Professional Documents

Culture Documents

SalarySlipwithTaxDetails JUNE

SalarySlipwithTaxDetails JUNE

Uploaded by

Parveen SainiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SalarySlipwithTaxDetails JUNE

SalarySlipwithTaxDetails JUNE

Uploaded by

Parveen SainiCopyright:

Available Formats

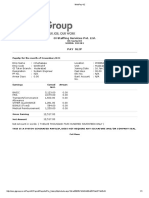

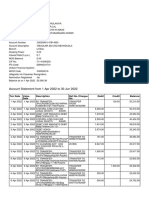

MABARA MANUFACTURING COMPANY.

8, 100, 1st St, Kamarajar Nagar, Thiruvalluvar Puram

, Choolaimedu, Chennai, Tamil Nadu

600094

Pay Slip for the month of JUNE 2022

All amounts in INR

FG City : CHENNAI

IFSC Code : YESB0001062

Emp Code : MA057321 Doj : 19 FEB 2019 Bank A/c No. : 106291900010362 (YES BANK LTD)

Emp Name : ANCHAL WORHA Payable Days : 30.00

Company : MABARA

Department : P A YR OLL Paid Holiday : 0.00 PAN : AHLPW6048C

Designation : ADMIN

Arrear Day(s) 0.00 PF No. : TH/048473844/848483

Band : 2B PF UAN. : 1017365869274

Cost Center No. : 8696848593

ESI No. : 364758594

Gender : FEMALE FG Date Of Joining: 19 FEB 2019

DOB : 01 A P R I L 2000 9073

Site Code :

Format : Lee Cooper Apparels

Functions : PAYROLL

Employee Zone : South

Official Email ID : A A AN CH A L.WO RH A .PA YR O LL@MAB A RA .C

O .IN

Earnings Deductions

Paid Holiday

Description Monthly TDS Total Description Amount

Amt.

BASIC 80104.00 -13083.00 0.00 67021.00 PF 3190.00

int_w k_prk_all 10000.00 0.00 0.00 6622.00 ESI 231.00

Company Contribution to PF 395.00 Company Contribution to PF 395.00

Company Contribution to EPS 895.00 Company Contribution to EPS 895.00

Company Contribution to ESIC 559.00 Company Contribution to ESIC 559.00

GROSS EARNINGS 90104.00 -13083.00 0.00 75492.00 GROSS DEDUCTIONS 5470.00

Net Pay :70,022.00 (SEVENTY THOUSAND AND TWENTY TWO ONLY)

Income Tax Worksheet for the Period April 2022 - March 2023

D e s c ri p ti o n Gross E x e mp t Taxable D e d u c ti o n U n d e r C h a p te r VI-A Taxa ble HRA Calculatio n (M e tro )

BASIC 764980.00 0.00 764980.00 I n v e s t m e n t s u/s 80C Rent Paid 0.00

int_w k_prk_all 112003.00 0.00 112003.00 Provident F und 5980.00 From: 01/04/2022

To: 31/03/2023

1. Actual HRA 0.00

2. 10% or 15% of Basic 65992.00

Gross 876980.00 0.00 876980.00 T o ta l I n v e s t me n ts u/s 80C 5980.00 3. Rent - 10% Basic 0.00

Tax Wo r k i n g U/S 80C 5980.00 Least of above is exempt 0.00

Standard Deduction 25000.00 T o tal Ded Un d e r C h a p te r VI- A 5980.00 Taxable HRA 0.00

Previous Employer Taxable Income 0.00

Previous Employer Professional T ax 0.00

Professional Tax 0.00 TDS D e d uc te d Mo n thl y

Under Chapter VI-A 2990.00 Month Amount

Any Other Income 0.00 April-2022 13083.00

Taxable Income 597190.00 May-2022 13083.00

Total Tax 0.00 T o ta l 26166.00

Tax Rebate u/s 87a 0.00

S urcharge 0.00

Tax Due 0.00

Health and Education Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 13083.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 26166.00

Tax to be D educted 0.00

Tax per month 13083.00

Tax on Non-Recurring Earnings 0.00

T o tal Any O the r I n c o me

Tax D e d u c ti o n for this mo n th 13083.00

Personal Note: This is a system generated payslip, does not require any signature.

You might also like

- Pay Slip-June-21Document1 pagePay Slip-June-21tejpratap pandeyNo ratings yet

- Payslip 9 2021.pdf3301655635205489526Document1 pagePayslip 9 2021.pdf3301655635205489526ShecallsmefraudNo ratings yet

- Adecco India Pvt. LTD.: Payslip For The Month of May 2019Document2 pagesAdecco India Pvt. LTD.: Payslip For The Month of May 2019Secret EarthNo ratings yet

- Subramani PayslipDocument2 pagesSubramani PayslipMr. HarshaNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsN Quinton SinghNo ratings yet

- Feb-2023Document1 pageFeb-2023Rny buriaNo ratings yet

- Payslip Jul 2023Document1 pagePayslip Jul 2023Kartika RaguvanshiNo ratings yet

- Infinity Fincorp Solutions Private Limited: Payslip For The Month of March 2023Document1 pageInfinity Fincorp Solutions Private Limited: Payslip For The Month of March 2023venkata surendraNo ratings yet

- February 2023 Salary Slip E000052897Document1 pageFebruary 2023 Salary Slip E000052897rajvNo ratings yet

- Hardik PaySlipDocument1 pageHardik PaySlipnokia6No ratings yet

- Awais Ahmed (UTL0477)Document1 pageAwais Ahmed (UTL0477)Awais AhmedNo ratings yet

- Pay SlipDocument1 pagePay SlipVISHESH JAISWALNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Apr 2021Document1 pageApr 2021Suraj KadamNo ratings yet

- Intex Technologies (I) LTD.: D-18/2 Okhla Industrial Area, Phase-II, New Delhi-110020Document1 pageIntex Technologies (I) LTD.: D-18/2 Okhla Industrial Area, Phase-II, New Delhi-110020rakeshsingh9811No ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279No ratings yet

- PayslipDocument1 pagePayslipAlec Paolo FabrosNo ratings yet

- October 2022: Employee Details Payment & Leave Details Location DetailsDocument1 pageOctober 2022: Employee Details Payment & Leave Details Location DetailsPritam GoswamiNo ratings yet

- PayslipDocument1 pagePayslipSahil shahNo ratings yet

- THVSH01176780000411504 PDFDocument1 pageTHVSH01176780000411504 PDFKamini Sumit ChouhanNo ratings yet

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- SalarySlip 5876095Document1 pageSalarySlip 5876095Larry WackoffNo ratings yet

- Chandan Cy Feb Payslip 2021Document1 pageChandan Cy Feb Payslip 2021x foxNo ratings yet

- Pay Slip For The Month of July-2023: Bandhan Bank LimitedDocument1 pagePay Slip For The Month of July-2023: Bandhan Bank LimitedBIKRAM KUMAR BEHERA0% (1)

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- Anuja Tejinkar3Document1 pageAnuja Tejinkar3javed9890No ratings yet

- Salary January2023Document1 pageSalary January2023AKM Enterprises Pvt LtdNo ratings yet

- Ixfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Document1 pageIxfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Anonymous NoxtOPCWNo ratings yet

- Amrit Placement Services Pvt. LTD.: Salary Slip For The Month of September 2021Document1 pageAmrit Placement Services Pvt. LTD.: Salary Slip For The Month of September 2021Anil SharmaNo ratings yet

- PAY May 2022Document1 pagePAY May 2022Rohit raagNo ratings yet

- Pay Slip 10949 February, 2021Document1 pagePay Slip 10949 February, 2021Abebe SharewNo ratings yet

- Divi Atchut Kumar - TCL11442 - April - 2021 - Employee - Basic - PayslipDocument1 pageDivi Atchut Kumar - TCL11442 - April - 2021 - Employee - Basic - PayslipDivi AtchutNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Aprl 23Document1 pageAprl 23Asif KhanNo ratings yet

- PaySlip-210 (ASHISH SHARMA) - APR - 2018 PDFDocument1 pagePaySlip-210 (ASHISH SHARMA) - APR - 2018 PDFAnonymous OXzOm4oNo ratings yet

- JUL 2023 PayslipDocument1 pageJUL 2023 Payslipgpsexy7No ratings yet

- M/S Vrvs India Private Limited: Total 17124.54 Total Deductions 1434.54 Payable Amount Rs. 15690.00Document1 pageM/S Vrvs India Private Limited: Total 17124.54 Total Deductions 1434.54 Payable Amount Rs. 15690.00AnilNo ratings yet

- March 2022Document1 pageMarch 2022Urmila UjgareNo ratings yet

- Venus Precision Tools and Components PVT - LTD: Salary Slip For The Month of October, 2020Document1 pageVenus Precision Tools and Components PVT - LTD: Salary Slip For The Month of October, 2020pyNo ratings yet

- Sum A 1589Document1 pageSum A 1589Suma KishoreNo ratings yet

- March PDFDocument1 pageMarch PDFRNo ratings yet

- April 21 PayslipDocument1 pageApril 21 PayslipStephen SNo ratings yet

- Powerweave Software Services Pvt. LTDDocument1 pagePowerweave Software Services Pvt. LTDSnehal ManeNo ratings yet

- SalarySlip Prasar-6Document1 pageSalarySlip Prasar-6mishramanu1990No ratings yet

- Uni-Com India PVT - LTDDocument1 pageUni-Com India PVT - LTDcredit cardNo ratings yet

- Pay Slip MayDocument1 pagePay Slip MayAYUSH MishraNo ratings yet

- Payslip Feb 2023Document1 pagePayslip Feb 2023love entertainmentNo ratings yet

- GI-Nov PayslipsDocument1 pageGI-Nov PayslipsmahendraNo ratings yet

- Allcloud Enterprise Solutions Private Limited: Payslip For The Month of June 2019Document1 pageAllcloud Enterprise Solutions Private Limited: Payslip For The Month of June 2019Shaik IrfanNo ratings yet

- Murali Krishna Chollangi Payslip Nov 2022.PdfmDocument1 pageMurali Krishna Chollangi Payslip Nov 2022.Pdfmanuteck1No ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- May 2020 PDFDocument1 pageMay 2020 PDFshaklainNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Pay Slip - 604316 - Oct-22Document1 pagePay Slip - 604316 - Oct-22ArchanaNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Yogesh August PayslipDocument1 pageYogesh August Payslipशिवभक्त बाळासाहेब मोरेNo ratings yet

- PayseptDocument1 pagePayseptJasmine SinglaNo ratings yet

- SalarySlipwithTaxDetails JulyDocument2 pagesSalarySlipwithTaxDetails JulyParveen SainiNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsIndian LegendNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsIndian LegendNo ratings yet

- SalarySlipwithTaxDetails Feb-22Document2 pagesSalarySlipwithTaxDetails Feb-22Divyanshu BaghelNo ratings yet

- Acct Statement - XX3378 - 16102022Document11 pagesAcct Statement - XX3378 - 16102022Parveen SainiNo ratings yet

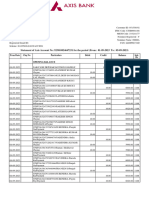

- Statement of Axis Account No:923010024647231 For The Period (From: 01-09-2023 To: 05-09-2023)Document3 pagesStatement of Axis Account No:923010024647231 For The Period (From: 01-09-2023 To: 05-09-2023)Parveen SainiNo ratings yet

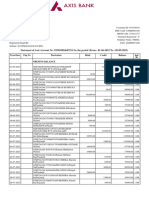

- Statement of Axis Account No:923010024647231 For The Period (From: 01-06-2023 To: 05-09-2023)Document3 pagesStatement of Axis Account No:923010024647231 For The Period (From: 01-06-2023 To: 05-09-2023)Parveen SainiNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument40 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceParveen SainiNo ratings yet

- Salary Slip Aug 2012Document1 pageSalary Slip Aug 2012Parveen SainiNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument36 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceParveen SainiNo ratings yet

- Salary Slip SEP 2022Document1 pageSalary Slip SEP 2022Parveen SainiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument8 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceParveen SainiNo ratings yet

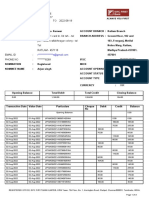

- Opening Balance 0.00Document3 pagesOpening Balance 0.00Parveen SainiNo ratings yet

- AccountStatement 3451699105 Sep 06 115137 220827 153522Document6 pagesAccountStatement 3451699105 Sep 06 115137 220827 153522Parveen SainiNo ratings yet

- Account Statement From 1 Jun 2022 To 1 Sep 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Jun 2022 To 1 Sep 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceParveen SainiNo ratings yet

- Account Statement From 1 Apr 2022 To 30 Jun 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument10 pagesAccount Statement From 1 Apr 2022 To 30 Jun 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceParveen SainiNo ratings yet

- Account Statement: Mahendra Singh SolankiDocument15 pagesAccount Statement: Mahendra Singh SolankiParveen SainiNo ratings yet

- StatementDocument54 pagesStatementParveen SainiNo ratings yet

- June SalaryslipDocument1 pageJune SalaryslipParveen SainiNo ratings yet

- StatementDocument25 pagesStatementParveen SainiNo ratings yet

- July SalaryslipDocument1 pageJuly SalaryslipParveen SainiNo ratings yet

- Salary Slip 07Document1 pageSalary Slip 07Parveen SainiNo ratings yet

- GP Fund Calculation Formula Sheet For GP Fund StatementDocument4 pagesGP Fund Calculation Formula Sheet For GP Fund StatementmarchkotNo ratings yet

- Department of The Treasuryein ConfirmationDocument1 pageDepartment of The Treasuryein ConfirmationMikeDouglasNo ratings yet

- Exercises On Individual Income Taxation 3BDocument11 pagesExercises On Individual Income Taxation 3BSean San AntonioNo ratings yet

- Budget ProjectDocument2 pagesBudget ProjectErnesto OrozcoNo ratings yet

- Bsa2105 FS2021 011 Vatex1 Solution PDFDocument6 pagesBsa2105 FS2021 011 Vatex1 Solution PDFedrianclydeNo ratings yet

- FirstDocument1 pageFirstSean Derrick BlancoNo ratings yet

- Understanding Life Insurance and Imputed Income: Table 1 RatesDocument3 pagesUnderstanding Life Insurance and Imputed Income: Table 1 RatesarbindokiluNo ratings yet

- Notes Sales Interstate ExemptDocument3 pagesNotes Sales Interstate Exemptananya jainNo ratings yet

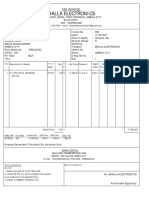

- A.P.N. Engineering: I (IND' Korumori Fhlruuerhodu, Chennoi-6ooozDocument3 pagesA.P.N. Engineering: I (IND' Korumori Fhlruuerhodu, Chennoi-6ooozYuvaraj SekarNo ratings yet

- Federal Democratic Republic of Ethiopia Ethiopian Revenue and Customs AuthorityDocument1 pageFederal Democratic Republic of Ethiopia Ethiopian Revenue and Customs Authorityashe100% (1)

- Time Sheet FormatDocument1 pageTime Sheet Formatsavita10No ratings yet

- Process For Application To Use LooseleafDocument1 pageProcess For Application To Use LooseleafFrancis MartinNo ratings yet

- GR No. 78133Document1 pageGR No. 78133ElleNo ratings yet

- GST ReturnDocument7 pagesGST ReturnJCGCFGCGNo ratings yet

- Bank Recon FindingsDocument4 pagesBank Recon FindingsJerwin Cases TiamsonNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearHarjot SinghNo ratings yet

- Form-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)Document1 pageForm-Ii (See Regulation 4) Postal Bill of Export - II (To Be Submitted in Duplicate)mrthilagamNo ratings yet

- Declaration Form (22-23)Document4 pagesDeclaration Form (22-23)vasavi kNo ratings yet

- NIRC Amendments Up To 2016Document3 pagesNIRC Amendments Up To 2016jusang16No ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Ramandeep SinghDocument1 pageRamandeep SinghRaman SinghNo ratings yet

- RMC 70-2010 Use of Reappraised Value As Basis For Computing Depreciation of PPE Is Not Allowed For Tax Purposes.Document2 pagesRMC 70-2010 Use of Reappraised Value As Basis For Computing Depreciation of PPE Is Not Allowed For Tax Purposes.zooeyNo ratings yet

- Goods & Services Tax (GST) - User DashboardDocument3 pagesGoods & Services Tax (GST) - User Dashboarddurgpalsingh2023No ratings yet

- No. Departmental Interpretation and Practice Notes Date IssuedDocument3 pagesNo. Departmental Interpretation and Practice Notes Date IssuedsiupakcatNo ratings yet

- Income Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument31 pagesIncome Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersLove FreddyNo ratings yet

- Taxation: Dr. Maina N. JustusDocument10 pagesTaxation: Dr. Maina N. JustusSkyleen Jacy VikeNo ratings yet

- Kerala Gazette: ExtraordinaryDocument2 pagesKerala Gazette: ExtraordinaryArjun Manghav PuthanpurayilNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- VAT 100 PrintDocument3 pagesVAT 100 PrintSwamy HNNo ratings yet