Professional Documents

Culture Documents

Global Railway News Release

Global Railway News Release

Uploaded by

NorthbaynuggetOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Railway News Release

Global Railway News Release

Uploaded by

NorthbaynuggetCopyright:

Available Formats

LACHINE, QC, July 5, 2011 /CNW/ - Global Railway Industries Ltd., - (GBI:TSX): Global Railway Industries Ltd., www.globalrailway.

com, today announced the signing of an agreement for the sale of its operating subsidiary, CAD Railway Industries Ltd. (CADRI), to 2290693 Ontario Inc., a company controlled by Mr. Fausto Levy, Global and CADRI's President and Chief Executive Officer, with the participation of the Caisse de dpt et placement du Qubec (CDPQ) as a financial partner, as well as other members of CADRI management. The transaction is valued at approximately Cdn.$12.9 million, including the assumption of debt outstanding of approximately Cdn.$550,000. Cdn.$1 million of the purchase price will be held in escrow for one year following the closing for potential indemnification claims under the purchase agreement. The sale of CADRI represents the culmination of the strategic review process commenced by the Global Board in 2009 to maximize shareholder value and follows the sale of Global's other operating businesses, G&B Specialties and Bach-Simpson, to Wabtec Corporation in the third quarter of 2010. As part of this strategic review process, Global entertained proposals from a number of potential purchasers of the Company as a whole, and of the operating businesses of the Company, including CADRI, separately. After the Special Committee of the Board determined interest in CADRI from third parties was insufficient, it invited management to consider whether they would participate in the sale process and consider submitting an offer for CADRI. The announced transaction represents the most attractive offer available to the Company, and Global's board of directors have unanimously determined it to be in the best interests of Global and its shareholders. In approving the CADRI sale, the Global Board considered, among other things, the advice of its financial and legal advisors, a formal valuation of CADRI prepared by RSM Richter Inc. and a fairness opinion from RSM Richter to the effect that the CADRI sale is fair, from a financial point of view, to the Company. Mr. Thomas Dea, Chairman of the Global Board, said "We are very pleased that we have concluded the strategic review process by reaching an agreement to sell CADRI to Mr. Levy's company. The Special Committee and its advisors have worked diligently over the past two years to ensure that all alternatives were considered. The Board of Global believes that in the circumstances this is the best possible outcome for the Company and its shareholders." Mr. Fausto Levy welcomes the participation of CDPQ, one of the largest financial institutions in Canada, in the management buy-out. Mr. Levy added that he is confident the acquisition of CADRI by management will ensure continuity for CADRI's clients and other stakeholders. The completion of the CADRI sale is conditional on obtaining the approval of the shareholders of Global, as well as other customary conditions including approval of the Toronto Stock Exchange. The closing is currently anticipated to occur in the later part of the third quarter of 2011. The purchase agreement between Global and 2290693 Ontario Inc. provides for, among other things, a non-solicitation covenant by Global, subject to customary provisions that entitle Global to consider and accept a superior proposal relating to Global or CADRI, and the payment by Global to 2290693 Ontario Inc. of an expense reimbursement for outof-pocket invoiced expenses if the transaction is not completed as a result of a superior proposal. Global has agreed to call and hold a special meeting of shareholders within 75 days. At the meeting, Global will seek shareholder approval for the CADRI sale by a majority of not less than two-thirds of the votes cast by shareholders voting at the meeting, including a majority of the votes cast by shareholders other than Mr. Levy, 2290693 Ontario Inc. and their "related parties" (within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions). The Global Board has unanimously recommended that shareholders vote in favour of the transaction at the meeting. A copy of the formal valuation and fairness opinion prepared by RSM Richter will be included in the management information circular that will be sent to shareholders in connection with the special meeting. Forward Looking Statements: This news release contains certain forward-looking statements about the objectives, strategies, financial conditions, results of operations and businesses of Global and CADRI. Statements that are not historical facts are forward-looking and are subject to important risks, uncertainties and assumptions. These statements are based on Global's current expectations about its business and the markets in which it operates, and upon various estimates and assumptions. The results or events predicted in these forwardlooking statements may differ materially from actual results or events if known or unknown risks, trends or

uncertainties affect Global's business, failure of any of the conditions precedent to the CADRI sale, indemnification claims or other proceedings in connection with the CADRI sale or the Wabtec transactions, the termination of any of CADRI's material client relationships, or, generally, any other material adverse event that prevents CADRI from implementing its business plans following the sale, or if Global's estimates or assumptions turn out to be inaccurate. As a result, there is no assurance that the circumstances described in any forward-looking statement will materialize. Significant and reasonably foreseeable factors that could cause Global's results to differ materially from its current expectations are discussed in the section entitled "Business Risks" contained in the Global's Management's Discussion and Analysis for the year ended December 31, 2010 filed by Global with the Canadian securities commissions (available on SEDAR at www.sedar.com), as updated in its most recent Management's Discussion and Analysis for the three months ended March 30, 2011. Global disclaims any intention or obligation to update any forwardlooking statement even if new information becomes available, as a result of future events or for any other reason. About Global Railway Industries Ltd.: Global Railway Industries Ltd. is a public company whose shares are listed for trading on the Toronto Stock Exchange (TSX) under the symbol "GBI". For more information: visit www.globalrailway.com or www.investorfile.com.

You might also like

- Strategic Business Management Answers: Advanced Level Examination JULY 2016 Mock Exam 2Document24 pagesStrategic Business Management Answers: Advanced Level Examination JULY 2016 Mock Exam 2Suman UroojNo ratings yet

- DerivativesDocument344 pagesDerivativesAnonymous j6xVyah1RJ100% (4)

- TMAC Special Meeting MICDocument156 pagesTMAC Special Meeting MICOwm Close CorporationNo ratings yet

- Reverse MergerDocument24 pagesReverse MergerOmkar PandeyNo ratings yet

- Citigroup Research PaperDocument4 pagesCitigroup Research Paperzqbyvtukg100% (1)

- Gardner Denver Enters Into Definitive Agreement To Be Acquired by KKR (Co-Founded by Henry Kravis and George Roberts)Document9 pagesGardner Denver Enters Into Definitive Agreement To Be Acquired by KKR (Co-Founded by Henry Kravis and George Roberts)Mariah SharpNo ratings yet

- Burger King Holdings, Inc. To Be Acquired by 3G CapitalDocument6 pagesBurger King Holdings, Inc. To Be Acquired by 3G CapitalSam HamadehNo ratings yet

- Rating Action - Moodys-assigns-Baa3-rating-to-Country-Gardens-proposed-USD-notes - 11may21Document5 pagesRating Action - Moodys-assigns-Baa3-rating-to-Country-Gardens-proposed-USD-notes - 11may21Winnie WongNo ratings yet

- Press Release Closing Private PlacementDocument3 pagesPress Release Closing Private PlacementAriel TenoreNo ratings yet

- 10 Market Street, Suite 6 Camana Bay, Po Box 30900 Grand Cayman Ky1-1204 Cayman Islands T +1 345 936 9900 Mhcayman - KyDocument10 pages10 Market Street, Suite 6 Camana Bay, Po Box 30900 Grand Cayman Ky1-1204 Cayman Islands T +1 345 936 9900 Mhcayman - Ky4444444444444-311661No ratings yet

- Auditing and AssuranceDocument15 pagesAuditing and AssuranceWanambisi JnrNo ratings yet

- FINAL Joy Global Presentation For Investors 00793403xA26CA FinalDocument9 pagesFINAL Joy Global Presentation For Investors 00793403xA26CA FinalEdson MirandaNo ratings yet

- 1773006669aaa - LPS 4 - Q PDFDocument2 pages1773006669aaa - LPS 4 - Q PDFAhmad Ali AyubNo ratings yet

- Factiva 20230109 1309Document6 pagesFactiva 20230109 1309david kusumaNo ratings yet

- 2943 0 2023-03-26 00-50-17 enDocument61 pages2943 0 2023-03-26 00-50-17 enabdullah.h.aloibiNo ratings yet

- Wockhardt Limited: Management Discussion and Analysis ReportDocument5 pagesWockhardt Limited: Management Discussion and Analysis ReportpedrooshkaNo ratings yet

- GTXMQ - 2020-09-20 - Doc 15 - First Day Declaration (CFO)Document136 pagesGTXMQ - 2020-09-20 - Doc 15 - First Day Declaration (CFO)jrweber912No ratings yet

- Central European Distribution Corporation Wins Overwhelming Creditor Approval of Proposed Restructuring PlanDocument3 pagesCentral European Distribution Corporation Wins Overwhelming Creditor Approval of Proposed Restructuring PlanChapter 11 DocketsNo ratings yet

- Plains All American Pipeline To Acquire Remaining 50% Interest in Natural Gas Storage JVDocument3 pagesPlains All American Pipeline To Acquire Remaining 50% Interest in Natural Gas Storage JVKenny CasillaNo ratings yet

- Globe Commodities LimitedDocument8 pagesGlobe Commodities Limitedanshul.mishra1089No ratings yet

- Lse PLS 2018Document85 pagesLse PLS 2018gaja babaNo ratings yet

- Final Output in Audapp1Document9 pagesFinal Output in Audapp1Ma Stephanie Kate Labro0% (1)

- Williams Grand Prix Holdings PLCDocument6 pagesWilliams Grand Prix Holdings PLCMiguel García MirandaNo ratings yet

- JV Heads of TermsDocument6 pagesJV Heads of Termssharaf.kazim5No ratings yet

- Competition Merger Toolkit June 2021Document40 pagesCompetition Merger Toolkit June 2021ricdick33No ratings yet

- Goodyear Completes Acquisition of CooperDocument3 pagesGoodyear Completes Acquisition of CooperAlex OnkenNo ratings yet

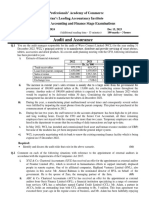

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- 60 Cds Big BangDocument7 pages60 Cds Big BangBad PersonNo ratings yet

- Sprintclass Mock - Q1Document4 pagesSprintclass Mock - Q1Nur AmirahNo ratings yet

- Carlyle IPODocument462 pagesCarlyle IPOValentyn Makarenko100% (1)

- Kraft's Acquisition of Cadbury - An Ethical and Financial HighlightDocument11 pagesKraft's Acquisition of Cadbury - An Ethical and Financial HighlightLLM smk100% (1)

- "Merger and Consolidation of Icici Ltd. and Icici Bank": A Project Report ONDocument90 pages"Merger and Consolidation of Icici Ltd. and Icici Bank": A Project Report ONRidhima SharmaNo ratings yet

- Simar Kaur 0223Document3 pagesSimar Kaur 0223simar leenNo ratings yet

- Call Warrant PaperDocument14 pagesCall Warrant PaperWong Zhen JeeNo ratings yet

- Aumni Enhanced Model Term Sheet V3.0 06142022Document5 pagesAumni Enhanced Model Term Sheet V3.0 06142022bg2gbNo ratings yet

- Gati LimitedDocument1 pageGati LimitedeinsteincNo ratings yet

- 23 Jul 09.S&P's Published Report For Syndicate 0386Document12 pages23 Jul 09.S&P's Published Report For Syndicate 0386QBE European OperationsNo ratings yet

- Country Garden Holdings Company Limited 碧 桂 園 控 股 有 限 公 司: Inside InformationDocument4 pagesCountry Garden Holdings Company Limited 碧 桂 園 控 股 有 限 公 司: Inside InformationNointingNo ratings yet

- CDS Big Bang - Mar 13 2009Document26 pagesCDS Big Bang - Mar 13 2009jdobbs2001No ratings yet

- Brookfield Letter To General Growth Re Reorganization PlanDocument7 pagesBrookfield Letter To General Growth Re Reorganization PlanDealBookNo ratings yet

- Marking Scheme: Strategic Business ReportingDocument11 pagesMarking Scheme: Strategic Business Reportingamy najatNo ratings yet

- Nyi 8468140v.iDocument12 pagesNyi 8468140v.iChapter 11 DocketsNo ratings yet

- 2016 Q3 Earnings Presentation PDFDocument19 pages2016 Q3 Earnings Presentation PDFdfauchier1No ratings yet

- Revised Gsco Financial Statement 5-30-08Document24 pagesRevised Gsco Financial Statement 5-30-08aruncoolguyNo ratings yet

- Shougang Concord Grand (Group) Limited: (Incorporated in Bermuda With Limited Liability)Document104 pagesShougang Concord Grand (Group) Limited: (Incorporated in Bermuda With Limited Liability)l chanNo ratings yet

- GeoBio EnergyDocument2 pagesGeoBio EnergyAlsalam ToursNo ratings yet

- Simarleen Kaur 0323Document3 pagesSimarleen Kaur 0323simar leenNo ratings yet

- Raising Capital Through IPODocument80 pagesRaising Capital Through IPONaimur Rahman JoyNo ratings yet

- Mergers and Acquisitions 2020 3Document36 pagesMergers and Acquisitions 2020 3Joan KamwanaNo ratings yet

- Sigma Announces US$45 Million Project Finance Facility With Societe GeneraleDocument3 pagesSigma Announces US$45 Million Project Finance Facility With Societe GeneraleRogerioNo ratings yet

- Public Mergers and Acquisitions in Saudi Arabia OverviewDocument23 pagesPublic Mergers and Acquisitions in Saudi Arabia OverviewHeru JuliantoNo ratings yet

- General Motors Co.'s Recovery Rating ProfileDocument6 pagesGeneral Motors Co.'s Recovery Rating ProfileVladimir BulutNo ratings yet

- (2022) SGHC 35Document26 pages(2022) SGHC 35Michel KlunzingerNo ratings yet

- GS DellDocument20 pagesGS DelljwkNo ratings yet

- Case On PrologisDocument4 pagesCase On PrologisFreida AyodeleNo ratings yet

- Q4 2022 Earnings PresentationDocument21 pagesQ4 2022 Earnings PresentationCesar AugustoNo ratings yet

- November 2020 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument24 pagesNovember 2020 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- Gpsi Cim FinalDocument22 pagesGpsi Cim Finalapi-249675528No ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- The Regional Comprehensive Economic Partnership Agreement: A New Paradigm in Asian Regional Cooperation?From EverandThe Regional Comprehensive Economic Partnership Agreement: A New Paradigm in Asian Regional Cooperation?No ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Sean Lawlor ReleaseDocument2 pagesSean Lawlor ReleaseNorthbaynuggetNo ratings yet

- KPMG Audit of Memorial Gardens' ProjectDocument20 pagesKPMG Audit of Memorial Gardens' ProjectNorthbaynuggetNo ratings yet

- Mayor McDonald PresentationDocument5 pagesMayor McDonald PresentationNorthbaynuggetNo ratings yet

- ONTC Report by Auditor GeneralDocument31 pagesONTC Report by Auditor GeneralBrian MacLeodNo ratings yet

- North Bay Police Service: Media ReleaseDocument3 pagesNorth Bay Police Service: Media ReleaseNorthbaynuggetNo ratings yet

- NNDSB 2012 Eqao, September 15, 2012Document2 pagesNNDSB 2012 Eqao, September 15, 2012Northbaynugget0% (1)

- Fall Colour Thurs Sept 13, 2012Document2 pagesFall Colour Thurs Sept 13, 2012NorthbaynuggetNo ratings yet

- Sean Lawlor ReleaseDocument2 pagesSean Lawlor ReleaseNorthbaynuggetNo ratings yet

- Burning Bans August 7, 2012Document2 pagesBurning Bans August 7, 2012NorthbaynuggetNo ratings yet

- Media Release 20jul12Document1 pageMedia Release 20jul12NorthbaynuggetNo ratings yet

- Kraft Celebration Tour - 09 - Ontario 1Document3 pagesKraft Celebration Tour - 09 - Ontario 1NorthbaynuggetNo ratings yet

- The StereosDocument2 pagesThe StereosNorthbaynuggetNo ratings yet

- Memo Announcing New E.D. To The Community Partners.Document2 pagesMemo Announcing New E.D. To The Community Partners.NorthbaynuggetNo ratings yet

- 2012 Premier's NomineesDocument2 pages2012 Premier's NomineesNorthbaynuggetNo ratings yet

- NR Lhin July16Document1 pageNR Lhin July16NorthbaynuggetNo ratings yet

- July 20 2012Document1 pageJuly 20 2012NorthbaynuggetNo ratings yet

- AspinDocument2 pagesAspinNorthbaynuggetNo ratings yet

- NR ElliotLake (v11) PO (WithMayorQuote) (Withlinks) FINALDocument1 pageNR ElliotLake (v11) PO (WithMayorQuote) (Withlinks) FINALNorthbaynuggetNo ratings yet

- AspinDocument2 pagesAspinNorthbaynuggetNo ratings yet

- Wetland Policy EIS Guideline Open HouseDocument1 pageWetland Policy EIS Guideline Open HouseNorthbaynuggetNo ratings yet

- NR Response July19Document1 pageNR Response July19NorthbaynuggetNo ratings yet

- Wetland Policy EIS Guideline Open HouseDocument1 pageWetland Policy EIS Guideline Open HouseNorthbaynuggetNo ratings yet

- Media Release June 19, 2012-1Document1 pageMedia Release June 19, 2012-1NorthbaynuggetNo ratings yet

- NR Lhin July16Document1 pageNR Lhin July16NorthbaynuggetNo ratings yet

- 2012 06 12 Community UpdateDocument2 pages2012 06 12 Community UpdateNorthbaynuggetNo ratings yet

- 2012 June13 OSSLTDocument1 page2012 June13 OSSLTNorthbaynuggetNo ratings yet

- Media Relese OMSPADocument2 pagesMedia Relese OMSPANorthbaynuggetNo ratings yet

- Media Release June 15 2012Document1 pageMedia Release June 15 2012NorthbaynuggetNo ratings yet

- TOROS News ReleaseDocument1 pageTOROS News ReleaseNorthbaynuggetNo ratings yet

- Aci - The Financial Markets Association: Examination FormulaeDocument8 pagesAci - The Financial Markets Association: Examination FormulaeJovan SsenkandwaNo ratings yet

- SSRN Id4342008Document98 pagesSSRN Id4342008Jack MonroeNo ratings yet

- Egypt National Bank of EgyptDocument1 pageEgypt National Bank of Egyptbasemmohamed01506No ratings yet

- Class 12 Economics Project FileDocument19 pagesClass 12 Economics Project FiletusharNo ratings yet

- Geojit On Power MechDocument5 pagesGeojit On Power MechDhittbanda GamingNo ratings yet

- Security Analysis and Portfolio Management: Question BankDocument12 pagesSecurity Analysis and Portfolio Management: Question BankgiteshNo ratings yet

- Sense and Nonsense in Modern Corporate FinanceDocument119 pagesSense and Nonsense in Modern Corporate Financecongsang099970No ratings yet

- Week 5 - ch17Document61 pagesWeek 5 - ch17bafsvideo4No ratings yet

- Margin Rule 1999 - BangladeshDocument4 pagesMargin Rule 1999 - BangladeshAfm Mainul AhsanNo ratings yet

- Motilal OswalDocument104 pagesMotilal OswalSathavara Ketul100% (2)

- Liste Noire Forex 17 Aout 2021Document4 pagesListe Noire Forex 17 Aout 2021Seck SYNo ratings yet

- Average Score: MSM Malaysia Holdings (Msm-Ku)Document11 pagesAverage Score: MSM Malaysia Holdings (Msm-Ku)Afiq de WinnerNo ratings yet

- Accounting Standard (AS) 30 Financial Instruments: Recognition and MeasurementDocument22 pagesAccounting Standard (AS) 30 Financial Instruments: Recognition and MeasurementkarthickvitNo ratings yet

- Valuation Problems With HintsDocument2 pagesValuation Problems With HintsKawsar AhmedNo ratings yet

- Let's Talk About Volatility PDFDocument17 pagesLet's Talk About Volatility PDFVIX HunterNo ratings yet

- CGFD Ipeople - Inc SEC - Form.17-C CertificatesOfAttendanceCorporateGovernanceSeminar (26july2021)Document13 pagesCGFD Ipeople - Inc SEC - Form.17-C CertificatesOfAttendanceCorporateGovernanceSeminar (26july2021)dawijawof awofnafawNo ratings yet

- CombinationDocument8 pagesCombinationNabila Lubna Manuhara PutriNo ratings yet

- TemenosDocument13 pagesTemenosthejerry11No ratings yet

- Delta and GammaDocument69 pagesDelta and GammaHarleen KaurNo ratings yet

- Chapter 5 IntAcct Sum21-DropboxDocument68 pagesChapter 5 IntAcct Sum21-DropboxPhuong Anh NguyenNo ratings yet

- Test 1 NewDocument2 pagesTest 1 NewQuỳnh Trần Thị ThúyNo ratings yet

- Insert Account Info: Forex Money Management Calculator by HectorDocument3 pagesInsert Account Info: Forex Money Management Calculator by HectorKalfy WarspNo ratings yet

- QuarterlyBo 12081800 01739053 31122019 PDFDocument1 pageQuarterlyBo 12081800 01739053 31122019 PDFSangamesh Sangu0% (1)

- 2023 Report PDFDocument60 pages2023 Report PDFPruthvi BrahmbhattNo ratings yet

- Project Report On Stock MarketDocument2 pagesProject Report On Stock MarketSandesh Jadhav100% (1)

- Basel IV Big BangDocument13 pagesBasel IV Big BangfilNo ratings yet

- Case 3.1 Enron FDocument3 pagesCase 3.1 Enron FswetaNo ratings yet

- Problem Examples Cost DepartmentalizationDocument6 pagesProblem Examples Cost DepartmentalizationApril Joy InductaNo ratings yet

- HDFC Securities Demat Account Closure Request FormDocument2 pagesHDFC Securities Demat Account Closure Request FormRajesh KumharNo ratings yet