / 18

You might also like

- Wrestling Strength and ConditioningDocument12 pagesWrestling Strength and ConditioningTintin BilatbatNo ratings yet

- Ssangyong Rodius ABSDocument9 pagesSsangyong Rodius ABSMTK2016No ratings yet

- AS 1670.1-1995 Amdt 4-2001 Fire Detection, Warning, Control and Intercom Systems - System Design, Installation and ComDocument5 pagesAS 1670.1-1995 Amdt 4-2001 Fire Detection, Warning, Control and Intercom Systems - System Design, Installation and ComRobert SultanaNo ratings yet

- PallorDocument16 pagesPallorManal AlQuaimi100% (1)

- LV Ph2020 - Bid Set - ArchitecturalDocument30 pagesLV Ph2020 - Bid Set - Architecturalart cafeNo ratings yet

- MB141 Economics Jan2006Document26 pagesMB141 Economics Jan2006Priyank MalkanNo ratings yet

- Assignment - Engineering EconomicsDocument13 pagesAssignment - Engineering Economicssenzo scholarNo ratings yet

- Economics Term IDocument9 pagesEconomics Term IPiyush JhamNo ratings yet

- Economics Assignment: (Decline in Sales in Automobile Sector)Document5 pagesEconomics Assignment: (Decline in Sales in Automobile Sector)AryanNo ratings yet

- Economics Department: Syllabus For M. Sc. in Applied EconomicsDocument25 pagesEconomics Department: Syllabus For M. Sc. in Applied EconomicsAzhaan AkhtarNo ratings yet

- Economics PDFDocument38 pagesEconomics PDFUtkarsh TiwariNo ratings yet

- Chapter 1 Micro EconomicsDocument4 pagesChapter 1 Micro Economicsshashikumar shashiNo ratings yet

- Business Economics MainDocument8 pagesBusiness Economics MainJaskaran MannNo ratings yet

- Economics Model PaperDocument31 pagesEconomics Model Paperapi-3699388100% (3)

- Reading EconomicsDocument4 pagesReading EconomicsJeysson BacaNo ratings yet

- Economics Papper PatternDocument5 pagesEconomics Papper PatternRonit GuravNo ratings yet

- Economics Unit OutlineDocument8 pagesEconomics Unit OutlineHaris ANo ratings yet

- Career Opportunities in EconomicsDocument12 pagesCareer Opportunities in Economicssujith kumarNo ratings yet

- Economics Open Closed SystemsDocument37 pagesEconomics Open Closed Systemsmahathir rafsanjaniNo ratings yet

- Economics Grade 11 NCERT CBSE ProjectDocument2 pagesEconomics Grade 11 NCERT CBSE ProjectBhavesh Shaha0% (1)

- Excess and Deficient Demand HandoutDocument3 pagesExcess and Deficient Demand HandoutTashiTamangNo ratings yet

- Chap - 2 PPT OF INDIAN ECONOMY 1950-1990Document54 pagesChap - 2 PPT OF INDIAN ECONOMY 1950-1990arshil10c25No ratings yet

- History: Size of TheindustryDocument38 pagesHistory: Size of TheindustryDikshit KothariNo ratings yet

- CH 3 Macroeconomics AAUDocument90 pagesCH 3 Macroeconomics AAUFaris Khalid100% (1)

- Balance of PaymentDocument9 pagesBalance of PaymentMuskanNo ratings yet

- Pre-Board Economics Question Paper PDFDocument6 pagesPre-Board Economics Question Paper PDFmohitNo ratings yet

- Lecture Notes International EconomicsDocument105 pagesLecture Notes International EconomicsWilliam HeffnerNo ratings yet

- Economics and NatureDocument8 pagesEconomics and NatureChintaan PatelNo ratings yet

- Economic ReformsDocument77 pagesEconomic Reformssayooj tvNo ratings yet

- Lewis' Theory of Unlimited Supply of Labour PPT 3.2Document23 pagesLewis' Theory of Unlimited Supply of Labour PPT 3.2Kat SullvianNo ratings yet

- Functions of The Central BankDocument6 pagesFunctions of The Central BankVenkat SaiNo ratings yet

- Derivation of Compensated and Un Compensated Demand CurveDocument8 pagesDerivation of Compensated and Un Compensated Demand CurveAnita PanthiNo ratings yet

- 14th Finance Commission VISION IASDocument14 pages14th Finance Commission VISION IASimranNo ratings yet

- m02 Government Budget and The EconomyDocument17 pagesm02 Government Budget and The EconomyAman patidarNo ratings yet

- Macro CH 7 & 8 PDFDocument26 pagesMacro CH 7 & 8 PDFAKSHARA JAINNo ratings yet

- Aggregate Demand and Related Concepts Series 1 NewDocument11 pagesAggregate Demand and Related Concepts Series 1 Newsharique alamNo ratings yet

- Chapter 1 Introduction To Economics BMDocument42 pagesChapter 1 Introduction To Economics BMSKYRunner 777No ratings yet

- Cbse Sample Papers For Class 12 Economics With Solution PDFDocument19 pagesCbse Sample Papers For Class 12 Economics With Solution PDFniharikaNo ratings yet

- Allmacroeconomicsppts 130321114704 Phpapp02Document291 pagesAllmacroeconomicsppts 130321114704 Phpapp02infoeduNo ratings yet

- Class 12 Economics Chapter 5 Important Extra Questions Human Capital Formation in IndiaDocument11 pagesClass 12 Economics Chapter 5 Important Extra Questions Human Capital Formation in IndiaBhumi SalujaNo ratings yet

- Mankiw Chapter 5 Open Economy InvestmentDocument59 pagesMankiw Chapter 5 Open Economy InvestmentYusi PramandariNo ratings yet

- Chapter 13 - Foreign Exchange Rate - Chapter Notes, Macro Economics, Class 12 - EduRev NotesDocument14 pagesChapter 13 - Foreign Exchange Rate - Chapter Notes, Macro Economics, Class 12 - EduRev Notesswatisin93No ratings yet

- Chapter 2 Eco561Document55 pagesChapter 2 Eco561norshaheeraNo ratings yet

- Macroeconomics: Money, Banking, Prices, and Monetary PolicyDocument32 pagesMacroeconomics: Money, Banking, Prices, and Monetary PolicyBrian NguyenNo ratings yet

- Board Question Paper EconomicsDocument18 pagesBoard Question Paper Economics9137373282abcdNo ratings yet

- II PUC EconomicsDocument5 pagesII PUC EconomicsArvind KoreNo ratings yet

- Business Economics GradeA EssayDocument14 pagesBusiness Economics GradeA EssayPradheep AyyanarNo ratings yet

- Economics ProjectDocument7 pagesEconomics ProjectMadhusmita BeheraNo ratings yet

- Question Bank: Short Answer QuestionsDocument29 pagesQuestion Bank: Short Answer QuestionsPayal GoswamiNo ratings yet

- Central Problems of An Economy - GeeksforGeeksDocument10 pagesCentral Problems of An Economy - GeeksforGeeksAKSHAT TANWAR100% (1)

- National Income Numerical QDocument2 pagesNational Income Numerical QGongju Esya100% (1)

- FALL2019 ECON2113 HomeworkDocument9 pagesFALL2019 ECON2113 HomeworkNamanNo ratings yet

- Income Determination: in Closed and Open EconomyDocument8 pagesIncome Determination: in Closed and Open EconomyPramod Pyara Shrestha100% (1)

- Worksheet On Business Environment Board QPDocument3 pagesWorksheet On Business Environment Board QPLivesh SinglaNo ratings yet

- Sample Paper Accountancy 12, Set-3, 2022-23Document10 pagesSample Paper Accountancy 12, Set-3, 2022-23AKKI YTNo ratings yet

- Eco With Atm: Government Budget and The EconomyDocument11 pagesEco With Atm: Government Budget and The EconomyKeshav KhandelwalNo ratings yet

- Mundell FlemingDocument40 pagesMundell FlemingAnkita Singhai100% (1)

- AGGREGATE DEMAND COMPONENTS AND RELATED CONCEPTS Important Questions PDFDocument23 pagesAGGREGATE DEMAND COMPONENTS AND RELATED CONCEPTS Important Questions PDFVicky mishra0% (1)

- Economic Question Bank With Solutions PDFDocument172 pagesEconomic Question Bank With Solutions PDFlimuNo ratings yet

- CH 6 Product 1011Document51 pagesCH 6 Product 1011Amir BhattiNo ratings yet

- MCQ Indian Economy (1950-1990)Document2 pagesMCQ Indian Economy (1950-1990)divya shrichandaniNo ratings yet

- Human Capital FormationDocument16 pagesHuman Capital FormationxhaviNo ratings yet

- 12 Economics Sp04Document21 pages12 Economics Sp04devilssksokoNo ratings yet

- 2021 Economics Solved Guess Paper Set 6Document20 pages2021 Economics Solved Guess Paper Set 6NitikaNo ratings yet

- 12 Economics Sp05Document20 pages12 Economics Sp05devilssksokoNo ratings yet

- 12 Economics Sp02Document21 pages12 Economics Sp02devilssksokoNo ratings yet

- 12 Economics Sp03Document19 pages12 Economics Sp03devilssksokoNo ratings yet

- 12 Economics Sp05Document20 pages12 Economics Sp05devilssksokoNo ratings yet

- 12 Economics Sp07Document19 pages12 Economics Sp07devilssksokoNo ratings yet

- Same Sex Marriages in IndiaDocument23 pagesSame Sex Marriages in IndiadevilssksokoNo ratings yet

- 12 Economics Sp01Document18 pages12 Economics Sp01devilssksokoNo ratings yet

- 12 Economics SP 2Document17 pages12 Economics SP 2devilssksokoNo ratings yet

- 12 Economics SP 1Document13 pages12 Economics SP 1devilssksokoNo ratings yet

- 12 Economics Sp09Document19 pages12 Economics Sp09devilssksokoNo ratings yet

- 12 Economics Sp10Document20 pages12 Economics Sp10devilssksokoNo ratings yet

- 12 Economics Sp04Document21 pages12 Economics Sp04devilssksokoNo ratings yet

- 12 Economics Sp06Document21 pages12 Economics Sp06devilssksokoNo ratings yet

- Invoice 2 PDFDocument4 pagesInvoice 2 PDFjeevanNo ratings yet

- (PH D EL-Graduate-ProgramDocument2 pages(PH D EL-Graduate-ProgramRina Lorraine CagasNo ratings yet

- PathoPhysiology of Renal Failure (Overview)Document7 pagesPathoPhysiology of Renal Failure (Overview)Tiger Knee100% (3)

- OCLC Top 1000 Books Complete List - 2005 - With CoversDocument191 pagesOCLC Top 1000 Books Complete List - 2005 - With CoversmtwdrmNo ratings yet

- Moyland Wood OverlordDocument1 pageMoyland Wood OverlordAlex SommervilleNo ratings yet

- IndustrialEcology Herman Miller 17mar06 PDFDocument20 pagesIndustrialEcology Herman Miller 17mar06 PDFJulien KerroucheNo ratings yet

- Colours of Magic Indigo 5e PDFDocument6 pagesColours of Magic Indigo 5e PDFGreyScholarNo ratings yet

- Document Types and Number Range Objects in New GL - ERP Financials - SCN WikiDocument5 pagesDocument Types and Number Range Objects in New GL - ERP Financials - SCN WikiManas Kumar SahooNo ratings yet

- Orthogonal Frequency Division Multiplexing-OfdmDocument30 pagesOrthogonal Frequency Division Multiplexing-OfdmPREMALATHA GOVINDNo ratings yet

- UPSC-CSE-Yogesh-Kumbhejkar-8-2015 Exam View PDFDocument11 pagesUPSC-CSE-Yogesh-Kumbhejkar-8-2015 Exam View PDFB AspirantNo ratings yet

- Infographics WK5, Sanjose, CherryjoyDocument2 pagesInfographics WK5, Sanjose, CherryjoySanjose CherryjoyNo ratings yet

- Hybrid Robot Design - PBenTzviDocument13 pagesHybrid Robot Design - PBenTzviIvan AvramovNo ratings yet

- Uow Thesis GuidelinesDocument6 pagesUow Thesis Guidelinesbk4h4gbd100% (2)

- Industrial Seminar ReportDocument1 pageIndustrial Seminar ReportAkul Sirohi ce22m104No ratings yet

- Q3 - ARTS8 - LAS2 - MELC2 From Capiz To RO 12921 Pages DeletedDocument9 pagesQ3 - ARTS8 - LAS2 - MELC2 From Capiz To RO 12921 Pages DeletedJohn Rey Manolo BaylosisNo ratings yet

- Compre F&EDocument6 pagesCompre F&EArcon AlvarNo ratings yet

- The Source of Power: Product Design FeaturesDocument2 pagesThe Source of Power: Product Design FeaturesSahand ArasNo ratings yet

- (NMMO) : The Lyocell Process: Cellulose Solutions in N-Methylmorpholine-N-oxide Degradation Processes and StabilizersDocument4 pages(NMMO) : The Lyocell Process: Cellulose Solutions in N-Methylmorpholine-N-oxide Degradation Processes and Stabilizersronald pecheraNo ratings yet

- Department of Education Catbalogan City Samar National School Senior High School (GAS)Document17 pagesDepartment of Education Catbalogan City Samar National School Senior High School (GAS)NAYANGA, BRIANNE MEARL L.No ratings yet

- Kathrin Seidl Gomez - The Creativity of DisplacementDocument390 pagesKathrin Seidl Gomez - The Creativity of DisplacementSantiago Ospina CelisNo ratings yet

- The Power of Letting Go - Part OneDocument4 pagesThe Power of Letting Go - Part OneMichael CliftonNo ratings yet

- Penerapan Kurikulum ThailandDocument26 pagesPenerapan Kurikulum ThailandRAAR GamingNo ratings yet

- Overdenture VVDocument37 pagesOverdenture VVVikas Aggarwal50% (2)

- 13 SynopsisDocument16 pages13 SynopsisUDayNo ratings yet

- Descriptive Text MaterialsDocument2 pagesDescriptive Text MaterialsAyin Katili100% (1)