Professional Documents

Culture Documents

Vdocuments - MX - Test Bank Chapter 9 Profit Planning

Vdocuments - MX - Test Bank Chapter 9 Profit Planning

Uploaded by

duc truongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vdocuments - MX - Test Bank Chapter 9 Profit Planning

Vdocuments - MX - Test Bank Chapter 9 Profit Planning

Uploaded by

duc truongCopyright:

Available Formats

Ch

apt

er9

Pr

ofitPl

anni

ng

True/False

1. The usual starting point in budgeting is to make a forecast of

F cash receipts and cash disbursements.

Medium

2. Budgets are used for planning rather than for control of

F operations.

Medium

3. A continuous or perpetual budget is one which covers a 12-month

T period but which is constantly adding a new month on the end as

Easy the current month is completed.

4. Control involves developing objectives and preparing the

F various budgets to achieve those objectives.

Easy

5. One of the distinct advantages of a budget is that it can help

T to uncover potential bottlenecks before they occur.

Easy

6. A self-imposed budget can be a very effective control device in

T an organization.

Easy

7. Sales forecasts are drawn up after the cash budget has been

F completed since only then are the funds available for marketing

Medium known.

8. A production budget is to a manufacturing firm as a merchandise

T purchases budget is to a merchandising firm.

Medium

9. The direct materials to be purchased for a period can be

F obtained by subtracting the desired ending inventory of direct

Medium materials from the total direct materials needed for the

period.

10. In companies that have "no lay-off" policies, the total direct

F labor cost for a budget period is computed by multiplying the

Hard total direct labor hours needed to make the budgeted output of

completed units by the direct labor wage rate.

Managerial Accounting, 9/e 65

11. In the merchandise purchases budget, the required purchases (in

F units) for a period can be determined by subtracting the

Medium beginning merchandise inventory (in units) from the budgeted

sales (in units).

12. The beginning cash balance is not included on the cash budget

F since the cash budget deals exclusively with cash flows rather

Hard than with balance sheet amounts.

13. When using the self-imposed budget approach, it is generally

F best for top management to accept all budget estimates without

Easy question in order to minimize adverse behavioral responses from

employees.

14. (Appendix) The economic order quantity is that point where the

T total costs of ordering inventory just equal the total costs of

Medium carrying inventory.

15. (Appendix) As the lead time increases, the safety stock should

T also increase.

Medium

Multiple Choice

16. The budget or schedule that provides necessary input data for

B the direct labor budget is the:

Easy a. raw materials purchases budget.

CMA b. production budget.

adapted c. schedule of cash collections.

d. cash budget.

17. The cash budget must be prepared before you can complete the:

B a. production budget.

Easy b. budgeted balance sheet.

CMA c. raw materials purchases budget.

adapted d. schedule of cash disbursements.

18. Which of the following is not a benefit of budgeting?

C a. It uncovers potential bottlenecks before they occur.

Easy b. It coordinates the activities of the entire organization by

integrating the plans and objectives of the various parts.

c. It ensures that accounting records comply with generally

accepted accounting principles.

d. It provides benchmarks for evaluating subsequent

performance.

66 Managerial Accounting, 9/e

19. The materials purchase budget:

B a. is the beginning point in the budget process.

Easy b. must provide for desired ending inventory as well as for

production.

c. is accompanied by a schedule of cash collections.

d. is completed after the cash budget.

20. The master budget process usually begins with the:

C a. production budget.

Easy b. operating budget.

CMA c. sales budget.

adapted d. cash budget.

21. There are various budgets within the master budget. One of

C these budgets is the production budget. Which of the following

Easy BEST describes the production budget?

CMA a. It details the required direct labor hours.

adapted b. It details the required raw materials purchases.

c. It is calculated based on the sales budget and the desired

ending inventory.

d. It summarizes the costs of producing units for the budget

period.

22. (Appendix) The economic order quantity (EOQ) in an inventory

C management system is:

Medium a. the order quantity that yields the lowest unit purchase

cost.

b. the order quantity that yields the lowest inventory handling

cost.

c. the order quantity that yields the lowest total cost of

ordering and carrying inventory.

d. the order quantity with the largest purchase discount.

23. (Appendix) The Stewart Company uses the Economic Order Quantity

D (EOQ) model in its inventory management. A decrease in which of

Medium the following variables would increase the company's EOQ?

CMA a. Annual sales.

adapted b. Cost per order.

c. Safety stock level.

d. Inventory carrying costs.

24. (Appendix) The level of safety stock depends on all of the

D following except:

Medium a. the level of uncertainty of the sales forecast.

b. the level of customer dissatisfaction when goods are

unavailable.

c. the level of uncertainty in the lead time for shipments from

suppliers.

d. the ordering cost per order.

Managerial Accounting, 9/e 67

25. A method of budgeting in which the cost of each program must be

B justified every year is called:

Easy a. operational budgeting.

CMA b. zero-based budgeting.

adapted c. continuous budgeting.

d. responsibility accounting.

26. Fairmont Inc. uses an accounting system that charges costs to

A the manager who has been delegated the authority to make

Easy decisions concerning the costs. For example, if the sales

CMA manager accepts a rush order that will result in higher than

adapted normal manufacturing costs, these additional costs are charged

to the sales manager because the authority to accept or decline

the rush order was given to the sales manager. This type of

accounting system is known as:

a. responsibility accounting.

b. contribution accounting.

c. absorption accounting.

d. operational budgeting.

27. Parlee Company's sales are 30% in cash and 70% on credit. Sixty

D percent of the credit sales are collected in the month of sale,

Medium 25% in the month following sale, and 12% in the second month

following sale. The remainder are uncollectible. The following

are budgeted sales data:

January February March April

Total sales $60,000 $70,000 $50,000 $30,000

Total cash receipts in April would be budgeted to be:

a. $38,900.

b. $47,900.

c. $27,230.

d. $36,230.

28. Budgeted sales in Allen Company over the next four months are

Difficult given below:

September October November December

Budgeted sales $100,000 $160,000 $180,000 $120,000

Twenty-five percent of the company's sales are for cash and 75%

are on account. Collections for sales on account follow a

stable pattern as follows: 50% of a month's sales are collected

in the month of sale, 30% are collected in the month following

sale, and 15% are collected in the second month following sale.

The remainder are uncollectible. Given these data, cash

collections for December should be:

a. $153,000.

b. $138,000.

c. $120,000.

d. $103,500.

68 Managerial Accounting, 9/e

29. The PDQ Company makes collections on credit sales according to

D the following schedule:

Medium

25% in month of sale

70% in month following sale

4% in second month following sale

1% uncollectible

The following sales have been budgeted:

Month Sales

April ... $100,000

May ..... 120,000

June .... 110,000

Cash collections in June would be:

a. $113,400.

b. $110,000.

c. $111,000.

d. $115,500.

30. Orion Corporation is preparing a cash budget for the six months

D beginning January 1. Shown below are the company's expected

Medium collection pattern and the budgeted sales for the period.

Expected collection pattern:

65% collected in the month of sale

20% collected in the month after sale

10% collected in the second month after sale

4% collected in the third month after sale

1% uncollectible

Budgeted sales:

January ....... $160,000

February ...... 185,000

March ......... 190,000

April ......... 170,000

May ........... 200,000

June .......... 180,000

The estimated total cash collections during April from sales

and accounts receivables would be:

a. $155,900.

b. $167,000.

c. $171,666.

d. $173,400.

Managerial Accounting, 9/e 69

31. Pardee Company plans to sell 12,000 units during the month of

A August. If the company has 2,500 units on hand at the start of

Easy the month, and plans to have 2,000 units on hand at the end of

the month, how many units must be produced during the month?

a. 11,500.

b. 12,500.

c. 12,000.

d. 14,000.

32. Modesto Company produces and sells Product AlphaB. To guard

C against stockouts, the company requires that 20% of the next

Medium month's sales be on hand at the end of each month. Budgeted

sales of Product AlphaB over the next four months are:

June July August September

Budgeted sales in units 30,000 40,000 60,000 50,000

Budgeted production for August would be:

a. 62,000 units.

b. 70,000 units.

c. 58,000 units.

d. 50,000 units.

33. Friden Company has budgeted sales and production over the next

B quarter as follows:

Hard

April May June

Sales in units ......... 100,000 120,000 ?

Production in units .... 104,000 128,000 156,000

The company has 20,000 units of product on hand at April 1. A

minimum of 20% of the next month's sales needs in units must be

on hand at the end of each month. July sales are expected to be

140,000 units. Budgeted sales for June would be (in units):

a. 188,000.

b. 160,000.

c. 128,000.

d. 184,000.

34. Walsh Company expects sales of Product W to be 60,000 units in

B April, 75,000 units in May and 70,000 units in June. The

Medium company desires that the inventory on hand at the end of each

month be equal to 40% of the next month's expected unit sales.

Due to excessive production during March, on March 31 there

were 25,000 units of Product W in the ending inventory. Given

this information, Walsh Company's production of Product W for

the month of April should be:

a. 60,000 units.

b. 65,000 units.

c. 75,000 units.

d. 66,000 units.

70 Managerial Accounting, 9/e

35. Superior Industries' sales budget shows quarterly sales for the

C next year as follows:

Medium

CMA Quarter Sales (units)

adapted First ..... 10,000

Second .... 8,000

Third ..... 12,000

Fourth .... 14,000

Company policy is to have a finished goods inventory at the end

of each quarter equal to 20% of the next quarter's sales.

Budgeted production for the second quarter should be:

a. 7,200 units.

b. 8,000 units.

c. 8,800 units.

d. 8,400 units.

36. The Tobler Company has budgeted production for next year as

A follows:

Medium

Quarter ............... First Second Third Fourth

Production in units ... 10,000 12,000 16,000 14,000

Four pounds of raw materials are required for each unit

produced. Raw materials on hand at the start of the year totals

4,000 lbs. The raw materials inventory at the end of each

quarter should equal 10% of the next quarter's production

needs. Budgeted purchases of raw materials in the third quarter

would be:

a. 63,200 lbs.

b. 62,400 lbs.

c. 56,800 lbs.

d. 50,400 lbs.

37. Marple Company's budgeted production in units and budgeted raw

D materials purchases over the next three months are given below:

Hard

January February March

Budgeted production (in units) .. 60,000 ? 100,000

Budgeted raw materials

purchases (in pounds) ........ 129,000 165,000 188,000

Two pounds of raw materials are required to produce one unit of

product. The company wants raw materials on hand at the end of

each month equal to 30% of the following month's production

needs. The company is expected to have 36,000 pounds of raw

materials on hand on January 1. Budgeted production for

February should be:

a. 105,000 units.

b. 82,500 units.

c. 150,000 units.

d. 75,000 units.

Managerial Accounting, 9/e 71

38. The Waverly Company has budgeted sales for next year as

A follows:

Medium

Quarter .......... First Second Third Fourth

Sales in units ... 12,000 14,000 18,000 16,000

The ending inventory of finished goods for each quarter should

equal 25% of the next quarter's budgeted sales in units. The

finished goods inventory at the start of the year is 3,000

units. Scheduled production for the third quarter should be:

a. 17,500.

b. 18,500.

c. 22,000.

d. 13,500.

39. The Willsey Merchandise Company has budgeted $40,000 in sales

A for the month of December. The company's cost of goods sold is

Hard 30% of sales. If the company has budgeted to purchase $18,000

in merchandise during December, then the budgeted change in

inventory levels over the month of December is:

a. $6,000 increase.

b. $10,000 decrease.

c. $22,000 decrease.

d. $15,000 increase.

40. ABC Company has a cash balance of $9,000 on April 1. The

B company must maintain a minimum cash balance of $6,000. During

Easy April expected cash receipts are $45,000. Expected cash

disbursements during the month total $52,000. During April the

company will need to borrow:

a. $2,000.

b. $4,000.

c. $6,000.

d. $8,000.

72 Managerial Accounting, 9/e

41. Avril Company makes collections on sales according to the

D following schedule:

Easy

30% in the month of sale

60% in the month following sale

8% in the second month following sale

The following sales are expected:

Expected Sales

January ....... $100,000

February ...... 120,000

March ......... 110,000

Cash collections in March should be budgeted to be:

a. $110,000.

b. $110,800.

c. $105,000.

d. $113,000.

42. The Stacy Company makes and sells a single product, Product R.

B Budgeted sales for April are $300,000. Gross Margin is budgeted

Hard at 30% of sales dollars. If the net income for April is

budgeted at $40,000, the budgeted selling and administrative

expenses are:

a. $133,333.

b. $50,000.

c. $102,000.

d. $78,000.

43. (Appendix) Canesco Enterprises uses 84,000 units of Part 256 in

A its production over a 300-day work year. The usual lead time

Hard for delivery of the part from the supplier is six days;

CMA occasionally, the lead time has been as high as eight days. The

adapted company wants to implement a safety stock policy (it presently

carries no safety stocks). The safety stock size, the likely

effect on stockout costs of implementing the safety stock, and

the likely effect on carrying costs of implementing the safety

stock, respectively, would be:

a. 560 units, decrease, increase.

b. 560 units, increase, decrease.

c. 1,680 units, decrease, increase.

d. 1,680 units, increase, no change.

Managerial Accounting, 9/e 73

44. (Appendix) Karpov Enterprises, a wholesaler of electronic

B instruments, uses the economic order quantity model in its

Medium inventory management. Data concerning one product appear below:

Total units purchased annually .............. 810

Costs to place one order .................... $10

Selling price per unit ...................... $40

Annual cost to carry one unit in stock ...... $ 2

The economic order quantity (EOQ) for this product would be:

a. 18 units.

b. 90 units.

c. 81 units.

d. 180 units.

45. (Appendix) The Aron Company requires 40,000 units of Product Q

D for the year. The units will be used evenly throughout the

Medium year. It costs $60 to place an order. It costs $10 to carry a

CPA unit in inventory for the year. What is the economic order

adapted quantity (EOQ) rounded to the nearest whole unit?

a. 400.

b. 490.

c. 600.

d. 693.

46. (Appendix) The following data relate to a part used by the

A Henry Company:

Medium

CPA Units required per year .......... 30,000

adapted Cost of placing an order ......... $ 400

Unit carrying cost per year ...... $ 600

Assuming that the units will be used evenly throughout the

year, what is the economic order quantity (EOQ)?

a. 200.

b. 300.

c. 400.

d. 500.

47. (Appendix) Politan Company manufactures 4,000 bookcases a year.

D Set-up costs are $20 for a production run. Using the economic

Hard order quantity (EOQ) approach, the optimal production lot size

CPA would be 200 units when the cost of carrying one bookcase in

adapted inventory for one year is:

a. $0.50.

b. $1.00.

c. $2.00.

d. $4.00.

74 Managerial Accounting, 9/e

48. (Appendix) Moss Converters Inc. uses 100,000 kilograms of raw

A material annually in its production processes. The raw material

Hard costs $12 per kilogram. The cost to process a purchase order is

CMA $45, which includes variable costs of $35 and allocated fixed

adapted costs of $10. Out-of-pocket storage costs are $4.20 per

kilogram per year. Moss's economic order quantity (EOQ) is:

a. 1,291 units.

b. 1,464 units.

c. 1,708 units.

d. 1,936 units.

49. (Appendix) Jasper Inc. produces automobile headlight assemblies

C for sports-utility vehicles. Data concerning a particular metal

Medium fastener that is used in a one of the company's products appear

below.

Economic order quantity ..... 600 units

Average weekly usage ........ 150 units

Maximum weekly usage ........ 175 units

Lead time ................... 2 weeks

The safety stock would be:

a. 350 units.

b. 175 units.

c. 50 units.

d. 75 units.

Reference: 9-1

KAB Inc., a small retail store, had the following results for May. The

budgets for June and July are also given.

May June July

(actual) (budget) (budget)

Sales ........................ $42,000 $40,000 $45,000

Cost of sales ................ 21,000 20,000 22,500

Gross margin ................. 21,000 20,000 22,500

Operating expenses ........... 20,000 20,000 20,000

Operating income ............. $ 1,000 $ 0 $ 2,500

Sales are collected 80% in the month of the sale and the balance in the

month following the sale. (There are no bad debts.) The goods that are

sold are purchased in the month prior to sale. Suppliers of the goods are

paid in the month following the sale. The "operating expenses" are paid in

the month of the sale.

50. The amount of cash collected during the month of June should

C be:

Easy a. $32,000.

CMA b. $40,000.

adapted c. $40,400.

Refer To: d. $41,000.

9-1

Managerial Accounting, 9/e 75

51. The cash disbursements during the month of June for goods

B purchased for resale and for operating expenses should be:

Easy a. $40,000.

CMA b. $41,000.

adapted c. $42,500.

Refer To: d. $43,500.

9-1

Reference: 9-2

Justin's Plant Store, a retailer, started operations on January 1. On that

date, the only assets were $16,000 in cash and $3,500 in merchandise

inventory. For purposes of budget preparation, assume that the company's

cost of goods sold is 60% of sales. Expected sales for the first four months

appear below.

Expected

Sales

January ....... $10,000

February ...... 24,000

March ......... 16,000

April ......... 25,000

The company desires that the merchandise inventory on hand at the end of

each month be equal to 50% of the next month's merchandise sales (stated at

cost). All purchases of merchandise inventory must be paid in the month of

purchase. Sixty percent of all sales should be for cash; the balance will be

on credit. Seventy-five percent of the credit sales should be collected in

the month following the month of sale, with the balance collected in the

following month. Variable operating expenses should be 10% of sales and

fixed expenses (all depreciation) should be $3,000 per month. Cash payments

for the variable operating expenses are made during the month the expenses

are incurred.

52. In a budgeted income statement for the month of February, net

D income would be:

Medium a. $9,000.

Refer To: b. $1,800.

9-2 c. $0.

d. $4,200.

53. In a budgeted balance sheet, the Merchandise Inventory on

A February 28 would be:

Medium a. $4,800.

Refer To: b. $7,500.

9-2 c. $9,600.

d. $3,200.

76 Managerial Accounting, 9/e

54. The Accounts Receivable balance that would appear in the March

C 31 budgeted balance sheet would be:

Medium a. $15,000.

Refer To: b. $16,000.

9-2 c. $8,800.

d. $12,400.

55. In a budget of cash receipts for March, the total cash receipts

A would be:

Medium a. $17,800.

Refer To: b. $8,200.

9-2 c. $20,200.

d. $16,000.

56. In a budget of cash disbursements for March, the total cash

B disbursements would be:

Hard a. $11,200.

Refer To: b. $13,900.

9-2 c. $22,300.

d. $16,900.

Reference: 9-3

Information on the actual sales and inventory purchases of the Law Company

for the first quarter follow:

Inventory

Sales Purchases

January ...... $120,000 $60,000

February ..... $100,000 $78,000

March ........ $130,000 $90,000

Collections from Law Company's customers are normally 60% in the month of

sale, 30% in the month following sale, and 8% in the second month following

sale. The balance is uncollectible. Law Company takes full advantage of the

3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of

$100,000. Operating expenses for the month of April are expected to be

$38,000, of which $15,000 is salaries and $8,000 is depreciation. The

remaining operating expenses are variable with respect to the amount of

sales in dollars. Those operating expenses requiring a cash outlay are paid

for during the month incurred. Law Company's cash balance on March 1 was

$43,000, and on April 1 was $35,000.

57. The expected cash collections from customers during April would

B be:

Medium a. $150,000.

Refer To: b. $137,000.

9-3 c. $139,000.

d. $117,600.

Managerial Accounting, 9/e 77

58. The expected cash disbursements during April for inventory

D purchases would be:

Easy a. $100,000.

Refer To: b. $97,000.

9-3 c. $90,000.

d. $87,300.

59. The expected cash disbursements during April for operating

B expenses would be:

Easy a. $38,000.

Refer To: b. $30,000.

9-3 c. $23,000.

d. $15,000.

60. The expected cash balance on April 30 would be:

A a. $54,700.

Hard b. $62,700.

Refer To: c. $19,700.

9-3 d. $28,700.

Reference: 9-4

The LaPann Company has obtained the following sales forecast data:

July August September October

Cash sales ..... $ 80,000 $ 70,000 $ 50,000 $ 60,000

Credit sales ... $240,000 $220,000 $180,000 $200,000

The regular pattern of collection of credit sales is 20% in the month of

sale, 70% in the month following the month of sale, and the remainder in the

second month following the month of sale. There are no bad debts.

61. The budgeted accounts receivable balance on September 30 is:

C a. $126,000.

Medium b. $148,000.

Refer To: c. $166,000.

9-4 d. $190,000.

62. The budgeted cash receipts for October are:

B a. $188,000.

Medium b. $248,000.

Refer To: c. $226,000.

9-4 d. $278,000.

78 Managerial Accounting, 9/e

Reference: 9-5

The LaGrange Company had the following budgeted sales for the first half of

the current year:

Cash Sales Credit Sales

January ............ $70,000 $340,000

February ........... 50,000 190,000

March .............. 40,000 135,000

April .............. 35,000 120,000

May ................ 45,000 160,000

June ............... 40,000 140,000

The company is in the process of preparing a cash budget and must determine

the expected cash collections by month. To this end, the following

information has been assembled:

Collections on sales: 60% in month of sale

30% in month following sale

10% in second month following sale

The accounts receivable balance on January 1 of the current year was

$70,000, of which $50,000 represents uncollected December sales and $20,000

represents uncollected November sales.

63. The total cash collected by LaGrange Company during January

D would be:

Hard a. $410,000.

Refer To: b. $254,000.

9-5 c. $344,000.

d. $331,500.

64. What is the budgeted accounts receivable balance on June 1 of

C the current year?

Hard a. $56,000.

Refer To: b. $64,000.

9-5 c. $76,000.

d. $132,000.

Managerial Accounting, 9/e 79

Reference: 9-6

Pardise Company plans the following beginning and ending inventory levels

(in units) for July:

July 1 July 30

Raw material 40,000 50,000

Work in process 10,000 10,000

Finished goods 80,000 50,000

Two units of raw material are needed to produce each unit of finished

product.

65. If Pardise Company plans to sell 480,000 units during July, the

D number of units it would have to manufacture during July would

Easy be:

CMA a. 440,000 units.

adapted b. 480,000 units.

Refer To: c. 510,000 units.

9-6 d. 450,000 units.

66. If 500,000 finished units were to be manufactured during July,

C the units of raw material needed to be purchased would be:

Easy a. 1,000,000 units.

CMA b. 1,020,000 units.

adapted c. 1,010,000 units.

Refer To: d. 990,000 units.

9-6

Reference: 9-7

Barley Enterprises has budgeted unit sales for the next four months as

follows:

October 4,800 units

November 5,800 units

December 6,400 units

January 5,200 units

The ending inventory for each month should be equal to 15% of the next

month's sales in units. The inventory on September 30 was below this level

and contained only 600 units.

67. The total units to be produced in October is:

B a. 4,530.

Medium b. 5,070.

Refer To: c. 5,670.

9-7 d. 5,890.

80 Managerial Accounting, 9/e

68. The desired ending inventory for December is:

C a. 960.

Easy b. 870.

Refer To: c. 780.

9-7 d. 690.

Reference: 9-8

Roberts Enterprises has budgeted sales in units for the next five months as

follows:

June ............ 4,500 units

July ............ 7,100 units

August .......... 5,300 units

September ....... 6,700 units

October ......... 3,700 units

Past experience has shown that the ending inventory for each month must be

equal to 10% of the next month's sales in units. The inventory on May 31

contained 410 units. The company needs to prepare a production budget for

the second quarter of the year.

69. The opening inventory in units for September is:

D a. 370 units.

Medium b. 6,700 units.

Refer To: c. 530 units.

9-8 d. 670 units.

70. The total number of units to be produced in July is:

C a. 7,630 units.

Medium b. 7,100 units.

Refer To: c. 6,920 units.

9-8 d. 7,280 units.

71. The desired ending inventory for August is:

B a. 530 units.

Easy b. 670 units.

Refer To: c. 710 units.

9-8 d. 370 units.

Reference: 9-9

Noel Enterprises has budgeted sales in units for the next five months as

follows:

January ..... 6,800 units

February .... 5,400 units

March ....... 7,200 units

April ....... 4,600 units

May ......... 3,800 units

Past experience has shown that the ending inventory for each month must be

equal to 10% of the next month's sales in units. The inventory on December

31 contained 400 units. The company needs to prepare a production budget for

the second quarter of the year.

Managerial Accounting, 9/e 81

72. The opening inventory in units for April is:

B a. 380 units.

Medium b. 460 units.

Refer To: c. 4,600 units.

9-9 d. 720 units.

73. The total number of units to be produced in February is:

A a. 5,580 units.

Medium b. 5,400 units.

Refer To: c. 6,120 units.

9-9 d. 5,220 units.

74. The desired ending inventory for March is:

B a. 720 units.

Medium b. 460 units.

Refer To: c. 540 units.

9-9 d. 380 units.

Reference: 9-10

Wellfleet Company manufactures children’s' recreational equipment. The

Purchasing Department is finalizing plans for next year and has gathered the

following information regarding two of the components used in both tricycles

and bicycles:

Part A19 Part B12 Tricycles Bicycles

Beginning inventory ... 3,500 1,200 800 2,150

Ending inventory ...... 2,000 1,800 1,000 900

Unit cost ............. $1.20 $4.50 $54.50 $89.60

Projected unit sales .. 96,000 130,000

Component usage:

Tricycles ....... 2 per unit 1 per unit

Bicycles ........ 2 per unit 4 per unit

75. The budgeted dollar value of Wellfleet Company's purchases of

B Part A19 for next year is:

Hard a. $383,580.

CMA b. $538,080.

adapted c. $540,600.

Refer To: d. $480,000.

9-10

76. (Appendix) If the economic order quantity (EOQ) for Part B12 is

D 70,000 units, the number of times that Wellfleet Company should

Hard purchase this part next year is:

CMA a. four times.

adapted b. seven times.

Refer To: c. eight times.

9-10 d. nine times.

82 Managerial Accounting, 9/e

Reference: 9-11

The LFM Company makes and sells a single product, Product T. Each unit of

Product T requires 1.3 hours of labor at a labor rate of $9.10 per hour. LFM

Company needs to prepare a Direct Labor Budget for the second quarter of

next year.

77. The budgeted direct labor cost per unit of Product T would be:

B a. $9.10.

Easy b. $11.83.

Refer To: c. $7.00.

9-11 d. $10.40.

78. The company has budgeted to produce 25,000 units of Product T

C in June. The finished goods inventories on June 1 and June 30

Medium were budgeted at 500 and 700 units, respectively. Budgeted

Refer To: direct labor costs incurred in June would be:

9-11 a. $293,384.

b. $304,031.

c. $295,750.

d. $227,500.

Reference: 9-12

The International Company makes and sells only one product, Product SW. The

company is in the process of preparing its Selling and Administrative

Expense Budget for the last half of the year. The following budget data are

available:

Variable Cost

Per Unit Sold Monthly Fixed Cost

Sales commissions ................... $0.70

Shipping ............................ $1.10

Advertising ......................... $0.20 $14,000

Executive salaries .................. - $34,000

Depreciation on office equipment .... - $11,000

Other ............................... $0.25 $19,000

All expenses other than depreciation are paid in cash in the month they are

incurred.

79. If the company has budgeted to sell 25,000 units of Product SW

C in July, then the total budgeted selling and administrative

Medium expenses for July will be:

Refer To: a. $56,250.

9-12 b. $78,000.

c. $134,250.

d. $123,250.

Managerial Accounting, 9/e 83

80. If the company has budgeted to sell 20,000 units of Product SW

A in October then the total budgeted variable selling and

Medium administrative expenses for October will be:

Refer To: a. $45,000.

9-12 b. $40,000.

c. $56,250.

d. $78,000.

81. If the budgeted cash disbursements for selling and

B administrative expenses for November total $123,250, then how

Hard many units of Product SW does the company plan to sell in

Refer To: November (rounded to the nearest whole unit)?

9-12 a. 33,444 units.

b. 25,000 units.

c. 22,952 units.

d. 20,111 units.

82. If the company has budgeted to sell 24,000 units of Product SW

D in September, then the total budgeted fixed selling and

Medium administrative expenses for September would be:

Refer To: a. $54,000.

9-12 b. $48,000.

c. $67,000.

d. $78,000.

Reference: 9-13

The Culver Company is preparing its Manufacturing Overhead Budget for the

third quarter of the year. Budgeted variable factory overhead is $3.00 per

unit produced; budgeted fixed factory overhead is $75,000 per month, with

$16,000 of this amount being factory depreciation.

83. If the budgeted production for July is 6,000 units, then the

D total budgeted factory overhead for July is:

Easy a. $77,000.

Refer To: b. $82,000.

9-13 c. $85,000.

d. $93,000.

84. If the budgeted production for August is 5,000 units, then the

B total budgeted factory overhead per unit is:

Easy a. $15.

Refer To: b. $18.

9-13 c. $20.

d. $22.

84 Managerial Accounting, 9/e

85. If the budgeted cash disbursements for factory overhead for

D September are $80,000, then the budgeted production for

Medium September must be:

Refer To: a. 7,400 units.

9-13 b. 6,200 units.

c. 6,500 units.

d. 7,000 units.

Reference: 9-14

The Bandeiras Company, a merchandising firm, has budgeted its activity for

December according to the following information:

I. Sales at $550,000, all for cash.

II. Merchandise inventory on November 30 was $300,000.

III. Budgeted depreciation for December is $35,000.

IV. The cash balance at December 1 was $25,000.

V. Selling and administrative expenses are budgeted at $60,000 for

December and are paid in cash.

VI. The planned merchandise inventory on December 31 is $270,000.

VII. The invoice cost for merchandise purchases represents 75% of the sales

price. All purchases are paid for in cash.

86. The budgeted cash receipts for December are:

D a. $412,500.

Easy b. $137,500.

Refer To: c. $585,000.

9-14 d. $550,000.

87. The budgeted cash disbursements for December are:

B a. $382,500.

Hard b. $442,500.

Refer To: c. $472,500.

9-14 d. $477,500.

88. The budgeted net income for December is:

C a. $107,500.

Hard b. $137,500.

Refer To: c. $42,500.

9-14 d. $77,500.

Managerial Accounting, 9/e 85

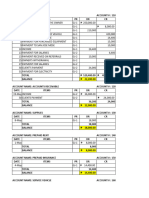

Reference: 9-15

A cash budget by quarters for the Carney Company is given below (note that

some data are missing). Missing data amounts have been keyed with either

question marks or lower case letters (a, b, c, etc.); these lower case

letters will be referred to in the questions that follow. (It may be

necessary to calculate a value for items where a question mark appears.)

The company requires a minimum cash balance of at least $10,000 to start a

quarter. All data are in thousands.

Carney Corporation

Cash Budget

Quarters o

1 2 3 4

Cash balance, beginning .................... $16 $ e $13 $10

Add collections from customers ............. a 70 67 80

Total cash available .................... ? ? 80 90

Less disbursements:

Purchase of inventory ................... 31 c 40 35

Operating expenses ...................... 35 22 ? 15

Equipment purchases ..................... 10 14 19 0

Dividends ............................... 0 6 0 5

Total disbursements ................. 66 ? f 55

Excess (deficiency) of cash available

over disbursements ...................... 7 17 (2) 35

Financing:

Borrowings .............................. b -- 12 --

Repayments (including interest) ......... -- d -- (21)

Total financing ...................... ? ? 12 (21)

Cash balance, ending ....................... 10 ? $10 $14

89. The collections from customers during the first quarter (item

C a) are:

Medium a. $50.

Refer To: b. $60.

9-15 c. $57.

d. $73.

90. The borrowing required during the first quarter to meet the

D minimum cash balance (item b) is:

Easy a. $0.

Refer To: b. $7.

9-15 c. $10.

d. $3.

91. The cash disbursed for purchases during the second quarter

D (item c) is:

Hard a. $13.

Refer To: b. $55.

9-15 c. $9.

d. $21.

86 Managerial Accounting, 9/e

92. The repayment (including interest) of financing during the

A second quarter (item d) is:

Medium a. $4.

Refer To: b. $0.

9-15 c. $17.

d. $7.

93. The cash balance at the beginning of the second quarter (item

A e) is:

Easy a. $10.

Refer To: b. $14.

9-15 c. $0.

d. $7.

94. The total disbursements during the third quarter (item f) is:

C a. $84.

Easy b. $78.

Refer To: c. $82.

9-15 d. $59.

Reference: 9-16

(Appendix) Ryerson Computer Furniture Inc. (RCF) manufactures a line of

office chairs. The annual demand for the chairs is 5,000 units. The annual

cost to carry one chair in inventory is $10 and the cost to set up a

production run is $1,000. There are no chairs on hand in inventory, and RCF

management has scheduled four production runs of chairs for the coming year,

the first of which is to be run immediately. A total of 1,250 chairs will be

produced in each of the production runs. RCF has 250 business days per year

and sales occur uniformly throughout the year.

95. If RCF does not maintain a safety stock, the estimated total

C inventory carrying costs for the chairs for the coming year

Medium based on their current production schedule is:

CMA a. $4,000.

adapted b. $5,000.

Refer To: c. $6,250.

9-16 d. $12,500.

96. The number of production runs per year that would minimize the

D sum of the inventory carrying costs and set-up costs for the

Medium coming year is:

CMA a. 1 production run.

adapted b. 2 production runs.

Refer To: c. 4 production runs.

9-16 d. 5 production runs.

Managerial Accounting, 9/e 87

97. A safety stock of a five-day supply of computer chairs would

C increase RCF's planned average inventory by:

Medium a. 20 units.

CMA b. 5 units.

adapted c. 100 units.

Refer To: d. 50 units.

9-16

Reference: 9-17

(Appendix) Cantor Creations, which has 250 business days per year,

manufactures desks for desktop workstations. The annual demand for the desks

is estimated to be 5,000 units. The annual cost of carrying one unit in

inventory is $10, and the cost to set up a production run is $1,000. Cantor

has scheduled four equal production runs for the coming year, the first to

begin immediately. Currently, there are no desks on hand. Assume that sales

occur uniformly throughout the year and that production is instantaneous.

98. If Cantor Creations does not maintain a safety stock, the

B estimated total carrying costs for the desks for the coming

Hard year is:

CMA a. $5,000.

adapted b. $6,250.

Refer To: c. $4,000.

9-17 d. $10,250.

99. If Cantor Creations were to schedule only two equal production

A runs of the desks for the coming year, the sum of carrying

Hard costs and set-up costs would increase (decrease) by:

CMA a. $4,250.

adapted b. $(2,000).

Refer To: c. $6,250.

9-17 d. $(250).

100. A safety stock of a five-day supply of desks would increase the

B number of units in Cantor Creations' planned average inventory

Hard by:

CMA a. 50 units.

adapted b. 100 units.

Refer To: c. 250 units.

9-17 d. 500 units.

Reference: 9-18

(Appendix) The Huron Corporation purchases 60,000 headbands per year. The

average purchase lead time is 20 working days. Maximum lead time is 27

working days. The corporation works 240 days per year.

101. Horun Corporation should carry a safety stock of:

C a. 5,000 units.

Medium b. 6,750 units.

CMA c. 1,750 units.

adapted d. 5,250 units.

88 Managerial Accounting, 9/e

Refer To:

9-18

102. Huron Corporation should reorder headbands when the quantity in

B inventory reaches:

Medium a. 5,000 units.

CMA b. 6,750 units.

adapted c. 1,750 units.

Refer To: d. 5,250 units.

9-18

Essay

103. Clay Company has projected sales and production in units for

Medium the second quarter of the coming year as follows:

April May June

Sales ......... 50,000 40,000 60,000

Production .... 60,000 50,000 50,000

Cash-related production costs are budgeted at $5 per unit

produced. Of these production costs, 40% are paid in the month

in which they are incurred and the balance in the following

month. Selling and administrative expenses will amount to

$100,000 per month. The accounts payable balance on March 31

totals $190,000, which will be paid in April.

All units are sold on account for $14 each. Cash

collections from sales are budgeted at 60% in the month of

sale, 30% in the month following the month of sale, and the

remaining 10% in the second month following the month of sale.

Accounts receivable on April 1 totaled $500,000 ($90,000 from

February's sales and the remainder from March).

Required:

a. Prepare a schedule for each month showing budgeted cash

disbursements for the Clay Company.

b. Prepare a schedule for each month showing budgeted cash

receipts for Clay Company.

Managerial Accounting, 9/e 89

Answer:

April May June

Production units................... 60,000 50,000 50,000

Cash required per unit............. $5 $5 $5

Production costs................... $300,000 $250,000 $250,000

Cash disbursements:

April May June

Production this month (40%)........ $120,000 $100,000 $100,000

Production prior month (60%)....... 190,000 180,000 150,000

Selling and administrative......... 100,000 100,000 100,000

Total disbursements................ $410,000 $380,000 $350,000

Payments relating to the prior month (March) in April represent

the balance of accounts payable at March 31.

April May June

Sales units........................ 50,000 40,000 60,000

Sales price........................ X $14 x $14 x $14

Total sales........................ $700,000 $560,000 $840,000

April May June

Cash receipts:

February sales................... $ 90,000

March sales...................... 307,500 $102,500

April sales...................... 420,000 210,000 $ 70,000

May sales........................ 336,000 168,000

June sales....................... ________ ________ 504,000

Total receipts..................... $817,500 $648,500 $742,000

90 Managerial Accounting, 9/e

104. Tilson Company has projected sales and production in units for

Medium the second quarter of the coming year as follows:

April May June

Sales ............ 55,000 45,000 65,000

Production ....... 65,000 55,000 55,000

Cash-related production costs are budgeted at $7 per unit

produced. Of these production costs, 40% are paid in the month

in which they are incurred and the balance in the following

month. Selling and administrative expenses will amount to

$110,000 per month. The accounts payable balance on March 31

totals $193,000, which will be paid in April.

All units are sold on account for $16 each. Cash

collections from sales are budgeted at 60% in the month of

sale, 30% in the month following the month of sale, and the

remaining 10% in the second month following the month of sale.

Accounts receivable on April 1 totaled $520,000 ($100,000 from

February's sales and the remainder from March).

Required:

a. Prepare a schedule for each month showing budgeted cash

disbursements for the Tilson Company.

b. Prepare a schedule for each month showing budgeted cash

receipts for Tilson Company.

Answer:

April May June

Production units................... 65,000 55,000 55,000

Cash required per unit............. $7 $7 $7

Production costs................... $455,000 $385,000 $385,000

Cash disbursements:

April May June

Production this month (40%)........ $182,000 $154,000 $154,000

Production prior month (60%)....... 193,000 273,000 231,000

Selling and administrative......... 110,000 110,000 110,000

Total disbursements................ $485,000 $537,000 $495,000

Managerial Accounting, 9/e 91

Payments relating to the prior month (March) in April represent

the balance of accounts payable at March 31.

April May June

Sales units....................... 55,000 45,000 65,000

Sales price....................... X $16 x $16 __ x $16

Total sales....................... $880,000 $720,000 $1,040,000

April May June

Cash receipts:

February sales.................. $100,000

March sales..................... 315,000 $105,000

April sales..................... 528,000 264,000 $ 88,000

May sales....................... 432,000 216,000

June sales...................... 624,000

Total receipts.................... $943,000 $801,000 $928,000

105. At March 31 Streuling Enterprises, a merchandising firm, had an

Medium inventory of 38,000 units, and it had accounts receivable

totaling $85,000. Sales, in units, have been budgeted as

follows for the next four months:

April ............... 60,000

May ................. 75,000

June ................ 90,000

July ................ 81,000

Streuling's board of directors has established a policy to

commence in April that the inventory at the end of each month

should contain 40% of the units required for the following

month's budgeted sales.

The selling price is $2 per unit. One-third of sales are paid

for by customers in the month of the sale, the balance is

collected in the following month.

Required:

a. Prepare a merchandise purchases budget showing how many

units should be purchased for each of the months April, May,

and June.

b. Prepare a schedule of expected cash collections for each of

the months April, May, and June.

92 Managerial Accounting, 9/e

Answer:

a. April May June July

Budgeted sales, in units ..... 60,000 75,000 90,000 81,000

Desired ending inventory (40%) 30,000 36,000 32,400

Total needs .................. 90,000 111,000 122,400

Less beginning inventory ..... 38,000 30,000 36,000

Required purchases ........... 52,000 81,000 86,400

b. April May June

Budgeted sales,

at $2 per unit .......... $120,000 $150,000 $180,000

March 31 Accounts Receivable $85,000

April sales ............... 40,000 $ 80,000

May sales ................. 50,000 $100,000

June sales ................ 60,000

Total cash collections ..... $125,000 $130,000 $160,000

106. TabComp Inc. is a retail distributor for MZB-33 computer hardware

Hard and related software. TabComp prepares annual sales forecasts of

which the first six months of the coming year are presented

below.

Hardware Hardware Total

Units Dollars Software Sales

January ....... 130 $390,000 $160,000 $550,000

February ...... 120 360,000 140,000 500,000

March ......... 110 330,000 150,000 480,000

April ......... 90 270,000 130,000 400,000

May ........... 100 300,000 125,000 425,000

June .......... 125 375,000 225,000 600,000

Cash sales account for 25% of TabComp's total sales, 30% of

the total sales are paid by bank credit card, and the remaining

45% are on open account (TabComp's own charge accounts). The

cash and bank credit card sale payments are received in the

month of the sale. Bank credit card sales are subject to a four

percent discount which is deducted immediately. The cash

receipts for sales on open account are 70% in the month

following the sale, 28% in the second month following the sale,

and the remaining are uncollectible.

TabComp's month-end inventory requirements for computer

hardware units are 30% of the next month's sales. The units

must be ordered two months in advance due to long lead times

quoted by the manufacturer.

Managerial Accounting, 9/e 93

Required:

a. Calculate the cash that TabComp can expect to collect during

April. Show all of your calculations.

b. Determine the number of computer hardware units that should

be ordered in January. show all of your calculations.

Answer:

a. The cash that TabComp can expect to collect during April is

calculated below.

April cash receipts:

April cash sales ($400,000 x 0.25)............. $100,000

April credit card sales ($400,000 x 0.30 x 0.96) 115,200

Collections on open account:

March ($480,000 x 0.45 x 0.70)................. 151,200

February ($500,000 x 0.45 x 0.28).............. 63,000

January (uncollectible)........................ 0

Total collections............................ $429,400

b. The number of units that TabComp should order in January is

calculated as follows.

March sales ..................................... 110 units

Add desired ending inventory (90 units x 0.30) .. 27 units

Total needs ..................................... 137 units

Less beginning inventory (110 units x 0.30) ..... 33 units

Required purchases .............................. 104 units

107. The Doley Company has planned the following sales for the next

Medium three months:

Jan Feb Mar

Budgeted sales ...... $40,000 $50,000 $70,000

Sales are made 20% for cash and 80% on account. From

experience, the company has learned that a month's sales on

account are collected according to the following pattern:

Month of sale ................ 60%

First month following sale ... 30%

Second month following sale .. 8%

Uncollectible ................ 2%

The company requires a minimum cash balance of $5,000 to start

a month. The beginning cash balance in March is budgeted to be

$6,000.

94 Managerial Accounting, 9/e

Required:

a. Compute the budgeted cash receipts for March.

b. The following additional information has been provide for

March:

Inventory purchases (all paid in March) $28,000

Operating expenses (all paid in March) $40,000

Depreciation expense for March ........ $5,000

Dividends paid in March ............... $4,000

Prepare a cash budget in good form for the month of March,

using this information and the budgeted cash receipts you

computed for part (1) above. The company can borrow in any

dollar amount and will not pay interest until April.

Answer:

a. Cash sales, March: $70,000 x 20% ............... $14,000

Collections on account:

Jan. sales: $40,000 x 80% x 8% .............. 2,560

Feb. sales: $50,000 x 80% x 30% ............. 12,000

Mar. sales: $70,000 x 80% x 60% ............. 33,600

Total cash receipts ............................. $62,160

b. Cash balance, beginning ......................... $ 6,000

Add cash receipts from sales .................... 62,160

Total cash available ......................... $68,160

Less disbursements:

Inventory purchases .......................... 28,000

Operating expenses ........................... 40,000

Dividends .................................... 4,000

Total disbursements ............................. 72,000

Cash excess (deficiency) ........................ (3,840)

Financing - borrowing ........................... 8,840

Cash balance, ending ............................ $ 5,000

108. Montero Corporation, a merchandising company, has provided the

Medium following budget data:

CPA Purchases Sales

adapted January ........ $42,000 $72,000

February........ 48,000 66,000

March .......... 36,000 60,000

April .......... 54,000 78,000

May ............ 60,000 66,000

Collections from customers are normally 70% in the month of

sale, 20% in the month following the sale, and 9% in the second

month following the sale. The balance is expected to be

uncollectible. Montero pays for purchases in the month

following the purchase. Cash disbursements for expenses other

than merchandise purchases are expected to be $14,400 for May.

Montero's cash balance at May 1 was $22,000.

Managerial Accounting, 9/e 95

Required:

a. Compute the expected cash collections during May.

b. Compute the expected cash balance at May 31.

Answer:

a. Expected

Sales Collections

March ............ $60,000 x 9% = $ 5,400

April ............ $78,000 x 20% = $15,600

May .............. $66,000 x 70% = $46,200

Total .......... $67,200

b.

Balance, May 1 ....................... $22,000

Expected collections ................. 67,200

Expected disbursements

April purchases to be paid in May .. $54,000

Cash disbursements for expenses .... 14,400

Total disbursements............... 68,400

(1,200)

Expected ending balance .............. $20,800

109. A sales budget is given below for one of the products

Hard manufactured by the Key Co.:

January ......... 21,000 units

February ........ 36,000 units

March ........... 61,000 units

April ........... 41,000 units

May ............. 31,000 units

June ............ 25,000 units

The inventory of finished goods at the end of each month

should equal 20% of the next month's sales. However, on

December 31 the finished goods inventory totaled only 4,000

units.

Each unit of product requires three specialized electrical

switches. Since the production of these specialized switches by

Key's suppliers is sometimes irregular, the company has a

policy of maintaining an ending inventory at the end of each

month equal to 30% of the next month's production needs. This

requirement had been met on January 1 of the current year.

Required:

Prepare a budget showing the quantity of switches to be

purchased each month for January, February, and March and in

total for the quarter.

96 Managerial Accounting, 9/e

Answer:

January February March April

Budgeted sales (units)....... 21,000 36,000 61,000 41,000

Add: Desired ending inventory 7,200 12,200 8,200 6,200

Total needs.................. 28,200 48,200 69,200 47,200

Deduct: Beginning inventory. 4,000 7,200 12,200 8,200

Units to be produced......... 24,200 41,000 57,000 39,000

January February March Quarter

Units to be produced........ 24,200 41,000 57,000 122,200

Switches per unit........... x 3 x 3 x 3 x 3

Production needs............ 72,600 123,000 171,000 366,600

Add: Desired

ending inventory 36,900 51,300 35,100 35,100

Total needs................. 109,500 174,300 206,100 401,700

Deduct: Beginning inventory. 21,780 36,900 51,300 21,780

Required purchases.......... 87,720 137,400 154,800 379,920

Beginning inventory, January 1: 72,600 x 0.3 = 21,780.

Ending inventory, March 30: (39,000 x 3) x 0.3 = 35,100.

110. A sales budget is given below for one of the products

Hard manufactured by the OMI Co.:

January ...... 25,000 units

February ..... 40,000 units

March ........ 65,000 units

April ........ 45,000 units

May .......... 35,000 units

June ......... 30,000 units

The inventory of finished goods at the end of each month

must equal 20% of the next month's sales. However, on December

31 the finished goods inventory totaled only 4,000 units.

Each unit of product requires three pounds of specialized

material. Since the production of this specialized material by

OMI's suppliers is sometimes irregular, the company has a

policy of maintaining an ending inventory at the end of each

month equal to 30% of the next month's production needs. This

requirement had been met on January 1 of the current year.

Required:

Prepare a budget showing the quantity of material to be

purchased each month for January, February, and March and in

total for the quarter.

Managerial Accounting, 9/e 97

Answer:

January February March April

Budgeted sales (units)... 25,000 40,000 65,000 45,000

Add: Desired

ending inventory 8,000 13,000 9,000 7,000

Total needs.............. 33,000 53,000 74,000 52,000

Deduct:

Beginning inventory 4,000 8,000 13,000 9,000

Units to be produced...... 29,000 45,000 61,000 43,000

January February March Quarter

Units to be produced..... 29,000 45,000 61,000 135,000

Switches per unit........ x 3 x 3 x 3 x 3

Production needs......... 87,000 135,000 183,000 405,000

Add: Desired

ending inventory. 40,500 54,900 38,700 38,700

Total needs.............. 127,500 189,900 221,700 443,700

Deduct:

Beginning inventory... 26,100 40,500 54,900 26,100

Required purchases....... 101,400 149,400 166,800 417,600

Beginning inventory, January 1: 87,000 x 0.3 = 26,100.

Ending inventory, March 30: (43,000 x 3) x 0.3 = 38,700.

98 Managerial Accounting, 9/e

You might also like

- 30 Apr 2021Document1 page30 Apr 2021Madhuri MadhuNo ratings yet

- Kims RLCO Trading System DescriptionDocument21 pagesKims RLCO Trading System DescriptionAmol b100% (2)

- Case-1 QuestionsDocument2 pagesCase-1 QuestionsadeshlNo ratings yet

- Assignment 2 GSB5031Document5 pagesAssignment 2 GSB5031peter njovuNo ratings yet

- SK Investment Group's ProposalDocument31 pagesSK Investment Group's ProposalLansingStateJournalNo ratings yet

- AttachmentDocument34 pagesAttachmentPia SurilNo ratings yet

- Latihan Budget 20142015Document48 pagesLatihan Budget 20142015AnnaNo ratings yet

- Latihan Budget 2014 - 2015Document48 pagesLatihan Budget 2014 - 2015Elizabeth DeeNo ratings yet

- Mas6 7Document46 pagesMas6 7Villena Divina VictoriaNo ratings yet

- Regulatory Framework of Financial Institutions PDFDocument149 pagesRegulatory Framework of Financial Institutions PDFPoliNo ratings yet

- Accounting For Business CombinationsDocument19 pagesAccounting For Business Combinationsvinanovia50% (2)

- QuizDocument9 pagesQuizCertified Public AccountantNo ratings yet

- 5 Operational BudgetingDocument6 pages5 Operational BudgetingJoanna MNo ratings yet

- Financial Management - Forecasting, Planning and ControlDocument3 pagesFinancial Management - Forecasting, Planning and ControlMizzy SargaduNo ratings yet

- FINALDocument8 pagesFINALpdmallari12No ratings yet

- Business PlanningDocument16 pagesBusiness PlanningEnola HolmesNo ratings yet

- HO7 - Functional and Activity Based Budgeting PDFDocument5 pagesHO7 - Functional and Activity Based Budgeting PDFPATRICIA PEREZNo ratings yet

- Louderback C6 TF&MCDocument4 pagesLouderback C6 TF&MCInocencio TiburcioNo ratings yet

- MAS 8 Short-Term Budgeting and Forecasting FOR UPLOADDocument10 pagesMAS 8 Short-Term Budgeting and Forecasting FOR UPLOADJD SolañaNo ratings yet

- Quiz On Business PlanningDocument9 pagesQuiz On Business Planningyes it's kaiNo ratings yet

- MSQ-06 - Master BudgetDocument12 pagesMSQ-06 - Master BudgetfrancklineNo ratings yet

- Budgeting - Seatwork MaDocument11 pagesBudgeting - Seatwork MaErica Caliuag100% (1)

- Chapter 09 - Profit Planning and Activity-Based BudgetingDocument105 pagesChapter 09 - Profit Planning and Activity-Based BudgetingNijeshkumar PcNo ratings yet

- Final Examination: Management Advisory Services Semester of A.Y. 2021-2022Document11 pagesFinal Examination: Management Advisory Services Semester of A.Y. 2021-2022Andrea Florence Guy VidalNo ratings yet

- Operational and Financial Budgeting: Multiple ChoiceDocument16 pagesOperational and Financial Budgeting: Multiple ChoiceNaddieNo ratings yet

- Pre FinalDocument8 pagesPre Finalpdmallari12No ratings yet

- Expected Cash Receipts Classified by Source Expected Cash DisbursementsDocument6 pagesExpected Cash Receipts Classified by Source Expected Cash DisbursementsRimuru Tempest100% (1)

- Budgeting - Exercises Without SolutionsDocument2 pagesBudgeting - Exercises Without SolutionsJohn Bornick Loudwig SanyegoNo ratings yet

- Brewer6ce WYRNTK Ch07Document5 pagesBrewer6ce WYRNTK Ch07Bilal ShahidNo ratings yet

- Homework NoDocument3 pagesHomework NoPrinceMontalanNo ratings yet

- Budget Costing Lyst3166Document23 pagesBudget Costing Lyst3166apurva chaturvediNo ratings yet

- Encircle The Letter of The Correct Answer.: Practice SetDocument3 pagesEncircle The Letter of The Correct Answer.: Practice SetShei FortinNo ratings yet

- CH 10 ImaimDocument37 pagesCH 10 ImaimBeatrice TehNo ratings yet

- MactDocument21 pagesMactsukanyaNo ratings yet

- Budgeting and Budgetary Control: MCQ'SDocument36 pagesBudgeting and Budgetary Control: MCQ'SAakash SonarNo ratings yet

- Mas - Midter-Ntc ExamDocument15 pagesMas - Midter-Ntc ExamRed YuNo ratings yet

- Midterm Topic 4.1 - Notes - Sales Budgets and Production BudgetsDocument2 pagesMidterm Topic 4.1 - Notes - Sales Budgets and Production BudgetslanoyjessicaellahNo ratings yet

- College of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDocument7 pagesCollege of Accountancy Final Examination Acctg.3A Instruction: Multiple ChoiceDonalyn BannagaoNo ratings yet

- 1Document14 pages1Rhea llyn BacquialNo ratings yet

- Sample MAS 3rd Evals KEY Set ADocument10 pagesSample MAS 3rd Evals KEY Set AJoanna MNo ratings yet

- ACC 213 D, RA, TP Assign QuestDocument8 pagesACC 213 D, RA, TP Assign QuestMariel DolinoNo ratings yet

- Quiz Bing M1-10Document32 pagesQuiz Bing M1-10Zidan SubhiNo ratings yet

- 15 Budgeting - Profits, Sales, Costs - ExpensesDocument15 pages15 Budgeting - Profits, Sales, Costs - ExpensesVanity Claire Tiburcio100% (1)

- Chapter 9Document62 pagesChapter 9Shruthi ShettyNo ratings yet

- Assignment PDFDocument11 pagesAssignment PDFJanine Lerum100% (1)

- WK 7 Lesson 7 Aa Budgeting Lecture NotesDocument6 pagesWK 7 Lesson 7 Aa Budgeting Lecture Notesnot funny didn't laughNo ratings yet

- Introduction To Managerial Accounting 6th Edition Brewer Test BankDocument38 pagesIntroduction To Managerial Accounting 6th Edition Brewer Test Bankleo6exthomas100% (23)

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Rizal Technological University College of Business & Entrepreneurial Technology Department of AccountancyDocument14 pagesRizal Technological University College of Business & Entrepreneurial Technology Department of AccountancyHatdogNo ratings yet

- MTG MAS Review Operations Budgeting ExtraDocument25 pagesMTG MAS Review Operations Budgeting ExtraLieza Jane AngelitudNo ratings yet

- Mid TermDocument7 pagesMid Termpdmallari12No ratings yet

- Ta WP CebuDocument43 pagesTa WP CebuYukiNo ratings yet

- Chapter 6 - CostDocument12 pagesChapter 6 - CostAngela AquinoNo ratings yet

- Act 6J03 - Comp1 - 1stsem05-06Document13 pagesAct 6J03 - Comp1 - 1stsem05-06d.pagkatoytoyNo ratings yet

- KA SET A Cost PrelimsDocument16 pagesKA SET A Cost PrelimsGeozelle BenitoNo ratings yet

- ReviewDocument6 pagesReviewgabrenillaNo ratings yet

- Reviewer For BudgetingDocument57 pagesReviewer For BudgetingHertz Dasmariñas GappiNo ratings yet

- Chapter 10 PDFDocument9 pagesChapter 10 PDFadarshNo ratings yet

- Chapter 10Document9 pagesChapter 10adarshNo ratings yet

- BudgetDocument15 pagesBudgetJoydip DasguptaNo ratings yet

- 6.3 Budget and Budgetary Control: Cost Accounting TechniquesDocument27 pages6.3 Budget and Budgetary Control: Cost Accounting Techniquessadhaya rajan100% (1)

- 2nd Evaluation Exam Management Services - January 11, 2017 (G.Sanchez)Document16 pages2nd Evaluation Exam Management Services - January 11, 2017 (G.Sanchez)Beverlene BatiNo ratings yet

- Operational BudgetingDocument7 pagesOperational BudgetingDave AlereNo ratings yet

- FInnancialDocument6 pagesFInnancialHans Pierre AlfonsoNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- BUSINESS PLAN TEMPLATE - FMS Dec22Document11 pagesBUSINESS PLAN TEMPLATE - FMS Dec22Iqlaas WarsameNo ratings yet

- Fitbase Cancellation FormDocument1 pageFitbase Cancellation FormMarley HarrisNo ratings yet

- Us Housing DataDocument18 pagesUs Housing Dataagarwala47No ratings yet

- Corporate Tax Planning and ManagemantDocument11 pagesCorporate Tax Planning and ManagemantVijay KumarNo ratings yet

- Theory and Practice of Venture Capital FDocument121 pagesTheory and Practice of Venture Capital FKeval Darji0% (1)

- Act BulletinDocument27 pagesAct BulletinpapergateNo ratings yet

- Examination: Subject CT5 - Contingencies Core TechnicalDocument7 pagesExamination: Subject CT5 - Contingencies Core TechnicalMadonnaNo ratings yet

- Berenberg European AerospaceDefence Sector Report Jun 17 2014 330pgs (Initiations)Document330 pagesBerenberg European AerospaceDefence Sector Report Jun 17 2014 330pgs (Initiations)angadsawhneyNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument32 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseShaindra SinghNo ratings yet

- Law - Commercal Law - LETTERS of CREDITDocument15 pagesLaw - Commercal Law - LETTERS of CREDITNardz Andanan100% (1)

- Investment Decisions: (Capital Budgeting Techniques)Document69 pagesInvestment Decisions: (Capital Budgeting Techniques)Dharmesh GoyalNo ratings yet

- Law On Partnership (Review)Document3 pagesLaw On Partnership (Review)Yumar Nico MediavilloNo ratings yet

- Interest To Annuity From 950 EconDocument54 pagesInterest To Annuity From 950 EconMarvin LabajoNo ratings yet

- Reissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Document1 pageReissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Sadiki LuhandeNo ratings yet

- Krispy Kreme DoughnutsDocument31 pagesKrispy Kreme DoughnutsAnkit MishraNo ratings yet

- Report Internshipe State Life RizwanDocument56 pagesReport Internshipe State Life Rizwanrizbecks86% (7)

- Vietnam at A Glance 4 Jan 2023Document8 pagesVietnam at A Glance 4 Jan 2023Nguyen Hoang ThoNo ratings yet

- Credit DerivativesDocument27 pagesCredit DerivativesMalkeet SinghNo ratings yet

- Doles Vs AngelesDocument2 pagesDoles Vs AngelesFred Joven GlobioNo ratings yet

- DSCR Ratio With ExampleDocument2 pagesDSCR Ratio With ExampleRanjeet SinghNo ratings yet

- Ledger 2Document4 pagesLedger 2Hellarica AnabiezaNo ratings yet

- Loan Agreement Reference: ST THDocument4 pagesLoan Agreement Reference: ST THKeszeg Beáta ZsuzsánnaNo ratings yet

- Buyers CreditDocument2 pagesBuyers Creditrao_gmailNo ratings yet