Professional Documents

Culture Documents

Lobrigas Unit5 Topic1 Assessment

Lobrigas Unit5 Topic1 Assessment

Uploaded by

Claudine LobrigasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lobrigas Unit5 Topic1 Assessment

Lobrigas Unit5 Topic1 Assessment

Uploaded by

Claudine LobrigasCopyright:

Available Formats

Lobrigas, Claudine L.

BSIA-IV

Intermediate Accointing - 2

Unit 5: Topic 1 - Lessee Accounting

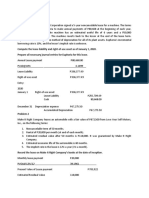

Problem 1

On January 1, 2021, Large Company leased a machine with the following provisions.

Annual lease payment in advance at the beginningof each year, starting

January 1, 2020

1,000,000

Lease term

10 years

Useful life of machine

15 years

Implicit interest rate in the lease

12%

PV of an ordinary annuity of 1 at 12% for 10 periods

5,650

PV of an annuity of 1 in advance at 12% for 10 periods

6,328

PV of 1 at 12% for 10 periods

0.322

The entity has an option to purchase the machine on January 1, 2031 by paying P200,000.

At the commencement date, it is reasonably certain that the purchase option will be exercised.

1. What is the initial cost of the right of use asset? = 6,392,400

PV of rentals (1,000,000 x 6.328) 6,328,000

PV of purchase option (200,000 x 0.322) 64,400

Cost of the right of the used Asset 6,392,400

Date Payment Interest Principal Present Value

01/01/2021 6,392,400

01/01/2021 1,000,000 1,000,000 5,392,400

01/01/2022 1,000,000 647,088 352,912 5,039,488

01/01/2023 1,000,000 604,739 395,261 4,644,227

01/01/2024 1,000,000 557,307 442,693 4,201,534

2. What is the interest expense for the current year? = P 647,088

3. What is the lease liability at year-end? = P 5,392,400

4. What is the depreciation for current year? = P 426,160

Depreciation of the current year P 6,392,400/15 years = P 426,160

Problem 2

On January 1, 2021, Verna Company negotiated a 15-year lease for a building. The building

has useful life of 20 years. Before occupancy, the lessee incurred leasehold improvement of

P600,000 with useful life 5 years. The lessee is required to restore the building upon expiration

of the lease. The present value of estimated cost of restoration is P644,000 discounted at 7%.

Annual payments of P1,000,000 are payable to the lessor on December 31 of each of the 15

years of the lease term. The lease was negotiated to assure the lessor a 10% rate of return.

PV of an ordinary annuity of 1 at 10% for 15 periods 7.606

PV of an annuity of 1 in advance at 10% for 15 periods 8.367

1. What is the initial cost of the right of use asset?

PV of rentals (1,000,000 x 7.606) 7,606,000

PV of restoration cost 644,000

Cost of the right of the used Asset 8,250,000

Date Payment Interest Principal Present Value

01/01/2021 7,606,000

12/31/2021 1,000,000 760,600 239,400 7,366,600

2. What is the interest expense for the current year? = P 760,600

3. What is the lease liability at year-end? = P 7,366,600

4. What is the depreciation for current year? 8,250,000/15 years = P 550,000

Problem 3

Dynamite Company has maintained a policy of acquiring equipment by leasing. On January

1, 2021, Dynamite Company entered into a lease agreement for an equipment. The lease

stipulates an annual rental payable of P600,000 to be paid every December 31 starting

December 31, 2021. The lease contains neither a transfer of title to the lessee nor a purchase

option.

The equipment has a residual value of P300,000 at the end of the 5-year lease period but is

unguaranteed by the lessee. The economic life of the equipment is 8 years. The implicit interest

rate is 12% after considering the unguaranteed residual value. The present value of an ordinary

annuity of 1 at 12% for 5 periods is 3.60.

1. What is the initial cost of the right of use asset? (600,000 x 3.60) = P 2,160,000

Date Payment Interest Principal Present Value

01/01/2021 2,160,000

12/31/2021 600,000 259,200 340,800 1,819,200

2. What is the interest expense for the current year? = P 259,200

3. What is the lease liability at year-end? = P1,819,200

4. What is the depreciation for current year? (2,160,000/5years) = P 432,000

You might also like

- V.I.P. System BASE I Technical Specifications, Volume IIDocument328 pagesV.I.P. System BASE I Technical Specifications, Volume IIsoricel2389% (9)

- Truly Human Leadership at Barry WehmillerDocument2 pagesTruly Human Leadership at Barry Wehmillermolly50% (2)

- 07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. BaulDocument5 pages07 Special Liabilities - Leases: Intermediate Accounting 2 - Bernadette L. Baulkrisha millo50% (2)

- Answer: C - 465,000Document9 pagesAnswer: C - 465,000kyle G50% (2)

- Intermediate Accounting 2 Quiz 2: You AnsweredDocument10 pagesIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakNo ratings yet

- Lease Modules ContinuedDocument8 pagesLease Modules ContinuedKenneth Marcial Ege0% (1)

- Example Exercise Lease Acctg With AnsDocument28 pagesExample Exercise Lease Acctg With AnsPrince Avena AquinoNo ratings yet

- CSC 201-Leones, Mary Grace O. - IntermediateDocument28 pagesCSC 201-Leones, Mary Grace O. - IntermediateMary Grace Ocampo LeonesNo ratings yet

- For The Wild-Hearted: Discover Your StoryDocument10 pagesFor The Wild-Hearted: Discover Your StoryKateřina SlezákováNo ratings yet

- 1 For An Additional Fee A Customer Purchasing A SearsDocument2 pages1 For An Additional Fee A Customer Purchasing A SearsAmit PandeyNo ratings yet

- Intacc2-Quiz ExamDocument10 pagesIntacc2-Quiz ExamCmNo ratings yet

- FINANCE LEASE-lecture and ExercisesDocument10 pagesFINANCE LEASE-lecture and ExercisesJamie CantubaNo ratings yet

- Solution - Quiz On Lessee AccountingDocument10 pagesSolution - Quiz On Lessee AccountingMeeka CalimagNo ratings yet

- Lease Modules ContinuedDocument8 pagesLease Modules ContinuedMariz RapadaNo ratings yet

- Intacc2-Quiz ExamDocument5 pagesIntacc2-Quiz ExamCmNo ratings yet

- FAR Problem Quiz 2 !Document6 pagesFAR Problem Quiz 2 !Ednalyn CruzNo ratings yet

- Assignment Problems On LeasesDocument4 pagesAssignment Problems On LeasesEllah Sharielle SantosNo ratings yet

- Problem 1: ComputationsDocument6 pagesProblem 1: ComputationsClarissa BorbonNo ratings yet

- Rayos, Lyka Mae A - Ia3 CompilationsDocument7 pagesRayos, Lyka Mae A - Ia3 CompilationsKayeNo ratings yet

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- 21 Finance Lease LesseeDocument3 pages21 Finance Lease LesseeTinNo ratings yet

- Interm 3 Quizzes Answer KeyDocument9 pagesInterm 3 Quizzes Answer KeyDanna VargasNo ratings yet

- Memory Enhancement ProgramDocument8 pagesMemory Enhancement ProgramLhowellaAquinoNo ratings yet

- Security DepositsDocument3 pagesSecurity DepositsQueen ValleNo ratings yet

- De Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-ModificationsDocument3 pagesDe Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-ModificationsNita Costillas De MattaNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- Module 9-DIRECT FINANCING LEASE - LESSORDocument10 pagesModule 9-DIRECT FINANCING LEASE - LESSORJeanivyle CarmonaNo ratings yet

- Case 1Document10 pagesCase 1Shawn VerzalesNo ratings yet

- Activity Lease Part 1Document1 pageActivity Lease Part 1Eric GuapinNo ratings yet

- 23 Operating Lease LeasebackDocument3 pages23 Operating Lease LeasebackAllegria AlamoNo ratings yet

- Leases Set CDocument12 pagesLeases Set CbessmasanqueNo ratings yet

- ACC314 A31 ProblemsDocument12 pagesACC314 A31 ProblemsaceNo ratings yet

- Activity Lease Part 2 ADocument1 pageActivity Lease Part 2 AEric GuapinNo ratings yet

- Note Payable: Feu - IabfDocument5 pagesNote Payable: Feu - IabfDonise Ronadel SantosNo ratings yet

- Asset For A Period of Time in Exchange For Consideration (IFRS #16)Document6 pagesAsset For A Period of Time in Exchange For Consideration (IFRS #16)Its meh SushiNo ratings yet

- Problem Solving-LeaseDocument2 pagesProblem Solving-LeasegadingancielomarieNo ratings yet

- Finance Lease LesseeDocument11 pagesFinance Lease LesseeAngel Queen Marino SamoragaNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesJhaybie San BuenaventuraNo ratings yet

- FR Suggested Dec 2021Document36 pagesFR Suggested Dec 2021Rahul NandurkarNo ratings yet

- Ðöńg Qüïz Šët - : Financial Accounting & ReportingDocument13 pagesÐöńg Qüïz Šët - : Financial Accounting & ReportingMonica MonicaNo ratings yet

- Chapter 21 - For StudentDocument16 pagesChapter 21 - For StudentAschNo ratings yet

- 6833 Finance Lease LesseeDocument2 pages6833 Finance Lease LesseeJeslyn Kris Alobba SaguiboNo ratings yet

- Question On Financial Instruments - Part 1Document9 pagesQuestion On Financial Instruments - Part 1pratikdubey9586No ratings yet

- Accounting For Leases-5Document5 pagesAccounting For Leases-5drywinterNo ratings yet

- MODULE 1 Midterm FAR 3 LeasesDocument31 pagesMODULE 1 Midterm FAR 3 LeasesKezNo ratings yet

- AP Quiz Liab2Document4 pagesAP Quiz Liab2maurNo ratings yet

- Problem 13-12 To 13-15Document3 pagesProblem 13-12 To 13-15Dominic RomeroNo ratings yet

- Chapter 13 Ia2Document18 pagesChapter 13 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- LeasesDocument3 pagesLeasesAngelica Rome EnriquezNo ratings yet

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- FARAP - Liabilities - Part 3Document10 pagesFARAP - Liabilities - Part 3vanNo ratings yet

- Far Project PrefiDocument16 pagesFar Project PrefiMarjorie PagsinuhinNo ratings yet

- FAR QUIZ 1 - ProblemsDocument4 pagesFAR QUIZ 1 - ProblemsAEHYUN YENVYNo ratings yet

- Leases - Practice QuestionsDocument18 pagesLeases - Practice Questionsosama saleemNo ratings yet

- Add'l Problems - Lessee AccountingDocument14 pagesAdd'l Problems - Lessee AccountingPoru Senpii100% (1)

- Assignment Ppfrs 16Document3 pagesAssignment Ppfrs 16Joseph DoctoNo ratings yet

- Module 7-Lessee Accounting - (OTHER ACCTG ISSUES)Document10 pagesModule 7-Lessee Accounting - (OTHER ACCTG ISSUES)Jeanivyle CarmonaNo ratings yet

- Problem Set 8. Finance LeaseDocument7 pagesProblem Set 8. Finance LeaseitsBlessedNo ratings yet

- Reassessment of Lease LiabilityDocument6 pagesReassessment of Lease LiabilityJULIA CHRIS ROMERONo ratings yet

- Audprob Bonds Problem With SolutionsDocument4 pagesAudprob Bonds Problem With Solutionsreviewrecord.rr2No ratings yet

- AP-LIABS-3 (With Answers)Document4 pagesAP-LIABS-3 (With Answers)Kendrew SujideNo ratings yet

- Practical Problems: Lustration 1 After 8Document4 pagesPractical Problems: Lustration 1 After 8Kiran Kumar KBNo ratings yet

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- Assigned TopicsDocument2 pagesAssigned TopicsClaudine LobrigasNo ratings yet

- Lobrigas Unit5 Topic5 AssessmentDocument6 pagesLobrigas Unit5 Topic5 AssessmentClaudine LobrigasNo ratings yet

- Sevilla Unit10 Topic1 AssessmentDocument6 pagesSevilla Unit10 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Rizals Life and Works ReferencesDocument2 pagesRizals Life and Works ReferencesClaudine LobrigasNo ratings yet

- Lobrigas Unit4 Topic2 AssessmentDocument7 pagesLobrigas Unit4 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit4 Topic1 AssessmentDocument4 pagesLobrigas Unit4 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit4 PretestDocument2 pagesLobrigas Unit4 PretestClaudine LobrigasNo ratings yet

- Sevilla Unit10 Topic2 AssessmentDocument7 pagesSevilla Unit10 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Sevilla Unit9 Topic1 AssessmentDocument2 pagesSevilla Unit9 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit3 PretestDocument4 pagesLobrigas Unit3 PretestClaudine LobrigasNo ratings yet

- Lobrigas Unit3 Topic2 AssessmentDocument6 pagesLobrigas Unit3 Topic2 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit3 Topic3 AssessmentDocument5 pagesLobrigas Unit3 Topic3 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit1 AssessmentDocument5 pagesLobrigas Unit1 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit2 Topic1 AssessmentDocument5 pagesLobrigas Unit2 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Lobrigas Unit2 Topic2 AssessmentDocument5 pagesLobrigas Unit2 Topic2 AssessmentClaudine LobrigasNo ratings yet

- BGE Presentation 20231024Document56 pagesBGE Presentation 20231024amarikaivagyNo ratings yet

- Shipping Business Examiners Report May 2019 RevDocument5 pagesShipping Business Examiners Report May 2019 RevdiablolcNo ratings yet

- Customer Relationship NotesDocument5 pagesCustomer Relationship NotesGina DiwagNo ratings yet

- Ringmaster: 2020 CatalogDocument176 pagesRingmaster: 2020 Catalogmher bakalianNo ratings yet

- British Standard Portland Cement Company Limited (Bamburi Factory) ActDocument11 pagesBritish Standard Portland Cement Company Limited (Bamburi Factory) ActDiana WangamatiNo ratings yet

- Pad BalanceDocument26 pagesPad BalancePrakash ChandraNo ratings yet

- How To End Off A Cover LetterDocument7 pagesHow To End Off A Cover Lettervyp0wosyb1m3100% (2)

- Airline Management: Professor Greg SchwabDocument260 pagesAirline Management: Professor Greg SchwabKrishna kurdekarNo ratings yet

- Induction Training Text Format - StaffDocument5 pagesInduction Training Text Format - StaffJohnNo ratings yet

- Cost Leadership - Bajaj Auto LTDDocument23 pagesCost Leadership - Bajaj Auto LTDspodalNo ratings yet

- Far FeDocument9 pagesFar FeMark Domingo Mendoza100% (1)

- Mad CHP2 QBDocument4 pagesMad CHP2 QBMufaddal MerchantNo ratings yet

- Hindalco Industries: IndiaDocument8 pagesHindalco Industries: IndiaAshokNo ratings yet

- Pubex ASIIDocument30 pagesPubex ASIIkurniaNo ratings yet

- Impact of Corporate Social Responsibility On ReputationDocument14 pagesImpact of Corporate Social Responsibility On ReputationPrueba Test RPANo ratings yet

- Poortinga & Darnton, 2016 - NDocument12 pagesPoortinga & Darnton, 2016 - NAnita UgarteNo ratings yet

- Herbal Mandis of UttarakhandDocument3 pagesHerbal Mandis of UttarakhandRavi VarmaNo ratings yet

- Mohammad Shahjahan IdrisiDocument4 pagesMohammad Shahjahan IdrisiFiroz Khan100% (1)

- COURSE PLAN Family Law - II Jan-June 2023Document17 pagesCOURSE PLAN Family Law - II Jan-June 2023Kshitiz BansalNo ratings yet

- Schlumberger LTD (SLB) : Financial and Strategic SWOT Analysis ReviewDocument73 pagesSchlumberger LTD (SLB) : Financial and Strategic SWOT Analysis ReviewRaam WilliamsNo ratings yet

- Indirect Tax AssignmentDocument3 pagesIndirect Tax AssignmentNitesh ShendeNo ratings yet

- Tax Invoice: FromDocument1 pageTax Invoice: FromMonirul IslamNo ratings yet

- Lecture 7 - 8 - Market Demand AnalysisDocument26 pagesLecture 7 - 8 - Market Demand Analysistechnical analysisNo ratings yet

- 2019 - A1 FinalDocument16 pages2019 - A1 FinalSayuri NaidooNo ratings yet

- Annual Report 2021: DBS Group Holdings LTDDocument115 pagesAnnual Report 2021: DBS Group Holdings LTDKevin ChenNo ratings yet

- SM MCQDocument22 pagesSM MCQSiva Venkata Ramana67% (3)